Executive Summary

There are many aspects of equity compensation that benefit both employers and employees, making it an attractive and lucrative niche for financial advisors. And while some financial advisors may be met with some basic challenges to establish a practice in this space, those who invest time to learn about the industry and its planning nuances may find ample business opportunities and a rewarding level of success.

There are three primary tiers of equity compensation recipients, the first of which includes C-suite executives. These employees receive numerous and sizable grants from their company and may greatly benefit from financial planning services but, while the C-suite executive may be the most financially promising client, they are generally also the hardest to engage by advisors not already affiliated with the company, as these employees are often already provided with comprehensive advisory services (provided by a wide range of competing providers of equity compensation guidance) as part of their employer benefit packages. The second tier includes the middle management group of directors and other critical staff, who represent a client ‘sweet spot’ for advisors to target. These prospects tend to be high-net-worth individuals with substantial stock holdings and options, but without the same access to comprehensive financial guidance that C-suite executives may receive. The last tier of equity compensation recipients includes non-executives and non-key employees who tend to receive the least generous benefits. While these employees may not generate much revenue for financial advisors outright, they should not be dismissed entirely – not only do they hold potential for their own financial growth, but they also help financial advisors better understand the company’s benefit plans and can serve as a valuable referral source.

In addition to identifying and pursuing their ideal equity compensation client, advisors will also need to develop a systematic process to analyze the broad spectrum of equity compensation benefits that a company offers its employees. This process generally consists of valuation and investment risk analyses and is often followed by some degree of tax strategy modeling, depending on the complexity of the client’s benefit package and their particular planning needs. Advisors will need to gather key information not just about the equity compensation plan itself (e.g., the client’s grant summary statement and vesting schedules, along with information about the company shares the client may already own), but also about the client’s other portfolio assets and tax situation. Helping clients understand how best to manage their options through tax-efficient diversification strategies can be an invaluable service, and showing clients exactly how to optimize their assets in the broader scope of their comprehensive financial planning goals will undoubtedly go a long way not just in building client awareness and trust, but in also creating valuable referral credibility and networking opportunities through existing clients.

Ultimately, the key point is that the equity compensation niche can be an attractive and rewarding opportunity for financial advisors, and by investing resources in seeking out prospects that work for particular companies, advisors can begin to really lean into and grow their niche. Financial advisors need not be intimated by large advisory firms who may seem to be competitors in the equity compensation space, as middle-tier employees provide ample opportunities for independent advisors to offer valuable and high-quality guidance, offering both the client and the advisor a rewarding planning-oriented experience!

Equity compensation is defined as a non-cash payment for services that provides ownership in a company. It is commonly offered to executives and key employees, in addition to their regular pay, and includes different forms of company stock. Equity ownership can build tremendous personal wealth, as demonstrated by the top 25 richest Americans (all of whom built their wealth through the equity value of owning businesses).

Consequently, the equity compensation planning niche can be very lucrative for financial advisors. Advisors who can successfully engage equity award recipients, and provide insights on how to get the most out of their company stock and option holdings, not only bring great value to the client but can also generate substantial assets under management (AUM) and planning fees.

However, while serving the needs of those receiving significant equity compensation is a sizable market opportunity for financial advisors, it also requires significantly more specialized knowledge and skills… which both makes it challenging for financial advisors to serve the niche (such that not everyone can and will), but also more rewarding for those who do so successfully!

Equity Compensation 101: Basics, Market, Clients, And Competition

In many competitive industries, equity compensation awards are used by both publicly traded and private companies to attract, retain, and motivate employees. These awards benefit both the company and the recipient. The company preserves cash flow by replacing (cash) salary compensation with equity and enhances success by establishing an ownership culture. Equity award recipients benefit financially from the success of the company as the stock price of the shares they received as compensation can subsequently increase in value.

There are a variety of different kinds of equity compensation that can come in the form of awards or grants, and corporate compensation consulting firms are continually devising new (and often more complicated) forms. However, there are two basic types of equity awards: option grants and share grants.

Employee stock options (ESOs) give the recipient the right (not the obligation) to buy company shares at a fixed price (known as “exercise” or “grant” price).

This right generally expires in 7 to 10 years and often has a vesting schedule that typically spans 3 or 4 years. Once vested, the option shares can be purchased at the grant price and then sold to realize a taxable gain.

Example 1: Sue is a Vice President at Nike. In 2014 she was granted 5,000 Non-Qualified Stock Options (NQSOs) to purchase the stock at a price of $40 per share.

These options became fully vested in 2018 and do not expire until 2024, which means that during this window, Sue has the option to buy the stock at $40 per share, regardless of what the market price of the stock is, and can also sell the stock anytime thereafter.

When the price of Nike hit $135 in December 2020, Sue decided to exercise the grant and sell the shares. By doing so, Sue generates [$135 (market price at time of sale) – $40 (Sue’s exercise price)] × 5,000 (number of shares) = $475,000 of (pre-tax) ordinary income.

Share grants, which are also known as restricted stock/units or performance shares, provide employees with shares of the company, but are also subject to vesting criteria. Vesting usually occurs in increments over several years or is based on company performance. Upon vesting, restricted shares are taxed as ordinary income, with subsequent growth taxed as capital gains if held for 1 year.

Example 2: Bob is a Senior Programmer with Microsoft and receives 5,000 restricted stock units annually. He does not pay anything for these shares, and each restricted stock award vests after 3 years.

The price of MSFT was at $100 in January 2019, when the restricted stock units he was awarded in 2016 vested. Bob realizes $100 (stock price at time of vesting in 2019) × 5,000 (vested shares) = $500,000 in ordinary income.

Notably, one of the significant challenges in equity compensation (and opportunities for financial advisors aiding clients receiving equity compensation) is that large grants of either options or shares can create substantial income tax consequences as well. This is especially given a top Federal tax bracket of 37%, plus top state income tax brackets as high as 13%, and the reality that when large share grants vest or options are exercised, the (taxable) income that is generated often occurs in sizable amounts all at once (clustering income into a single tax year). Such scenarios create not only tax planning needs and opportunities, but outright challenges in planning for available cash flow to pay the associated tax liabilities.

Example 2b. Continuing the prior example, when Bob’s restricted stock units vest and generate $500,000 of ordinary income, Bob faces a substantial income tax liability for which he will use some of his Microsoft shares to cover some of the liability, even if he otherwise remains ‘bullish’ on the company and wants to continue keeping the shares.

Accordingly, to cover some of the Federal tax liability, Microsoft withholds 22% in shares, so Bob nets 5,000 (original stock grant) – (5,000 × 22%) = 3,900 shares.

If Bob keeps the remaining shares for one year (assuming he is still bullish on the stock itself), and sells them in January 2020 for $150 per share, Bob will generate [$150 (market price at time of sale) – $100 (market rice at time of vesting)] × 3,900 (vested shares Bob netted) = $195,000 of additional (pre-tax) Long-Term Capital Gains income.

Fortunately, Bob’s tax liability will be covered from the final proceeds of the Microsoft stock sale itself.

Nerd Note:

22% is typically the default Federal tax withholding on vested amounts valued at less than $1 million. For vested amounts above $1 million, the default Federal tax withholding increases to 37%.

While state tax withholding percentages will vary by state, both the Federal and state withholding rates are low enough that individuals will generally owe additional taxes upon vesting of their restricted stock units.

Opportunities for Financial Advisors In The Equity Compensation Guidance Market

The wealth represented by equity compensation transactions creates a large niche opportunity for financial advisors who choose to pursue such clients. The executive-compensation-solutions provider Equilar conducted a study in 2014 that estimated companies grant over $110 billion annually to employees in company shares and options.

Additionally, the National Center of Employee Ownership (NCEO) reports:

- There are over 11,000 publicly traded companies that issue equity awards;

- Private companies from small startups to the largest private enterprises also use equity compensation to attract and retain talent;

- It is estimated that there are over 9 million equity compensation recipients; and

- Over 500,000 C-Suite executives receive 80% of their total compensation in stock and options.

To further quantify the equity compensation niche, the following chart shows the S&P 500 index over the past decade. This indicates that employee stock options granted over the last 10 years are likely to be deep in the money, and that most company shares have appreciated considerably.

Types Of Equity Award Recipients

To work with prospective equity compensation clients effectively, it is important to understand the different types of equity award recipients. As financial advisors may want to acquire the CEOs of Fortune 500 companies as clients, be aware that this is unrealistic unless they are already a relative or close personal acquaintance.

For simplicity, equity award recipients can be categorized into three tiers:

Tier 1: C-Suite Executives

Executive level officers referred to as the “C-Suite” commonly include the Chief Executive Officer (CEO), the Chief Financial Officer (CFO), the Chief Operating Officer (COO) and the Chief Information Officer (CIO). These employees are generally listed in company financial statements, so they are regularly prospected by financial advisors and all sorts of other financial services salespeople.

C-Suite executives are extremely attractive advisory prospects because they receive numerous and sizable grants that necessitate impartial guidance. However, they are difficult for advisors to engage. In addition to protective staff members that deter solicitations, C-Suite executives often receive personal financial assistance through in-house company perquisites (benefits known as “perks”). Perks are provided to executives in recognition of the extraordinary demands on their time. They can include a company car/allowance, corporate aircraft, country club membership, life insurance… and financial services, which can include tax preparation, retirement planning, investment management, and equity compensation guidance.

These financial services perks are typically provided by outside advisory firms and paid for by the company. This is an extremely competitive market, particularly for large Fortune 500 corporations. It is generally dominated by the large financial services firms that provide corporate services (discussed further in the next section).

Although C-Suite executives pose a big challenge to reach for smaller independent advisory firms, the challenge is not completely insurmountable. Advisors who thoroughly understand a company’s equity compensation program, and have a process for providing guidance, can acquire these top executives despite the competition. This is particularly true at small-to-mid-sized companies before they are so large that other big financial services providers are proactively competing for their business.

In practice, though, starting with the next tier of executives, before those executives make the C-Suite, is often a more realistic and feasible path.

Tier 2: SVP, VP, Director, Or Critical Staff

The second tier of stock plan participants consists of senior executives below the C-Suite (e.g., vice presidents, directors, regional managers, etc.), and other key employees that are essential to the success of the company (e.g., scientists, engineers, developers, salespeople, etc.). Like C-Suite executives, these highly compensated employees can also receive sizable regular grants of stock options and restricted stock.

Unlike C-Suite executives, though, these employees are not listed in the company’s annual report, so they can be harder to identify. Unfortunately (at least for financial advisors looking for business opportunities), there is no published list of senior/key employees and the amounts of company equity they receive.

Yet, this tier of equity compensation recipients is what I refer to as the “Sweet Spot” of this niche. Although these employees can be hard to identify, they are much easier to engage. This is because, as high-net-worth individuals with substantial company stock and option holdings, they usually need comprehensive financial guidance… but generally do not receive the C-Suite’s comprehensive financial services perk.

Instead, Tier 2 equity compensation participants more often get an annual stipend of between $1,000 and $5,000 for personal financial planning, to facilitate them going out to obtain a financial advisor for themselves. This benefit is not always utilized by these employees. It is helpful for advisors to learn as much as possible about the company’s financial assistance benefit program from these second-tier equity compensation employees.

Senior executives and key employees will generally have less wealth than C-Suite executives, but these prospects are more numerous and approachable. Targeting this tier is advisable, particularly if you can gain access to these employees.

Tier 3: Non-Executive Level And Non-Key Employees (Everyone Else)

The third and last tier of stock plan participants includes employees that receive small awards and/or have accumulated small amounts of company shares via an Employee Stock Purchase Plan (ESPP). ESPPs are company-run programs in which participating employees can purchase company stock at a (slightly, up-to-15%) discounted price. Employees contribute to the plan through payroll deductions.

Despite the more ‘modest’ share purchases, small award recipients and ESPP participants can accumulate a large number of shares that appreciate significantly over time. Such employees can make good prospects for financial advisors, but in general this tier has less complicated financial planning needs (at least with respect to planning for their equity compensation itself), and more modest (re-)investable assets (at least relative to Tier 1 and Tier 2 equity compensation participants). Additionally, these plan participants can usually obtain assistance with their company stock holdings from the firm’s stock plan service provider via online resources or from call center representatives.

Nonetheless, while this tier may not have as much wealth as Tier 1 or Tier 2 employees, it should not be dismissed entirely. Engaging Tier 3 employees can still lead to fruitful and rewarding relationships, especially for financial advisors who already focus on “mass affluent” clientele. Employees who participate in their company’s stock plan can also provide the advisor with the opportunity to learn more about the firm’s stock plan, better positioning them to work with other (potentially more senior) employees at the same company.

Competing Providers Of Equity Compensation Guidance

Although it may seem like there is an abundance of competition in this space for independent advisors to effectively compete, just because there are a lot of firms in this niche does not mean that every equity compensation participant is getting the guidance they actually need. On the contrary, there are not many financial advisors or firms that provide comprehensive and unbiased equity award guidance who have a real capability to help clients with their company stock and option holdings.

Nonetheless, because of the level of wealth opportunity amongst those who receive equity compensation, a number of large financial services providers do compete in the equity compensation niche alongside independent advisors, which any financial advisor considering the niche should be aware of.

Stock Plan Service (SPS) Providers

The major firms included in this group are Charles Schwab, Fidelity, Merrill Lynch, UBS, Morgan Stanley, and E*TRADE (recently acquired by Morgan Stanley, to consolidate its Stock Plan Service business). These companies provide both software and services to administer large corporate equity award programs.

The smaller SPS firms include Raymond James, RBC, and TD Ameritrade (recently merged with Charles Schwab). They generally focus on mid-sized companies, and partner with stock plan software providers such as Solium, Certent, and Computershare.

The real objective of SPS provider firms is to establish client relationships with select (i.e., Tier 2 and especially Tier 1) stock plan participants, as SPS revenue and transaction fees are modest (especially as transaction commissions at brokerage firms go to zero) compared to the value that can be derived from a long-term-client advisory relationship. Accordingly, both SPS firms and independent advisors are competing to establish long-term client relationships, and the opportunity to earn advice and planning (and investment management) fees from their equity compensation clients.

However, due to the nature of their corporate service in administering equity compensation plans themselves, SPS firms have access to equity compensation details for every stock plan participant at the company. This is a key advantage for SPS firms, as company stock plan participation information is otherwise proprietary and confidential and not accessible to “outside” independent advisors prospecting for new business opportunities. As again, while public companies must disclose the equity compensation details for a handful of Named Executive Officers (NEOs) in their annual 10-K financial reports, the names of the vast majority of a company’s equity compensation recipients and their award information are not available externally.

On the other hand, while access to a company’s stock plan information offers SPS firms an advantage over other advisory firms, they face disadvantages as well. Issuing companies (that provide the equity compensation to their employees) usually restrict the SPS firm from unsolicited contact with plan participants. This limits the SPS firm to providing participants with call center support using customer service representatives. They typically do not provide comprehensive equity compensation assistance.

Ayco’s Company-Sponsored Financial Counseling Program Services

Ayco, a Goldman Sachs Company, is the 500-pound gorilla and national leader in company-sponsored financial counseling programs for senior executives. As such, they are a major competitor in the equity compensation niche.

Ayco contracts directly with Fortune 500 companies to provide personal financial services to high-level executives. These services are paid for directly by the corporation, and include tax preparation, employee benefit guidance, investment management (via Goldman Sachs), and assistance with wealth transfer, estate planning and retirement planning. The annual fee per executive for Financial Planning services runs up to $100,000 (or higher for those who leverage the Ayco Family Office services). The objective of this company benefit is to help the executive focus on corporate goals, instead of their own finances.

Ayco’s business model, reputation, and 50 years of experience with executives from major corporations makes it difficult for advisory firms of any size to compete in this space. Yet, this pricey corporate benefit is generally limited to a handful of top (Tier 1) executives, which again still leaves numerous Tier 2 executives (e.g., SVPs, VPs, Regional Managers, Director-Level Executives, etc.) in need of financial planning assistance.

Accordingly, the sweet spot of the equity compensation niche most commonly focuses on the executives and key employees below the C-Suite (where Ayco’s services are less entrenched).

Back Office Teams

In addition to the Stock Plan Service firms and Ayco, there are a number of other financial services companies that are active in the equity compensation recipient niche. These firms will typically utilize a back-office or “advanced-market” planning team to provide equity compensation expertise to their field advisors with active client opportunities.

Some of the firms that have back-office equity compensation planning teams include Ameriprise, Edelman Financial Engines, Equitable, Lincoln Financial, Northwestern Mutual, Regions Bank, United Capital and RW Baird.

Nerd Note:

Goldman Sachs acquired United Capital in 2019, a move that appears to be positioning the company to expand further among corporate executives in a ‘downmarket’ direction to the ‘mere’ multi-millionaires (e.g., Tier 2 equity compensation recipients) that may have been too small for Ayco but that would be a perfect fit for United Capital.

Using back-office planning teams can be an appealing way to service a more sophisticated equity compensation clientele because it centralizes the required expertise and refines the process. However, the back-office approach is usually just a “one & done” analysis or plan, because the end advisor themselves is typically a generalist who does not have the expertise to advise on the ongoing equity compensation complexities of such clientele as they continue to receive new grants.

This means that clients need to do their own periodic (e.g., quarterly) reviews of the initial analysis provided by the back-office team, or to seek out a planning-oriented advisor who can provide the ongoing guidance that is often so important to equity award recipients.

Equity Compensation 201: Insights On Pursuing The Opportunity

Despite the competition, the equity compensation niche still represents a big opportunity for independent advisors, especially because of the lack of ongoing, comprehensive financial planning provided to equity compensation recipients, which industry research has shown is indeed needed by these employees. As explained previously, this is particularly true with the senior executives and key employees beneath the C-Suite (i.e., “Tier 2” and “Tier 3” equity compensation recipients).

Issuing companies may provide stock plan participants with basic education, but they do not offer personalized guidance. Typically, the HR/Compensation staff that administer the corporate equity award program simply distribute the plan/grant documents and coordinate the online resources. Although the program staff may be asked by participants for personal guidance, they are precluded by policy from providing employees with advice regarding when to exercise or sell and specific tax consequences.

Consequently, participants may often seek advice from their peers. ‘Water cooler’ equity compensation guidance is a pervasive substitute for qualified and professional expertise. Many companies may have one (or more) employees who are self-proclaimed stock plan “gurus” with a spreadsheet they created and who are eager to assist their fellow employees. And while these internal experts may be smart people with good intentions, their advice excludes third-party objectivity and broader financial planning expertise.

Another factor that creates opportunities for advisors who do want to specialize in equity compensation clients is that there are many advisors who actively avoid this space because the equity award planning niche often requires more than CFP certification and access to financial planning software given the tax and other complexities involved.

As while the CFP curriculum introduces the different types of employee stock options and share grants, it does not provide an extensive framework for evaluating the risk and reward associated with them. Additionally, general financial planning tools are not designed to determine when, why, and how clients should diversify their company stock and option holdings.

A client’s equity compensation generally represents a major portion of their wealth, so determining when to exercise and sell to maximize value and reduce risk is particularly important. These decisions also generate complex tax consequences which need to be evaluated. Accordingly, equity compensation guidance can generally be separated into two discrete planning processes - valuation and investment risk analysis, and tax/strategy modeling.

Valuation/Investment Risk Analysis Vs. Tax/Strategy Modeling

Financial advisors working with equity compensation recipients need a process for analyzing these holdings, illustrating strategies, and making recommendations. This is best performed using two separate planning steps because doing so simplifies the process and avoids unnecessary effort.

Step 1: Valuation And Investment Risk Analysis

Valuation and Investment Risk Analysis aims to provide a “big picture” overview with fresh insights regarding the client’s stock options, restricted stock/units, and their company-owned/long shares. This process helps clients to understand and appreciate these holdings by calculating values and illustrating risks. Presented and interpreted by an experienced financial planner, this analysis (described in detail in the upcoming case study) is highly effective at getting clients to make proactive diversification decisions and avoid costly mistakes.

Step 2: Tax Strategy Modeling

Tax Strategy Modeling aims to answer specific tax- and cash-flow-related questions that have been identified through the Valuation and Investment Risk Analysis. Developing a tax strategy model to assess equity compensation is complex and time consuming, so it is important to determine what needs to be modeled to avoid ‘analysis paralysis’.

For example, if the client needs to diversify a Non-Qualified Stock Option (NQSO) to reduce concentration risk, they may want to know how much to exercise/sell to stay in a specific tax bracket. Another example would be to determine the Alternative Minimum Tax (AMT) liability of exercising and holding the shares of an ISO grant.

Since the after-tax values of most equity awards can be calculated using estimated tax rates (which are included in the Step 1 valuation analysis), a subsequent step involving a complex tax model that requires details from the client’s tax return (e.g., income and deductions) is often unnecessary. The valuation/risk analysis helps determine why and when the client should consider diversifying their company stock and options, and the tax/strategy model addresses how to optimize for taxes and cash flow. Starting the equity compensation analysis process with a detailed tax strategy would be akin to putting the cart before the horse.

Equity Compensation Planning – Sample Client Case Study

The following equity compensation analysis case study illustrates a framework for providing guidance using a Valuation/Investment Risk Analysis and Tax/Strategy Modeling. It requires getting the following information from the client:

- Their grant summary statement with vesting schedule. This can be harder than it sounds, because stock plan participant websites do not always have an easy way to print off this information, and client-generated spreadsheets are not always accurate.

- Details regarding the company shares they own outright. This will include the acquisition date and price, which will be used to calculate the current after-tax value of these holdings. This is important because, like vested stock options, owned shares are immediately diversifiable.

- The pre-tax value of their other investable assets. This is used to calculate the client’s concentration percentage and it can be separated into three different types of accounts (brokerage, IRA/401k, and Roth) to estimate the total after-tax value. This excludes the value of the client’s company stock and options.

- Other required assumptions. These include information like tax rates, current stock prices, volatility, and the risk-free rate. Most commonly the advisor brings their own expertise to determine values for these assumptions, though client input on them can be helpful.

- Their most recent tax return. This is used for the tax/strategy model and includes Form 1040 with Schedule A (Itemized Deductions) and Schedule D (Capital Gains and Losses), along with Forms 6251 (Alternative Minimum Tax) and 8801 (Credit for Prior Year Minimum Tax). If a detailed tax analysis is unnecessary, this information is not needed.

In our sample case, the client has the following stock options, restricted grants, and owned shares:

- Stock Options:

- 4,000 ISOs (Incentive Stock Options) fully vested with an exercise price of $48.81.

- 20,000 partially vested NQSOs (Non-Qualified Stock Options) from 3 grants with exercise prices of $71.49, $96.17, and $127.29.

- Restricted Stock:

- 6,000 RSUs (Restricted Stock Units) from 2 grants vesting in 2021, 2023, & 2024.

- 2,500 PSG (Performance Stock Grant) shares vesting using company performance criteria over the next 5 years.

- Owned Shares:

- 3 lots totaling 7,100 shares acquired from restricted stock grants that vested over the past 10 years.

- 1 lot of 2,000 shares acquired from recently exercising and holding ISO shares.

- 1 lot of 100 shares acquired from an ESPP (Employee Stock Purchase Plan) in 2020.

In its raw form, this information is hard to mentally process, and does not clarify where the client really stands (nor what the advisor should ideally recommend).

Accordingly, financial advisors can add value for equity compensation clients first and foremost by simply bringing order to their equity grant information – similar to creating financial organization for the rest of their assets and liabilities within a financial plan, but specific to the domain and complexities of equity compensation clients.

Summarizing Client Holdings (On A Pre- And After-Tax Basis)

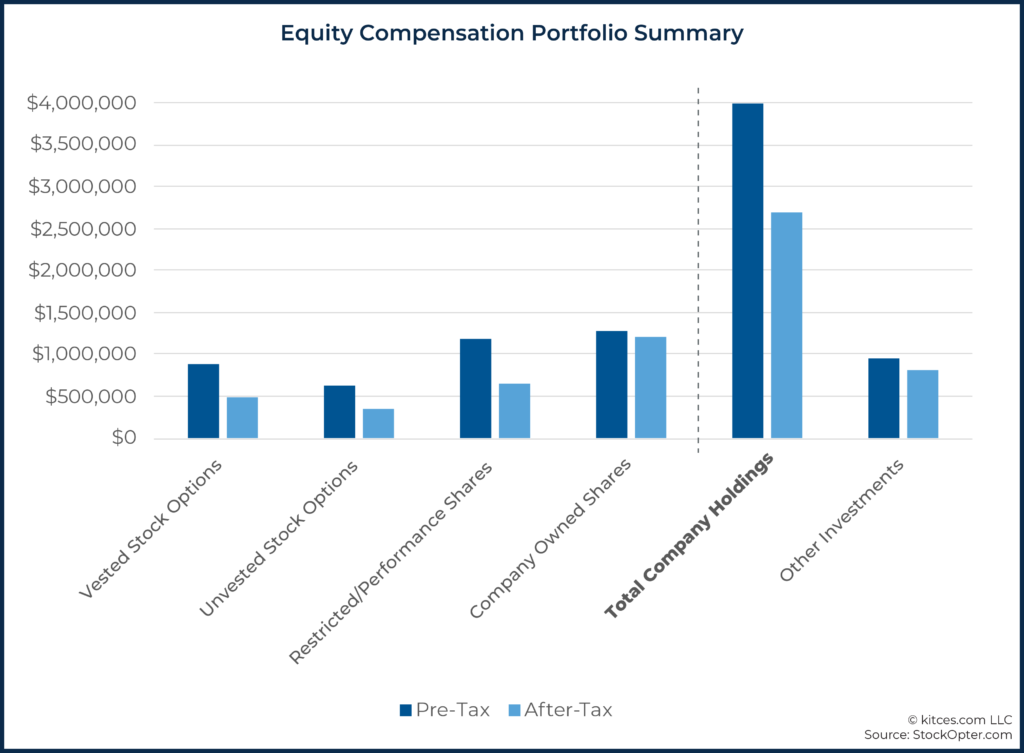

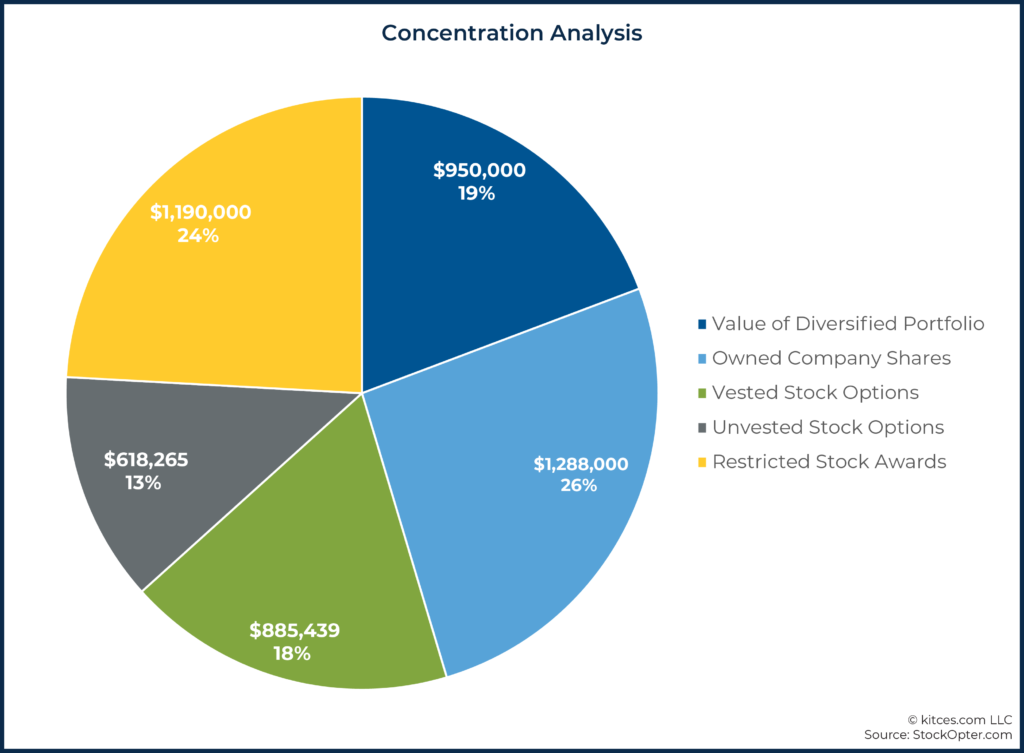

The first step in helping equity compensation clients make informed decisions is to provide them with a portfolio summary table or chart that shows the pre-tax and after-tax values of their company stock and options (i.e., vested/unvested options, restricted/performance shares, and owned/long shares).

This also allows them to see and compare their grouped and total company holdings, relative to their other investments. This summary also introduces the details contained in the remainder of the valuation and investment risk analysis.

Analyzing Stock Option Values

Drilling deeper into the value of the stock option portion of equity compensation requires looking at the value of the options across each of the three different option valuation methodologies: intrinsic value (excess of current stock price above the exercise or grant price, multiplied by the number of shares, also known as the “in-the-money” value), after-tax value (intrinsic value reduced by the estimated tax liability that would be due at sale), and full option value (also referred to as the Black Scholes value based not only on the intrinsic value but on other factors including the Time Value, which represents the theoretical potential prior to expiration).

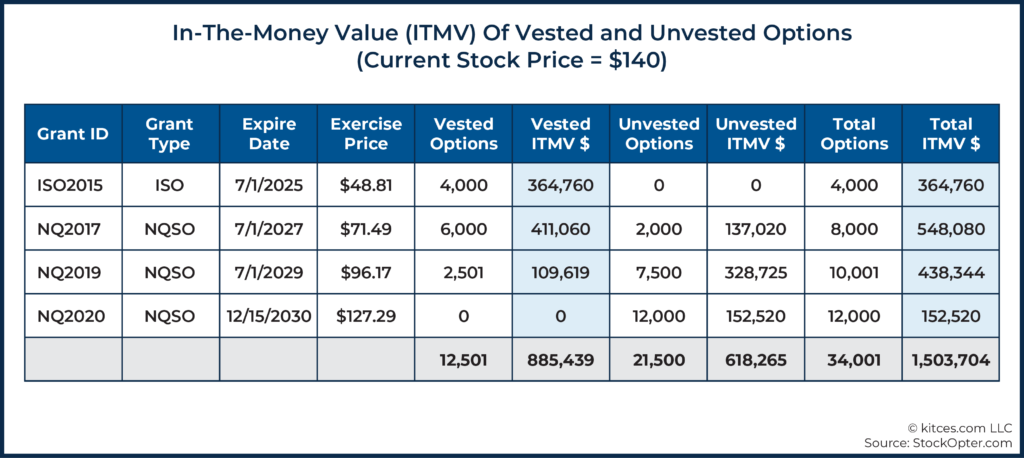

The table below summarizes the intrinsic/In-The-Money Value (ITMV) of both the vested and unvested options based on a current stock price of $140, which, in the aggregate, have a total value of $1.5 million. However, only the vested options can be presently exercised and sold to realize their pre-tax value ($885,439).

The remaining $618,265 of the total in-the-money value is presently unvested, so the client is not yet able to realize their value. Although these options cannot currently be exercised and sold, they represent a growth opportunity for continuing to work for the company during the vesting period.

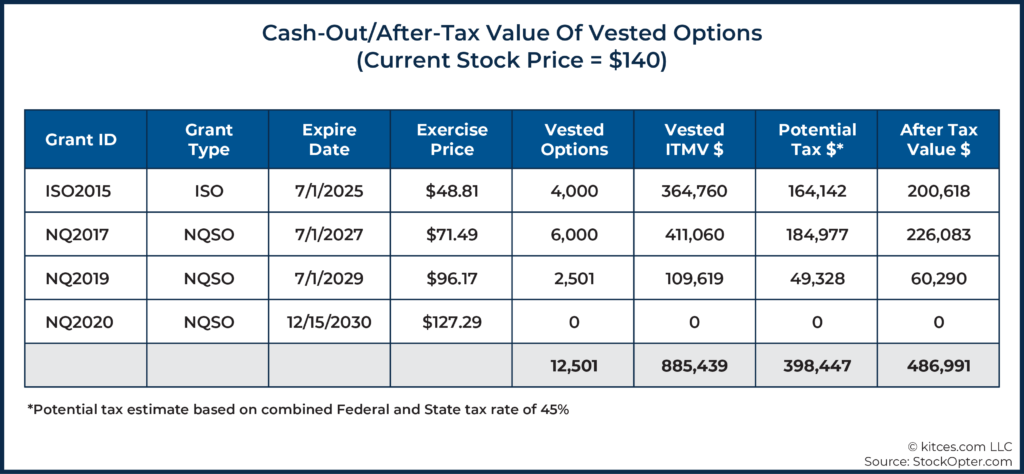

As illustrated by the following table, the client’s vested options have a total after-tax value of approximately $486,991. This is calculated by subtracting the client’s estimated combined Federal and State tax of 45% ($398,447) from the total vested in-the-money value ($884,439). Consequently, only $486,991 of the total $1.5M in intrinsic value can currently be harvested (and/or reinvested).

However, for a client who is interested in taking some of this value off the table, neither of these previous tables provides information that identifies which option “should” be exercised and sold. Determining the order and urgency for exercising and selling option grants requires a “Full Option Valuation” analysis.

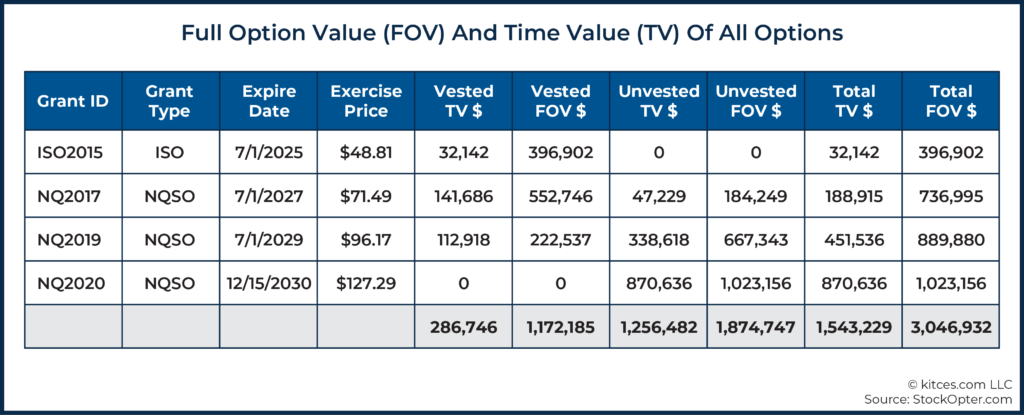

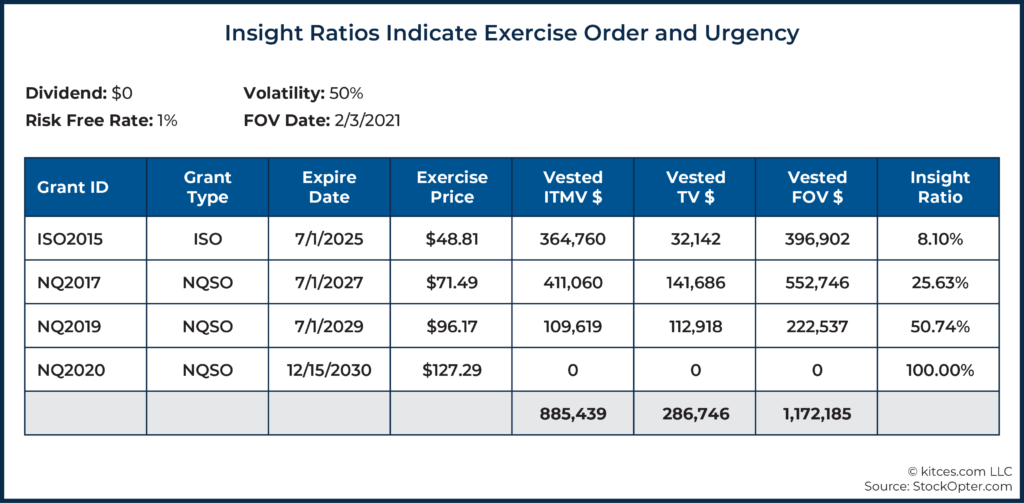

The table below calculates the Full Option Value (FOV) for the vested and unvested portion of each grant, where Full Option Value (FOV) = In-The-Money Value (ITMV)+ Time Value (TV). This value is calculated using the Black Scholes methodology, which assesses Expiration Date, Exercise Price, Current Stock Price, Stock Price Volatility, Risk-Free Rate, and the Stock’s Dividend. Time Value (TV) helps identify which options have the least theoretical potential over time and should be harvested first (and which have the most upside opportunity and should remain invested).

The Full Option Value and Time Value table above illustrates that employee stock options have value over and above their intrinsic value (i.e., the ‘in-the-money’ value). This is because stock options have a fixed exercise price and expiration date, and a company stock price that is likely to be higher prior to expiration. Although the current FOV cannot be realized, it can be used to highlight the “true” economic cost to an employee who may be considering whether to stay or leave their employer.

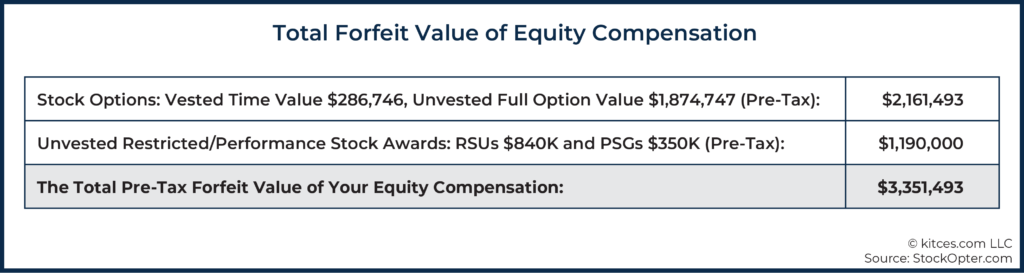

Accordingly, if our sample client were to consider leaving the company prior to retirement to work for a competitor, the option value they would lose would not be just the $618,265 of unvested in-the-money stock value reflected in the “In-The-Money Value Of Vested and Unvested Options” chart shown earlier (“Unvested ITMV $” total). Instead, the ‘true’ option value forfeited includes $618,265 (Unvested ITMV) + $1,256,482 (Unvested TV) = $1,874,747 of the total Unvested FOV, in addition to the Time Value of their vested options (Vested TV) of $286,746, for a total of $2,161,493. Time Value is factored into this loss because the client also forfeits the theoretical potential of all their vested options.

This client also has restricted stock that includes 6,000 RSUs from 2 grants and 2,500 Performance Stock Grant (PSG) shares (as displayed in the list of client holdings, provided earlier), which they will also forfeit by leaving the company. At the current stock price of $140, the pre-tax value of their unvested stock awards is (6,000 + 2,500) × $140 = 1.190M.

As calculated above, this client would currently lose a total of approximately $3.351M in equity compensation by walking away (equity award terms for retiring employees may accelerate the vesting schedules to reduce the forfeited amount).

Equity Compensation Investment Risk And Reward

An important dynamic for clients to understand their equity compensation is that stock options have leverage, while company-owned/restricted shares (and other “traditional” directly owned portfolio investments) do not.

Accordingly, it is important to illustrate the leverage effect using hypothetical stock prices. Recall that the client’s restricted stock and owned shares consist of the following:

6,000 unvested Restricted Stock Units

2,500 unvested Performance Stock Grant shares

7,100 owned shares from vested Restricted Stock grants

2,000 owned shares from ISOs exercised and held

100 owned shares acquired from an ESPP

17,700 RSU and owned shares

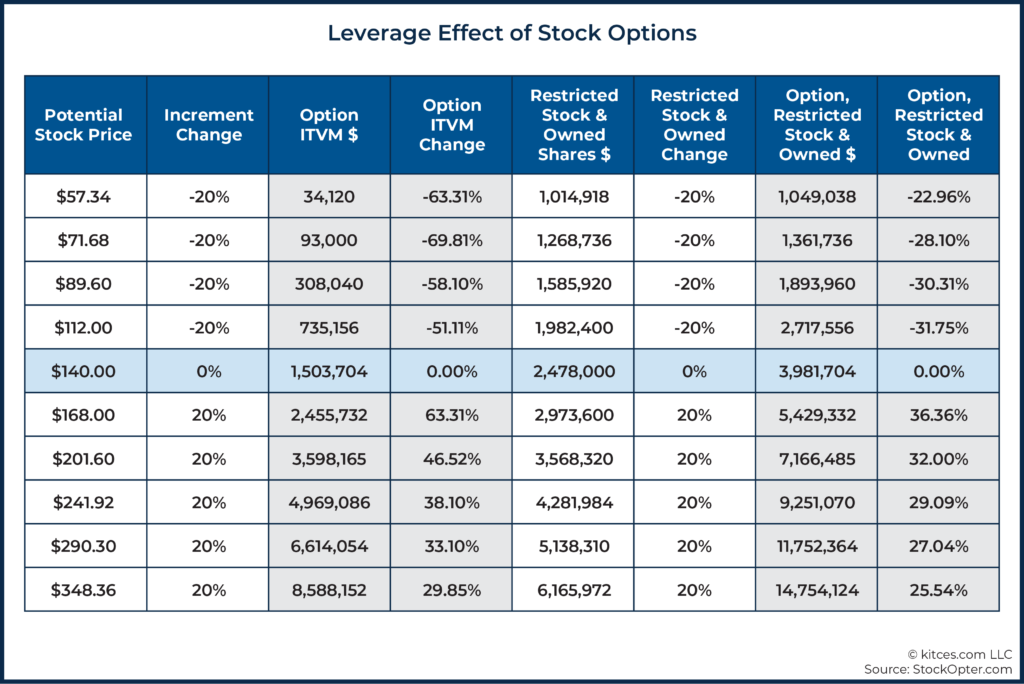

Thus, if the stock price increases by 20% from the current price of $140 to $168, the value of Restricted Stock Units (RSUs) and Owned Shares also increases by 20%, from 17,700 × $140 = $2.478M to 17,700 × $168 = $2.974M.

However, the intrinsic value (i.e., ITMV) of vested and unvested options (4,000 ISOs and 20,000 QSOs) increases by 63.31% (from $1,503,704 to $2,455,732) due to the implicit leverage!

Unfortunately, though, leverage is a two-edged sword. If the stock price decreases by 20% to $112, the value of RSUs similarly decreases by only 20%, but the client’s option value declines by 51%. This dynamic is a function of grant/exercise prices across all the stock options, where the value is “only” the portion above the exercise threshold, such that price changes for the entire stock have an outsized effect when compared to the value of the options.

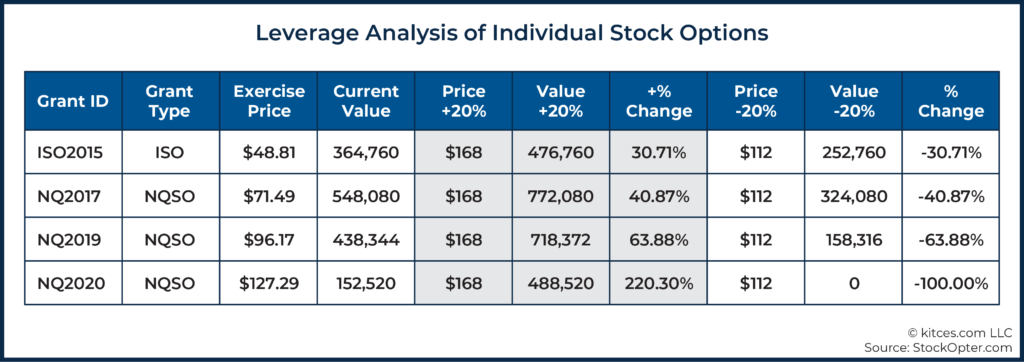

In addition to the reality that options have greater volatility than stock due to the implicit leverage of the stock option structure, options that are slightly in-the-money also have a lot more leverage compared to options that are deep in-the-money.

For example, as shown below, the 2015 ISO grant, deep in-the-money with an exercise price of $48.81 and market price of $140, increases in value by only 30.71% (from $364,760 to $476,760) when the stock price increases by 20%, from $140 to $168. However, the 2020 NQ grant, slightly in-the-money with an exercise price of $127.29 increases in value by 220% (from $152,520 to $488,520) when the stock price increase by 20%.

Exercising options terminates the powerful upside leverage effect, especially for options that are only slightly in-the-money. So, all else being equal (and for those otherwise still willing to take the risk), it is prudent to exercise options when they are deep in-the-money when first taking some money off the table.

Equity Compensation In The Broader Picture: Personal Risk And Reward

In addition to drilling deep on equity compensation and its various components, it is also important to analyze a client’s equity compensation holdings in the context of the bigger picture, including the level of concentration it is (or, for more affluent clients, isn’t) creating, and how directly equity compensation (and its risks and rewards) tie to the client’s overall financial goals.

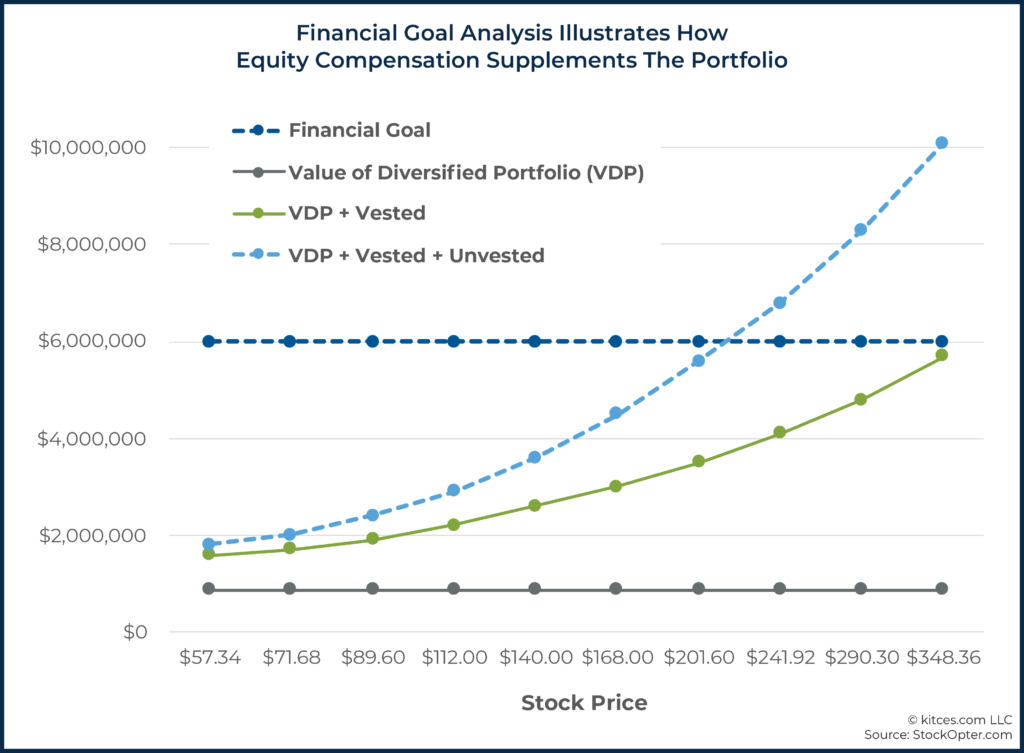

In our case study, the client has a financial goal to reach a net worth of $6 million. At the current stock price of $140, the client’s portfolio has not yet reached this goal based on the values of their vested and unvested options, along with their owned shares, and their other investments (represented by the VDP “Value of Diversified Portfolio” plotline below).

As the chart above shows, in order for the client to reach their stated net worth goal, they still need to have significant upside to their equity compensation. To achieve their goals with their vested equity alone (represented by the green “VDP + Vested” data series), the stock price would need to more than double (from $140 to $348/share). However, when considering the unvested portion as well, the stock would “just” need to appreciate by approximately 50% (to about $210/share) in the coming years, though obviously to harvest such value the client would also have to remain with the company long enough for those shares and options to vest.

Of course, building such wealth primarily through equity compensation also leaves the client very (and increasingly) concentrated over time… as already, the value of the client’s other investments (included in VDP) is “just” about 19%, while they remain over 80% concentrated in the cumulative value of their various vested and unvested stock options, restricted stock awards (RSA), and owned company shares.

Accordingly, the client can weigh the relative personal risk trade-offs of using the opportunities of equity compensation (and in particular, the leveraged opportunities of options) to achieve their wealth goals, against the 80%+ concentration risk of relying on the equity compensation of one company in particular to achieve those goals.

Aiding In Diversification Decisions For Equity Compensation

For those equity compensation clients who decide that they either are too concentrated, want to take some chips off the table, or are otherwise seeking to diversify, the reality is that exiting out of large equity compensation holdings is rarely a one-and-done decision.

Instead, working out of equity compensation often occurs over time, both as a function of ‘dollar cost averaging’ out (to avoid an ill-timed sale), and because many components of equity compensation continue to vest over time (necessitating a multi-year exit process).

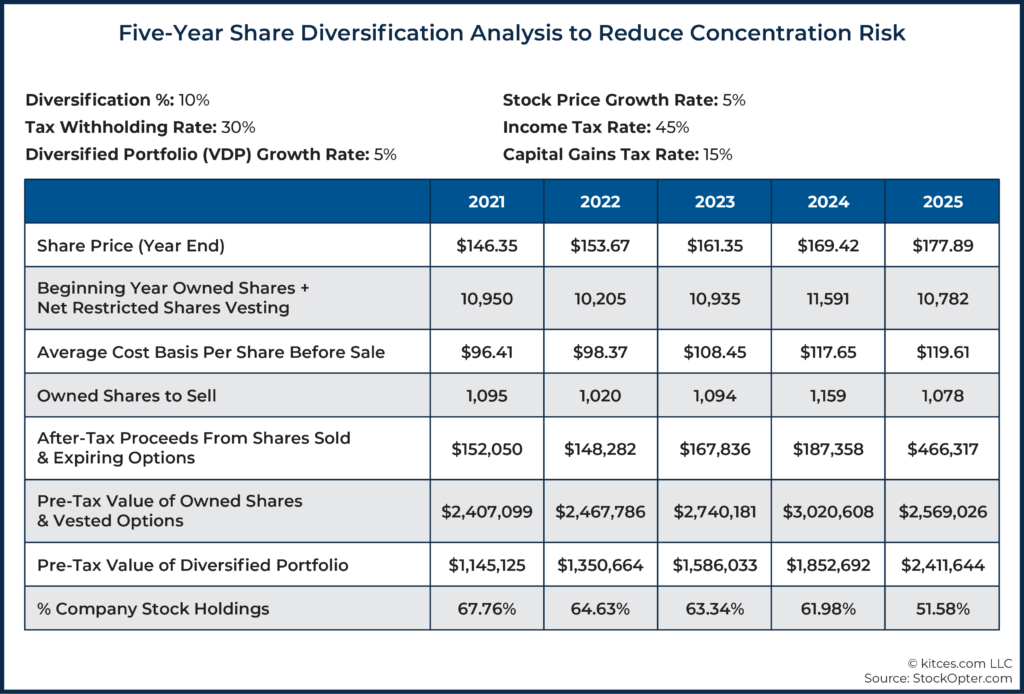

For instance, a starting point might be the decision to sell 10% of available directly owned company shares every year, and add the after-tax proceeds to the value of the client’s other investments. Over time, this builds the value of the diversified portfolio, and whittles down the concentrated risk (in this case, from 67.76% to 51.58%).

A common challenge for those with ongoing equity compensation is that, because additional restricted stock/units continue to vest even as shares may be sold and appreciate, it is possible to engage in systematic sales and still not materially reduce the level of concentration.

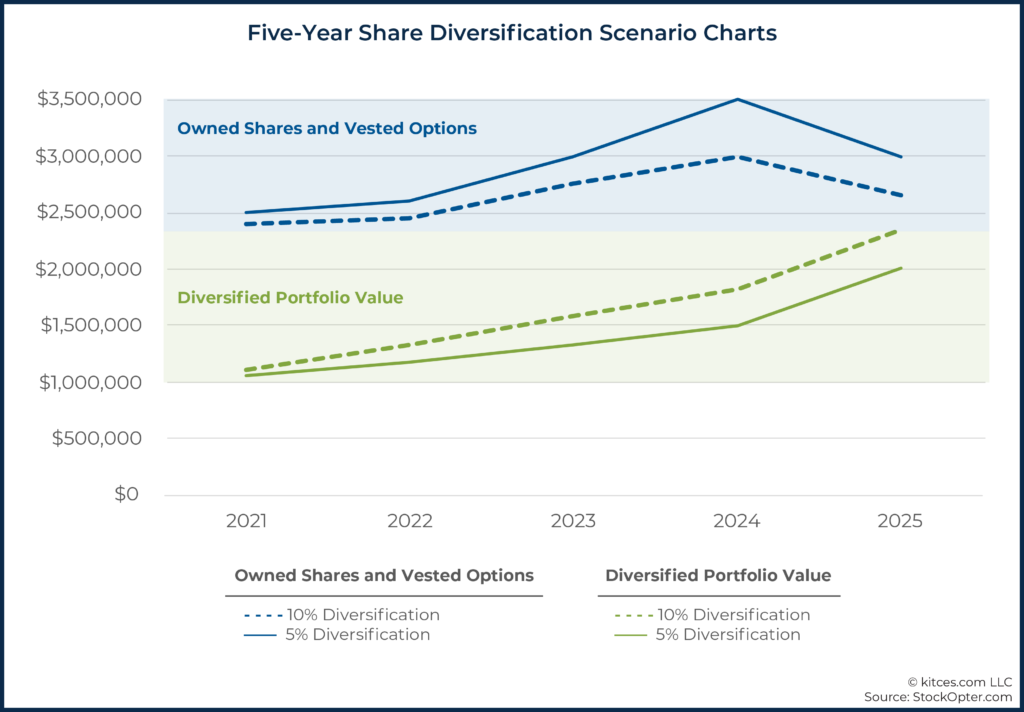

Consequently, as shown below, an alternative strategy of “only” selling 5% of company shares each year to diversify (represented by the solid graph lines) can be insufficient for avoiding concentration risk, as the owned shares and vested options still end up rising nearly as quickly as the diversified portfolio value. Increasing the owned shares to 10% (represented by the dotted graph lines), while more effective in reducing concentration risk, still does little to decrease the overall concentration of company shares/options.

For those equity compensation clients who may be more interested in “de-leveraging” by dialing down their (more volatile) option exposure, the Insight Ratio, which is calculated by dividing the Time Value by the Full Option Value, can provide helpful guidance on exercise order and urgency.

Insight Ratios below 10% identify options that are good diversification candidates because they indicate when an option’s full value is at least 90% intrinsic (an outright risk if the stock price declines), with only up to 10% of the value embedded in the Time Value (which means there is limited additional upside potential).

In our case study example, the 2015 ISO grant has an Insight Ratio of 8.10%, because it is deep in the money and approaching expiration. This analysis helps clients make option diversification decisions based on risk and not just stock price.

Tax Modeling For Equity Compensation Diversification

In addition to evaluating equity compensation from an investment perspective, there are often situations requiring a deeper dive into tax planning as well, especially once a prospective sale has been identified (e.g., the client has decided what to sell to begin the diversification process).

In this case, the client has decided to exercise their 2015 ISO grant (i.e., 4,000 shares, exercise price $48.81, in-the-money value of $364,760 at a current stock price of $140 and an Insight Ratio of 8.1%) in early 2021 and wants guidance on whether to sell them immediately or to hold the shares for one year to obtain more favorable capital gains treatment.

This is a relevant question to model because exercising and holding ISO shares generates an Alternative Minimum Tax (AMT) preference item for that year, which means the long-term capital gains treatment comes with a significant upfront tax ‘cost’. Albeit one that can also be subsequently ameliorated by a future Minimum Tax Credit for the additional AMT liability paid in the first year. Exercising and selling ISO shares immediately, however, is referred to as a “Disqualifying Disposition” and is treated like an NQSO, which would be taxed as ordinary income. Which avoids the AMT impact, in exchange for also losing out on the long-term capital gains treatment. But it also eliminates the 3.8% Medicare surtax that would otherwise apply to the future sale of the shares at long-term capital gains rates!

In order to do this equity compensation tax analysis, we have gathered the client’s filing status and exemptions, their estimated income, itemized deductions, AMT adjustments for the current year, their prior-year carryforward information, and their state income tax rate.

For this case, we used the following assumptions:

- Filing Status: Married Filing Jointly

- Number of Exemptions: 2

- Salaries and Wages: $250,000 ($175,000 for client & $75,000 for spouse)

- Other Income: $17,000 (investment income, dividends, and long-term capital gains)

- AMT Adjustments: $0

- Prior Year Information: $850 (minimum tax credit carryforward) & $5,000 (capital loss carryforward)

- Average state income tax rate: 10%

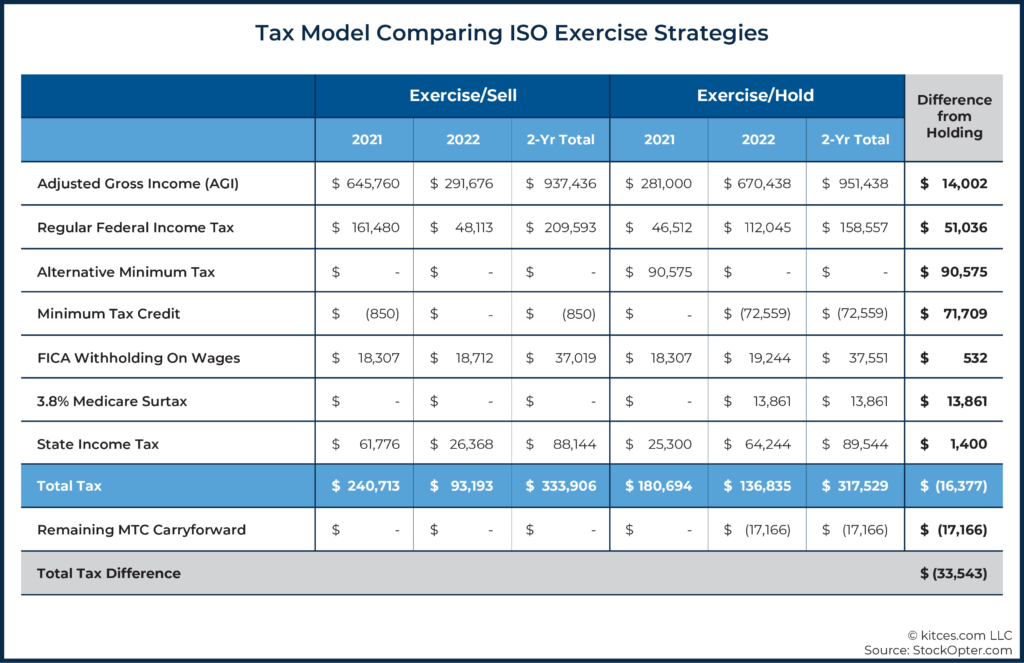

Using these assumptions, the tax analysis below compares these two ISO scenarios, in which the ISOs in both strategies are exercised in 2021 at a price of $140.

In the “Exercise/Sell ISO” strategy, the shares are sold immediately at $140 generating 4,000 (ISO shares) × ($140 FMV – $48.81 exercise price) = $364,760 of ordinary income in 2021, resulting in AGI of $645,760, which raises the taxpayer’s marginal tax bracket to 35% (up from the usual 24%) for that year alone. AGI in 2022 is $291,676, and is based mainly on ordinary income from salaries and wages outside of the ISO exercise.

In the “Exercise/Hold ISO for 1 Year” strategy, the shares exercised in 2021 are sold one year later in 2022 at a price of $146. This generates AGI of only $281,000 in 2021 (primarily attributable to the salary/wages the client was already receiving), but also an AMT preference item in 2021 (resulting in additional AMT of $90,575) for the ISO exercise. Subsequently in 2022, the 4,000 (ISO shares) × ($146 FMV - $48.81 exercise price) = $396,099 of capital gains income, which in turn increases AGI to $670,438 in 2022. Fortunately, though, while the taxpayer’s marginal tax bracket is raised to 37%, the credit for the prior year’s Alternative Minimum Tax can be used to mitigate the total tax liability in 2022.

Over a two-year period, the client will save a total of $51,036 of Federal income taxes with the Exercise-and-Hold strategy – by obtaining more favorable long-term capital gains rates – but in the process, will incur an additional $90,575 of AMT liability in the first year (that must be covered out of other assets or personal cash flow, as the shares themselves will not yet be sold to cover the liability!).

In the long run, though, the client does ‘get back’ the $90,575, in the form of a $72,559 minimum tax credit in 2022, and $17,166 of additional carryforward minimum tax credit that can be used in future years. On the other hand, holding for capital gains treatment does incur $13,861 of additional taxes in the form of the 3.8% Medicare surtax (which applies to ISO shares sold for long-term capital gains but not in the disqualifying disposition scenario).

When including the impact of state income taxes and FICA taxes, the net result is that the household saves $33,543 of taxes with the ISO exercise-and-hold scenario (assuming they can navigate the AMT cash flow obligation along the way at the end of 2021!).

Of course, while in this specific situation it would be better from a tax perspective to exercise and hold the ISO shares for one year, the decision to hold or disqualify is based on numerous unknowns, including current year income and deductions, and the stock price appreciation (or lack thereof) after one year. It also assumes no changes to the current tax code (which right now is a big uncertainty!).

This is just one example of an equity compensation tax/strategy model. Other models could compare multiple diversification strategies over several years, which significantly increases the required assumptions and the complexity. Consequently, this type of planning is more of an art than a science, and typically is an opportunity to work with the client’s CPA through the planning discussion.

Advice Fees And Keys to Success When Working With Equity Compensation Clients

Financial advisors need just one plan participant who will share the details of their equity awards to start off in the equity compensation niche. This enables the advisor to understand the company’s program, create an analysis, interpret the findings, make recommendations, create value for clients… and then ask for referrals to other employees with equity compensation at the same company to whom that value can also be delivered. As one of the great things about this niche is that everyone who receives equity compensation knows a lot of others that all have the same need for advice.

For those who are not sure where to start, the reality is that starting with current clients and their spouses is often viable… as again, it just takes one client amongst the existing client base who has equity compensation to open the door to others. (And may be much easier than prospecting for stock plan participants because your current clients already know and trust you.) After conducting an equity compensation analysis/review for existing clients, it is quite easy to ask them if they know anyone else who would be interested in this type of assistance.

Furthermore, advisors do not need to wait for the client to tell you they plan to exercise their options and/or sell their company stock to have the conversation and add value. As in practice, by the time they say they are getting ready to sell, the proceeds are usually already spent or at least earmarked for spending (e.g., clients have already chosen their boats, vacation destinations, remodels, etc.), so there is little to reinvest.

Proactively providing clients with updated equity compensation analysis reports and review sessions on a quarterly or semi-annual basis will drive timely diversification and reinvestment decisions. Regularly scheduled equity compensation reviews are important because these holdings are very fluid. Grants are added, vested, and expire, and company stock prices are more volatile than the market itself. Which means there is always something to talk about (besides the portfolio itself) at each periodic client review.

Equity award reviews are an opportunity to refine the client’s diversification criteria and address other financial planning issues. These sessions should not take much time or effort, as long as an efficient process is utilized to update the client deliverables and run what-ifs.

Finally, advisors can offer value and deliver unique insights to clients by providing them with equity compensation analytics not available from their company’s stock plan portal or from a general financial plan. Simply calculating the Intrinsic or estimated After-Tax Value of their options and shares does not necessarily show them anything new or identify if they need to diversify. Whereas going deeper and quantifying more sophisticated and unique analytics (e.g., Insight Ratios, Concentration Percentage, Leverage Analysis, Share Diversification Rates, etc.) for clients serves to confirm and differentiate one’s expertise in the equity compensation subject matter.

As client value is added, many advisors charge standalone fees for their services; e.g., charging $500 – $2,500 on an annually recurring basis for services that can include an initial risk analysis, quarterly updates, monitoring vesting and expiration dates, tracking diversification criteria (e.g., stock price targets and Insight Ratios) and modeling tax strategies.

Alternatively, because equity compensation clients tend to have significant wealth creation events and a need to diversify over time, they are often conducive to the AUM model; our internal analyses amongst advisors using StockOpter for equity compensation risk analysis and tax planning have found that, on average, advisors gather over $500,000 in assets under management per client engaged in this model.

Both the AUM and the planning fee billing models are fair to use in this niche because the advisor will be providing the client with ongoing assistance. Stock plan participants generally receive at least one additional grant every year, award program terms change, grants continue to vest and expire, and stock prices are always fluctuating. All of these factors combine to necessitate and justify ongoing professional equity compensation guidance.

Equity Compensation 301: Next Steps And Resources

The first step in pursuing the equity compensation niche is not to read every book written on this topic. CFP professionals and other experienced advisors typically already have a basic understanding of employee stock options and restricted stock/units, including how they are taxed. Instead, start by focusing on the clients you will be serving.

Understanding the concerns of equity compensation clients, developing a process to serve them, and designing a marketing strategy to connect with those clients are all key steps to succeed in the equity compensation niche.

Step 1: Acquire Knowledge For Equity Compensation Clients

The first step for financial advisors entering the equity compensation niche is to understand the circumstances of an existing client who has some equity compensation as a part of their financial situation and to figure out what their needs are. Advisors can do this by getting a hold of and reviewing the client’s grant agreements. This provides important information including grant details (i.e., award type, number of options/shares, option exercise price, vesting schedules, performance targets, and expiration dates), employment termination and company change-in-control provisions, and restrictive covenants (e.g., non-compete agreements and claw-back terms that require payback of profits upon violation).

Familiarizing yourself with these details that clients themselves often neglect to review is fundamental to providing good equity compensation guidance.

Additional equity compensation expertise will organically be acquired over time by working with such clients. If it has been a while since you studied for the CFP exam and you feel you need to brush up on this subject matter, here are some resources that can provide non-company-specific info on equity compensation for financial advisors:

- Book: Consider Your Options (by Kaye Thomas, published by Fairmark Press). A best-selling guide on all forms of equity compensation (not just options). It uses plain language to explain tax rules and strategies. In its ninth edition, it was updated in 2019 to cover the Tax Cuts and Jobs Act.

- Website: myStockOptions.com. A comprehensive source of information on stock options, restricted stock/units, performance shares, stock appreciation rights, and employee stock purchase plans (ESPPs). The premium (fee) membership provides access to equity compensation content, including FAQs, articles, podcasts, videos, tax guides, and self-study courses offering CE credits for CFPs.

- Blog: StockOpter University. A resource, specifically for financial advisors, that contains equity compensation industry, planning, and marketing materials to help them pursue this niche.

Step 2: Adopt A Process For Servicing Equity Award Recipients

Even more important than having a good understanding of equity compensation is having a systematic and repeatable process for analyzing a client’s equity compensation. This typically requires software, but there are not a lot of off-the-shelf options for advisors. Here are the main ones (and an outsourcing alternative):

General Financial Planning Programs: Applications like eMoney Advisor, MoneyGuidePro, NaviPlan, RightCapital, etc., are primarily designed for retirement planning, but the client’s equity compensation (typically by including the current in-the-money value) can be included in the plan. Generally, strategic retirement planning tools do not address tactical issues like when, why, and how clients should diversify their company stock and options, the tax implications of selling, and figuring out which particular share lots or options to sell first.

Spreadsheets: Advisors who realize their general financial planning software does not do a good job of analyzing equity compensation holdings or modeling diversification strategies will often build their own application using Excel. The drawbacks of this time-consuming alternative are that it can be non-compliant and may unwittingly introduce accuracy issues.

StockOpter Resources: Two completely different and sophisticated programs for providing equity compensation diversification guidance:

- StockOpter.com: Creates an equity compensation valuation and risk analysis that tracks client holdings, estimates taxes, illustrates risks, and identifies decision criteria. A brandable client deliverable can be created in less than 10 minutes, which provides a framework for having proactive diversification discussions. StockOpter.com can also run “what-ifs”, and monitor client diversification criteria such as stock price targets, Insight Ratios, and concentration levels, and then automatically notify the advisor and/or the client by email.

- StockOpter Pro: An Excel-based application for equity compensation tax planning. It enables advisors to quickly model employee stock options, restricted stock, and company share diversification strategies and to optimize them for tax/cash-flow efficiency. SO/Pro is equipped with a full tax engine so it can calculate tax brackets, and the Alternate Minimum Tax (AMT) effect of exercising Incentive Stock Options (ISOs).

myStockOptions.com (MSO): Although primarily an equity compensation content provider, myStockOptions.com (MSO) includes several company stock and option calculators. The MSO Pro membership allows advisors to use these tools for multiple clients and to save scenarios.

Outsourced Specialty Advice: Planning firms like Executive Wealth Planning provide planning services to RIAs and planners who do not have in-house equity compensation expertise. Fees range from $600 to $2,500 depending on the complexity of the participant's grants. Planning can be onetime or can include renewable monitoring and alert services.

Step 3: Marketing To Equity Compensation Clients

The key to acquiring clients that receive stock and options from their employers is having access to these employees. Realistically, referrals will be the best way for most independent advisors to attract these clients.

Beyond referrals and networking through existing clients, there are a lot of different ways to expand the prospecting circle further, including cold calls, workshops, email, social media, and more. Use any or all of these methods, but the key is identifying prospects that work for particular companies that issue equity compensation in the first place. Unfortunately, though, while there are a lot of companies that grant equity awards, there is no list of what companies are granting and to whom. To narrow the field, create a list of local companies (public and private) that are known (or can be determined) to be granting equity compensation to target your prospecting efforts.

It is important to focus your marketing message on equity compensation and not all the other services your firm can provide, because equity compensation awards are likely to be the target clients’ biggest concern anyway. Crafting a message for your website and marketing materials that clearly explains your equity compensation guidance process will ensure your marketing efforts resonate most directly with those who have a need.

For example:

My financial advisory firm helps our clients with equity compensation to maximize the value of their company stock and option holdings by facilitating timely and prudent diversification decisions.

We do this by providing a detailed valuation and risk analysis of equity awards and company stock holdings. This analysis is updated quarterly and looks at value, vesting, expiration, taxation, risk versus reward, leverage, concentration, and the role equity compensation plays in attaining your goals.

Using this analysis and your feedback, we establish decision criteria that are monitored daily to enable us to alert you when to take action. Additionally, we may be able to optimize your diversification strategy for tax efficiency and cash-flow. This iterative and ongoing process facilitates informed decisions.

To get started, all we need is a copy of your grant summary statement.

Some additional equity compensation niche marketing resources that can help with prospecting include:

- AdvisorFind: An online resource from myStockOptions.com that provides a free directory of financial, tax, and legal advisors for equity compensation recipients. This service enables equity compensation advisors to create a profile that lists their location and describes their planning services, which can be searched by grant recipients. While the directory is free to use for anyone seeking an advisor who works with equity compensation clients, advisors can register themselves for inclusion in the directory for a listing fee.

- FA Client Machine: A marketing firm that helps financial advisors attract clients via video marketing campaigns. The short videos address a variety of client issues, including equity compensation.

- Model FA Accelerator: A coaching and marketing program developed by advisor Patrick Brewer that helps advisors target a niche. They have a program specifically designed for attracting executive clients.

If you do not have any current clients with equity compensation, you will have to do some prospecting. Here are a few DOs and DON’Ts for engaging prospects with equity compensation.

- Do have a few questions and an elevator pitch memorized for whenever you meet someone that receives equity compensation. For example, ask about the types of grants they have, and their framework for making decisions. A good elevator pitch will describe your process for providing equity compensation guidance.

- Do remember to ask every client and prospect whether they or their spouse receives equity compensation. Clients do not always remember to mention their company stock and option grants, especially if they do not understand the value of their plans, or if the stock price is down. You may already have some clients with equity compensation plans that you do not know about.

- Do Not focus your marketing efforts solely on HR departments. Direct marketing to companies takes connections, expertise, resources, and lots of time. If you do not have all of these, consider starting with the ‘referral’ approach. Asking for referrals from clients can be an effective method of engaging executives and could help get your foot in the door with HR if you so choose.

- And finally, do not give up on an executive prospect too quickly. Even if they did not initially show much interest in getting help with their equity compensation, the opportunity is not lost. Explain how you propose to help them, and show them a sample equity compensation risk analysis. Often equity compensation clients are not ready to act and engage with the process until an exercise event approaches, and then they can become very motivated to engage very quickly!

Advisors need not be intimidated by large advisory firms that compete in the equity compensation niche. Independent and planning-oriented advisors can hold their own in this niche and provide equity award recipients with high-quality guidance by establishing an efficient process for analyzing and tracking company stock and option holdings.

Keep in mind, equity plan participants need and want advice. The ability to deliver insightful equity compensation guidance can provide a rewarding opportunity for the “planning-oriented” practitioner!

I don’t know if my prior post was saved. Very good article on various aspects of stock comp financial and tax planning with helpful guidance for advisors. Thank you for mentioning the educational resources and tools on myStockOptions.com. The site also has a Learning Center with courses on all types of equity comp (stock options, NQSOs, ISO, RSUs, ESPPs), taxes, and SEC rules with an abundance of CE credits. That’s at: https://www.mystockoptions.com/learningcenter/.

Does your company provide the same type of planning tools as StockOpter?

So glad someone wrote this article! I am frequently asked how to develop this expertise, and my answer is a hodge podge of stuff…this post is a much more thorough, better organized hodge podge. 🙂

Wow, this is awesome and so thorough. I have had to cobble together my information over the last couple of years from all over the place. MyStockOptions and @MegBartelt have also been super helpful!

This is written in a way to suggest that the full exercise and sale are taxed at ordinary income which is not the case for NSOs:

“When the price of Nike hit $135 in December 2020, Sue decided to exercise the grant and sell the shares. By doing so, Sue generates [$135 (market price at time of sale) – $40 (Sue’s exercise price)] × 5,000 (number of shares) = $475,000 of (pre-tax) ordinary income.”