Executive Summary

One of the biggest trends in the investment industry in recent years has been explosive growth in the variety, availability, and use of exchange-traded funds (ETFs). Not only because they are more tax efficient, have more flexible trading, and are typically less expensive – which has made them a popular way to implement passive investing strategies – but also because even advisors who actively manage portfolios themselves appear to be used ETFs are the core “passive” building block for their active ETF strategies. However, the industry still shows that the overwhelming majority of advisors still use mutual funds as well, which in turn raises the question: how, exactly, do advisors choose between mutual funds versus ETFs and select the particular investment vehicle they’re going to use… and from the asset manager’s perspective, what should fund companies be doing to get their investment solutions in front of advisors?

In this context, a recent industry study published by Erdos & Morgan provides a fascinating look into what advisors actually view as the most important factors when selecting fund providers. Not surprisingly, performance and fees rank were top-ranking factors, but advisors also place a high value on a fund provider’s approach to managing volatility and their perceived trustworthiness… and surprisingly (or not) weight at all on the fund company’s marketing materials, wholesalers, or “thought leadership” white papers. And the trend is especially pronounced amongst the RIA channel, which sits the furthest from traditional commission-based fund distribution models, and appears to be the most likely to take a “don’t call us, we’ll call you” approach to selecting fund providers to work with.

In fact, another study from Advisor Perspectives (also looking at fund company selection by advisors) found that advisors are becoming increasingly sophisticated in regards to evaluating a fund’s fees and performance, instead of relying on the higher-level “rankings” from research providers (e.g., Morningstar’s star ratings). And to the extent that advisors want “value-added” services from fund providers, the desire is not for practice management advice, but simply more accessibility to deeper investment expertise, from having more direct access to fund managers and research analysts, and demanding that wholesalers themselves be increasingly investment savvy (with real investment expertise like CIMA certification) as well.

The bottom line, though, is simply that with all the rapid changes occurring in the industry, there is growing recognition that the traditional distribution approach of fund providers and asset managers is changing. Yet thus far, fund companies appear to be struggling to adapt, leading to especially low reputation scores from RIAs compared to advisors working at broker-dealers, and substantial negativity towards traditional wholesalers. The good news, however, is that in the end, client assets still have to be invested somewhere… which means there is a substantial opportunity for the fund providers that can learn to adapt most quickly to the new normal of how advisors select investment solutions.

Trends in Investing Amongst Financial Advisors: Active, Passive, or Both?

The recent years have borne witness to a rise in passive investing and indexing, explosive growth in flows to exchange-traded funds (ETF)s, and an ongoing series of net outflows from (actively traded) mutual funds. In fact, with nearly half a trillion of net inflows into US ETFs in the past 5 years, paired with a half trillion in net outflows from US mutual funds (according to Lipper), some have even begun to raise the question of whether mutual funds themselves are dead or at least dying.

Yet a deeper dive into research on financial advisor investing trends suggests that what is actually occurring is far more nuanced than just a shift from active to passive, or from mutual funds to ETFs.

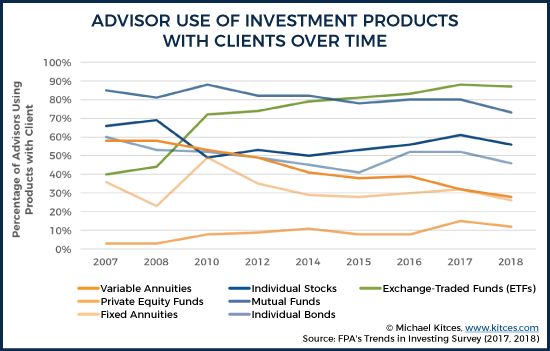

For instance, the latest 2018 Trends in Investing Survey from the Financial Planning Association shows that while a whopping 87% of financial advisors use ETFs, 73% of financial advisors are using mutual funds as well. And in fact from the broader historical data, the biggest shift for financial advisors hasn’t actually been from mutual funds to ETFs at all over the past decade, but from variable annuities into ETFs (and to a lesser extent, from individual stocks and bonds to ETFs as well), along with a rise of investing in private equity funds. In fact, mutual funds showed remarkably little decline in adoption rate over the past decade, at all, until just the past year!

In other words, ETF adoption rates have been rising dramatically even as mutual fund adoption has fallen only slightly… which suggests that advisors are not abandoning mutual funds en masse at all, and instead are merely being more selective about when/where mutual funds are used (versus just managing the ETFs themselves). As the data shows that, again, while 87% of advisors are using ETFs, 73% are (still) using mutual funds (and according to the FPA’s data, another 32% using mutual fund wrap programs, albeit with some overlap), along with 56% who are also using individual stocks and 46% who use individual bonds.

As a result, when the FPA surveyed to ask “which type of management style do you think provides the best overall investment performance”, a mere 22% reported themselves as being purely “passive” (no higher than the 25% that were reported 5 years ago), while just 12% of advisors reported that they think “active” is best (only slightly lower than 5 years ago). Instead, the overwhelming majority of advisors are really a blend of the two, with just barely 1/4th of advisor who eschews “full-active” actually going full-passive instead, while approximately 3/4ths of ETF users espouse the blended approach.

Or stated more simply, advisors don’t appear to be abandoning mutual funds or active management entirely… just the active funds they no longer believe are actually adding value over a (passive) ETF alternative.

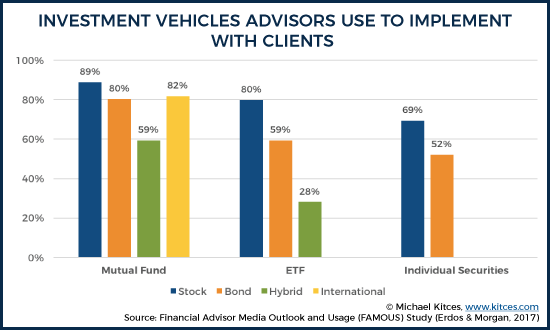

This trend was also affirmed in the recent 2017 Erdos & Morgan Financial Advisor Media Outlook and Usage (FAMOUS) Study, which similarly found that only 36% saw ETFs as an alternative to them, while 64% of financial advisors view ETFs as complementary to mutual funds to fill in certain areas or gaps where mutual funds aren’t perceived as adding value. Which also helps to explain why advisors are much more likely to hold targeted stock or fixed-income ETFs than hybrid or asset-allocation ETFs… because again, most advisors are using ETFs (and mutual funds) selectively, not as an all-out replacement for mutual funds to construct entire client portfolios!

What Do Financial Advisors Focus on When Selecting Mutual Funds and ETFs?

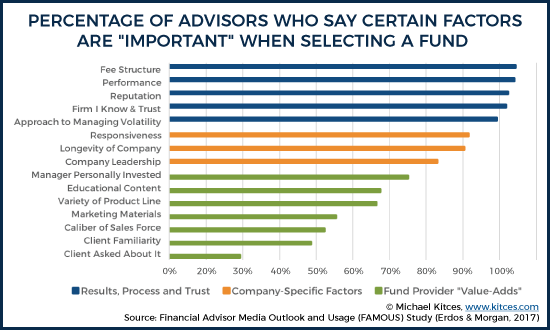

So what determines when and how exactly advisors select mutual funds over ETFs? According to the Erdos & Morgan study, the answer boils down to three core factors: Results, Process, and Trust.

Or more specifically, their research found that the driving factors in advisors selecting what fund providers to use were the fee structure and performance of the fund, its approach to managing volatility (the only answer option that Erdos & Morgan had on investment process), and the reputation and deemed trustworthiness of the fund provider themselves.

From there, more distant secondary factors included the longevity of the fund company, its leadership, whether its fund managers were personally invested, and its service responsiveness (likely recognizing that most “responsiveness” comes from the RIA custodians and broker-dealers anyway). While the least important tertiary factors included the educational content provided by the fund company, its marketing materials, the variety/breadth of its product line, and the caliber of its wholesalers. In fact, rather strikingly, the only factors that ranked worse than the importance of the company’s wholesalers were the client’s familiarity with the fund provider, and whether clients were asking for the fund in the first place (suggesting that direct-to-consumer marketing to get clients to ask their advisors to use the funds is not an effective strategy!).

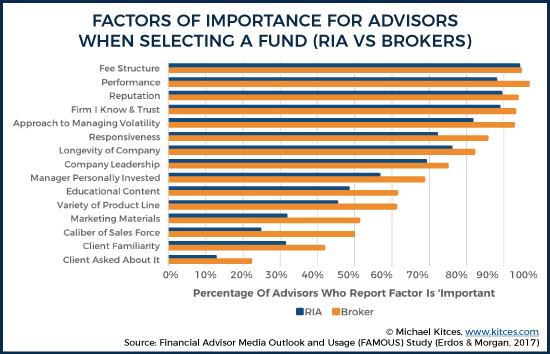

Perhaps even more notable, though, was that even amongst these selection criteria, there was a significant gap between what RIAs in particular used to evaluate fund companies, versus what advisors in brokerage firms focused on. In particular, RIAs were slightly less focused on performance, and ostensibly were at least slightly more forgiving about recent poor performance, while at the same time giving slightly more (relative) weight to the company’s fee structure and reputation/trustworthiness. On the other hand, when it came to company-specific factors, RIAs were more skeptical and less likely to consider them. And when it came to other fund provider “value-adds” from educational content to marketing support to the company’s wholesalers, the majority of advisors said they were unimportant, with a whopping 3/4ths of RIAs stating that the caliber of the company’s wholesalers mattered at all!

Or viewed another way, RIAs appear to be most likely to focus on “just the facts” of process and results, and having a level of comfort and trust, and were the least likely to give as much credence to any other fund company value-adds or company-specific factors.

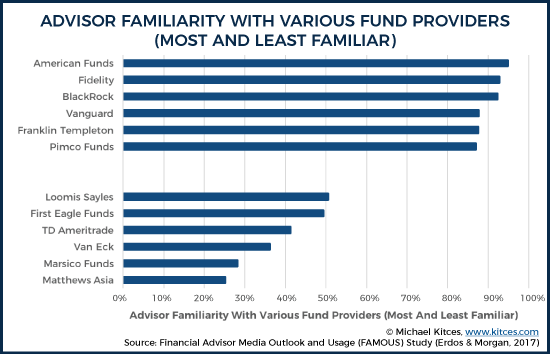

In addition – and perhaps not surprising in this context – the Erdos & Morgan study also shows that RIAs are by far the least likely to rate virtually any fund company favorably when it comes to their reputation! One of the most notable parts of the Erdos & Morgan study is an evaluation of how familiar advisors are with various fund providers, and amongst those who are familiar with the company, how they perceive the reputation of the company.

When it comes to familiarity, it is perhaps not surprising that many of the largest stalwarts of the fund industry are the best known, including American Funds, Fidelity, Blackrock, Vanguard, Franklin Templeton, and PIMCO, while smaller “niche” players like Matthews Asia, Marsico, and Van Eck are the least known.

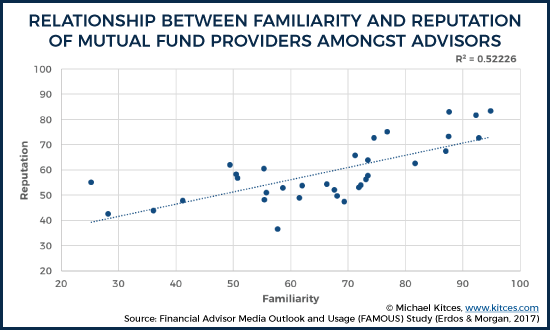

Perhaps even more striking, though, is the relative reputation of those fund providers, as reported by financial advisors. Perhaps not surprisingly, the fund companies that were most familiar to advisors were also deemed the most trustworthy – as the saying goes, familiarity breeds trust! Though given that the Erdos & Morgan reputation scores are specifically for fund providers that advisors said they were already familiar with, it’s also simply possible that fund companies which already have the best reputation amongst advisors are the ones that they’re most likely to try to get familiar with in the first place.

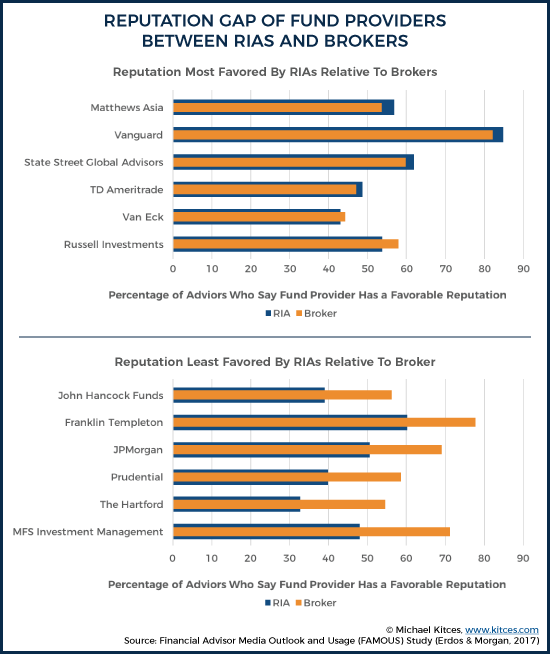

In the context of broader industry trends, though, one of the most striking results regarding Erdos & Morgan’s fund provider scores was the relative “trust gap” that exists between fund providers and RIAs. As the Erdos & Morgan study shows that virtually every asset manager – except ETF providers Vanguard & State Street, RIA custodian TD Ameritrade, and RIA niche mutual fund player Matthews Asia – has a materially lower reputation in the RIA community than the rest of the advisor (brokerage) community! Or stated more simply, the perception that RIAs are more cynical really is true!

Breaking Through to What Financial Advisors (And RIAs in Particular) Really Want

So given this data on the challenges of reaching financial advisors in general and RIAs in particular – a daunting outlook for fund providers, given the ongoing growth of the RIA channel – what does the research suggest that advisors actually do want from their fund providers?

Some interesting additional perspective on the issue comes from an in-depth focus group study with financial advisors conducted by Advisor Perspectives via their AP Viewpoint platform.

When evaluating how financial advisors themselves evaluate fund companies, the APV research found (not surprisingly) that advisors are focused on evaluating fund performance, expenses, and the manager’s investment process (particularly how the funds handle volatility and down markets).

However, the APV study also found that advisors are taking a more nuanced look at fund performance than just Lipper or Morningstar ratings, and while those tools are still frequently used to analyze and screen funds, the ratings themselves were found to be relatively unimportant to financial advisors now. Instead, advisors are increasingly doing their own deeper dives into fund evaluation… from evaluating relative performance over 1-, 3-, 5-, and even 10-year time horizons, to looking at active share to determine if the fund is “truly active” and worth paying the manager’s fee.

In turn, this raises the potential for fund companies to both better differentiate themselves on a wider range of relevant performance factors (e.g., tax-efficiency and after-tax alpha), and to simply educate advisors on more/different ways to evaluate fund choices in the first place.

For instance, while financial advisors continue to cite “expenses” as a key factor for fund selection, the advisors studied were split around whether it was best to just eschew high-cost funds altogether, or focus on net returns (and at least give higher-cost funds a chance to show better net performance). Similarly, many advisors were less focused on year to year outperformance, and more focused on consistency of performance as a factor to differentiate luck from skill. And advisors showed a far greater interest in understanding qualitative information like the investment manager’s philosophy, process, and outlook, beyond just the quantitative results themselves.

Perhaps most significant, though, was the APV study’s insights into how advisors want to be communicated with regarding these issues. The research found that advisors stated they do not like TV and print advertising at all (digital advertising was not separately mentioned), and are increasingly turned off by the overwhelming volume of emails and direct mailings from fund companies.

In addition, while a subset of advisors did report finding value in “educational” opportunities from fund providers, the financial advisors rated “practice management” ideas as the least valuable (despite the rising popularity of fund wholesalers trying to add value with practice management insights), and instead stated a preference for more fund-relevant market outlook and economic information, commentary from the fund’s manager on his/her current forecast of where the economic and markets are heading, and product-specific research insights. In other words, financial advisors don’t actually want the fund providers to help them with the advisor’s business; instead, advisors want the fund companies to demonstrate their own unique investment expertise and value-add!

Perhaps most striking, though, was the AP Viewpoint study’s affirmation of the Erdos & Morgan study results – that advisors really are not happy with the current state of fund company wholesaling, with the most frequent complaints including wholesaler visits, wholesaler phone calls, and wholesaler “excessive” emails (which, notably, are all the wholesaler communication channels!). In fact, advisors specifically noted that wholesalers asking to spend 20-30 minutes “to find out about my business” is just a waste of time, and expressed frustration that wholesalers asking for a visit “because they are in town” is not a value-add at all (unless the wholesaler genuinely brings a solution to a key and present challenge or market issue).

In turn, to the extent that financial advisors indicated they want to talk to fund companies and their representatives at all, the APV study found a clear preference of advisors to talk directly to portfolio managers or product specialists who could add real investment insight, while reporting that a whopping 70% of product wholesalers have “no impact” on their investment selection choices. Suggesting that at a minimum, wholesalers must be trained to be real product specialists (not practice management ‘experts’ to add value), and have the expertise to really “talk shop” on investment issues to increasingly sophisticated financial advisors (e.g., wholesalers pursuing their CIMA certification because the advisor is increasingly likely to have CFP certification or even the CFA marks themselves).

Or stated more simply, financial advisors are asking their fund companies to invest less in distribution and “off-[investment]-topic” thought leadership, and more in actual product quality (e.g., focusing on their top products, because advisors don’t care about the rest/breadth of the lineup anyway if they’re not actually top performers), while having wholesalers step up to be able to provide real value in investment expertise, supplemented by access to deeper product specialists and fund managers directly.

Historically, financial advisors were primarily financial salespeople in the business of selling investment (and insurance) products, including and especially mutual funds through the (independent) broker-dealer model. Yet as technology has increasing commoditized basic investment product purchases, and forced advisors to become more educated and add more value on top, more sophisticated advisors are constructing increasingly more complex and nuanced portfolios, and in turn are demanding more from their fund company providers as a result.

The good news of this shift is that, as the data affirms, advisors are actually quite unlikely to simply “abandon” an entire investment vehicle like mutual funds altogether, and instead the current flows from for the mutual fund industry are less about an industry-wide shift to ETFs (which helps to explain the rather poor adoption of various active ETFs), and more about advisors constructing portfolios where they selectively choose the “right” investment vehicle for the particular asset class exposure.

The bad news, however, is that it suggests that advisor scrutiny of mutual funds and their fund company providers will only increase, as the growth of the RIA channel suggests growth in the highly skeptical advisor with a “just the facts” attitude to screening and selecting mutual funds. Where qualitative and other trustworthiness and reputation factors do still matter, but only to the extent that the fund company (and its wholesalers) can actually demonstrate real expertise and value-add, not in the business of the advisor (i.e., practice management), but by demonstrating thought leadership in the fund company’s own business in the investment domain.

In the meantime, for those who want more information on the available research, see:

- 2017 FPA Trends In Investing Survey

- 2017 Erdos & Morgan FAMOUS Study

- 2017 Advisor Perspectives Study on “How RIAs Selective Actively Managed U.S. Equity Funds”

So what do you think? What are your most important factors when selecting fund providers? What value-added services are you looking for from wholesalers? Do you clients want diversification, not only in asset class, but in approach as well? Please share your thoughts in the comments below!

One of the biggest trends in the investment industry is the explosive growth in variety, availability and use of ETFs. These vehicles are more tax-efficient, have more flexible trading and are typically less expensive than most mutual funds, which has made them popular tools in passive investing strategies — even among advisors who otherwise actively manage client portfolios.