Executive Summary

Refinancing debt to consolidate multiple loans into a single one is a standard of debt management. Sometimes it’s to get access to a more favorable interest rate. Sometimes it’s to reduce the monthly payment requirements by stretching them out of a longer repayment period. And in some cases, it’s just for the administrative ease and simplification of being able to make all the payments to one loan servicer.

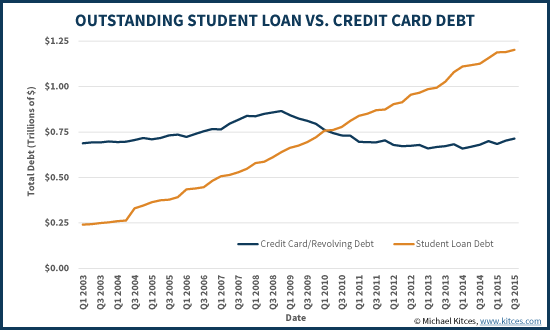

When it comes to student loans, however, the refinancing picture is more complex. The reason is that today’s student loans are actually a combination of Federal and private loan programs, and to help alleviate explosive levels of student loan debt (the total of which now exceeds all outstanding revolving credit card debt in the U.S.!), Federal student loans are getting access to multiple forms of “flexible” repayment plans. Some of which even include terms that allow unrepaid student loans to be forgiven after 25, 20, or even 10 years in some circumstances.

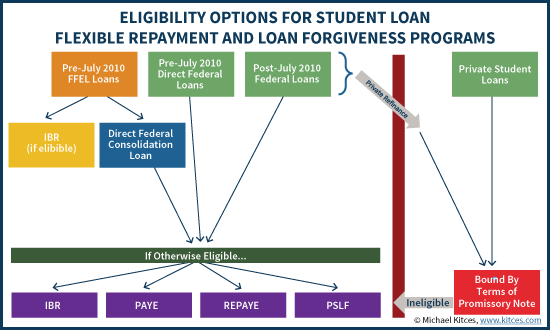

But flexible Federal student loan repayment programs are only available to Federal student loans. In fact, old Federal student loans (under the prior Federal Family Education Loan [FFEL] program) can even be consolidated into new Federal loans eligible for (more) flexible repayment and potential forgiveness, under the Federal Direct Consolidation Loan program.

Unfortunately, though, students who refinance old (or new) Federal student loans into a private loan lose access to all of the flexible repayment and potential forgiveness programs. Which means when it comes to student loans, refinancing – even if it’s for a lower interest rate or a smaller monthly payment – can actually be far more damaging in the long run than keeping the original Federal loans, or simply consolidating (but not refinancing!) into the latest Federal programs!

(Michael’s Note: This article is based on an educational session delivered by Student Loan Expert Heather Jarvis at the XY Planning Network conference in 2015.)

The Benefits Of Debt Refinancing And Consolidation

For those who need to borrow money from time to time, debts can accrue from a variety of sources. And ultimately, a large number of loans are at best unwieldy to oversee and manage – with a variety of loan servicers to pay, with varying interest rates and loan terms – and at worst can compound too rapidly and spiral out of control, leading to default and bankruptcy.

In this context, debt consolidation strategies have become increasingly popular in recent years as a means to manage multiple debts. Consolidating multiple loans into one can simplify the number of payments to make and manage, and may even save money in the long run by obtaining a lower overall interest rate (e.g., when consolidating from credit cards into a Peer-To-Peer loan for borrowers with good credit). Refinancing multiple loans into a single consolidated one can also be appealing if the new loan has a longer repayment period, which may significantly reduce minimum debt payment obligations and make it easier to avoid default (though obviously, making smaller payments will also lead to more cumulative loan interest being paid over time).

Debt consolidation and refinancing strategies are often appealing to consider because most debt itself is otherwise fungible – a debt is a debt, interest is interest, and a payment obligation is a payment obligation – so if restructuring existing loans into a new one provides an opportunity for some combination of better loan terms (interest rates, repayment periods, etc.), so much the better.

Historically, the focus on debt consolidation has been around consumer debt – e.g., credit cards and other non-secured personal debts – but there has been an explosion of student loan debt over the past decade, with total student loans now exceeding all credit card debt in the US! Accordingly, this massive growth in debt has led to similarly massive growth in refinancing and consolidation programs specifically for student loans, including “traditional” lenders like Citizens Bank to alternative lenders like Earnest, and new “non-bank” marketplace lending alternatives like CommonBond and SoFi.

Student Loan Refinancing Versus Federal Direct Loan Consolidation

In general when discussing consumer debt management, terms like “consolidation” and “refinancing” are often used interchangeably, as the act of consolidating multiple loans into one typically involves the action of refinancing them (taking out a single new loan with new terms and using the proceeds to repay and replace the old loans with less favorable terms).

However, when it comes to student loans, there is actually a difference between refinancing (which may include consolidation of many loans into one) versus just consolidating multiple loans into one, thanks to the Federal Direct Consolidation Loan program.

The Federal Direct Consolidation Loan combines together multiple Federal student loans into a single loan. This process of consolidation does not actually change the interest rate being charged (aside from a miniscule adjustment that may occur because the consolidated rate is recalculated as the weighted average interest rate of all the individual loans being consolidated rounded to the nearest 1/8th). However, a Federal Direct Consolidation Loan can stretch out payments over a longer repayment period in some cases.

More important, though, a Federal Direct Consolidation Loan can render the student loan borrower eligible for several flexible repayment programs only available for certain Federal student loans.

Favorable Federal student loan repayment programs include:

- Income-Based Repayment (IBR). With IBR, payments are capped at 15% of the borrower’s discretionary income, and can be as low as $0 for those below 150% of the Federal poverty level. Any excess interest is capitalized, with no maximum limit on negative amortization, but any remaining balance is forgiven after 25 years (this was reduced to 20 years and a 10%-of-income cap for recent borrowers since July 1st, 2014). To qualify for IBR, the borrower must have a “partial financial hardship” (in addition to otherwise being eligible).

- Pay As Your Earn (PAYE). Under PAYE, a student loan borrower’s monthly payments are capped at 10% of discretionary income (and can even be recalculated down as life and circumstances change), and again excess interest may be capitalized (i.e., negatively amortize) in some circumstances (but is capped at up to 10% above the original principal amount). Also similar to IBR, if the borrower still has a balance after 20 years of payments, the balance is forgiven (though the forgiven amount is taxable as income, unless specifically part of the Public Service Loan Forgiveness program described below). Notably, PAYE is a more recent program and older student loans may not be eligible for PAYE (unless consolidated, as discussed below!).

- Revised Pay As You Earn (REPAYE). The newest Federal loan program, which just became available in December of 2015, REPAYE has terms similar to PAYE, where monthly payments are again capped at 10% of income, and again allows forgiveness after 20 years (for undergrad, 25 years for graduate school). Unlike PAYE, though, negatively amortizing interest charges with REPAYE only accrue at 50% of the unpaid interest, and only capitalize if you leave the REPAYE program.

- Public Student Loan Forgiveness (PSLF). The PSLF program, which can apply on top of any of the aforementioned programs, turns a forgiven loan from a taxable event into a non-taxable one. In addition, loans can be forgiven after only 10 years of payments (technically, after making 120 qualifying monthly payments). Notably, though, as the name implies, PSLF is only available to those who work (full-time) in the public sector, which generally means working for the government (Federal, state, or local), a 501(c)(3) charity, or certain other qualifying non-profit organizations.

Consolidating Into (Or Refinancing Out Of) Favorable Federal Student Loan Programs

Prior to 2010, Federal student loans were administered by a combination of the Federal government itself (which provided some Direct loans) and the Federal Family Education Loan (FFEL) program, which facilitated Federal loans through private company lenders. The caveat, however, was that only Direct Federal loans were eligible for the most generous payment and forgiveness programs like PAYE and PSLF.

Since 2010, the Treasury took over the entire Federal student loan program, and FFEL was phased out for new loans beginning after July 1st of 2010. Which means that all Federal student loan programs since mid-2010, including subsidized and unsubsidized Stafford Loans, PLUS loans (made directly to students), and more, have been potentially eligible for at least some Federal flexible payment programs.

However, many former students still hold FFEL loans that were taken out prior to 2010, which were not eligible for certain payment programs originally. Fortunately, though, these loans can become eligible, if consolidated through the Federal Direct Consolidation Loan! In other words, various FFEL loans that were not eligible for flexible repayment programs, including potential loan forgiveness after 10 or 20 years of repayment (e.g., under PSLF, PAYE, or REPAYE), can become eligible if they go through a Federal Direct Consolidation Loan (though only for loans of the student, not PLUS loans taken out by parents, and the repayment plan options will not include PAYE for those who had a student loan balance prior to October 1, 2007).

Notably, though, these improved repayment options are only available if the consolidation is done under the Federal Direct Consolidation Loan program, and is generally only available if it is the original FFEL loan. (Though if the “old” FFEL loan was being repaid under IBR and several years into its 25-year “forgiveness” timeline, consolidation may reset the forgiveness time horizon when re-starting under a new flexible payment program.)

In certain circumstances, Federal Direct Consolidation is also available for an FFEL loan that is not the “original” loan (if it was consolidated into a special FFEL Consolidation Loan program that existed prior to July 2010), and Perkins Loans may also potentially be consolidated with Federal Direct (even though they’re not actually part of FFEL).

The significance of these rules is that not only can “older” student loans under FFEL potentially become eligible for more favorable loan terms by consolidating, but private loans are not eligible, and going through the process of refinancing a Federal loan into a private loan will irrevocably lose access to these programs. Again, the reason is that the Federal Direct Consolidation Loan program is only available for existing Federal loans; private loans are not eligible, including prior Federal loans that were refinanced into private loans. Furthermore, if an existing Federal student loan taken out since 2010 – and thus already potentially eligible for flexible payment programs – is refinanced into a private loan, access to those favorable payment programs are also permanently lost.

In other words, just as a Federal Direct Consolidation Loan can turn an ineligible FFEL loan into an eligible Federal loan for unique repayment and forgiveness options, refinancing from a Federal loan into a private one can forfeit these opportunities! Which means even if a private loan offers a slightly better interest rate – and especially if it does not – it can be very damaging to refinance Federal student loans!

Notably, an existing post-2010 Direct Federal loan program can also be consolidated under the Federal Direct Consolidation program, though it doesn’t result in any better, or worse, eligibility or treatment for flexible Federal repayment programs (though consolidation could adversely impact industry-specific service-based repayment programs, such as HRSA for nurses). It may still be desirable to do so simply for some level of administrative convenience. However, if multiple Direct loans have different interest rates, it may be preferable to keep them separate, to allow any prepayments to be directed to the highest interest rate loan first (as a Consolidated version would be subject to one blended interest rate).

Determining Which Student Loans Are Federal Versus Private

Many students that have accumulated student loans over the years may not even be aware whether or which loans are actually Federal loans (eligible for Federal consolidation) or private loans (only eligible for private refinancing).

To determine whether any of the student’s loans are actually Federal, the student can request their (Federal) loan information through the National Student Loan Data System (NSLDS). By claiming their account, the system will show any and all student loans that are actually part of Federal programs, and the relevant loan details (including which program it is, when it was taken out, and the current loan balance and interest rate).

To identify and verify all other loans, students should obtain a copy of their credit report (e.g., via the Federal once-per-year free credit report program) to identify all outstanding loans. Any loans that are shown on the credit report, and not listed in NSLDS, will be private loans. (Ideally, the student should also find or obtain a new copy of the actual promissory note for each private loan, to really understand the loan terms and details.)

Once all of this information has been gathered, it’s possible to organize all the details of the student loans, private and Federal, FFEL or Direct, and the terms, to identify whether it may make sense to either consolidate (for Federal loans) or refinance (for private loans). Of course, it’s possible that a student may wish to refinance Federal loans as well – e.g., to obtain a better interest rate – though that will likely only be desirable for those with substantive incomes, where there is both an opportunity to get favorable private loan terms and the flexible repayment rules of the Federal programs aren’t likely to be relevant. (A high-income high-credit-score borrower will also likely want to refinance private student loans as well, if a favorable rate and payment term is available.)

If there are significant Federal student loans – either Direct loans eligible for flexible payment plans, or FFEL loans that could be consolidated to become eligible – it will be desirable to delve further into whether the student may be eligible for a better repayment plan. The Department of Education provides some repayment estimator tools, and if desirable the student can begin the Federal Direct Consolidation Loan process, or it may be worthwhile to engage a standalone student loan expert as well to help navigate all the choices (there are both experts that work directly with consumers, and also some like Jarvis herself who specialize in partnering with advisors on student loan issues).

But the bottom line is simply this: while “debt consolidation” may be a standard recommendation in the world of personal finance, when it comes to student loans it’s necessary to be more cautious, because it’s not just about the loan interest rate and repayment period. Federal student loans are potentially eligible for special repayment rules, but only as long as they remain Federal loans (and/or are consolidated with other Federal student loans under the Federal Direct Consolidation Loan program). So be very cautious about refinancing Federal loans into private ones, unless you’re absolutely certain you won’t want or need access to the various flexible repayment programs available for Federal student loans!

(For advisors interested in more student loan education, you may wish to check out the Comprehensive Student Loan Training Series for Financial Advisors also available from Heather Jarvis.)

What’s interesting is how the addition of REPAYE has exponentially complicated an already tricky refinance decision – especially for young physicians. For the average medical resident, it used to be EITHER go for PSLF and pay the least amount possible monthly 120x’s and be done with it. OR refinance as soon as possible because all the debt must be fully repaid and lower interest rates save big $’s on $200K to $300K in loans. Several private refinance lenders made this possible by creating special programs with lower rates and very low monthly payments specifically for medical residents – companies like DRB and Link Capital. So if I am a medical resident and I owe $300K that I must certainly pay 100% back (no forgiveness options), refinancing from 6.5% down to 4.5% is extremely appealing.

However now REPAYE has the 50% interest subsidy on unpaid interest. So lets say the medical resident that owes $300K at 6.5% will owe $0/mo under REPAYE because their income is low. 50% of their unpaid interest is forgiven therefore 50% of ALL their interest is forgiven. Basically the effective REPAYE rate becomes 3.25% (while income is low). This looks even better than the refinance deal while income is low. But as income increases, it basically ramps up your rate. If it gets too high you could refinance then, but maybe private loan rates increase as well.

And this is all assuming most medical residents have a clear understanding of their 10 year career path and can determine PSLF or Full Repay. But in reality most have no clue. And that’s all just scratching the surface.

I’ve been grappling with this topic in my practice on a regular basis. Asking for clarity as someone goes through there residency is like asking where you will be in 20 years during college orientation.

I am Mr Ernest, i saw a testimony online about how one Craig Bernard got His Loan from this legit loan lender. I”m currently living in USA. i was stuck in a financial situation and i needed to refinance and pay my bills. I tried seeking loans from various loan firms both private and corporate but never was successful, and most banks declined my credit. i also followed the link and got my loan too. if you are interested in getting a loan contact Him via email [email protected]

I’m considering refinancing my student loans. I’m seeing websites that are lenders and then some seems to be brokers for the actual lender. Surely, these student loan companies have to make money, how do they do

it? Do they charge fees, make it back on the interest rate? I know they

don’t work for free. No one talks about that part, but I’m sure they’re

getting paid. How do they stay in business and have large staffs if they

aren’t charging?

I was actually captured with the piece of resources you have got here. big thumbs up for making such wonderful blog spot. I like and recommend it very much.

A friend of mine was neck deep in debt, not just because of credit cards but because of his college loan as well. He had to talk to a debt attorney http://www.mccarthylawyer.com/about-us/ just to get out of that fine mess that he was in. He is on a financial plan right now, its working but its not an easy journey.

Competition among financial institutions is very real, which makes finding the right lending company difficult. Mango Credit Reviews shows positive feedback coming from entrepreneurs plus home and property owners who have successfully taken advantage of our loans.