Executive Summary

In the early days of the financial advice industry, an advisor's options for generating new business were somewhat limited. Cold calls, country club memberships, Chamber of Commerce networking, and referrals (from clients or centers of influence) were staples for growth, and determining how successful those sales-centric efforts were was rather straightforward. Over the years, though, as the focus of the profession evolved from being almost exclusively transaction-based sales to having a focus on building long-term relationships, so too did growth shift from sales-based approaches to more long-term trust-building marketing tactics. The good and bad news of this shift has been the emergence of a near-dizzying array of growth tactics, including blogging, webinars, social media, podcasts, paid search, lead-generation services, and (of course) good old-fashioned cold-calling and networking (to name just a few!). And when they're so different from each other, the challenge can quickly become figuring out which are really working the best (especially when some take more time, and others cost more upfront in hard dollars). Fortunately, by tracking key marketing KPIs and sales metrics, advicers can measure their business development efforts and not only learn which tactics are most effective, but also how to iterate over time to make them even more marketing-efficient and scale the growth of their business!

An advicer's business development activity can be measured across 2 main phases: the Marketing Activities that generate new leads and prospects, and the Sales Process that converts those prospects into new clients. As a first step, the most important is to gather data around whatever activity it is that the advicer is doing to attract new prospects (such as the number of podcasts produced, webinars hosted, blog posts published, networking meetings attended, or cold calls made). From there, advicers can determine if the activity is actually having any effect by measuring the number of Prospect Inquiries, or how many people reach out to learn more about what the advicer offers. Along the way, advicers can track their website traffic, which is a good proxy for whether their brand awareness is growing as a result of their marketing activities, as measured (in Google Analytics 4) by Users Per Month. Finally, advicers should track how much they're spending (in total) on their efforts, both from an actual hard-dollar cost, and the time that's spent on the activity itself, in order to understand if their tactics are improving over time and which tactic is outperforming another.

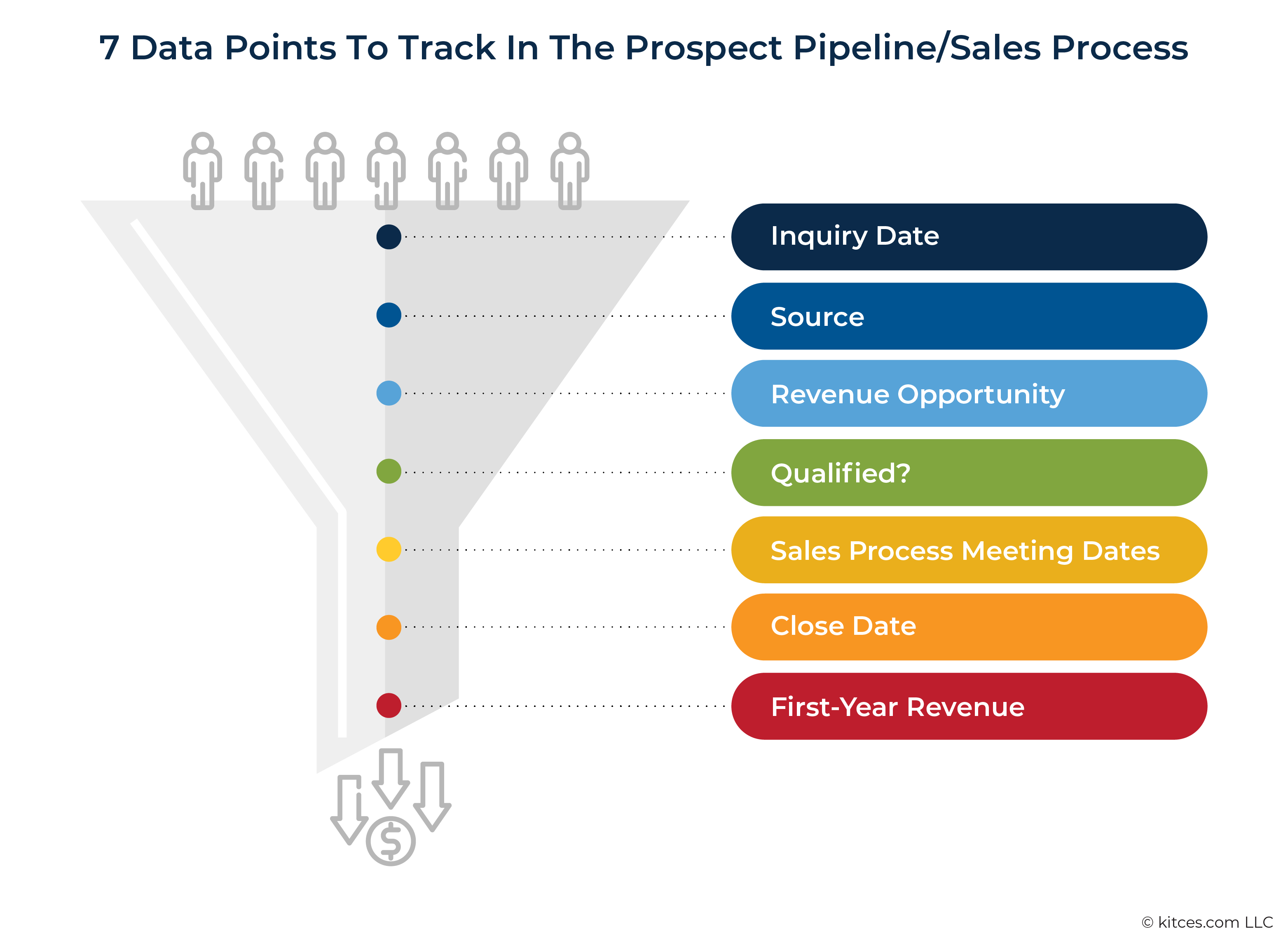

Once an advicer has generated new inquiries, the next step is to determine how well they are converting new prospects into new clients. Key data points around the prospects themselves that advicers should record along the Prospect Pipeline include the date that the prospect first reached out, how that prospect first learned about the advicer, if the prospect is actually 'qualified' (i.e., they're a good fit for and can afford the advicer's services), and how much revenue the prospect can be expected to bring to the practice. From there, tracking the dates of each meeting in the Sales Process and the date that the prospect signed the paperwork to become a client can help identify potential bottlenecks or issues in the Sales Process itself. Finally, advicers can also record the amount of revenue the client ended up committing in order to track and measure their growth.

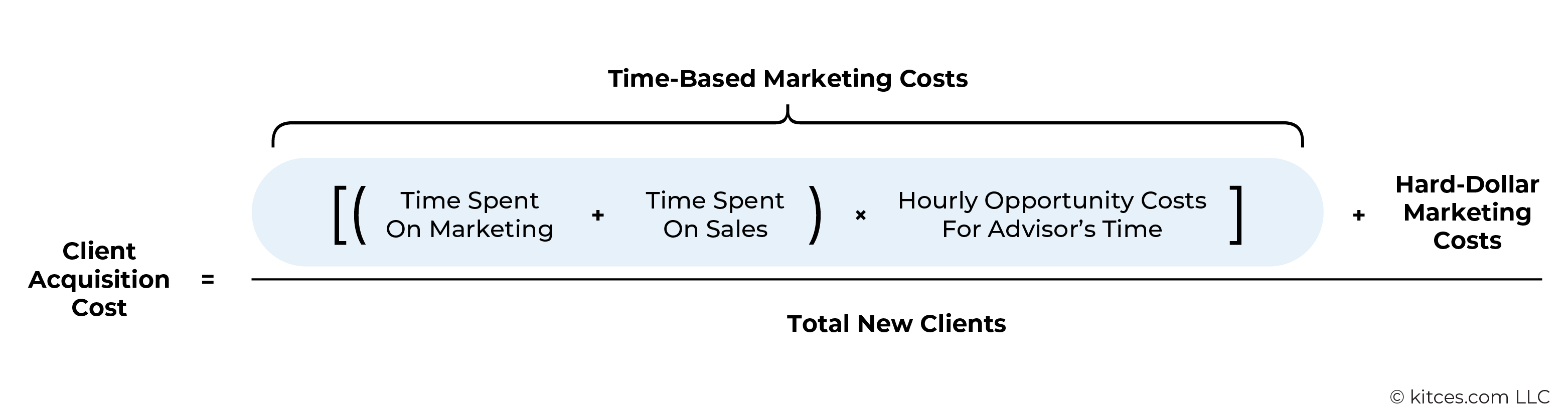

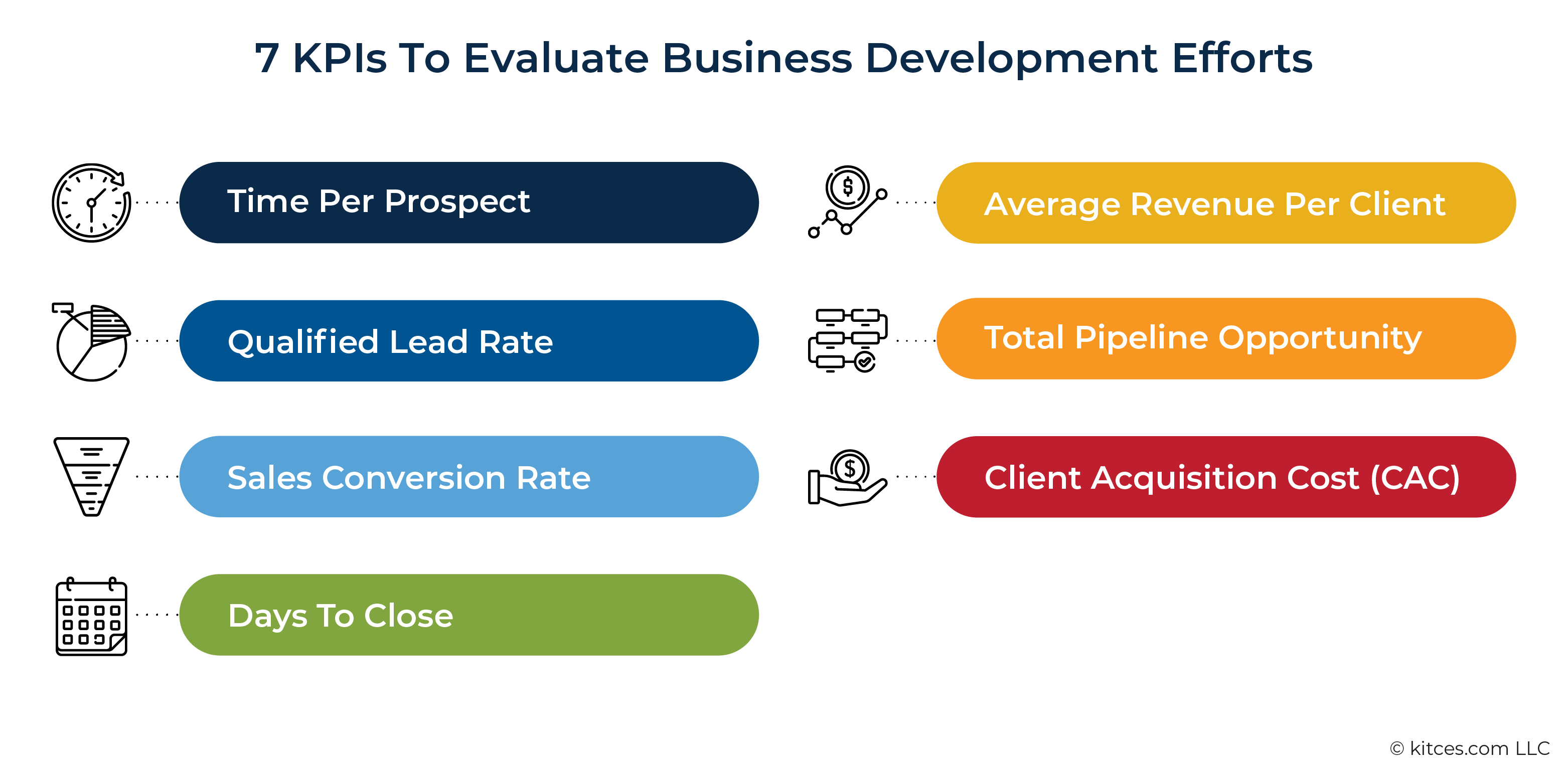

The real opportunity in gathering all this data is learning which channels and activities an advicer should be focusing their time and dollars on, and determining what key metrics they should try to improve. Specifically, advicers can take this raw data and turn them into Key Performance Indicators (KPIs) that will help them become more efficient and effective. These KPIs include the total amount of time spent generating each new prospect, the percentage of those prospects that were actually "qualified", and how many of those qualified prospects became clients, along with the number of days between when a prospect first reached out and when they signed on as a client, the average revenue generated by each new client, and the total new revenue opportunity of all the prospects currently in the Sales Pipeline. Finally, advicers can arrive at the grandaddy of all marketing and sales KPIs, the Client Acquisition Cost (CAC), which measures the all-in cost of what it takes for an advicer to get a new client. By calculating the amount of time and dollars spent on marketing and dividing that by total new clients, advicers can determine if their sales and marketing efforts are truly contributing to the growth of their practices.

Ultimately, given how important it is for nearly all advicers to generate new business, gathering the raw data from their marketing and sales efforts and then calculating the key metrics resulting from those processes is a crucial step towards effectively growing their practices. Importantly, though, advicers can't improve their business development efforts if they don't first measure them. By doing so, it becomes possible to determine what's working (and what's not!), and learn where the advicer's time and money are best spent as they build and scale their ideal financial planning practices!

Growth is a struggle for most financial advisors, especially those who are newer to the profession (or at least newer to running their own practice) and have to get their own clients for the first time. There are so many different marketing tactics, and ways that advisors can spend their time prospecting, and different approaches to the sales process, that it's hard to know where to begin. And because the results can be 'lumpy' in the early years – where 1 new client may be a good month, and 2 new clients are 'a 100% improvement' because there was 1 extra lead close – it's especially hard to figure out what's really working. Which is problematic, because as the famous saying goes, "You can't manage what you can't measure".

Except the good news is that financial advisors really can measure their business development activity across its 2 main phases – the first is the marketing and prospecting activity that generates prospects advisors can engage in a sales process, and the second is the sales process itself as prospective clients move through the pipeline.

5 Data Points To Measure Advisor Marketing Activity

During the first main phase of business development, which focuses on marketing and prospecting activity, there are 5 key metrics that can be used to assess marketing activity. These include the marketing activity itself, the number of prospect inquiries, website user traffic, and the costs associated with the marketing activity – in both time and dollars.

Tracking Advisor Marketing Activity

When it comes to Marketing Activity, the first and most important thing to measure is the activity itself – the actual prospecting 'thing' advisors are doing. This will vary by whatever the marketing tactic(s) happen to be. If advisors cold-call, it's the number of cold calls every month. If they cold-knock, it's the number of doors. If it's writing blog posts, it's the number of blog posts they hit 'publish' on every month. If it's networking meetings, it's how many of those are attended each month.

Ultimately, though, activity isn't a direct measure of results. It's just activity. But as advisor coach Nick Murray has quipped (and published in his book of the same title), business development for financial advisors is a "Game Of Numbers", where if the advisor engages in the activity enough, it will eventually and inevitably yield some results (and the more "no's" they get through quickly, the faster they get to a "yes"!). Which means measuring and tracking (and being held accountable to) the activity is the starting step to seeing results.

Counting Prospect Inquiries

The next thing to measure is whether the activity really is producing some kind of results – and since this is the prospecting phase of the marketing process, the main thing to measure is prospects who inquire about the advisor's services.

At this stage, a "Prospect Inquiry" is simply a meeting with anyone who has expressed interest in learning more about the firm's services and what the advisor offers. We haven't determined if they're necessarily a good fit yet (that comes later). If they are willing to sit down to meet (virtually or in-person) for 30 minutes – not as a generic 'get to know you' meeting (though get-to-know-you 'networking' may have been the marketing activity that got us here), but specifically to learn about the services and what the advisor does – it counts. This could be because the advisor met them at a networking event and asked for a follow-up meeting to share more about what they do as a financial advisor, or because the prospect reached out through the firm's website to schedule a meeting and learn more about what the firm offers, or because they were introduced by a friend/colleague/center-of-influence providing the advisor an opportunity to talk about what they do.

Nerd Note:

Some marketers will distinguish between an "inquiry" versus a "lead" versus a "prospect", and a few will go so far as to delineate a "marketing-qualified lead" (MQL) and a "sales-qualified lead" (SQL) as various stages of qualifying whether the individual will receive the firm's marketing materials or enter into the sales process. That's more than most financial advisors need, especially if they don't have a history of tracking their business development efforts. For our needs, we're just going to talk about 2 types: "Prospect Inquiries", who have reached out to learn about the advisor's services, and "Qualified Prospects" (which we'll discuss further in the next section).

In a Game-Of-Numbers framework, if you get enough swings at the plate ("at-bats" in the baseball world), the presumption is that, eventually, you're going to connect and get a hit. Accordingly, though, it's important to be strict about how Prospect Inquiries are counted and to be clear in counting what is (or isn't) an 'at-bat' requirement for eventually getting a client, otherwise, the strikeout rate will be incorrectly calculated later when it matters. What makes an individual a prospect often involves the question of whether they have asked to learn more about what the advisor actually does, and/or if they've given permission to have a meeting where the advisor describes the services provided. These questions are often the 'at-bats' needed to eventually get a client.

Measuring Website User Traffic

Notably, for a lot of marketing activity, it's not a straight line from prospecting activity to a prospect (unless, perhaps, the advisor is cold-calling or cold-knocking, and the activity is prospect solicitation). Usually, the reality is that the advisor is trying to build some visibility, some reputation, or some brand awareness. So a good intermediate measure – between the Marketing Activity and the Prospect Inquiries – is to measure website traffic as a proxy for whether brand awareness is growing in the right target market.

If the advisor networks well, some people will be looking the advisor up. If the firm is getting talked about from its marketing activity, people will be web-surfing their way to the firm. If the advisor is getting referred, they're being checked out online. In the modern digital age, even 'analog' marketing activities often show up with a digital component. (For example, an advisor might cold-knock and leave their business card, and then the person looks the advisor up online to decide whether they're a 'legit' professional before they follow up on the business card left behind.) So installing Google Analytics 4 and looking at Users per month (which was counted as "Unique Visitors" in Google Analytics 3) is a good measure. (Note: The key metric is Users, not Views or Sessions. While Views and Sessions can include the same prospect looking at multiple pages or coming back for a repeat visit, Users represent the number of unique people who came to check out the website, which makes it the best measure of whether brand awareness is growing.)

In fact, sometimes measuring website visitors can even help reveal marketing alternatives. For instance, one advisor (we'll call him "John" in deference to his privacy) who was networking locally in his community started to track his website traffic, and realized he had far more people coming to his website (dozens every week) than his networking efforts alone could produce. He eventually figured out this was because he was the only fee-only RIA on the south side of his mid-sized metropolitan area (other major advisory firms were all to the north or east of the city), and prospects were finding their way to him simply because of his convenient geography. So he focused further into optimizing his website for local searches of "fee-only financial advisor" and the names of local towns, and improved his online scheduler to make it easier for interested people searching for him to reach out. And his growth shot through the roof. (Of course, Your Mileage May Vary. But advisors can't discover the opportunity that might be if they're not looking at the data!)

The Cost Of Marketing Activity – Both In Time And Money

The other important thing to track in marketing activity is its cost. For a lot of early-stage advisors, that's mostly a cost in time – the hours spent networking, blog writing, or cold-calling. It may also be a hard-dollar cost on business meetings, buying leads, paying for a ghostwriter or a podcast producer, etc. In the long run, it's important to understand total costs – in dollars and time (and the opportunity cost/money value of time!) – to both understand whether the firm's marketing efforts are getting better over time, and to compare one marketing tactic to another.

In summary, the key Marketing Activities to track (on a monthly basis works for most advisors) are as follows:

- Activity measurement itself;

- Number of Prospect Inquiries;

- Website traffic (Users);

- Money spent; and

- Time spent.

The 7 Data Points To Track In The Prospect (Sales) Pipeline

If marketing is about making the phone ring, sales is about what to do when the call is answered. Which means that while generating Prospect Inquiries is the end of the marketing/prospecting process, it's only the beginning of the Sales Process. And Sales Processes have their own key metrics to track. Or what we'll call a Prospect Pipeline.

Notably, though, a key difference in tracking Sales versus Marketing is that while Marketing tends to measure overall activities in the aggregate, Sales tracking is about tracking each individual prospect opportunity. In part because if an advisor has a good marketing process, they'll get their name and brand in front of lots of people (too many to track individually), but at the sales stage, each bona fide prospect must be tracked individually to ensure that nothing falls through the sales cracks. In other words, data trackers for the Prospecting Pipeline aren't just used to track the results of sales efforts; they're also typically the tool used to manage the sales process itself.

Accordingly, the most straightforward way to measure and track the Prospect Pipeline is simply to use a spreadsheet, such as the downloadable template we've created for readers, where each row is a prospect, and the columns are the key stages or data points in the sales process to be tracked. For most advisors, the key data points that should be captured for each prospect (the columns) are discussed below.

Inquiry Date. What was the calendar date that they first reached out? Tracking by date allows advisors to easily look back from the future and see how many clients they had in any particular month, quarter, or year.

Source. Also known as "Lead Source", the question is how this prospect first found the advisor to reach out? Most often, this is captured either as a standard question in the initial sales/screening call ("Where did you first hear about us?"), or as a question added to the intake/submission/scheduling form ("What led you to reach out to us?" with a dropdown list of relevant options like "Google Search", "Referral", or "Follow You On Social Media").

Revenue Opportunity. How big is this prospect opportunity? Most commonly, advisors can simply estimate the potential amount of revenue here. AUM-based firms often track the potential amount of assets (rather than calculate the graduated-fee-schedule fee on that balance). Subscription firms might track the expected tier (e.g., Bronze/Silver/Gold) if they have fee tiers, or just enter the dollar amount of prospective (annual) revenue.

Qualified? Is the lead actually qualified to do business with the advisor? This means that they would be a good fit for the firm's services (e.g., the advisor helps retirees, and the lead is actually a retiree), and they can afford the services (e.g., they have enough income to reasonably pay the $400/month subscription fee or they meet the firm's asset minimum). Whether or not the lead was Qualified is very important to track, even simply as a Yes or No entry, as it helps to make sure the advisor isn't just getting at-bats (inquiries), but the pitches coming at them are actually in the strike zone that they at least could hit.

Dates Of Each Meeting In The Sales Process. Most advisory firms have some standard cadence of meetings they engage in for their sales process. It might be a screening meeting and then a second meeting to close the client. Maybe it's a screening meeting, then a data-gathering meeting, and then a preliminary-plan meeting where the prospect is invited to become a client to implement that plan. Or an intro meeting and a proposal meeting where the prospect agrees to become a client if they like the planning ideas proposed. Whatever it is, the purposes for this part of the Prospect Pipeline tracking are twofold: first, simply to note where prospects are in the process (if each meeting is tracked in a separate column, it can be easy to determine who hasn't advanced to the second/third/final meeting), and second, to enter dates for each meeting, which make it possible later to calculate the length of each stage of the sales process (e.g., how many days/weeks it takes to get through each part of the process). The key is that by entering dates, it's easier to calculate later. Notably, if a Sales Process has multiple steps (as most do), this will actually involve multiple columns (Screening Call, Intro Meeting, Proposal Meeting) that each gets a separate date entered to track when they happened (or leave blank if they didn't/haven't).

Close Date. This is the date they signed the paperwork to become a client. Again, by entering it as a date, advisors can later calculate the time it takes to go through the entire process (e.g., average time from Inquiry Date to Close Date), as well as the time for each sub-stage (if the process is taking too long, is it because the firm needs to speed up how quickly the first meeting is scheduled, or how quickly the prospect gets the paperwork after the last meeting to actually sign on as a client?). Which will be helpful to decide if the process needs to be refined.

1st-Year Revenue. This is the amount of revenue an advisor can anticipate getting paid in the first year, given what the client actually committed to or signed up for. This is projected (their expected planning subscription fee tier, their committed assets to roll over, etc., because we won't know the actual first-year revenue until 12 months from now!), but it helps to clarify the actual amount of annual revenue being adding from new clients that are closing. Hopefully, this amount will be similar to the Revenue Opportunity recorded earlier, but is tracked separately because sometimes they're not the same, and that's good to know. (For example, the Revenue Opportunity might have been $3M, but the client is only giving us $1M to start… which is good to know because it helps us realize that we closed a client who may still become a bigger client in the future!)

7 KPIs That Show Where To Improve Business Development Efforts

While there can be some personal accountability benefits to tracking marketing activity (if advisors are documenting whether they did 'the activity' every week or month, it helps to stay on target because they're not going to want to write down that they missed their own numbers 😊), and some execution benefits to tracking the Prospect Pipeline ("Oh yeah, I have to follow up with those 2 prospects; it's been 3 weeks since the first meeting and they still haven't scheduled the second one yet!"), the real opportunity of tracking marketing and sales activity is figuring out where to focus time and energy to make improvements that result in better business development outcomes. Which is all about taking the raw marketing activity and prospect pipeline data being tracked and turning them into useful Key Performance Indicators (KPIs) that advisors can evaluate and work towards improving.

7 relevant KPIs to measure and evaluate for improvement include the following:

Time Per Prospect. How much time was spent in total on prospecting efforts over the past year (tracked as marketing activity), and how many Prospect Inquiries were generated for the year? Dividing one into the other gives a measure of how 'efficient' the advisor's marketing time is. In practice, this number tends to be very high in the early years (it could be 10–20+ hours per prospect when advisors first start out). The biggest question is whether it's coming down over time (which indicates that the marketing efforts are building a brand that's compounding into more opportunities over time with less effort – the very essence of marketing that is scaling).

Qualified Lead Rate. Out of the total Prospect Inquiries, what percentage of them were actually Qualified? If the number is less than 75%, there's still some work to do, as this literally means the advisor is spending a significant portion of their time talking to prospects who won't and/or can't do business with them. Solutions here could include adding a screening process if there isn't one already (e.g., a 15-minute call to screen whether the prospect is Qualified so the advisor doesn't book 30-60 minutes with a bad-fit prospect), adding more details to the scheduling form about who should book a meeting or not (e.g., a field that says "I affirm that I am able to meet the firm's minimums" that they must check "Yes" to before they schedule), or posting the firm's fee schedule and minimums on the website (at all, or more prominently) to help filter out bad-fit calls.

Sales Conversion Rate. Out of the Qualified prospects, how many actually became clients? Notably, the key here is to measure based on the Qualified prospects, not just the total Prospect Inquiries. By filtering out the non-qualified prospects, this number will be a fairly 'pure' representation of how effective the sales process really is. A good benchmark here is to be somewhere between 50% and 80% of Qualified prospects who say "yes" and become clients. If the conversion rate is below 50% with otherwise qualified prospects, advisors will need to tweak their sales process or get some additional sales training. If the conversion rate is above 80%, advisors are probably undercharging. (If everyone is saying "yes", then most of them would still be saying "yes" if the fees were a bit higher, because they're seeing the value being provided!)

Days To Close. Measured as the number of days from Inquiry Date to Close Date, this helps to capture how long it takes for prospects to go through the entire Prospect Pipeline process. In practice, there is a fairly wide variance in what's 'normal' for advisors here… some are relatively quick to get to a 1-meeting close, and some prefer a more drawn-out multi-meeting process to build trust more deeply before asking for the business. Realistically, it's going to be hard to get the average close under 2 weeks (prospects only move so fast), and it's likely problematic if it averages more than 2 months (prospects had some reason and motivation to reach out and start the process… if it's 2 months later, they're almost certainly losing their own momentum). Over time, different approaches can be tested to determine if the firm's sales conversion rate holds as the advisor tries to bring the days-to-close down, though for most, this is much less important to refine than Qualified Lead Rates and Sales Conversion Rates in the first place.

Average Revenue Per Client. This is the average of projected first-year revenue across all the prospects that have closed. For some firms, tracking this number makes it clear that they need to raise their minimums because the average new client revenue isn't even enough to cover their internal staff costs anymore. For other firms, this is helpful to track over time as a measure of whether the firm is successfully attracting (and closing) higher-dollar prospects that place increasing value on the firm's increasingly valuable services and brand. Each firm will have its own ideal client that it's pursuing with its own average revenue, so there's no 'right' answer here… beyond making sure it's high enough that the firm can sustain (i.e., covering staff costs), reinvest for growth (if desired), and to track how it changes over time (especially if the firm is trying to move 'upmarket' over time).

Total Pipeline Opportunity. The total pipeline opportunity reflects the total new-revenue opportunity of all Active prospects (e.g., all those still within 60 days of the Inquiry date who have not already become clients). Some firms will include an "Active?" column in their Prospect Pipeline specifically so they can filter for "Active" prospects, as distinct from those that are "Closed" (already became a client) or are "Dead" (a sales label for prospects that have declined to do business, and are therefore a 'dead' lead no longer worth actively pursuing). The goal of the Pipeline Opportunity is to understand the overall health of the firm's forward-looking growth – whatever closes from this quarter's Pipeline Opportunity will be next quarter's new revenue (or at least 25% of the opportunity is next quarter's revenue for firms that bill quarterly or monthly), so the pipeline opportunity over time becomes a revenue growth forecasting tool (especially when the firm has clear and consistent Sales Conversion rates to be able to predict what proportion of the Pipeline is likely to close, and a consistent Days To Close to know how long it will take for them to become clients). For fast-growth firms, clarity about the coming quarter's and coming year's revenue can also be extremely helpful to build confidence and clarity about when the firm can afford to pull the trigger on the next hire for growth capacity.

Client Acquisition Cost (CAC). Arguably the most important KPI of the entire process, Client Acquisition Cost (CAC) measures the all-in resources it takes for the firm to get a new client. It is measured by first taking the total amount of time spent on Marketing (adding up the Time-Spent from the Marketing Activity tracker each month across the year) plus the total amount of time spent on Sales (adding up the number of Sales Meetings from the Prospect Pipeline across the year and multiply by the 1 or 1.5 or 2 hours of prep + meeting time + follow-up per meeting), and then multiplying this Marketing and Sales total by the hourly opportunity cost of the advisor's time (a simple calculation would be to take total take-home income for the year, and divide it by 40 hours/week x 50 weeks/year = 2,000 working hours, to get an hourly rate equivalent). Add to this the total hard-dollar marketing expenditures (from the Marketing Activity tracker), and then divide by the total number of New Clients for the year. According to Kitces Research on Advisor Marketing, the average is about $2,000 for newer, earlier-stage advisors, and averages $4,000+ per client for established advisors (who have a much higher cost of time as their revenue and income grow). Though arguably the biggest question is simply how this Client Acquisition Cost compares to the Average Revenue/Client; if Revenue/Client is higher than CAC, it means the firm generates more than $1 of annual revenue for every $1 spent on sales and marketing efforts, which is a positive sign for sustainable growth.

For those who want to delve one step further – as their marketing efforts grow and expand – the same series of statistics above can be calculated not just for the firm's total marketing and sales activity, but by lead source. Do the clients who come from COI referrals have a better close rate than the prospects from the firm's seminar marketing efforts? Client referrals often have a high close rate, but are they better when it comes to revenue/client (helping the firm move upmarket?), or do they tend to be smaller clients dragging the firm's profitability down? That new social media advertising initiative seems to be generating some results, but it costs a lot more money upfront… how does the all-in Client Acquisition Cost really compare with the advisor's long-standing but time-consuming approach of going to Chamber of Commerce networking meetings? Based on the numbers, towards which marketing channels should the firm put more (or less) emphasis in the coming year?

Given how essential business development is to virtually all advisory firms – from sustainability of the owner's personal income, to creating career track and growth opportunities for associate advisors and other team members – it's crucial to measure the key metrics of the firm's marketing and sales efforts.

For financial advicers who want to begin measuring and tracking for themselves, the "Kitces Marketing Activity and Prospect Pipeline Tracker" to the right provides a starting point, with separate tabs for Marketing Activity, the Prospect Pipeline, and the relevant Marketing KPIs. (Cells colored Yellow are for advisors to input; those in Blue auto-calculate output.)

For those who want to delve even further into tracking their marketing and sales activity, other available tools (for purchase) include Taylor Schulte's "Advisor Marketing Tracker", and the "Track That Advisor" tools from Erica Pauly (with additional services support for firm-specific customizations).

By whatever means, though, the key point is simply that firms can't improve upon their business development efforts without first measuring them. By tracking both activity and results, firms can identify their strengths and their weaknesses, the tactics that are working and those that are not (or at least, not as efficiently as the rest), and be able to measure whether their marketing is really scaling as the firm grows!