Executive Summary

Historically, the best financial advisor software was available from the largest advisory firms that had the size and scale to develop best-in-class proprietary software solutions… while independent advisory firms languished with a small subset of “homegrown” solutions that one advisor might have made for themselves and then sold to other independent advisors. But with the rise of the internet, the ability to deploy software efficiently through the cloud, and the availability of APIs to easily facilitate cross-software integration, a boom has emerged in the world of independent advisor software.

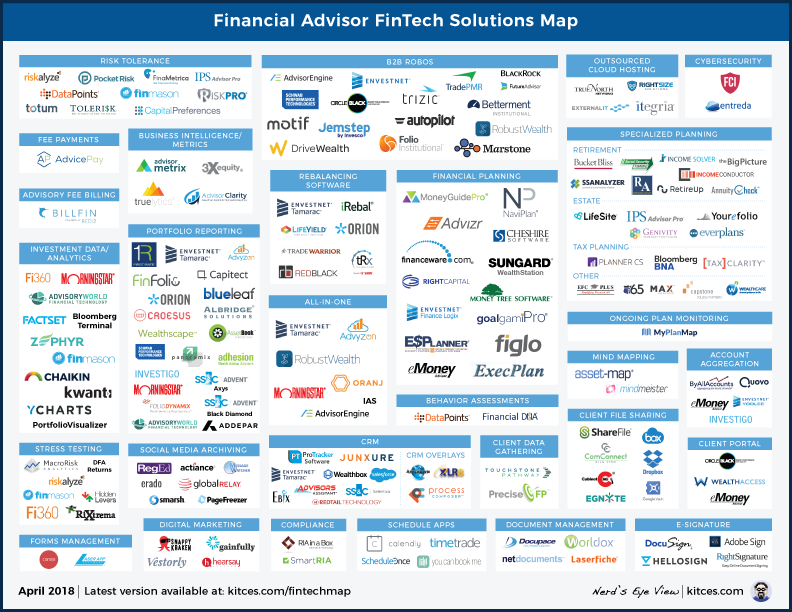

In fact, the greatest problem for many advisors today is just keeping track of all the choices that are available in each of the various categories, and figuring out how they potentially fit together! Accordingly, we’re excited to announce what will become the first of a continuously (monthly) updated map of the advisor FinTech landscape… so advisors have a reference tool to identify the potential options in various categories!

In addition, the rise of independent surveys like the T3 Advisor Software Survey is now providing, for the first time ever, some perspective on not just what software is available, but what software is actually “good”, based on User Ratings from real advisors who actually use the software. Revealing that there is still substantial room for improvement in many advisor software categories (in particular, portfolio performance reporting tools), while others that have received a lot of buzz – like “robo” digital advice tools – may actually just be overhyped (with both poor user ratings and poor advisor adoption!).

Nonetheless, with more venture capital than ever coming in to support advisor software startups, and a wider range of solutions than ever, arguably we’re seeing the Golden Age of financial advisor software today. And in fact, with more and more competitors entering the space, the pace of advisor software innovation may only accelerate from here!

Surveying The Financial Advisor FinTech Landscape

In the early decades of advisor technology – the 1980s and 1990s, when personal computers first started to be used by financial advisors in their offices – the “best” technology was typically associated with the largest firms that had the most resources to develop that technology, and then offered it as a benefit for their (captive) advisors. Independent advisors had few options, because there were few independent software providers in the first place; as a result, the overwhelming majority of early independent advisor technology were “homegrown” solutions, built by an advisor to solve their own problem, and then sold to other independent advisors who needed a similar solution.

However, the rise of the internet, which both enables advisors to more directly access technology solutions, increases the scalability of the software providers themselves, and facilitates the potential for independent software providers to integrate with each other via APIs, has dramatically shifted the landscape over the past 20 years – to the point that now, the largest independent software providers often have far more users (and therefore resources and scale) than even the largest captive financial advisor platforms. Which in turn means that independent advisor software firms can now become valuable enterprises, capable of having successful “exits” for $10s or even $100s of millions of dollars, which in turn is just attracting a new wave of venture capital into advisor software startups.

As a result, while as little as a decade ago, the range of financial advisor technology solutions was fairly limited, often with no more than 2-3 real competitors in each category, now there is an ever-widening range of advisor software solutions. The good news is that the breadth of technology solutions makes it possible for even small advisory firms to having competitive technology, facilitating a new golden age for solo advisors with record levels of profitability and productivity. The bad news: suddenly, one of the biggest challenges for advisory firms is that there are too many solutions to choose from, and it can be hard to even keep track of all the options in the various categories!

And ironically, the difficulty of choosing from such a breadth of solutions is only made worse by the fact that while the internet and APIs facilitate cross-software integrations, the lack of established data standards means that not all software integrates with all other software, as integrations are typically still built point-to-point, one at a time. And the expansion of many software platforms into “complementary” areas of functionality makes it even harder to assemble together the pieces of the jigsaw puzzle, as often various combinations of platforms really do have redundancies and overlaps, especially with the rise of so-called “digital advice” platforms that are aiming to be the next generation of all-in-one solutions (regardless of how many components the advisory firm already had in place!).

As a result, it now takes a comprehensive “map” just to get a handle on the entire landscape of financial advisor software solutions, from the range of choices in the 3 “core” categories of CRM, portfolio management, and financial planning (essential for any comprehensive wealth management firm), to the complementary software tools that fit in around them (from document management to risk tolerance to digital marketing and rebalancing and more).

And so to help financial advisors navigate the current environment, below is the first version of what we intend to be a monthly-updated chart of the financial advisor software landscape, highlighting both the breadth, and range, of choices for advisors in various software categories (an extension of the extremely popular advisor software landscape map we did of all the vendors that exhibited at the 2017 T3 Advisor Technology Conference).

Evaluating The Quality Of Solutions With The T3 Advisor Software Survey

While the first step of evaluating potential advisor software solutions is just to know what the various options are – and get some understanding of how they fit together – the secondary challenge is that just knowing what is available doesn’t necessarily provide any indication of what’s “good” to use. In other words, which software actually gets favorable reviews from its advisor users.

Historically, there was very little data available on actual software reviews for advisors. As while there have been many financial advisor software surveys from trade publications over the years, the fact that many of those publications relied on advertising dollars from the vendors limited their ability to comment on the good – and especially the bad – of the various vendor (and potential advertiser) solutions. Accordingly, it wasn’t until the T3 Technology Hub launched its own independent advisor software survey in 2017 – and for the first time ever, surveyed not just what software advisors used, but whether they liked their software or not – that advisors began to get some perspective on which solutions are actually “good” or not.

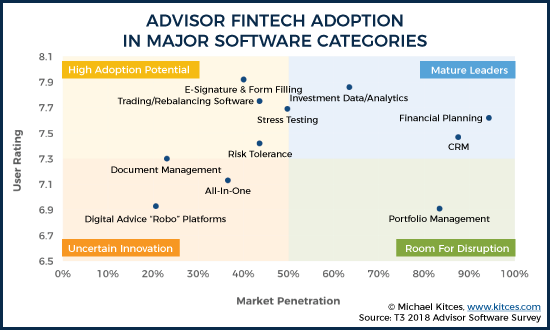

The chart below shows the average Advisor User Ratings of each of the major advisor software technology categories in the latest 2018 T3 Advisor Software Survey, along with the percentage of advisors who reported using at least some type of software in each category, based on a total sample size of 1,554 advisors. (Advisors had the opportunity to rate each software solution they use on a 1-10 scale, and average category scores are weighted by the reported utilization rate of each individual software solution).

As the chart reveals… there is still ample room for improvement when it comes to financial advisor software, where even the highest-rated software categories couldn’t even average an 8-out-of-10 score!

Not surprisingly, when it comes to the “core” advisor technology stack of CRM, financial planning, and portfolio management, all have high adoption (almost by definition of being “core” technology!). However, portfolio management tools arguably still have some room for disruption, showing high market penetration but relatively low reported User Ratings (although a deeper look in the survey results themselves reveals that this is due in large part to the below-average ratings given to “legacy” solutions that advisors still haven’t moved away from, like PortfolioCenter and Advent Axys).

On the other hand, a number of advisor software solutions still have substantial room for growth, showing high User Ratings (which means advisors are happy with the software), but still-low market penetration – including e-signature and form-filling software, rebalancing software, and risk tolerance assessment tools.

At the same time, the advisor software survey also reveals a few categories that are still struggling in both quality (low User Ratings) and market penetration (limited adoption)… specifically, the various forms of “digital advice” and other all-in-one platforms. While there were a few one-off exceptions – in particular, the performance reporting/CRM (but not financial planning) “all-in-one” platform Advyzon (created by Hailin Li, the former product manager for Morningstar Office!) actually had one of the highest User Ratings of any software surveyed – overall, the results suggest that thus far, digital advice platforms may be overhyped, and all-in-one platforms for financial advisors are still struggling to stay competitive against best-in-class standalone solutions in each category (a long-standing problem of all-in-one platforms, as prior-generation all-in-ones like IAS had the lowest score of any all-in-one or digital advice solution).

Drilling Down To Growth And Disruption Opportunities In Advisor Software

While the adoption rates and User Ratings in broader advisor software categories reveal a lot about the current landscape – and where opportunities remain for either growth or new disruption – drilling down further into several of the advisor software categories reveals additional trends (and opportunities) as well.

Portfolio Performance Reporting Software

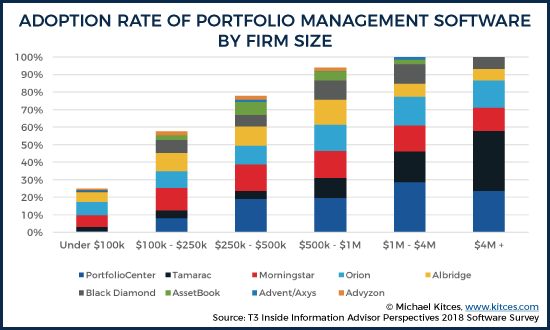

For instance, as noted earlier, while market penetration is strong for portfolio performance reporting software, User Ratings remain relatively low, due primarily to advisors still using “first generation” server-based tools like PortfolioCenter and Advent Axys that haven’t fully migrated to the cloud and upgraded to the depth of capabilities in cloud software today. In fact, PortfolioCenter still has the highest adoption rate of any portfolio performance reporting tools, despite the fact that it has not been actively developed in years, and Schwab announced all the way back in 2013(!) that it was developing a new solution to replace it (which still hasn’t been released yet!).

Which suggests that for any new performance reporting software solutions to gain traction (or for existing players to gain market share), the real focus may not be on rolling out more features, but getting better at helping advisors migrate away from one platform (e.g., PortfolioCenter) to the other (as virtually all buyers of performance reporting tools will be switching from existing software), or offering a “low-end” solution for small firms (where adoption of performance reporting tools remains weakest).

Notably, though, there is still some variability in where the various portfolio performance reporting tools are being used across channels as well – as PortfolioCenter has the highest adoption in RIAs (and thus also where Orion, Black Diamond, and Tamarac appear to be growing fastest by replacing it), while Albridge and Morningstar Office dominate the broker-dealer marketplace (with Morningstar having just announced a new cloud version of its performance reporting tools to stay competitive against the threat of Orion, Black Diamond, and Tamarac).

Yet with the looming appearance of a ‘next generation’ performance reporting tool from Schwab, and the rise of Fidelity Wealthscape’s portfolio performance reporting tools, the greatest disruption in this space may come from these new RIA custodian offerings (especially since Fidelity’s Custody and Clearing division also services a substantial number of broker-dealers as well, where it may increasingly compete with Envestnet’s Tamarac).

CRM (Client Relationship Management) Software

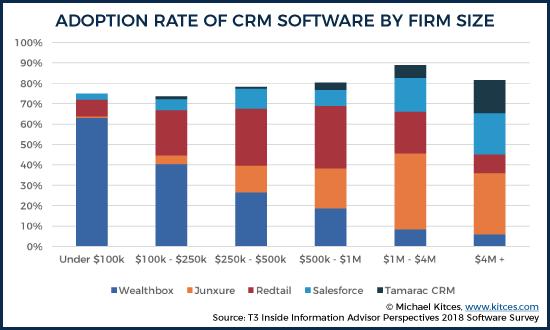

When it comes to advisor CRM solutions, market penetration for advisors continues to grow – which is notable, because up until just a few years ago, the #1 CRM for financial advisors was simply “Outlook” (i.e., managing clients via email, and not an actual CRM).

Notably, though, in the case of advisor CRM, the advisor marketplace also shows the clearest segmentation by firm size, with Wealthbox dominating the small-firm and solo advisor market (under $250,000 of revenue), Redtail showing greater adoption in multi-advisor firms (revenue of $250k to $1M), Junxure working with mid-to-large-sized independent firms ($1M to $4M+ of revenue), and both Tamarac and Salesforce concentrated in larger firms (mostly above $4M+ revenue threshold).

To some extent, this is simply reflective of the fact that newer CRM solutions tend to start with smaller advisory firms and move upstream over time (as Redtail and Junxure did in their early days), and also that the newer players also tend to be less expensive (which matters for smaller firms that tend to be more cost sensitive). But it also reflects the unique “enterprise” CRM demands of larger firms (around integrations, customization, and business intelligence reporting capabilities), for which Tamarac and especially Salesforce are uniquely suited.

In turn, this also suggests that advisor CRM may be one of the most challenging categories for new players to break in to, as a mature technology component that already has strong adoption, and good user ratings, with key players well entrenched at each of the various firm sizes. And as CRM providers increasingly build out deeper integrations and more automated workflow capabilities, the harder it will be for advisors to switch CRMs (as even if client data is portable, workflows are not!).

Financial Planning Software

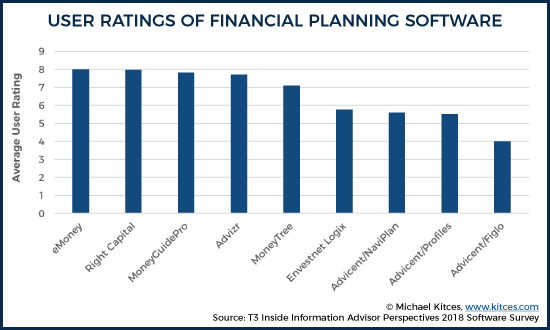

Of the core technology stack for financial advisors, the T3 survey shows that financial planning software actually has both the highest ratings of the three primary categories (which would have been even higher without the high volume of Advicent users giving low ratings dragging down the average), and the highest user adoption. Which isn’t entirely surprising, as even “small” advisory firms that don’t need robust performance reporting yet, and have few enough clients they don’t need a full CRM system, still need financial planning software to do planning with clients.

Yet despite the relative ‘maturity’ of the financial planning software marketplace, with relatively high User Ratings, financial planning software actually shows the highest rate of prospective newcomer disruption – which suggests that there is either still room for new planning software to differentiate, and/or that advisors may be “satisficing” with what they have relative to the alternatives, but still want more overall. In fact, recent newcomers RightCapital and Advizr are already adding up to a combined double-digit market share (nearly 14% in total), and more advisors stated that they plan to try out switching to either RightCapital or Advizr than established market leader MoneyGuidePro. In fact, when coupled with the fact that eMoney Advisor remains second by market share but is the software advisors are most likely to add in the coming year, the question arises as to whether MoneyGuide Pro is at risk of losing its market share lead over the next few years!

On the other hand, it’s also notable that a number of financial planning software newcomers in recent years – including inStream Wealth and GoalGami Pro – didn’t show any material market share at all. A reminder that financial planning software still remains a highly competitive space – compounded by the fact that it’s the software most difficult to switch out for advisors, due to the lack of any portability of existing financial plan projections and data.

The bottom line, though, is that despite some categories of advisor software having more competitive opportunities and openings than others, the landscape of software solutions for financial advisors has never looked better. More and more competitors are emerging in both existing software categories to threaten incumbents – from RightCapital and Advizr challenging MoneyGuidePro, to the rise of Kwanti and YCharts in the world of investment data and analytics aiming to challenge Morningstar and Bloomberg – such that even large firms now often just white label independent software solutions, rather than build their own from scratch.

Yet with the rapid growth of the financial advisor software landscape, it becomes harder than ever to keep track of it all. Which is why going forward, we’ll continue to maintain this map of the financial advisor FinTech landscape!

So what do you think? Has it become more difficult for financial advisors to keep track of all of the many different software options available? Are we currently living in the Golden Age of financial advisor technology? How do you decide which software to adopt? Please share your thoughts in the comments below!