Executive Summary

As owners of financial planning firms approach retirement, some may decide to sell to an external buyer, while others may plan for an internal succession. Sometimes, this succession plan can include the owner's child, providing an opportunity to keep the business in the family. At the same time, the business strategies that worked for the original owner might not be suitable or as successful for their successor, which can force the 2nd-generation owner to take a different path to ensure the firm thrives into the future.

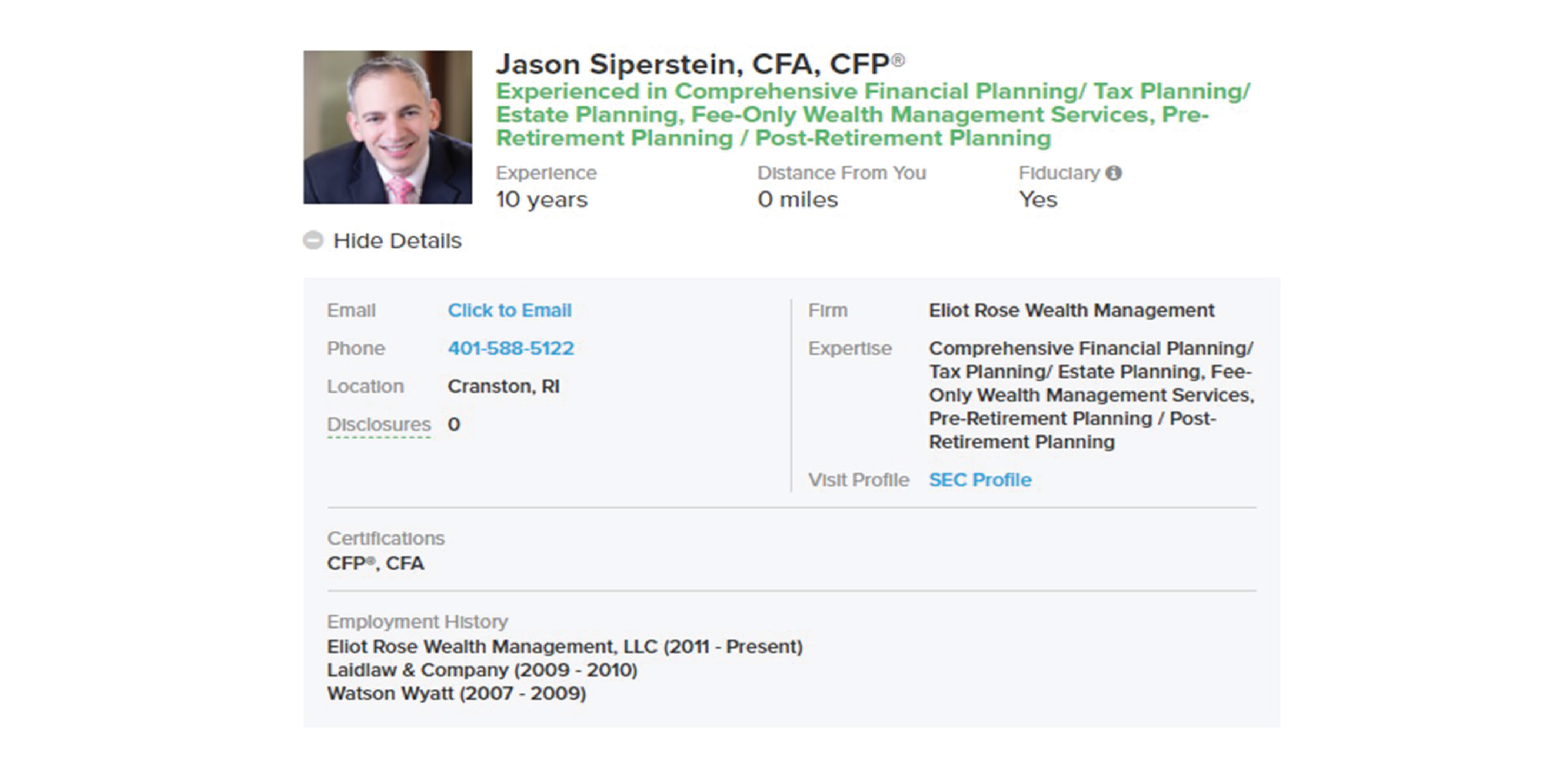

In this guest post, Jason Siperstein, President and Wealth Advisor at Eliot Rose Wealth Management, outlines the range of (often unsuccessful) marketing tactics he tried in an effort to boost business after taking over his father's investment management firm, and the pivot he made to provide comprehensive financial planning services to a niche clientele that has ultimately turned around the fortunes of his business for the better.

Gary Siperstein, Jason's father, had built a successful investment management firm exclusively focused on managing portfolios of small-cap value stocks. But as market trends changed (with the performance of this asset class falling behind large-cap stocks during the 2010s) and clients entered retirement (often consolidating their investment management with 1 advisor), Eliot Rose started losing clients, eventually becoming unprofitable in 2016, the year Jason became president of the firm. To stem the outflow of clients, the firm tried a number of marketing strategies – from creating an off-brand Facebook page, to using print advertisements, and to buying paid referral services – most of which were unsuccessful. With revenue in a bad place, Jason found ways to cut costs liberally in order to stay afloat, saving the company approximately $200,000 annually by streamlining expenses from technology to salaries (including his own and that of his firm's 2 long-time employees).

Jason's next move was to shift the firm away from pure investment management by incorporating comprehensive financial planning for his clients. The firm first implemented an $85/month program for young professionals; this brought in new clients but did not generate revenue commensurate with the time required to service them. Jason then pivoted to offering financial planning services for those nearing or entering retirement, which required the firm to retrain its staff on the ins and outs of retirement planning. This move was more successful, and as prospects started to come in, the firm refined their ideal target client further to individuals within 12 months of retirement, who wanted planning and investment management, and had investible assets greater than $1 million.

Like other firms, the onset of the pandemic led the Rhode Island-based firm to shift to virtual operations, which opened the door to clients from other parts of the country, finding their way through client referrals and internet searches, and even from national publications featuring Jason's content. With more confidence, the firm increased its planning fee incrementally over a 3-year period from $1,500 to $5,400. The firm is now getting more clients that fit their niche (with 1-2 'ideal' prospects each month) and has increased its AUM from $55 million in 2016 to $115 million today.

Ultimately, the key point is that it is sometimes necessary to reinvent a business in order to thrive as time goes by. In Jason's case, this meant being open to experimenting and making changes, staying tenacious and holding on to his sense of humor throughout challenging times, finding the right niche, and focusing on serving his firm's ideal target client, which has turned a once-struggling practice into a thriving business!

When I graduated college in 2007, I felt grateful to have several opportunities out in the 'real world'. The easy choice would have been to return home to Rhode Island and work with my dad at his investment management firm, though we both agreed it would be better for me to gain outside experience first. So, like many recent college business grads, I moved to New York City and worked the grind for 4 years – first at a consultancy, then at an investment bank. It didn't take long for my hair to go gray!

In 2011, I felt ready to make the leap back to Rhode Island, where I would join my dad at his firm, Eliot Rose Wealth Management. My dad and I have always been close, and he is the smartest person I know… so I envisioned this being a dream job. 12 years later, I can confidently say I do have a dream job now, but the journey required a lot of failures, an extreme amount of patience, and total reinvention.

Joining Forces With My Father To Run Our Family-Owned Business

My father founded Eliot Rose Wealth Management in 2002 as an investment management firm exclusively focused on managing portfolios of micro/small-cap value stocks. It was (and still is) a small firm. He was the sole advisor with 2 support staff until I joined as another advisor in 2011. Investing in this 1 asset class was all he (and I, when I first joined) did. While my dad had an exceptionally successful career, his strategy worked… until it didn't. During my first few years at Eliot Rose, I saw many clients leave for 2 primary reasons – performance and account consolidation.

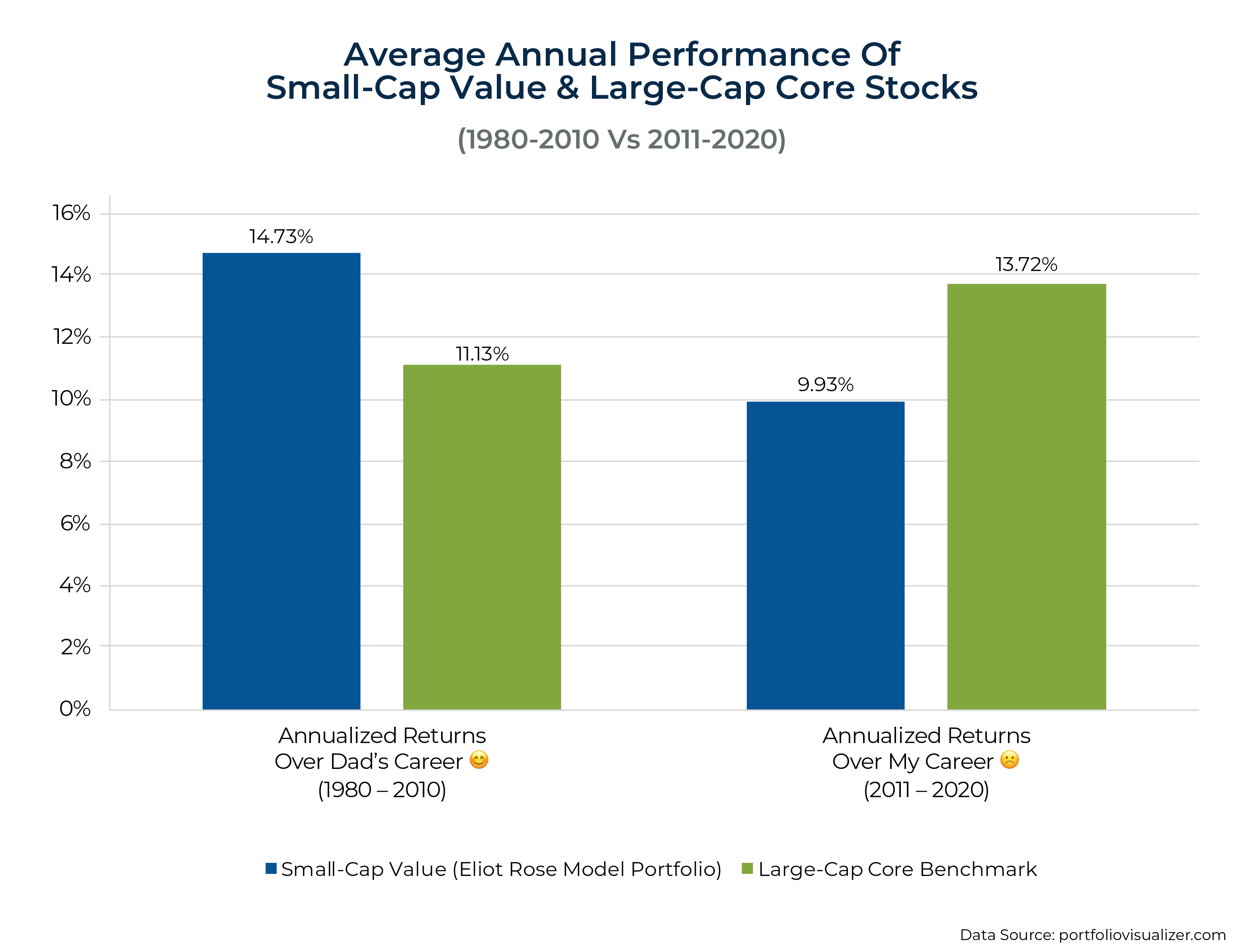

Even though large-cap stocks (i.e., S&P 500) are not the right comparison to judge performance, it was the benchmark clients used to evaluate our success. Unfortunately, once I joined the firm in 2011, small-cap value-stock performance began to decline:

I was surprised but really shouldn't have been. Our category fell out of favor, and we were no longer outperforming the market at large. Put simply, our clients came to us for performance, and left us for performance.

Since we only managed 1 asset class, it was not uncommon for clients to have 2 or 3 other advisors at different firms. Usually, this consisted of another 'specialist' advisor and a 'generalist' advisor overseeing total allocation. It was more work for clients to keep track of their different accounts, but performance compensated for the hassle. However, as they aged, their priorities shifted. My dad was in his 60s, and so too were most of our clients. Clients were nearing retirement and wanted to simplify their lives. Instead of having several advisors, they now only wanted 1 – the one that could manage their entire portfolio and provide planning advice along the way.

Eliot Rose was profitable for many years, though the year I became President in 2016, we became unprofitable, and we hit our company's low in AUM at $55 million and peak in expenses at $800,000. At this point, it was clear that if we did not make a change to our business, we would most likely have to restructure and/or close our doors. One statistic from Harvard Business Review cites that 70% of 2nd-generation businesses fail before the 2nd generation can take over, and I certainly didn't want to be in that majority.

As co-owners of the business, my dad and I were at very different places in our careers. I was in my early 30s and anticipated a long career ahead, while my dad already had a successful career and wasn't particularly interested in maintaining as active a role in the business as he had in the past. So it was easy to convince my dad that we needed to pivot; he was supportive of the idea in general and, while he was still part owner of the business, he was also nearing retirement, which meant that he would be transitioning the business and its success (or failure!) into my hands… no pressure!

Marketing Strategies We Used In An Effort To Improve Business

From my current vantage point in 2023, the improvements we have made as a company since 2016 are remarkable. While the outcome has been great, I want to focus on the process of how we got here because that’s how I learned the most about the industry and myself. Most importantly, our journey highlights the idea that you should not be afraid to take risks in trying new things because it is the only way to find something that works better than what you may currently be doing.

Initially, we knew we needed to make a change, though we didn't know how or what exactly to change. So we tried an unbelievable number of things… and failed at almost all of them along the way. The examples below are not necessarily in chronological order; rather, they are ordered by attempts at growth.

Hiring A Marketing Director

In 2015, we hired a full-time marketing director to help with business development. I'll call him Sam to protect his identity. Sam was not your typical hire as he had no industry experience, though he did have a successful online affiliate marketing company providing passive income. We hoped to use his expertise and apply it to our business. After he passed the Series 65 and became familiar with financial regulations, we were off to the races. We had no issue trying new marketing approaches; we wanted to give him as much free reign as allowable to not stifle his efforts.

Here are a few non-traditional examples of what Sam implemented:

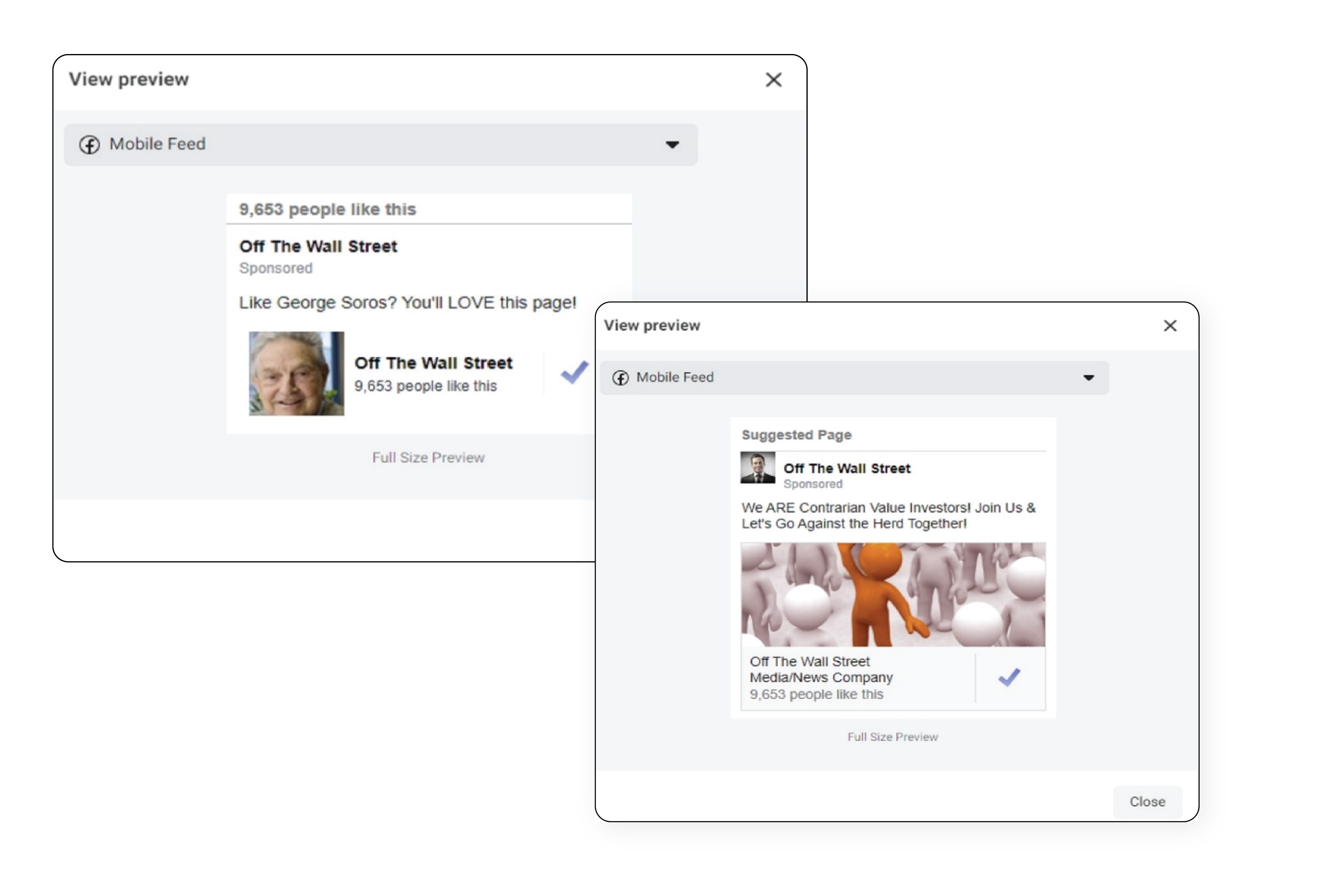

- He created an off-brand Facebook Page, "Off the Wall Street", to build a group interested in finance. The goal was to convert a small percentage of members into paying clients. He viewed it as a numbers game and believed it could work if we kept the acquisition cost low. Before creating the page, we had a long discussion on whether to use the firm name or something else entirely. We ultimately went with the latter because we thought that we would have a better conversion rate.To grow the page, we used Facebook ads like the ones below, which worked quite well. It only took about $500 to gain 10,000 page likes ($0.05 per page like).

Our posts were a combination of 3 things: 1) quotes from celebrated investors, 2) dad jokes about finance, and 3) every once in a while, a call to action to schedule a consultation with Eliot Rose.

We pursued this effort for about 6 months and stopped after getting no takers on the free consultation. We thought about other ways to leverage the group but learned that the majority of members were young DIYers. Looking back on this now, I see many mistakes with this approach. The biggest, in my opinion, was not focusing on a niche, thereby making it difficult to demonstrate our relevant/targeted expertise.

- During the time Sam was building the Facebook page, he tried his luck with a 'snail mail' campaign. Sam's father was a well-known doctor, and Sam thought that maybe he could leverage his dad's last name. As such, we bought contact information on 5,000 doctors in our region.

- He used LetterFriend to ship and handwrite addresses on every envelope because this was known to have a higher open rate than print. Our all-in cost was $1.49/letter, so this came out to a total spend of $7,450. This is the letter Sam sent out:

Dear [Dr. X]:

I won't waste your valuable time. Since you are a doctor, I am sure you have a lot of competition for your attention. Therefore, I will be short and to the point. Read this brief letter if you are interested in potentially improving your investment portfolio.

My name is -----. If my last name sounds familiar, you might know my father, Dr. ----- He has had a medical practice in ----.

Although, I've always admired my father's success in medicine, I was more attracted to business and investing. I began investing as a teenager when my father gave me a few thousand dollars to open an eTrade account. I've stuck with it ever since. Now, I work for a boutique wealth management firm – Eliot Rose Asset Management.

Eliot Rose Asset Management is an investment advisory and portfolio management firm focused on small-cap value securities. In other words, we buy small stocks that we believe are trading below their true values. Many of the stocks in our portfolio are strong businesses you may have heard of that are not closely followed by analysts and this is where we gain our strategic advantage.

It is highly likely that you are already invested in the stock market. However, it is also highly likely that your portfolio does not contain adequate exposure to these small companies.

I would welcome the opportunity for my team to evaluate your portfolio and assess its strength and weaknesses. We will discuss your current portfolio, financial goals, and share our thoughts and recommendations. Our conversations are always confidential.

To best serve existing clients, I am limiting the number of complimentary portfolio evaluations. If you are interested, please call me at -------- or email me at -------. I am also happy to meet with you in person.

For more information on our firm, please visit our website at www.eliotrose.com. I look forward to speaking with you!

I was never the 'salesy' type, and this type of letter made me cringe. But I did not want to step on Sam's toes just because of the way I felt. In the end, the letter yielded no responses… literally none.

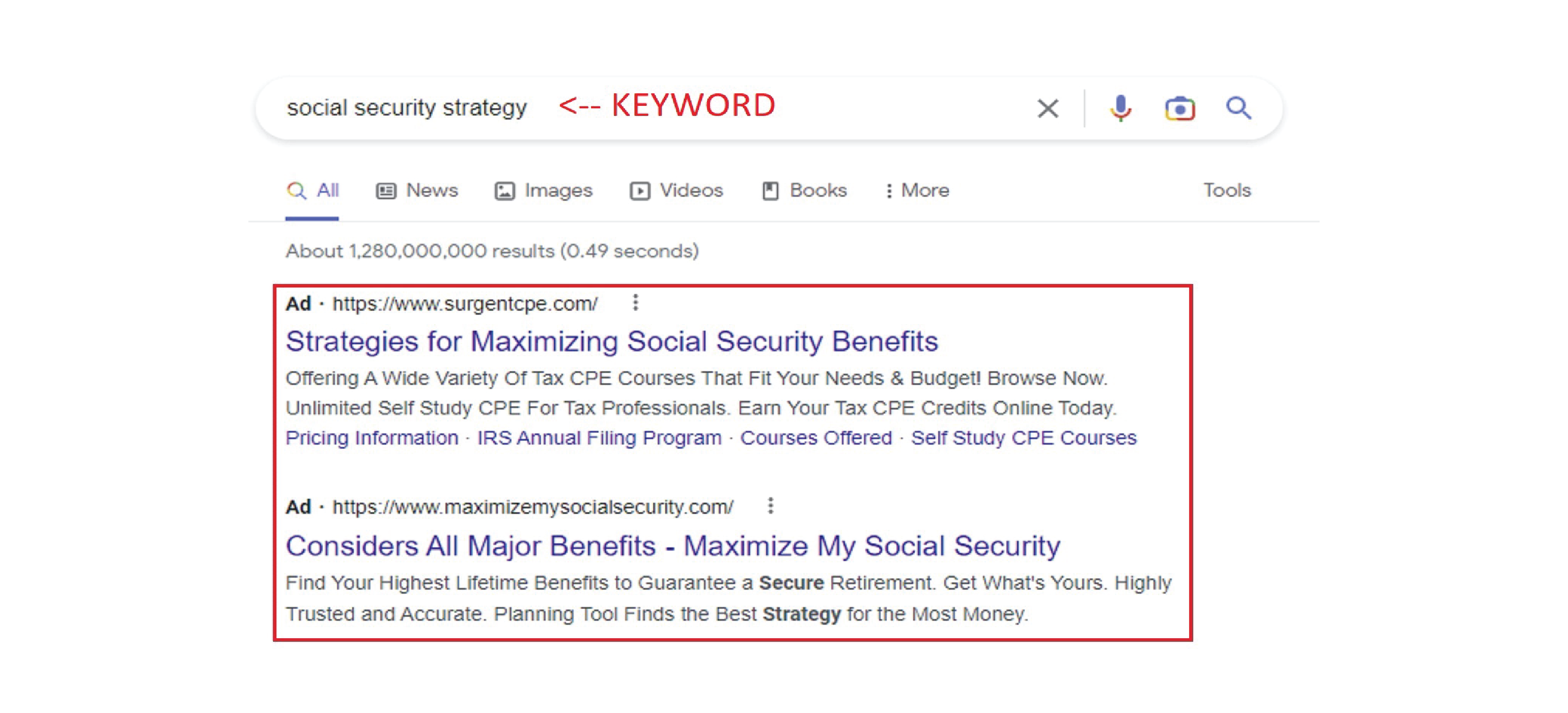

- Another lackluster effort was testing Google Search Ads. This is the type of ad that is placed on top of your search results (highlighted in red in the graphic below). While we were spending around $0.05 per click on our Facebook campaign, we were spending anywhere between $1.00 and $5.00 per click depending on our keyword (example below).

In total, we spent $4,500 testing out this strategy. While I no longer have the ad copy or the landing page available, it produced 3 calls. 2 dialed us accidentally, and 1 called in from Spain.

In 2016, we let Sam go. We spent a lot of money experimenting with marketing strategies (the 3 above are just a few examples). In retrospect, this was more our failure than his. We did not know how to direct him and were hoping for success from what was ultimately a 'Hail Mary' effort.

Generating Awareness And Paid Marketing

We tested out many strategies to generate brand awareness and get in front of clients. In this entire list below, only 1 strategy produced quantified results.

The sections below don't include an exhaustive list of our efforts, but they hopefully give a sense of the range of what we were willing to try. Not only did we spend a lot of money on marketing, but we also spent a tremendous amount of our time researching and implementing each strategy.

Unsuccessful Attempts

- Website Redirects: I purchased 8 different highly searchable domain names and redirected them to our website. The idea was not my own, but one I had heard about from someone I met at a networking event who had success doing this in the 401(k)-planning space. It was a cheap strategy as each domain name and hosting service cost less than $20. These are the sites we bought:

a. howtoinvestinstocks.co ($16.98)

b. undervaluedstocks.co ($16.98)

c. valuestocks.co ($16.98)

d. microcapstocks.co ($16.98)

e. longterminvesting.co ($16.98)

f. valuefund.co ($16.98)

g. highnetworthinvestors.co ($16.98)

h. valuevsgrowth.com ($15.16)

Our total spend was $134.02. Notably, many of the domain names had a ".co" extension. This was intentional and a bet that ".co" would eventually be as popular as ".com." In the end, these extra domain names received no visitors to redirect to our website. It turned out that the person I met at the event started this strategy back when these 'black-hat' tactics could 'outsmart' the Google search algorithm. It's also notable that he was a computer nerd and probably didn't share all his secrets during our short conversation!

- Meetup Networking Group: I created a networking group on Meetup.com called "Rhode Island Young Professionals" with the intent to network and meet potential prospects. At its height, we had 500 members. I couldn't believe it had gotten as popular as it did! However, after hosting 3 events, it was clear this had turned into more of a singles mixer. I clearly explained the purpose of the group in the description, but I guess this is what happens when you bring together a bunch of young (mostly single) professionals! If interested, it is now called Kick Start Networking Professionals and has over 2,000 members (I no longer have anything to do with the group and am not sure if it still caters to singles 😉).

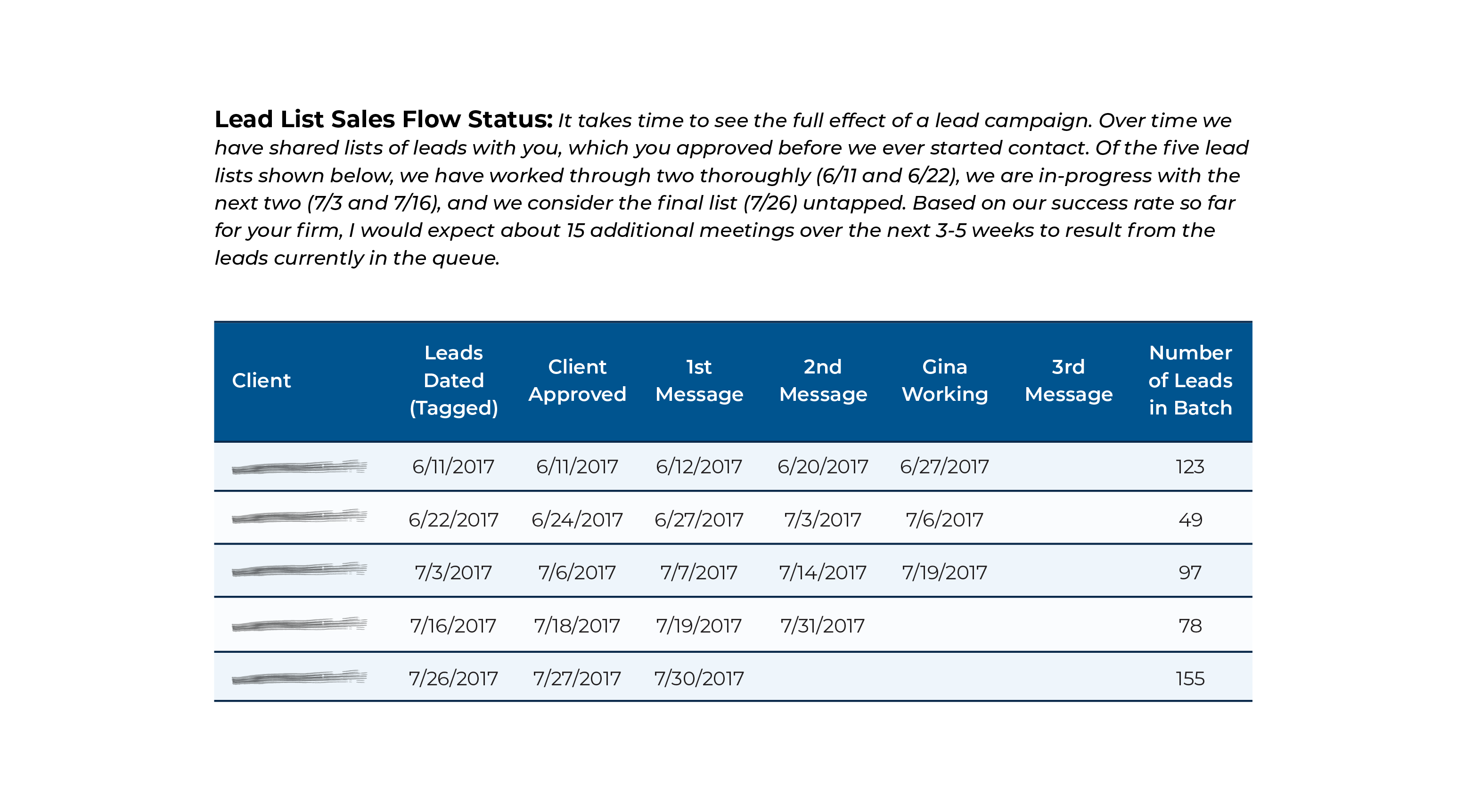

- LinkedIn: We used Milava Consulting (no longer in business) to generate meetings on LinkedIn. The 2-part strategy involved 1) viewing a potential client's profile and 2) asking to connect if they viewed me back. The goal was to send a couple of messages back and forth to generate a call or meeting. Everything was automated by their software.This is an example used in their marketing material of what to expect:

- 19,312 profile views (top of the funnel)

- 1,714 new connections added

- 732 messages sent (points of engagement)

- 573 leads generated

- 502 met the standard to move to a phone call (after we screened out those who were clearly not a fit)

- 10 meetings set, with an estimated 15 additional to be set once all leads were contacted based on the conversion rates already seen in the early part of the campaign (bottom of the funnel)

They charged $1,500 per month, an additional $150 per appointment with a new prospect, and took 20% of revenue in perpetuity. We spent $11,250 in total with Milava net of a small refund. After using them for about 8 months, we had 5 scheduled calls. 3 of those were CPAs and attorneys new to the profession looking to network. The other 2 took the call just to be nice.

- Advertisements: Partners Plus Media, an advertising firm, reached out to us about an opportunity to be featured in funeral papers for 2 local funeral homes for 2 years. It sounded odd, but we were fine with odd. This cost a total of $4,160. Our thinking was if only 1 reader became a client, it would pay for itself. We are still waiting on that 1 reader! Here is the actual ad they designed for us:

- Blog: My psychiatrist wife and I created a blog called MentalCents.com (now owned by someone else), where we wrote about the intersection of finance and mental health. While we wrote a bunch of articles, we never grew the blog beyond 50 subscribers. Both of us were way more interested in (and capable of) sharing knowledge than actually growing the blog.

- Zoe Financial: This is another lead generation service. I believe Zoe uses ads to reach people interested in working with an advisor. There was no cost to speak with prospects, but if a client signed on, there would be a revenue share with Zoe. I think this model involves less risk and less reward compared to Smart Asset. I don't know where Zoe is today, but back then, we only got 8 prospects over 8 months.

Unquantifiable Successful Attempts

- Speaking Engagements: I did free speaking engagements at a large company headquartered in Rhode Island. I spoke at several locations about investing and personal finance. The only investment other than time was the pizza, videographer, and drinks we provided. While this didn't generate new business, it helped me hone my speaking skills and ability to get in front of a large group.

- Newspaper Column: I wrote a monthly column for a local newspaper. I did this for about 3 years and generated 2 meetings over that period. While neither meeting went anywhere, my name was out there in the community as a financial 'expert'.

- TV News: In that same vein, I also appeared as a financial expert on local television This generated 1 prospect (discussed later) with big promise.

- Sponsorships: I sponsored golf tournaments for local hospitals, schools, and organizations. Each tournament cost anywhere between $1,000 and $5,000. Everyone said you needed to golf to get clients, and I never played. So I took a bunch of lessons to become halfway decent. However, I was never the salesy type, and the topic of business never came up! (I think I was hoping for it to somehow come up 'naturally'?) The good news, again, is that my name got out there. And research shows (or at least I told myself) that you need a certain number of touches to make a sale.

Quantifiable Successful Attempts

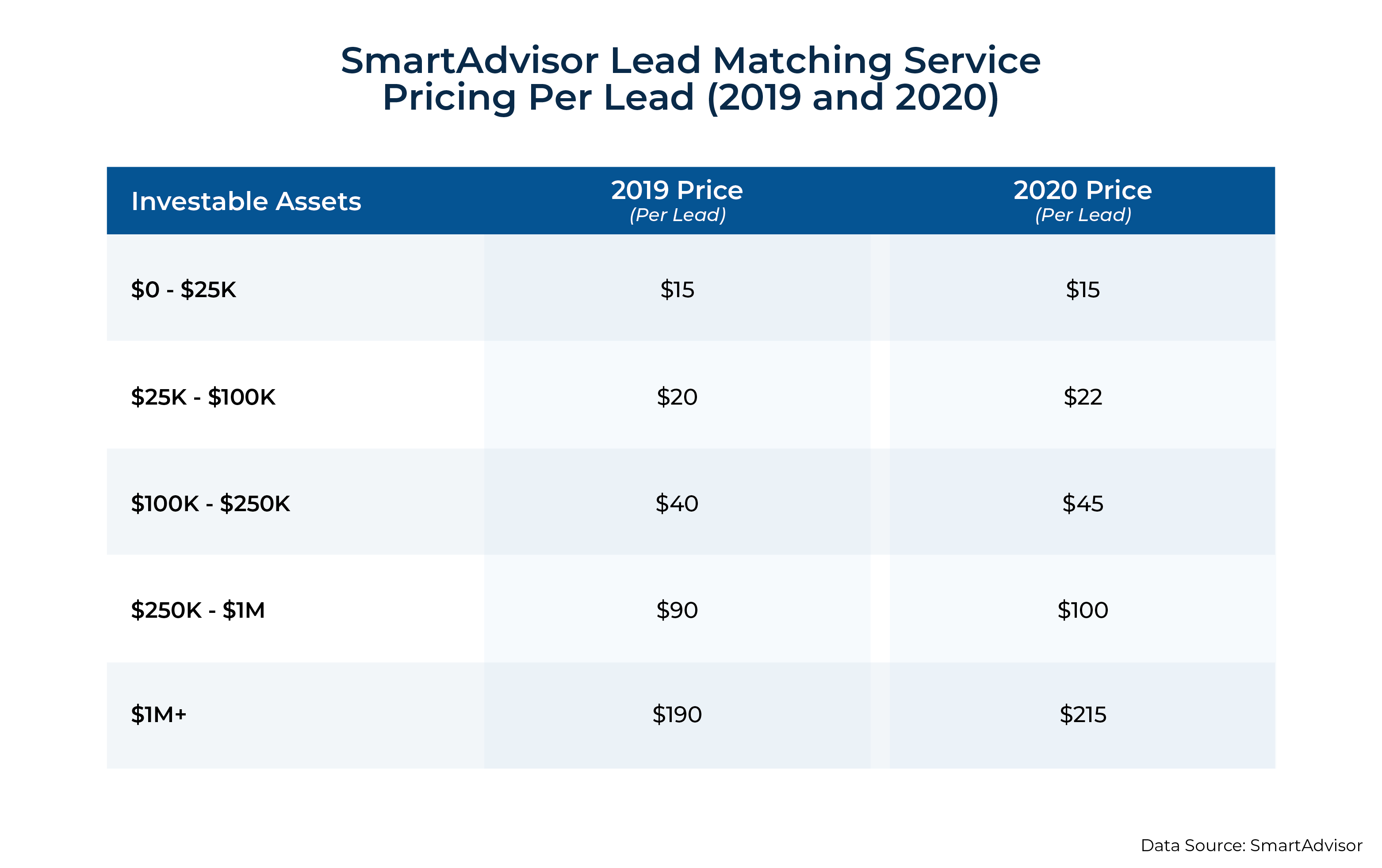

- Smart Asset: Smart Asset has a ton of content on personal finance, and its website receives 100 million unique visitors each month. Some of its visitors are looking for financial advisors, and SmartAdvisor connects these individuals with advisors for a fixed price depending on asset level.

We decided to test this out for 12 months. During this period, we spent $10,300 at a cap of $1,000/month for prospects with at least $1 million in assets. We ended up receiving 48 leads (a handful were good), which broke down to $215/lead.

Of all the things we tried, this produced tangible results! We brought on 2 new clients through this venture, and from 2019–2022 this brought in $60,516 for our firm – a 6x return on our initial investment. If you are wondering why we stopped, it is because it was a BIG time commitment. And as we got busier, we just didn't have the time.

Attempting To Recruit And Acquire To Expand The Firm

While we continuously evaluated and pivoted our marketing strategies, we also attempted to grow Eliot Rose through both recruitment and acquisition. We tried to recruit 3 of my dad's former colleagues from a brokerage firm. They had worked together for decades, and each one had a book of business anywhere between $50–$100 million under management.

Our pitch was that fee-only advisors (like us) would be the way of the future and that we would handle everything aside from business development. Even though we were close to finalizing a deal several times, it never panned out. We made an infographic that we shared with potential hires to further explain our value (note: almost everything contained in the graphic is different today):

In addition, we used Succession Link to find firms looking to sell. It was very difficult to find a good fit, but we eventually found one local firm. They had great people, processes, and similar philosophies. We had several meetings and still talk to this day. However, we didn’t end up moving forward.

Mastering Cryptocurrency For The Wrong Reasons

In 2016, after appearing on a local broadcast about cryptocurrency, I got an interesting call. There was a young investor with about $500 million, all in cryptocurrency, that wanted to liquidate and move to investing in the stock market.

After the client engaged us, our whole team spent much of 2016 and 2017 learning everything we possibly could about cryptocurrency. We became experts in the space and met with this investor monthly. We also met with his attorney, CPA, close family, and friends, and we even updated our ADV to create a concierge model designed to provide 1st-class service for this one prospect.

At the time, liquidating a large amount of crypto was not easy and there were very few legitimate options – it felt a lot like being in the Wild West. After a while, we discovered a principal trading firm, Cumberland Mining, that could get the job done.

We put in many hours and made a total of zero dollars, as this prospect ultimately decided not to liquidate. And then, a few months later, he ghosted us. I don’t think we will ever know what caused him to change his mind. This was a huge heartbreak, though it taught me a lot about running a business and how you shouldn’t do much work until you are paid. Soon after, we developed a financial planning fee schedule for situations when there are no assets to manage. I think we didn’t mind working for free because we ‘knew’ $500 million would hit our AUM upon liquidation.

This period of my professional life was really hard and unbelievably disheartening. I was in my 30s, newly married, anticipated having a child, and was feeling the pressure of a declining business. I knew I could close Eliot Rose and take a job at another wealth management company, probably be compensated well, and not have the headaches of being a business owner. But I also knew there was more to try.

Streamlining Business Expenses

Because I couldn't expand the business and bring in new revenue (yet!), we needed to drastically cut down our expenses. In addition to my dad and me, there are 2 full-time employees who have also worked for Eliot Rose for many years. I consider these 2 exceptional employees to be part of my family: they have worked with my father since the 1980s, watched me grow up, and are the most reliable and trustworthy people I know. I wanted to make sure we could continue paying them.

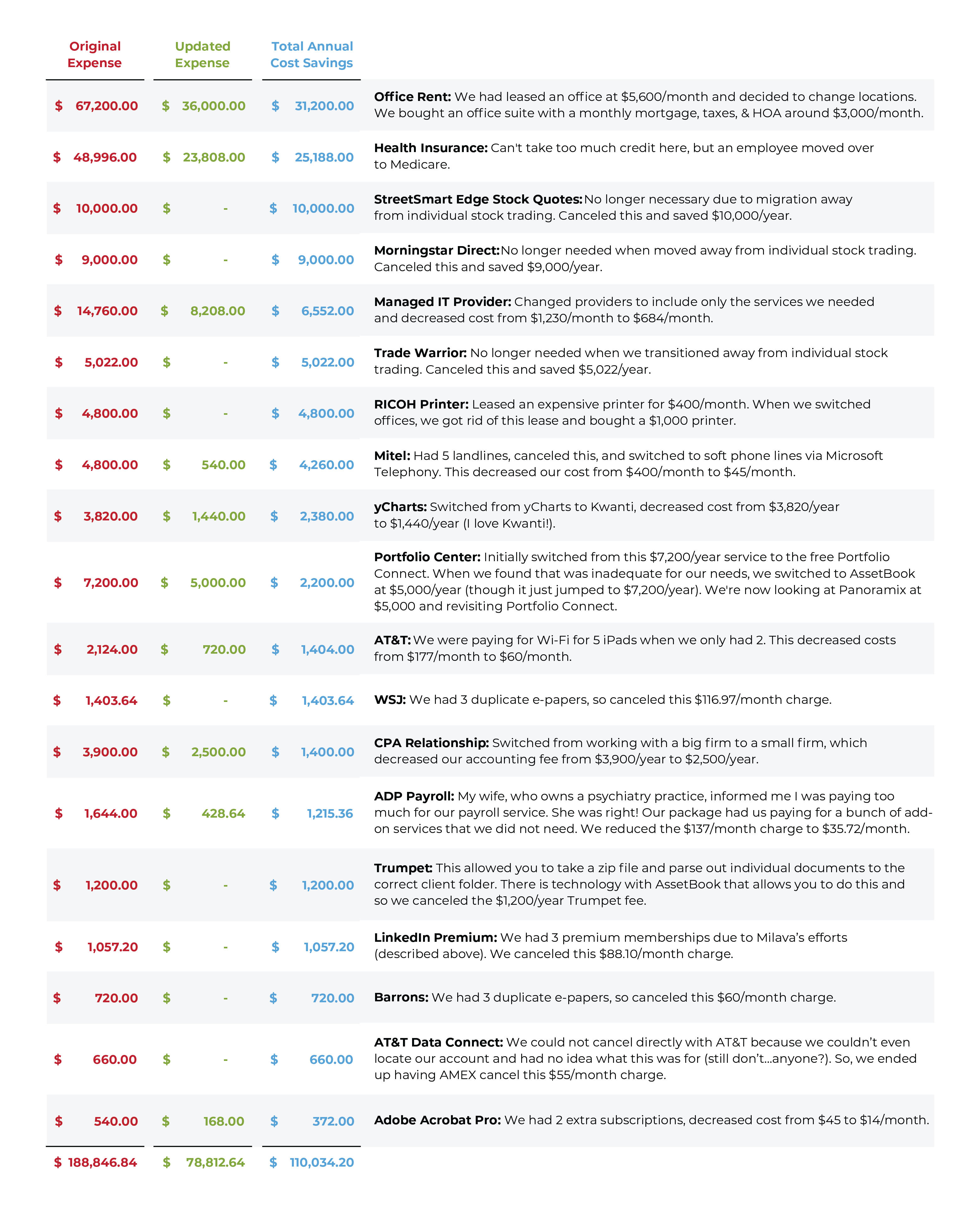

A lot had changed with our business over the years. And when I took a deep dive into our financials, I could not believe how many expenses were no longer necessary. I made the following changes/cuts during 2018–2020:

This list is not exhaustive but represents the degree of excess I found that accumulated slowly over decades in business. When we added everything up, the annual savings came out to just over $110,000!

Cutting these costs was easy and mostly unnoticeable. In fact, this exercise kind of became a game to me, and it was fun to see how much of these office expenses I could possibly reduce. It became apparent that a lot of these goods and services were not useful to our evolving business model, and we were able to find more cost-effective companies to work with that better served our needs.

However, the difficult part of cutting our expenses was having to reduce our payroll by $100,000, which would allow us to save a total of about $200,000 per year in expenses. Of course, when it came to making payroll cuts, I reduced my own salary first, though I also had to reduce the salaries of our longtime employees, who, as I mentioned before, are like family. While they were disappointed with the cuts, they were also understanding. Fortunately, we eventually became profitable again later that same year, at which point we made everyone whole (and then some) in annual bonuses.

The Path To Becoming A Financial Planning Firm

It was clear that our team was open to trying new things; however, our ideas weren't turning into new business. We needed to stop marketing what we were offering – micro-cap value investing – and focus instead on reinventing our offering. We had to develop a service that people needed and already knew they needed.

At the time, there was an industry shift from investment-centric advice to planning-centric advice that was gaining momentum. So, I decided to study for and take the exam to attain CFP certification. Once I received the CFP mark, I made early attempts to implement a financial planning model to grow Eliot Rose by offering plans to current clients for no additional fees. However, our clients at the time still looked to us mainly for micro/small-cap investment management, and most weren't interested in planning or perhaps had their financial planning done elsewhere. While these early financial planning efforts didn't grow into much new business, this is where I learned how to communicate effectively with clients.

While this pivot felt like the right move for our firm, offering 'generalist' financial planning seemed too broad. I think one of the reasons my dad was successful was that he carved out a niche in micro-cap value investing. However, there were tons of generalist financial planners. Why would someone choose us instead of someone else?

We decided to niche down and focus on young professionals. As a young professional myself, I already had a decent network in this space. So, I started an $85/month program for HENRY (High Earning Not Rich Yet) individuals. Most of these leads ended up being young doctors recruited by my wife.

We were finally successful in bringing on new clients. The downside was that we overserviced to prove our worth (perhaps a result of imposter syndrome as a new financial planner?) without much compensation. We brought in 16 clients that required a lot of our time, and the reward was less than $20,000/year. In addition, I learned that I did not enjoy working with younger clients. They wanted to meet in the evenings or on weekends, their goals changed constantly, and they tended to get swept away by the next 'hot' investment. Nonetheless, I found that the idiom "the riches are in the niches" was true.

Shifting To Retirement Planning

I always had an old soul – I even look 15 years older than I am. At weddings and on vacations, the oldest people in the room always gravitate towards me (or I toward them). So, shifting our focus to those nearing or entering retirement seemed natural. And most clients that my dad originally brought on were also in this demographic.

The transition was not easy. We all had to significantly change our roles to support this shift. Previously, I focused exclusively on the portfolio. Investing was the job, and outperforming the market was the goal. The shift required me to put retirement planning first and center. We started learning about Medicare, Social Security, Estate Planning, advanced aging, tax-efficient withdrawal strategies, etc. Investing was now in the background to support life in retirement.

Paul, who previously focused on technology, compliance, and operations, shifted to become our Director of Retirement Education. He learned everything he could about the life changes that occur in retirement. As such, he now joins me in client meetings to advise on the non-financial elements of retirement.

Kris, who primarily focused on client services and allocations, replaced a significant portion of her time with paraplanner responsibilities. While she is not in most meetings, she builds the first draft of our deliverables (e.g., the Asset Map, Financial Plan, etc.). We re-vamped our website to appeal to older clients who were approaching or already in retirement:

We initially offered one-time financial plans for $1,500 per plan. We got a lot of referrals (initially from Google Searches… maybe due to our new website?), which was a startling experience, having not received many referrals for quite a long time and not having an official marketing strategy in place. However, referrals begot more referrals, and even better was that some of these new financial planning clients decided to become investment clients as well.

We were excited but weren't seeing success reflected in our numbers. When we dove into the details, it was because many clients that my dad originally brought on were leaving. They no longer resonated with the direction of the firm. It was like shaking a tree and watching the loose leaves fall off.

When we first offered financial planning, we had very long in-person meetings and gave out lengthy documents that I'm sure no one read. We spent a lot of time on the 'theater' of financial planning, and we had all read the book The New Gold Standard by Joseph Michelli in an effort to recreate the Ritz-Carlton experience and go above and beyond expectations. We baked cookies in-house, brewed coffee and tea, played soft jazz music, had fragrance diffusers, and more.

When we first offered financial planning, we had very long in-person meetings and gave out lengthy documents that I'm sure no one read. We spent a lot of time on the 'theater' of financial planning, and we had all read the book The New Gold Standard by Joseph Michelli in an effort to recreate the Ritz-Carlton experience and go above and beyond expectations. We baked cookies in-house, brewed coffee and tea, played soft jazz music, had fragrance diffusers, and more.

In 2020 we fine-tuned our definition of an ideal client: 1) individuals within 12 months of retirement, 2) who wanted planning and investment management, and 3) who had investable assets greater than $1 million. To deepen our expertise in this niche, I earned the Retirement Management Advisor (RMA) designation.

We felt like we were just starting to hit our stride… and then the pandemic hit (c'mon!). Obviously, COVID has changed the way we all live and work in the world. In March 2020, I had a 5-month-old baby, a reinvented business that was just gaining traction, and a dining room table that became my new office. Like many other advisors, we began doing all our meetings virtually, though we had never once done a virtual meeting pre-pandemic.

Moving virtual meant that we had to shift our infrastructure from one based on physical documents to a cloud-based system of soft documents. Fortunately, my colleague Paul had already started working on making this switch before the pandemic, so the transition was easy and much more efficient. And because I tend to thrive on research, I quickly became an expert in all the best choices for microphones, cameras, and lighting, and I even found a great under-the-desk foot massager (highly recommend!).

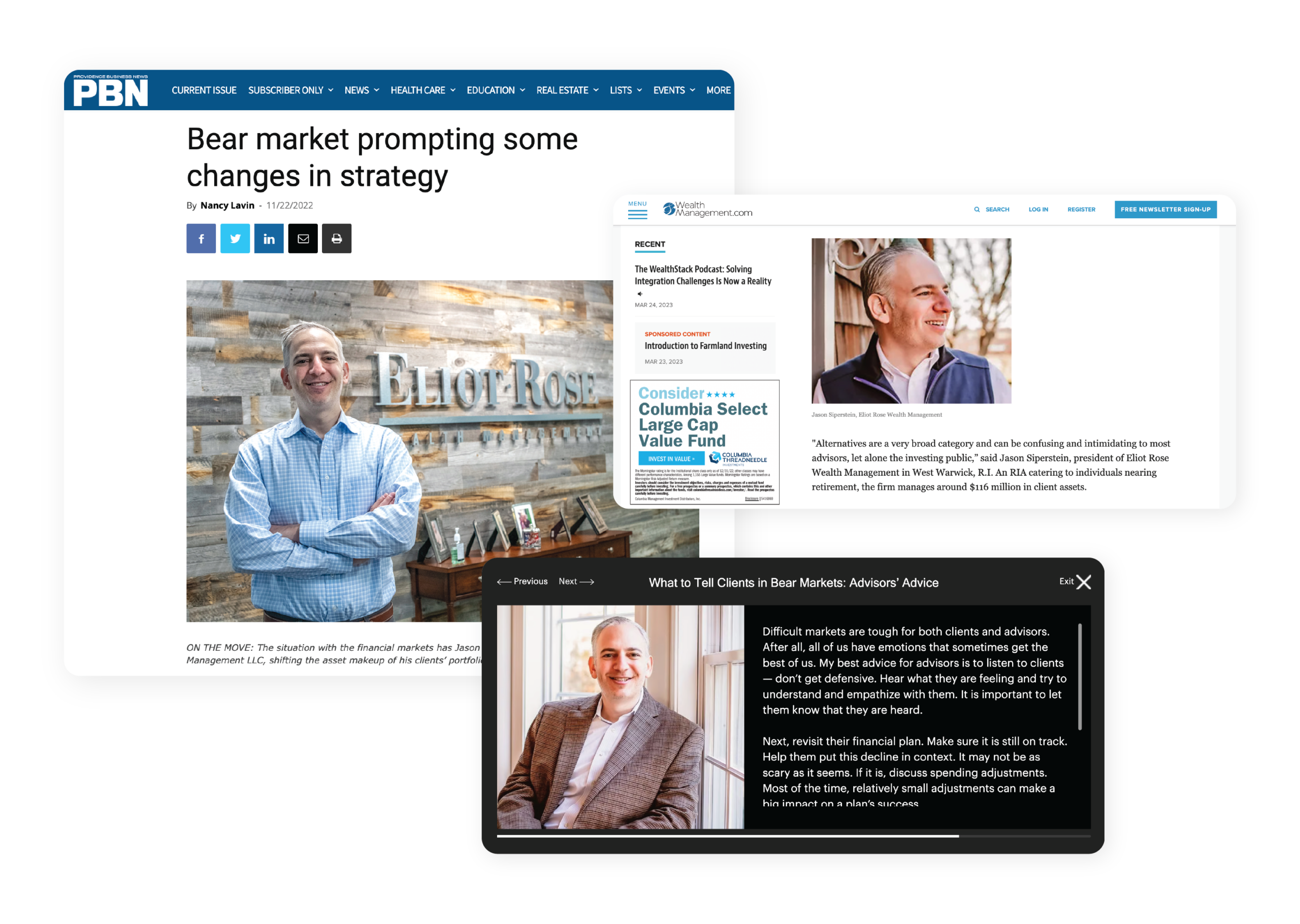

I started responding to press requests for input on stories about retirement planning and investing during uncertain times, which have been featured in many local and national publications.

What we hadn't expected was the pandemic opening up a lot of opportunities for us. Traditionally, our client base had been centered in Rhode Island and Southern Massachusetts. Since the pandemic began, though, a growing number of prospects, and ultimately new clients, were finding us from across the country: California, New York, Oregon, South Carolina, Kentucky, Texas, etc. Many of these new clients were referrals from our existing client base, though some found us through national publications they read or through internet searches. Now, with a virtual business, we can easily meet with many clients across the country.

As our credibility and expertise increased, we started increasing our planning fees incrementally over a 3-year period, from $1,500 to $2,500 to $4,000, and finally, to our current fee of $5,400.

As we increased our fees, we brought on fewer new clients, but these new clients better represented our ideal client. This was the first time we started saying "no" to clients. Our criteria were pretty simple… no more than 12 months away from retirement, investable assets over $1 million, and likable. From time to time, we will budge on retirement date and asset level, but never on personality mismatch.

Where We Are Now

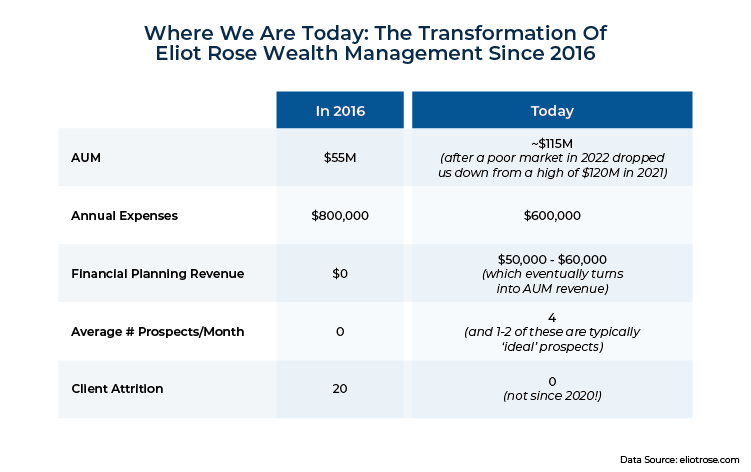

Even though the transformation may be complete, it doesn't mean our journey is over. While our story might come across succinctly on paper, our process was arduous; it was an absolute grind and took about 5 years (2016–2021). There were countless moments when we felt like giving up, though we stuck with it even through a laughable number of failures.

Keeping this family business (which is named after me and my sister) in business was really important to me. Eventually, when things finally started falling into place, it felt kind of surreal!

In 2016 we had $55M in AUM and $800k in expenses. In 2021 we reached a high of $120M (today, we are at about $115M after a poor market in 2022) and have $600k in expenses.

In 2016, we had no financial planning revenue. Today we have about $50,000–$60,000 in financial planning revenue that eventually turns into AUM revenue.

In 2016 we had 0 prospects per month. Now we have an average of 4 new referrals per month, of which 1-2 are 'ideal'.

In 2016 approximately 20 clients left, and since 2020 not a single 'ideal' client has left.

Throughout this journey, I have also tried to constantly check in with myself. I feel happy and genuinely fulfilled in walking through life with my clients in both the good and bad times. It has been rewarding, as clients are incredibly appreciative and I have also been able to take on some pro bono work.

Overall, I have learned that it is important to measure success through both objective data (like AUM, number of prospects, portfolio performance, etc.) and the subjective experience of doing the actual job and finding a satisfying work/life balance.

Ultimately, what worked for the founding generation (my father) didn't work for the successor generation (me). Though… that was okay; we were able to reinvent and grow the business to one I am incredibly proud to run. Importantly, I learned the power of believing in myself and enjoying the journey – not just the destination!

Leave a Reply