Executive Summary

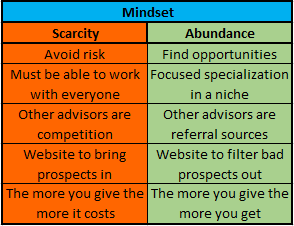

For some clients, the focus of financial planning is just about protecting the limited resources they’ve got. For others, it’s about maximizing the potential of what their financial resources and their lives can become. The mindset of clients as they approach the world can have a significant impact their behavior.

Yet this mindset of abundance versus scarcity is not unique to clients; in fact, as financial planners our view about the world also shapes our behaviors. For instance, some become active as volunteers in the industry to get involved, give back, and even network for referrals, while others see little purpose in getting involved in a professional association with “the competition” – even though the reality is there are still more than enough clients out there for everyone.

The challenge is that, just as with clients, an excessive fear of scarcity – whether its assets and financial resources, or potential clients for the advisory firm to grow – can actually lead to outcomes that result in scarcity. Extremely conservative investment clients can actually find that inflation undermines their own financial goals, and advisors who are so fearful that there are too few clients can end out wasting time trying to convince mismatched prospects to work with them (even though it won’t be a good fit in the end). So what’s your mindset, and how does it shape your (business) behavior?

Abundance vs Scarcity Mindset in Financial Planning

The inspiration for today’s blog post was a concept once posed to me many years ago by financial planner Jon Guyton, who pointed out that in doing financial planning with clients, some people seem to have an overall mindset of scarcity in how they approach all their (financial) issues, while others have more of an abundance mindset. And the differences in how they plan and prepare for challenges are profound.

The inspiration for today’s blog post was a concept once posed to me many years ago by financial planner Jon Guyton, who pointed out that in doing financial planning with clients, some people seem to have an overall mindset of scarcity in how they approach all their (financial) issues, while others have more of an abundance mindset. And the differences in how they plan and prepare for challenges are profound.

For instance, the scarcity mindset that views money as an extremely limited resource may obsess about hoarding and protecting it, to the extent that the client may be altogether fearful of spending and enjoying it at all. How many of us have seen clients who are genuinely wealthy yet terrified of running out of money, and afraid to use any of their money for their own enjoyment?

An extreme scarcity mindset can lead to severe risk-averse behaviors, often to the point of long-term self harm. For instance, a scarcity view around money might lead a younger person to just save cash flow instead of investing it into themselves and their career, ultimately hindering income growth and making future money more scarce (despite the savings itself). Similarly, a “Money is so scarce I can’t risk much/any of it in the markets and have to keep most/all of it in cash” attitude may drive portfolios to be so conservative that the long-term damaging effects of inflation really do make money more scarce in the future! Sadly, most of us have seen these kinds of problematic and even self-destructive scarcity-minded issues arise with clients.

By contrast, the clients with an abundance mindset are remarkably different. They may be more inclined towards taking risks – recognizing that money lost is something that can be made back again in a world of abundance – but the distinction is more than just about risk tolerance. The abundance mindset doesn’t necessarily ignore risks, it’s simply about seeing the opportunities that lie beyond them, and perhaps a recognition that the world is a dynamic place that will always be changing and presenting new opportunities along the way.

Notably, the abundance versus scarcity mindset isn’t just about clients, though. It’s an issue for all of us – including as advisors – and in practice, I find it affects many of us in how we run our own advisory businesses and conduct our affairs, as much as in how we actually craft advice to clients.

Abundance vs Scarcity in Industry Volunteerism

An excellent example of abundance versus scarcity mind amongst advisors is in our behaviors in getting involved with and volunteering for membership associations like FPA and NAPFA. For some, it’s an opportunity to get involved, to give back, or to network and build connections. For others, they ask “why would I want to do volunteer work with my competition?”

While I have written in the past that financial planners are experiencing a crisis of differentiation – we say we’re experienced credentialed advisors who provide customized individualized financial plans for our clients and deliver great service, but it’s not a differentiator when we all say it – the problem exists only because we have brought it upon ourselves by remaining an emerging profession of generalists and not moving towards specializations and niches (yet).

In truth, we are not literally in direct competition with each other much at all, for the simple reason that there are about 316 million people in the US, comprising about 115 million households, of which nearly 1/3rd have more than $100,000 in net worth (not including their primary residence), over 15 million have at least $500k, and almost 10 million of them are millionaires. Which means in a world where there are “only” about 70,000 CFP certificants to do financial planning, there are 142 millionaires and over 500 mass affluent households per advisors, while most of us make our living with no more than about 75-125 active client households (and it’s not clear our brains can even handle more than about 150 total relationships).

In other words, clients may feel “scarce” because so many of us are going after the same “target market” (if we want to call “people who can afford my services” a target market, which it’s really not!) with the same undifferentiated solution, but the scarcity is caused by how we have narrowed our target clientele and the way (or lack thereof) we differentiate what we do! In reality, the number of potential clients is still quite abundant, and for those who have a clearly defined niche – and work and volunteer with other advisors who have different niches – the opportunity of networking with advisors is that it is not a competitive environment but actually an opportunity to generate cross-referrals! For example, planners with Garrett Planning Network (hourly planning) and XY Planning Network (planning for Gen X and Gen Y clients) often gather referrals by establishing relationships with other advisors who have a different target clientele!

Simply put, while the scarcity mindset would imply there’s no reason for industry volunteerism with “the competition”, an abundance mindset reveals that in the end there are still more than enough prospective clients to go around for all of us… at least once we focus our businesses and choose a (more) clearly defined target clientele!

Abundance vs Scarcity in Marketing

The abundance versus scarcity mindset is also clearly illustrated in the way that most financial advisors market themselves.

For example, I find that it’s still incredibly rare for advisors to share the most basic of consumer information on their websites and marketing materials, like how much their services cost and what their minimums are. The reasoning usually goes something like this: “I prefer to have a conversation with prospective clients about the value that I provide and the associated cost, to be certain they evaluate my services appropriately. In addition, this allows me the opportunity to evaluate whether the prospective client might be a good long-term fit, even though he/she doesn’t meet my official minimums [e.g., someone with less in assets but a high income making large annual contributions to savings]”. The underlying message of the approach: potential clients are so scarce, I believe it’s a productive use of my time to meet with every single person who could possibly be interested in talking to me, just to have the opportunity to hopefully convince one or two to become clients.

By contrast, marketing with an abundance mindset is about putting as much information on your website as possible, including your pricing/fee schedule and also your asset/client minimums, and letting the website be the screening process that ensures the only prospective clients you sit down are those who have already qualified themselves as people who are willing to pay your fees and meet your minimums (as if all that is clearly stated on your website, the only people who should contact you and those who are already comfortable with those amounts/limits/thresholds!).

Accordingly, with an abundance mindset, the goal of marketing as an advisor is to get your valuable information out to as many people as possible, recognizing that if even just a few need some additional help to implement the advice you will have as many clients as you can handle. At that point, your website is not a marketing brochure to tell people what you do, it’s actually a filter to limit who contacts you to only those who really want to do business with you (saving you time from go-nowhere prospect meetings along the way!).

In the end, our view about the world and its opportunities – or perceived lack thereof – can significantly and dramatically shape our actions. And as you might have guessed from the tone of this article, my own view is certainly one of abundance over scarcity; it shapes everything from the amount of time I put into this blog and sharing content with all of you my readers, to the time I volunteer with the membership associations, to how the websites of my various businesses are structured in a world where my own personal greatest challenge has been learning how to filter and say “no” to the sheer number of opportunities that arise.

So whether it’s going through the planning process with clients who are limiting their own success with a scarcity mindset, or taking a fresh look at your business and evaluating whether a scarcity mindset has become your own self-limiting factor, hopefully the idea of an abundance mindset may help to look at the world and what you do in it a little differently!

So what do you think? Do you approach your advisory firm with a mindset of abundance, or a mindset of scarcity? Has it impacted the decisions that you make in how you operate and try to grow your business? Does it impact the advice you give to your clients? Do you see this mindset distinction present in the decisions that your clients make for themselves?