Executive Summary

For those who are retiring, their income needs for the remainder of their lives will be funded by their financial capital - the numerous assets that have been accumulated in various types of accounts, that can either generate income directly, or be systematically liquidated to free up necessary cash flows. For younger clients, though, the reality is that their "human capital" - the ability to generate earnings from their labor - is actually the greatest asset on their balance sheet, and financial capital simply represents human capital that was converted to income and saved rather than spent.

From this perspective, the reality is that for younger clients, financial planners can bring significant value to the table by helping clients to enhance and maximize not just their financial capital, but also their human capital. Sometimes, it may even be better to invest in the client's career than a tax-preferenced retirement account, and many clients unwittingly fail to diversify between their financial and human capital.

Accordingly, in the future firms that are aiming to serve younger clientele should consider adding "career asset management" services, and advising clients on their career decisions, and not focus too heavily on "just" the financial products clients need to purchase or the assets they have available to manage. In fact, such services may be especially conducive to an ongoing retainer-style financial planning engagement, and become a way for advisors to bring value to the large number of underserved Gen X and Gen Y clients. And of course, clients who are effective maximizing their human capital in the early years may even become the clients with the most financial assets in the future, too!

Defining Human Capital

The concept of "human capital" is relatively simple: as human beings, we have the potential to labor, create products, and/or render services in exchange for compensation (in the past for barter and trade, in today's modern economy for money that can be used to fund various consumption needs). The more income we can generate, and/or the longer we're willing to do the work, the greater the economic value of our worker capabilities. Accordingly, the total value of our "human capital" is simply the (net present) value of our future earnings potential.

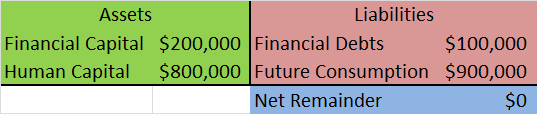

Ultimately, as we work and labor, we convert our human capital potential into actual income and cash flow, which in turn we can choose to spend (consume now) or save in the form of financial capital (to consume later). In fact, viewed from this perspective, arguably then our primary source of wealth as human beings is actually our human capital, and our financial assets simply represent the portion of our human capital that we chose to save for future consumption rather than spend at the time it was earned (supplemented, perhaps, by an outside inheritance). In fact, we could show a client's balance sheet as a combination of assets in the form of financial and (lifetime) human capital, against which we have financial and (lifetime) spending/consumption goals. If our lifetime assets exceed our lifetime liabilities, the remainder is positive and we will leave a financial legacy behind; if the remainder is negative, we are living beyond our means and need to either decrease our liabilities (spending) or increase our assets (earn more or work longer to expand our human capital).

The moment of retirement represents the point where human capital goes to $0, and our remaining consumption needs for life must be dependent upon financial capital alone. Conversely, in the earlier years, total wealth may be dominated by potential human capital, as little has yet been earned and saved in the form of financial capital. Accordingly, we also purchase disability insurance to protect against the risk that the value of our human capital - especially in those early years when it represents the dominant portion of our wealth - might unexpectedly experience a precipitous decline as a result of an accident or significant change in health.

Planning For Human Versus Financial Capital

The reason why this distinction between financial and human capital matters is that just as we engage in financial planning to help clients maximize their use of financial capital, so too can we engage in financial planning strategies to maximize their human capital. In fact, for younger clients - where the size of human capital may dwarf the value of their financial capital - effective human capital planning may actually represent the greater opportunity to add value!

For instance, over a multi-decade working career, helping clients to negotiate a raise, or earning some additional income from consulting or self employment, can have a dramatic financial impact. Similarly, when human capital is viewed as an asset that can be invested in and enhanced, it even raises the question of whether young people should focus on saving more in the early years, or instead trying to reinvest into their careers with job skills that can secure a future raise may be an even better deal than contributing to a Roth IRA. Overall, the reality is that for many clients, helping them negotiate a 1% raise will have drastically more financial impact than trying to generate another 1% of returns.

In addition, it's notable that sometimes planning lies at the intersection of financial and human capital. For instance, from the perspective of total balance sheet diversification, arguably those with more stable human capital can afford to take more portfolio risks, while those with volatile human capital should invest far more conservatively. Thus, for instance, a government worker or a tenured professor might have an aggressive portfolio, while a salesperson or an athlete might be invested far more conservatively... leaving both with comparable volatility on their total balance sheet. Similarly, when an individual's human capital is already tied to their company and industry, it becomes even clearer why their financial capital shouldn't be concentrated there as well.

And of course, in practice many clients will make decisions about one part of their balance sheet to help the other. For instance, choosing to work longer and adding more years of income to the picture can help to shore up a shortfall of financial capital (as can choosing to spend less and reducing the 'liability' of cumulative future consumption).

Financial Planning Services To Enhance Human Capital

So how does this fit into the framework of services that a financial planning firm provides to its clients?

The first is to simply recognize the intersection of decisions about financial and human capital, from recognizing that sometimes investing in the human capital is a better decision than saving financial capital, to the fact that sometimes the risks of one may need to be balanced against (or diversified away from) the risks of the other.

The second is to acknowledge that there is a material potential benefit for financial planners to provide advice for clients about their careers, and that "career asset management" is a significant value proposition under itself. Envision a world where financial planners don't only compare investment performance to benchmarks, but also help clients benchmark their compensation given their job duties and capabilities, help them make decisions about which investments in education and job skills may have the biggest payoff, and even assist them in taking a break from the workforce to reinvest themselves into a new more lucrative career path. In the meantime, planners might engage clients with Ramit Sethi's "Earn 1K" program to help start generating income on the side, or the kind of guidance that Sethi includes in his video below:

Certainly, for advisory firms that concentrate on retirees and near-retirees, the benefits of a focus on human capital will be limited; quite literally, the clients will have nearly depleted their human capital at that point, and their financial capital will be the larger of the two, and the one justifiably most deserving of attention. But for younger clients, particularly those in the Gen X and Y demographics, human capital may represent a far greater opportunity and value-add, and a way for advisors to provide value for those who don't have the financial assets to purchase traditional financial products or engage on an assets-under-management basis. In fact, human capital advice services - and the ongoing nature of the opportunity as the client's career unfolds over time - may be a particularly effective service to wrap into an ongoing monthly retainer style business model for serving the younger demographics.

The bottom line, though, is simply this: for a huge number of clients, especially amongst those who are not already retired, human capital is not only an asset that can be managed, advised upon, and enhanced by good financial planning, but may actually be the largest asset on the client's balance sheet. Isn't it time to give that asset more financial planning attention? Or are you one of the few who are already providing value to clients in this area?