Executive Summary

With the ongoing rise of technology commoditizing pure investment management, a growing chorus of critics are raising the question of whether the AUM model is “toast”, or at the least that financial planning fees may soon need to be unbundled from AUM fees.

Yet a look at the most recent Investment News and FA Insight benchmarking studies reveals the exact opposite trend: the most profitable and highest growth firms continue to be those that embrace the AUM fee, and are not adopting financial planning fees en masse. And in fact, the larger the advisory firm, the more likely the top performers are to focus solely on the AUM model!

In fact, the benchmarking data reveals that the only firms successfully implementing standalone financial planning fees are the smallest “solo” advisor firms who tend to serve the least affluent clientele – for whom planning fees may be effective simply because their clients don’t have the assets to fit an AUM model in the first place (and also because they don't have the overhead demands of large firms).

More broadly, what this data suggests is that to the extent there is any rise in the use of standalone planning fees by advisory firms, it is primarily being done by firms serving clients who can’t even be reached as effectively by the AUM model anyway (i.e., they don’t have a large amount of assets available to be managed), rather than competing head-to-head with the largest AUM firms that continue to be more profitable and capable of reinvesting more to outgrow their non-AUM competitors!

The Rise (And Fall?) Of The Advisor AUM Fee Model

The Assets Under Management (AUM) model has experienced explosive growth amongst financial advisors in the past 15 years. In the early 2000s, the Moss Adams advisory industry benchmarking survey pegged the average independent advisory firm with just $25M of AUM, but by 2008 the typical firm was over $100M of AUM, and that amount grew to nearly $200M of AUM in the most recent 2015 industry benchmarking survey. Another even more recent study found that in the aggregate, advisors now derive more total revenue from fees than commissions, an astonishing shift in just a decade or two, given the industry’s deep commission-based roots.

Yet in parallel to this trend, recent years have witnessed the rise of the robo-advisor, and more generally technology’s ongoing commoditization of pure investment management services. Advisors are being driven to differentiate themselves by providing financial planning and wealth management advice beyond just portfolio management alone, and the growth of advisory firms away from investment management services is raising the question of whether it’s also time to migrate away from investment management business models – i.e., the AUM revenue model. In fact, industry commentator Bob Veres has already suggested that “the AUM fee is toast” and it’s only a matter of time before advisors transition en masse to financial planning project and retainer fees as an alternative.

Nonetheless, the caveat of all this concern and criticism is that the AUM model appears to be remarkably robust. The behavioral finance research suggests that because clients don’t like writing checks and prefer less “salient” payment mechanisms, alternatives to the AUM model – like hourly or project fees – may have difficulty gaining traction. And although it has become more popular amongst independent advisors in recent years, the roots of the AUM model date back literally hundreds of years in the world of asset management services (back then, primarily for trusts and wealthy merchants at sea).

In fact, arguably the biggest change to the AUM model in recent decades has simply been that a compensation model historically only available for the ultra-high net worth client and institutional firm has been “democratized” to an ever-larger share of “merely affluent” clientele. A trend that’s only accelerating with the entrance of mega-financial services firms like Vanguard Personal Advisor Services and the retail segments of Schwab and Fidelity.

Of course, if a change is going to occur, it has to start somewhere. One of the best opportunities to identify new trends in advisor business models is to look at the aforementioned industry benchmarking surveys, and see what they show in terms of the “best practices” of advisory firms and their business models. So what does the data show regarding the AUM fee and the prospective rise of non-AUM alternatives like hourly, project, or retainer fee models?

Adoption Of Non-AUM Planning Fees – Top Financial Advisory Firms Vs The Rest

In today’s environment, the two leading financial advisor benchmarking studies are those produced by Investment News (in collaboration with Philip Palaveev’s Ensemble Practice), and from FA Insight. In both studies, the researchers examine the metrics of a broad swath of advisory firms, and compare them to the subset of firms that have the best profitability and growth, which are dubbed the “top performers” group.

So what do we see when we look at how top performing advisory firms are using AUM vs non-AUM fees, compared to the average advisory firm?

Investment News 2015 Financial Advisor Compensation And Staffing Study

The latest Investment News Financial Advisor Compensation and Staffing Study came out in 2015 (based on 2014 business data).

The advisory firms in the study were segmented into four groups:

1) Solo advisory firms – which have one owner, but may include several staff members and vary from $100k to over $1M of gross revenue

2) Ensemble firms – which have multiple owners (and staff) working to build a common business, sized up to $5M of revenue

3) Enterprise Ensemble firms – multi-owner ensemble firms that have grown to more than $5M of revenue (generally $500M+ of AUM)

4) Super Ensemble firms – the largest multi-owner ensemble firms with over $10M of revenue (generally $1B+ of AUM)

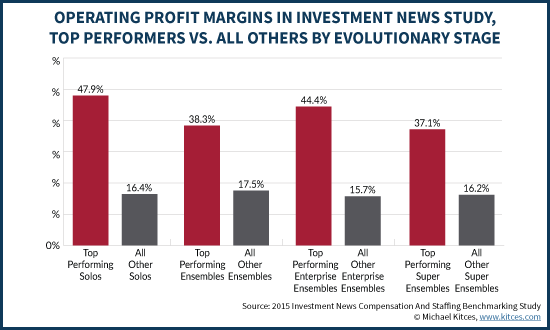

As noted earlier, the researchers then analyzed the business strategies of top advisory firms by segmenting out those with the highest profit margins and growth rates. And as shown below, there was in fact a substantial difference in the profitability metrics of the top advisory firms versus the rest!

So when it comes to the revenue models of the “top” advisory firms versus the rest, what does the Investment News study show?

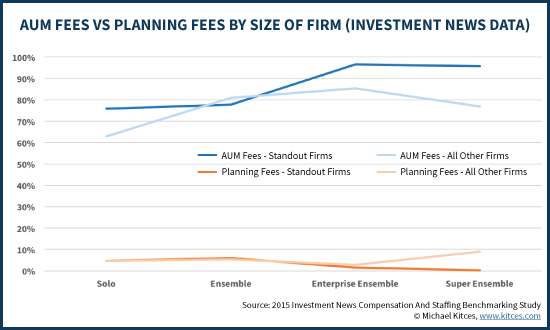

Broadly speaking, revenue amongst advisory firms can be broken into three categories: AUM fees, planning fees (which may include hourly, project, or retainer fees), and “other” revenue sources (which includes commissions paid on new business, commission trails on old business, and other forms of solicitation or third-party revenue-sharing fees).

As the chart above shows, there are some clear trends in how the “top” most profitable and fastest-growing advisory firms structure their revenue, versus the rest. Top performing firms are more likely to rely on AUM fees over adopting planning fees. For the “Ensemble” firms in the middle, efficient staffing and infrastructure appears to drive profitability more than fee structure, but as firms grow larger, they become more and more likely to focus purely on AUM fees, to the exclusion of planning fees (and the elimination of commissions)! In fact, the most successful of the largest advisory firms do so little in planning fees, that it rounds down to 0%!

FA Insight 2015 “People And Pay” Study

Similar to the Investment News study, the FA Insight “People And Pay” study was also conducted in 2015, based on data from the trailing 2014 fiscal year.

Also similar to the Investment News study, the FA Insight research segments advisory firms into multiple groups by size. However, FA Insight defines its group categories slightly differently, as follows:

1) Operators – which have one owner, may or may not have employees, and generate $100k to $500k of revenue

2) Cultivators – larger one-owner “solo” firms, typically with multiple supporting staff members, and generating between $500k and $1.5M of revenue

3) Accelerators – multi-owner ensemble firms with a large and growing staff, generating between $1.5M and $4M of revenue (akin to “Ensemble” firms in the Investment News study)

4) Innovators – the largest multi-owner ensemble firms, with $4M+ of revenue (a combination of the “Enterprise Ensemble” and “Super Ensemble” firms from Investment News)

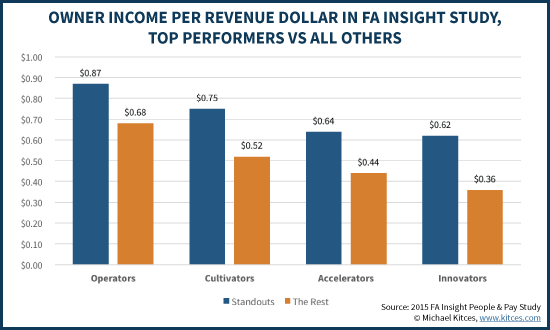

As with the Investment News study, FA Insight then examines the differences between the “standout” top performers (by profits and growth) versus the rest. (Notably, “profitability” is analyzed slightly differently; Investment News focuses on profit margins of the entity, while FA Insight “standout” profitability is based on the total “take-home pay” per owner – a combination of both profit margins and the owner’s salary compensation in the business. Nonetheless, both studies are similar in identifying top/standout firms based on the amount of net income they generate.)

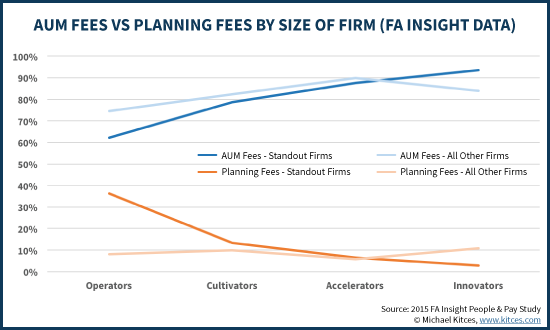

So when it comes to the FA Insight firms, how do the revenue models of the standout firms compare to the rest, in terms of the breakdown between AUM, planning, and “other” (commission-based) revenue sources?

From a size perspective, the results of the FA Insight affirm the data from Investment News: for the largest advisory firms (FA Insight “Innovators” include both Enterprise and Super Ensembles in the Investment News data), the most profitable advisory firms are the ones that focus the most on AUM fees. For the largest of the standout firms, they are significantly more likely to use AUM fees and less likely to charge planning fees! (And similar to the Ensembles in the Investment News study, the Accelerators in FA Insight have similar revenue models between standouts and the rest, as their profitability is driven by staffing and infrastructure decisions.)

However, because FA Insight delves deeper into solo advisory firms (Investment News groups them all together, while FA Insight segments “smaller” Operators versus “larger” solo firms as Cultivators), a notable counter-trend occurs amongst the smallest advisory firms: for solo Operators, the top standout firms are substantially more likely to focus less on AUM and charge significant planning fees (still a smaller component of total revenue than AUM fees, but drastically larger than other Operator firms, or firms of any size in other categories).

The Business Problem With Non-AUM Fees For Large Advisory Firms

So what should advisors make of this trend that the most profitable advisory firms actually eschew planning fees (and commissions) to focus almost solely on AUM fees (and focus more and more on AUM fees as they grow to a larger size)?

To some extent, the trend shouldn’t actually be surprising. While some advisors have lauded the stability of planning fees – especially recurring revenue retainer fees – as a virtuous opportunity to defend against a potential bear market, the reality is that because markets go up far more often than they go down, eschewing AUM fees is more likely to forfeit fee increases than to buffer against fee declines.

In fact, to a large extent the superior profitability of AUM-centric fees is simply a reflection of the current 7-year bull market we’re currently in. That’s the whole point. When markets go through a significant bull cycle, the profit margins of AUM firms expand as portfolios (and the associated AUM fees) rise, allowing the firm to both build a buffer against the inevitable future bear market. Thus even though AUM fees do take a hit in a bear market, the firm still ends out significantly larger and more profitable in the long run.

In addition, because markets growth at a real rate above inflation on average, tying the revenue of the firm to AUM fees ensures the firm will have the long-term growth in revenue-per-client to give steady compensation increases to the staff serving those clients. In other words, to the extent that a retainer-fee firm has trouble raising their retainer fees every year (as the saliency of retainer fees tends make them “sticky” with clients and more resistant to increases) while staff expect annual raises, the profit margins of the advisory firm get squeezed over time. AUM-based firms don’t have this problem as the rising tide of markets lifts revenue as well, allowing more room for staff raises.

In this context, it is also easier to see why solo Operator firms become the “exception to the rule” for the success of charging standalone planning fees: because they’re the firms with the fewest staff members in the first place. In other words, to the extent that “flat” planning fees creates a long-term squeeze on profit margins due to staff raises, the smallest firms with the fewest staff face the least potential squeeze and the most success using planning fees.

Notably, though, even in the FA Insight data, the planning-fee-heavy solo Operator firms are actually still smaller on average (with 22% less in total revenue) than the AUM-fee solo Operator firms. They become “standout” firms with superior profitability because they also tend to serve 22% fewer clients, and therefore rely on fewer staff to service their clients, allowing their solo owners to take home a larger share of the firm’s smaller revenue base as profits. (To some extent, the same is true of Cultivators as well, where standouts are slightly more likely to charge planning fees and average 12% less in revenue, but are more profitable because they serve 5% fewer clients and manage to operate with slightly less staff overhead expenses.)

AUM Fees For Wealthy Clients, Planning Fees For Smaller Ones?

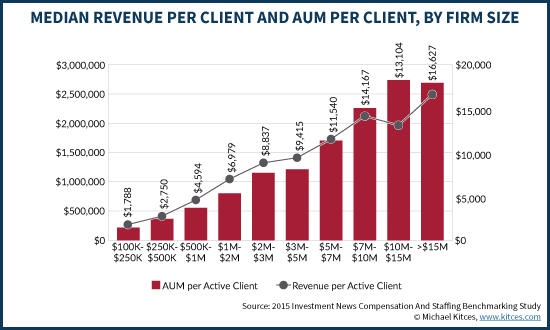

Another notable distinction in the industry benchmarking trends is that not only do firms differ in their use of AUM vs planning fees by size – with the largest and most profitable firms the least likely to adopt planning fees – but they also differ in who they serve… given the well-documented trend that the largest advisory firms also tend to have the wealthiest clients in the first place.

In other words, when we’re talking about the tendencies of “large firms vs small firms”, we’re also talking about how advisory firms tend to serve “wealthy vs smaller clients” too. And in this context, a different trend begins to emerge: advisory firms are tending to use AUM fees for their wealthier clients, and planning/retainer fees for their smaller clients.

To a large extent, this trend makes perfect sense. AUM fees work well for wealthier clients who have assets, and who are already accustomed to paying AUM fees. And the profitability of the larger firms serving the larger clients gives them the capital to reinvest into further marketing and growth and bring in the highest volume of new clients.

Conversely, AUM fees are less effective for smaller clients, in many cases because the smaller clients don’t even have assets to be managed via an AUM fee in the first place. Classically, such clients have been deemed “unprofitable” by advisory firms – or are the kinds of clients that hybrid advisors service by selling commission-based products. So, for the (smaller) firms who are serving these (smaller) clients, planning fees appear to be emerging as a viable (non-commission-based) alternative to work with them profitably. (So profitably, in fact, that solo advisors serving small clients are actually one of the most profitable segments of all advisory firms!)

More broadly, though, what all of this suggests is that – at least based on the latest 2014 data – there is zero evidence that financial planning fees are undermining AUM fees. Instead, the situation appears to be the exact opposite – the firms most focused on the AUM model are the most profitable, and the larger advisory firms that are most capable of attracting the wealthiest clients are the most likely to be sticking with AUM fees. To the extent that non-AUM-fees are being adopted successfully at all, they tend to be offered by the smallest advisory firms, serving the least wealthy clients, for whom planning or retainer fees are more effective in part because those clients may not even have the assets to fit an AUM model.

In turn, this implies that if non-AUM planning or retainer fees do grow in adoption in the coming years, they are more likely to grow amongst new segments of clients who don’t fit the AUM model in the first place – in other words, that planning and retainer fees are opening new markets of clientele to be served, while remaining less profitable than AUM fees for the clientele who actually have assets to be managed and fit the AUM model in the first place. Which means firms considering a switch to, or expansion into, a retainer fee model may be better served to think of it as a way to reach new non-AUM clients, rather than a path to convert their existing (and currently profitable) AUM clients to what may be a less profitable business model in the long run (especially for the largest firms with the most staff to squeeze their long-term margins!).

(Michael’s Note: A special thanks to Matt Sirinides from Investment News, and Dan Inveen from FA Insight, for their timely responses to follow-up questions and willingness to provide further slices of their benchmarking data!)

So what do you think? Is your firm focusing on AUM fees or planning fees? For which types of clients are you using planning fees – those who could also be served by AUM fees, or those for whom AUM fees wouldn’t have been a fit anyway? Please share your thoughts in the comments below!

Michael. many thanks for this industry update. It’s hardly surprising that the annuity model proves more profitable than the hourly one, as the annuity model allows advisory firms to leverage their time investment many-fold. As a client advocate, I am looking for the exact opposite, as the one proven fact in investing is that expenses serve as a risk-adjusted dead-weight loss. I’ve been rather frustrated in trying to find high-quality, independent, un-conflicted HNW hourly advice (what you are terming planning-fees) for my newly widowed mother. I’m looking for someone who is laser-focused on cost control and simplicity, but who understands complex taxation issues (including asset location, disclaimers, and handling trusts), asset location, and has a robust asset allocation model. Any hints?

For numerous practical reasons no good advisor would ever want to go exclusively on the hourly model so it’s not surprising you’re having issues. I know people who tried hourly and quickly ran away from it.

Besides you’re only trying to find hourly because you think it’ll be cheaper, but when you actually do find a good advisor charging hourly you will scream when he tells you its $500 an hour and then bills you 4 hours for every “minor” project you have him do.

The next thing you’d find out is that 75% of this industry (largely legacy salesmen in their 50s) who apparently are already charging too much (by your implication) are really not that good at offering financial advice. So the remaining 25% who are at least somewhat good know they don’t have to jump through a bunch of hoops to get or keep clients.

To give you a sense, I live in a major metro and have a pretty good idea of most of the firms and the overall talent in my city. There are probably 4-5k individual practices if you include the wirehouses. There are only 2 firms (about 5 practices) that I know that have fee schedules under .5% for those over $1 million that I would trust to offer anything worthwhile in “complex tax matters” and estate/trust planning. I don’t know of a single good firm that does hourly only that I would trust to provide that kind of value. I am aware of a few that do offer a hourly to some sophisticated clients, but they don’t advertise it anywhere.

There are others as cheap or in a couple cases cheaper, but not much that came out of their mouth would be worth anything in my mind.

Also all expenses count against future asset growth. Your Starbucks habit counts against your future growth in the exact same way as an AUM because it was spent and not saved. There is no difference between a percentage fee and the same amount in dollar fees or other expenses. And a really good advisor can in most cases recoup the cost of their AUM fee in tax savings alone.

Lastly, an AUM fee assessed against a pre tax IRA has an implied deduction and an hourly financial planning bill is only probably an itemized deduction subject to AGI floor. So what you’re looking for is also not all that tax efficient.

I would expect the largest firms to charge by AUM since they have been around the longest (in general) and have used the “standard” pricing model during that time. That doesn’t mean that AUM is best for all of those clients. Just like the “Top of the Table” life insurance salesman use a lot of permanent insurance – it can be great for the client in some cases but not all.

The flat retainer model I use undercuts the cost of the AUM fee for my $500k-$5M clients by 50%+ and still is a fair price to me and for the client (like in your recent post on what an hour is worth TO THE CLIENT). Also, by not working on a project/hourly basis, my clients pay a recurring fee deducted from an investment account for on-going help. The fee is reviewed every two years so I can increase it fairly as needed, but I don’t need to squeeze every available dollar out of the client either.

Of course, I am Operator/Solo advisory firm and I left the AUM fee model because of my views on how to serve my clients the best, so I’m sure I’m biased…

Elliott Weir

I don’t disagree with your statement Elliott. I do however, find it curious that the retainer model advocates emphasize the cost savings of the retainer model on large accounts $500k-$5M, understandably so, but fail to acknowledge the reverse for smaller accounts in that the retainer model, if applied fairly across the board, often will cost the client more than the AUM model, in fact, the smaller the account, the greater the fee disparity relative to the AUM. Of course, it all depends on the fees, etc. You can’t have it both ways.

I also think there is a bit of a “turn a blind eye” going on in the industry in pursuit of the smaller clients in that I don’t see the nobility of putting young people on the retainer model for “ongoing” planning services when their planning needs are modest. The retainer model simply is one more monthly bill young people are paying instead of building wealth. I think the question I would like to see Michael really address is if the “retainer model” on young clients over charges for the services they really require. I think the industry, as a whole, greatly exaggerates the amount of “annual upkeep” needed to keep abreast of one’s “financial plan.”

It seems to me this all about nothing. Vanguard has pretty much set the bar as to where this is all heading over the next decade or so. The fee structures, regardless of how computed or marketed are all going to eventually gravitate to “all in” between .03% for Vanguard and .05% for independent firms with a more personal touch.

I agree that for small accounts, the retainer fee model may not be preferable to an hourly fee. For a $100k account, you’ll have a hard time finding an adviser to work with (assuming a 1% AUM fee, with or without a B/D taking 1/2 of the fee).

I have a few of them that I help on an investment-only basis for $99/mo. If they are young and all they need is investment management (not more comprehensive advice), they aren’t a good fit for me anyway and a robo-advisor can do that.

Because of that, my target market is in the $500k-$5M range. More specifically, my focus are divorced/widowed women who want/need the significant personal touch to get them organized and back on their feet. With them, I have enough “clay” to do some great things, but without the needs/expectations of the $5M+ clientele.

We’re considering moving to net worth pricing. Are any of you? This eliminates the conflicts of debt repayment and to me, better aligns us with the client objective.

In theory it’s the most logical form of pricing, in practice it looks like a nightmare to implement.

-Creates an incentive for client to deliberately not mention assets or downplay value of outside assets.

-Creates disagreement for harder to value assets like real estate.

-Requires arcane billing procedures

-Requires more frequent discussions about cost

-Requires more paperwork to implement billing procedure

-Account aggregation breaks frequently and there is a limit to how much you want to bother clients to get things working again. Now you’re pricing is dependent on annoying old clients into logging in and reentering credentials.

Michael is finally coming around to the fact that there really isn’t anything wrong with the AUM model other than people being too damn lazy and short sited to see it as a moving retainer that covers all your services and not a severely overpriced investment management fee to put another person on a near one sized fits all model that maybe involves 20 min a year of labor.

If it isn’t broke, don’t fix it. Liquid net worth in aggregate tracks total net worth reasonably well. Billing procedures are streamlined and if you’re like us and you typically meet with clients twice a year, why would you want every other meeting to require taking about fees again and needing them to sign another agreement/form for the new updated fee amount. No thank you.

And lastly(and most importantly) you’re screwing the client if you do it that way. Advisory fees from pre tax qualified money already have an implied deduction so they’re only paying ~2/3 of the states cost. But if you bill direct or against a non qualified it’s an itemized deduction subject to AGI floor. So if their income is too high or they don’t itemize than you screwed them out of an implied deduction.

As Michael said above, focus more on differentiating on what you deliver, not the way you charge. Nothing bothers me more than a bad advisor (who does zero quality planning work) changing the way they charge and then picks up a holier than though attitude throwing around terms like “conflict of interest” in order to make it sound like everyone else is screwing the client; meanwhile he’s still the same bad advisor focused more on getting to 4 hour work weeks (Tim Ferris) than delivering any value to anyone he works with.

I’m not saying the above is you, but the vast majority of the AUM model haters are precisely the types or people I mention above.

We’re a successful firm based completely on the AUM fee. I’m talking about the conflict that occurs when a client asks you about paying off debt… or liquidating real estate, business, etc… Obviously those decisions can significantly affect our compensation. I’ve always thought this was a better way to do it… but until aggregation game along, it looked ugly.

Now we’re calculating net worth at least annually… we have the billing data. By the way, the fee would be reassessed annually and charged quarterly… not with a new contract but with the existing contract adjusted by the new net worth.

We want to have those sticky conversation about the non liquid assets… aligning our interests with the client by charging less, on more, seems like a better way to do it.

What custodian do you use because I know more than 1 that requires the client to sign paperwork annually authorizing non AUM fee payments.

My attitude is that if the debt payoff makes sense (or the 401k, HSA, 457, etc. contribution or the capital contribution to busines or the gifting or whatever) than that is precisely what I’m going to recommend. I really don’t concern myself with the change in revenue because:

A) I don’t ever want to feel entitled to revenue from a client just because I got $x last year. Human psychology is amazing where a client gives me $5k and you’re pissed off because it was $6k last year if it wasn’t for them moving up in a house. I don’t ever want to fall in that trap.

B) It really does balance out. At the same time you have 1 client drawing for something outside you have another bringing something from the outside in.

C) I have a deal in my head. If they’re paying my fees per fee agreement and transferring assets when they come available, then I’m never going to think about my revenue considerations when giving advice. I just say what I would do if I was in their shoes. It’s not right to expect a client to always transfer a 401k to you when they switch jobs, but then feel bad recommending sums of money under your management leave. Its disengenous.

Now at the same time I would never recommend people distribute a bunch of money to pay off a large mortgage balance either. For non callable debt if it’s not effectively at least a couple points above the treasury yield curve for its term structure than I don’t see any good reason why someone should try to pay it off earlier than required.

If you somehow thought everyone should payoff a 2.5% effective rate 30 year fixed mortgage than yeah maybe finding a way to bill against illiquid real estate would make more sense.

And I will admit that we took a close look at Net Worth based fee as well and might take another look. I just want to say that there are quite a few issues that make it one I wouldn’t want to go in lightly.

At the very least pilot it on for a new program paired with a new service for only a few clients first.

We work with 4 custodians.

I know you’ll say that you can resist the conflicts over time. We all do. But they are still there and I’d like to eliminate them. By the way, that is the argument that commission salespeople make. “I alway recommend the best strategy for my client regardless of my big fat commission” Baloney. I’ve been on that side.

In my experience, people generally follow financial incentives. Me included.

And yes, this would first be offered to our best clients and select new ones.

I really appreciate your vigorous defense of the status quo. You gave me some things to think about.

I’d love to see Mr. Kitces tackle this.

While I completely agree that people generally follow financial incentives, that doesn’t automatically mean that you do or that all people do. Nor do I think that “I was just following the incentives that were there” is an adequate defense for you giving bad advice.

News Flash: There is no way to “eliminate conflicts”. Every pricing structure has them. Hourly firms over bill hours and care less about output. Retainer people will try to set up barriers to overutilization and also care less about output. Hedge Fund pricing encourages excessive risk taking. AUM encourages people to ignore what isn’t under their management and focus on avoiding overutilization of their time (of which reverse churning is only one example). Commission gets people to focus entirely on the initial few meetings and then ignore their clients after they sign and also forces advisors into limited investment options to match their comp requirements. And you’re net worth pricing will force people with assets you have nothing to do with into paying on them. Both AUM and Net Worth pricing are imperfect substitutes for complexity as sometimes higher net worth people don’t have more complex financial lives and some with lower net worth people do have really complex lives. Don’t think you solve that by going to flat retainer model though as you’re either giving everyone a 1 sized fits all service model or you’re overcharging your less complex clients to subsidize your more complex clients. The worst in my opinion, is the notion that you’re somehow helping the client by charging them extra to analyze how much term insurance/DI they need. A small term insurance policy or supplemental DI already pays little, certainly not enough to cover the hassle factor involved when you do it right, and somehow it’s more pure to charge the client more money over the commission and have someone else collect it all. Now if there *legitimately* existed a wide array of cheaper commissionless insurance that would be great, but for the time being that isn’t the case; yet I still have to listen to people who charge the client more acting like they’re somehow special for doing it.

And it sounds like you spent time in a wirehouse where a culture that could careless about the client pervaded. I’ve been fortunate enough to never have spent time in a wirehouse, bank, or any type of captive firm. I deliberately avoided them because I knew quite a bit about the industry before I joined it and I didn’t want to sell my soul.

But I will tell you this, the problem of those environments is not caused by the way they charge. Those places get infected by a cultural virus and that same cultural virus could take your “Net Worth Pricing” and find a way to treat clients like meat.

And I’m not providing a vigorous defense of the status quo because right now the status quo is the idea that the only thing that differentiating is the way people charge. The status quo is also one in which simply providing a Money Guide Pro output is considered cutting edge. The problem is that people don’t want to spend the time to change planning deliverables, and that is because no one (including the Fee Only crowd) wants to put in the hours of labor it takes to learn 10+ new subjects and think through how to offer that level of service, and then spend the time to execute it. That requires a lot of effort and instead they would just rather make some pricing method change and act like they’re a revolutionary for it.

Regarding your comment: “Don’t think you solve that by going to flat retainer model though as you’re either giving everyone a 1 sized fits all service model or you’re overcharging your less complex clients to subsidize your more complex clients.”

Flat retainer doesn’t necessarily mean the SAME retainer for all clients. My flat retainer is flat per-client, but I have three tiers (under $250k, $250k-$1M, and $1M+) that serves as a proxy for value I can add to their situation.

Then there really isn’t that much separating you from AUM based pricing then as that really is all AUM fee is (if you’re using assets as a primary proxy). Also, if you’re offering different pricing to each person than you’re required to maintain a very clear methodology for charging or a regulator can fine you (they’ll hit you for favoritism and not uniform pricing) or at the very least give you a deficiency letter.

I’m also guessing that if you’re giving your clients the choice of direct billing vs. drawing from their NQ account, most will ask that you take it against the account (assuming you don’t try to influence them towards one). Reason: Because clients see direct billing as directly impacting their cash flow and ability to spend. At least that has been the case in the few instances where we had to retainer an amount because they wanted a service package that their AUM didn’t qualify for.

Lastly, since you’re mostly yardsticking to AUM, but not quite then you’re also screwing the client out of a better implied deduction. Having fees paid by a pre-tax IRA is superior to NQ or direct billing for tax purposes (and actually direct billing financial planning fees could conceivably be challenged as non deductible since it’s arguable not an investment expense). This is the primary reason why I’ll probably never completely move off AUM primary fee. It’s tax status is far better.

The fee grids are net worth proxies, which differs from AUM in that it doesn’t matter to me whether assets are in investments, home equity, or other products.

My methodology is clear, and my ADV states that I have the right to discount my fees where I deem appropriate.

Regarding the tax deductibility, Michael addressed that recently (https://www.kitces.com/blog/deducting-financial-planning-and-retainer-fees-and-the-tax-problem-with-bundled-aum-fees/). The IRS hasn’t been clear yet on how they want retainer fees handled, and none of the CPAs my clients work with have expressed any concerns yet.

Yes, but fees deducted right from an IRA are effectively super above the line deductions.

Your planner fees are an itemized deduction subject to a 2% AGI floor. In all cases it’s at least worth less as a deduction. In most cases the client will likely receive no deduction at all as you live in TX and have no state income tax and mortgage balances tend to be smaller than most of the country due to lower real estate prices(and before you point to real estate taxes and sales tax… it’s just not close to higher state income states).

So even though I too would interpret retainer fees as a legitimate itemized deduction(but I don’t really see the point of even dealing with that issue if I can avoid it), you’re still missing the boat by not directly billing a pre tax IRA.

What inputs are you using in the computation of net worth? I will reserve judgement until you answer, but it seems to me that such a pricing scheme is outrageous. If I am a client and I come to you with a portfolio of $500K and a small business valued at $2M, are you going to slap a fee on the value of my business that you did not create, did not maintain, and have zero input into day to day operations? I could go on, but I suspect if this were the case, 99% of my clients would get a shot gun and shoot me if I were to hatch such a pricing scheme.

It won’t be for everyone… think about how many business owners don’t prepare for succession and maximization of business value. Your advisor now has an incentive to help you optimize that asset. The reason “advisors” don’t do it, is the liquid asset focus.

Remember this also, the fee isn’t going to be much different than it is now. So, I don’t think clients will care. I’d probably make it a bit cheaper to give them an incentive.

We use aggregation software to track all clients assets and liabilities. A variety of methods are required to value different assets. We aren’t going to fight with the client over the values… and if you fight with us about tremendously higher values (good for you), you probably aren’t someone we want to work with.

We’re just tired of managing assets and “throwing in” financial planning when asset management has been commoditized.

We’d rather charge for personal CFO services and “throw in” asset management.

“We’re just tired of managing assets and “throwing in” financial planning when asset management has been commoditized.”

^This is entirely a creation of peoples mind(including yours). It has no practical meaning.

I.e. you’re saying that because you’re charging a retainer that is yardsticked against liquid assets you manage, that in effect means you’re “managing assets and throwing in financial planning”.

You could just as easily say “We charge a wealth management fee/retainer that is designed to primarily cover our financial planning services. In addition we include our asset management services as part of that cost as well. Because peoples financial complexity tends go up with assets and to simplify billing we do use assets under management as a yardstick for the size of the retainer. Here is our fee schedule.”

Just because a retainer is yardsticked based on something doesn’t make it anything more than just a fee retainer. You decide the way you want to think about it. You decide the way you want to communicate it. And you decide what you want to offer in service in exchange for that retainer. If you want to include pet advice for that retainer you can. And that doesn’t automatically make it pet advice “thrown in” with asset management.

It’s no different than people trying to claim that loans secured by automobiles are for cars, mortgages are for homes, student loans are for college, and credit cards for luxury spending… as if to say that because other people call it something that its not supposed to be used for other purposes (even when repurposing debt can result in cheaper net interest expense for the person).

Truth be told some of us have or are unveiling service offerings that involve considerable regular advice to businesses, real estate investors, etc. and in that case it’s certainly justifiable.

Also, if you don’t view an AUM fee or a Net Worth fee as a portfolio management fee (massively overpriced if it is) and instead view it as a planning retainer of which portfolio management is only part of, then it’s completely reasonable. All you have to point out is that

A) People with higher net worth tend to have more complexity

B) It’s logistically unworkable and regulatorily questionable in many cases to price each person out individually in some manner (and that includes hourly billing).

You are supposed to be a fiduciary. If it is better for the client to pay off debt than is what you are supposed to advise. It is upon all of us under the fiduciary standard to rise above our own interests. Isn’t this what separates us from the clowns at the commission houses? Why is this even an issue? In a well established firm with depth and diversity in client base, assets flow in and out all the time. It is up as business owners to build enough margin of safety into our businesses that allow for this.

Agreed. And I’ll say that it’s not even just about being a fiduciary. You spend almost a 1/3 of your life (half of your waking life) in a career. It amazes me how many people can’t bring themselves to give a hoot about consistently delivering value to the people they serve for half their waking life.

It’s depressing that an activity that someone devotes so much time to is one they struggle not just do well in, but to even want to do well in (given other temptations). It’s amazing that so many people would sacrifice decades of pride in their work to make an extra 10 or 15% in annual fees from a client advising them to do the wrong thing.

In my mind it’s not really hard. I know how I would personally handle thousands of financial issues if I were in the clients shoes and the times I get something new I know how I would work it out if I was in their shoes. The revenue doesn’t even remotely enter my mind and actually I prefer to look or think about it as little as I can all year. I get to do what I love and people pay me for it. Why should I care about trying to squeeze an extra few cents out of people? Where is the fun in that?

Micheal,

Great article and sensible conclusion.

It seems to me that most of the advocacy for hourly or retainer models tend to be from very well meaning industry insiders (FAs, press etc), the supply side. Whereas the demand side is clearly still indicating a preference for payment arrangements that require less decision making. A result that, as you point out, we should expect from behavior economics.

Rather than debating the reasons or if it should be this way, it’s more interesting for me to think about one hypothesis this appears to support: This is not a price driven market. Within quite a large price band, clients appear not to shop on price. For the analytical and advocates among us that can difficult to accept. However, if true that fact can illuminate ways to improve the business by helping us to focus on adding more value to the services we provide rather than simply trying to use price to differentiate.

John,

Indeed, much of our pricing debate appears to be a “supply side” issue, not a demand issue. Consumers are still voting heavily with their feet towards the AUM model, both in terms of new client acquisition and also client retention. For likely a whole host of reasons (some of which are the pricing dynamics I noted here).

My gut is that the supply side of pricing changes – advisors wanting to price differently – is being driven almost entirely by the ongoing differentiation crisis for most advisors. The issue is that they’re struggling to differentiate their SERVICES, so they’re trying to differentiate on PRICE instead. Except doing so is problematic, both because the demand for the alternative pricing models is limited (especially amongst people already comfortable paying AUM), and also because it ultimately seems to be a more challenging model to scale (can make a good living at it, but hard to build a business beyond the founder).

– Michael

I would reference John, and others, back to your discussion about the value of your speaking fees. Just because managing a 1mm portfolio doesn’t take 10x more time than the 100k portfolio doesn’t mean the value of what we do isn’t there, or that it should be based on an hourly rate. And you are dead-on correct about differentiation. Price is what you pay; value is what you get. If value is perceived, then AUM, flat fee, or a new mortgage can be easily accepted. (Okay, just kidding about a mortgage to pay fees.)

Hi Michael,

Interesting post and thanks for the update. In the interests of full disclosure we are a UK firm of independent advisers that sucessfully moved from an AUM model to annual flat fee retainers some time ago. We don’t fit precisely into any of the standard models that you quote but we do deal with HNW (average portfolio size c$2m and closer to $3m for new clients over the last 18 months).

* The article seems to focus on the importance of profitability of the advisory firms. I do think we need to begin to start considering the people that actually pay the fees (AUM or Flat) – the clients! It would be interesting to see the data analysis on a 1% AUM fee vs. a similar Flat fee (i.e. say £10k on £1m portfolio) increasing in line with inflation – over an average 30 year, 2 person retirement. Arguably fees are a zero sum game – if the adviser receives more in fee revenue, the client has paid more across and has less in his/her own pocket.

* I think we need to be cautious over the data based on surveys from 2014 which presumably are based on accounting periods in 2013 – we may be looking at numbers 3 to 4 years out of date which is a very long time in the current fast moving environment.

* Just because a model is profitable now (or in 2014) doesn’t mean it always will be. Borders were making multiple $m profits until Amazon came along, Same for Blockbuster and Netflix, Kodak and digital cameras and many others. The status quo rarely persists. So far, financial services have seen little impact but I think its wise to assume that the future will be different from the past.

* Selecting stocks and bonds used to have an aura of real expertise and all the knowledge was in the hands of the chosen few stockbrokers and wire houses who the retail public trusted to find the latest hot stocks to boost their returns. However, nowadays, so much data (including the latest report from SPIVA http://www.spindices.com/documents/spiva/spiva-europe-year-end-2015.pdf )

shows a sorry tale of active managers inability to beat their benchmarks. Surely its a matter of time before investors realise that paying an advisor 1% a year to find fund managers who will probably underperform the market is not the best option available,particularly when that service (asset allocation and fund selection) is available at 25bps or less.

* AUM must by its very nature create a conflict – how many advisers will recommend a client gifts their assets or use funds to reduces debt if it means a big pay cut on their AUM fee? Even if their intentions are good, many clients will identify this issue as a potentially conflicted one.

* There is also the issue of cross subsidy – we can all agree that managing a $1m portfolio is not 10x the work of a $100k portfolio and yet the fee is! This means wealthier clients are effectively cross subsidising smaller less profitable accounts.

* As baby boomers reach retirement, the huge market is now in advising those in retirement who are spending their savings and are in need of great advice. The AUM model means that as the clients needs increase, the adviser receives less income each year as the clients spends their retirement pot. That doesn’t appear to be a solid commercial structure for any business.

* What many clients appear to want is wise counsel, planning, objective analysis, identifying potential road bumps ahead and working collaboratively with a trusted adviser to help them achieve clarity and confidence across their entire financial ecosystem, from investments, to real estate, private company shares and so on. This is akin to a consulting role and so pegging the annual fee to a % of the funds solely managed by the adviser seems inherently wrong.

I could go on but will leave it there..!

These comments are intended to stimulate debate and don’t suggest in any way that our approach is better than anyone else’s. We have simply sat down and looked at the whole issue from the point of view of our clients as well as our own stability and profitability and arrived at our own conclusions.

It will be very interesting to see how this plays out over the next 5 years!

Keep up the good work,

Best wishes,

Alan Smith

http://www.capital.co.uk

(standing clap)

Well said, Alan.

I have charged every way under the moon and flat fees just feel right. It feels so much more in line with what I actually want to provide for people – which is advice. And brings with it so much less baggage. Am curious to see how these benchmarking studies shake out in the next 10 yrs. My suspicion is they will change dramatically.