Executive Summary

One of the biggest challenges of planning ahead – whether with respect to our finances, or anything else in life – is that it takes time. It takes time to sit down and think about the possibilities, how they might play out, and what must be done to reach the desired goal. And for an advice-giving professional, the time to support the planning process can be even more arduous… as it both takes time to do the planning and analysis itself, plus the time to gather all the relevant information up front, and translate it into advice that can be presented and implemented.

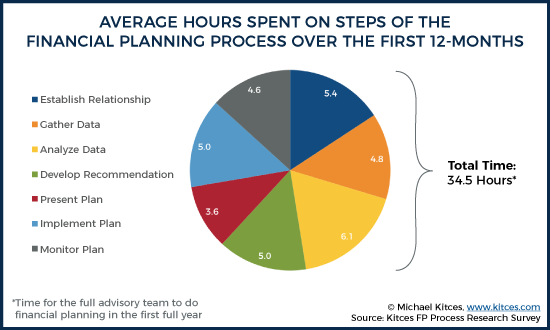

Consequently, it is perhaps not surprising that one of the biggest hindrances to the delivery of financial planning is simply the time it takes. As according to our recent Kitces Research study on “How Financial Advisors Actually Do Financial Planning”, the typical financial plan takes 10 hours to construct, and the average financial planner spends a whopping 34.5 hours on the entire financial planning process through the first year of working with the client (from establishing the relationship and data gathering, to analysis and crafting recommendations, along with plan presentation, implementation, and monitoring). Which severely limits how many clients a typical financial planner could even handle (to generally no more than 2-3 new clients per month at the most!).

In theory, the repeatable nature of the financial planning process would be highly conducive to technology – i.e., financial planning software – simplifying the process, and making it more efficient and less time-consuming. Except as it turns out, there actually is no apparent relationship between the use of (more efficient) financial planning software and time-savings in the financial planning process.

In fact, it turns out that advisors who use account aggregation tools to better automate (and streamline, and reduce the time for) the data gathering process end out spending more time in the data-gathering phase – as faster quantitative data collection supports an even-more-in-depth qualitative discovery process with clients. And more generally, the most highly-rated financial planning software amongst advisors is the software that takes the longest to use and is the most comprehensive and customizable… because it also happens to be the most comprehensive, and therefore the most effective at helping the advisor to actually demonstrate their value.

The significance of these findings is that it suggests broker-dealers seeking to grow adoption of financial planning by purchasing “simpler, faster, and easier-to-use” financial planning software may be misguided, as planning software is not actually the time-saving tool it was once presumed. It helps advisors go deeper into planning, not faster through it… which makes it not terribly useful to brokers who aren’t interested in the planning process in the first place.

Instead, it turns out that the single greatest path and predictor of time-savings in the financial planning process is whether the advisor has their CFP certification in the first place. Or stated more simply: making financial planning more efficient (and more widely adopted in a large enterprise) is primarily an advisor training issue, not an advisor software issue.

On the other hand, there’s still substantial room for financial planning software companies to increase their own value proposition by developing what their financial advisor users actually want and need, which is not “simpler” financial planning software, but instead to become even more comprehensive and in-depth, to help financial advisors get even better in creating and demonstrating value to their own clients!

The Time-Consuming Process Of Financial Planning

Providing personal financial planning advice can be a time-consuming process. Not necessarily because the advice itself is complex and time consuming to craft and deliver (though it can be), but simply because it takes time to understand the client’s situation in the first place, and then implement the advice recommendations.

1) Establish and Define the Client Relationship

2) Gather Client Data and Determine Goals & Needs

3) Analyze Client’s Financial Situation

4) Develop Financial Planning Recommendations

5) Present Financial Planning Recommendations

6) Implement Financial Planning Recommendations

7) Monitor Progress and Update

In practice, this financial planning process typically takes at least 3 meetings (the first to establish the relationship with a prospective client, the second to gather data, and the third to present and implement the plan), along with a non-trivial amount of work between the meetings (particularly to analyze and develop financial planning recommendations).

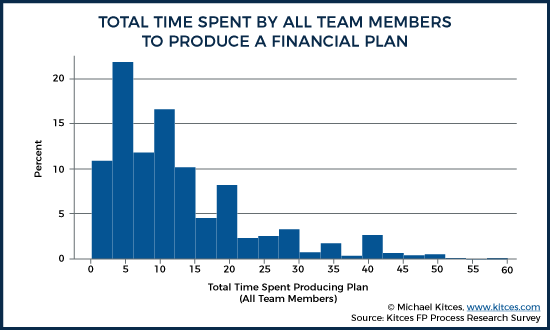

Consequently, in our recent Kitces Research study on How Financial Advisors Actually Do Financial Planning, we found that the median time to create and deliver a comprehensive financial plan is 10 hours, with a mean of 15 hours and a long positive tail of in-depth time-intensive plans.

Of course, the financial planning process itself typically does not end at “just” the delivery of the financial plan, both because it subsequently takes time to implement the plan recommendations, and because the monitoring process then begins. Accordingly, financial advisors actually spend an average of 34.5 hours (including themselves and supporting team members) in the financial planning process throughout the first year.

Given the time-consuming nature of the financial planning process, it is perhaps no surprise that the median cost of a standalone financial plan is $2,225, which at a median time to construct and deliver of 10 hours, amounts to a “typical” professional hourly rate of $223/hour.

More significantly, though, the amount of time it takes to deliver a comprehensive financial plan also becomes a limitation to how many clients a financial advisor can serve in the first place (or at least, how many new clients an advisor can take on at once). After all, with a typical 2,000 hour work year, and the fact that advisors generally need at least 1/4th of their time for professional development and to manage the business itself, an advisor wouldn’t have the capacity to take on more than about 40 new clients (or roughly 3 per month), and that’s with no other clients to serve. If the advisor has existing clients that necessitate ongoing meetings as well, the average advisor might not have the capacity to take on more than 1-2 new clients per month due to the time limitations.

Accordingly, in recent years, there has been a growing demand for improvements to today’s financial planning software solutions to make them faster and easier to use. For existing financial planners, it’s a matter of advisor productivity and capacity to be able to construct and deliver financial plans more efficiently in less time. And for advisors who don’t currently do financial planning at all and already have an existing book of clients… it’s often simply not feasible to do such time-consuming financial planning in the first place... because there’s literally not enough time left on top of what they already do for their existing clients!

How Faster Financial Planning Software Won’t Actually Save [Much] Time

The caveat, however, is that while, in general, one of the great benefits of technology is the efficiency it can bring to a (repeated) process… it’s not clear that “faster” financial planning software actually can save advisors much time in the financial planning process.

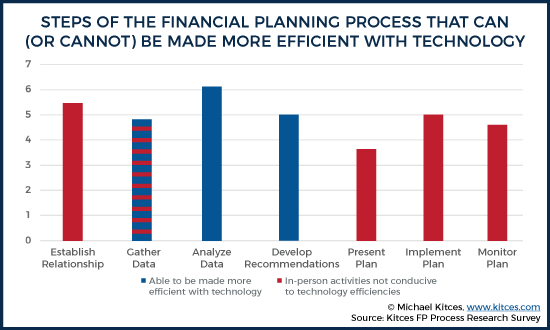

After all, the reality is that of the 7 steps of the financial planning process, more than half of them (establishing the relationship, gathering data, presenting the plan, and implementing) actually pertain to client-facing meetings and activities, which technology alone would struggle to replace. Of course, individual parts of the process might be leveraged with technology – for instance, quantitative data gathering might occur via account aggregation technology instead of asking the client how much they have in each account – but the more personal aspects of literally “establishing the relationship,” delving into more qualitative goals (and the entire “goals discovery” process), actually presenting the financial plan in a way that creates buy-in from clients, carrying that through to an implementation phase where clients actually take action, and working with clients to ensure they stay on track throughout the year, takes interpersonal time (typically, three in-person meetings upfront, plus implementation and ongoing client monitoring/review meetings) with the advisor that technology can’t do much to improve!

In other words, technology or not, as advisors we still have to establish the relationship with the client and set the scope of advice. We still have to engage in a discovery process. The financial plan recommendations still have to be presented to the client. Implementation follow-through still must happen. And while a subset of self-directed consumers might solely use technology to do this themselves, the whole point of hiring a financial advisor is that a certain segment of consumers want to have a professional – another human being – to guide and support them through (and hopefully add further value to) the process.

In fact, arguably the only stages that can actually be materially impacted by technology efficiency at all are the analysis and recommendations stages (where all the “number crunching” occurs), and perhaps a slightly expedited discovery phase where technology can augment the process (e.g., using technology to collect the hard data so the advisor only has to focus the discovery conversation on the “softer” qualitative information about goals and constraints).

Which means even if better technology saved financial advisors half the time of the analysis and recommendations stage, and 1/4th of the time for the data gathering phase… it would still be a 28-hour financial planning process throughout the first year (down from 34.5 hours)! Which is certainly some improvement… but still a substantially time-consuming process, and one where technology alone cannot and would not cause non-financial-planners to suddenly find financial planning “time-efficient-enough” to be able to easily add it.

Or stated more simply: while it is crucial to do the requisite analytical work in the financial planning process, the bulk of the actual time to “do” financial planning isn’t the part driven by technology in the first place. It’s the actual client conversations, which are naturally limited by how quickly clients can absorb potentially-life-changing information and recommendations, change their own mind and attitudes, and be willing to implement something new and different than what they were already doing!

How Technology Efficiencies Actually Impact The Financial Planning Process

Of course, given the time-consuming nature of the financial planning process, arguably even any time savings associated with better adoption of technology, in any phase of the financial planning process would be appealing. Yet it turns out that advisors don’t necessarily save time with financial planning software at all!

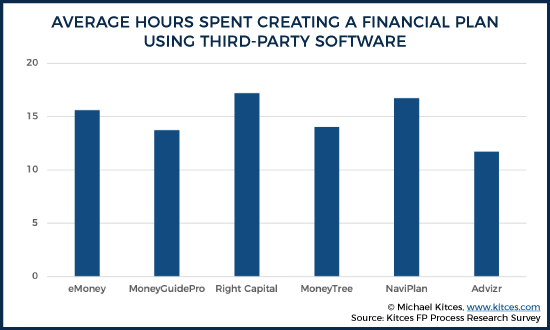

For instance, the average advisory firm that prepares a financial plan using third-party planning software spends anywhere from 11.7 hours (in Advizr) to 15.6 hours (in eMoney Advisor) to a high of 17.2 hours (in RightCapital).

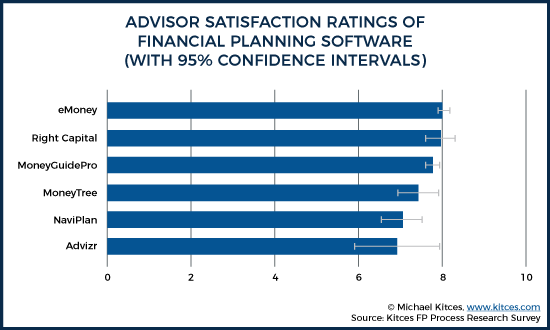

Overall, these are non-trivial differences and do suggest there are some material differences in the depth and time-efficiency of various planning software tools. Yet notably, the most time-consuming advisor software actually has the highest user satisfaction ratings.

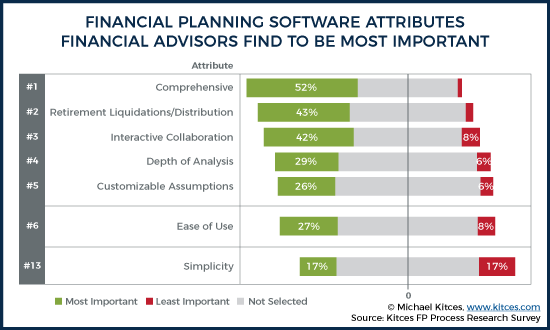

In other words, despite the common concern that “financial planning is too time-consuming” and that advisor software tools “need” to become more efficient, it turns out that the most “time-consuming” software is actually the most desirable and appreciated amongst those who actually use the software to do financial planning! In fact, comprehensiveness, customizability, interactivity, and the ability to present that information in a polished manner were the usability factors that most directly correlated to each financial planning software platform’s User Satisfaction rating… while “Ease of Use” and “Simplicity” themselves were at the bottom!

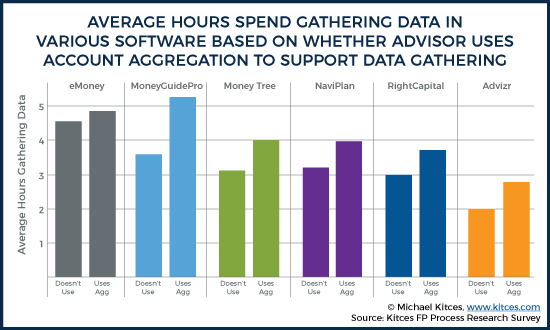

Similarly, with the growth of account aggregation software tools, one would hypothesize that the financial planning data gathering process would be expedited by the technology, which can “automatically” collect data from linked accounts, without the need for a time-consuming process of filling out an advisor’s data gathering questionnaire. Yet our research finds the exact opposite to be true: advisors who use account aggregation tools to automate their data-gathering process then spend more time in the data-gathering phase… because automating the quantitative data allows them to take even more time to go deeper on the more-enriching qualitative goals discussions with clients instead!

In other words, what the actual data of how financial planners use technology suggests is that good software doesn’t actually make advisors faster and more productive… instead, it makes them “better”, enabling them to go deeper and be more comprehensive (and hopefully, add more value!) in a similar or slightly longer financial planning process instead!

In turn, it is perhaps no surprise that when advisors were asked to rank the attributes of financial planning software they thought were most important, neither “Ease Of Use” or “Simplicity” even made the top-5!

Implications For The Future Of Financial Planning (Software)

Ultimately, the significance of the phenomenon that financial planning software makes advisors better (or at least, go deeper and more comprehensive, ostensibly in the hopes of adding value) but not faster is two-fold.

First, it suggests that the ongoing effort, predominantly in the broker-dealer community, to develop “simpler and easier” financial planning software tools that are more streamlined for speedy use in order to gain adoption from the typically-70%-of-brokers that are not already doing financial planning software is destined to fail. Because, to the extent that the brokers there don’t want to use financial planning software because “financial planning is too time-consuming,” simpler and easier planning software still doesn’t appear capable of realistically closing the gap. Because, as noted earlier, even software that cuts the time to create a financial plan in half only cuts the overall time of the process by approximately 20%. And in practice, when advisors get software tools to make parts of the process easier, they tend to simply reinvest that time to go even deeper – not faster – as evidenced by the fact that the use of technology in the data gathering process increases the time in the data-gathering phase. In other words, planners who want to spend time using planning software do so even as it makes them more efficient (they just reinvest the time savings back into the planning process), while brokers who don’t want to spend time on financial planning in the first place don’t show any indication of doing so even if “faster” software saves them a little time in the process.

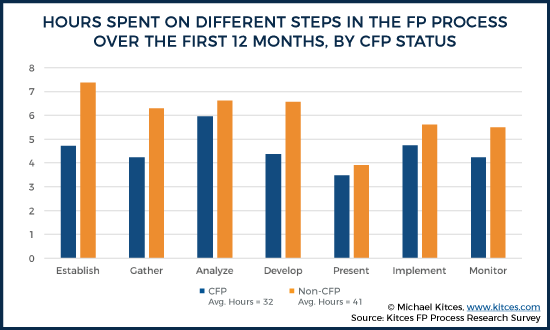

In fact, it turns out that the biggest constraint to the expediency of the financial planning process may not be software at all, but a human capital problem of broker training in the first place. As while the data shows that advisors using planning software tend to go deeper using technology – not faster – it turns out that merely having CFP certification in the first place is the single greatest time-saver in the financial planning process!

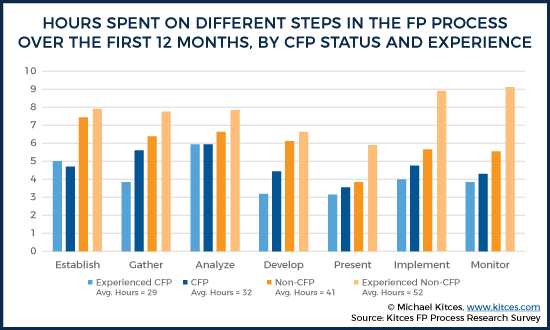

In other words, while technology allows financial advisors to go deeper in the planning process (without necessarily being faster), CFP certification actually does result in a time and productivity savings for the advisor team… an effect that appears to be driven in large part by the more knowledgeable CFP certificant not needing to rely as much on staff support for key parts of executing the financial planning process, because the advisor themselves is more knowledgeable to answer questions and resolve issues in the spot. And the difference only extends even further as advisors become more experienced… where the average experienced CFP (with 20+ years of experience) gets through the first-year planning process in only 29 hours, but an experienced non-CFP takes a whopping 52 hours on average (as experienced advisors tend to work with more affluent clients, but non-CFPs have fewer skills to handle such complex clients!).

In the meantime, the other significant implication of the real role of financial planning software in the financial planning process is that recent efforts from the leading software companies to go “downmarket” into simpler financial planning software (e.g., eMoney Advisor’s “Foundational Planning” and MoneyGuidePro’s new “MoneyGuideOne”) may be missing the true opportunity in the planning software space, which is to go “upmarket” into more comprehensive planning software instead, given that financial advisor software preferences are all focused on greater comprehensiveness, more depth, and more tools to use the software to model complex situations interactively with clients (while “simplicity” isn’t even a top-10 request).

Which means, in the end, firms struggling with financial planning software adoption are trying to solve with technology what is actually a human capital and advisor training problem (i.e., it’s not about making planning software simpler, but training their brokers to get CFP certification and adopt a more planning-centric approach in the first place), while financial planning software companies are neglecting the primary focus of how actual financial planners use their software (which is for comprehensiveness to go deeper and demonstrate the advisor’s value, not to save time in slimming down the advisor’s process).

The key point, though, is simply to recognize that as the tools do become more and more capable, the ultimate value proposition of financial planning software technology is not actually to make advisors faster and more productive, per se, but simply to help make advisors better (or at least, better able to demonstrate their own advice value proposition) in the first place!