Executive Summary

When it comes to industry benchmarking studies, there are a number that look at compensation for advisors, typical spending for advisory firms in various categories, and trends in growth and hiring. However, the recent “2015 Trends in Adviser Compensation and Benefits” study, jointly produced by the Financial Planning Association’s “Research and Practice Institute” and the industry trade publication Financial Advisor IQ, takes a unique look at some of these categories, providing an especially in-depth look at typical employee benefits in an advisory firm and current trends in hiring (including what kinds of positions firms are hiring for).

For instance, the FPA’s research shows that almost 80% of firms that offer ‘basic’ employee benefits like health insurance, also offer reimbursement for licensing and exam fees and a budget for professional education and development. However, ‘lifestyle perks’ like paid parking, health club membership, and telecommuting are still relatively uncommon.

Also notable in the FPA’s research was the ongoing rise of financial planning itself, as advisory firms look to deepen their solutions to compete against the so-called “robo-advisors”. In fact, more than 50% of firms report interest in hiring financial planning staff, from senior advisors to associate planners and even paraplanners – a growth trend we’re seeing within New Planner Recruiting as well.

Unfortunately, though, when it comes to compensation trends, the FPA’s study had a limited sample size that may have been too small for very accurate data – further muddled by inconsistent categorization of jobs that make it hard to rely on the average incomes that were reported. Nonetheless, the FPA’s recent “compensation” study is worth a skim, if only for the non-compensation data it provides. And fortunately, at least this year it’s free to all.

Typical Employee Benefits In A Financial Advisor's Firm

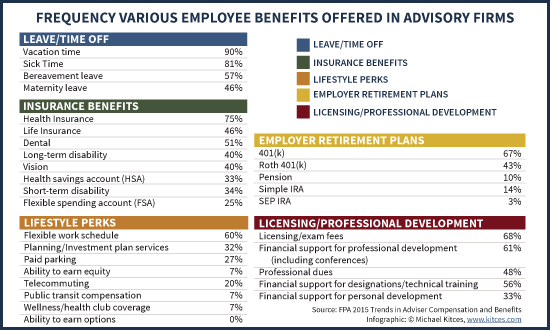

When it comes to employee benefits, the FPA’s recent “2015 Trends in Adviser Compensation and Benefits” study found, not surprisingly, that the most common employee benefit is the typical offering of vacation time, offered by a reported 90% of firms (along with 81% who provide sick time, 57% that provide bereavement leave, and 46% offering maternity leave). In fact, given what a standard “vacation time” is for employees across all industries, one might presume that most of the other 10% not offering vacation are simply firms that either don’t have employees, and/or were perhaps employee advisors with large broker-dealers who don’t give this benefit to their “employees” because technically their parent firm does. (Unfortunately, the study results do not provide a breakdown by channel to differentiate between broker-dealers vs RIAs, nor between ‘larger’ firms with multiple employees, small firms with just 1-2 employees, and the self-employed.) Notably, the results showed that 78% of firms do not pay out their unused vacation time, implying “use it or lose it” is an industry standard, despite the long hours typical in many advisors firms.

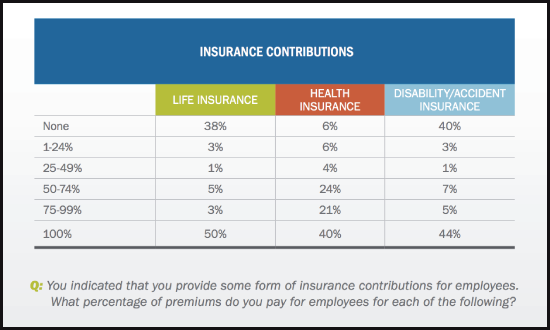

From there, the next most common employee benefit was health insurance, offered to staff in 75% of advisory firms (and paired with a Health Savings Account in 33% of firms, and a Flexible Spending Account in 25% of firms). Given the relative ubiquity of health insurance as an employee benefit, I suspect that most of the other 25% not providing health insurance may simply be firms that don’t even have employees, or at most only have one or two employees who happen to have other means/access to health insurance. Or, as noted above, these may be firms where the health insurance is provided directly by a parent broker-dealer, and not the advisor themselves (though again, alas, the study did not provide a breakdown). When it comes to paying for the health insurance, the FPA study also found that of the firms offering coverage, 40% of them pay 100% of the employee premiums, and another 45% pay at least 50% of the premiums. In the case of other types of insurance benefits, though, the frequency of use is far less, with dental plans offered by just 51% of firms, life insurance by 46%, long-term disability at 40%, vision at 40%, and short-term disability at 34%; with most of those coverage types, firms either paid all the premiums, or none.

When it comes to employer retirement plans, there were 67% of firms offering a 401(k), another 14% of firms using a SIMPLE IRA, 10% providing a pension, and 3% using a SEP IRA. With a cumulative total of 94% of firms offering some type of employer retirement plan (given that these would rarely overlap), this suggests that having an employer retirement plan may actually be the most common employee benefit – not entirely surprising, given that many advisors establish such retirement plans for the business, even if there are no employees, simply to provide for their own retirement savings. The study also found that 80% of firms match employee contributions to at least some degree, although unfortunately the data on the exact percentage of salary or contributions that are matched does not appear reliable, as the FPA study seems to have provided the wrong answer choices on the percentage of salary matched by employers. The study does also show that only 42% of firms vest the retirement benefits for employees immediately, while nearly 1/3rd go to the opposite extreme by imposing vesting schedules of 3-5 years.

Following “the big 3” of vacation time, health insurance, and retirement benefits, the next most common employee benefit was covering the cost for licensing and exam fees, at 68% of firms, followed closely thereafter by financial support for professional development (e.g., conferences) at 61%, and financial support for designations/technical training at 56%. Relative to the fact that “only” 75% of firms even provide health insurance (and/or have the employees to provide health insurance to), this implies that some form of financial support for licensing and professional development is an overwhelming standard (i.e., approximately 80% of firms providing health insurance appear to also cover licensing/exams and provide reimbursement for professional education). Less common but also worth recognizing was financial support for other forms of personal development, at 33% of firms.

Also notable amongst the listed employee benefits was a “flexible work schedule”, offered by 60% of firms, although the opportunity to telecommute is provided by only 20%. Other “lifestyle” perks were generally uncommon, such as paid parking (27%), compensation for public transit (only 7%), and wellness/health club membership (only 7%). Though notably, nearly 1/3rd of firms offer some kind of financial planning/investment planning services to their employees.

In terms of gaining access to employee benefits in the first place, the results showed that about 1/3rd of firms give access to employee benefits immediately (within the first week), another 30% provide access to employees within the first two months, and only about 40% wait longer than that for employees to become eligible. Though while only about 8% of firms wait at least one year for employees to participate in benefits, almost 1/4th of firms require employees to wait a year to participate in bonuses, and 1/3rd require a one-year wait to participate in other incentive plans.

Growth and Hiring Trends – RIAs And Planning Staff On The Rise

When it comes to hiring, the FPA study found that 65% of hybrid firms plan to hire in the coming year, along with 60% of RIAs, but only 45% of advisors working solely in a broker-dealer environment – reflecting the broader industry trend of greater growth in the RIA and hybrid channels compared to independent broker-dealers and wirehouses.

When it comes to the type of hiring, though, the most common type of role is the “junior [associate] advisor” (at 36%) of firms, with another 18% of firms aiming to hire a paraplanner. The rising trend of hiring employee advisors that has been underway in recent years appears if anything to be accelerating – a phenomenon we’re also witnessing with our own pace of hiring at New Planner Recruiting. And notably, in addition to hiring paraplanners and junior advisors, 27% of firms also indicated a plan to hire a senior advisor, implying perhaps that many firms are already behind the ball (and that they ‘should’ have hired associate advisors 3-5 years ago to groom them into senior advisors today).

Hiring interest for additional service staff is also strong, with 29% of firms aiming to hire a client service associate, and 25% some other type of administrative support as well. Outside of administrative and advisor staff, the next most common position was for marketing and business development with 15% of firms expressing interest (9% for general marketing staff, 4% for a marketing manager/director, and 2% for a business development manager/director) – which is not entirely surprising as advisory firms are increasingly struggling for organic growth amidst the ongoing crisis of differentiation.

Another trend captured by the FPA study is the ongoing rise of outsourcing, with a whopping 42% of firms now reporting that they outsource at least some work – most commonly in the form of technology (54% of outsourcers), compliance (45%), finance/bookkeeping (34%), and marketing (30%). There were also 34% of firms reporting they are now outsourcing portfolio/investment management, which combined with the scalability of investing, perhaps explains why only 6% of firms indicated they plan to hire an “analyst” in the coming year.

Perhaps somewhat surprising, though, is that while advisory firms seem to be outsourcing functional areas like technology, compliance, bookkeeping, and portfolio management, the use of “virtual assistant” style outsourcing support to leverage the time of advisors themselves is still relatively uncommon. Only 12% of outsourcers are doing so for administrative support, only 10% get financial planning support (e.g., virtual paraplanners), and a mere 4% outsource any direct client service. At this point, it’s not entirely clear whether the lack of deeper outsourcing is due to advisors just not being familiar and comfortable with virtual assistants, or perhaps just not being aware of service providers dedicated to serving financial advisors, like Back Office Solutions, Consider It Done, and PlanPrep.

One other interesting trend that the FPA study indirectly highlighted was the ongoing dynamics of gender imbalance in financial services – with some implication that the situation actually is improving, albeit slowly. For instance, results showed that only 11% of the Presidents/CEOs of advisory firms are female, but 16% of senior planners are female, and 28% of junior planners are female. Given that the less senior positions also tend to be filled by younger people, this implies that financial planning is at least somewhat improving in its ability to attract women, at least compared to the distant past. It also implies that as veteran planners retire in the coming years, to be replaced by today’s junior planners, the overall percentage of women in the industry should continue to improve (though it’s still a loooong way to a 50/50 split!).

(Muddled) Income Trends In Advisor Average Compensation For Advisors

In addition to its data on hiring trends and employee benefits, the FPA’s study also includes data on advisor compensation trends. Unfortunately, though, muddled data and categorization in the study makes it almost impossible to fully trust and parse the data.

The problem is that the FPA’s compensation data was broken into categories based on self-reported job titles, instead of categorizing by looking at the actual job duties being performed or providing clear and mutually exclusive job descriptions (as most other industry benchmarking studies are done). And the options for self-reported job titles themselves were arranged into a confusing hierarchy of “President/CEO”, “Senior Financial Advisor”, “Junior Financial Advisor”, and “Non-Advisor Management”. Yet of course, “President/CEO” and “Non-Advisor Management” are overlapping categories for some advisors, as is “President/CEO” and “Senior Financial Advisor” (in point of fact, 16% of those classified as “Senior Financial Advisors” were solo practitioners, which means they are the President/CEO, along with every other possible job title!). Ironically, even the FPA’s prior 2012-2013 compensation study more clearly delineated roles along the traditional hierarchy of Owner-Advisor, Senior Advisor, Junior Advisor, and Paraplanner, and classified those roles more consistently, but that framework was not replicated here.

In addition, the FPA’s study was notably smaller than its prior efforts, with a sample size of just 649 (by contrast, its 2012-2013 study drew on over 1,000 survey responses). The limited sample size was reflected in the fact that the results couldn’t/weren’t separated by advisor channel, so it’s impossible to answer questions like whether employee benefits are different amongst RIAs versus hybrids versus broker-dealers, and is the reason that 90% of firms offer vacation simply because only 90% of firms even have employees? Similarly, while compensation data was separated by firm size and geographic region, this was done only for the ‘core’ planner positions and not for any of the non-advisor management or support team roles, due to limited sample size.

Consequently, it’s hard to draw much of any conclusions about actual compensation trends from the FPA study. The median compensation for junior financial planners was reported at $60,000/year in the study, which is actually lower than the median compensation in the FPA’s (more detailed) 2012-2013 study that pegged median compensation for this group at $63,000. In this case, the data appears to be muddled by the fact that “junior planner” included paraplanners, while the prior study separated them into a standalone category (with median compensation of $51,000). Similarly, this year’s FPA study showed senior financial advisors with median compensation of $170,000, but in doing so blended together advisors who are employees and advisors who are partners/owners, which are two very distinct groups; by contrast, the prior FPA study separated these, where the former had median compensation of $120,000 and the latter were much higher at $177,500.

One notable trend that did emerge – which was evident in some of the prior FPA studies as well – is that advisors based in the northeast part of the country consistently reported the lowest median total compensation. This implies that despite the higher cost of living in the northeast versus other regions of the country like the midwest and the south, the sheer supply of advisors (given the concentration of financial services in the northeast) appears to be holding the pricing down. In fact, when taking into account the differences in cost of living, advisors in the south and midwest appear to enjoy significantly higher standards of living, ostensibly due to a relatively greater shortage of advisor talent relative to the demand there. Though again, the caveat here is that due to the FPA’s small sample size, it’s not entirely clear how statistically significant these differences really are.

Given some of these data challenges around compensation, at least this time around the FPA’s study is probably more valuable for its broad perspective about hiring trends, and its relatively unique data on employee benefits. And hopefully in the future, the data collection process can be improved with a much larger sample size (an admittedly difficult thing to do!) and much better categorization of job positions, to the point that the data set is robust enough to provide the kind of in-depth reporting the FPA’s studies did years ago.

On the plus side, though, at least the FPA has made this study publicly available – unlike prior versions that charged everyone, including FPA’s own members for access – so if you’re curious for a deeper read, you can download a full copy of the study directly from the FPA’s website.

It’s better than nothing, but with such a small sample size, and with the lack of clarity you mention, not much more.