Executive Summary

We’re all aspiring to grow into better advisors, with more clients, better niches, or bigger firms, but sometimes realizing that growth can be another challenge entirely. When we’re looking to grow, we may look to the most successful advisors, but feel that we can never truly emulate them due to a lack of time, networking, development know-how, or any other resources. In reality, those ultra-successful advisors have one secret weapon: mindset. Advisors who have a growth mindset, rather than a fixed one, are the ones most likely to see results!

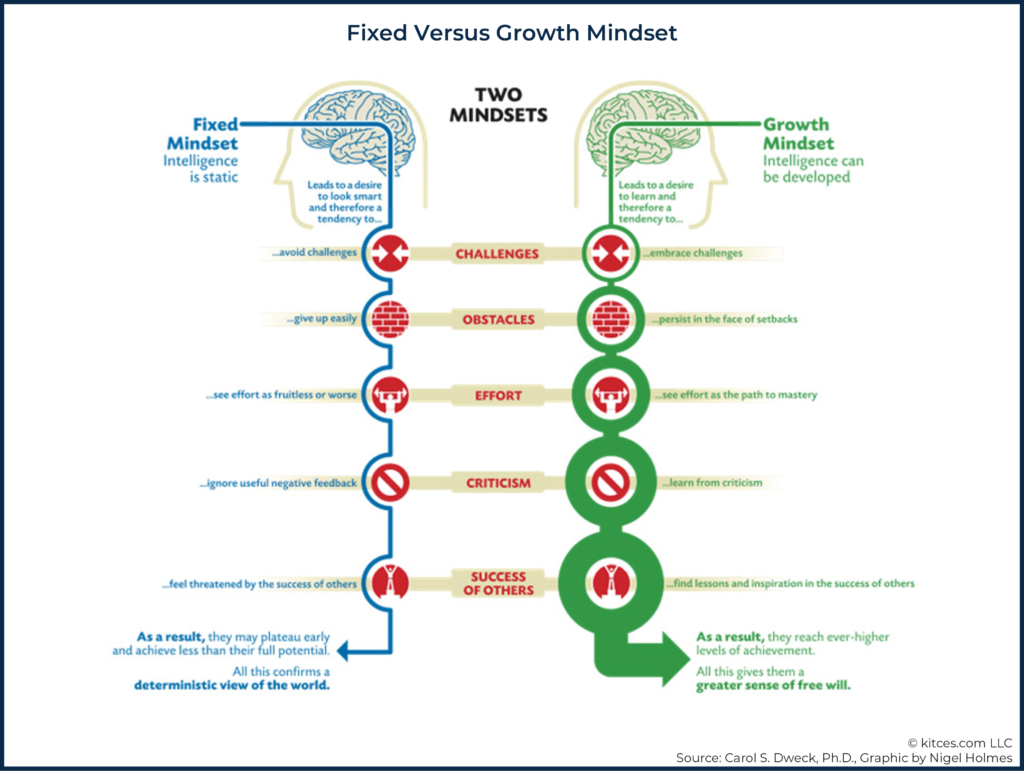

Rather than having an exclusive growth mindset or fixed mindset, though, most of us tend to flex somewhere between a fixed and growth mindset. Whereas a fixed mindset tends to avoid challenges and criticism, ultimately plateauing more often than not, a growth mindset will embrace challenge and criticism, persisting through setbacks to reach increasingly higher levels of achievement. Therefore, in order to succeed, advisors can start by focusing on developing a growth mindset as an attainable goal, and cultivating the habits that sustain high performance in order to get there.

Importantly, high performance is not about grinding one’s way to success no matter the cost; instead, it’s more about sustainable success and achieving a lot without sacrificing too much. Accordingly, the key to high performance is in finding a balance between reaching goals and sustaining well-being and healthy relationships, which is supported by six primary attributes that are characteristic to help them efficiently overcome the roadblocks that come their way: clarity, energy, purpose, courage, and productivity.

To start, advisors can take a closer look at what may be holding them back. For example, many advisors fall into the ‘busyness’ trap, citing lack of time as their primary reason for not growing. Another common pitfall is a negative association with sales. Many advisors enjoy the art of financial planning and/or investment management and making a difference in others’ lives, but they shy away from the sales aspect. Lastly, and perhaps most critically, advisors can run into subconsciously limiting beliefs.

Each of these roadblocks is a common challenge faced by many advisors. To overcome these challenges, advisors can start by conducting a high-performance audit to help them identify their subconscious limiting beliefs (which we all have!) and assess their strengths. From there, a roadmap can be developed to bolster their most impactful key strengths and to develop weaknesses, one by one.

Ultimately, for financial advisors who have adopted a growth mindset, getting stuck is just part of the growth cycle. Getting past setbacks generally starts with self-understanding, having a clear purpose, developing a sustainable action plan, and committing to the courage and focus needed to implement the plan. The great news is that advisors who take the time to find and address their weaknesses, pivot, and create sustainable plans of action to resolve one weakness can reuse these principles again and again, to eventually reach their goals—and even to exceed them!

After working with hundreds of financial advisors, business owners, leaders, and salespeople, I've discovered that sustained success and growth can largely be attributed to the belief that it's possible in the first place. Early in my career, I incorrectly thought growth was all about your strategy, tactics, resources, and know-how. While these things certainly do matter, growth also requires a certain mindset and habits to support that mindset, driving action and sustaining progress. What's important for financial advisors who may be struggling with growth is to recognize that growth doesn't need to be hard, complicated, or to come at a high cost. You don’t necessarily need to do more work overall in order to grow; rather, it can actually take less work if you’re doing the right things with the right attitude!

Many of us look to reasons outside of ourselves to rationalize why we struggle to achieve our growth goals. However, our inability to make meaningful progress is rarely due to these often-cited external challenges such as a lack of time, network, or development know-how. In reality, internal and subconscious emotional blocks – such as fear, lack of confidence, and not truly believing that we are worth the fees that we are charging – may slow us down and hold us back more than any external challenges.

We shrink and expand to our own – and others’ – expectations.

Through the process of rationalizing experiences, we may be unintentionally limiting ourselves. Part of the issue is how our brains are wired; we seek to understand and create patterns to help predict and expect what’s coming. By our nature, we avoid chaos and uncertainty and seek safety.

For example, based on my experience, I know that if I want to grow, then I will need to put in more effort. If I need to put in more effort, then I will need to sacrifice (time with my family, quality time with clients, fill in the blank).

Of course, growth comes with sacrifice, but it doesn’t often need to be as dire as it may seem. This “if-then” rationale helps us make sense of the world around us. However, it can be very useful to a fault.

I want to offer a different approach to growth, which starts with understanding and cultivating a growth-focused, healthy mindset. What if, instead of approaching situations with an “if-then” mentality, you functioned from an “and” state – a state of safety and abundance. I want to grow and have time with my family and ensure my clients feel supported.

Control your narrative to influence your approach, experience, and outcome.

Most advisors I talk to have everything they need to succeed now, but are struggling to see it and take action. As advisors who are seeking to grow start to make progress, they will expand in confidence, resources, and know-how. Gaining insight into what internal forces may be holding us back can help us identify what to do to unlock our potential for more growth, engagement, joy, and confidence – trademarks of high-performers.

Mindset And Beliefs Are The Greatest Indicators Of Success

How are you approaching the world – with a fixed or growth mindset? Your answer to this question is a strong indicator of your ability to succeed.

Someone with a fixed mindset believes that one’s abilities have a limited chance of improving. Are you afraid to fail because you view failure as an irreparable outcome? If so, you may have a fixed mindset.

On the other hand, someone with a growth mindset believes that abilities can be developed. Do you view failure as an opportunity for learning? If so, you likely have a growth mindset.

See the image below to determine which mindset(s) you have.

Carol Dweck is the author of Mindset: The New Psychology of Success and the psychologist who coined the term "growth versus fixed mindset." According to Dweck, how you approach learning and failure correlates directly with your ability to persevere to succeed.

Carol Dweck is the author of Mindset: The New Psychology of Success and the psychologist who coined the term "growth versus fixed mindset." According to Dweck, how you approach learning and failure correlates directly with your ability to persevere to succeed.

Most of us flex between having a fixed and growth mindset. It’s very common for many of us to have a growth mindset in multiple areas. These are areas where we likely have experienced growth and are more comfortable taking risks.

In your business, where are you thriving? Where do you feel stuck? What do you avoid? In what ways do you feel threatened or envious of your peers? The answers to these questions will give you useful information into where you are approaching your business and life with a growth versus fixed mindset.

Many Advisors Take A Fixed Approach To Business Development

A very experienced advisor I know well had, by all external measures of success, “made it.” His firm had $250 million in AUM, his clients were happy, his family and personal life were good. He had a capable team and the capacity to take on more. He said that he had a desire to grow. However, no matter what he did – client events, email marketing, a blog, targeting a niche, getting in the media – growth eluded him. He was stuck at $250 million in assets in his current practice and life, which wasn’t so bad!

What was bad, though, was that through the experience of trying to grow and failing over and over, he became stuck in a fixed, negative feedback loop around development and growth. He began to believe that he wasn’t capable of creating the new levels of success he desired. Over time, this fixed mindset started to have implications in all areas of his life – his health, relationships and engagement in the business. Many things became harder than necessary. The more he tried to force growth, the harder it became, and the more fixed-minded he became.

Ironically, just a few years earlier, when he had perceived his situation as good and that he was capable of success, he was thriving and growth came more easily. How you choose to view your situation influences your experience, confidence, and, ultimately, your mindset.

The good news is that mindset is malleable. High-performers welcome discomfort and failure because they know it's the fastest path to growth. Being aware of and pursuing the attributes and habits of high performance can be powerful tools to continue to disrupt and grow yourself and your business.

What Is High Performance?

According to the High Performance Institute (HPI), high performance is "succeeding beyond standard norms over the long term, while maintaining positive wellbeing and relationships." In other words, “high performance” is about achieving a lot without sacrificing too much.

Yet, throughout the history of financial services, advisors have often been encouraged to seek growth at any cost, especially those at large broker-dealer firms. The traditional approach and its fixation on asset gathering, client acquisition, and increasing reputation have given growth in our industry – and especially sales – a bad rap (and rightfully so!).

It's no wonder that an increasing number of financial advisors are proudly claiming to be fiduciaries – to distinguish themselves from the commission-based sales world – where the assumption is that the emphasis is on revenue above all else. If you're not working in your clients' best interests, then whose interests are you focused on?

In reality, though, it's not a zero-sum game. You can be a fiduciary and be great at sales and marketing, too. I'd argue that it's actually in the best interest of your prospects and clients for you to be capable of sales, which simply involves being able to influence, deliver relevance, and foster trusted relationships.

Growth Can Amplify Your Impact

Advisors who feel daunted by the challenge of growth and the associated requirements to improve sales and marketing techniques can start by developing a high-performance mindset – focusing on growth as an attainable goal – and the habits that sustain that mindset.

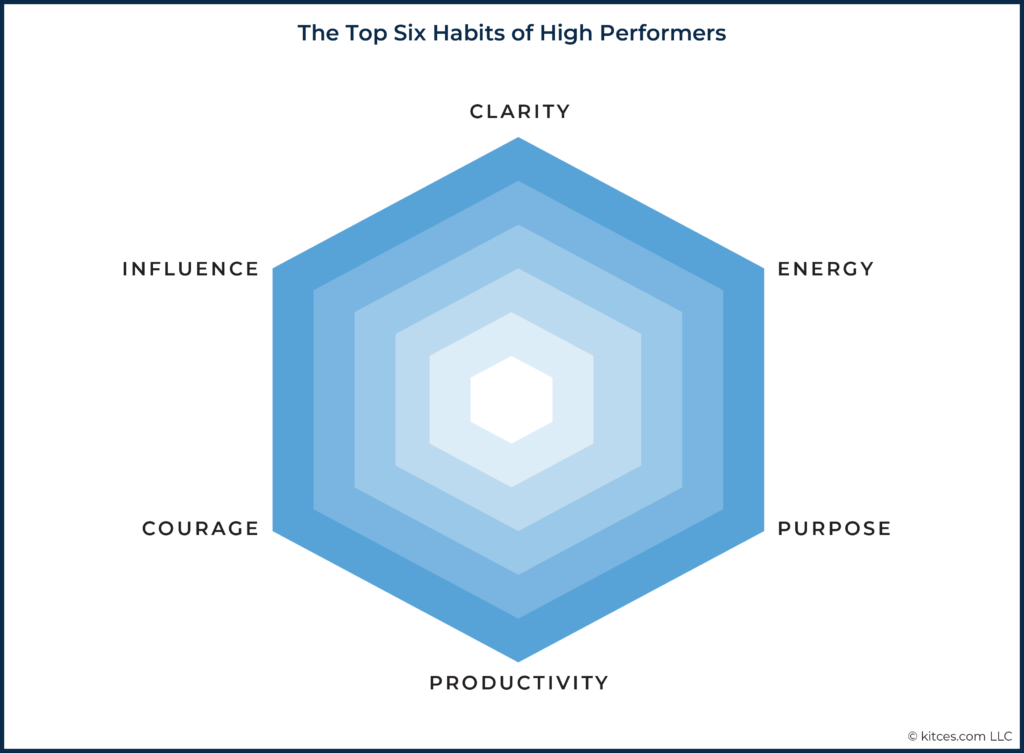

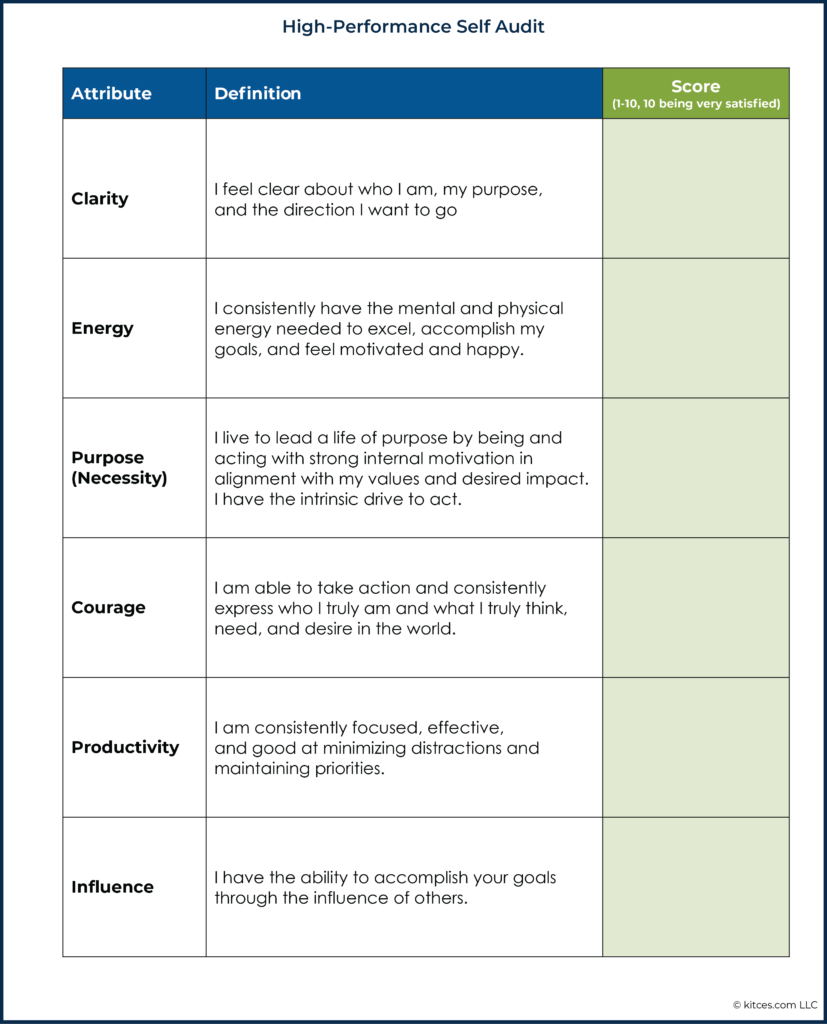

A research study conducted by the High-Performance Institute identified six core attributes in which high-performers consistently score highly: clarity, energy, purpose (necessity), productivity, influence, and courage.

Having worked in the industry and with financial advisors for 16 years, I know that growth and development success start with mindset and habits. We will focus on what it takes to be a high-performing financial advisor, the common challenges, and some best practices that can be applied today.

Your Subconscious Is Largely Running The Show

Philosopher and writer Alain de Botton is famous for saying, "Anyone who isn't embarrassed of who they were last year probably isn't learning enough." Are you embarrassed by who you were last year?

For most of us, the answer to the question is "no." While we want to grow, improve, and evolve, our subconscious is hard-wired to protect the status quo. Change is risky!

According to the Cambridge Dictionary, the subconscious is the part of your mind that notices and remembers information when you are not actively trying to do so, and influences your behavior even though you do not realize it.

This is because our subconscious' primary function is to ensure we respond as we should, according to our master programming. Its job is to protect us from threats and to keep us alive and well. However, while today's stressors are very different from those of thousands of years ago, our brains still don't know that. When we subconsciously perceive growth, or the actions needed to grow, as negative in any way, growth isn't easy.

What is your relationship with success? What initial negative worries come up when you think about adding new clients, committing to that niche, or investing in resources such as people or technology?

This information is critical. Becoming aware of your master programming and underlying fears moves them from the subconscious to the conscious brain, where they can be acknowledged, processed, and rationalized. (Note: you will see a positive impact even if you don’t rationalize your fears; simply acknowledging a block without resolving it can be helpful).

Acknowledging fears and threats allows us to inform our programming, actions, and ultimately our outcomes. You can start to uncover subconscious fears by paying attention to your thoughts and feelings. What unhelpful stories are you telling yourself and others? When do you feel anxiety or discomfort in your body?

The RIA firm I worked at early in my career used Strategic Coach, an entrepreneurial coaching program. The program provided coaching, systems, and tools to accelerate progress and satisfaction professionally and personally. We often used Strategic Coach exercises in the business to plan, prepare, and resolve issues as we were making a change.

For example, before starting a new initiative, we would run a Strategy Circle. Through this exercise, we would proactively identify all potential obstacles and solve them before they happened. Bestselling author and thought leader Tim Ferris takes a similar approach to overcome fear by naming everything that may go wrong and playing out worst-case scenarios. These are two examples of processes to intentionally help you become aware of the fears and obstacles that may hold you back.

By intentionally seeking obstacles and bringing them into your awareness, you can address many issues before they have a chance to hold you back. However, there will be fears that live in your subconscious, which you can start to identify by getting out of your head and into your body.

Continually pushing forward without stopping to honestly check in on how it’s going (or not going) is not advised. When you feel tension or avoidance, that is important information. Yes, you can continue to push through, but at what cost?

Common Mindset Challenges That Hold Financial Advisors Back

Proactively acknowledging underlying emotional blocks and fears can be a powerful way to maintain progress towards goals. If you're stuck, there is a reason… your job is to figure out why. The good news is that some of the most common challenges advisors face can be addressed by adopting the habits of high-performers!

Challenge #1: The 'Busyness' Trap

Are you in control of your day, or is your day in control of you? The top reason I hear advisors say they aren't taking action or making progress on their growth goals is lack of time. If I had a dollar for every time I heard "I'm too busy," or "Now is not the right time," I'd be rich!

We all have the same 24 hours every day, yet top performers and the most effective advisors have mastered their relationships with and use of time. They aren't busy; they are intentionally productive. They know that now is never the right time. Readiness (or not being ready) doesn't stop them.

I challenge you to own your busyness. Unless someone is forcing you against your will to do the things you are doing, you are making many conscious and subconscious choices every day that are creating your current reality.

Busyness is often really used as an avoidance tactic. What are you avoiding? If you had unlimited time, what would you really like to get to but never seem to?

You may be stuck in the busyness trap if you:

- Stick to the work that’s comfortable (hint: it never stops and seems important and urgent).

- Stay in ‘planning’ mode and rarely take action. When you do act towards your goals, it’s ad hoc and ineffective, which reinforces why it’s not worth your time and should be avoided.

- You often find yourself feeling and saying “I’m too busy,” especially when it comes to things that are important but not urgent (e.g., relationships, development, strategic work, etc.).

High-Performing Advisors Are Not Busy, They Are Productive

A common outcome of chronic busyness, especially when it’s not productive, is burnout. On the other hand, if you’re busy bringing your desires to life, you are likely productive and feeling energized instead of stressed (which is how many high-performers experience busyness).

Common dynamics fueling busyness versus productivity include:

- A lack of clarity on the future and current ideal state of the business and self. This includes what should be prioritized and how it should be done. What do you need to do? What should be delegated or outsourced?

- Low energy and necessity to act.

An important note: productivity, clarity, energy, and necessity (purpose) are four of the core attributes that high-performing advisors excel at.

Growing Firms Inevitably Run Into Productivity Ceilings

If you’re looking to grow, you will likely need to deal with these common growth paradoxes:

- You want to grow but don't have enough time or resources to do the development work you think you need to succeed;

- You've worked hard to get new clients, but can't onboard them fast enough;

- Growth hinders your ability to deliver the service level you aspire to deliver to your clients; and

- You receive a less-than-ideal prospect or referral, which you take (even though it limits your growth capacity) because you are afraid to pass on new AUM or threaten an existing relationship.

These paradoxes force questions about what resources to invest in and when. Do you hire, outsource, or leverage technology? How do you best scale and maintain the quality of service and relationships? How do you handle less than ideal clients, especially referrals? It may feel easier (and safer) not to act and to blame busyness.

However, planning for these situations may be uncomfortable but is necessary to handle them productively. As you work out plans, do it from the perspective of your future desired state using the “and” structure discussed earlier. For example, you may wonder, “How do I grow and maintain strong client relationships?” This question will help you address how to handle prospects that aren’t a great fit. (Tip: have a network of other advisors that you can confidently refer to, to create a win-win situation for you and the prospect).

The real question is, “At what point do I become my future self and business?” (Hint: The answer is now). The more you think and act like your future self or firm, the more quickly you will evolve. If you’re overwhelmed in your current firm or situation, your subconscious will make growth very difficult as a means of self-protection.

The Interconnected Role Of Clarity, Energy, And Necessity In The Growth Mindset

Necessity is the internal drive that demands action, it’s why you do what you do, in other words, your purpose. Taking action on the right things (often the things that are important but not urgent, the things you may be avoiding) is what drives productivity. Being able to act consistently requires energy.

According to HPI, there are four types of energy:

Physical energy involves your body, strength, and stamina. Are you able to physically move and engage in activities as you desire? Do you eat well and take care of your body?

Mental energy involves the quality of your mind and thoughts. Are your thoughts clear and sharp?

Emotional energy involves the general state of your emotions, how you feel. Are you generally positive and happy? Do you easily turn negative or down? What’s your overall vibe? (Note: Your energy, especially your emotional energy, matters in sales and marketing. It’s crucial in building early trust and rapport. Even over the phone, people can pick up on your energy).

Spiritual energy involves a personal connection to something you identify as larger than yourself, a feeling of interconnectedness. For example, this may be God, the universe, or nature.

We tend to be strong in some, but not necessarily all, of the four areas of energy.

Clarity, energy, and necessity are interconnected and positively influence each other. Without clarity and purpose, it’s difficult to have necessity. Without energy, it’s hard to maintain necessity, which drives outcomes and positive internal feedback.

Challenge #2: Avoiding Sales And Marketing To The Detriment Of Growth

Are you giving yourself a pass because you don't think you're 'good' at sales and marketing? Whether we like it or not, we are all in sales. Sales involves the ability to influence – another attribute of high performers.

You may be compromising your ability to influence because of a negative association with sales if you:

- Label yourself in a specific, limiting way. Do you think or say things like, “I’m a planner, I’m bad at sales,” “I’m just a numbers guy (or gal),” “I’m an introvert.” It’s one thing to recognize how we are wired, how our internal operating systems work, and our strengths and weaknesses, but it’s another to let these ideas dictate the limits of your abilities. This is an example of employing a fixed mindset.

- Reject anything sales-related. Does the word sales make your skin crawl? Some advisors pride themselves on not being good at sales. This tends to be a more common mindset in the fee-only RIA world.

Advisors often come into the industry in one of two ways, either through a role where they had to bring in business to prove their value (e.g., the wirehouse model), or through earning their position by learning the art of financial planning and/or investment management (e.g., the planner or RIA model).

However, in both models, as advisors earn tenure, their development responsibilities often expand. For many advisors and RIA founders, this is the opposite of what they want. As they progress, they are forced into new (and often unwelcome) roles of salesperson or rainmaker. According to the InvestmentNews 2020 Pricing and Profitability study, 52% of new business comes from the firm's founders. Across all firm models - solos, ensembles, enterprise ensembles, and super ensembles - founders are the largest drivers of growth.

If you are a founder who has a negative association with sales, consider this: what would the impact be if you were good at sales, influence, and growth? How many more people could you connect with and impact? How is your negative association with development impacting the future leaders of your firm?

The reality is that the ability to influence amplifies your impact.

Influential people teach us how to think, challenge us, and serve as role models along the way. The ability to influence and persuade are necessary skills, especially when you are managing millions of dollars. There is an entire field of study dedicated to behavioral economics. Your investors are wired to make bad decisions with their money. They need you to be able to influence and persuade.

The Ability To Influence Begins With Having The Right Sales Mindset

If you want to build your ability to influence, focus on upping your sales effectiveness. This is the order I'd start:

- Mindset (where this article is focused);

- Process (listen to our conversation about sales process on the Financial Advisor Success Podcast); and, finally,

- Skill and acumen.

When I talk about getting better at sales, most advisors assume I mean sales skill… I don't. Sales skills are essential, but they are generally the last area that needs to be developed (unless you are in a direct sales role, having development conversations daily).

You can significantly increase your ability to influence by first developing a healthy mindset around the role that sales plays in your business’ growth. Especially in the financial services industry, there is plenty of evidence of bad sales behavior. However, not all sales practices need to be bad, and, in fact, you get to define what good sales practices are.

I believe that sales is about addressing real needs with the right solutions, and about building trust and rapport by taking an other-centric approach.

Ultimately, by developing the right mindset about your role in sales, you're more likely to have a better experience influencing others in a way that will feel good, for both you and the client, and that is clearly aligned with your vision and purpose.

Establish Sales Processes To Track And Follow Up With Leads

InvestmentNews' 2020 Pricing and Profitability Study found that only 37% of advisor respondents track leads at the firm level, which represents a significant level of lost opportunities when working on business growth! Accordingly, by building a sales process to support firm growth, advisors can ensure that they have a systematic mechanism to keep track of leads, allows you to forecast, informs your marketing efforts, provides essential information to your team, and keeps you focused on following up with the appropriate next steps to name a few of the benefits.

In a previous role, I ran a sales operations team that supported over 100 salespeople. I can attest firsthand that having a centralized sales process (or pipeline) helps teams and firms gain consistency in the overall sales experience and increases efficiency; it can also provide valuable insights that ultimately drive new business. Even solopreneurs with small pipelines benefit from tracking and managing new business via a defined process.

Having a system for following up with leads and prospects is another area that can significantly impact your ability to succeed in sales but is often overlooked. According to IRC Sales Solutions, only 2% of sales are made in the first follow-up. It typically takes 5-7 outbounds before you get a response, and because most advisors tend to give up after 1-2 tries, establishing an email follow-up system to track leads, using some best practices can help increase your chance of scheduling an initial (and secondary) meeting.

Moving someone from ‘lead’ status (who the advisor is aware of, but has not yet met with) to ‘prospect’ (who the advisor has met with) can increase conversion rate by 32% according to the InvestmentNews’ 2020 Pricing and Profitability Study. Getting a meeting is a significant early buying signal and confidence booster.

Develop Your Sales Skills

Last but certainly not least, to expand outside of your comfort zone in support of growth, develop your sales skills. Like any other skill, it improves with practice. Unfortunately, sales is often not something taught in school. There are techniques and best practices to help you run an effective meeting, ask powerful questions, navigate objections, close business, and more. If you want to increase your sales acumen, consider investing in a training program or coach.

However, you don't need to be an expert salesperson to be effective. Developing interpersonal skills grounded in emotional intelligence – the ability to identify, assess and control the emotions of oneself and others – is key in establishing trust and rapport, which inspires influence.

Examples of interpersonal skills that will help you sell include:

- Asking open-ended questions that cannot be answered by “yes” or “no” to create space for the client or prospect to fully express what they are seeking;

- Being genuinely interested in others. Listen deeply to really understand what the other person is communicating and what is most important to them; and

- Lead the meeting or conversation by focusing on the other person’s needs.

Dale Carnegie's How to Win Friends and Influence People is a great primer on emotional intelligence and influence.

Dale Carnegie's How to Win Friends and Influence People is a great primer on emotional intelligence and influence.

Challenge #3: Subconscious Limiting Beliefs Such As The Fear of Failure, Rejection, And Success

You've overcome busyness and have refined your relationship to sales, but you're still not growing. What is holding you back? Chances are it's a subconscious or emotional block.

Our subconscious is responsible for 95% of our purchasing decisions. Your ego or inner critic is more in control than you think.

You may be stuck because of an underlying subconscious fear if you:

- Aren’t progressing or are unable to make progress towards certain goals and don’t know why;

- Are using all of the best practices that others are using, but they don’t feel right and there is little to no impact.

- Feel stuck, lack confidence, and are getting in your own way (Note: at some point we all feel like this; it’s a normal part of growth!).

Courage Is Required For Sustainable Growth

As financial advisors, the stakes are high – not only are your clients' life savings and dreams potentially at risk, but so are your reputation and career. The fear of making a mistake in any of these important areas is not unwarranted and needs to be rationalized.

Common fears that financial advisors have:

- Fear of failure or being wrong;

- Fear of rejection or not being liked; and

- Fear of the uncertainty of success.

What if I'm wrong and lose my clients' money and trust? What if the referral from my client doesn't go well? What if, in my pursuit of more, I lose everything?

You can "what if" yourself crazy with these fear-based questions.

The antidote to fear is safety. It takes courage to cultivate safety amid uncertainty.

However, what if you do succeed? What if you help more people? What if you have more time and resources with your family and friends? What if you are able to prioritize things that excite and engage you?

In 2008, I was working at a mid-sized RIA outside of Philadelphia. I was three years out of college, and it was my first experience with a bear market. Not only was I working at an RIA, but my soon-to-be husband was working on an advisory team at Lehman Brothers. We were married on September 6, 2008, nine days before Lehman Brothers filed for bankruptcy. It was an interesting time and an amazing education on the importance of mindset and courage.

Through the financial crisis, the advisors I worked with had courage. It took courage to cultivate an environment of safety for the team and clients. As the market got scary, the advisors proactively increased their communications and put cash to work. They hosted weekly client events to address client fears and provided thoughtful short- and long-term perspectives. By the end of the bear market, they retained all clients, and only one sold out (near the bottom).

In bear markets, periods of volatility, and times when your investment approach is out of favor, it takes courage to stay the course and to consistently and confidently communicate with your clients. Your clients hire you to have the wisdom and courage they don't, whether they realize it or not.

Three Best Practices To Cultivate The Mindset And Habits Every Advisor Needs To Grow

We are all works-in-progress. High-performing advisors are constantly working to maintain and expand their mindset and habits. Growth, especially when it’s sustained, doesn’t happen by accident; it’s not a destination, it’s a journey. Your experience on the journey is largely informed by your mindset and habits.

Regardless of how you decide to pursue growth, I want to give you permission to do it your way. If there’s one thing you can do quickly to improve your mindset and happiness, it’s to give yourself a break. When we jump into problem solving through new strategies and tactics without checking in on how we’re feeling, we can unknowingly create tension and unproductive feedback loops that can be difficult to overcome.

As a Certified High-Performance Coach, I am trained to use a science-based approach that is designed to improve performance across the key attributes of high-performance.

To start making progress today, start with these three high-performance best practices:

- Identify your limiting beliefs and habits (and strengths) with a high-performance audit;

- Start by amplifying your strengths; and

- Focus on one area to start to develop.

Identify Your Limiting Beliefs And Habits (And Strengths)

In reflecting on the common challenges advisors face – the busyness trap, staying in your comfort zone, and subconscious fears – did any resonate?

Awareness is a great place to start tackling the challenges of growth. If you are dealing with a subconscious block, you may not be able to identify exactly what’s going on – and that’s ok. You start to uncover subconscious blocks by paying attention to your thoughts and feelings of discomfort, anxiety, and disengagement.

Situations when you are quickly frustrated and stressed can provide valuable information on limiting beliefs and habits. Next time you notice yourself in a downward or negative spiral, try this three-step exercise to help gain insight into what’s going on:

- Become aware: Pause and ask yourself, "Why am I frustrated?"

- Explore why: Continue to ask yourself “Why” until you get to the root of the issue. Often it takes three or more 'whys' to get to the root of the issue. Process these situations in a journal by simply allowing yourself to write whatever comes up can help you get out of your head.

- Reframe: Once you are aware of the underlying belief driving your experience, reframe the situation and your response. Reframing can happen by reliving or playing out a situation using visualizations, reframing, positive self-talk, mantras, or journaling. Our brains cannot tell the difference between real and manufactured emotions. By ‘experiencing’ a positive outcome or emotion, we can start to create a new reality.

For example, I may ask myself, “Why am I feeling frustrated?” and come to realize that it’s because I feel like I don’t have what it takes to grow, even though I know I’m good at what I do.

Now that I am aware of the reason behind my frustration, I can explore further to get into the root of the issue, so I next ask, “Why don’t I have what it takes?” I acknowledge that I am terrible at sales and I never know what to say to keep a prospect engaged and moving forward.

Asking “Why?” again, I realize that I’ve always been terrible at influencing others. I’ve never been ‘good’ at interacting with others. The real issue surfaces: I feel that I’m not enough, and wonder why clients would even waste their time, attention, and money with me?

With this insight, I can begin to reframe my negative feelings of not being enough with more positive feelings of being enough. What would it look and feel like to be enough? Playing out scenarios where I felt I had more than what it took to be considered ‘enough’. Intentionally spending time every day to live in the desired feeling can actually help to bring that feeling into reality.

The truth is, we were all born enough, worthy, and capable. Our internal stories shape our experiences. We can each influence our own experience by owning our stories.

Now that you’ve identified the mindset challenges holding you back from growth, take an audit of your high-performance attributes and habits.

If mindset is the attitude and perspective you bring to a situation, the attributes of high-performance are the specific tools you have to navigate that situation and enhance your likelihood of success. As you continue to develop clarity, energy, productivity, purpose (necessity), courage, and influence, you enhance your abilities and outcomes.

Perform a High-Performance Self Audit

To quickly discover where you have the most significant impact on your performance, rate yourself across the six areas of high-performance (1 being very dissatisfied to 10 being very satisfied).

Notice what areas have the highest and lowest scores.

You should now have a good idea of what is keeping you stuck and the high-performance habits to leverage and develop.

Start With Strengths

High-performers don't rely on only their strengths; they recognize that, in order to grow, they also need to develop the areas that may be weak. However, leaning heavily on strengths can provide the foundation for short-term success. Small short-term wins can have a big, long-term impact.

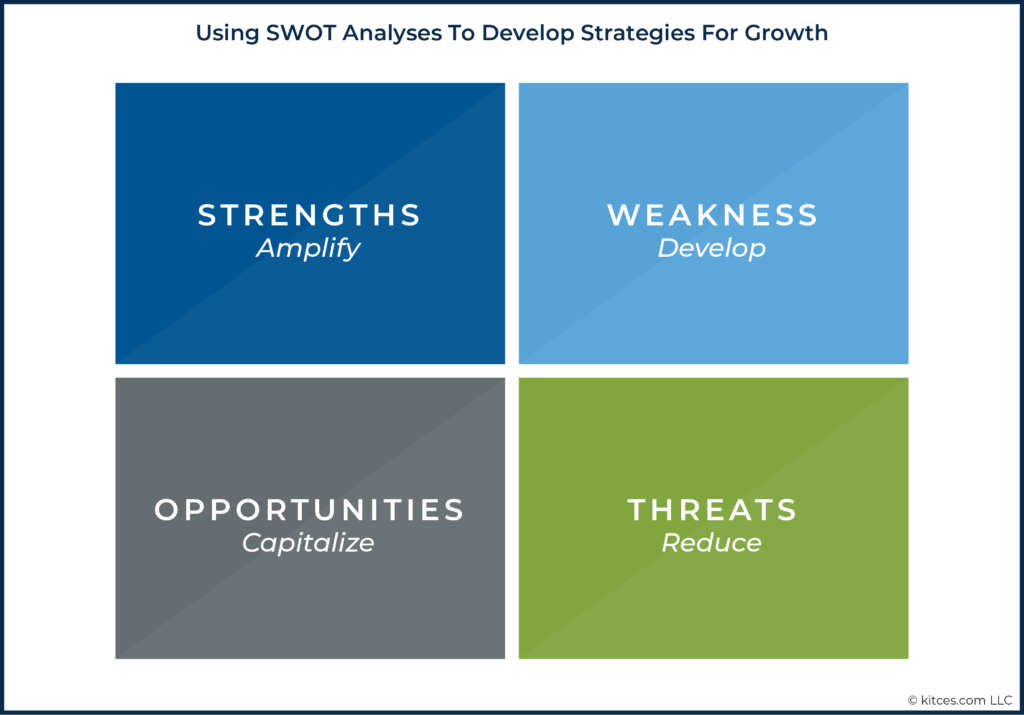

Conducting a SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis can be especially helpful to uncover areas that you (or your firm) can amplify and improve. When I'm developing a Growth Business Plan for a client, the strategy and tactics of the plan always rely heavily on the client's and firm’s strengths.

As a general rule of thumb, always amplify your strengths.

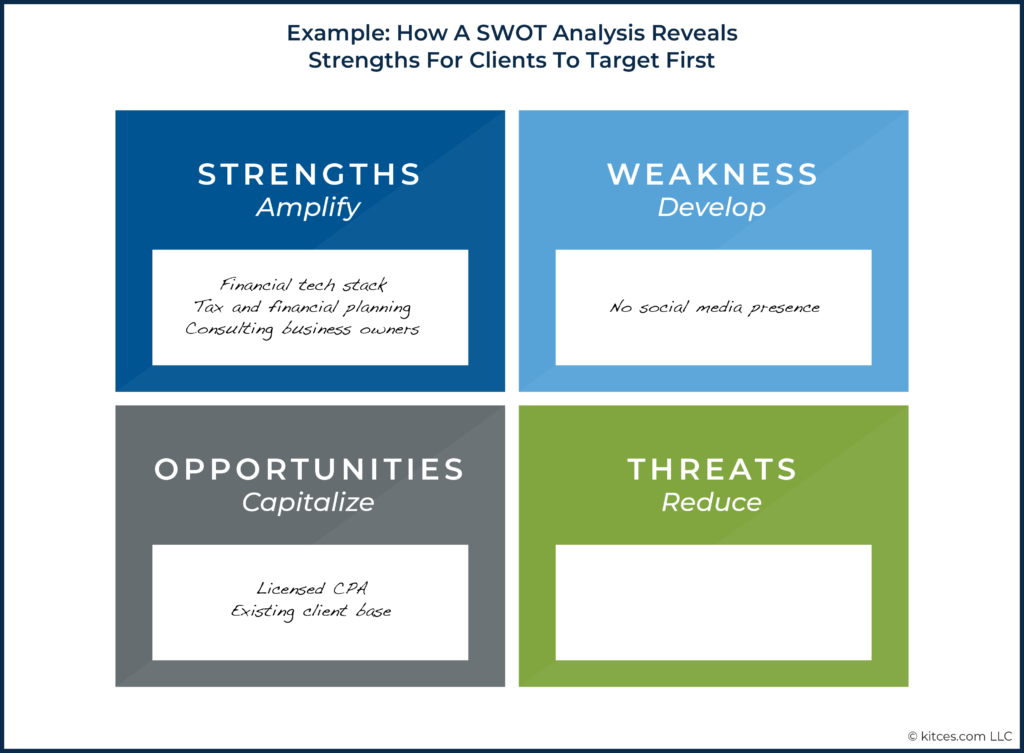

For example, consider a mid-sized firm that has carried out a SWOT analysis to identify strategies to grow their practice. They identified their established and loyal client base as one of their key strengths, and their limited marketing resources and know-how as a primary weakness. In this case, I would start with their strength and recommend that they focus on referrals or client introductions instead of looking for a way to grow organically through marketing efforts.

A financial advisor client once reached out to me for help with social media. However, through an initial discovery conversation, I learned that he had almost no followers, he was using curated content, and he didn't really have a desire to spend time engaging on social media. However, he did have a solid financial tech stack and deep expertise in tax, financial planning, and consulting business owners. He wanted to grow his practice modestly and had a great client base that was using him for his tax services (he was also a CPA) but not his planning services. It was clear that social media wasn't the right path for him (at least at this time).

Based on his strengths and interests, I recommended that he reconsider his approach. Instead of social media, we developed a plan to focus on uncovering opportunities in his existing client base. We started with his tax-prep clients, defined his service model, and productized an offering. Not only was he thrilled to get permission not to pursue social media as a growth tactic, but he was also excited and re-engaged in his business because he was promoting and doing more of the work that he loved and played to his strengths.

Growth doesn't have to be hard, nor does it require a big investment or new skills. By starting with your strengths, you'll find that the best growth path is often the easiest one!

Narrow Your Focus And Be Intentional

In growth, clarity is key. Long-term clarity should serve to reveal who you and your business are becoming – your future self. Short-term clarity identifies what you need to do and who you need to be now, in order to become your future desired self.

While managing an internal sales team, I learned that development happens most effectively when focusing on a single skill. In sales coaching, it’s a best practice to identify all opportunities for growth but also to encourage individuals to determine the specific area they will focus on practicing and developing. The same concept was reinforced in my coaching training programs – focus on one thing, not everything.

With the focus on intentionally developing a strong mindset and high-performance habits, consider what you’ve learned about yourself through this article. In reviewing the common mindset challenges and your high-performance audit, what area are you most called to develop? What would it look like for that area to be improved? What would the impact be?

An Exercise To Help Identify Purpose

Becoming aware of what you want to develop is key. Most advisors get into this business because of the necessity to act on a larger purpose – often to help clients create fulfilling lives supported by their financial wellbeing and to make a good life for themselves – not because they love to manage everyday tasks.

If you've lost sight of your purpose or need help keeping it front of mind, this exercise will help.

Find a quiet space and grab a pen and some paper. Consider these questions and write out your answers. There is no right or wrong; trust yourself.

- Why did you start your business?

- What aspects of your work and life are you most proud of? Why?

- What aspects of your work and life are you most passionate about? Why?

The answers to these questions are powerful clues into what really matters to you, and what drives you to act in accordance with your purpose.

Many high-performers develop purpose statements that they share and revisit often. I keep my own purpose statement by my desk with the most important attributes highlighted. Here’s mine: “My purpose is to be inspiring, present, and to live vibrantly to build meaningful relationships, to push my own and others’ limits, and to follow my intuition so that I can help myself and others unlock our potential, amplify our impact, and have fun along the way.” Inspiring, present, intuition, potential, impact, and fun are all highlighted. These are the values that are most meaningful to me today.

Every day I ask myself, “Am I taking inspired action? How can I add value and inspiration into the world today? How can I show up and be present for the people who need me today?”

I intentionally find ways to incorporate my purpose into my day-to-day life, which informs how I use my time. The goal is to stay focused on your 'why' to ensure you're spending time on the things that matter.

You will know you’re straying from your desires and purpose when you start to feel like a lot of effort or force is required. Again, pay attention to how you feel.

Regardless of the situation, high-performers do what they say they are going to do, and they do what needs to get done. No excuses. It may not necessarily be a question of how to do it, but rather who or what can help them gain productivity by managing the tasks at hand.

I am constantly amazed at the power of incremental progress. Small wins can make a big difference when working towards larger goals. Recall the negative feedback loop I described earlier. Being stuck in busyness is an example of a negative feedback loop that needs to be disrupted. Breaking the cycle can start with small but intentional shifts, specifically where and how you choose to spend your time daily.

Are you stuck in the busyness trap? What can you start and stop today that will move you from busy to productive?

Impact, Alignment, And Process – The Keys To Action

Once you have identified what you want to develop, the next part, taking action, can be the hard part. I’ve found that action requires three things:

- Recognition of impact (motivation);

- Alignment (rationalization); and

- Clarity on how to start and maintain progress (a process).

To help you start taking action on the one area of development you’ve identified, get clear on the three dimensions of action using these prompts:

Impact

- What’s in it for you?

- What do you lose by not taking this action?

- What external value will it provide? To whom?

Alignment

- How is this aligned to your values and purpose?

- Does it support your prospects’ or clients’ values and/or needs?

- What aspects of this decision are most uncomfortable? Are they valid?

Process

- Do you know how to start? If yes, where? If no, who can help you figure it out?

- Are you confident in your plan to act and realize your desired impact?

- Is this action sustainable over the short and long term? If not, how can you solve for it?

Making progress in one area of your life or business can have a ripple effect that will often lead to natural progress throughout other areas. Ultimately, the key is simply to start!

You are exactly where you need to be to take the next best steps towards your desired future.

Your ability to grow with engagement, joy, and confidence is limitless when you commit to cultivating your mindset and habits. When you’re looking to grow, start with a strong foundation rooted in the belief that it’s possible, because it is!

Nice article, but too much to consider. I was a founder of Buckingham and discovered concentrating on one factor could build growth—revenue per client. Doing those things that drove that number higher, while following a fiduciary model, could help the firm grow. That, combined with industry specialization can do the trick. Oh, it worked at the CPA firm too.

Almost a BOOK by length ;), though every “chapter” is worth reading again and taking action accordingly.

Great article – the key takeaways can be applied to many different professions and aspects of life. Mindset is everything!