Executive Summary

As we live in the "Golden Age" of advisor fintech, the number of great products to help financial advisors increase the value they deliver to clients continues to expand. Yet, an unfortunate reality of switching from one technology solution to another is that such changes can often come with substantial switching costs, both in terms of the financial costs that might be incurred during the process, and also the costs of the time and effort that must be invested by staff and advisors in order to get data transferred to the new tool and the entire team up to speed on using it. And when it comes to financial planning software, these costs can be even higher, as planning software generally doesn't have an export functionality needed for migrating data from one program to another, and the required training of advisory staff is higher relative to some other types of technology (e.g., CRM and performance reporting software), since advisors increasingly need to be able to confidently use planning software "live" in the client meeting in order to not undermine their credibility with clients.

In this guest post, financial planner Matt Cosgriff shares his perspective on BerganKDV Wealth Management's recent transition from MoneyGuidePro to eMoney, including their lessons learned, how to build an internal transition team, tools for "gamifying" the process, and how the transition can actually serve as a great training opportunity for both advisors and administrative staff. As Matt notes, a successful transition is crucial not only for preserving your existing work for clients, but also understanding how much variation exists between the results of your old software and your new software and why, so that you can effectively use your new software going forward and communicate any different outcomes to clients.

So if you’re contemplating a transition from one financial planning software program to another, or perhaps are just interested in how you can incentivize staff to make progress on a large goal by "gamifying" the process, I hope that you find today’s guest post and the insights from BerganKDV's transition from MoneyGuidePro to eMoney helpful!

The Challenge Of Switching To New Financial Planning Software

As financial plans are delivered and updated over time, most advisory firms accumulate a substantial amount of client history inside their financial planning software. Yet unfortunately, the reality is that “old” financial planning software tools don’t always keep up with the pace of change – especially as the pace of advisor technology change continues to accelerate. In other cases, the focus and philosophy of the advisory firm itself changes, and existing tools are simply no longer a good fit. And sometimes, new financial planning software companies start up that just provide a superior solution for an advisory firm’s particular needs.

At the least, the growing volume of alternative and new financial planning software solutions makes the decision of which one to pick – or change to – very challenging. The challenges, however, do not simply stop at making the right selection. In fact, in the case of financial planning software, the rather in-your-face heavy lifting effort of changing software has only just begun once an advisory firm selects the new planning solution.

Ultimately, the primary challenge of changing financial planning software is not actually the selection at all, but instead of the more hidden and far less discussed challenge of migration – of rebuilding dozens, hundreds, or even thousands of financial plans into the new software. Because unlike most industry CRM and performance reporting solutions, most financial planning software solutions do NOT offer any useful ability to port client data, creating a significant barrier to switching in the first place!

And even once you’ve managed to migrate all client data, from birthdates and investment holdings to insurance policies and income streams (not to mention the actual recommended scenarios you’ve built out in the past), you still have the unenviable pleasure of trying to rebuild the underlying assumptions (e.g. Social Security inflation, investment returns and standard deviations) to ensure that client’s results don’t dramatically sway simply because you’re using a new tool to deliver your value—advice.

Overarching the challenges noted above is the more common barrier to any change—while no easier to solve—and that is simply overcoming the fact that it is remarkably difficult to teach old (and young) dogs new tricks. In other words, even if the new financial planning software will be objectively “better” for the firm, that doesn’t mean every advisor in the firm wants to go through the process of changing what they do and learning new tools!

The change management aspect of changing any software can be extremely difficult, but even more so for financial planning software solutions. On a grossly oversimplified level, changing CRMs for advisors amounts to changing where advisors are prompted to enter client notes (though for operations staff it’s still a far larger undertaking!). By contrast, though, changing planning software requires shifting away from the vehicle that fundamentally allows us as advisors to deliver on our value proposition, and can dramatically alter the nature of client conversations that advisors may have grown comfortable with (based on the familiar output of their existing financial planning software). And that change requires an extremely strong level of commitment on the part of the firm, and ALL of its people, to make the switch for the betterment of the business, and ultimately the client. Overlook the critical step of establishing the “why change,” and lose the buy-in of the advisors in the firm, and the previously noted challenges only multiply.

In this blog post, we examine the all-too-painful challenges of switching financial planning solutions and migrating existing client data, and share ideas on how to handle those challenges, to better arm advisory firms with the critical knowledge necessary to make a transition as painless as possible. The focus will be less on the actual selection of which solution is “best”, given that there are so many tremendous resources on this topic already, from T3’s 2018 Software Survey to Nerd’s Eye View’s very own blog on the topic, and instead focus on laying the groundwork for how to successfully make the transition in your firm, given many of the lessons we learned over the last nine months at BerganKDV Wealth Management as we made the switch from MoneyGuidePro to eMoney.

Also, noteworthy and in fairness to both providers, our switch is not meant to be an indictment on MoneyGuidePro, or an anointing of eMoney as the holy grail of planning software. In fact, I remain (as do many at our firm) big proponents of MoneyGuidePro, even as we’ve transitioned away from it. Ultimately, planning software, like any software solution is more about fit for the style and planning philosophy of the firm, rather than simply which one is “better”, and for us, eMoney was more aligned with our current business model than MGP. However, I will miss a lot of MoneyGuidePro’s unique features, like their health care cost estimator, Play Zone, and Portfolio Probability Matrix!

The (Painful) Migration of Financial Planning Data

Having participated in both performance reporting and CRM migrations, it remains remarkable to me that only two-thirds of the typical advisor technology stack is “portable” from one solution to the other. Sure, in a CRM conversion, “ported” data must still be massaged once it finds its way into its new home, and there is significant effort required to map fields in one CRM to another. But when it comes to financial planning software, the migration is considerably clunkier.

Ultimately, there are only two ways advisory firms can migrate data from one planning software to another with today’s financial planning software. You can either pay someone else to manually migrate the data (which assumes you can find someone to do this in the first place!), or you can rebuild each plan manually yourself (or as a firm), one client at a time, into the new planning software. In other words, the only choices are a lot of manual labor, or a lot of manual labor!

In the case of paying someone from the outside to do the manual conversion, the options are incredibly limited. In fact, most tech consultants (at least the ones I’ve spoken with) don’t even offer this as a service anymore, and only did it to begin with when they launched and were starving for business (not dissimilar from advisors working with anyone early in their careers, to simply help keep the lights on!), or continue to do this only on a one-off basis if they are deeply embedded with a client and the migration of data was preventing the client from executing on a strategy they were collectively embarking on. This is largely because the business of simply migrating data is such a low margin, labor-intensive, and fairly high-stress business (but one that will hopefully become easier in the future as integrations at the very least minimize the amount of data that has to be ported!).

In some cases, the new planning software provider will itself take on the task of helping with the manual migration of data. But as far as we’re aware, the only planning software company that actually offers this is eMoney, and even their process isn’t very seamless, as it still requires the advisor to basically fill out fact finders for ALL clients that they eventually will rebuild into plans for you. In other words, the advisor still has to manually re-create every client scenario… eMoney will at best just help then re-enter that manually created data into their software. Additionally, the challenge is really that an outside party knows nothing about the client they’re migrating data for, which virtually guarantees that the entire process will be an ongoing (and potentially seemingly endless) loop of inefficient back-and-forth communications to get inevitable data questions answered (e.g., “This field doesn’t exist in the new solution, how do you want us to handle this?”).

In the end, we decided to manually transition over 300 financial plans on our own, for two primary reasons. First, we didn’t feel like any of the limited outside parties would be very efficient (i.e., cost-effective), or accurate, given their lack of insight into each client situation. Most importantly, however, we viewed the data transition as a critical training opportunity for advisors and client service reps—because what better way to learn how to use new planning software, than to build out over 300 financial plans from scratch in three months!

Creating An Internal Financial Planning Conversion Team

The first critical step to conversion success is simply setting up a clearly defined task-force (serving as a project-management team) that will ultimately own the planning and execution of the transition. This project management group for us included an advisor (myself), an operations lead, a client service rep, and an intern, all with the end-goal of successfully transitioning all financial plans from our old software to our new software in three months (we picked summer months, because they tend to be a little quieter with respect to the number of client meetings being scheduled).

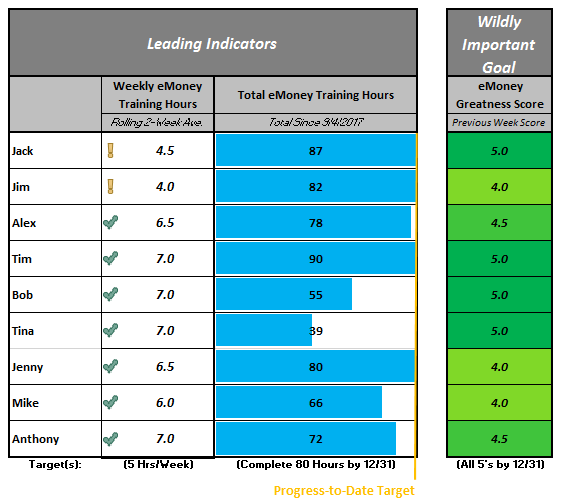

Once our conversion team was built, we spent considerable time working to gamify the process, and to create clear expectations around our collective goal, as well as a clear mechanism for tracking progress in real-time over the three-month conversion cycle that would allow us to reallocate support resources to those who needed it most. This mechanism was built largely off the book, The Four Disciplines of Execution, and our tracking sheet can be seen below. We believe it was likely one of, if not the most, critical aspects of our successful conversion.

Once our conversion team was built, we spent considerable time working to gamify the process, and to create clear expectations around our collective goal, as well as a clear mechanism for tracking progress in real-time over the three-month conversion cycle that would allow us to reallocate support resources to those who needed it most. This mechanism was built largely off the book, The Four Disciplines of Execution, and our tracking sheet can be seen below. We believe it was likely one of, if not the most, critical aspects of our successful conversion.

![]()

After a month of planning, it was off to the races on June 1, with each advisor committing to a full rebuild of six financial plans per month throughout the summer, which we found proved to be an incredibly valuable training ground (discussed further below) for advisors to learn the new software solution from scratch. For all other plans, we had Client Service Reps (CSRs) and an intern work tirelessly to manually migrate all plan data into eMoney (coordinating with advisors when questions arose) to help with a large chunk of the time-consuming data entry.

Throughout the entire conversion process, we used a process checklist cheat sheet to help outline the critical steps necessary to achieve an efficient and accurate transition of data, while also being able to track in real-time our team’s progress. As part of this process, we also required that advisors validate plans before they could be officially completed, so while CSRs and interns helped do much of the heavy lifting when it came to data entry, the advisor, with his/her intimate knowledge of the client, still had to go back and validate the data to ensure the new plan’s data and ultimately the results looked accurate relative to the prior solution. In addition, this validation process proved extremely helpful for troubleshooting plans that had dramatically different results, which could have been due to incorrect data entry, a missing piece of information, or even simply because the calculation methodology and assumptions differed (see below for more).

New Planning Software: Not Necessarily Better or Worse, But Definitely Different

We currently live in the golden age of advisor fintech, and yet with that comes an overwhelming number of options. And in the case of most software for advisors, it’s important to recognize that broadly speaking, solutions in a category aren’t necessarily inherently good or bad, but rather just different.

In the case of financial planning software, the most visible differences are the user experience for the client or features like offering account aggregation (or not), but ultimately, it’s the differences that exist under the surface level that can have the biggest hidden impact on the advice we give to clients! This stems from the fact that different planning solutions all have different underlying calculation engines, use and apply assumptions differently, and therefore may end out with different conclusions based on how “success” is calculated.

With these differences, it’s critically important to truly understand how planning solutions differ in their philosophy, calculation methodology, ability to customize assumptions, and what the default underlying assumptions are, before making the final decision to switch. In the end, however, you won’t likely really know the true impact until you start rebuilding your plans in the new solution. Sure, most advisors will (and should) try comparing a couple clients in the new solution while using a free trial to kick the tires, but until you really get into the nitty-gritty, it’s tough to truly grasp how the differences—again, neither good nor bad—will impact a clients’ results on a firmwide basis. What follows is a breakdown of some of the major (and minor) differences that we experienced when switching between the industry’s two leading solutions: MoneyGuidePro and eMoney.

Differences Between MoneyGuidePro and eMoney Advisor

The first difference to be sensitive to when it comes to financial planning software is that different tools can differ dramatically in their philosophical approach to planning.

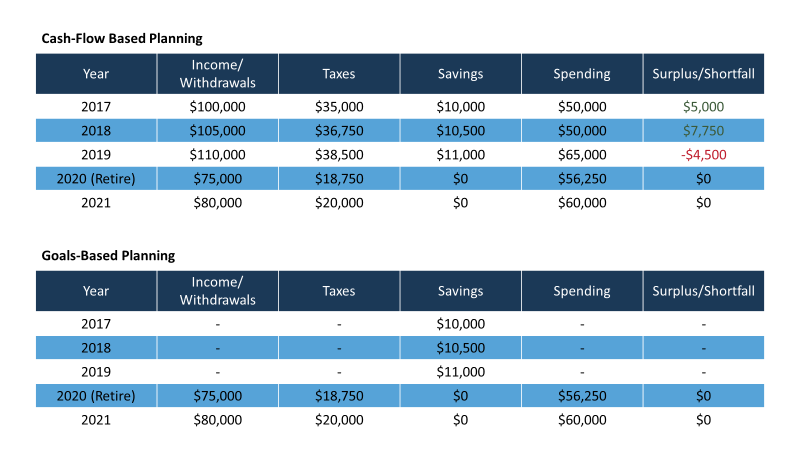

On the one hand, MoneyGuidePro, Advizr, RightCapital, and many others take a more simplified (simplified should not be construed as less accurate) goals-based approach to planning, whereas eMoney and NaviPlan take a more robust cash-flow based approach. The goals-based approach can be simpler and more efficient when it comes to planning with clients, because it generally doesn’t require you (or the client) to pinpoint every dollar they spend now and well into the future. Instead, you and the client can simply state how much a client plans to save per year (regardless of income or expenses) towards their goals, the cost of those goals, and the resources available to meet them, to project the outcome. On the flip side, cash-flow based solutions require considerably more data to properly calculate results.

This transition from goals-based to more robust cash-flow based planning created challenges when it came to converting plans properly, as in some cases we didn’t have the additional data required of a cash flow-based planning solution like eMoney (i.e. up-to-date monthly expenditures), which were necessary to generate any kind of legitimate plan.

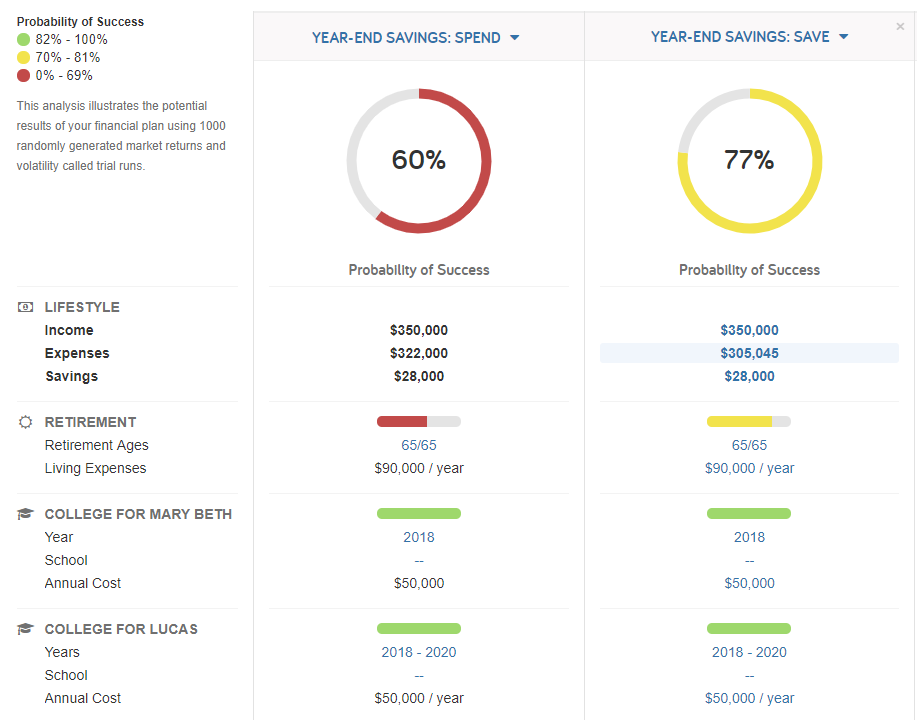

Additionally, the philosophical change brought to light the “Year-End Savings” setting in eMoney. In short, once you enter a client’s income, their annual expenses, their annual savings amounts, and the system estimates projected tax figures, there will either be a surplus or shortfall of money at the end of each year the plan is run for. In the case of goal-based planning solutions, year-in and year-out cash flow during accumulation years doesn’t matter, as it simply asks you to tell it (generally speaking) how much you plan to save, and the software doesn’t much care what income you use to do it with. When it comes to eMoney’s cash-flow-based planning, however, that end-of-year surplus or shortfall during accumulation years must be dealt with, and it can be done in one of two ways. The software can either assume it is saved/invested, or that the money simply disappears (more akin to the implicit assumption of goals-based planning software). And as you can imagine, the difference between the two can have a DRAMATIC impact on the client’s successful outcomes.

To hit home the point, below is a comparison of one affluent couple using the exact same data in eMoney, where they earn $350,000/year and are known to be saving $28,000, but by changing the “Year-End Savings” setting from “Spend 100%” of excess money at the end of each year to “Save 100%” of those dollars the results differ dramatically. Yes, you read that right: it took them from 60% probability of success to 77%. The dramatic change in results makes sense when considering that the first scenario has the client spending $322,000 per year (includes taxes), whereas the “Save” scenario has them spending $17,000 less and instead saves that money (on top of the already-stated $28,000/year of savings).

Note: The blue highlighted row signifies a lower expense level for the year, because that money is being defaulted to “saved.”

In the end, we defaulted to having the system effectively spend any excess cash at the end of the year, as we figured if the client can’t account for the money, it’s unlikely they are saving it. This also proved to be a valuable new aspect of our planning process, as it allowed us to show on the annual cash flow breakdown how much money was essentially unaccounted for. The conversation went something like, “Mr. and Mrs. Client, you make $150,000 a year, save $30,000, pay tax on $30,000, and spend $75,000, which leaves you with about $15,000 unaccounted for. Let’s spend our next 12-months focusing on trying to account for where those dollars are going, to ensure they are being used most efficiently. If it turns up that the money is being saved then it will only serve to help improve the odds of successfully accomplishing your goals; and if not, it will be an opportunity to improve how you budget and manage your cash flow!”

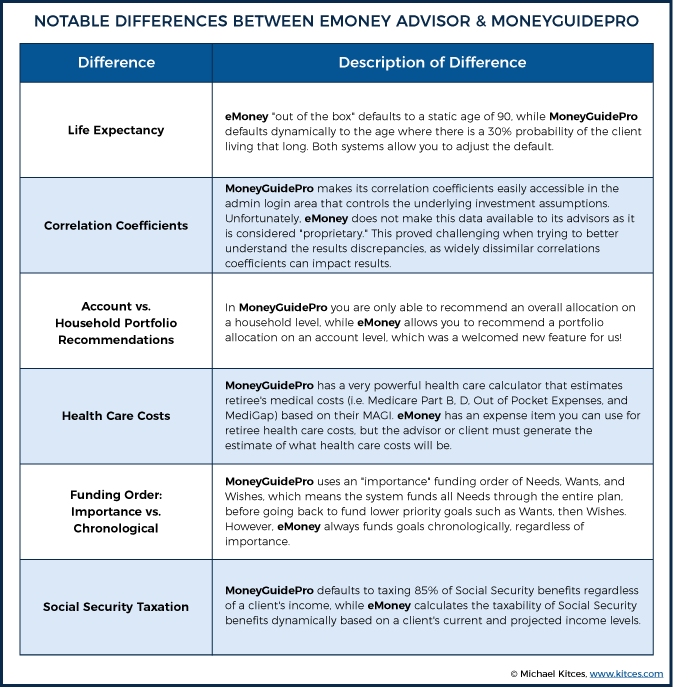

Additionally, one of the other major differences between the two systems is how they estimate a plan’s annual tax liability, and how much flexibility exists from an advisor perspective to edit those assumptions. In the case of MoneyGuidePro, their “design philosophy focuses on reasonable estimates” as they “do not believe it is possible to accurately predict certain tax assumptions for 20, 30, or 40” into the future. Thus, instead of trying to get overly granular, it simply calculates state and federal taxes using progressive rates in retirement (while using marginal rates on only investment earnings before retirement, but not calculating taxes on employment income pre-retirement because of its goal-based nature), while taking into consideration the standard deduction and personal exemption (pre-2018), in addition to accounting for capital gains. On the other hand, eMoney (again being cash flow based) attempts to dive deeper into the weeds on taxes, projecting out a full 1040, and even going so far as to account for the fact that if the client has a mortgage some portion of that interest is deductible (eMoney also allows you to simply apply a flat tax rate). Neither one of these methodologies is inherently good or bad, and we could likely spend the remainder of this post debating the validity of each approach; the point, though, is that they’re different, which can ultimately lead to dramatically different results for the “same” plan! In one case, we had a client with a couple million in qualified assets and roughly a million in taxable assets, that had their tax bill differ by well over $300,000 over the course of their 30-year plan between the two planning tools, which not surprisingly had a dramatic impact on the plan’s results! Now to be clear, part of the large discrepancy was that the client earns over $250,000 per year and is about five years from retirement, which means MoneyGuidePro, being cash-flow based, doesn’t factor in employment income and subsequently the appropriate taxes on that income during working years, whereas eMoney does. Additionally, differences surrounding long-term gains, Social Security taxation, and other granular differences played a role once the client was in retirement and both systems effectively both become cash-flow based (as MoneyGuidePro does get more granular in retirement).

The third critical difference—and the one that seemed to have the biggest impact on skewing client’s results from one solution to the other—was the difference in Monte Carlo engines, which is ultimately driven by the underlying investment assumptions! In the case of MoneyGuidePro, the system defaults to roughly 10 standard asset classes (including the ability to use both historical and either system default or custom-created projected assumptions), while also allowing advisors to customize additional asset classes and assign them specific returns, standard deviations, and even correlation coefficients. eMoney, on the other hand, allows you to build asset classes (while also having roughly 25 default asset classes “out of the box”) using their roughly 50 underlying indices (data provided by FactSet and Ibbotson Associates). Unlike MoneyGuidePro, however, eMoney allows you to set both the average return for an index (and ultimately an asset class built with that index), as well as the geometric average and standard deviation.

One of the tricky downsides we learned the hard way, though, that can have an unintended big impact on the variance of results, is that eMoney does not allow you to customize (or even view) the correlation coefficients assigned to an asset class matrix, nor even get access to the underlying coefficients (they claim it’s proprietary!). This blind spot created challenges for us as we tried to reconcile why and how client’s results differed from one system to another, with the eventual goal of being able to explain the variance to a client on a high level to ensure that they were comfortable with the new solution in the first place! I was ultimately able to work with an eMoney planning analyst to have him review our MoneyGuidePro correlation coefficients, and then provide commentary on how eMoney’s assumptions differed. For example, in speaking with the eMoney planning analyst, he was able to inform us that eMoney generally had higher correlations between equities, with more instances of negative correlation between stock and bond indices in eMoney, than MGP. Again, not good or bad, but definitely different (and admittedly a little into the weeds!).

In the end, both systems do a tremendous job of allowing advisors to provide comprehensive planning to clients, and ultimately the process of changing from MGP to eMoney or vice-versa is more a process of recalibration than recognizing one system as right or wrong. In the spirit of helping advisors reconcile all the major differences between the two solutions, the following is a list of additional aspects of the two systems that varied significantly in our experience and can ultimately impact results—making them good to be at the very least cognizant of when making the leap!

The Challenge of Teaching Old and New Advisors New (Financial Planning Software) Tricks

As noted above, changing CRMs and performance reporting software is a difficult undertaking, but one that largely falls on the shoulders of a dedicated operations team tasked with rebuilding processes into a new CRM, or porting and validating decades worth of transactions into a new performance reporting solution. Advisors largely just need to learn how to log into a new software website, and how to navigate around enough to enter notes into the new CRM or to hit “run” to pull up various performance reports for a client. Both of which tend to be done in the safe confines of an advisor’s office, where a client can’t see our initial ineptitude as we learn the software and scramble around trying to change the time-period from year-to-date to quarter-to-date.

On the flip side, however, is financial planning software which is increasingly shifting to front and center in the client meeting as an interactive platform for exploring various planning strategies and the feasibility of client goals. This makes for wonderfully engaging meetings, especially relative to the textbook-thick financial plans we, as an industry, used to produce. But it makes it critical that we as advisors are well trained and dynamic enough to navigate the planning software adeptly in front of a client in the first place! The consequences of not being able to model out various scenarios in real-time at best might simply lead to an awkward pause while one clicks around trying to figure out how to model delaying Social Security and boost pre-retirement savings, but at worst could jeopardize the perceived competence of us as advisors and undermine the client’s trust in our planning recommendations. Which means the unfortunate reality is that while we could be the most knowledgeable advisors in the business, if we are unable to effectively use the “tool” of our craft, we threaten our very own credibility, no different than a doctor struggling to use the latest and greatest x-ray machine might cause a patient to question a doctor’s abilities to diagnose one’s ailment.

All of this is to say that training is a remarkably important aspect of any transition, especially when it comes to financial planning software, and one that must not be overlooked. This is precisely one of the reasons we did not pay an outside consultant to help port data and required advisors to do some of the heavy lifting. The actual rebuilding of six plans per month per advisor over the course of the summer meant that each advisor had to effectively build out eighteen financial plans in 3 months as a means of learning the basics of the software. This was largely step-number-one in our training efforts, as our advisors needed to walk (enter client data) before they could run (know how to dynamically use the software in front of a client)!

Once we wrapped up the data migration over the summer and heading into Labor Day weekend, we set sights on officially turning off our MoneyGuidePro license by December 31. This allowed us to continue to reference MoneyGuidePro in a pinch as we began using eMoney with clients but gave us a hard deadline and a certain level of urgency behind actually learning how to use eMoney! As we headed into the fall months, we set a three-month target of 80-hours per advisor of eMoney “training,” which on the surface sounds like an unconscionable amount of training, but we loosely defined training to include any time spent in group or 1-on-1 training, time spent building financial plans (what better way to learn than to build!), or even time spent in meetings with clients engaging with the new software. This broke down to roughly five hours per week of eMoney training (or at least using the software in practice as a means of training) in our effort to become great at using our shiny new tool.

Like our data migration efforts, we also crafted an accountability scorecard to help gamify the process of training, as well as weekly advisor-led group and 1-on-1 training sessions. The scorecard looked at two simple numbers: how many hours have you trained (input), and how would you rate your abilities in using eMoney (output). This allowed us to track our progress towards our goal of being great with eMoney, while controlling for the key activity that would eventually allow us to reach it!

When it came to conducting internal training, one of the other advantages we had in kicking off our training efforts is that I had personally been using eMoney in somewhat of a beta fashion for over a year as the planning solution of choice for our next-gen efforts through Lifewise. When we launched our intrapreneurial venture of serving younger clients, one of the goals of it was to create a testing grounds of sorts for trying out innovative new tech solutions and in this case, we wanted to explore eMoney more broadly but didn’t want to make a huge investment firmwide in a solution that might not end up being a good fit. By launching it with our next-gen efforts (eMoney works especially great with young accumulator clients trying to master their cash flow!), it gave me a year’s head start on learning the nuances of the system that could then be transferred to our larger group of advisors as we made the formal switch into our primary business. This proved to be incredibly valuable in our training efforts, as even though eMoney and MoneyGuidePro have no shortage of recorded training videos, they tend to be fairly dry (not a great recipe for getting advisors to watch!), and they aren’t dynamic enough to answer real-life questions about client scenarios that an advisor may have just run across in a prior meeting. Being able to then serve as the in-house trainer proved to be an invaluable resource for crafting our own training, which we even turned into a day-long training effort around specific topics unique to our advisor’s needs, instead of spending the money to travel to an eMoney-led training session (although we did have them call in to conduct a couple deep dives on more sophisticated planning topics as part of our internal training day).

One of the last aspects of out training efforts was simply to help advisors self-assess their eMoney abilities, and where they should be focusing their efforts on improving. Outside of just asking advisors to grade themselves on a weekly basis on a 1-5 scale, we didn’t have a great way to score our abilities until the end of our training efforts, when we developed a simple self-assessment exercise to help advisors gauge if they really were a 4 out of 5, or just a 2. The simple framework seen below allowed advisors to actually gauge their level of competence when it came time to use eMoney.

Making the Client Facing Transition to New Financial Planning Software

The last big piece of the conversion puzzle is ultimately rolling out the new planning software to clients once all data has been migrated and advisors feel confident utilizing the new solution. While this aspect of the conversion did not require nearly the heavy lifting that came with data migration, nor the challenges of training advisors, it proved to be the last critical step in making the switch a positive in the eyes of those who matter most—the clients!

When it came to rolling out eMoney to clients there were four primary areas we focused on: (1) communicating the enhanced benefits of eMoney to clients, (2) helping them understand the necessary differences, (3) making sure advisors were capable of using the software in front of clients, and (4) getting clients set up with their fancy new eMoney client portal!

In working to educate clients on the benefits of the transition we used email newsletters, client agendas, good old-fashioned phone calls, and in-person client meetings, all to reiterate the value of the new solution. Talking points included outlining the added robustness of the cash-flow based planning software, deeper tax planning abilities, more capable estate planning functionality, and a sleek client dashboard to help streamline the data collection process, as well as giving the client constant access to their aggregated spending, investments, reporting, etc. We were also careful to communicate that this was not an indictment on our previous solution being incapable (and ultimately us for using it!), but rather a natural progression in our industry as tech evolves and our business evolves—we are staying proactive in using the best solutions to serve our clients!

Ultimately, the largest hurdle in rolling out new planning software to clients is what to do when a client’s results differ dramatically from one solution to the other. In our case, we tracked the probability of “success” difference between the current scenarios in both solutions so we could troubleshoot results that differed greatly. In the end, we found there to be a roughly 2.5% average difference in Monte Carlo results (with eMoney having slightly higher results; keep in mind this could vary in your firm based on the underlying assumption you use), which is actually pretty good, but this is only after we got all the underlying assumptions adjusted to mirror our old solution as much possible. However, even with a muted difference “on average” we found that 40% of plans had a difference of more than 10% in their probability of success! With a roughly equal number of plans being better off in eMoney than in MoneyGuidePro, and vice-versa.

Now admittedly, some of the differences can be attributed to data integrity, or lacking certain cash-flow based data points in eMoney that weren’t required in MoneyGuidePro. However, the ultimate point is that changing planning software is more than just adding sexy data aggregation functionality, cleaner aesthetics, or more dynamic in-meeting functionality, but requires keeping a careful eye on the difference in results and ultimately how that will be communicated to clients. It also required us to “re-calibrate” our belief of what “success” was defined as. For example, in one software you might require clients to have an 80% probability of success but find that your new solution tends to skew results more positively, so you may need to adjust your version of success to 85% being the new hurdle rate for “success.”

In wrapping up our client rollout we focused on ensuring advisors were comfortable utilizing eMoney in front of clients as noted above in the training section, which included being able to interactively demonstrate various scenarios and planning strategies, as well helping clients get their portals set up (one of the big selling points of the new software!). This was largely done in meetings or over the phone to help walk them through how to get their portals set up, as well as in meetings drawing parallels to the old software (i.e. the Goal Planner section is like MGP’s Play Zone, etc.) to help familiarize and get clients comfortable with the new solution.

The Financial Impact of Changing Financial Planning Software

In wrapping up, one of the other critical aspects of changing planning software is simply the hard dollar cost, both in the form of any data migration costs, as well as any financial incentives for the team that are used to motivate them to reach your firm’s conversion goals (e.g., we did Amazon gift cards drawing for those who completed their 6-plans per month, but one-time bonuses could also factor in), and ultimately the ongoing price difference between solutions. The good news for advisors is that while planning software costs can differ widely relative to each other (for example, eMoney costs nearly 3x as much as MoneyGuidePro), the total cost of planning solutions remains relatively small when compared to many of the industry’s performance reporting solutions (which is largely tied to the fact that performance reporting solutions remain a direct revenue-generating cost of the business, rather than being viewed as an overhead cost like financial planning software—at least for now!).

When it comes to pricing, I will throw out the disclosure that pricing, pricing structure, and ultimately what you can negotiate seem to change frequently with vendors, so the information below could be dated by the time you read this! Nonetheless, when it came to eMoney they offer two options: (1) Individual Pricing or (2) RIA office pricing. Individual pricing allows (and in fact requires) each advisor to have their own independent license and access to the software. The latter allows you to share clients across advisors in the firm, brand consistently, use global investment assumptions, etc., but bases pricing off the total number of advisors registered on your ADV. While this may increase the number of licenses you likely need to buy, eMoney does allow you to mix and match the licenses across their three solutions, which include eMx Select ($1,944/year/user), eMx ($2,592/year/user), and eMx pro ($3,888/year/user). This allowed us to ensure support staff (i.e. client service reps or paraplanner) had full data entry functionality, ability to help clients with account aggregation connections, (with eMx Select), etc., but that way we didn’t need to pay for full-blown licenses with client facing and planning functionality (i.e. eMx Pro) if it was unnecessary for a particular staff member.

On the flipside, MoneyGuidePro charges $1,295/year/user, which is a steep discount to what eMoney’s comparable solution costs, providing advisors with tremendous value for what is the #1 used financial planning software across the industry according to Financial Planning Magazine’s annual tech survey. Ultimately, we viewed the additional cost as an investment in our business, and one that we believed would make us more efficient, provide additional value to clients in the form of a robust client portal that functions as a full-scale Personal Financial Management solution for clients, as well as allowing us to go deeper into planning with (what we believed) is a more robust solution.

In the end, however, it wasn’t the actual decision of which software solution to pick (and its licensing cost) that was the real challenge, as you frankly can’t go wrong with MoneyGuidePro or eMoney (or many of the other great solutions available!); instead it was the unenviable challenge of switching, and migrating client data, that became the true barrier (and cost) to changing, and one that we’re happy to have behind us!

So what do you think? What additional challenges have you found in changing financial planning software solutions? Have any advisors had success using a third-party to “port” data? Has the thought of migrating all that data held you back from making the switch? Please share your thoughts in the comments below!