Executive Summary

For those who already have a charitable intent and are over age 70 ½, the now-permanent rules permitted a Qualified Charitable Distribution (QCD) directly from an IRA to a charity provide an appealing means to minimize the tax bite of an RMD. Of course, it’s always possible to simply donate to charity and claim a charitable deduction to offset the income of an RMD, but given that in practice the income and deduction rarely offset each other perfectly, the QCD offers a slightly better potential tax outcome.

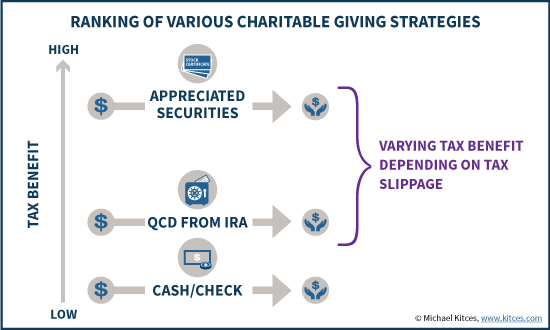

However, while donating from an IRA to satisfy an RMD obligation may be more effective than separately taking the RMD and donating cash (or writing a check) to the charity, it is usually not as good as donating low-basis stock or other appreciated investments instead. The reason is that while a QCD is a “perfect” pre-tax contribution, donating investments allows for a pre-tax contribution that also permanently avoids a long-term capital gain.

On the other hand, the reality is that charitable donations often have limits of their own, from the fact that they’re only valuable for those who itemize deductions in the first place, to the 30%- and 50%-of-AGI charitable contribution limits that may apply as well. Furthermore, donating low-basis stock may still not fully offset the income from an RMD, where that income increased AGI and triggered the phase-in of Social Security taxation or the phase-out of other significant deductions.

Ultimately, then, the relative benefits of QCDs will depend significantly on the facts and circumstances of the situation, driven primarily by whether or how much a donation of low-basis investments could really be claimed as a full deduction in the first place. On the other hand, it’s also important to remember that for those who don’t have a charitable intent in the first place, the optimal strategy is still to just take the RMD, pay the taxes, and keep the remainder; QCD strategies are still only best for those who want to maximize the tax benefits of charitable giving they already planned to do in the first place!

Benefits Of Doing A QCD From An IRA

The primary benefit of doing a Qualified Charitable Distribution (QCD) from an IRA to satisfy a charitable bequest is that it allows the funds to come out of an IRA without any tax consequences. In general, this makes the QCD an appealing way to ‘use’ IRA funds, and even more so since the direct charitable distribution can satisfy a Required Minimum Distribution obligation (which there must be, since QCDs are only permitted for those who are already at least age 70 ½ on the distribution date).

Notably, though, the reality is that anyone who is subject to an RMD and has a desire to contribute to charity could always just take the RMD proceeds and use them to make a charitable donation. The IRA distribution would be reported as income, but the subsequent charitable contribution – using the dollars from the RMD, or simply any other equal dollar amount that is contributed – would largely offset the tax consequences anyway.

Example 1. Charlie is 73 and has an $8,000 RMD from his IRA this year, and also plans to contribute at least $8,000 to a charity. Since he’s already taken his RMD – and will have to report the $8,000 distribution in income for tax purposes – he simply writes an $8,000 check to the charity, with the plans to use the $8,000 charitable deduction to offset the $8,000 of RMD income.

Of course, the caveat to this strategy of simply using a charitable donation – and the associated deduction – to offset an RMD is that the two rarely offset each other perfectly.

For instance, the Required Minimum Distribution is reported as income on the front page of the tax return, and increases Adjusted Gross Income, which can indirectly impact everything from the threshold for deducting medical expenses and miscellaneous itemized deductions, to the phase-in of Social Security taxation, and the phase-out of itemized deductions and personal exemptions.

Similarly, the charitable contribution is reported as a “below-the-line” itemized deduction, which means it’s only valuable for those who itemize in the first place (which is a non-trivial threshold, given that with the extra amount for being over age 65, a senior married couple’s standard deduction is a whopping $15,100 in 2016). And then there’s the charitable deduction AGI limitations for those who make “large” charitable contributions (at least, relative to their income).

The end result is that while taking an RMD as income and making a charitable deduction to offset it may “mostly” neutralize the tax impact, it is rarely as clean as the “perfect” pre-tax deduction that occurs by doing a QCD directly from the IRA to a charity.

Example 2. Andrew and Harriet are 74 years old. Between the two of them, they have $45,000 of Social Security benefits, $40,000 of portfolio income, $35,000 from Andrew’s military pension, and Andrew faces a $30,000 RMD from his $714,000 IRA. In addition, the couple wish to make a significant bequest to their alma mater this year, and have pledged a $30,000 donation (to offset their looming RMD obligation).

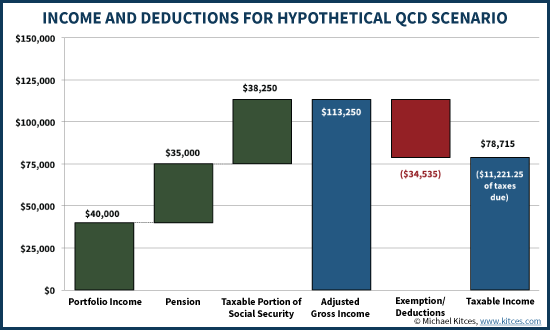

If the couple commits the $30,000 RMD directly to the charity as a qualified charitable distribution, the couple’s AGI is $40,000 (portfolio income) + $38,250 of taxable Social Security benefits + $35,000 pension = $113,250. They will be eligible for 2 personal exemptions of $4,050 each, and their itemized deductions include paying $5,500 in state income taxes, $4,000 in property taxes, $11,000 in mortgage interest, and $8,000 in investment management fees (which are limited to $5,935 in excess of the 2%-of-AGI floor). Thus, their total deductions are $34,535, and their taxable income is $78,715. Based on the 2016 married filing jointly tax tables, this puts the couple in the 15% tax bracket, with a total tax liability of $11,221.25.

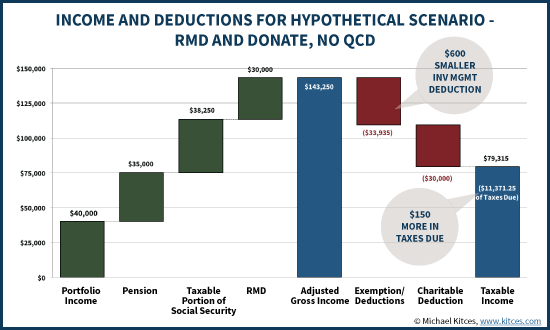

By contrast, if the couple were to take the $30,000 RMD directly, their AGI would rise to $143,250. The subsequent $30,000 contribution to their alma mater would produce a $30,000 tax deduction, but their investment management fee deduction would fall to only $5,335 (due to the higher 2%-of-AGI threshold). As a result, the couple’s total deductions would be $63,935, and their taxable income would be $79,315, resulting in a tax liability of $11,371.25.

The end result is that while the couple takes a $30,000 RMD and contributes $30,000 to charity, their net tax liability rises by $150. This “tax slippage” is due to the fact that the higher income from the RMD increased their AGI and adversely impacted their miscellaneous itemized deductions in a manner that the charitable deduction could not perfectly offset.

Or viewed another way, utilizing the QCD rules over “just” donating to the charity directly saves the couple $150 in taxes on a $30,000 contribution (or a 0.5% marginal tax rate savings), because the QCD is slightly more tax efficient way to engage in charitable giving.

QCDs vs Appreciated Securities To Minimize The IRA RMD Tax Bite

A significant limitation to the benefit of donating the proceeds of an RMD (or donating any cash to charity, and using the charitable deduction to offset the income from an RMD) is that cash donations are not necessarily the most effective charitable giving strategy, compared to alternatives like donating appreciated securities instead.

The reason is that under IRC Section 170, an individual who donates a stock or other investment that has appreciated in value and has been held for at least 12 months (eligible for long-term capital gains treatment) is able to deduct the full fair market value of the investment as a charitable deduction, without being forced to recognize the capital gain in the process. Instead, the capital gain just “disappears” entirely. (Although notably, the property must be held long enough to be eligible for long-term capital gains treatment, as the charitable deduction for investments with a short-term gain is limited to just the cost basis of the investment under IRC Section 170(e)(1)(A).

Example 3. Rebecca has $10,000 of Apple stock that she purchased years ago for just $2,000. She has decided that she will use the Apple stock to satisfy her charitable giving bequest for the year. Accordingly, Rebecca donates the $10,000 of Apple shares, in kind, to the charity. This provides Rebecca a $10,000 charitable tax deduction, even though she could never have used the whole $10,000 for herself, as a liquidation of the stock would have trigger $1,200 in long-term capital gains taxes (assuming a 15% long-term capital gains rate on the $8,000 gain). Thus, by donating appreciated securities, Rebecca obtains a $10,000 tax deduction for property that would have only be worth $8,800 if she tried to use it for herself!

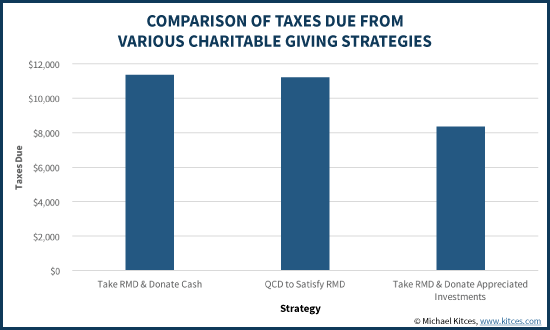

In the context of trying to minimize the tax impact of an RMD through charitable giving, this favorable treatment is notable, as it means that while doing a QCD from an IRA may be more appealing than just donating the cash proceeds, it may still be inferior to donating appreciated investments from the portfolio instead.

Example 4. Continuing the earlier example #1, assume that Andrew and Harriet decided to take their $30,000 RMD in cash and offset the tax consequence by donating $30,000 of highly-appreciated stock that had a cost basis of only $10,000. While the strategy produces the same tax liability of $11,371.25 that occurred when $30,000 of cash was donated, the couple also saves $3,000 of long-term capital gains taxes that otherwise would have been owed someday on the $20,000 gain (assuming a 15% long-term capital gains rate).

In other words, while a qualified charitable distribution from an IRA is slightly superior to contributing cash, donating appreciated securities is far superior to “just” a qualified charitable distribution from an IRA. The reason is that donating either as a QCD or with cash is a pre-tax contribution to charity, but contributing appreciated securities is a pre-tax donation and permanently avoids a long-term capital gains tax liability that otherwise would have been owed in the future.

In addition, it’s notable that donating appreciated securities also has the potential to be tax deductible for contributions to a donor-advised fund, a charitable remainder or charitable lead trust, or a private foundation – all charitable types where a QCD is not permitted in the first place.

Tax Slippage When Donating Appreciated Investments Still Loses To IRA Charitable Distributions

When evaluating whether to donate appreciated investments or do a qualified charitable distribution from an IRA, it’s notable that the larger the embedded capital gains exposure, the more substantial the benefit for donating a stock, ETF, mutual fund, or other investment that has been appreciated in value.

However, the greater the “tax slippage” of reporting an RMD in income and trying to claim an offsetting charitable deduction, the less appealing it is to “just” to donate appreciated securities.

Factors That Increase Tax Slippage

As noted earlier, tax slippage occurs when the increase in income (or specifically, the increase in Adjusted Gross Income) from an RMD triggers additional tax consequences, such as the phase-in of Social Security taxation, the phaseout of itemized deductions or personal exemptions, or the thresholds for specialized deductions like medical expenses and miscellaneous itemized deductions.

In addition, to the extent that the charitable deduction cannot fully be utilized, either because the donor wasn’t itemizing deductions in the first place, or because the charitable deduction limits are being reached, additional tax slippage may occur. (Although notably, the Pease limitation on itemized deductions does not adversely impact charitable contributions, although additional RMD income might.)

A combination of both factors can result in scenarios where donating appreciated securities is actually worse than simply doing a QCD from an IRA.

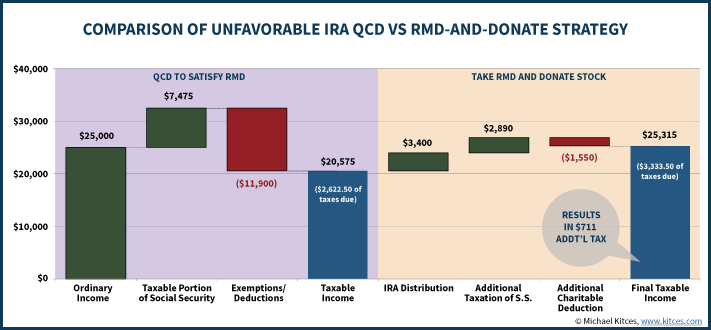

Example 5. Harry is 72 years old, lives on a combination of $25,000/year of Social Security and another $25,000/year of interest income from his portfolio, and has an $87,000 IRA faced a $3,400 RMD this year. In addition, Harry gives several thousand dollars annually to the American Cancer Society, in memory of his late wife who passed away from leukemia. In the past, Harry donated low-basis stock from his brokerage account to the American Cancer Society to offset the tax consequences of his RMD, and now he would like to assess the tax savings benefit if he simply did a qualified charitable distribution directly from his IRA to the charity to satisfy his RMD obligation.

Currently, Harry’s AGI is $25,000 (ordinary income) + $7,475 (the taxable portion of his Social Security) = $32,475. Since Harry has only $6,000 of itemized deductions, he instead claims the $7,850 standard deduction (including the additional amount for being over age 65), and also receives a $4,050 personal exemption, which brings his taxable income down to $20,575. Based on the 2016 individual tax tables, this puts Harry in the 15% tax bracket, with a total tax liability of $2,622.50.

By contrast, if Harry were to take the $3,400 RMD directly, his income would increase by $3,400. In addition, the higher income would also phase in the taxability of $2,890 of his Social Security benefits, boosting his total AGI to $38,765. The subsequent $3,400 stock donation to the American Cancer Society would produce a $3,400 tax deduction, bringing his total tax deductions to $9,400 (although since he already had a $7,850 standard deduction, only the last $1,550 produces any tax savings). Thus, Harry’s final taxable income is $38,765 - $9,400 - $4,050 = $25,315, which produces a tax liability of $3,333.50.

In other words, because of the indirect effects of Harry’s additional income and the limited value of additional itemized deductions (when he already claims the standard deduction), Harry will owe an additional $711 of taxes by taking his RMD and donating it, versus simply doing the QCD from the IRA, even though both involve a “pre-tax contribution” to charity! In fact, even if the cost basis of the stock were $0/share, his potential tax liability at a 15% capital gains rate would be only $510 of additional tax savings, compared to $711 by doing the QCD. (And notably, Harry is actually eligible for the 0% long-term capital gains rate, which just makes donating his low-basis stock even less appealing!)

IRA Charitable Giving Strategies Beyond Just RMDs

As shown, there is virtually always a tax benefit for doing a qualified charitable distribution from an IRA over just taking an RMD and separately donating cash (or writing a check) to a charity. And in extreme circumstances, the tax slippage can be so severe, it’s even better to do a QCD rather than donating appreciated low-basis investments to charity.

However, the QCD rules are broader than “just” covering an RMD obligation from an IRA. Any IRA owner is permitted to do up to $100,000 per year in QCDs from an IRA to a charity, which may be far in excess of their RMD alone. (And up to $200,000 is possible for a married couple, as long as each contributes up to the $100,000 maximum from his/her own IRA, and each is over the requisite age 70 ½ on the date of their respective distributions.)

Generally speaking, larger QCDs will continue to be appealing in situations where the charitable deduction could not be fully utilized directly – either because some or all of the charitable deduction falls below the threshold of the standard deduction in the first place, or because the charitable contribution is so large that it reaches the 30%- or 50%-of-AGI contribution limits and must be carried forward.

As a result, larger QCDs will tend to be most appealing for those with very little in other deductions at all, or for those who are already doing significant charitable giving and may be close to the charitable deduction limitations. QCDs may be especially desirable for those who are already at the full charitable deduction limits (or worse, already trying to use prior carryforwards after reaching the limits in prior years), because the tax-free QCD can be done on top of the charitable contribution limits (as since the QCD is never reported as a deduction at all, it’s not counted in the charitable limits).

When NOT To Do A Qualified Charitable Distribution From An IRA

Notwithstanding the prospective tax benefits of doing a qualified charitable distribution from an IRA (or donating low-basis investments), it’s important to note that ultimately, the strategy is only worthwhile for those who otherwise already plan to contribute to charity.

For those who do not actually have a desire to donate the money in the first place, the ‘optimal’ strategy is still to take the RMD, pay the taxes that are due, and keep whatever is left. In other words, from a pure wealth maximization perspective, it’s still better to keep the $0.60, $0.70, or $0.80 cents on the dollar left over after an RMD occurs, than to donate it and keep $0.00 instead.

Thus, while a QCD can be an effective way to leverage the tax benefits of charitable giving, for those already over age 70 ½ who have an IRA (and face RMDs), it should still only be done after deciding to make a charitable donation in the first place!

So what do you think? In what circumstances do you recommend a qualified charitable distribution from an IRA? When do you suggest donating low-basis investments instead? Please share your thoughts in the comments below!

If you are doing binary options trading manually, you are losing alot of money. I’m doing it automated and made $1678.00 today so far. Check it out http://rurl.us/vktWn

An additional factor in the tax slippage consideration is how much any RMDs might subject folks to IRMA increases for Medicare Parts B and D.

Agreed Ben, although in practice the marginal tax rate impact of IRMAA is fairly modest (see https://www.kitces.com/blog/income-thresholds-for-medicare-part-b-and-part-d-premiums-an-indirect-marginal-tax/ ), unless the client is RIGHT next to the line, where a QCD (or not) can put them on the other side of the line. And then it’s somewhat more appealing. 🙂

– Michael

Very true, although that impact is magnified in a year like last year when IRMAA folks get nailed because they aren’t protected by “Hold Harmless” provisions.

Hi Michael,

Great article.

A few things I was thinking about as well while reading this was the consideration of the basis-step up for the non-qualified investment, the lack of a step-up for the IRA (IRD), and the excess RMD problem. If someone was choosing between gifting appreciated securities or doing a QCD, but were also concerned about the tax-efficiency of their estate upon death, they might end up doing the QCD so that the appreciated security gets a step up and is left to heirs.

Also, if someone was facing looming RMDs which greatly exceeded their actual income need, they might also lean more toward the QCD… since they don’t HAVE to sell the stock, but DO have to take the RMD.

We have been having conversations with clients around these issues… and the problem I’ve been seeing is that it’s extremely difficult to, in advance, make these calculations. I think it will be good for us to just have a sort of “cheat sheet” of issues to consider when making these charitable decisions.

Thanks for the article!

I am in the same situation. I have been donating stock for years and just now started looking into QCDs. I don’t need to sell the stock (in which I have less than a 20% cost basis). It probably never will be sold in our lifetime and wind up in our estate where the stepped up basis will settle the issue. But one could still go that way, take the RMD in cash, donate the stock, then use the proceeds from the RMD to buy back the same number of shares of stock. Now the stock has zero basis and only growth from there on will be taxable if sold.

Is a QCD reported specifically anywhere in a tax return?

Rob,

The tax preparer writes in total IRA distribution amount (including the QCD) and then writes in the taxable amount a number less than the QCD and then writes next to that line the letters “QCD” so that the IRS can reference that note when they notice that the taxable amount doesn’t match the 1099 that was issued by the IRA custodian.

I.e. you better tell your accountant you did this or there is no way its getting reported right.

Thank you!

Wouldn’t the 1099-R Box 2a (taxable amount) show a reduction for the QCD from box 1 gross distribution? So it should match what the IRS sees on the 1099-R

Michael,

I’ve put this comment a dozen times now on your blogs posts discussing this comparison.

In practice, with 98%+ of the clients out there the QCD is better than donating appreciating securities. I know this is true because I live in a high state income tax state where retirees are more likely to itemize.

The scenario you bring up is so narrow it almost never happens:

-If you’re a good advisor there is often little NQ money to speak of because its all qualified for anyone that made on average less than $200K a year while working.

-Social Security acceleration bites a lot, lot harder than you make it sound for those that aren’t fully accelerating (so you can wipe out 80%+ retiree clients right there). It generates in my state temporarily over 40-60% marginal brackets with itemized deductions for only part of that vs. full deduction in QCD.

-The healthcare AGI floor hits hard for those people (which is more common among retirees)

-The vast majority of retirees have paid off or mostly paid off homes and don’t have mortgage interest deduction. Therefore, a large number don’t itemize at all ***and I’m in a high state tax state***. You’re in Virginia where its even lower. For ~1/3 of the states now there is no state income taxes on non earned income and itemized deductions are even lower.

-There really just isn’t that many retirees running around with cost basis only at 1/4 or 1/3 of a securities value. Most are in excess of 1/2 which means the extra benefit from donating appreciated securities is typically only half or less of 15% assuming they’re in a bracket that actually recognizes capital gains taxation at all.

I’m sorry, but if you had done this analysis in practice a few hundred times you would know that while in theory you can invent a scenario where donating appreciated securities is better, in practice most of the time its not.

…where retirees are more likely to itemize. *So if I’m seeing that clients are more often better off to QCD here than in most advisors states its an even higher percentage of the population.*

We’ve been through this analysis many many times with clients of our firm. This does not come from theory. It comes from practice. In fact, I’ve written it in part because we so often see clients ready to do QCDs and find/show them that in their situation, donating appreciated securities is more effective for them.

Bear in mind that advisors work with a wide range of clients. Depending on the advisor, the taxability of Social Security may be irrelevant (because clients are already over the line). If you work with business owners who have had liquidity events, they often have very large NQ accounts. Many advisors strongly advocate to keep mortgages in retirement, and their clients mostly carry large mortgages.

If YOUR particular clients happen to fit the scenario for QCDs, that’s great. This article makes several points about where QCDs are superior for that very reason.

But you seem to imply that the article is saying “ALWAYS donate and NEVER QCD” and that’s simply not what it says. This article discusses a wide range of issues and parameters to consider. Apply it to your client base accordingly, and other advisors serving other clients will apply it to theirs.

– Michael

I’m saying that your implying that the scenario you’re giving is far more common than it is. If you’re firm is loaded up with perfectly sized clients for this than I can understand, but its a small segment of the population.

1) If I’m a business owner with a liquidity event at retirement, I likely don’t have much embedded gains from age 62/65 to age 70.5 so donating appreciated securities isn’t going to yield me that much capital gains savings. Also business owners tend to retire and sell out later than most people retire.

2) If we’re talking the $10M+ crowd than its also pointless because of step up in basis at death. The securities will eventually be tax free anyway unless they specifically want to sell that security do change in expectations for its future growth, but even then it can probably be washed out with some loss harvesting.

3) Also if they’re high NQ assets than their taxable income is typically low in retirement because NQ is always the first spend source. Now you may be attempting to artificially increase income via Roth conversions, but its unlikely you’re pushing those up much beyond the $80K+ per year marker.

4) We encourage clients to not pay mortgages early, but its a big compliance issue to start talking about cash out refinances for the purposes of cheap interest (net of tax) financing. You live in a metro that is high transplants so your typical client likely acquired their home in the last decade which may contribute to higher quantity of itemizers. For most of us, our retiree clients acquired their homes more than a decade ago. So unless you’re willing to take your chances with regulators or a clients attorney, many of us *are not* recommending cash out refinances of homes for the purposes of additional retirement assets which would leave in place high mortgage interest deductions.

Also I’m a little thrown off you saying that you’ve learned this by practice because:

A) Practically zero clients know what a QCD is, so I’m a little suspicious of a comment that says there is a bunch of clients ready to do them. If you claimed that even 5% of your 70+ client base knew about QCDs before you told them, I would have trouble believing that.

B) Such an analysis is just as much a question of logic as it is math. I.e. what you choose to include in the analysis is just as important as the math you do once you start it. Example: Did you include any notion of highly appreciated securities getting a step up in basis at death into the equation? If not, then you skipped an important element into whether that advice was in fact “more effective for them”.

C) I’m even more suspicious if you claim to have run it in a tax preparation software like BNA above because the capital gains from the appreciated securities wouldn’t have happened that year so any analysis would have to be forward looking to some date in the future.

D) Your firm appears to be on MGP which is incapable of being any help to these calculations.

So forgive me. I guess its possible that Pinnacles client base perfectly fits a narrow set of circumstances where appreciated securities makes more sense, but I find it unlikely. What is more likely is that the “in practice” discussions with clients were in fact incorrect due to important factors not being included.

Mr. Kitces, can you share the name of the software you used for your analysis?

Microsoft Excel. :/

BNA Income Tax Planner (see https://www.bnaitweb.com ) is a good option to show clients the side-by-side if you don’t like doing the tax calculations ‘manually’.

– Michael

Wonderful. Thank you Michael!!

Michael, this issue came up with a (rare) older client of mine who moved from Virginia (state tax) to Washington (no state tax). She had been donating appreciated securities, but between the move and selling her house (so no more deductible house-related expenses) means that itemized deductions are probably a thing of the past. Hence QCDs are likely her best bet…and bonus is that her Medicare Part B premium might not be raised as much, which has always been a source of annoyance for the client.

I really do love the tax-efficiency of certain types of charitable donations, and it really seems to be an area where clients are quite ignorant so it’s instant value-add. Even for younger clients who don’t know about the “donate appreciated securities” strategy.

Meg,

Yeah, eliminating itemized deductions altogether tends to quickly undermine donating appreciated securities. And it’s usually “hard” to get there for people whose income is still high enough to trigger higher Medicare Part B premiums. But no longer owning a house, and living in a zero-income-tax-rate state, would certainly do it… 🙂

– Michael

Michael:

The other thing to consider here is state taxes. In the QCD scenario, the taxpayer does not have to pick up the IRA RMD in gross income for state tax purposes. So, for a taxpayer that is in a state with a 6% tax rate and does the max QCD, he or she would also save 6,000 in state taxes. The charitable contribution for some states is irrelevant.

Can I use a QCD to give $1000 to a local library and ask them to purchase sets of Blu-ray videos, which I would specify, and which I would request priority access from the library?

Please don’t make that donation to our library. Either freely donate (no strings attached) or “help” elsewhere.

It would very helpful to see an updated version of this article post-SECURE act and the new 2018 tax code!

Thanks,

Kay

It would be great to get an update on this topic as others have mentioned.

However, I think that both strategies can be used hand-in-hand. Particularly for those with RMDs that get them to cross tax bracket, QCDs is a above-the-line number that could get them to get back under that line without much stress. At the same time, a gift of highly appreciated stock could also be made. They then have 5 years to use up the balance of the charitable deduction.

What would your thoughts be for a client still working at age 76, access to a 403B, to Roll the IRA’s into the plan, avoid the RMD, let assets grow for the next 5 years, in the meantime, donate NQ assets / cashflow take the deduction, they qualify to itemize