Executive Summary

In a classic case of “the gift that keeps on giving,” the new IRC Section 199A included in the sweeping changes to the Internal Revenue Code introduced in the Tax Cuts and Jobs Act enacted by Congress in December 2017 has the potential to help certain business owners significantly reduce their annual tax bill with a 20% deduction against their “qualified” pass-through business income. With the caveat that when it comes to real estate, the new Qualified Business Income (QBI) deduction only applies against business income, and not against “mere” investments in real estate.

In other words, to qualify for the 20% QBI deduction as a rental real estate owner, a taxpayer must establish that they’re engaged in a “qualified trade or business” in the first place. Which, when it comes to rental real estate activity, isn’t always clear (especially since Congress didn’t fully define what constitutes “a business” for the purposes of the new IRC Section 199A in the first place)!

Fortunately for some, at the same time the IRS issues it’s first round of IRC Section 199A Final Regulations, it also released IRS Notice 2019-07, which provides a safe harbor for when a rental real estate enterprise will qualify as a business for purposes of the Section 199A deduction. Specifically, to qualify for the 20% QBI deduction on rental real estate, the taxpayer’s real estate must be directly owned by an individual or eligible pass-through entity (or through a disregarded entity), and their must also be at least 250 hours of total documented “rental services” activity performed in order to qualify.

Notably, though, this 250+ hour requirement carries its own quirks and nuances. Importantly, it’s not an overall requirement, but rather, the 250 hours of “rental services” must be performed for each enterprise, which again, potentially forces the taxpayer to make some important tradeoffs, since treating individual rental properties as separate enterprises has typically offered more flexibility for planning purposes but will now make it harder to qualify each separate property for the QBI deduction. Still, for purposes of counting those 250 hours, the IRS doesn’t require that the services (including such things as advertising, collection of rent, supervision of employees, operation and maintenance, etc.) be performed by the owner themselves, but instead can be performed by an agent, employee, or independent contractor.

Ultimately, individuals who don’t meet those safe harbor requirements still have the opportunity to “prove” that they have such a business (but they will bear the burden of backing up their claim (possibly in court) should the IRS stop in for a visit). Though shifting all rental activities to the lessor – e.g., via a triple-net lease – will unequivocally not qualify for the QBI deduction in the future, as it transitions the real estate purely into a passive investment holding!

Fortunately, for at least some rental real estate business owners, the safe harbor in the IRS Notice 2019-07 provides reasonable clarity about whether their rental enterprise(s) will qualify as a business. But significant complexity remains for some, especially those who own multiple rental real estate properties, and must make decisions that weigh maintaining them as separate enterprises, against the new burdens of ‘proving’ it is a rental real estate business without being able to meet the 250-hours-per-enterprise requirement.

In December 2017, the Tax Cuts and Jobs Act gave us the most significant and dramatic changes to the Internal Revenue Code in more than 30 years. One of the most intriguing changes made by the Act was the creation of new IRC Section 199A, which allows certain business owners to claim up to a 20% deduction on profits of their business. Thus, the new 199A has to potential to save business-owning taxpayers hundreds, thousands, or even millions of dollars in income taxes annually.

This benefit, however, is not without cost. Like many areas of the Tax Code, IRC Section 199A is complex and riddled with nuance. To help business owners and their advisors make order from the chaos, the IRS has done yeoman’s work since the Tax Cuts and Jobs Act was passed. In just a little over a year, the IRS not only produced a full set of Proposed Regulations (August 8, 2018), but also held hearings on those Proposed Regulations (October 16, 2018) and, on January 18, 2019, delivered some 247 pages of Final Regulations (including related discussion, along with a slew of additional guidance).

To many, the Final Regulations were a breath of fresh air. They definitively answered many of the open questions that lingered after the creation of the 199A deduction and the release of the Proposed Regulations. But they aren’t perfect, and there are still plenty of grey areas. Indeed, one need not look very far to reveal what, for some, is likely to be one of the most problematic of all the unresolved 199A issues. Specifically, will various rental activities and enterprises be considered more than just an investment, and rise to the level of a “business”?

After all, IRC Section 199A(C)(1) explicitly states:

“The term ‘qualified business income’ means, for any taxable year, the net amount of qualified items of income, gain, deduction, and loss with respect to any qualified trade or business of the taxpayer.” (emphasis added).

Thus without a “qualified trade or business,” you can’t have “qualified business income.” And if you don’t have “qualified business income,” the profits of your business are not eligible for the 20% 199A deduction.

Which means the answer to the question “are my various rental activities and enterprises ‘just’ an investment or actually a ‘business’” is of critical importance, because without a rental activity/enterprise rising to the level of a “business,” the 199A 20% deduction for qualified business income (QBI) is simply not available!

Rental Real Estate Activities Raise Unique Questions About “Regular” And “Continuous”

In many situations, it is patently obvious that a taxpayer is engaged in an activity with regularity and continuity (and is seeking a profit), and thus, there will be no question that taxpayer is engaged in a “business.”

For example, there is no question that a CFP Professional who is advising and serving clients on an ongoing basis is engaged in a “business.” Similarly, whether Frank’s Butchery makes a profit or not, if Frank shows up to work at 9AM and leaves at 5PM, Monday through Friday, to try and make a profit as a butcher, Frank has himself a business for tax purposes.

When it comes to other activities, and particularly rental real estate, however, things are not always quite so clear.

For example, if you own a large apartment building and spend a substantial amount of time there each week, you’ve probably got yourself a Section 162 business (and may, therefore, take advantage of the Section 199A deduction). But what if you only rent out the basement of your home? Or what if you rent out a commercial building for a year, but structure the lease so that your tenant is responsible for all taxes and maintenance and insurance on the property, in addition to the monthly rent check (e.g., a triple net lease)?

On one hand, one could argue that you are regularly and continuously renting out that commercial property since it will literally be rented 24-7 for the next 365 days. But on the other hand, you aren’t really doing anything! There is no activity – in the most literal sense of the word – that you are (or anyone else in your rental real estate “business” is) involved in on a regular and continuous basis. So are you an IRC Section 162 business?

That question, to a large degree, has never really been adequately answered. Not by Congress in the Tax Code. Not by the IRS in Regulations or other guidance. And not even in the courts.

And while an increasingly large number of rental properties today are owned by institutional investors, there are still millions of Americans who own rental property, either directly, or via pass-through entities potentially eligible for the 199A deduction, such as S corporations, partnerships, and LLCs. Obviously, these taxpayers have a vested interest in understanding how and whether the IRS will treat their rental real estate activities as a business, and thus potentially eligible for the Section 199A deduction.

Defining “Business” For Purposes Of The 199A Qualified Business Income Deduction

Here’s a simple question for you… if you’re trying to claim a deduction attributable to qualified business (hint, hint) income, what might it be necessary to own?

That’s right! A business! But that raises the question, “Just what exactly makes something a business?”

The answer is surprisingly complex. And in fact, as far as the Tax Code is concerned, there is actually more than one answer depending upon which part of the Tax Code you’re looking at (i.e., IRC Section 469 vs. IRC Section 162).

Notably though, when Congress created IRC Section 199A, they didn’t fully define what constitutes a “business” for purposes of the new section. Rather, IRC Section 199A(d) simply says:

QUALIFIED TRADE OR BUSINESS For purposes of this section—

(1) IN GENERAL The term “qualified trade or business” means any trade or business other than—

- a specified service trade or business, or

- the trade or business of performing services as an employee.

In absence of additional guidance from Congress in the form of statutory language defining “business” for 199A purposes, that left the matter up to IRS interpretation. And in addressing the issue in the Section 1.199A-1(b)(14) of the Final Regulations, the IRS opined that:

“Trade or business means a trade or business that is a trade or business under section 162 (a section 162 trade or business) other than the trade or business of performing services as an employee. In addition, rental or licensing of tangible or intangible property (rental activity) that does not rise to the level of a section 162 trade or business is nevertheless treated as a trade or business for purposes of section 199A, if the property is rented or licensed to a trade or business conducted by the individual or an RPE [relevant pass-through entity (i.e., partnership, S corporation, etc.)] which is commonly controlled under §1.199A-4(b)(1)(i) (regardless of whether the rental activity and the trade or business are otherwise eligible to be aggregated under §1.199A-4(b)(1)).”

But for the nerdiest of tax nerds, this definition poses some serious challenges. Notably, one big “problem” with the IRS using IRC Section 162 to determine whether an activity rises to the level of a “business” for purposes of the 199A deduction is that IRC Section 162 doesn’t do a good job, itself, of defining what a business is. In fact, it doesn’t really define it at all, nor do its associated regulations!

Instead, we are forced to turn to case law, which frankly, is not always all that helpful. As the IRS noted in the Preamble to the Final Regulations, the courts have developed two “definitional requirements” for an activity to be considered a “business” for purposes of IRC Section 162.

The first is that the business has a profit motive; that is to say that the taxpayer engages in the activity with a good faith intention to make a profit, or that s/he believes that a profit can be made. Simple enough.

The second definitional requirement of an IRC Section 162 business, stemming largely from the U.S. Supreme Court’s 1987 decision in Groetzinger, is that an activity must be performed regularly and on a continuous basis. From Groetzinger:

“We accept the fact that to be engaged in a trade or business, the taxpayer must be involved in the activity with continuity and regularity and that the taxpayer's primary purpose for engaging in the activity must be for income or profit. A sporadic activity, a hobby, or an amusement diversion does not qualify.”

Here’s the question though… how often, and for how long, must a person engage in an activity in order for it to be considered “regular and continuous”? In other words, if “regular and continuous” action taken with the intent of making a profit defines a “business,” what defines “regular” and “continuous”?

This, my friends, is “the $1 million question.”

Notice 2019-07 Safe Harbor For Rental Real Estate

In an effort to help provide at least some clarity and guidance on the Section 162-ness of various rental activities, the IRS released Notice 2019-07 concurrently with the IRC Section 199A Final Regulations.

Notice 2019-07 contains a proposed Revenue Procedure providing a safe harbor for treating a rental real estate enterprise as a business for purposes of the Section 199A deduction. Thus, by meeting the requirement of the proposed Revenue Procedure (outlined in Notice 2019-07), a taxpayer can be certain that their rental real estate venture will qualify as a business and thus be eligible for the 199A deduction (subject to the taxable income limit and, for high-income individuals, wage/wage-and-depreciable property testing).

To qualify for the safe harbor, the rental real estate must be owned by an individual or eligible pass-through entity (e.g., S corporation, partnership, LLC), directly, or via a disregarded entity. Further, a total of at least 250 hours of documented “rental services” activity must occur during the year.

Those taxpayers/entities who do not meet the safe harbor requirements may still qualify as a “business” for purposes of the 199A deduction but will bear the burden of “proving” that they have such a business.

And although the Notice only contains a proposed revenue procedure, the Notice does indicate that:

“Until such time that the proposed revenue procedure is published in final form, taxpayers may use the safe harbor described in the proposed revenue procedure for purposes of determining when a rental real estate enterprise may be treated as a trade or business solely for purposes of section 199A.”

Thus, for the time being, taxpayers who meet the requirements outlined in the proposed Revenue Procedure can be certain that they have a rental “business” potentially eligible for the 20% qualified business income deduction allowed under 199A. Furthermore, it is likely that, when released, the final revenue procedure’s requirements will be the same as, or substantially similar to, the requirements now outlined in Notice 2019-07.

That’s great news for some rental owners who, once certain that their rental enterprise qualifies as a business for IRC Section 199A purposes, can begin to engage in more comprehensive planning to maximize the value of their potential deduction. Unfortunately, however, the requirements and restrictions imposed by Notice 2017-09 mean that many rental owners will still be left with greater uncertainty.

Direct Ownership Requirement

In order to qualify for the “it’s-a-business” safe harbor for the Section 199A deduction, rental real estate must be owned directly by a taxpayer or qualifying pass-through entity (e.g. S corporation, partnership, etc.), or be treated as owned directly by either for tax purposes - because it is actually owned by “an entity disregarded as an entity separate from its owner under Section 301.7701-3” (e.g., by being a Single-Member Limited Liability Companies [SMLLC]).

Single-Member LLCs are often used when planning with real estate because they can help owners potentially limit liability without requiring them to file separate returns for each entity. For instance, an S corporation that is the sole owner of eight separate (Single-Member) LLCs, where each of those LLCs is the owner of a single piece of rental real estate, could provide the S-corporation-parent asset protection (because any creditor/lawsuit issues arising within one of the SMLLCs should be limited to that SMLLCs assets). Yet under the new regulations, such a structure should still allow the S corporation to qualify for the safe harbor (assuming all other requirements are also met), even without being owned directly, because all the rental properties would be owned via disregarded entities.

Note: In community property states, an LLC that is owned jointly by a married couple may be treated as a Single Member LLC as well.

To Group, Or Not To Group (Similar Enterprises)… That Is The Question

Another requirement to qualify for the safe harbor under Notice 2019-07 is that taxpayers make a choice “up-front”: either treat all similar rental properties as a single enterprise or treat each property as its own separate enterprise. For purposes of this rule, residential real estate and commercial real estate would not be considered similar, and thus, must be considered separate enterprises. And once established, the treatment must remain the same in future years unless there is a “significant change” in facts and circumstances (though the Notice provides no guidance as to what would qualify as a “significant change”).

From a tax planning point of view, the ideal scenario would be for taxpayers to elect to treat each rental property as its own enterprise. This would permit each enterprise to qualify as a separate business, creating maximum flexibility under the Section 199A aggregation rules, which allows taxpayers to group two or more entities together for 199A testing purposes (e.g. the wage and wage-and-depreciable-property tests).

However, the reality is that, due to other requirements outlined within Notice 2019-07 (most notably the 250-hour requirement discussed below), most rental owners looking to use the safe harbor will need to elect to treat all similar properties as a single enterprise.

250-Hour Rental Services Requirement

To qualify for the safe harbor outlined under Notice 2019-07, each enterprise must maintain separate books and records. In addition, through 2022, there must be 250 hours or more of “rental services” performed for each enterprise, each year. In 2023, the requirement changes to a “3 out of 5 requirements,” where to meet the requirements of the safe-harbor, each enterprise must meet the 250-hour requirement in at least 3 out of the last 5 years, including the current year.

Note that the 250-hour requirement is not an overall requirement, but rather a per-enterprise requirement. This is precisely why most taxpayers with multiple properties seeking to use the safe harbor outlined under Notice 2019-07 will need to elect to group all of their properties into a single enterprise.

Consider, for instance, the case of an individual who owns 4 separate residential rental properties. In such a situation, Notice 2019-07 allows for two options; either the taxpayer can elect to group all of the properties into a single enterprise, or the taxpayer can elect to treat each of the four properties as a separate enterprise.

If the taxpayer chooses the former, there is “only” one 250-hour requirement that must be satisfied across all of the properties. If, however, the taxpayer chooses the latter option, there will be four separate 250-hour requirements that must be met in order for all four of the enterprises to be treated as a business under the Notice 2019-07 safe harbor… meaning that there would need to be at least 1,000 total rental activity hours. Frankly, by that time, there is probably sufficient “evidence” of an overall “rental business” that the taxpayer would have little to no need to use the safe harbor anyway!

Defining And Documenting Rental Service Activities

While the 250-hour-per-enterprise rule is not a particularly taxpayer friendly, other aspects of the 250-hour requirement are more generous.

Notably, unlike the “material participation” tests that many individuals engaged in rental activities are familiar with, the “rental services” test under Notice 2017-07 does not require that the services actually be performed by the business owner themselves. Instead, any rental activities performed by the owner, agents of the owner, employees of the rental business, and/or by independent contractors count towards the 250-hour requirement. Again, the IRS and Treasury are simply trying to ensure it is a real estate business, and not simply an entirely passive (non-business) idle real estate investment.

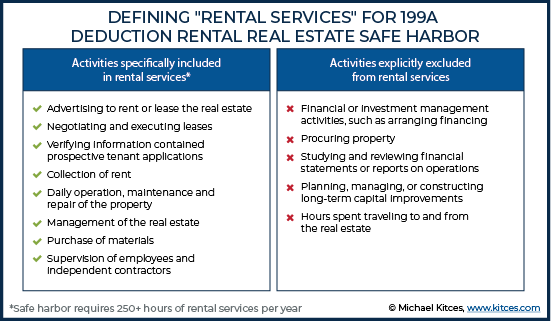

Activities that are specifically included in “rental services” include:

- Advertising to rent or lease the real estate

- Negotiating and executing leases

- Verifying information contained in prospective tenant applications

- Collection of rent

- Daily operation, maintenance, and repair of the property

- Management of the real estate

- Purchase of materials

- Supervision of employees and independent contractors

Meanwhile, activities that are explicitly excluded from rental service include:

- Financial or investment management activities, such as arranging financing

- Procuring property

- Studying and reviewing financial statements or reports on operations

- Planning, managing, or constructing long-term capital improvements

- Hours spent traveling to and from the real estate

Beginning in 2019, rental real estate owners must maintain proper documentation of rental activities performed (taxpayers may still rely on the Notice for 2018, but the record-keeping requirement will not apply). Notice 2019-07 requires that such records be kept contemporaneously with rental services performed, and be made available to the IRS upon request. Specifically, records must include:

- The number of hours performed for each rental service activity

- A description of the rental services performed

- The date(s) on which such rental services occurred

- Who performed the rental services

Rental Real Estate Arrangements Excluded From Using The Notice 2019-07 Safe Harbor

While the safe harbor outlined under Notice 2019-07 can be used by taxpayers with a variety of different rental real estate arrangements, there are two situations in which the safe harbor’s use is explicitly prohibited.

The first scenario in which the safe harbor cannot be used is if you have used the real estate as a residence for any part of the year (as defined under IRC Section 280A). The second situation in which the safe harbor may not be used is in when the rental agreement has been structured as a triple net lease (because it so shifts the rental activities to the lessor, that the rental property owner themselves is no longer conducting a rental business, they’re simply owning a passive rental investment). For purposes of the safe harbor, a triple net lease is a lease that:

“…requires the tenant or lessee to pay taxes, fees, and insurance, and to be responsible for maintenance activities for a property in addition to rent and utilities. This includes a lease agreement that requires the tenant or lessee to pay a portion of the taxes, fees, and insurance, and to be responsible for maintenance activities allocable to the portion of the property rented by the tenant.”

In light of these exclusions, certain rental real estate owners may wish to make certain modifications to their plans and/or rental agreements. For example, a family spending 3 or 4 days at a vacation home that is otherwise rented out during the year and for which the safe harbor would otherwise be available may wish to forego that stay. Similarly, some landlords who have executed triple net leases may wish to renegotiate such leases with tenants in order to revise the terms in such away that they no longer are treated as a triple net lease.

Qualifying As A “Business” Without Meeting The Safe Harbor Requirements

While the “its-a-business” safe harbor outlined under Notice 2019-07 will indisputably qualify many rental enterprises as a business for purposes of the Section 199A deduction, there are clearly going to be many rental owners who fail to qualify for the safe harbor. Such individuals include those who use the real estate for any part of the year as a residence, or who have structured their lease arrangement as a triple net lease (both of which are explicitly excluded from the safe-harbor), as well as those who simply can’t meet the 250-hour requirement for one or more of their rental enterprises.

For such taxpayers, it’s important to understand that that safe harbor is just that… a safe harbor. It’s not the only way in which an enterprise will be treated as a “business” for purposes of qualifying for the IRC Section 199A deduction, but rather, it’s a way of making sure that such an enterprise automatically qualifies as a business without further investigation.

As such, many rental owners may still claim – or at least want to claim – that their rental enterprise is a “business” and is eligible for the 20% QBI deduction, even if the safe harbor requirement of Notice 2019-07 aren’t met. And thus, we come full circle, back to the ambiguity of the IRC Section 162 definition of “business,” particularly with respect to rental real estate.

Naturally, since the Section 199A proposed regulations were released, this has been the subject of much speculation and debate within the tax community. The Final Regulations and accompanying guidance (including Notice 2019-07) were of minimal help in resolving those differences, and so unfortunately, there continues to be no consensus. There are a number of experts, for instance, who continue to believe that the Section 199A deduction will ultimately be allowed for most rental enterprises (because they will be treated as a “business”). Others believe that Notice 2019-07’s safe harbor signals that the IRS is going to take a much narrower view of what qualifies as a business.

What pretty much everyone does agree on, however, is that in light of the IRS’s reluctance to provide further guidance outlining what constitutes a business under IRC Section 162 (and therefore under 199A, as well), this matter will ultimately be decided by the courts (e.g., because a taxpayer claims it’s a business, the IRS disputes it, and the Tax Court renders a final judgment on how the rules should be applied). And unfortunately, that will likely take many years to play itself out.

In the interim, those taxpayers with rental agreements who do not qualify for the safe harbor under Notice 2019-07 are left with a choice… claim their rental real estate is a business and eligible for the Section 199A QBI deduction… or not. There are many factors that can play into this decision, but ultimately there are three key questions taxpayers may wish to consider:

- How big of a benefit will treating your rental enterprise as a business provide? The reality is that many rental activities produce little to no profit for many years anyway, because depreciation and other expenses. The Section 199A deduction only helps if you have profits of a business (to then deduct 20% of those profits), so without profits to worry about, it becomes a moot point.

- How much of a leg do you have to stand on? If you have a triple net lease that’s pretty much on “auto-pilot” and the activity for the year consisted of depositing a check once a month, it will likely be hard to argue that you have a real business. On the other hand, if you can prove 300 hours of rental services were performed during a year, but used the rental for 2 weeks as a residence during a vacation, you’ve probably got a pretty strong case that your rental enterprise should still be considered a businesses.

- How conservative or aggressive are you? Planners often speak of conservative vs. aggressive in investment situations, but it can also apply in tax planning as well. Much of the time, the tax rules are black and white, and in such situations, you just follow the rules. But there are times, like this, when there is sufficient ambiguity and no clear “right” or “wrong” answer. And when such grey areas present themselves, how aggressive of a position a tax preparer takes may simply come down to how willing a client is to deal with an audit… or in the most extreme cases, how willing they are to push matters further (e.g. to Tax Court) if disagreements with the IRS persist after an audit.

For those who don’t (and won’t) qualify for the safe harbor under Notice 2019-07 but plan to claim their rental activity is a business, the Notice is still of some use as well. For instance, taking a cue from the Notice, those who do not qualify for the safe harbor should probably still keep track of rental services performed. And in line with Notice 2019-07, those records should be kept for all rental services performed for the enterprise, and not just those performed by the taxpayer themselves.

Furthermore, it seems abundantly clear that the IRS has some sort of “grudge” against triple net leases when it comes to determining if an enterprise qualifies as a business. Therefore, as tempting as it may be for landlords to engage in such leases (since virtually all ongoing responsibility for the property is transferred to the tenant), there is a strong argument to be made that such leases should be avoided (in order to avoid losing the 20% QBI deduction). And for such leases already executed, the same consideration should be given to revising those agreements to make them non-triple net going forward to recover the 20% QBI deduction in the future.

The IRC Section 199A deduction is one of the most significant tax benefits now available in the entire Internal Revenue Code. To qualify for the deduction on business profits, however, one must actually have a bona fide “business.” Only then can more advance planning, such as aggregation elections and planning to reduce the impact of “testing” take place.

Unfortunately, determining what constitutes a business for IRC Section 199A purposes is far from clear. Thanks to a new safe harbor, however, created by IRS Notice 2019-07, some rental owners can rest easy knowing that their rental enterprise will achieve “business” status in the eyes of the IRS. For those who fail to qualify to meet one or more of the deduction’s requirements, however, the “guessing game” will continue, and the is-it-a-business-or-not decision will have to be made on a case-by-case basis on nothing more than a good faith effort. It’s not ideal, but for today, it’s all we have!

Who proofreads/edits this? In the summary you use “their” when you mean “there”, but even worse, you use “lessor” when you mean “lessee” – at least twice (either that or you don’t actually understand the meaning of the terms). A triple-net leave transfers responsibility to the tenant (“lessee”), but you keep saying “lessor”.

I am thinking the answer is you. You are the one who proofreds this.

I have a client who has net business income from their self employment that is eligible for the 20% deduction. However, they also have a short-term rental property (vacation home used by them a few days/yr in its second year showing a limited loss with fairly large carryovers) . In order to avoid the loss being netted with the business gain, thus reducing the 20% deduction from the profitable business, can you make the argument that the rental is “not a business” because you use it, even though you do spend 250+ hours on it?

I don’t see anything about self triple net rentals where the tax payer leases to a company that she owns. Can the income from these companies qualify for QBI 20%?????

if a person owns an unit in a 50 unit apartment building with 24/7 hour security services, how would the 250 hour service requirement work? A share of the time (24×365/50)?