Executive Summary

One persistent struggle for financial advisors has been to find ways to communicate the value that they bring to the table. Fortunately, several recent studies have tried to quantify that value - down to a specific number of basis points annually – and have generally shown that financial advisors can more than cover their advisory fees with a wide range of value-added benefits… most significantly, by helping clients overcome the dreaded “behavior gap” that exists between the returns of the market, and the (lesser) returns that investors would otherwise realize on their own due to their behavioral biases.

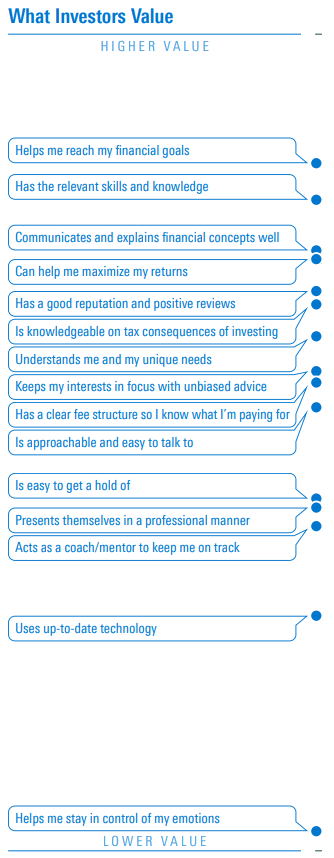

Unfortunately, however, a recent Morningstar survey of almost 700 individual investors found that the advisor’s ability to help “control their emotions” is perceived as the least valuable service an advisor can provide from the consumer’s perspective… even as it’s the most valuable benefit from financial advisors according to the advisor research! Yet this ironic gap in the value of getting help with the behavior gap actually makes sense, since investors themselves often don’t see that their behaviors are a problem in the first place.

Nonetheless, this gap between what the research suggests is a benefit of working with a financial advisor, and what consumers state they actually value, raises the question: Does the real gap lie between market and investor returns, or between what investors actually value and what advisors think they value?

In our fifth episode of “Kitces & Carl”, Michael Kitces and financial advisor communication guru Carl Richards sit down to discuss the question of whether advisors should even bother trying to communicate the value they provide when helping clients manage their “behavior gap”, why attempting to convince prospects that you can help them manage their behaviors is perhaps an uphill battle, and how maybe the best way to overcome the behavior gap (and the perceived value of getting help with the behavior gap) is by shifting a client’s perspective altogether.

The starting point is to realize that most clients don’t initially seek an advisor’s help because they suddenly decide they need help clarifying their life goals or making better decisions at key junctures; they come to an advisor first and foremost because they have an acute pain point they need help with. And while for some new clients, that pain point may be due to devastating decisions in the depths bear market - which then prompts them seek out an advisor because they (or more often their spouse) realize that they do need guidance when it matters most – for many consumers, the pain point that drives them to a financial advisor is about some other non-portfolio issue in the first place.

Furthermore, even if many people do undermine themselves by making poorly timed decisions, it’s nearly impossible to “sell it” as a benefit of entering into an advisory relationship, since a client will first have to admit to themselves that they are so bad at making financial decisions that they have no other choice than to hand the task off to someone else! And denial about our own failings – even if it’s true – can be quite powerful. Which is why, in general, trying to position yourself as someone who can help clients “control their emotions” or change their “bad” behaviors is challenging at best. Which is not to say that managing those clients’ behaviors isn’t beneficial… it simply means that people who are in most need of that help will likely have a hard time admitting it.

Ultimately, the bottom line is that advisors do truly add value for their clients by managing the “behavior gap”… but selling that as a key feature of the relationship probably isn’t going to get most advisors very far. Instead, the best way to help clients close that gap is by connecting their use of their capital with what they say is important to them in the first place. And the only way to help a client down that path is to absorb with empathy where they are presently, and then gradually help them understand continuing to make them same decisions that they’ve made in the past won’t get them different results. Which creates the real opportunity for financial advisors to demonstrate their value!

***Editor's Note: Can't get enough of Kitces & Carl? Neither can we, which is why we've released it as a podcast as well! Check it out on all the usual podcast platforms, including Apple Podcasts (iTunes), Spotify, and Stitcher.

Kitces & Carl Video Transcript

Michael: All right, we are recording so we will get underway. Well, welcome back Carl.

Carl: Greetings, Michael.

Michael: Episode 5, like it's now a thing. It's a sustaining thing.

Carl: Yeah.

Michael: Once is an experiment, two or three is “this is interesting.” By the time you get to Episode 5, this is a real thing now.

Carl: Amen, it is, yeah. There's no stopping now.

Michael: We have people who come back just to see the new episodes. It's very exciting.

Carl: We need to do a season. This is Season 1 Episode 5.

Michael: Season 1 Episode 5, all right. Well, what determines we go from Season 1 to Season 2 though?

Carl: I don't know, it should be Season 0 Episode 5 because I like zeros but Season 1...

Michael: No, you did that with the first episode, you confused everyone when you said Episode 1 was Episode 0.

Carl: All right, Michael, get on, it's Episode 5.

Morningstar's Study On What Consumers Value From Advisors [01:01]

Michael: Episode 5. So Episode 5, I wanted to talk about this Morningstar study that came out a couple of weeks ago. We covered in a weekend reading. It was really popular in weekend reading, because it was about what do consumers value from advisers, right? We always love talking about ourselves and what makes us valuable. So Morningstar did this interesting study where they went out to about 700 individual investors and said basically, "Here is a list of useful things that advisers do or can do for you, is knowledgeable about taxes, can help me maximize my returns, is easy to get ahold of, uses current technology." And one of the ones they put in there was the old infamous, "helps me stay in control of my emotions." Close this thing I've heard called the behavior gap. Right? “Adviser helps you close the behavior gap.” So they put this list in front of consumers and said, "Rank for us from 1 to 15 what are the most valuable things that an adviser does for you or brings to the table. What do you value in an adviser?" So no great surprise, number one, helps me reach my financial goals. Number two, has the relevant skills and knowledge. Number three, communicates and explains financial concepts well. And if we roll all the way down to number 15 out of 15...

Michael: Episode 5. So Episode 5, I wanted to talk about this Morningstar study that came out a couple of weeks ago. We covered in a weekend reading. It was really popular in weekend reading, because it was about what do consumers value from advisers, right? We always love talking about ourselves and what makes us valuable. So Morningstar did this interesting study where they went out to about 700 individual investors and said basically, "Here is a list of useful things that advisers do or can do for you, is knowledgeable about taxes, can help me maximize my returns, is easy to get ahold of, uses current technology." And one of the ones they put in there was the old infamous, "helps me stay in control of my emotions." Close this thing I've heard called the behavior gap. Right? “Adviser helps you close the behavior gap.” So they put this list in front of consumers and said, "Rank for us from 1 to 15 what are the most valuable things that an adviser does for you or brings to the table. What do you value in an adviser?" So no great surprise, number one, helps me reach my financial goals. Number two, has the relevant skills and knowledge. Number three, communicates and explains financial concepts well. And if we roll all the way down to number 15 out of 15...

Carl: It's almost like they don't have room on the bottom of the page.

Michael: ...helps me stay in control of my emotions. And we'll include a copy of the chart when we put out, post the transcript board is because frankly, the chart makes it even worse. It's not even just that helps me stay in control of my emotions is 15 out of 15, but they actually rank them based on the scores that consumers gave. And so it's like the first 14, then a big gap, a big blank space, and then all the way at the lowest possible part that existed on the chart was "helps me stay in control of my emotions."

Carl: Yeah.

Michael: And so to me, we get this interesting gap because this is the same Morningstar that published the now incredibly popular adviser Gamma study that says what's the value advisers bring to the table and they estimated a two or three percentage points a year of additional Alpha of which more than half is closing the behavior gap at helping people stay in control of their emotions.

Carl: Yeah.

Michael: So we get this quantitative study, advisers had immense value by helping to close the behavior gap and then we ask consumers what they value and they've ranked it 15th out of 15.

Carl: Yeah.

Michael: So as the guy who trademarked behavior gap how do you feel about this, Carl?

Carl: Okay. Now, first, there's so much that we're going to have to cover but that last sentence, let's make this one thing clear. I trademarked the behavior gap name so that no one could tell me never to use it, right? We've done enough enforcement of that to keep it trademarked. My attorney is like, "Once a year, could we just send a letter?" I'm like, "Fine." So let's just be clear about why it's trademarked. Then you could tell me...

Michael: We talked about this on your podcast as on your podcast as well....

Carl: That's right, that's right, but that's not the point.

Michael: ...cracked out on everyone you just wanted to defend your territory.

Carl: That's not the point. So this is fascinating to me because I have two, there's two...and I was really curious to see where Morningstar went with this because Morningstar doesn't do shabby research.

Michael: No, no. They take their methodologies seriously about doing good credible studies and serving people right. That's why it jumped out to me all the more. This was not a random organization with an ulterior motive, takes swipe at behavior gap. This is an organization who published that the driving value of advisers is closing the behavior gap, did a study with investors, and got told that no one values this.

Carl: Yes. So I think there's a couple of things we have to clarify. So number one, we should think, okay, maybe we're just drinking our own whiskey, maybe none of this matters, maybe it's all inside baseball. I don't think that's the right answer for obvious reasons and I'm totally prepared to argue about those with anybody. But the thing I think we need to clarify is the wording that was used.

Michael: Okay.

Carl: The actual statement is "helps me stay in control of my emotions." Now, there is nothing on here, because I was curious. I was really looking where I first saw this study, I'm looking at right now on a little iPad here, trying to find anything that says, right, helps me behave or helps me avoid big mistakes. There's nothing on there, so we're sort of lumping, “helps me reach my financial goals.” We could say that's number one. It's interesting, that's the smallest gap because advisers put that as number two.

Michael: Right.

Carl: That's pretty impressive. It helps me stay in control of my emotions. Advisers put that down at...

Michael: What was that?

Carl: Number 12.

Michael: Yup.

Carl: Right. So I think one thing that we need to be clear about is no one, and I'm under no delusion, no one has ever, and if any of you listening or watching this have had an experience that's the exception of what I'm about to say, please email me. But so far as I'm aware, no human being has ever walked into a financial planner or financial adviser's office and said these words, either "please help me control my emotions," "please help me behave," or even "please help me clarify my goals."

Michael: Yeah.

Carl: Right. They come with an acute problem. The acute problem normally is something to do with a pile of money that's sitting there or a pool of insurance that just got paid out or there's some acute...I need to pay for college, there's some acute problem, and they don't even know, and I think this is interesting because I think it's where Morningstar went with this. I mean if you read the study as you already pointed out, they pointed out the discrepancy between the adviser gamma thing. We have taught them the thing to care about... I'm shocked that returns… where is returns on here?

Michael: It actually did decently. It was fourth.

Carl: Yeah, helps me maximize returns.

Michael: Helps me maximize returns.

Carl: Isn't that the big, yeah, that's the single biggest gap between what...because advisers put that as 14th.

Michael: Fourteenth, yeah.

Carl: Right. So investors are saying 4th, advisers are saying 14th, so most people I think would walk in and go...this was actually, I was happy that investors said, "help me reach my financial goals." That's pretty shocking to me because I'm used to, "What do you got for me, kid?"

Michael: Yeah.

Carl: They're like, "Help me find the best investment." It's really great that we're at least moving that up. So back to those...

Michael: Although, cynically, I could still make the case, right, if my goal is to have more money and be wildly rich and retire now because I don't want to work anymore, sell me the thing that makes this magically happen might actually still be the conversation that is my version that helps me get to my financial goals.

Carl: Yeah, exactly. And you're, like, what's your financial goals? "Ah, get a great return."

Michael: There you go.

Carl: Right.

Michael: And maximize those.

Do Clients Really Want Help Managing Their Behaviors [09:15]

Carl: We all know beating an index is not a financial goal. But clients, humans, normal humans, and again, I don't think...well, this brings up a really interesting point too. When data or research comes up that, we have a tendency in our industry, and we've all been guilty of this, to point at the humans and go, "Oh, look how silly they are." Right? And this is one of the studies where we have to go, "Wow, okay, does it matter?" Does staying in control of my behavior, even though they use the word emotions, matter in your lifetime returns?

Michael: So I have a slightly different take on this. So first, actually, I want to say, getting back to your earlier comment of does anybody ever have clients that come in and just literally say, "You got to help me behave better." I actually have seen that. I saw it in 2003 and I saw it in 2009, 2010. I actually have seen that effect. After a bear market, there's some subset of people that just really over concentrate, under diversify, chase it all the way down, do something horrible, really do blow themselves up at least partially. I guess if they blow themselves up completely, there's nothing left to manage, but blow themselves up badly and kind of have that surrender moment of saying, "Okay, I clearly cannot do this for myself. I just blew myself up."

And actually for at least the three clients I can think of where this was essentially the driver, all three of them, at least for me, were spouses who actually said, "You, my husband..." and it's always, going to the husband, unfortunately, "You, my husband are not managing our money anymore because you just blew up half of our life savings. We're going to go hire a financial adviser to help us behave because we are clearly not getting it done on our own." So there is some segment out there who I think basically has to blow themselves up badly enough to be willing to surrender control. There are some people like that.

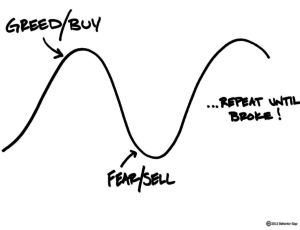

Carl: Let me just clarify something just because I think it would be really valuable for us to move the conversation along as we go. I totally agree, that's a good point. And in fact, I've had tons of stories from advisers that have that little sketch that we did; fear, greed, buy, repeat until broke, I've had plenty of stories where advisers tell me that a client walks in and goes, "Oh." Right? Because that sketch has repeat until broke, it allows you permission to kind of enter it and laugh at yourself. People will go, "Oh, I do that. Help me not do that."

Carl: Let me just clarify something just because I think it would be really valuable for us to move the conversation along as we go. I totally agree, that's a good point. And in fact, I've had tons of stories from advisers that have that little sketch that we did; fear, greed, buy, repeat until broke, I've had plenty of stories where advisers tell me that a client walks in and goes, "Oh." Right? Because that sketch has repeat until broke, it allows you permission to kind of enter it and laugh at yourself. People will go, "Oh, I do that. Help me not do that."

Michael: Help me not do that.

Carl: So, yeah, you're right. But let me change the question, how about people who walk in and go, "Could you help me clarify my financial goals?"

Michael: No.

Carl: Yeah. That's...

Michael: Not that I can ever...

Carl: And over there we're still talking about investments, investment performance, but when we get to this thing around clarifying our financial goals I don't think anybody thinks that's what they're coming to you for.

Michael: Yeah.

Carl: Now, when you give it to them, I always think this is a bit like the Supreme Court's definition of pornography. Real financial advice, real financial planning, is the Supreme Court's definition of pornography. Right? Where they said, "Yeah, we don't know but we know it when we see it." It's almost impossible for us to describe the experience beforehand. We sort of have to take you through it and then afterwards you go, "Of course, that's valuable." Clarifying my goals, helping me behave, keeping my emotions in check. So that's the question I'd like to sort of… you were headed somewhere but if I haven't derailed you, is it important? Is it valuable to help somebody behave with their investments?

Michael: Yeah. I think it's important but I think the challenge is most people don't know it's important until after the fact, right? They don't know it's important until they've blown themselves up, and I think part of the challenge that comes from that, right, if you're an adviser and you've been doing this for any period of time, you've seen clients that have done this themselves, right? Fear, greed, fear, greed, repeat until broke, they may not be at the point of capitulating and coming and actually saying, "Oh, I'm just hopeless. You got to do this for me." But we see those people, I think we see those people because at some point, even if they can't articulate it, they know they're doing bad things themselves and that's what brings them in.

And a part of what I actually wondering reflecting on the study like this from Morningstar is do we overvalue or overaccentuate how much the behavioral stuff matters because we just happen to see the small percentage of the population that's most likely to blow themselves up on this. Right? If you think of all the people who don't screw up the fear/greed cycle and just keep an even keel, stay invested, stay at the course, get all the way through, they're doing fine. They don't call us, at least not about investment stuff, like they're doing okay with their portfolio.

Carl: Do you think that there are a lot of people who do just the...so in 2007, 2008, and 2009, you think there are a lot of people… would you even say… if you just have to split over or under, 50% of people misbehaved with their investments in 2008, 2009, and 2010, over or under, Michael?

Michael: I think the misbehave segment is under.

Carl: Under 50%?

Michael: I think it's a small portion. I think it's a small portion that do it and when they do it, they do it really badly. Right? if you're going to go off the keel in a 2008, 2009, you probably hurt yourself badly. My gut...and I think part of what you're seeing in a study like this is that's actually not those people. Now to be fair, it's not because I think most people are super investors, I think most people are just so busy with their lives that they hardly open their statements. They probably didn't even realize how bad the damage was in 2008 and 2009, but it takes a certain person to pay attention, be so invested in this that if they see it, freak out and do something bad and they can't recover and then say, "Oh, my god. I got to go get me a financial adviser."

But we only work with a couple of percent of the population at the end of the day. I mean just we as advisers, there's only a couple hundred thousand of us, if we can each work with 100 or 200 households, if you do the math, we just literally can't work with more than 5% to 10% of the population in the country. There aren't enough of us when we do deep relationship because we only have 100 clients per adviser. So I think we see a disproportionate segment where... look by the time they're coming to us because they've done it this badly, they really need help on behavioral stuff and it's valuable for us to give it to them. But I think part of what you see in a study like Morningstar's is when you ask the whole population, most of whom are not self-destructing, they don't ranking high because they're not self-destructing.

Carl: You cause all sorts of problems today. We have so many...

Michael: So I take it you are not on the under on what percentage of people…

Carl: I know, yeah, I'm trying to sort through my mind what it means when we know most people are selling in January, February, and March of 2009, we know that because the market was going, there were way more sellers than there were buyers. So either that was one gigantic - I'm over exaggerating - either that was one gigantic institution and a bunch of the really smart private investors which we know normally that's the flipside. The dumb money thing. And then I'm also thinking back to just Morningstar's own study on the behavior gap, putting it at what would we say to that. I don't even like to talk about this anymore because there will be ones to debate the number, but I'm saying a 110, 120 basis points or something. I'm not saying DALBAR is 600 or whatever.

So if we know that that gap exists in the aggregate, that people in the aggregate are losing 100, let's just call it 100 basis points to be fair, generous. I think it's a little bit more, 120 or something. We know in aggregate, people are losing that to poor...to at least...

Michael: Well, okay. So how do you get it to an average negative Alpha of 1%. Here's a way, one idiot who blows himself up from minus 20 and 19 people who stay the course.

Carl: Okay.

Michael: And then it averages out to one.

Carl: I had this conversation with an academic that everybody would recognize, that hasn't given me permission to use the name so I won't. But that's exactly what he said, "I think this is a dubious assumption. That people on average are making terrible decisions because if people on average are making terrible decisions, that means on average you could do the opposite of what everybody does." And, yeah, so I think there's a lot here. All I know is my experience is a lot of the people that I knew that weren't clients were saying things in January, February, and March of 2009 like, "I'm done." Right? And now clients too but they weren't prospective clients. These were friends, family members, guys I was riding bikes with. I mean, I'd remember a lot of people saying, "I'm done. I'm never going to own equities ever again in my life, ever, ever, ever until 2012." Right? But I think we do repeat that. But that's, I don't think, maybe we should put a pin in that and have a specific episode about the behavior gap. Right?

Michael: Yeah.

Carl: Because...

Why Handholding Is A Lousy Value Proposition [19:40]

Michael: But the follow-up piece that it does raise to me as well, and frankly, one of the reasons why I've historically have actually been negative on sort of this angle of trying to sell, "we'll handhold you through the emotions" is at best… even if they do this to themselves and lots of people do this to themselves, we got lots of people in this pool, you can't sell this as a value from the adviser until you convince them or they convince themselves that they are so hopeless and beyond repair personally that they have to delegate it to protect them from themselves. And that requires people to admit something about themselves that I don't think a lot of people necessarily want to admit either. It doesn't necessarily mean the handholding is not helpful for them. They may very well need it. But it's hard to sell it to them because they can only buy it if they admit something about themselves they may not want to admit.

Carl: This is such a great conversation because of that. Obviously, 15 years ago, 17 years ago, I tried that. It doesn't work, it's no fun, and what I mean by trying that is telling people, “you're dumb, I'm smart,” and it's not that you're dumb and because I'm not you. I can be your... that does not work. The only way to get there is gently and through, I call them righteous tricks, because they're in service of the people, they're not bait-and-switches, right? But, yeah, you...

Michael: That's an interesting nuance there. It's a bait-and-switch if it's being manipulative but it's a righteous trick if it helps them.

Carl: Exactly, exactly.

Michael: What are one or two righteous tricks If we're going to do this value for people, and we're going to get “helps me with my emotions” out of the number 5 cellar and up a little bit, how do you sell this? How do you convey this to the people that do need to hear it even if they haven't admitted it to themselves yet?

Carl: Yeah, and by the way, we should just point out, read the study… because the way I interpreted Morningstar's own wrap up is as an industry we've spent, whatever, 100 years convincing people that certain things matter.

Michael: Yup.

Carl: And now, they're actually believing us and parroting that behavior back to us and we're like, "Oh, that's not what we meant!" Nobody was born expecting a quarterly performance report. Right?

Michael: Right. We train them on that by sending it to them every quarter.

Carl: We taught them that they should tear up the tree and look at the roots, right?

Michael: Right.

Carl: And I think Morningstar gets the same place. We have an education problem here.

Michael: Yup, right.

Carl: And that education problem, which I think is really fascinating, goes along with number three, communicates and explains financial concepts well, that was number three which I thought was fascinating to me, and by the way is that the smallest gap? Yeah, that's the smallest gap, because it's number four for advisers. Your ability to communicate this, the importance of understanding your behavior and your emotion as it relates to money is critical. And it's incredibly difficult as you and I have pointed out in multiple other venues, right, because how do you do that in the way that allows people the space to walk into that and doesn't...I mean if you just think about everything we're doing when you bring out a new client, you are essentially telling them they've done things wrong.

Michael: Yup.

Carl: We're going to reallocate the portfolio, we're going to da-da-da. How do you do that in a way that it allows them space to not feel shame and blame and guilt and not have the experience of, you just dug a pit, threw them in there and looked down and said, "Hey, I'm the only one with the rope." No one likes being treated that way. And I think the way you do that is you just, right, we absorb with empathy where they're at. If they walk in, they've got the look on their face like, what have you got for me kid? That's the look I'm familiar with, best investment sitting there, a big, big firm with the bull in its symbol, right? They're expecting that and I used to say sort of essentially, "that's a dumb question, let me prove to you why." That didn't work. So I started thinking, "Okay...hey, I understand how important that is to you, Michael. We're going to get there," because it actually turns out that performance matters.

Michael: Oh yeah, maximizing returns was 4th out of 15. It wasn't at the top but it was pretty high.

Carl: And it turns out that actually we.… It's maybe the number that, if I can change the return, it turns out that matters.

Michael: Yes.

How To Best Help Clients Manage Their Behavior Gap [24:27]

Carl: So it matters, it matters, it matters. And then we slowly help them understand that the only way to actually maximize that return and get them to behave, I think the only way to get somebody to behave is they connect their portfolio design and even more broadly, their use of capital with what they say is important to them. It turns out that help me reach my financial goals, gives us some room to navigate that space because the only way to behave correctly, the only way to say no to that spending mistake you want to make or the investment mistake you want to make, I think the only way to say no to that is to be reconnected to a much bigger yes. And that much bigger yes are called goals and maybe even underneath that, financial purpose. Bill Bachrach would use the term values.

I think that's the righteous trick, absorb where you are, slowly carefully lead you down a path to help you understand that if we do it the same way you've always done it…. Sorry, there's one last thing. I think it's a fascinating conversation to me. This was my last arrow conversation if somebody wouldn't...

Michael: Your last ditch. Your Hail Mary to save this problem.

Carl: This is like, yeah. It turns out we're probably not going to be a good fit.

Michael: Yup.

Carl: And before I kick you out, I just want to have this last conversation. "Why are you here today?" "Well, because I want you to help me invest my money." "Oh, well, where is it now?" "Well, it's with that guy over at," whatever. "Oh, well, why...are you unhappy?" "Yeah, it's been terrible." And you have to do this in a way that's not so sarcastic, but, "How did you hire that person?" "Oh, well, somebody sent me to him and I asked him for his investment perfor-..." "Oh, so you asked him for his investment performance and you've got this result and you would like me to do the same thing and expect a different result. Can I just humbly suggest, Michael, that there's a different way." That's, I told you, that's the last..."

Michael: That's a zinger. That's a zinger.

Carl: Yeah. But it's quite fun if you already decided it's not going to go anywhere.

Michael: Yeah, I got nothing to lose. That's why it's the Hail Mary. They'll either say, "Wow, that's a really interesting point." Or they'll get pissed and storm out, but that's okay because you weren't going to get them anyways.

Carl: Either way, good fun. And I want to be clear, I don't do it that way, right? We can do that in a gentle way. But I think back here, I think I would choose to believe and I think this is where Morningstar took it. I think Morningstar took it the way I would take it which is it sounds like we've got an education problem here, and the way we talk about this is not a match with the words the clients are expecting. And that I think that if you talk to clients of let's say maybe 5-year or 10-year clients of really good financial planners, people that you and I know, I bet they would rank that higher. I bet they would say, "Oh, this person really helps me behave. I let go of a lot of anxiousness around money." I bet they would put that higher. That's my hope.

Michael: Well, look, as we wrap up, I’m curious for people who are listening as well - how do you have this conversation? We got comments below the video, below the transcript here, down, just keep scrolling down, there'll be places where you could type things. Let us know. What do you do? How do you have this conversation? If you're finding a way to successfully convey the value of I help you with your behaviors, how are you having that conversation?

Carl: Yeah, beforehand, that's the...

Michael: Beforehand, yeah, because it's easy to afterwards. How are you saying it all.

Carl: Amen. Super good.

Michael: Well, thank you, Carl, always an interesting conversation.

Carl: Thanks, Michael, for sure.