Executive Summary

Launching an RIA firm can be a rewarding experience for advisors who desire the independence, flexibility, and control of owning an advisory practice. At the same time, the process of establishing a new business can be daunting, especially when the firm is ‘truly’ starting from scratch with zero clients, revenue, or infrastructure. These challenges, along with the sheer number of priorities that must be addressed (e.g., choosing fee structures, identifying target client profiles, and developing marketing and lead generation strategies) – and the fear and uncertainty of making the ‘wrong’ decision – can keep many potential new firm owners from making the leap to starting their own practice.

In this guest post, Jake Northrup, CFP, CFA, CSLP, founder of Experience Your Wealth, LLC, relays some of the lessons he learned himself during the first three years of building his own fee-only RIA firm from scratch, to help advisors who are thinking about launching their own firms understand how they can navigate the early pitfalls of owning an advisory practice.

Many of the key business decisions in an RIA’s early startup phase revolve around marketing and selling the firm’s services. For Jake, having limited business experience prior to launching his firm made these elements especially daunting as he sought to attract his first few clients. But significantly investing early on in marketing (notably, creating a custom-designed website to clearly communicate his firm’s values and story) and sales training made it much easier for Jake to find and ‘hire’ the kinds of clients he wanted to work with most. Likewise, many individual firm owners will be stronger in certain areas than others, so finding and investing time and resources in areas that may need extra attention early on can be crucial to achieving a sustainable business.

But launching an RIA is not only a business decision, it is also a personal decision that can reshape many aspects of an advisor’s life. While offering the potential rewards of choosing where and when to work – and, with virtual planning becoming a more popular option, giving firm owners flexibility over where to live, regardless of where their clients are located – starting an RIA also comes with potentially significant risks. This is especially true given that firm owners must often tap into their own personal savings to keep it running, at least until the firm generates enough revenue to cover both its own business expenses and the owner’s personal expenses. For aspiring firm owners, then, understanding why launching an RIA from scratch is worth the risks to them – whether that be on account of their personal values, lifestyle preferences, or hard-wired personality characteristics that make them especially suited for running an advisory firm – is a crucial step in creating a practice that supports the ideal life that the owner wants.

Ultimately, what’s important to remember for aspiring advisory firm owners is that virtually everything about the firm – from its fee structure to its target niche and even to the owner’s long-term vision – can change. For Jake, what started in 2019 as a vision for a solo advisory practice quickly expanded to include an associate advisor, and since then has integrated a plan to build out a five-person team… all because his vision for the firm evolved based on wanting to spend more time on high-value advisory activities (and less time on other tasks that could more easily be outsourced). And while it’s important for new firm owners to plan out how the business will look and operate in its first few years, perhaps even more vital is to build in flexibility to account for how the firm’s vision will change over that time, especially since the flexibility to make firm decisions itself is often one of the main reasons advisors choose to start their own practice in the first place!

I launched Experience Your Wealth, LLC in November of 2019 from absolute scratch. No clients or revenue; a completely blank slate.

Thanks to the many other advisors before me who shared their stories on blogs, podcasts, etc., combined with the support provided by XY Planning Network, I felt as prepared as I could before launching.

Although there have been bumps along the way, I’m fortunate to have experienced a relatively successful first two years, with a bright future ahead. Our Year 1 revenue was $80,000, Year 2 revenue was $180,000 and our projected Year 3 revenue is $350,000. We’re currently a team of 2 working with 50 clients, with hopes of adding another 13 clients and one new team member by year-end.

Looking back, I can confidently say that none of this happened as expected. My original revenue projections were half of this, I expected to stay solo forever, and my firm looks vastly different now from my initial vision of what it would become.

For those who are contemplating starting a fee-only RIA from scratch, or have recently started one, I want to share the 7 lessons that I’ve learned through my own journey so far, to help them increase their own chances of success.

Lesson 1: A Really Clear “Why” Will Be Your Guiding Light

One of the most rewarding aspects of being a financial planner is being able to build whatever business will support a particular, unique lifestyle. Advisors can control the number of clients, amount of revenue, the number of hours worked, etc., which is exciting, but can also be intimidating at the same time. What if the advisor can’t choose the lifestyle they want to pursue? Before building a firm, it’s crucial for advisors to really dive into their “why” – their central reason/motivation for doing and pursuing what they want to do – so that they can be sure they are building the right firm for themselves.

After lots of soul searching, conversations with my wife, and going through George Kinder’s 3 questions (thanks to Jude Boudreaux for leading us through this!), I got crystal clear on my own “why”.

For me, my “why” is having the freedom to do work I love when I want, where I want, and how I want. I want the ability to work only with clients that I enjoy working with most. I want the freedom to work with clients in new, creative ways without feeling constrained, to utilize and experiment with new technology, and to market myself freely without worrying about what others think.

On a more personal level, I want the ability to fully control my time so I can be the best version of myself, a spouse, (hopefully future) parent, family member, and friend that I can be. I also want the ability to travel extensively and work from anywhere in the world.

However, I realized this wasn’t enough. While I was contemplating starting my own firm, I had opportunities to join established firms that could present this lifestyle flexibility, without the financial risk and stress of starting a firm from scratch. Sounds ideal, right?

Well, I couldn’t help but shake the bothersome feeling that I would never truly view these firms as ‘mine’. My DISC assessment, Predictive Index, Myers-Briggs, etc., all say the same thing – I like to be in control, and I like to be a leader.

Even if I could join the ‘perfect’ firm, I know I wouldn’t have been fully happy because I’d have to give up some control. I wouldn’t have had the opportunity to make the decisions on technology, marketing, clients, fee structure, etc., that are so crucial at the beginning stages of a business. I also would have felt guilty for living a non-traditional life, working remotely from another country, or taking extended time off, even if the firm owners were supportive of it. This may likely have been a self-limiting belief, but I didn’t want to uproot how established firms have historically operated to accommodate my desire to live a non-traditional life.

In a way, I felt as if a firm’s identity and culture would have needed to change if I joined, which I was frankly not comfortable with. Nowadays (especially as we approach the post-COVID era), changing a firm’s identity and culture is certainly not considered a bad thing, and many firm owners would certainly be open to it. Looking back, though, I believe my discomfort was likely tied back to my own hard-wired desire to be in control and to make my own workplace truly ‘mine’.

In addition, I never wanted to look back and wonder, “What if?”, nor jeopardize any of the life goals that my wife and I had. I didn’t want to miss out on escaping the Northeast winters and working remotely from New Zealand for a month if we wanted to. I wanted the freedom to play hooky during the week to enjoy time outside during one of the first beautiful spring days and work over the weekend to make up for it. This type of culture was far from the “norm” (especially pre-COVID), so finding an established firm with this existing culture was rare at the time.

While the opportunity to join an established firm was enticing, especially financially, I felt like starting a firm from scratch was a risk I had to take. If I failed, I believed the opportunity to join an established firm would always be there as a backstop. Thanks to the industry’s aging demographics, there’s no shortage of reasonably salaried financial advisor ‘jobs’ for experienced advisors who try and don’t succeed at financial advisor entrepreneurship.

With this clear vision of “why” in mind, making business decisions was much easier for me because I knew how I wanted the business to support my ideal life.

Lesson learned: Getting crystal clear on my “why” was crucial, but also understanding how I am uniquely hard-wired was equally as important. Notably, in a post-COVID world, if an advisor’s “why” involves flexible (and remote) work arrangements, it may actually be supported by an existing firm. So the decision of whether an advisor should launch their own business requires digging deeper into how a person is hard-wired (i.e., how their personality and behavioral proclivities may influence their priorities and values), because not everyone is hard-wired to start a business from scratch… and that’s totally okay! I highly recommend taking one of the many personality tests mentioned above and talking to an expert to help translate the results.

Lesson 2: A Niche Is Crucial To Success… And It Will Change Over Time!

The importance of having a niche is no surprise. The challenge is how to choose one and how to evolve it over time.

The most popular approach to niches is to specialize with clients in a particular professional field. To be honest, choosing a profession-specific niche right out of the gate scared the s#!t out of me. I’ve worked in the financial planning field my whole life, so I didn’t have a previous profession that I could focus on. My wife is a wedding planner, but I didn’t want to focus on working with wedding professionals. Focusing on a profession is a great way to choose a niche, but I didn’t feel like it was the right way for me. So I had to find another way.

Questions To Help Identify The Right Niche

Because targeting my niche based on profession alone didn’t feel like the right strategy for me, I had to search inwards to help me identify my right niche. To do this, I asked myself three important questions:

What makes me different?

What do I value?

Who do I like working with?

What Makes Me Different?

The first thing that came to mind was a very impactful life experience. My dad passed away suddenly at the age of 63, right before he was about to retire. He was so looking forward to this next exciting stage of his life and it was cut short just like that. This experience gave me the valuable insight that life is precious, and we should experience as much as we can, knowing that tomorrow is never promised.

At the same time, I strongly believed that the movement of untraditional work-life paths was gaining a lot of steam. Reading The 4-Hour Workweek by Tim Ferriss, seeing the FIRE movement grow, and realizing the gig economy was here to stay, I believed this whole “9-to-5, work-until-you’re-65” concept was archaic.

This helped me arrive at the first component of my niche – ditching the “9-to-5, work-until-you’re-65” concept. But that wasn’t enough…

What Do I Value?

Travel is a huge priority in my life and something that certainly changes our various financial decisions. My wife and I intentionally spend less on ‘things’ so we can splurge on experiences. Prioritizing the ability to travel impacts many traditional financial decisions such as choosing a job, purchasing a house or car, saving for education, etc.

Therefore, I added “travel-loving” to the niche and now had “travel-loving” and “ditching the 9-to-5, work-until-you’re-65” concept. But now I had to decide who I want to do this for.

Who Do I Like Working With?

I decided that the demographics of young families were a great fit. Life transitions = money transitions, and most life transitions you go through typically happen when you are starting a family.

In addition, I was 27 years old at the time of starting a firm, so I knew that I’d have way more in common with a 30-something-year-old than a 65-year-old retiree that had kids my age!

Combine these 3 areas together, and I arrived at my initial niche: travel-loving young families who don’t buy into the traditional “9-to-5”, work-until-you’re-65” concept. I knew this was still pretty broad, but at least I was hitting on values and demographics which were enough for me to start with and differentiate myself from other advisors.

How My Niche Evolved

Once I had about 20 clients and enough revenue to at least cover our living expenses, I felt more comfortable narrowing the niche further, since the business was actually working.

At this point, I added qualifying criteria that included household income greater than $200,000, and an underlying planning need for a) equity compensation, b) student loans of $100,000 or more, and/or c) a current or aspiring business owner.

All three of these planning needs require unique expertise and are ‘sticky’. In other words, clients’ needs in these financial situations would always be changing and evolving, which meant that I could continue to deliver high value on an ongoing basis. This also allowed me to confidently change my minimum annual fee from $3,000 to $5,000, since I knew any new clients would have extra layers of complexity, and the financial wherewithal to be able to pay those fees.

Lesson learned: Advisors just starting out will benefit from picking some type of niche that makes them different, especially if they are with a virtual firm that doesn’t focus on working with clients in their local community. However, this doesn’t mean that the niche can’t change. It likely will, and it helps to refine and improve the business over time. Advisors should be prepared to add extra layers to their niche as their business (and confidence!) grow. You don’t have to pick the perfect ‘final’ niche out of the gate.

Lesson 3: Marketing Is Storytelling

One of the most impactful books that I’ve ever read is Building a StoryBrand by Donald Miller, and it is one that I recommend all business owners should read before they start putting together a marketing plan.

One of the most impactful books that I’ve ever read is Building a StoryBrand by Donald Miller, and it is one that I recommend all business owners should read before they start putting together a marketing plan.

The basic framework for a good marketing story includes a hero (the client) who faces a problem, and then meets a guide (the advisor) who comes up with a plan that helps them avoid failure and achieve the desired outcome.

Sounds simple, right? Well, this requires business owners to be really clear on their messaging, which is actually quite difficult, especially in financial planning, where clients’ needs are often very different. After lots of brainstorming and going through Donald Miller’s StoryBrand BrandScript, I ultimately arrived at the message:

We help travel-loving young families live a life they never want to retire from.

Prioritize your cash flow – Grow your net worth – Make work optional.

I tried to answer the “who” (travel-loving young families), the “what” (living their ideal life), and the “how” (prioritize cash flow and grow net worth) in 2 sentences, which is difficult!

Now, do I also provide 100+ other services for clients besides helping them prioritize cash flow and grow their net worth? Of course. But I wanted to start with something simple to serve as an umbrella statement, to which I could add more specifics later as they were funneled into my marketing.

Once I got my messaging down, though, I prioritized 3 things: 1) website, 2) content creation, and 3) lead generation.

Website

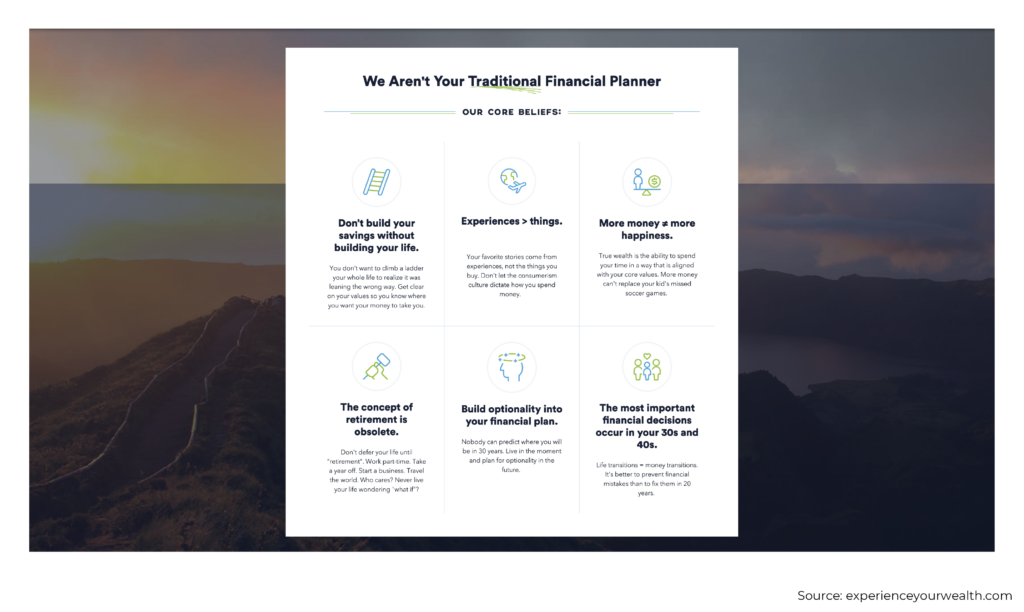

My website is my storefront. Since I was 100% virtual straight out of the gates, I wanted to build a website that looked, felt, and sounded different from any other financial planner’s website. Because my niche was primarily values-based to start, I knew that I had to create my website in a way that people would immediately think, “Yes – I agree” or, “No – I don’t agree” upon visiting it.

Therefore, I started the site design by putting our core beliefs on the home page to help build trust with a prospective client.

Since I was marketing to travel-lovers, I also included travel pictures as backgrounds on each of the pages, which reinforced my own value on travel that I preach.

As prospective clients go through the website, my intent was to bring them along on a journey, according to the outline provided in Building A StoryBrand. I eventually added a 2.5 minute animation video (created by JumpStart Video) which turned my full financial planning process into a quick, simple story using a sailing metaphor (I don’t know how to sail… it’s just a good metaphor that works!).

The website was a big investment and I partnered with Zach Swinehart to help me bring my idea to life. Once the website was done, I shifted my attention to creating content.

Content Creation

There are many ways you can create content – videos, Instagram reels, TikTok, podcasts, blogs, media, etc. For me, being in front of a camera is my worst nightmare. I’m a bit introverted and highly critical of myself, so I felt like video was not the best route for me.

However, I do like writing and I’m pretty good at it, so I decided to go all-in on writing blogs and contributing media articles instead of trying a little bit of everything.

While I was still getting registered as an RIA, I decided to pre-write a handful of blogs on topics that I was passionate about. My ongoing goal is never to write anything that can be Googled and, therefore, each topic often covered a highly subjective financial planning topic that was offered with my own unique perspective, specifically written as if I were speaking to my niche.

I started writing blog articles once a week, and submitted every article to XYPN's Consumer Blog, which then is shared with their thousands of subscribers. To my pleasant surprise, more than 5 of my blog articles were picked up by XYPN, which led to more website traffic and increased my Google website authority.

At the same time, I was responding to media requests from Help A Reporter Out (HARO), the National Association of Personal Financial Advisors (NAPFA), the Financial Planning Association (FPA), and XYPN whenever a topic was relevant to my target market. Just like my goal with blog articles, I wanted to provide reporters with unique insights into how a certain topic would apply to my target audience.

For example, a reporter from CNBC asked for quotes on a story covering how newlyweds should choose a tax filing status. Instead of providing them with more boiler-plate insights about how you lose some tax deductions when filing separately, I provided quotes talking about how student loan borrowers may want to file taxes separately, especially if they are pursuing some type of loan forgiveness program. This type of unique perspective resulted in being featured in the article.

As I wrote more blogs and was featured in more articles, my website traffic really started to increase. My SEO also significantly improved when I received backlinks from major news outlets like Business Insider, Bloomberg, and Forbes. I focused on building relationships in the media and providing as much value as I could, as opposed to just focusing on getting featured. Now, I’m fortunate to be at a point where I have established relationships in the media and they seek me out for quotes.

Creating content and being featured in the media was great, but that doesn’t always lead directly to clients. Accordingly, I had to have a plan on how to actually get clients.

Lead Generation

This is the scariest part of starting a firm from scratch – how do you actually get clients? Unless your natural market (i.e., your family, friends, or existing network of prior-industry colleagues) is ripe with prospects, it’s unlikely that you’ll have people running to the door when you open the firm.

Reverting to my awareness of how I’m hard-wired as an introvert, I knew going to several networking events and meeting a ton of new people would not be the right thing for me (and COVID-19 quickly shut down those options anyway!). I prefer having high-quality relationships with fewer people, which meant that I focused more of my energy on deepening established relationships within my existing network.

Before I launched my firm, I luckily already had an established network of Centers Of Influence (COIs) from both my prior firm and my involvement on the Massachusetts FPA board of directors as the NexGen director. Therefore, I reached out to my existing network for advice, and to tell my story about how my firm was working with a specific target market and solving specific financial planning needs.

This naturally led to referrals from COIs as my firm’s story grew, because any time one of those COIs was talking to a travel-loving young family who wanted to reject the traditional 9-to-5 and had a specific planning need that I specialized in, I was immediately top of mind. Combined with my unique website and consistent content creation, I began generating a high number of leads about 4 months into the business.

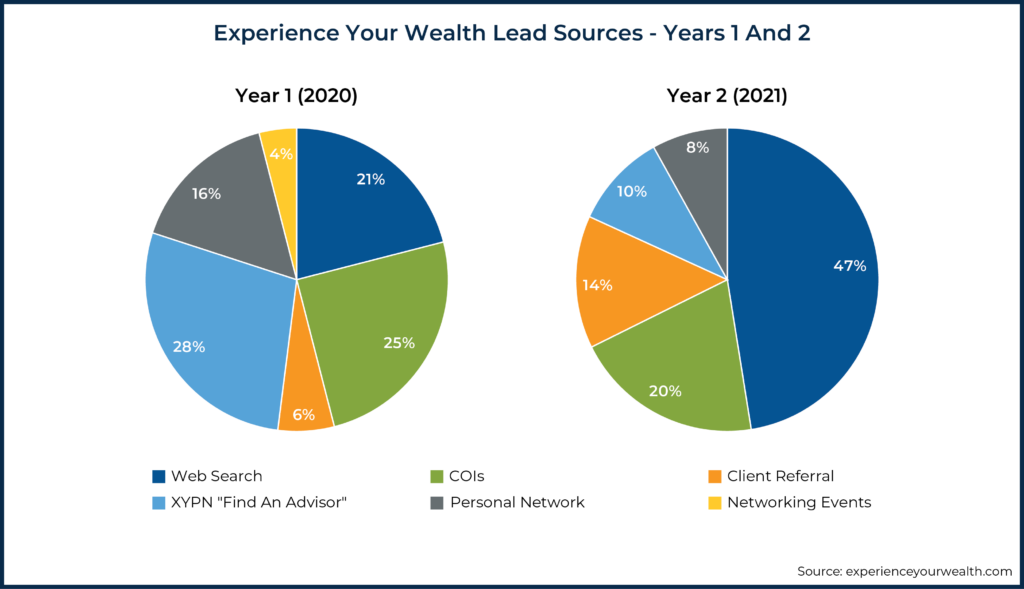

Here are our lead sources from 2020 (first year of business) and 2021 (second year of business).

Looking back on the 2020 and 2021 statistics about lead generation, I came to a couple of key conclusions –

- Google reviews really helped. I’ve been asking all clients for Google reviews since day 1 and my leads from web searches have more than doubled year over year. (I confirmed with my state regulator that such reviews are compliant, and I have a documented, consistent program on how I do this.). While my classification of “Web Search” also includes NAFPA + Fee-Only Network, the majority of prospects in this category selected “Google” when filling out my scheduling form, which I also confirmed when reviewing my Google Analytics statistics.

- My established network of COIs was crucial to generating leads, especially since we were working with a very specific type of client with specific planning needs. This made it easier for them to think of our firm in particular, even amidst a sea of other financial advisors also asking them for referrals, whenever they ran across a potential prospect that fit into our firm’s specific niche.

- My own natural personal network wasn’t my target market anyway, so I wasn’t counting on that for primary lead generation.

- Client referrals picked up, but not right away. We implemented a charitable-giving, client-referral program and provided clients with very specific instructions on how to make referrals to us. Whenever a client refers someone to us and that person becomes a client, we donate $100 to one of three pre-specified charities of the client’s choosing (AAAA Foundation, Foundation For Financial Planning, or Bunny’s Buddies) as long as the client isn’t involved in those charities (for compliance reasons). We don’t proactively ask clients for referrals, but we continue to provide exceptional service, letting clients know that we are a growing firm with the capacity to help people they care about. I’ve found the charitable-giving, client-referral program to be a very effective way to thank clients for the referral and donate to a good cause at the same time.

Lesson learned: Making sure our target market and messaging were clear before generating any content made it easier to decide which marketing methods would be best for the firm, and to implement them in a way that we actually enjoyed (i.e., not networking as an introvert!).

Lesson 4: Refining A Sales Process Is A Process

Before launching my firm, I was a Senior Advisor at a large fee-only RIA firm in the Boston area. I felt very confident as a financial planner, but clients were essentially handed to me in my role there, so I had minimal opportunities to gain direct sales experience. We had a dedicated business development officer and other senior advisors who were more actively involved during the prospecting process. Which meant that most clients were already sold on working with the firm by the time I met them.

Fast forward to launching my own firm, where it was just me, myself, and I managing every single part of the sales process. I knew how to deliver financial plans, but successfully transitioning someone from being a lead to a client? That was brand new to me.

I honestly wasn’t very good at sales for the first few times I met with prospects, but that was okay – it was like training a new muscle that hadn’t been used before. To expedite my learning process, I decided to enroll in a sales training program.

Genuine Sales Course By Nancy Bleeke

I first read Nancy’s book Conversations That Sell: Collaborate with Buyers and Make Every Conversation Count which was really helpful in providing structure to my sales calls. However, that wasn’t enough – I wanted to stop practicing on actual prospects and receive hands-on coaching to help me take my sales skills to the next level. I enrolled in Nancy’s Genuine Sales Course to learn how to structure a conversation, collaboratively work through objections, and how to ask for a sale in an authentic way. Throughout Nancy’s course, I was able to practice conversations, refine my process, and brainstorm actual prospect scenarios while I was going through them at the same time.

I first read Nancy’s book Conversations That Sell: Collaborate with Buyers and Make Every Conversation Count which was really helpful in providing structure to my sales calls. However, that wasn’t enough – I wanted to stop practicing on actual prospects and receive hands-on coaching to help me take my sales skills to the next level. I enrolled in Nancy’s Genuine Sales Course to learn how to structure a conversation, collaboratively work through objections, and how to ask for a sale in an authentic way. Throughout Nancy’s course, I was able to practice conversations, refine my process, and brainstorm actual prospect scenarios while I was going through them at the same time.

Once I felt more confident about where the conversation would go, I was able to better focus my attention on what the prospect was saying and demonstrate that I was actively listening to them. I also created a list of questions to reference during prospect meetings to ensure I was asking the right type of questions during the meeting.

Show A Client What It’s Like To Work With You

Most of the prospects that I met with had never worked with a financial planner before; therefore, they often had no idea what to expect. It can be hard to articulate what financial planning actually is, so I decided to make it collaborative and actually show them.

We first start off by telling them a story using the sailing metaphor again, explaining that our job is to build and sail them in a ship, going from where they are today to where they want to be tomorrow.

Step 1: We help paint the picture of what tomorrow looks like for the prospect (The “Discovery” meeting, which includes asking George Kinder’s 3 life planning questions).

Step 2: We help get clear on where the prospect is today (The “Get Organized” meeting).

Step 3: We help build a ship that will be customized to the client’s unique needs (The “Initial Recommendations” meeting).

Step 4: We create the navigational route for the client’s ship to sail, so we are clear on our next steps (The “Road Map” meeting).

Step 5: Finally, we set sail as the client’s captain, where we help them implement, monitor, and adjust the sail plan to navigate life’s changes along the way (our ongoing planning services offered throughout the client relationship).

At each step of the process, I share my screen by Zoom, showing prospects exactly what we do for them, what the deliverables look like, and how it will benefit them.

Will prospects remember each step? No. But I’ve had many prospects say, “We need a captain” at the end of conversations!

Write A Summary Email To Prospects After Meetings

What advisors do after an initial prospect meeting is crucial to continue the momentum and keep prospects progressing through the sales process.

Our goal for the first introductory meeting is twofold: a) to confirm a fit, and then b) to schedule a free follow-up meeting to dive deeper into specifics. In between the first introductory meeting and our second meeting, I send them a comprehensive email with links to 2 relevant blog posts, links to take their Financial DNA profile (which we discuss in depth during the next meeting), and then include 6 to 10 bullet points outlining “Here’s what I learned about you” to reiterate that they were truly listened to, and using their words as much as I can.

This takes approximately 15 to 20 minutes for each qualified lead and will make advisors stand out from other planners.

Don’t Be Afraid To Ask For Qualifying Information Upfront

When I first started out, I would talk to anyone who was interested in potentially working with me since I had all the time in the world. As my firm grew, though, I knew the quality of prospects became far more important than the quantity of prospects.

Therefore, beginning in 2021, I implemented a series of questions in my Schedule Once prospect booking form with pre-selected questions to auto-fill. This allowed me to immediately qualify prospects. These questions included:

- Household income range

- Age range

- Do you share finances with a partner?

- Do you have any kids?

- Do you have any student loans?

- Do you have any equity compensation?

- Are you a business owner or do you receive a Schedule K-1 statement?

- What is your estimated total bank account balance?

- What is your estimated total investment account balance?

- What is your favorite place you’ve traveled to?

Honestly, this was terrifying for me to do. I thought, “What if nobody ever books a meeting now?!?” Not surprisingly, it didn’t change anything – I saw the same exact number of leads in 2020 and 2021.

Beginning in 2022, I’ve added an additional checkbox statement that says, “I understand that EYW’s minimum annual fee starts at $5,000/year and I’d like to learn more”, to further qualify prospects. I have seen a slight decrease in the quantity of leads this year, but the quality is even higher. Why spend time talking to a prospect who isn’t interested in paying at least your minimum fee in the first place?

Lesson learned: Marketing and selling ourselves is one of the biggest challenges we face as new firm owners. While I wasn’t very good at first, with some practice and training, it has become much easier. And for those who aren’t confident in learning entirely on their own, there are training programs out there (e.g., Nancy Bleeke’s Genuine Sales) to help.

Lesson 5: Get Clear On Your Business Start-Up Costs

I used XYPN's first-year budget projection sheet, which was really helpful for me to properly plan for startup costs. Before finding this sheet, I was overwhelmed thinking about the number of costs that I’d need to plan for, and, more importantly, I was afraid that I was missing something that I should have been considering in the first place. This sheet identified approximately 80% of the costs that I needed to account for, and the remaining 20% I was able to tack onto the sheet.

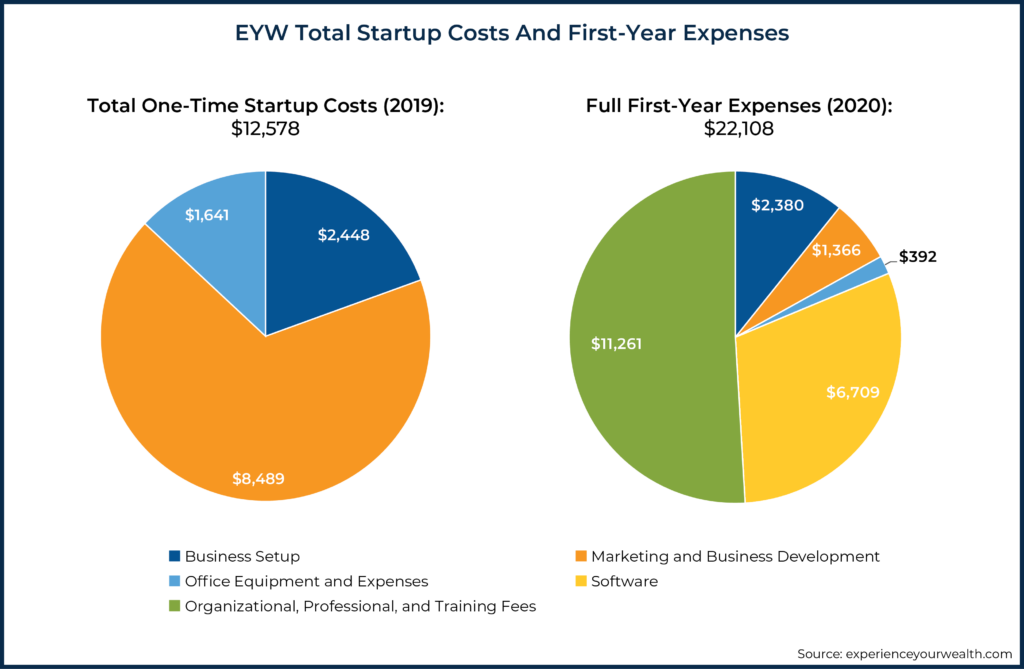

My total one-time startup costs were $12,578 in 2019 (September through December, much of which was building my initial website) and my full first-year costs were $22,108 in 2020.

My startup costs could have been much lower, but I prioritized spending a higher amount on a website (which definitely paid off!). My total website creation cost was $7,350, which is likely on the higher end for most advisor websites, but it was a complete custom-build in WordPress.

My first-year ongoing costs were pretty reasonable. I didn’t have an office, and conferences were essentially non-existent due to COVID. My four biggest costs were XYPN membership fees, the Genuine Sales course training, eMoney as my financial planning software, and Financial DNA which made up 58% of my total costs; all of which were crucial to my firm’s success.

Lesson learned: It’s very valuable to create an initial budget projection, but it’s important to allow for plenty of financial buffers for things to be different. Looking back at my initial business plan, my estimated upfront, one-time costs were quite different from and substantially higher than what they turned out to be in reality. I estimated only $6,600 for startup costs (which ended out to be $12,578 in reality) and estimated the first year, ongoing expenses to be $15,800 ($22,108 in reality).

Lesson 6: Adjust Your Own Personal Financial Situation To Support You In The Start-Up Phase

Thanks to the many advisors who helped lay the path that was ahead of me, I was prepared for the first year to be very financially challenging. According to the XYPN 2021 Annual Benchmarking Survey, the average total revenue for a first-year business owner that joined XYPN in 2020 with <10% of current clients (i.e., starting more or less from scratch) was only $25,000.

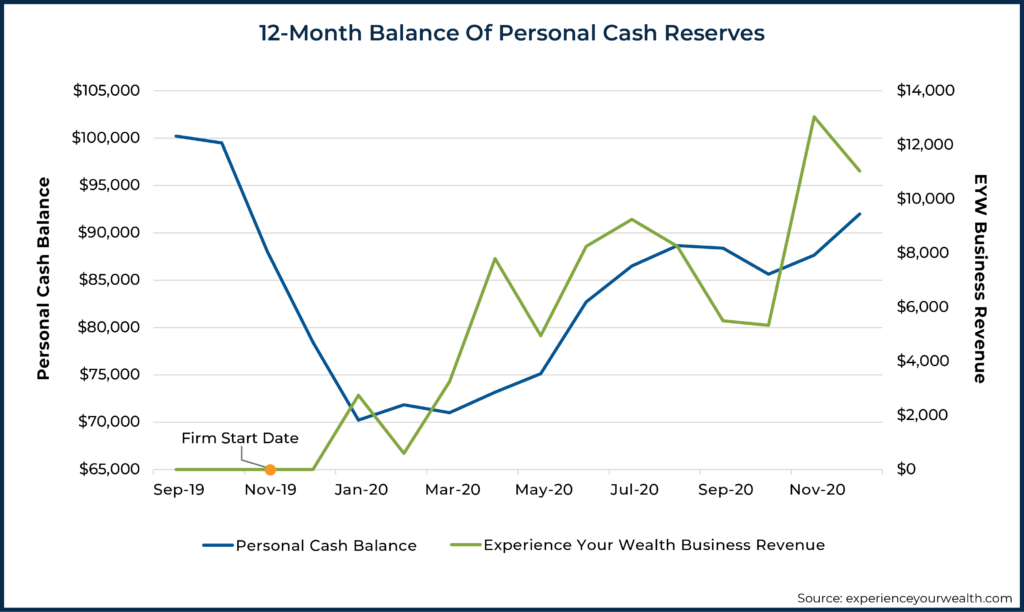

Therefore, I had been saving up cash for a long time prior to launching the business to help replace my income during the startup phase. Prior to launch, we had $100,000 of cash in the bank, which equated to about 18 months of living expenses (roughly $5,500/month). In the few years leading up to 2019, we halted retirement-account contributions, so we had this cash for the business saved (in addition to paying for a portion of our wedding in Greece!). We also made many financial sacrifices after I left my job, such as moving from Boston to Rhode Island to cut our rent in half, pushing back plans to buy a home, and pausing all our own travel plans.

The initial plan was for my wife to continue working at a different W-2 job, but she was miserable there and she ultimately ended up launching her own wedding planning business from scratch 2 months after I launched. Having the $100,000 of cash in the bank gave us the confidence to run our businesses the right way, and not to feel pressured to take on the wrong type of clients.

We saw our cash continuously fall from September 2019 until it bottomed out in January 2020, at around $70,200. After that, we essentially stayed afloat for a few months while the revenue coming in was at least enough to cover our core household expenses (after start-up business expenses). As my revenue quickly began to pick up around May 2020, 6 months after my official launch in November 2019, we started to slowly save more money, replenishing our cash reserves and reinvesting back into our businesses. We were also able to begin saving for our future travel plans (once COVID was better!).

Lesson learned: Cash is king when starting your own business because it gives the owner the flexibility and freedom to run the business the right way without having to worry about paying day-to-day bills. We tried to identify the low point of our financial situation during the startup phase ahead of time by considering the cash level ($30,000) where we would need to explore supplemental income options, so that we would be more emotionally prepared (though it was still hard!) when we watched our cash reserves go down. Playing out some of the “What if?” scenarios ahead of time was very valuable for our peace of mind and helped us sustain the business during its first year of operation.

Lesson 7: Revisit, Challenge, And (Potentially) Alter Your Long-Term Vision For Your Firm

Some advisors know right off the bat that they want to build a boutique or enterprise-type firm, which is great because strategic business decisions will be easier to make in some ways, as the choices involve thinking past just yourself and can be anchored on a potentially more stable view of what the firm’s longer-term objectives will be.

The challenge is for the advisor who believes they just want to stay solo, but who may also want to maintain the flexibility to change direction and grow beyond ‘just’ themselves in the future.

Starting out, I was convinced that I would stay solo… only to end out hiring an associate financial planner less than 2 years into the business!

The decision was related to my “why” for starting a firm in the first place. I vividly recall taking 3 days off for the first time about 18 months into starting a business, and I felt like I was drowning when I returned. I simply didn’t feel like I could truly live my ideal life when I was responsible for all aspects of the business.

I quickly realized that fulfilling the role of the technician, manager, and entrepreneur in a business is very time-consuming; especially when you are doing truly comprehensive financial planning for a demographic with rapidly changing demands (young families). I can outsource parts of a business, but I can’t outsource the client service part that requires my expertise without compromising the high standard I promise to my clientele.

Having a team allows me to do more of what I love, and less of what I don’t. I love being a financial planner, but I’ve also realized how much I love being a business owner, too. As my firm grows, my hope is to spend more time on the business and less time in the business.

My long-term vision evolved from being a solo firm with 60 clients to a team of 5 (myself, two lead advisors, and two associate advisors) with 160 clients. And that will probably change over time, too.

Lesson learned: Advisors don’t need to immediately know if they want to stay solo or grow a team when first starting out. However, if there’s a chance that they may want to expand in the future, it can impact some immediate decisions such as naming the firm, selecting the technology used, establishing workflows and processes, creating long-term financial projections, and deciding on the number of clients to work with. The only certainty in launching a firm is that things will change; advisors just won’t know how those changes will manifest right away.

Bonus – Other Random Lessons Learned

- A client that an advisor life-plans for will be a client for life. We utilize George Kinder’s 3 questions during our discovery meeting process and dive deep into what’s most important to clients and what their ideal life looks like (knowing they are total guesses) before we ever talk about what they should do with their money. This makes financial planning much easier by helping advisors actually understand what they are financial planning for in the first place! In addition, I’ve seen some of the most impactful changes come out of these meetings, like changing jobs to start a family, taking a year-long sabbatical around the world, mending relationships with family, etc. Some of these involved money and some had nothing to do with money.

- Tracking time religiously using time tracking software like Toggl lets advisors measure their number one asset: time. Seeing the amount of time that I spent servicing clients gave me the confidence to raise my fees quickly after year one. In addition, tracking time allows advisors to identify bottlenecks, reflect on the highest value of their time, and measure progress amongst team members. Getting into the habit of tracking time can help advisors to make better, data-informed decisions as business owners.

- Finding a study group with firm owners who have similar baseline values, but operate their businesses in different ways, can help to broaden an advisor’s perspective and to make better business decisions. I found my study group in February of 2021, and we’ve been meeting on a bi-weekly basis ever since. Every solo business owner has blind spots, so having the objective opinions of those you trust is crucial for most major business decisions you make.

- Advisors can learn from the tech industry about the software they are using. Some of my most valuable software (Miro for visual whiteboarding, and MeisterTask for interactive client task dashboard) were inspired by the tech industry. We use Miro in two ways: 1) to create a “life planning timeline” after our discovery meeting for clients to visually illustrate some of the various life priorities in the next 10 years, and 2) to review recommendations such as investment accounts to open/transfer, how to bucket their investment strategy, and how to prioritize their estimated savings. We use MeisterTask to help clients actually do things – we have Trello-like boards set up for each client with short-term, mid-term, long-term, and recurring tasks with checklists and guides so we can communicate to clients in a project-management-type way.

- Being very intentional about spending time on self-care is of utmost importance for advisors to do their best work and to take care of their clients. Schedule time to meditate, exercise, read, walk, etc. Business never stops and there will always be things for an advisor to do. This is still something that I struggle with and I’m actively taking steps to improve it. The journey of starting your own RIA will absolutely be worth it, but not if you lose yourself along the way!

The journey of starting an RIA from scratch will undoubtedly be a rollercoaster. Advisors will experience high highs and low lows. There will be days when they may want to throw in the towel and quit. There will be other days when they feel on top of the world. For some, this may seem like an exciting challenge and for others, it may seem like a nightmare.

Before embarking on the journey of starting an RIA, advisors should be truthful with themselves. Does this path excite you? Does your personal financial situation support you? Do you have a supporting spouse/partner and family?

The first three years will likely be a struggle, but the reward waiting on the other side as your practice succeeds will be worth it. The ability to select your clients, control your time, conduct financial planning your way, and, most importantly, be yourself, will easily outweigh the difficulties you face early on.

During this process, it’s important for advisors to continuously challenge and evolve the vision for their firm. What you envision your future firm will look like as you first start out will likely be vastly different three years down the road. My vision has evolved from wanting to stay solo, to building a 5-person team where advisors are able to work hands-on with our amazing clients without the pressure to bring in business, all while having the freedom to control their time and live their ideal life at the same time – which directly aligns with my own ‘why’ for launching EYW in the first place!

An amazing look behind the curtain of a new practice! Stories like these are incredibly valuable to our industry.

Thanks, Matthew! I’m hopeful other advisors will be able to apply some of these specifics to their practice.

Jake, thank you for sharing your journey! It is helpful for those of us considering starting our own firms.

As someone just starting out, where did you decide to custody assets and what went into that decision for you?

Thanks for the feedback, Joe – happy to hear it!

I decided to outsource all investment management and operations to First Ascent who uses TD as a custodian. This has been a hugely valuable relationship since it allows me to focus on financial planning and growing the business. They handle all account openings, transfers, trading, communication with TD, etc. I also receive Orion for free as part of the relationship.

I don’t charge any AUM fee, but rather have clients pay their fee directly if they want to use them. They charge 0.35% up to $400,000 and then cap the fee at $1,400 until $3 million where there is an extra $500 charge per million. They are the only flat-fee TAMP from what I’ve seen.

Awesome article and there are so many lessons. When starting from scratch, too much time is spent on networking with the wrong type of people (clients and referral sources). If you know your niche, you have the opportunity to open conversations via FB Groups, LinkedIn etc (obviously don’t be a spammer in these groups). You need to add value and then people will reach out for help.

Also having a content strategy which will help position you in front of your audience is important. Keep adding value without expecting a lead. Over time, this will work and you will be in a great position to attract your ideal future client.

Great suggestions! I’ll be looking at JumpStart. Our firm uses Monday.com to keep track of clients tasks, extremely helpful.

Question: Is asking a client to write Google Reviews really state-compliant in RI? In MD where I’m based, it’s not. Also, approximately how many hours per client do you end up devoting (after you’ve created the initial Plan)?

That’s great – I checked out Monday.com a while ago, but I was already too deep into MeisterTask to make the switch. I really like the simple user face of MeisterTask though.

Re: compliance of Google reviews – I had 2 calls with my RI regulator and they said as long I have a) procedures documented in my compliance manual, b) a log showing that I asked ALL clients and c) proper disclosures (aka – nobody was paid), then it’s allowed. I know this is state by state, even given the new SEC advertising rule.

Re: time spent with clients – It varies based upon the client, but looking back at 2021 for clients that were in year 2 of working with me, it ranged from 13 to 71 hours with an average of 31. I believe this is on the higher side compared to industry standards, but I’m comfortable with that.

Thank you Jake, that’s really helpful! Thanks again for sharing, I admire your practice!

Excellent article and a great story!

Thanks, Jay! Much appreciated 🙏