Executive Summary

The traditional view of business is that the best way to grow a better business is to implement better business methods, often gleaned from industry benchmarking studies that try to identify the “best practices” being used by leading firms. Yet while it certainly is important to implement effective business tactics, the reality is that especially in solo advisory firms, the business itself is often a reflection of the owner and his/her mindset. When the owner has a good day, the business has a good day. When the owner has a bad day, the business has a bad day. And any mindset limitations of the owner become mindset limitations of the business.

In this guest post, practice management consultant and coach Stephanie Bogan explores how the foundation of an advisor’s mindset ultimately defines his/her practice, and how changing your business methods isn’t nearly as powerful as changing your own mindset to improve the current state and health of the business, especially for those who want to pursue a highly leveraged “lifestyle” practice for themselves.

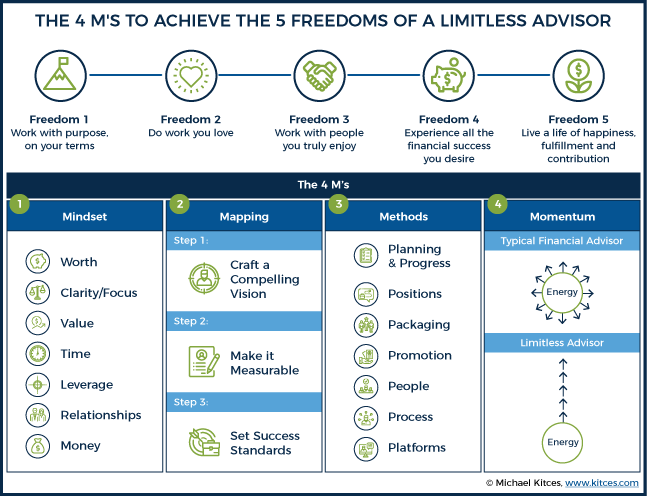

To break through to the next level, Bogan advocates focusing on what she calls the “Four M’s” of Mindset, then Mapping (towards real goals of the advisor), then Methods (which can’t change the direction of your business, but can multiply the results once you know where it’s heading), and finally building Momentum to accelerate progress in the direction that has been mapped out (and not succumbing to distractions of other ideas or business opportunities that don’t actually help achieve that focused goal).

The bottom line, though, is simply to understand that often the greatest challenge in achieving a more efficient “lifestyle” practice as a solo financial advisor, earning more dollars while spending less time in the business, isn’t about finding the “right” technology or the key best practice, but changing your mindset to shed the limiting beliefs that you “can’t” achieve the success you want in the first place!

Steve Jobs said, “What human beings can do is amazing, what they usually do is disappointing.”

After our respective appearances on the Financial Advisor Success podcast sharing our success (Episode #24, Stephanie Bogan and Episode #7, Matthew Jarvis) my client and now Limitless Adviser Success Coach, Matthew Jarvis, and I each received a stream of inquiries from advisors asking how they too could achieve this type of success while enjoying so much freedom.

For some, this might look like Matthew’s highly profitable lifestyle practice, with over $1M+ in revenue, a take-home profit margin of 55%, and 120 days off per year (and he’s only 36!). For me, it was building a multimillion-dollar firm by the age of 34, selling to a Fortune 200 and 5 years later transporting my American Dream to the beach in Costa Rica. In 2017, with 4 years of retirement spent studying the science of success and some powerful learning under my belt, I un-retired and built a 7-figure practice in 18 months while working 20 hours a week, taking 3 months off, and doing work that I absolutely love.

For many advisors, success simply looks like a better version of their current practice, with greater income and time away from the office; for others, it’s something radically better.

Whatever your definition of a bigger, better future, I assure you there is a way to accelerate your success, gain back your time and freedom and build a wildly successful practice and life that you love.

We’ll explore the search for success from a new vantage point, reveal new insights on the hidden forces holding us back, and explore a powerful framework for accelerating your success so that you, like Matthew and I, can live The 5 Freedoms of Limitless Advisers:

- Freedom #1: Work with purpose, on your terms.

- Freedom #2: Focus your time and energy on work you love.

- Freedom #3: Work with people you truly enjoy.

- Freedom #4: Enjoy all the financial success you desire.

- Freedom #5: Experience a life of happiness, contribution, and fulfillment.

It is possible to live The 5 Freedoms, to build a $1M+ practice and take off more than 100 days per year when you realize that success isn’t about your size, it’s about your state of mind.

I’ve been blessed to start, grow and run two businesses with 7-figure revenues that allow me to take off more than 100+ days per year. But it is the difference between these two experiences that is striking. I started my first firm, Quantuvis Consulting, at the age of 24 and sold it 12 years later to a Fortune 200 company. It took me 8 years to break the $1M revenue mark the first time. By contrast, since starting my current firm, Educe, in 2017, I’ve taken 3 months off and worked 20 hours per week. This time, it took only 15 months to break the $1M+ revenue with a fraction of the time invested. The second time I have the science of success on my side, and I’ve learned it can be a powerful sidekick.

If any of you can live The 5 Freedoms as I and Matthew have, the question must be asked, "Why would you settle for anything less?"

We settle for a long list of reasons, discussed at length in last year’s podcast with Michael Kitces, chief among them comfort. That seems contrarian, but looking over 20 years of work with successful advisers and my own journey, I've noticed that comfort is the enemy of creation. Many of us settle for being “uncomfortably comfortable” in our work and home lives.

There really is a better way. Combining my 20 years of consulting and coaching experience with thousands of hours of research in the fields of performance psychology, behavioral psychology, neuroscience, quantum physics, and even epigenetics, I’ve expanded and elevated the model I use to help advisors experience new levels of success.

What I learned in those 4 years of studying success blew my mind, created a passion project that is now my new firm, and transformed the way I do business myself. Science is providing us with some powerful shortcuts, and a way to create greater success without all the suffering, or at least far less of it.

Master Your Mindset

I realize that prevailing conversations about success in the advisory profession aren’t littered with conversations about mindset. However, the latest research in fields like neuroscience and performance psychology strongly suggest that there should be.

As shared in my last Kitces post, success, according to Cambridge Institute of Technology, success is driven by three key factors: environment, skill, and psychology (mindset). The staggering part of this (and similar research) is that success is considered to be 80% mindset and only 20% methods. For every adviser that has ever wondered, “why does this success thing have to be so hard?” The answer has just been revealed to you.

If success is 80% mindset, it suddenly seems self-evident that, no matter how much energy and effort we focus on methods, our mindset may be what’s really holding us back, far more than most realize.

Take Robert, a typical adviser with $500,000 in revenue, who had maxed out his ability to grow and navigate the complexity of his practice. Robert’s story is real, though his name has been changed (and he could easily be one of the countless examples of firms over $50M of AUM suffering similar circumstances, so don’t assume size is the issue here).

Robert had been in business for 9 years, had maxed out his ability to grow with his 1.5 staff, and felt he desperately needed another just to keep up. Personally, he was suffocating in the long hours, stress, feelings of being overwhelmed, and complexity of his supposed success. He was keeping 35% of his gross revenue, a decent living, but it was nowhere near what he wanted to be taking home. It was also costing him far more than that in personal sacrifices, as the demands of his practice kept him from spending more time with his wife and children. We concluded that Robert wasn’t running his practice, it was running him.

My first conversation with Robert sounded a lot like a lesson in brain science, mostly because it was. The abridged version follows this storyline:

We can talk about what’s happening, and I can give you some advice and best-practices and you’ll progress. Or, we can talk about what’s happening really, and you can crack this thing wide open and transform your practice. If you prefer the latter, there are some ground rules you’ll need to know, starting with how your brain not only works, but how it’s so often working against you and your goals. But this isn’t airy-fairy woo-woo, Robert. This is hard science, neuroscience actually.

And then I shared with Robert the quote that started it all, literally:

“Our brains produce as many as 50,000 thoughts per day (National Science Foundation). Ninety five percent of these thoughts are repeated daily and reflect the mindset or belief we hold that lead to those 50,000 thoughts.” Of these 50,000 or so thoughts, 80% are negative.

This means that 95% of your thoughts are happening on auto-pilot “behind the curtain” of your subconscious, and whatever beliefs drive those thoughts sit squarely in the driver seat. There’s a good reason for this from an evolutionary perspective. The subconscious part of our brain has as its most important job: don’t die. Your brain figured out long ago that the best way not to die is to be vigilant about threats and dangers. Anything that is new, different, or unique, warrants special attention and is highly suspect – if it even sniffs a threat, your brain will have you hightailing it out of the situation before the 5% of your conscious mind even has a chance to know what happened. By the way, any and all change and challenge (without training) is perceived as a threat by your brain, actually lighting up the same centers one would expect to see if you were faced with a hungry lion. Our brains don’t recognize that we live in a modern world and that being overwhelmed at work or being asked to discount a fee is not the same as running for our lives – but it's interesting to note that’s often how it feels.

Robert understood, but it was taking time for him to process this new information. I went on to explain that our brains take in 11,000,000 bits of information a second yet can only process 40 bits per second consciously.

As a result, our brains develop shortcuts to process all that information. The oldest part of our brain, the limbic system, evolved long before the modern age. Back in caveman times, if your brain had to process every threat consciously, you’d see a hungry tiger, stop and think about that consciously, and then realize you were in the jaws of said tiger before you even finished your thought. In other words, if you took the time to think about the threat, you’d die. So, survival of the species demanded that our brains evolve shortcuts to process threats in milliseconds.

When new information is perceived, in 1/5 of a second a part of your brain called the Reticular Activating System does what it was designed to do: survey the landscape, filter based on your internal perceptions, form a conclusion (based on your past experiences, not your future possibilities), and send a signal to react. The job of your subconscious is to make sense of everything coming at you so that you can respond in a pattern that is consistent with your own self-concept.

This self-concept is embedded in our brains through our internal representations of reality, otherwise known as our belief systems. Your subconscious mind works tirelessly to ensure your behavior fits the patterns consistent with your beliefs, and of paramount importance is that you understand that all of this happens without your conscious knowledge or permission.

Turns out, it’s what you repeatedly hear, see, and experience as a child that you subconsciously download as programs for survival. As an adult you may think you’re consciously in charge of the quality, condition, and direction of your life, but the reality is that we are simply living out patterns and programs learned during childhood. Some of these patterns (aka “belief systems”) help and empower us, and others hinder us and hold us back.

By the age of 35, 95% of who we are and how we behave is pre-programmed into our subconscious. In short, you are operating on “auto pilot” and will be about as successful and happy as your subconscious beliefs allow you to be. If you want to change your business and your life, you start by changing your mind.

Robert understood this intellectually, but I could sense he didn’t quite grasp the implications in his own practice. After identifying a few of the all-too-common compromises he was making, Robert realized just how much mindset mattered – and just how much not mastering his had cost him:

Myth #1: Not feeling he could charge a higher fee for planning.

When you know your worth and the value you deliver, you’ll stop hesitating and start charging what you’re worth, creating equitable relationships that serve your business as well as you serve the clients. Most advisers who don’t charge a fee – at least the ones I speak with – don’t do so because they fear it creates a hurdle for the prospect, or that they’ll lose clients if they raise their fees. Still, others are charging planning fees well below what’s fair for the value being delivered. This crisis of confidence stems from a limiting value mindset, and costs advisers far more than they realize.

For Robert, this meant getting clear on the fact that it wasn’t his desire to charge less, it was his compromise. He was making a repeated choice, and it wasn’t a thoughtful business decision based on his success standards, but rather an instantaneous auto-pilot action triggered by the perceived threat of a prospect saying "No" or a client leaving.

After careful consideration and some mindset coaching, Robert raised his planning fees by 60% to $8,000. He prepared and held his first fee increase discussion, to which the client replied: “Ok. That seems fair. But, instead of paying monthly can we just write you a check for the year?”

Now, they’re not all that easy, but in 20-years of helping advisers charge and/or raise their fees, not once have I had an adviser report back that it wasn’t a success, and something they should have done sooner. Most often, a fee increase literally results in no more than 1 or 2 clients (out of a hundred or more) who say “no”, which means, even after losing a client or few, the advisor ends out with far more revenue from all the clients who stay than losing much to the few who don’t (very favorable from a cost-benefit analysis perspective). Robert puts it best, “Turns out, I was the only one who ever doubted my value. If I’d done this with my top 37 clients 5 years ago, I’d have potentially earned $555,000 more in revenue every year.”

Had he mastered his mindset sooner, Robert – a somewhat above-average $550,000 adviser – could have been a $1M+ top-income adviser in the same amount of time.

Myth #2: Believing “yes” is the only good option.

Advisers readily discount fees, take referrals below their minimums, and say yes in ways that compromise their standards… and unwittingly put a stranglehold on their own success. This isn’t because any of us want to do these things to ourselves (who would!?), or because there’s even a good business case for doing them (there usually isn’t).

Advisers do these things because they aren’t comfortable saying “No,” leaving “Yes” as the only good option. With a strong clarity/focus mindset, you will no longer feel the need to back down off your standards, because you’re clearly focused on building the practice you want, and have no interest in a business that doesn’t align with your definition of success.

In Robert’s case, after years of struggling with the stress, feelings of being overwhelmed and the complexity that resulted from this behavior, he realized it was all done with the goal of getting the “yes” and avoiding the discomfort of losing the client or risking a referral source. With coaching, though, he was able to re-educate his clients and COIs on “who he does his best work with” after receiving a too-small referral… and received his largest referral ever the next week!

Now Robert has positioned himself as a helpful expert for smaller friends and family, and the paid expert for those who meet his ideal client profile - and is now getting more and better referrals in the process. On a $550,000 practice, Robert had lost $27,000 a year in revenue as a result of AUM fee discounts. At only age 39 after 9 years in the business, the cost was easily over $240,000 in lost revenue – assuming no more discounts granted, assuming no compounding interest, and making no mention of the equity value loss on that revenue. And that’s before considering the aforementioned impact of raising his fees (beyond the fact that he was also sometimes discounting them to prior/current clients).

Myth #3: There’s not enough time.

No one has a time problem; instead, we have (very real) prioritizing problems.

Too many advisers unintentionally design their practices for complexity, rather than ease and efficiency. By learning how to shift your time mindset and re-focus your time on what really matters, you can leverage people, process, and platforms to reach far greater results.

Robert was able to reduce his work hours from 55 to 40 per week in 6 months by structuring his time, reorganizing his service model and the timing of client meetings, and his support model, dramatically improving his return on time and accelerating his success.

Myth #4: Success has to be hard.

Most advisers have become convinced that they have to put in long hours over many years to be successful. And while hard work is one of the ingredients to success, my experience suggests that it’s more about momentum and focus rather than raw hours alone.

Robert didn't believe success had to be hard, he just knew it had become that way. Robert was working as much as he could at 55 hours a week, but he was expending all his energy just to run in place. The issue Robert faced was the focus of the force and energy he was applying. Robert, like many advisers, believed he was the only one who could do things right and had no models for managing his time, delivery of client services or for leveraging his people, process and platforms. He had limiting mindsets around value, leverage, and relationships. With a few hours of coaching, Robert shifted his views and began taking decisive action. We designed a time blocking model that focused Robert on energy creating, revenue producing activities and delegated the balance of work to his team and a virtual paraplanner. Robert created a client service model that clearly defined what segments of clients received what services, with what frequency, and developed processes to empower his team to deliver those services. A year later, Robert's schedule was aligned with his goals, his team had taken on more responsibility, his clients were being served predictably and consistently and Robert was working 40 hours per week and had taken his first real vacation in years.

These are just a few of the limiting beliefs that were holding Robert back… and impact a lot of other advisors, too. And hopefully, Robert’s example gives insight into the true costs of not mastering your mindset and, perhaps, a new awareness that the same experiences are available to you, when you too are ready to expand your perspective.

This all leads to the real question: what exactly did Robert do to create the results he’s now enjoying so that you can enjoy them too? The coaching model I followed with Robert covers the four elements that support living The 5 Freedoms of Limitless Advisers: Mapping, Mindset, Methods, and Momentum.

Mapping To Maximize Results

Robert and I sat down to talk about how to unwind the feelings of being overwhelmed and complexity that came with his supposed success.

The first step in Mapping is to explore what you really want to achieve and experience, and why it matters to you. Why? Because you need to provide a better set of instructions to your brain and upgrade your belief systems in order to get a better result.

Robert’s goal was “to grow,” because he believed that all growth is good. And he did… until the costs became too high, at which point Robert’s growth stalled out. But until now, he’d had no idea why. If you believe that you have to work long and hard to be successful and you really want to spend more time with your family, whether you’re aware of it or not you have an inner conflict – and that battle will rage for years if left unchecked.

I shared the Cheshire Cat quote from Alice in Wonderland with Robert: “If you do not know where you are going, it does not matter which road you take.”

I shared with Robert that without updated instructions, his brain would continue to engage the same autopilot programs that got him here – it was hard-wired into his neural pathways at this point.

Turns out what Robert really wanted was the income from a $1M practice so that his wife could stay home with their children; and he really wanted a practice that gave him ample time off to spend with his family, as his father didn’t have that luxury. Those are two very powerful Whys. This is the single biggest reason you don’t have more of what you want in your practice and life – your what-ifs are bigger than your whys. In which case, change simply cannot occur.

After creating a vision and knowing your Whys, the next step in Mapping is setting clear goals. And setting goals is where Robert got stumped. “Goals,” he said, “I can pick some arbitrary numbers, but what does that really change?” Robert is not the first adviser to speak these words to me.

So, I shared with Robert what I share with every adviser when discussing goals.

A study conducted on Harvard MBAs in 1979 (as discussed in Mark McCormack’s famous book “What They Don’t Teach You at Harvard Business School”) asked graduates if they’d set clear, written goals for their future, and then followed up 10 years later to evaluate their results. The study found that:

- 84% of the students did not have specific goals.

- 13% of the students did have goals, but no formal method of committing to or reviewing them.

- Only 3% had clear, written goals they reviewed regularly, with plans to achieve them.

The results 10 years later were staggering. The 13% with goals but no formal methods earned twice as much as the 84% of students with no clear goals. But that’s not even close to the surprising results this Harvard research revealed.

The mind-blowing results were that the 3% of students with clear, written goals took home ten times as much as the remaining 97% of their class, combined.

Why does having clear, written goals matter? Because they provide your subconscious brain with clear instructions on how to process and navigate the gauntlet of information and options you face all day, every day. In short, your brain is hard-wired to spend 95% of your mental capacity working to get you what you subconsciously believe is available to you – which 100% of the time is less than what is really available to you.

I asked Robert to answer the following question, and I invite you to do the same: If I gave you a blank canvas and asked you to paint me the most idyllic picture of your practice and life, what would you paint?

Robert gave his goals some room to surface and concluded he wanted to grow to $1M in revenue, take home $400,000 a year, and work a regular 40-hour week with Fridays off in the Summer, and 2 months off per year.

He did this, as should you, without any concern for how he would get there. One of the oldest security strategies our brains rely on is to inundate us with the “hows” and “what ifs” whenever we start to think bigger. Thinking bigger, after all, means change, and that is terrifying to our instinct to survive, even if means remaining squarely rooted in the (potentially uncomfortable) status quo.

In order to have, do, and achieve more than he ever had, without all the stress and strife, Robert had to create clarity about what he wanted to achieve, otherwise his brain would default to the path of least resistance: just keep working harder and hoping for different results.

With this commitment to step into more of his possibility, it was time for Robert to up-level his software system. After all, how could he expect to live a version 2.0 life on a version 1.0 mindset?

Ultimately, though, Mapping is about more than setting goals; it’s about defining the path from your current practice, income, and lifestyle, to those you want to achieve.

The following is a simplified version of the mapping process I used with Robert and in my coaching:

- Craft a Compelling Vision. The first step to creating a vision is to figure out what you really want to create for yourself. What does your ideal practice and life look like? Not only should you not be afraid of dreaming too big, but you should also push yourself to think bigger and bolder than ever before. If it has been done before (and it has), it can be done again. You’ve learned that the only limitations you have are the mindset-based ones you place on yourself, so the first step to experiencing greater success is defining what that success looks like to you.

- Make it measurable. The more clear, specific, and measurable your goals are, the more likely you are to achieve them. Beyond this, break down your strategic goals into those behaviors that help and hinder you, and then refocus, retrain, and reinforce the development of habits that support helpful behaviors and move away from the hindering ones, to empower you to experience greater success.

- Set success standards. If you want to elevate your success, you start by raising your standards. Having conducted extensive industry research on top-performing firms I know the power of benchmarking performance to give you a yardstick for measuring your own personal performance. But what matters more than any industry benchmark is that you establish your own personal standards for success. Start by translating your new version of success into personal success standards and business metrics that are meaningful to you, and that can be measured. This may include setting not only traditional financial goals for revenue, business value and income, but your definition of success can expand to include many other factors such as: client profiles, services, minimums and fees, client experience, team satisfaction, sellability & successability, as well as personal measures such health & well-being, quality of life, time off, and happiness quotient.

Knowing that over 95% of what we experience in life is based on our mindset, developing a mental map of the future and aligning your mindset with this map is a critical ingredient in achieving greater levels of success with greater ease.

Methods As Multipliers

Which brings us to the next element in becoming a Limitless Adviser: mastering your business Methods as a means to multiply your results.

“Methods” encapsulates how you run your practice day-to-day: the strategies you engage; your decision making process; the tools and techniques you use to address client services, sales and marketing, staff management, operations, investments, and financial planning; your analyses of capacity, performance and profitability; partnership and succession; and many other factors. All of these are essential to running an efficient, profitable, satisfying practice. And while best practices aren't the driver of success – Mindset is the key ingredient – best practices Methods are the high-octane fuel in the car that helps you reach your destination.

Methods can be distilled into 7 sub-categories, and overhauling key business practices and upgrading business methods in each area can help you to more closely align with the success you’re working to create.

Planning & Progress: The process by which you set strategic objectives, develop a tactical plan, manage execution, monitor performance and progress, and pivot to adjust based on what is learned along the way.

This is the “how” for making sure you have a clear vision and goals, and that your practice is managed to your goals.

With his vision and goals clearly set, Robert was ready to begin measuring and managing his progress. A review of his metrics revealed several key items that needed attention, giving Robert clarity on just where there was work to be done. To start, he wanted to grow his average revenue per client from $4,300 to $7,500 over the next 3 years, which meant that work on the firm’s Client Service Model, along with its branding and marketing, was in order. We put a quarterly business review process in place to help Robert measure and manage progress toward his goals.

Positions: The strategic decisions that define your business plan, such as products and services, pricing, financial models, team structure, Founder/Adviser focus, time off, and income.

Positions represents the “business blueprint”, and defines the key structural foundations necessary to achieve the success you envision and informs how your business is built.

With his Vision & Goals clearly in place, and a process for managing to those goals, Robert could now re-evaluate his business positions with clarity. He made some key decisions and settled on positions (aka “commitments”) across the business that would serve as “success standards” to keep him on track toward his goals.

Robert decided to discontinue services to smaller, unprofitable clients, offering them the option to choose a different service offering or transition to another adviser. He also decided to raise his planning fee to $8,000, as shared earlier.

Notably, decisions like these were for Robert – and usually are for most advisors – among the scariest that are made on the path to becoming a Limitless Adviser. After all, these are not just clients, they are relationships – and changing them often brings feelings of guilt and outright fear. Robert was initially resistant, until I asked him the following, “Do you spend as much time as you would like with your top clients?” “No, I don’t, I wish I had more time for that,” he quickly answered.

So I suggested to Robert the following thought experiment: Imagine that at your next Client Appreciation Event, you put a gold star on the name badges of your top clients. Then, sit one top client at each table, and let the remaining clients fill in around them. At the opening, when you stand to say thank you for being a client of this firm, instead say, “I’d like to thank you for being a client of this firm, but instead I’d like you to find the person at your table with a gold star and thank them, because their fees are underwriting your relationship with our firm.”

Upon hearing this Robert uttered a phrase I’ve heard thousands of times in my career, “Well, when you put it that way.…” The key point here is not merely to say “draw the profitability line and fire any client under it,” though. From a business perspective, that can feel harsh, considering these are the same clients that placed their trust in you. But Robert realized that the best way to serve the clients he wanted to serve was to make sure he had the time to show up for them in the first place.

Ultimately, Robert solves his Positioning problem, and the conflict between the business (not enough time/revenue) and the relationship (serve fairly), by simply giving his client options. We created three types of clients, set the segments, services and fees for each, and created a simple 1-page Service Summary to share with clients. We then drafted a script that Robert rehearsed, explaining that the ongoing planning relationships was where he could add the most value, and was focusing the practice on these more comprehensive and personal relationships. He shared that he would love to expand the way he served them, but would understand and not take it personally if they didn’t feel this option was right for them. And if that was the case, he would happily refer them to those same referral sources mentioned earlier.

To manage the transition, Robert also developed an 18-month transition timeline that presented this ‘option’ offer to a set number of clients each quarter. We modeled this assuming a 25% loss of clients related to the increase in fee, and a 50% loss of smaller clients who did not want to up-level. That hasn’t happened (and as noted earlier, it virtually never does!), but it did give Robert the comfort he needed to make this bold leap.

Most important, though, were that these changes positioned him to better serve all the stakeholders in the process: himself, his business, and his clients.

Packaging: The process by which you brand, message, and position your firm to your desired audience, with the goal of capturing attention and creating engagement and interest.

Packaging is “the stories” you tell about your value, your work, and the firm, and how those stories are delivered.

With the decision to up-level his client profile and focus on those he most enjoyed working with, it became clear to Robert he needed to upgrade his packaging. We began by creating a brand platform that defined key messaging, upgraded his website, and redesigned his prospect process, including a re-design of his first prospect meeting and presentation, adding a services summary that made it easy for prospects to decide what services they wanted, and developed a new script for quoting his fees that focused on the value he delivered instead of the fear he felt.

Promotion: Your marketing strategies and plans, together with your sales/client enrollment process.

Promotion represents the various “ways” you market your firm, increasingly important given the shift in sources of new business, and rapidly accelerating competitive changes in the marketplace.

Now clear on where he was going, who he did his best work with, and the message he wanted to share, Robert knew achieving his new definition of success would require that he more actively promote his services. But given his situation, time was still scarce.

So, we developed a simple, straight-forward marketing plan that applied new thinking around leverage, one of the 7 Mindsets of Success. We laid out a 12-month calendar, defined campaigns for brand/credibility, clients, COIs, and digital marketing. We recommended quarterly themes so that all marketing could leverage the same content and conversations, and developed a monthly playbook for what needed to be done each month.

People: the staffing and client services/team model that supports your work and the delivery of client services.

The “who” in how things get done in your practice, and a key ingredient to creating focus, leverage and freedom, even for those advisors who don’t want to hire staff.

Robert had 1.5 staff: a full-time assistant, and a part-time staffer to help keep up. He and his assistant were convinced they needed another full-time hire. Upon closer look, though, we realized Robert’s assistant was under-utilized, as she was not well-managed due to Robert’s busy schedule, wasn’t empowered, given Robert felt the need to touch everything, and was doing so much of everything she didn’t feel good at any of it. In short, she was really just a glorified receptionist and paperwork processor, spinning in the tornado that was Robert’s workday.

We re-defined the assistant role to focus exclusively on client services and operations, retained a virtual paraplanner to provide advisor support, and focused the part-time staffer on all general administrative duties. The role focus alone made a huge difference to how his team performed.

Robert also outsourced a virtual marketing manager 10 hours a week, so that his personal time could be spent actually marketing, not just managing the marketing. This work was pivotal to the next step in the process.

Process: the business systems that create the operational framework for key processes and workflows.

Process documents the “how,” as in “how your practice runs and delivers services to clients,” so that everyone is clear on what happens, when, how, and by whom so as to create a seamless, well-orchestrated process from onboarding to ongoing service.

With clarity around the service model, Robert and his team set to work creating the internal systems they needed to be more efficient and effective and to scale the business in a more leveraged way. They defined services by client segment, and then processes and checklists to define who would do what, when, and how. This gave Robert and his team total clarity on how Robert wanted things to run, and allowed him to let go in ways he’d been unable to before. It also made for a much happier and more productive team.

Platforms: the firms, tools and technology used to support business operations.

Platforms are the “foundations” that that serve and support your business model, such as what B/D or custodian you use (and what tools, resources, support they provide), as are your tech platforms (CRM, financial software, portfolio rebalancing, etc.) and the other vendor platforms on which your business runs.

Robert replaced his Excel spreadsheets with portfolio management software, upgraded his CRM, engaged training for the team to maximize productivity, and added calendaring software that would allow clients to schedule their own meetings and calls during set times. All but a few of his older clients now use it regularly, and it saved a huge amount of time for his team.

I always stress just how critical mindset is to your success, but learning to effectively manage your day-to-day business is the routine that paves the way to improved performance and personal prosperity.

As it turns out, most advisers are better advisers than business operators, and the net result is an industry of under-performing practices that – with the right mindset and methods – have the potential to be wildly successful businesses.

Magical, Mystical Momentum

The success or failure of every advisory firm is in part dependent on its supply of a magical, mystical fuel source: Momentum.

Our culture is cluttered with routine references to momentum: a company has “momentum going into earnings season,” and a sports team has “momentum going into the playoffs.” In such examples, it is commonly understood that the reference implies the harnessing of some power, of being propelled forward in some way.

Momentum is more than the speed of your daily life, though; it is the force and direction in which your energy is being focused, and the velocity of your progress toward goals.

Just as it is important as momentum is focusing it in the right direction. Which is why Momentum is the happy bedfellow of Mapping. If you are not pointed squarely in the direction of your dreams, then all your momentum is easily distracted into situations and directions that will produce more work, but not your desired results.

The ability to create new levels of success will rely heavily upon the daily energy and effort you apply in pursuit. In other words, your ability to achieve your goal will match your daily commitment to show up for it.

What is critical to note here is that how you choose to consistently show up will also be mirrored in your results. Which is why mastering your mindset, mapping your future, and maximizing your methods are essential ingredients in being limitless – your energy is applied as efforts to back up your work in these areas.

Minding your momentum really matters when it comes to making the most of the energy and effort you expend, to help you achieve success with greater effortlessness and ease.

Dr. Seuss, considered by many to be a genius of literature and life, summed this beautifully in his book, Oh the Places You’ll Go:

“You have brains in your head, you have feet in your shoes,

you can steer yourself any direction you choose.”

The challenge for most of us isn’t that we don’t want more, it’s that the tongue in our mouth and the tongue in our shoes aren’t moving in the same direction.

When you harness your momentum in the direction of your desires, you will transform the speed and ease with which you succeed.

Learning To Be A Limitless Advisor

I’ve had the pleasure of living these insights and sharing them with advisers like Robert who were ready for a better way. Robert has grown his revenue by 21% in a year, reduced his work week from 55 to 40 hours, and has more freedom than ever before. He’s already set his 2019 calendar, including all his client meeting blocks, conferences, 4-weeks of vacation, and “Family Fridays” (taking off every Friday in the Summer to spend with his family). Most important, Robert has made a major pivot and is just beginning on this new path.

Robert learned what Albert Einstein observed decades ago, that "No problem can be solved with the same consciousness that created it."

Knowing what I know is possible for you, my parting question to you is simply, “Why would you settle for anything less?”

(Michael’s Note: For advisors interested in more material from Stephanie, go to www.limitlessadviser.com, or check out her upcoming November 28 webinar here.)