Executive Summary

Welcome back to the 120th episode of Financial Advisor Success Podcast!

Welcome back to the 120th episode of Financial Advisor Success Podcast!

My guest on today's podcast is Manisha Thakor. Manisha is the founder of MoneyZen, a financial literacy and education platform focused on empowering women, and is also the VP of Financial Wellbeing at Brighton Jones, a $5 billion AUM independent RIA based in Seattle, Washington.

What's unique about Manisha, though, is the way that she's been able to build her own personal brand platform around personal finance over the past 10 years after starting her career in institutional money management, and the ways that she's been able to turn her brand around personal finance education into a financially successful business.

In this episode, we talk in depth about what it really takes to build a personal finance brand. Why most financial advisors struggle to gain visibility with the media, and even when they do still typically fail to get any new clients from it, the ways that a personal finance brand can be monetized, not only from getting clients directly, but also even becoming a corporate spokesperson or brand ambassador, and the way that Manisha has been able to successfully build a personal brand as a speaker and media personality despite the fact that she's actually an introvert.

We also talk about Manisha's fascinating personal career journey, from her early success being an intrapreneur, building out a new separately managed account line of business at an institutional money management firm that ultimately grew to nearly $6 billion under management, to a decision to relocate with her new husband that forced her to make a switch out of the firm and launch her personal finance brand instead, how marital troubles and a subsequent divorce eventually led Manisha back to working at a larger advisory firm to get better infrastructure support, and why ultimately Manisha decided to make one more switch to her current firm, Brighton Jones, to once again become an intrapreneur and help them transition their advisory firm from traditional wealth management to a focus on holistic financial well-being.

And be certain to listen to the end, where Manisha shares how she managed the ups and downs of her advisory firm while going through a stressful divorce. Her frank discussion about dealing with depression, anxiety, and now medicated bipolar disorder, and how through it all she's managed to stay successful by forming relationships and connections around her that she can rely upon, and by simply relying on the power of being yourself. Because, as Manisha puts it, it's so much less exhausting to just be your authentic self than to try to be someone you're not anyways.

So whether you're interested in learnings about the steps Manisha took to build a personal finance brand, how she, as an introvert, was able to find her groove as a presenter and public speaker, or how she paved her own path by simply being herself along the way, then we how you enjoy this episode of the Financial Advisor Success Podcast.

What You’ll Learn In This Podcast Episode

- What she wishes she had known earlier. [06:24]

- The strengths that come with being an introvert. [13:03]

- Manisha’s unique career path. [14:35]

- What made Manisha decide to write a book on financial literacy for women. [36:15]

- How she built and monetized her personal finance brand. [45:46]

- What led to her creation of MoneyZen. [53:03]

- What Manisha thinks led to her success. [1:04:45]

- What surprised Manisha the most about dealing with individual clients. [1:09:35]

- How she managed the ups and downs of her advisory firm while going through a stressful divorce. [1:11:30]

- The difference between being an intrapreneur and being an entrepreneur. [1:14:25]

- What her typical week looks like. [1:27:42]

- How she built her confidence within the industry. [1:30:52]

- Her struggle with depression, anxiety, and bipolar disorder. [1:36:20]

- How she defines success. [1:39:53]

Resources Featured In This Episode:

- Manisha Thakor

- MoneyZen

- Brighton Jones

- Quiet: The Power Of Introverts, by Susan Cain

- On My Own Two Feet: A Modern Girl's Guide To Personal Finance, by Manisha Thakor

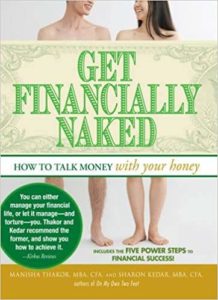

- Get Financially Naked: How To Talk Money With Your Honey, by Manisha Thakor

- BAM Alliance

- True WELLth Podcast

Full Transcript:

Michael: Welcome, Manisha Thakor, to the "Financial Advisor Success" podcast.

Manisha: Michael, I feel like I'm on the RIA version of Oprah. So thank you for having me.

Michael: The RIA version of Oprah. I like that. So welcome to the couch. Let's talk. You know, I'm excited for the episode here because you have, I think, taken a path in the industry that very few have, where, you know, like, I don't know how else to put it. You carry this message that you want to get out of the world or get out to the world and have just built your own platform to share your message around, you know, women's empowerment and financial education literacy for women, and then have figured it out over the years, like, you've built a business around this. I know at one point you had an advisory firm around this, now you're tied into an advisory firm after you switched from another advisory firm and have what I think is a fascinating and very non-traditional, I guess, both current role and career path in the industry.

And so, you know, I know for a lot of advisors, just, their goal is, "I want to serve clients well. I want to get a base of my own clients and do that and get paid well for the work that I do. And maybe someday I'll be a partner in the firm." And like, and that's their vision. And more power to them. But I know there is a subset out there that I think are closer to you. That, like, there's this message inside them, this thing that they've seen, this, like, secret that they understand about the world that they wish more of the world understood so that they can have a, you know, better finance or better relationship with their money or be more empowered. And they want to figure out how to do more of that and can't because our traditional industry is really not built for people that have done cool but different things like you. And so I'm just, I'm looking forward to this discussion today of like, how do you craft these positions for yourself? How do you make these platforms for yourself and just find a business and a role and a way to get paid to share your message with the world?

Manisha: I'm laughing internally as you said, "How do you craft?" Because the answer to that is you do not craft. It's one of those things where if I had told myself this is...you know, how many years ago it was, 20-plus years ago when I got out of Harvard Business School, if I had said to myself like, "This is the career path I'm going to have," I would have laughed. It was so different than what I had originally expected. And so much of it was serendipitous. So much of it was my faceplanting. And then the person who kindly offered me a hand up took me in a whole new direction. And I know it sounds cliché to say you make your own luck or there was a lot of luck involved, but I'm just going to say there was a lot of faceplanting involved.

Michael: Excellent. And luckily a nearby hand to help you up after faceplanting.

What She Wishes She Had Known Earlier [06:24]

Manisha: Many, many kind hands. And I have to say if there's one big thing I would say that I have learned about creating something is, you don't do anything alone. Nothing meaningful happens alone. It happens through honest, authentic connections with others and being curious. And that leads you from one open door to another door that may open. And yeah, I think the thing I wish I had known 25 years ago was just how important true human relations are to crafting a career, whether by design or by default or by faceplant.

Michael: I love that. I love that framing of just how important, as you put, like, true human relations are. For me, I've felt a similar path forward. And, you know, obviously, I have kind of a similar dynamic myself having crafted this role over time where one foot is in an advisory firm and one foot is external. Mine is a little bit more industry-facing these days, yours is a little bit more consumer-facing, but that same kind of split.

And I've certainly had the same, I don't know, phenomenon or realization looking back, if you had asked me even just 10 years ago as I was taking one step out from being all in in the advisory firm as I had been previously, like, I never would have painted it to be this, to be what it turned out to be. I had to find that over time. A bunch of it was serendipity and luck. Some of it was faceplanting. Some of it was just at least being ready to open the door when opportunity knocked. I've kind of grown an appreciation for that saying having experienced it a few times.

And recognizing that a huge portion, a huge portion of the success I've had over the past 10 years came from all these relationships I built in the first 10 years of my career, which for me was mostly, like, getting involved in membership associations. I was active with Financial Planning Association, FPA, I co-founded NexGen. I got really immersed in the NexGen community. And, like, all these friendships and relationships I formed in my 20s then, like, became my business partners in my 30s and now I'm finding are, like, people I can do even more interesting business and opportunities with as I'm now in my 40s because I'm at a further position along in my career and they're at further positions along their career. But we have all these relationships that go back 15-plus years because we just connected with other people in the industry and, like, lo and behold, that networking stuff, if that's what you want to call it, sometimes it takes 10 or 15 years to matter, but boy, it really does end out mattering in the long run.

Manisha: And did you...like, did somebody tell you that's what you needed to do or did you just organically develop those relationships? I'm always fascinated by people who have as deep a set of, I hate the word "network" because it sounds so manipulative, but you have a lot of people who have your back. So did you plan that?

Michael: No. No, not at all. At least for me, I'm an introvert and actually a pretty strong introvert. So not only am I really not a fan of thinking of it like literally as networking, but you say networking meeting and I'm immediately trying to figure out in my head what my appropriate excuse will be to get out of a networking meeting, because that sounds absolutely horrible to me. I would much rather be in, like, quiet dark corner maybe talking to one person than circulating in a networking meeting.

You know for me at least, the only... what got it started was the senior partner at the firm where I was that said, "We are a firm that supports the Financial Planning Association, that means our team supports the Financial Planning Association, so let me know which committee you're going to be joining next year." And that's just the way it was. That was the culture of the firm, was...and I don't think they even did it for networking purposes. I think for us, it was actually much more of just, "This is a profession that's been good to our firm, so we are going to be good to the profession and give back." And we had a firm that just had been involved with local chapter leadership for, even at the time, 10-plus years. Now, we've had someone on the local board virtually every year for 30 years.

And that was just the culture and I was sucked into it because there was no other choice. So I found my own path, which was actually much more, you know, volunteering on committees and getting involved in small groups, because giant networking chapter meetings were intimidating as an introvert. But that probably, in retrospect, ended out forming even more deep relationships because when you volunteer and get engaged, you really spend more time with people. And, you know, you just do that repeated over time and it turns out you get to know a whole lot of people.

Manisha: I asked you that because we sat next to each other at, oh gosh, I think it's like five years ago now, at a dinner, and I think I was still at BAM. I can't remember if I had moved over.

Michael: It was a dinner at Buckingham. It was, I think, one of their conferences. And I remember we were at a table. Dan Solin was at the table with us.

Manisha: Yes. Yes.

Michael: And just talking about the industry and meeting people we'd never met before.

Manisha: Well, and I remember you and I both mentioning to each other that we were introverts. And I think a lot of people would find that surprising because neither of us had problems getting on a stage and talking to people or doing things like we're doing now.

Michael: It was funny to me, like, we were the quiet persons' table. Because, like, Dan is also a very openly self-professed introvert that does not like these networking meetings as well. Like, I sat down next to him and the conversation for the first five minutes was all these jokes back and forth of the ideas that we had been tossing around about how we were going to try to bow out of the dinner because none of us wanted to go to the dinner meeting and have to network. But we decided like, you know, he was there because he was involved with Buckingham and BAM at the time, as I know you were. I was there as a speaker, so we all decided propriety meant we should probably show up at the dinner. But, like, we all sat at the introverts' quiet kids table. I don't think we meant to, but we managed to find each other. It was probably the table furthest from the loud music that was gravitating out.

The Strengths That Come With Being An Introvert [13:03]

Manisha: Actually, it was. It was a corner table. And Dan and I laugh. We always find ourselves in a corner table. I bring it up because a lot of people think in order to have a successful career you need to be an extrovert. And if people haven't read Susan Cain's book "Quiet," it's so powerful. I had always thought being an introvert was a weakness, especially on the institutional. You know, the first 15 years of my career when I was on the institutional side, I've got lots of stories about how I struggled with introversion and while I was trying to build out a $6 billion business for my employer. But I have come to find that it actually is almost a plus that you connect with people more deeply one on one because the big group thing, just being at that superficial layer, like, I can't make small talk. Like, I just go right to the heart of it. So, you know, I feel like both personality types can succeed. And for the first 15 years, I thought that I was going to have to carry the ball and chain of introversion with me. And now I see it as a plus.

Michael: So was there a particular thing for you that, like, pushed you into this direction? Like, "Oh geez, I guess I have to go to some meetings and form relationships with other people." Was there something that nudged you over the line or some realization? Right? Because otherwise, as introverts, I think we'll just default to avoiding those forever as much as we can.

Manisha’s Unique Career Path [14:35]

Manisha: Yeah. So when I got out of business school, I started off in the world of institutional money management where we managed money for corporations, endowments, foundations. And our clients were CFOs or investment committees. And I started off deliberately as an equity research analyst. I had a really strong bent towards Warren Buffet-style of investing. And Warren wasn't hiring, but there's a very under-the-radar but exceptionally successful self-made billionaire who also went to HBS, and his name is Fayez Sarofim. And he recruits, the firm recruits at HBS and University of Texas. He's based in Houston. And who knows? He's probably worth $3 billion, $4 billion-plus, even more at this point. But he invests using the same strategy as a very similar high-quality, low turnover growth strategy. And so I went to work for him. And my goal was to be an analyst forever because I could then build models and stay in my 10-Ks and my 10-Qs and...

Michael: And your safe four walls.

Manisha: Yes, exactly. And in the early days, I used to always have my door shut and I'd be in there and then I'd come out with my, you know, stock recommendation. And one thing led to another and I was following the...one of the different industries. I followed retailers and then I also followed asset managers and security brokers. And I noticed at the time there was this thing called separately managed accounts and that we only were managing money for large institutions. And I felt so strongly in the quality of the way we were investing. We were on the active side, but, like, just over, you know, I would put it like 1 inch further than DFA. You know, not indexing but...not DFA but...

Michael: Right. So, like, Warren Buffett active, not day trader active.

Manisha: Exactly. And I just felt so strongly that individual people should have access to this as well. And this is before I learned...I had no idea what suitability was or fiduciary was. I knew nothing about that. But I knew that these major wirehouses were offering separately managed accounts and we could get hired by those large firms and they would take care of the bulk of the details of dealing with...well, they'd take care of all of the interaction with the end clients. And a huge portion of the operational details, though not all of them, of managing the accounts. But essentially to us, it would look more or less like one big account.

And because I was an analyst following the industry and I saw the opportunity, I had mentioned this to Mr. Sarofim, and he was an entrepreneur, so he said, "Well, let's give it a shot." And I did and it basically made my career. I started to build this business out. One of the things that I had to do was actually go tell people about it. And I can remember my very first...and when I say tell people about it I mean once we had all the infrastructure in place, at this point I was now a portfolio manager and I needed to go out and tell the clients of Morgan Stanley or the clients of Merrill Lynch, as it was at the time, about our investment strategy, about our firm and why they might want to consider us as one of the firms to select in their separately managed account. Or alternatively, I talked to teams of advisors about why they should do this. So I talked to advisors and I talked to the end clients.

So long story short, I can still clearly remember my first time speaking about this. It was at a steakhouse way out in, like, the burbs part of Houston. And it was hosted by a wholesaler from Dreyfus named Marla Press who's been a dear friend of mine ever since. And there are, I don't know, 12 people, 14 people at this table and I dry-heave the entire way from the office to the steakhouse. Like, the whole way. Thank God I didn't hit anyone. And it was like a 30-minute drive. That's a lot of dry-heaving.

Michael: Yes. That's a lot of time to sit in your car and build up even more tension and anxiety about the fact that when you get to where you're driving, you have to give a speech in front of other people.

Manisha: Oh, it was...I just remember it so clearly. But I was terrified. But once I started talking and once I got past the small talk part and I got talking about the philosophy, which I so believed in, I discovered suddenly I actually had a gift for the gab as long as I was talking about something that I felt passionate about and not making small talk.

Anyways, fast forward, by the time, I guess I had been at the firm over a decade, by the end, I was often doing six presentations a day. I mean, I was living out of my roller bag, traveling all over the country building this thing up. And while I was the portfolio manager, I also was the face of it. And I, just through sheer repetition, honed really strong speaking skills. But it was not pretty in the first year or 18 months of listening to me.

Michael: So two things that come to mind just hearing this. The first is this point that you make that the small talk is terrifying, at least for most of us as introverts, but then get me on a topic that I'm knowledgeable about and passionate about and all of a sudden a lot of these challenges and fears melt away. I mean, it's certainly been the same experience for me, right? How do I end out in a world where a big portion of my business is public speaking in front of giant audiences as an introvert when I'm normally terrified to be out in front of, well, giant offices or even a room full of networking colleagues? Once you get some topic that you're passionate about and confident about it, it's kind of fascinating how some of that fear starts to melt away.

And I was struck, you mentioned earlier Susan Cain's book on introverts. And, truly, for anyone out there who's listening who either, you know, is an introvert or frankly just would like to better understand the introverts in your life, a friend, a colleague, an employee, a spouse, whoever it is, it's a fantastic and very well-researched book.

And one of the points that Susan Cain actually makes in the book is that this is a well-documented phenomenon, that there's at least a subset of introverts that turn out to be remarkably active public speakers because as long as they can get into a topic that they're passionate and knowledgeable about, suddenly, most of this fear disappears. I won't say it all disappears because at least for me there's still that moment right before you're about to go on stage going like, "Oh my God, I hope I don't screw this up and, like, the slides don't break and there's not a heckler in the audience." Like, all these things that you still have as a fear every time you're about to go up on stage. But then you get three minutes in and nothing has blown up and it's like, "Okay, I'm going to find my groove now." And then it's fine. But this idea that there actually is this strange comfort zone for introverts in public speaking as long as you get something that you're passionate and confident and be knowing in the first place and then suddenly it works out amazingly oddly well.

Manisha: Yeah. And not to belabor the point, but in the decade that I was building out this separately managed account business, in order to do this as an institutional asset management firm, typically, institutional asset management firms have equity analysts, portfolio managers, and client relation executives. And the roles are sort of blended together. And oftentimes by the time you rise up, you're doing a bit of all three.

Oh, and as a result, we tend not to have, most of these firms tend not to have a sales force. So we had teamed up with the Dreyfus Corporation. They have a whole bunch of mutual funds that they offer on their own and then they also sub-advised for firms that were trying to do what we were trying to do with the separately managed account. So they had a team of 50 wholesalers. And so I would travel to all of these 50 different...you know, I traveled to all the states with the wholesalers. And they all knew, if there's an evening event, like, Manisha stays in the corner and is not to be talked to during the cocktail intro section. And the minute the dinner is over, she is in the car and gone. And I mean, it was like legendary. Like, people would laugh at my, you know, complete inability to handle anything other than the meat of the conversation.

And the reason I just go over and over this is I feel like, especially in the financial services industry and on the RIA side where there's so many natural extroverts, that I want to give introverts who might be listening just this knowledge that they're not alone.

Michael: The other thing I want to ask about is, you sort of glossed over lightly this, like, "I was a junior analyst and I went to a billionaire and said, 'Hey, can I make this business line?' And he said, 'Sure, go for it.'" How exactly does that happen?

Manisha: First of all, I was terrified to go talk to him. And he, I've now come to call him Papa. He's the kindest, most brilliant, amazing person, but he's a man of very few words. And back in the day, he's in his 80s now, but back in the day when he was, like, a real...one of the powerhouse investment figures in the state of Texas, "Barron's" called him the Sphinx because he originally was from Egypt and also because he just was so...what's the right word that I want to use? If he spoke in a conversation with you, 30 words, that was a big conversation. And those 30 words were spot on. Like, unbelievably insightful.

So anyway, I say I want to do this and he's an entrepreneur, so he says, "Sure, go figure it out." Well, he didn't actually come out and say this, the implication was, "And you have no resources, so you need to go do this all by yourself. And when you have something to show me, come back." So, you know, the first 18 months it wasn't like somebody handed me the keys and I had this team. I mean, I was working seven days a week for, you know, a very long time. Well, beyond the first 18 months. But the first 18 months it was, like, me and my assistant and we're just trying to figure this whole thing out. And I think that's one part a lot of people don't recognize or honor enough is what it looks like when you're starting anything. Even when you're starting something within a corporation that has lots of resources, it's rare that somebody lets you, especially when you're young, start off by accessing those resources.

Michael: And so you made your case, he at least gave you enough rope to hang yourself with or something to that effect, and you just started trying to figure it out because you really wanted to do it? Like, just, it was a personal drive thing?

Manisha: No, it was more of...like, I've heard people say like, "You need to do the thing that you can't not do." And that was my first experience with that. It's not that I was, like, wanting to do it, it was that I couldn't not do it. And I can't explain why.

Michael: Okay, you need to do the thing you can't not do. Just accept it and go do it.

Manisha: Yes. And usually, those things are stuff, again, coming back to this theme of terror, which I think will come up several times during our conversation, I went out of business school specifically into the role of an equity analyst because I did not want to manage people. I did not want to have to deal with a wide set of ever-changing decisions. I wanted to become an expert at one thing and do it over and over and over again. And all I can say is something must have happened through my analysis because at this point, I'm analyzing as potential investments all of the publicly traded asset management companies and securities brokerage houses. So everyone from T. Rowe Price to, you know, Citi with its...well, now Smith Barney.

And so I think there's just something in my gut that felt like I needed to do it. And in retrospect, you know, I'd like to think it was something truly noble. Like, I could see all of these individuals out there invested in funds that are having 150% turnover and generating unwanted tax consequences. And they need to be with us and our 10% turnover and our higher quality companies. But it wasn't that... you look back and you think, "Why did I do it?" I hope that was running through my head, but all I knew was I started doing it and then I wanted to do it more, then I wanted to do it more. It was like a Sudoku and I just couldn't stop till I could finish it.

Michael: So you're obviously not still there. So does that mean at some point you finished it, as you put it? Like, it ran its natural course? You know, how did you get from building this business line, being there? And I know, like, you got it to, as I understand, many billions of dollars by the end of this SMA platform, so had an incredible, successful run. But you're not there now. So what happened? What changed?

Manisha: When I left, I think it was at $5.8 billion. And, I mean, literally, I can remember, we started with zero. And, I mean, I can remember when we hit our first $100 million, like, whooping and hollering. And then as we started, you know, to move up to $500 million and then $1 billion and then $2 billion and then $3 billion, like, you know, we'd have, like, all firm cheers as this...you know, every time we'd hit...cross over another $1 billion. And I genuinely thought I would be doing this just forever. And at this point, I was in my mid-30s. And I'm of Indian heritage. So if you're a woman in your mid-30s and you are not married, you are, like, milk past its sell-by date. And I just, I don't know, because I'm an introvert, I went to a women's college. I went to Wellesley College for undergrad. I just never dated very much. And I just thought, "Well, I guess I'm going to be married to my work."

And then serendipity popped in. I had done well. I decided to buy a loft. And I did. And two doors down from me was the man who ended up becoming my husband. And he was 20 years older than me and an intellectual property trial lawyer. Had been his whole career in Texas and done very well. And so he was, you know, in his mid-50s and thinking about...starting to think about retirement. And he ultimately decided he wanted to retire, and his dream had always been to retire to Santa Fe.

And back then the idea of working remotely was just... now we don't think anything of it, but it was just almost inconceivable in the financial services world to work remotely. So I got married because, in the Indian culture, you need to have your elders' blessing. In addition to my parents, I had Mr. Sarofim. He brought my husband over to his home and he met him. And he came by and told me I had done well and I had his full support. And he was really happy for me. But working from Santa Fe was just not...at that time just not an option. And so that's why I moved on for marriage.

Michael: And so where did you land? I mean, I guess in Santa Fe, but where did you land as you built this huge SMA platform and then had to leave it for marriage? Or I guess not had to, like, chose to leave it for marriage.

Manisha: So thus begins my very weird trajectory through the retail world. So at that point, I had been working for 15 years on the institutional side. And towards the end, one of my dear friends from business school, Sharon Kedar and I had noticed... Sharon has an identical twin sister who went to Harvard Medical School, so how happy are her parents, right?

Michael: So one went to Harvard Business and one went to Harvard Medical.

Manisha: Yeah.

Michael: Fantastic.

Manisha: Just a little brain power in that family.

Michael: The twins are doing well. Good.

What Made Manisha Decide To Write A Book On Financial Literacy For Women [36:15]

Manisha: So what we came to realize was not only were our super-smart girlfriends from business school who went into strategy or operations or other areas of business that were not directly related to the financial functions of the firms they were working for and then our smart friends who were doctors and lawyers and architects and graphic designers, they all started asking us these really basic questions about personal finance. And we would recommend, you know, books that we liked and they'd be like, "Okay, I can't get past chapter two. This is so boring."

So we thought, "Well, what the heck? Let's write, like, the summer chicklet beach read version of the basics that a woman should know in her 20s and her early 30s. Because we knew, if we can get you in your 20s and early 30s, we can change your life. Certainly, we can help you later, but it's way easier if we can get you started right out of the gate. And so we wrote this basic, basic primer for women in their 20s and 30s called "On My Own Two Feet: A Modern Girl's Guide to Personal Finance." And it still exists. We did a second edition in 2013. I think we need to update it again and do a third edition. And it sold over 40,000 or 50,000 copies over that time period. Slowly. I mean, this is like, you know, it was never a bestseller, it was like a creeper. But it's the evergreen nature of the desire for women to have this information in a very straightforward manner that we noticed. And then we wrote a follow-up book called "Get Financially Naked: How to Talk Money with Your Honey."

And while I was still in the institutional world, we had done these and they were like...you know, back then the word "side gig" didn't exist, but if it had, this would have been our side gig. It was just something we did for fun on the weekends. I loved writing, Sharon is a big strategic thinker.

Michael: So, like, this wasn't a whole, you know, book project, pitch a publisher or get a contract to go make a book. You were just writing/venting things you thought other women should know about their personal finances in their 20s and 30s and your friend helped you make it into a book.

Manisha: So we had the idea, but then, you know, being triple Type A people, we did go and get a literary agent and they sought out a publisher. But it wasn't like we were trying to write...it wasn't like we were doing this to create careers as authors. Because again, this is before self-publishing. If you have a book, that's how you get it out there. So yeah, we did have a publisher, Adams Business, which has since been acquired by Simon & Schuster, and our literary agents are Waterstones Productions out of Southern California. And they've all been wonderful to us. But the bigger driver behind that was just sharing this information so we didn't have to keep repeating it. We could be like, "Here's the book." And then we also really wanted, and this is where it first started bubbling up for me, to help younger women. And so we didn't want the book to come out in hardcover even though we would have made more money if it had, because we wanted it to be $12 or less so people would actually buy the thing.

And so long story short, those books happened while I was still on the institutional side. But it was a true labor of love, you know. And some people cook and some people, you know, knit, and we wrote books on personal finance, you know. But the thing was we both were in a position because of the nature of our work. We both worked for institutional asset management firms. And the pay structure in that world is dramatically different than on the retail side. And so it was like nothing for us to hire a top publicist to get the word out, so we did. And we hired the publicist because we genuinely wanted to spread the word to 20 and 30-somethings that if you do a few basic things, we can change your financial life forever. But what happened is we started doing this...the PR person got going, and it turned out I love doing media and was a natural at it, and so, of the two of us, I just kept doing more and more and more.

And so by the time I left and we had built our home in Santa Fe and I tried retiring for about four months and that was an abysmal disaster, I thought, "Well what can I do?" And I thought, "Well, there's all these media around the books, and there's Suze Orman, why don't I try and be like her?" So I then entered, I call it my Suze Orman light phase, where for three years I literally tried to figure out how to build a career being a financial, I don't like the word "guru," but...

Michael: Thought leader? Is that better?

Manisha: Well, I was going to say...a thought leader is what I hope I morphed into. In the media world, I wanted to have a financial media presence in a unique way that would make an impact likely on TV and/or radio. Podcasts weren't a thing back then.

Michael: So when was this just timing-wise?

Manisha: You know, it's so funny Michael. As you look back you try and think, "When was this?" So it would have been right during the financial crisis because I had perfect timing on that. So 2009. Yeah, 2008, 2009, right at the end of one, beginning of the other.

Michael: So I'm just trying to sort of understand the context. So, you know, you had this amazing stint in the institutional world; did very well for yourself. I know it tends to pay relatively well in the first place. Probably a lot better when you actually build an entire nearly $6 billion SMA blind for the firm. You know, you make a transition to Santa Fe, getting married to a husband who's at least semi-retiring. You tried semi-retirement, got bored really quickly, as do most of our clients, and I guess came back into this with...like, was there a lot more vision to it beyond just, "Hey, Suze Orman seems to do this and it works out well, I'm going to try that too since the media is already calling?" Like, is that about what it came down to? Was there a grand vision of, like, where you were going with it?

Manisha: Yes and no. Thankfully, I had done well enough on the institutional side. And I'm just going to diverge for a brief second talk about prenups, which I feel very strongly about. And only 3% of prenups as I...the last data I saw are initiated by women. When I married my husband, I was his second wife and he had two adult children, and I didn't want...I had done very well, so I didn't want them, and he'd done very well, but I didn't want them to think I was a gold digger. And so I asked that we have a prenup that he could show the kids that we have only one joint asset, and it's a house we built in Santa Fe. Other than that, each of us have our own set of assets. There's nothing I'm going to be taking away from his family. And I was really glad that we did that for a variety of different reasons. But as a result, like, I'm sitting there and I'm looking at the funds that I have and I realize I can literally do anything that I want. And not because it's, like, a super huge number, but I'm a super frugal person. So the number worked with my frugality.

There's a certain style that a lot of people are attracted to with Suze Orman, and I realized that there are a number of people that are not attracted by that style. And so I wanted to bring to the media world another kind of option and personality for learning about that. I will say that my passion for helping women become economically empowered has...it's been a long-running theme throughout my life, and I owe...my mom and my dad are the ones that instilled that in me at a very young age. So that was the altruistic part.

But then there's the ego part. And when you first start doing media, there's, like, this head rush. And when I first started doing it, it was back in the day when everybody watched CNBC. And so, I'd go on CNBC and literally, my, because back then we all used BlackBerrys, my BlackBerry would blow up, and people would be... all over the country, people that I had met as I am, you know, visiting all of these different offices in the 50 states while I'm building this business, I'd get emails like, "Oh my God, I just saw you. I just saw you." And, you know, I'd like to say when I was doing that that it was all about sharing the information, but when you're on TV for three minutes, you're not sharing information. When you're a woman, you are actually in the hair and makeup chair typically 10 times as long as you are actually on air. And I'm not joking.

Michael: So, like, for every 3 minutes spot is 30 minutes of hair and makeup.

Manisha: Yes. Yes. It's crazy. But it was an ego rush. And when I look back at that period now, I'm very clear that I was driven 20% by altruism and 80% by just sheer ego. Because in the institutional world, and especially at Fayez Sarofim where I worked, we were very much taught to stay beneath the radar and be quiet and let the work speak for itself. But it's a very genteel sort of world where self-branding, like, that just doesn't fly. So I didn't have any of that before, and then this came and it was like, "Whoa." It was like the media version of like cocaine or something. You know, it's like, "I want more."

Michael: It feels good. I want more.

Manisha: Yeah. And that's a dangerous slope to go on. We can talk more about that if you'd like. I can't say I'm proud of that period. I'm just saying that honestly, I wish I could tell you it was 100% altruism, but it was at least 80% ego.

Michael: So I actually do want to come back to that in a minute. But, like, you did actually start building this, you know, self-brand, this media brand along the way. You know, now the platform is called MoneyZen. And I don't know if you were calling it that out of the gate. Like, can you talk to us a little bit more of how MoneyZen came out? Like, I guess maybe you can tell us how you turned an ego rush into an actual brand? Because that's still a really cool evolution to be able to get it there. You know, certainly, we know or can think over the years of a zillion different people who get into the media, have their proverbial 15 seconds of fame and then vanish. But you have sustained this into much more of a platform and a business. So how did that come about or how did you figure that out? What was the evolution from, "Hey, this media stuff is just fun because it feels really good and what an ego rush," to building a business?

Manisha: So I think it was two things. First, I have a gift for making complex things simple, mostly because I need them to be simple to understand them myself. And so what I found happening was that the media just kept reaching out and then kept referring me to other people because I was such a different voice. And, you know, I'm 48 now, and by the grace of God, when I was younger, I always looked...through the bulk of my institutional career, I looked like I was 12. And I hated that. You know, this was back in the day, so people were literally ready to give me their coffee orders when I would walk in the room and then I could see the shock when they realized I was the speaker. Now that I'm, you know, within a stone's throw of AARP eligibility, I'm glad that I look a lot younger than my years so far, knock on wood.

But as a result of being able to explain things simply and looking younger than I did, I seemed like a fresh new face, and so I was a bit of a dancing monkey. And so that picked up on the media side. And then you have a business head, it just kicks in. And I started to realize, "Wow, there are a lot of different things I can do. I could be a corporate spokesperson." And so I teamed up with a number of wonderful organizations over the years. The longest standing one was TIAA-CREF, now just called TIAA. And, I mean, they're a phenomenal organization, and they help the medical and educational communities. And I loved the work that I did with them, which was a lot of public speaking to their clients.

How She Built And Monetized Her Personal Finance Brand [45:46]

Michael: I'm curious because this whole realm of, what does it look like to be, I guess I don't even know what you call it, a corporate media spokesperson or a corporate ambassador. Because you weren't their spokesperson, I mean, they're their own corporation, you're attaching your media brand to it. How does that work? Because we don't get that in advisor world. How does that work?

Manisha: No. Yeah. So it's an interesting subworld. A lot of corporations like to team up with personalities. Today the hip word for that would be "influencers," but back then, they would call you either a corporate spokesperson or a brand ambassador. And the idea was that you would be sharing your knowledge in one of two ways, and sometimes you would do both and sometimes one or the other. One would be speaking directly to their customer base as a fresh voice to explain the things that they're doing. The other would be when they're doing media message...when they want to get out a media message about an initiative or something that they're doing, they will do a press release where they hire an expert that is able to talk about a wide range of topics that also has the ability to work in the messaging about that initiative. And it's all straightforward. Like when they're pitching to the media, they let them know, "This is a corporate spokesperson, these are the different topics she could speak to, but she's also going to make a plug for what we're doing."

Michael: And so the idea is not just that you can speak well to talk about their issues per se, because they can also just hire their own employee to do that, the point in part is you are your own brand entity, I guess to use the modern term, as you said, you're your own influencer with your own audience as well, that's why they want you to do it because you bring third-party credibility as this separate personality brand, but you'll carry their message, and that's what makes it work for them.

Manisha: Precisely. And in the early days, your brand came from being on TV and from print mentions. Today, that influence is driven by your social media presence. But back then I did a lot of TV and print media, and therefore I filled those boxes. And that's the model.

And the model still exists today, it's just shifted more towards social media influencers. But it's like a whole sub-business, just like there are headhunters for jobs and there are talent agents for actors. There are agencies that do nothing but look for brand ambassadors and corporate spokespeople for various different campaigns. And sometimes it's as short as a satellite media tour, where you are just doing a series. Like, you'll sit in a room, literally, for an entire 12, 14-hour day, and from coast to coast you'll do all the morning shows, afternoon shows, evening shows. And you do TV and radio. And you're usually hooking into a specific message for the company. And those would be like a one-off engagement. And then sometimes you'll work with a company for 4, 6, 12 months or, you know, multiple years doing this work. And so, that's the first way I monetized what I was doing.

Michael: And, you know, not that you have to give, like, exact details of particular companies, but can you just give us some context? Like, how do you get paid or what does this pay? Like, is this, you know, you get $1,000 for the day just to do all these media appearances and a marathon or is this like, you know, "Your brand is fantastic, we'll give you $50,000 just to do all of these media brand interviews for the day and talk about our big announcement?" And, you know, you only have to do a couple a year to make your dollars. Like, how does this work financially?

Manisha: So like everything, it's negotiable, and it depends on how big a name you are. I can't see Michelle Obama being a corporate spokesperson, but if she were, like, there would be, like, many more zeros after what she was paid.

Michael: Right. Like, just sheer brand visibility still is a driver here. I understand.

Manisha: Right. So I was certainly not at the Olympian level of doing this kind of work. But it actually is quite lucrative if you are skilled at bringing in the company's messaging in an authentic way so it doesn't seem slimy, it seems straightforward. And that's a rare gift. So they pay well for it. And so most, I would say a fairly common way to price is either a day rate or a project fee. And the project fee essentially backs into how many days of work are you going to have to do for this? And most people start off with a day rate of $5,000. And I peaked at $12,000. And I would say $15,000 is sort of the upper end if you're not super huge. If you're super huge, like, whoa, the sky is the limit. But it's a fairly darn lucrative...

Michael: Interesting. So that's actually not dissimilar to the speaking world as well, where, you know, lots of people in like National Speakers Association hit the speaking circuit and, you know, for a day of their expertise, it's $5,000, $10,000, $15,000. Most people tend to top out there unless you're, again, like, one of these uber-media stars, uber-popular folks and then, you know, the sky is the limit in speaking, as I guess it is in spokesperson brand ambassador roles. But that's interesting how paralleling that actually is. I never really thought of, like, you know, the National Speakers Association and brand ambassadors in, like, similar business models. But I guess it really is.

Manisha: Well, and then serendipitously, I met a woman who's now...has been a dear friend, but she was very active in NSA. So I hadn't thought about keynote speaking, but she was like, "You totally should be doing that." So then the next part of my business model was I joined NSA and I started doing keynote speaking. And so, you know, then you get in with some bureaus and one thing happens to another. So my monetization model in my Suze Orman light period was corporate spokesperson revenues and keynote speaking predominantly.

Michael: So, like, that was in addition to doing brand ambassador work or is the idea like, "I want to move away from brand ambassador work and more directly to speaking?"

Manisha: Well, they're both kind of the same. They're just in different ways. And so I never...I mean, I had envisioned them at that period as being a barbell approach and a wonderful way to have diversity of impact and work and keep my skills fresh. And so they actually...you can build an entire business off corporate spokesperson and keynote speaking as long as you're continuing to develop your expertise so that you have something fresh and new to keep saying.

What Led To Her Creation Of MoneyZen [53:03]

Michael: So when did this formalize into this MoneyZen platform that I know you have now? Like, was that there from the start? You began this, launched MoneyZen and then started doing brand ambassador or spokeswoman work and then started the speaking world, or did it come later?

Manisha: So I can't remember the exact year, but I first started off just calling myself very creatively Manisha Thakor Enterprises. And then, I don't know, 18 months, 2 years into it, sitting out on our portal staring at the gorgeous Santa Fe blue sun and the water fountain is going and our little, you know, pebble rocks are around it and I'm feeling really zen, and the phrase "MoneyZen" comes into my head. And so I'm like, "I think that's what I should call this." At the time I wasn't really thinking of it as a business. I was thinking of it as, "I am too young to let my brain rot." And Santa Fe is a magical, magical, magical place, but the neighborhood we lived in was predominantly made up of retirees. And so I was, by wide margin, one of the youngest people floating around, and I just felt this urge to stay engaged.

So at the time, I wasn't thinking MoneyZen was a business so much as it was for me to have a growth vehicle and make an impact. And so I think about my time in sort of chunks. So the beginning chunk was Suze Orman light, corporate spokesperson, keynote speaker. And then what started happening is people started asking me if I would manage their money and I'm like, "Oh, I don't do that." And, you know, after about, like, the 14th time of saying, "No, I don't do that" I thought, "Why don't I do that?"

And so that's when I decided like, "Well, let me try this RIA thing." And I knew nothing, nothing about this world. And so I researched it for, like, a year because I had been so living in the suitability world predominantly. Because when I was researching, although Fayez Sarofim & Co. is a fiduciary, most of the investments that I had been looking at in terms of stocks to recommend. And then also when we were doing the SMA business, unbeknownst to me at the time and not understood by me at the time, was that those were being distributed primarily if not entirely by advisors operating under the suitability standard. So, you know, it took me a whole year of research to kind of dive in and figure out what it would take to try and start my own practice, having never ever been a financial advisor.

Michael: And it's kind of an interesting effect, that, you know, like, you're...I mean, I'm just envisioning it solely... you're writing books for predominantly young women in their 20s and 30s around financial literacy, and then low and behold, a few people who have a lot of money are actually asking you to manage theirs. I would imagine that's sort of a strange like, "No, wasn't really writing this book for you, but gee, I'm flattered. Thank you." Is that a strange transition? That this was not what you were looking for, but it's part of what showed up?

Manisha: You know, it's outgrowth of who my girlfriends were and the stage of life they were at. While I was doing the financial literacy work for younger women, my just natural friend tribe were my, you know, classmates from undergrad and business school who are now hitting stages in their careers where they're making, you know, well into the six if not in the seven figures. And so it was just a life stage that my girlfriends were at, and they trusted me, and I loved talking about this stuff. And, you know, if you're not in our...you know, if you are a management consultant at Bain or McKinsey, you are flipping smart, but you don't...you're generally not immersed enough in personal finance to understand the difference between asking somebody who's spent their career on the institutional side and done a lot of financial literacy work versus somebody who has been a CFP for 15 years and is deeply knowledgeable about all aspects of financial planning. Like, you don't know the difference between those two.

Michael: So ironically, you're stating like, they...you were like, "Why are you asking me? You should be calling a CFP?" I feel like that's what you just said.

Manisha: At the time, I didn't even know that. I thought like, "Well, of course, you're asking me. Like, I have spent my whole career in business, of course, I would know."

Michael: All I've done is manage billions of dollars. Sure, I can manage yours.

Manisha: And that's the key thing that I want to emphasize is that this shift from corporate...managing money in a corporate setting versus personal finance, they're totally different worlds, yet naively, when I first got started, because I had been so immersed in the financial literacy component, it seemed like, well, it must not be much of a stretch to have all that...you know, to have built out nearly a $6 billion business, to have built this media presence around financial literacy, the logical next step seems, "Why don't I start my own RIA?" And it was one of those cases of, you don't know what you don't know. So I had my CFA, and so I studied for the CFP, and I got it and took all the other 65 and everything else and thought like, "Well, let me give this a go."

And so I just didn't know how much I didn't know. Thankfully, the people that were coming to me for advice and guidance were at a stage in life where what help they needed me to provide was exactly...was matching the limits of my knowledge. As they got wealthier, and it's not like I did this for a long time, I think I had it for two and a half or three years, but, you know, eventually it became clear to me that either I needed to get deeper in my knowledge and interest in the intricacies of managing money holistically for high-net-worth individuals or blend into somebody who had that capability.

So, I mean, I don't want to sound like I was taking it on lightly. I think the point that I want to make is that a lot of people do not...A, who are starting firms do not know what they're getting into if they have not come out of an advisory firm. And so a lot of people who were like me in the institutional world often will say like, "Well, in my retirement I'll manage money for people." Just how wrong that notion is. Like, ha, completely misguided and misinformed about how much work and expertise it takes to thrive in the RIA world.

Michael: So as you were diving in, like, were you literally managing the money? Like, "I did this for years for billions of dollars, I was an equity research analyst, like, sure I can do this with the dollars that come in. I'll just, you know, manage the portfolios and then do my media stuff in the rest of the time." Like, was it that kind of model from the start, "I know how to do this, I'm going to manage the money myself?"

Manisha: Yes, although I had the good sense to know that from an infrastructure standpoint, I would need a TAMP. And so I interviewed a whole bunch of prospective TAMPs, and I really adored Adam Birenbaum and the team at the BAM ALLIANCE, and so I decided to go with them. And so, you know, that took a lot of the operational pressure off of me. And I agreed so strongly with their investment philosophy. And so it was just a natural fit. So it made it much easier to be a solo person.

And then again, because I had done well enough in my institutional career, I was able to come out of the gate with a little bit of extra help that most people wouldn't be able to have. So I had a right hand who now has his own practice that he's merged into a larger firm. So it was me and another wonderful, wonderful man, Chris Girbes-Pierce. So yeah, I mean, we did everything a normal RIA within the BAM ALLIANCE world would do. I also just happened to do a lot of media on the side.

Michael: Well, and I know one of the unique things about BAM, unlike a lot of TAMPs, is they actually have some flexibility about whether you...essentially, like, whether you solely use their models and systems or I guess whether you solely use their models and actual investment portfolios or whether you do some of your own investment model creation and design, but they're your back office that helps you implement it and execute it so you can do the portfolio design but have their infrastructure for some of the portfolio implementation. Which I guess is particularly appealing when you were coming from a background like yours that said like, "I know how to do portfolio design stuff but I don't want to hire all the traders and operations and all the internal stuff. Y'all do that for me. Great."

Manisha: It was plug-and-play. I don't mean that it was...it was conceptually plug-and-play. There were a thousand and one things that I needed to learn that caused me to faceplant, like, every third day. It is really hard to get something like this off the ground and running. But if I look back in retrospect, I was blessed that I had a number of friends, most of whom had worked in financial services on the corporate side, made great money, had no time to manage it on their own and trusted me. So, you know, I walked in with an advantage that most people don't have when they're starting up. It wasn't like I was trolling for people to give me their money. It was the reverse. I got the questions, so I started a business to help.

And thanks to the TAMP model, it let me do what I was naturally good at and then to grow the business in non-traditional ways because I was out doing media. One of my largest clients came because she was in the airport and she read an article I wrote in a now-defunct magazine for women executives called "More Magazine" and she reached out to me. And so it all was very symbiotic.

Michael: That's interesting unto itself. You know, I feel like there's a perception out there that, "Does anybody with money really pick their financial advisor because they saw them on TV or in the media?" For which I guess you would say like, "Yeah, some people really do, including some who have money."

Manisha: I'm part of a DFA study group on media and we talk about this a lot. And I will say that it is the very, very rare person who can generate client leads from media in an organic way. So either you're doing, like, a Fisher model and you're like, you are just out there with a complete media strategy or you're more of a unicorn. And I was in that unicorn camp. There's just something about the way that I write and I talk. It doesn't work for everyone. But I didn't need it to work for everyone. I needed it to work for women with $3 million or more in dollars who wanted to work with a fiduciary that believed in evidence-based investing. Like, that was my world. And for those women, the way I spoke and taught and presented the material was a fit for a number of them. And that was my niche.

What Manisha Thinks Led To Her Success [1:04:45]

Michael: Just having been in that world and seen this, and seen this work, do you have any sense? I mean, what is it that it works for you and doesn't work for other advisors? I know it's kind of strange saying to a unicorn, "What makes you a unicorn?" Right? Do you have any idea? Why does it seem to click for you when it doesn't click for so many other advisors?

Manisha: Michael, I have absolutely no idea. I mean, I think that sometimes, because, I mean, I feel like I've just made, like, a thousand and one mistakes as everybody who has achieved any amount of success has. And so anyone who has kept going oftentimes is a very tough critic on themselves and constantly, like, looking back and analyzing, "What could I have done better or differently?" And I'm very much like that. And I look and I don't know. I mean, like, all I can tell you, it's like why do some people like butter pecan over strawberry ice cream? I just seem to have a strong following amongst butter pecan lovers. And I can't tell you why, but we just fit. And I don't fit for everyone, but for a specific niche, I just have worked really, really well.

And the one thing that I do wonder as I look back is whether the keyword and all of that was "niche." And the other key might have been a word I didn't use in there, but "authentic" is overused right now, but it was just like, I was just raw and uncensored and myself. And I think that being that way with my tribe worked really well. I didn't try to be that with everyone because I just knew there were groups I wasn't going to resonate with. I think it's figuring out the group or groups of people in front of whom you can truly be yourself. Because we all know, the stickiest client relationships are the ones where they feel a deeply personal connection to not just your skills but you. And so that's what I think, in retrospect, happened, but it's only in retrospect that I can even begin to see that.

Michael: So, it's an interesting point there to me that just, you kind of framed it around niche and authenticity, which I get. To me at a high level, it's just sort of this recognition that, particularly when you're involved in the media, the reach is so wide, I mean, just, if you get to some large platforms, it reaches a whole lot of people, you really get to a world where, look, if you're just your authentic self to a particular group of people that you connect with, you know, if 1 in a 100 thinks what you're doing is interesting and you're on national television, 1 in 100 is a lot of prospects. One in 1,000 is a lot of prospects that potentially show up.

And I feel like most of us spend our time just trying to make sure, well, make sure we don't offend the majority of people or even a small minority of people, right? And, like, must always look professional and credible and never say anything that's edgy and awkward. And I think particularly in advisor world because we have this pressure, must maintain professional credibility to be an expert that people pay, when, as you kind of note there, the flip side reality of that is why do so many advisors struggle to get any successful business and generate activity off of the media? And you do because, as you said, you're raw, uncensored self.

And, you know, just, when you say what you really think, you still have to at least say it reasonably well and tactfully and be educational and helpful to someone, but it's okay if you're not for everyone. It's even okay if you're not for most people, because if you actually just get 1% or a fraction of the percent of the people that see you in the media, you can actually generate a tremendous amount of business because the reach of the media is so wide in the first place. Focus on being awesome connected to 1 out of 1,000 more so than, "How do I be moderately appealing to 50% of the viewers?"

Manisha: Exactly. As soon as you start going down that second end, you twist yourself up like a pretzel and you don't please anybody. So best to please a small percent and have a really good relationship with them. That would be my takeaway from that period in my life.

What Surprised Manisha The Most About Dealing With Individual Clients [1:09:35]

Michael: So what surprised you the most of just the dynamics of dealing with individual clients versus where you'd come from in the institutional world?

Manisha: That the part I loved most was the conversations about money, meaning, purpose, life. You know, from a pure investment standpoint, you know, I believe in being debt-free. I believe in saving as much as you possibly can as early as you can. I believe in deeply living within your means. You know, the kinds of things that I feel like people need to have in place are straightforward. I mean, this is what I'll just...like, the analogy that comes to my mind is my dentist says this to me all the time. Like, it's like, "I can tell you floss." "Yes, I floss." He's like, "I'll tell you, if everybody flossed, I'd be out of business." And so, I kind of think about, that's my approach to being a financial advisor. I'm not saying that's the right approach, that's just my approach.

And so the part that I loved the most was about helping people create lives of financial well-being. I don't know if we'll have time to get to this or not, but, I mean, it's actually what brought me to where I currently am, where I...the question that dominates my days and that I am just...I really think all of this led up to was, what is the difference to being wealthy? W-E-A-L-T-H-Y. And what is the difference between that and being "wellthy," W-E-L-L-T-H-Y? But I'm fast-forwarding a number of years. At that time, what really surprised me was how much I enjoyed having those conversations, which after years of an exceptionally technical, you know, where I'm talking about Sharpe ratios and Treynor ratios and tracking error on a very regular basis, that that's the part I liked was a huge surprise.

How She Managed The Ups And Downs Of Her Advisory Firm While Going Through A Stressful Divorce [1:11:30]

Michael: So what was the next shift that came? You launched the advisory firm, you know, the RIA a couple of years into the MoneyZen platform by, you know, I'm trying to remember when it was, like, around 2015, give or take a little, when we had the, you know, fateful dinner at our little introverts' corner. You were tied in more directly with BAM ALLIANCE, I think, by that time. So what changed in the trajectory of the advisory firm?

Manisha: Well, my marriage fell apart. That was the primary catalyst. So I actually started the advisory firm in 2012, and in 2015 I was just about to sign the client that would...no, in 2014 I was just about to sign the client that would have pushed us over $50 million in 2 years. So I felt like, well, for a lifestyle business, we were heading in the right direction.

Michael: That's a phenomenal number. There are advisors that take 20 years to get to $50 million and half a million of recurring revenue at a 1% fee. Like, that's phenomenal growth trajectory.

Manisha: And I'll tell you, I look back and I don't think I had nearly the...because those numbers were so different than what I was used to in the institutional world, I did not realize the magnitude of the success that I was having.

Michael: Oh, right. Because institutional world, this was like $6 billion in a couple of years. I guess the scales are a little different.

Manisha: And my mind hadn't shifted yet to that world. And because I had employees, the revenue wasn't generating the level of profits that it would have been if I were truly a solo. You know, I've got my TAMP fees and then I had a full-time employee. And then, because of the media stuff I needed help with, I also had an assistant to help with that. So it's not like it was a wildly profitable endeavor at those levels.

And right at the time that I was about to sign with this client that would have pushed us over the edge, to use a phrase that Princess Di used when she was interviewed in that famous interview with Martin Bashir and she said, "There were three of us in this marriage, so it was a bit crowded." So that's what happened to me. And we started divorce proceedings. And I'm a TAMP client, if you will, of the BAM ALLIANCE. And at that time, the head of marketing for Buckingham and the BAM ALLIANCE was Dave Levin, and he's now the president. And Dave's a real sweet, kind man. And he was checking in, as he would on any, you know, firm within the network, just as periodic check-in, and we did it via video, and he asked me this fateful question. He said, "How are you?" And I just burst into tears and I'm just, like, sobbing.

The Difference Between Being An Intrapreneur And An Entrepreneur [1:14:25]

And one thing leads to another and pretty quickly, because Adam Birenbaum is very visionary, as is Dave, the next thing I know, you know, we're talking and they invited me to come in-house and head up an initiative around women. And it just kind of all came together. And it came together as like a big, you know, mud puddle, right? My personal life is completely falling apart. I'm realizing that I enjoy meaningful conversations and I enjoy motivating women, but I don't enjoy the logistics of being an advisor on a day-to-day basis. I also realize that I am an intrapreneur, not an entrepreneur. And I also, to be just completely honest, was exhausted. And the folks at BAM were just so kind and had been like family when I was trying to get the RIA off and running that it just felt like I was, like, coming back into a nest to blend my practice in with the firm and take on another role. It was just profoundly comforting at a really difficult point in my life. It wasn't like I planned for that to happen.

Michael: I love that framing, though, that to say you realized you were more of an intrapreneur than an entrepreneur. You know, for those who haven't heard the term, I think we all kind of know entrepreneur. Like, going out and starting your business. You know, foraging in the wilds to build it from scratch with your own two hands and that kind of business startup vision.

You know, and then there's this other domain that sometimes gets called intrapreneurship, which is, like, trying to build that within an existing business. And it's just a different kind of phenomenon. You know, the good news is you tend to have more access to resources, or at least can get access to them quickly and infrastructure if this starts to work and scale because you're within a larger firm. The challenge is, you know, there's a whole bunch of existing culture and business lines and dividing lines and corporate politics that may come up if your new thing you're making is doing better than someone else's. Like, you have to navigate some internal corporate business dynamics, but you also sometimes get to leverage some internal corporate infrastructure. And it's just a different style of building and creating something.

Manisha: And I had just not realized how starkly different the two are until I fast-forwarded into my current role at Brighton Jones and I'm back to being an intrapreneur and I'm like, "Whoa, this is who I am." But just to wrap the Buckingham BAM stage of my life. So I was there for three years. They could not have been better to me. It was a great time. They were experimenting with having external thought leaders, so Carl Richards, Dan Solin, myself, Tim Maurer. And, you know, things shift. They're an innovative firm, and as the younger generation, as some of the founding partners started to retire and the younger generation was starting to implement new, more innovative ideas, lots of shifts.

And I think that the universe just sort of conspired because they're in St. Louis and I was in Santa Fe, and I had decided I could either...when I got divorced, I decided I could either go back east where my family was and admit that I had failed adulating, or I could go west and see what was out there. And so I did a mini eat, love, pray. While the divorce proceedings were going on, I rented places on Airbnb in a bunch of different cities, picked very strategically for density of artisanal coffee per capita.

And so amongst the cities on the list was Portland, Oregon. And I came here and I just loved it immediately. But by this time, I was just tired. For all these years, I'd been traveling almost weekly. And just going from Portland to St. Louis, the flights aren't great. It was just exhausting. And my, again, serendipity, my accountant moved from one of the largest accounting firms in Portland to Brighton Jones, who has a tax practice in addition to a wealth management practice. And I came in with my tax work and I was just exhausted from travel and she said, "You know, you should talk to our CEO." First I talked to Charles Brighton on a Friday, and then Charles was like, "I think you need to talk to Jon." So I talked to Jon. And one thing led to another and it all just came together. And also, Brighton Jones has an office in Portland. And it just all came together. And so I was ready to finally set some roots down, and that's how I ended up where I am now. And I'm back to being an intrapreneur, and it's like a dream come true.

Michael: So help us understand, I guess let me even start one moment back at Buckingham and then kind of update us to Brighton Jones. Like, what did this role look like when you're at Buckingham? Was it still largely the media stuff you were doing? The deal now was just, "Hey, rather than worrying about building your own advisory firm, we're a big firm, we've got all these advisors that can take the clients and build and scale this, and we've got the back office and the rest, like, just go be media Manisha and generate some business and the firm will get the business and we'll pay you a, whatever, you know, a salary and a bonus for business development and just, you can attach to us and go make rain." Like, was that the deal or did it look different?

Manisha: Exactly like that. And, I mean, for the time in my life, it was perfect. And I'm just...I'm so profoundly grateful. And Larry Swedroe, in particular, took me under his wing. And I get teary just talking about it. Larry was such a kind figure during a very difficult period in my life. They were wonderful people. And that was the role that I did there, and it was the exact role for the painful stage of life that I was in then.

Michael: And so, you seem to have made this distinction now of what your role is at Brighton Jones that you framed it as more intrapreneurial in nature. So can you talk a little bit now about, like, I guess, what is Brighton Jones? Just bring everyone up to speed, for those who aren't familiar with the firm, and then, like, what is this intrapreneur role thing you're doing there now?

Manisha: Sure. So Brighton Jones is a 20-year-old RIA based out of Seattle. We have offices in Seattle, Portland, D.C., Scottsdale, and San Francisco. And we offer a wide range of services right now. So we have traditional high-net-worth offering. We've also just launched what we call Open, which is entry-level for individuals that are in asset accumulation but not yet at the high-net-worth level. We have an entire tax practice. We're just launching an estate law practice. So pretty soon people can come and it'll literally be truly one-stop shopping. And we're a traditional fiduciary RIA in the DFA world, strong believers in evidence-based investing. And the thing that really sets Brighton Jones apart, in my opinion, is just the incredibly unique culture that Charles Brighton and Jon Jones have built. They certainly could have made more money personally, but they have deeply invested in clients and colleagues and the community in a way that I've not seen before. So that's who the firm is.

And so, you know, from an investment standpoint, so we have...we look at it in two different ways because we have assets in the tax...just over $5 billion in assets under management, but because our revenue source comes from other sorts of products as well, we also think about assets under advisement. And so we're at $8 billion in assets under advisement. So it's a natural fix. I'm still in the DFA world, I'm still on the only evidence-based world. I'm just not on a plane every three days.

Michael: So can you talk to us a little bit more about what the role looks like? Like, are you still heavily similar to Buckingham, BAM, just, "Manisha, go be your awesome media-facing self, at some point, people are going to look you up and it will bring them back to Brighton Jones and we'll have an opportunity to work with them?" Or is there other...not that there's anything wrong with, like, simply doing that, but it sounds like there's some other stuff to the role as well?

Manisha: Yeah. So when I came aboard, the idea was that I would be a brand ambassador for Brighton Jones and that I would essentially do the same kind of work that I was wearing a hat for at BAM. The change was a month or two after I got to the firm, Jon Jones, who reminds me of Richard Branson in every sense of the way, like just... he actually looks like him... and just off the charts creative. We do twice-a-year team meetings, we call it Team Week, and everybody comes together, and he announces at Team Week that we are pivoting towards well-being with all four limbs and we don't know exactly what that's going to look like from a monetization standpoint. And we don't even know what that's going to look like right now from a service offering standpoint. But from this point forward, we are incorporating well-being into absolutely every nook and cranny of the business. And so this was 12 months ago now. So, I mean, it's still very, very new. And the idea is 10 years from now, we'll know exactly what it is and we will be monetizing it.

What I was able to do was early on be a part of this process. And so for me, the most fun part of it has been doing what you have been doing and what we've been doing right here, which is, we've just launched a podcast called "true WELLth," W-E-L-L-T-H. And the idea is to use it as, on one hand as a place to discuss questions that we don't always talk about. Like, what if everything we've ever been taught about money and "making" it is wrong? And what if, you know, the modern definition of success is actually just a recipe for increased disconnection from yourself and others in your life?

Michael: Well, that's kind of depressing.

Manisha: No, well, there's always fun...