Executive Summary

In the early days of financial planning, advisors often relied on marketing strategies that were based on a phone book, telephone, and their own ingenuity. As the internet developed, though, advisors became able to reach wider audiences, which has only compounded with the rise of social media. At the same time, advisors identified an emphasis on personalized money management as becoming more prevalent than the use of one-size-fits-all sales techniques. These shifts of focus and opportunity have provided advisors with liberating flexibility around the services they can offer and the clients they can serve; however, they can also be intimidating: how can advisors establish a niche and grow their client base with the right marketing strategy, when there are seemingly infinite ways to market effectively?

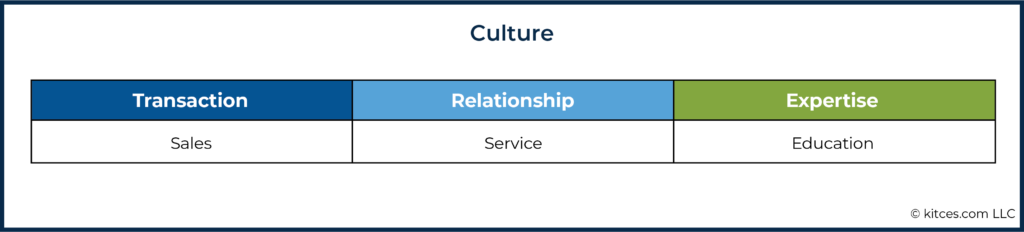

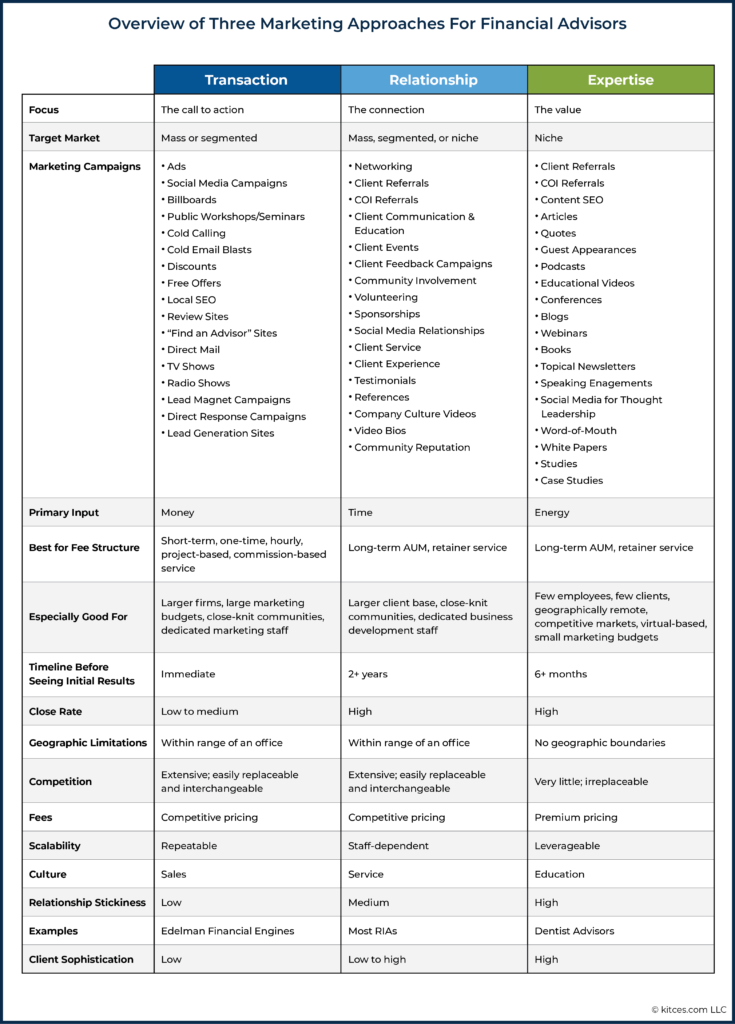

Given the dizzying array of marketing options to attract clients, it may help advisors to understand the three primary types of marketing strategies before they select the best approach for them and their firm. The Transaction approach has a culture focused on sales and is comprised of direct marketing campaigns such as workshops, direct mail, and ads to generate leads. Advisors who choose this approach rely on a numbers game of maximizing outreach to prospects, focusing on raising awareness of the firm, and capitalizing on call-to-action conversion. Alternatively, advisors may opt for a Relationship approach, which has a focus on service, and relies on clients, centers of influence, or community connections for referrals. Lastly, advisors may lean into an Expertise approach, which focuses on education. With this approach, advisors leverage their thought leadership by creating publications and offering workshops, for example, in order to establish themselves as experts in a particular niche.

Fortunately, advisors can identify an appropriate marketing approach relatively easily by assessing their firm’s style. Large firms that are willing to pour money into their marketing campaigns, looking for quick results, and have sales-driven cultures would likely find the most success in a Transaction approach to marketing. On the other hand, firms that focus on close-knit communities and who seek to provide a high-level client service experience for a large client base might benefit from a Relationship approach. Finally, smaller firms with energy (in lieu of financial resources), an education-based mindset, and that seek a specific type of client would be likely to find an Expertise approach most suitable. While each of these approaches can be helpful and has its own set of merits, it’s important to remember that there is no foolproof marketing method for advisors. It’s all about the approach that is most sustainable and that works best with the firm’s unique style!

Once advisors have determined which marketing approach best fits their firm, they can move into action to design a suitable marketing strategy. A firm looking to foster a Relationship approach to their marketing may decide to review their client experience, create marketing materials for their centers of influence, or host an annual holiday open house, whereas a firm choosing an Expertise approach may develop weekly blogs or a podcast. Advisors might also choose to incorporate a blend of different approaches, adopting a primary marketing approach serving as their top priority strategy, with auxiliary activities involving a secondary approach. Other advisors who have realized they want to transition to a different approach can begin to gradually shift their marketing investments of time, money, and energy towards the new approach, while letting original marketing resources gradually trickle over.

Ultimately, no matter what approach advisors end out using, being thoughtful, intentional, and dedicated can help them ensure they stay on the right track to effectively market their firms. Investing the time and energy to find the right marketing approach can make all the difference in ensuring not only that advisors are providing the best service and experience to their clients, but also that the right clients are being attracted to the firm!

In my experience, most financial advisors find it a challenge to figure out which marketing strategy works for them. Making it even more difficult is the seemingly endless list of ideas to try. But before you start picking tactics, take a step back and approach your marketing from a 30,000-foot view.

Choosing the right marketing tactics first requires knowing your overall marketing style. To better understand where to begin, you can start by deciding whether you are pursuing one of these three approaches to attract clients:

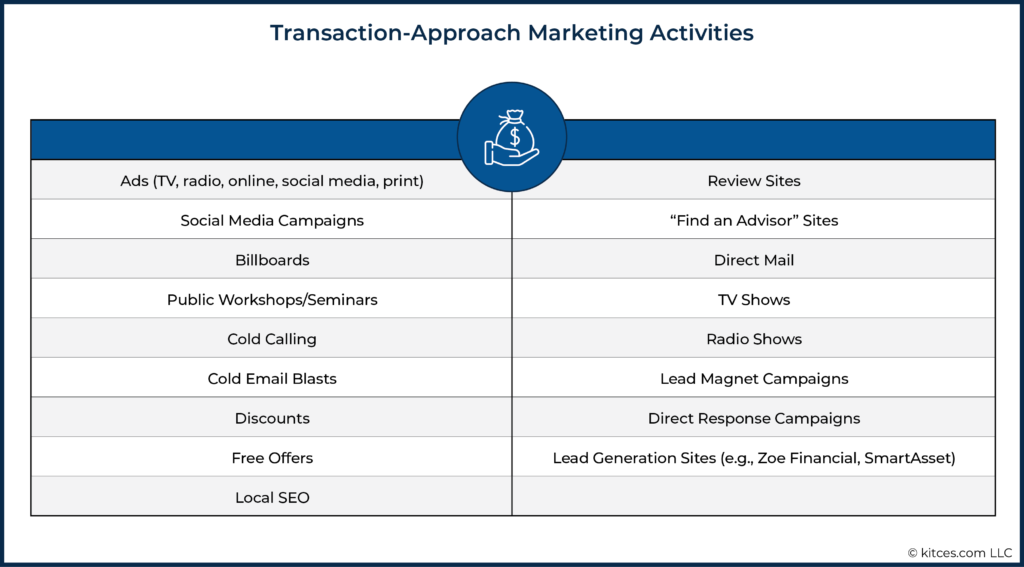

- Transaction Approach: You engage in direct marketing campaigns such as workshops, direct mail, and ads to generate leads.

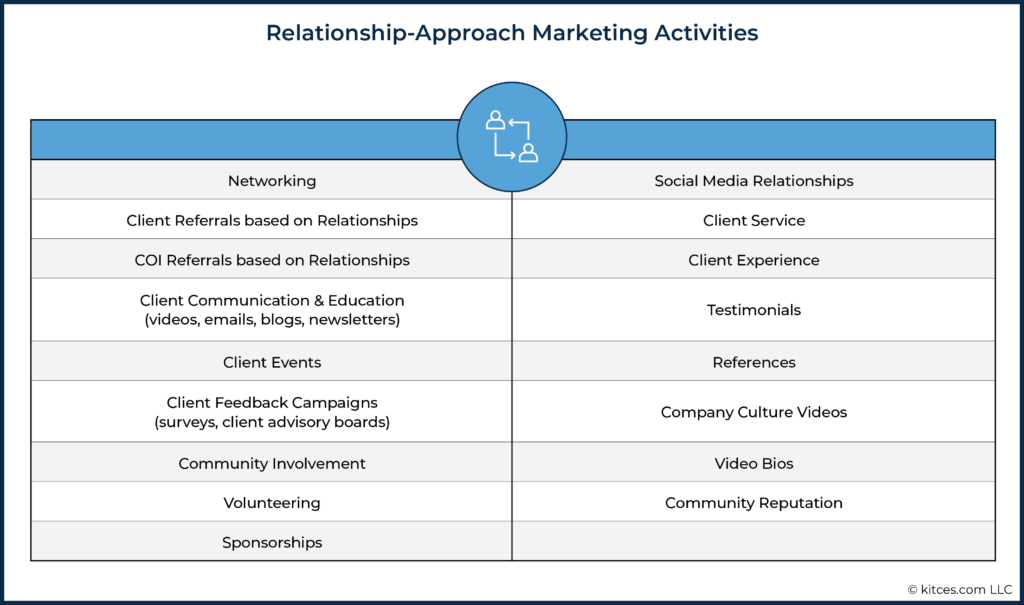

- Relationship Approach: You rely on clients, centers of influence, or your connections in the community for referrals.

- Expertise Approach: You focus on being an expert in a niche market to attract ideal prospects.

Each approach has its pros and cons, and some approaches are more or less appropriate for certain types of advisory firms than others. Additionally, each approach is most effective when coupled with specific tactics (to be covered below).

An Introduction To The Three Approaches To Marketing

While financial advisory firms can be wildly successful using any one of these three marketing approaches, the goal is to choose the approach that is the best fit for the firm and then for the firm to fully commit its time, money, and energy to this approach. Without a full commitment, advisors and their firms are likely to end up with watered-down results, coming to the (possibly unfair) conclusion that the approach wasn't right when it simply needed more of the firm's focus.

Before describing the three approaches in more detail, it is important to clarify that these terms describe a marketing style, not a client service style. For example, choosing the Transaction Approach does not mean that advisors don't have relationships with their clients, nor does it mean that they do not provide valuable expertise. It just means that marketing strategies rely on emphasizing transactional tactics, and while they don't necessarily lead with a reliance on relationships or expertise as a method of attracting new clients to the firm, it does not suggest that the firm considers client relationships a low priority nor that its advisors lack subject matter expertise!

The Transaction Approach

The Transaction Approach is what most people think of when they hear the word 'marketing'. The focus is on the call to action—getting an appointment set and then closing the sale. Think of this approach like fishing—you put your bait in the water and wait for something—or, in this case, someone—to bite.

With this approach, there is no existing relationship guiding a prospective client's choice. Nor does the prospect perceive you as an expert beyond what is considered 'table stakes' for financial advisors. The Transaction Approach is a classic Game Of Numbers.

Traditional marketing activities that fall into this approach primarily aim to increase visibility as broadly as possible and to reach as many people as possible within the firm's geographic locale. Because there is usually no pre-established relationship to leverage, activities like old-fashioned cold calling and 'free chicken dinner' workshops are typical marketing approaches. In more recent years, the approach has expanded to include digital campaigns, such as local Search Engine Optimization (SEO), Google ads, and direct-response social media campaigns.

Firms that successfully implement the Transaction Approach usually have large marketing budgets and can leverage their brands, such as retail brokerage firms like Schwab, TD Ameritrade, and Fidelity, and the large, national RIAs like Edelman Financial Engine or Fisher Investments. In addition, traditional wirehouse and insurance companies historically engaged in a transactional approach, hiring brokers and insurance agents to engage in cold-calling and similar high-volume transaction marketing strategies.

The Relationship Approach

The Relationship Approach, in my experience, is the most common way RIAs approach marketing. The focus is all about connecting with other people to generate referrals and word-of-mouth leads. You might think of this approach as my advisor friend does, who calls it the "1,000 cups of coffee" approach.

With this approach, you nurture relationships and build your reputation in the community to generate business for the firm.

Traditional marketing activities that fall into this Relationship Approach include networking, client and center of influence referrals, client appreciation events, hospitality events, nonprofit board memberships, and sponsorships of local organizations and events. Online, it includes nurturing relationships and highlighting your firm's community involvement through social media and other marketing collateral.

Firms that successfully implement the Relationship Approach are usually client service-oriented and pride themselves on having personal relationships with clients… which they then seek to extend to new client relationships with friends, family, and colleagues of their clients as the relationship network grows.

The Expertise Approach

The Expertise Approach can be thought of as a content-based, inbound, or niche marketing approach. The focus is on the value you bring by sharing in-depth expertise to a narrow set of clients (a niche) that is not offered by most other advisors. Think of this as the Michael Kitces approach to marketing, which uses content specifically aimed to help a particular niche of financial "advicers" – advice-centric financial advisors who aim to create value through their advice (as opposed to the sale of any particular products) – become better and more successful.

With this approach, advisors position themselves as experts within a niche. Prospects seek an advisor out because that advisor specializes in solving problems for people just like them. This is the financial advisor who is an invited speaker at a special needs association conference that talks about financial strategies to safeguard a child's future after the death of the parents, versus the advisor who puts on a public workshop about "retirement planning" at the local community center in the hopes that some attendees will hire them and/or buy their insurance/annuity/investment products (Transaction Approach).

More broadly, traditional marketing activities that fall into the Expertise Approach aim to showcase the advisor's expertise and include speaking engagements, articles in consumer or trade publications, expert quotes, and white papers. In the digital age, the approach expands into niche-specific content in the form of blogs, podcasts, videos, and webinars.

Advisors who are successful in the Expertise Approach focus on one niche and design all aspects of their business around that niche. A good example of this type of firm is DentistAdvisors.com. (Note: I don't work with this firm, but I think they do a good job exemplifying the Expertise Approach.)

Matching Your Firm To The Right Marketing Approach

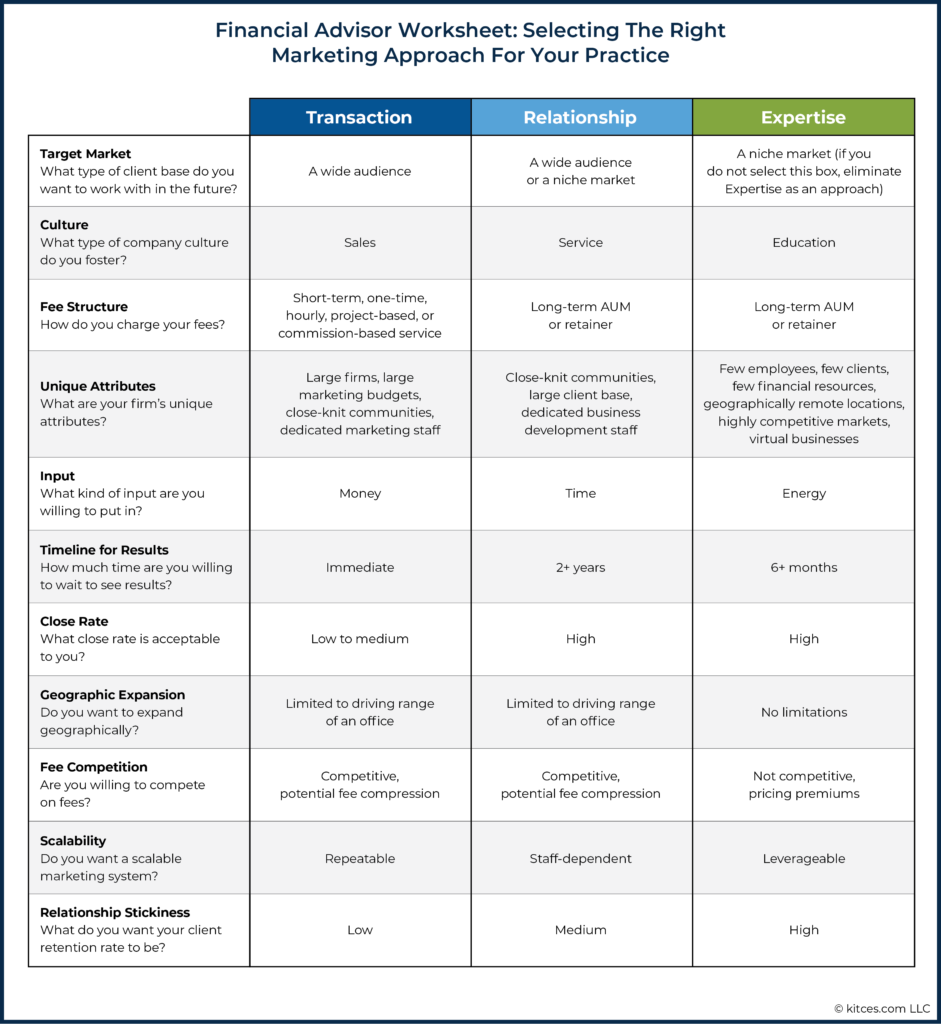

To help advisors and their firms decide which marketing approach is right for their business, let's look at a series of questions. These questions will not only help firms find the right style to use but will also help them evaluate the trade-offs by weighing the pros and cons of each.

Use the following worksheet to record your answers to each question, which are discussed in detail below.

What Type Of Client Base Do You Want To Work With In The Future?

The types of clients you want to work with should direct your approach. Note that the clients you envision for the future may not be the ones you are working with now. So, in answering this question, think about the type of client you would ideally like to work with.

Transaction Approach. This approach relies on a numbers game, so you will need to target a mass market or large segments of the population, such as pre-retirees or retirees. With this approach, you generally work with anyone who meets your minimum fee or account size (e.g., a $300,000 asset or $3,000 fee minimum) and personality requirements (e.g., people who are delegators and value third-party advice).

Relationship Approach. This approach also tends to target the mass market or large segments of the population. This is because prospects result from a referral or your reputation in the community, so they will have a high variability of backgrounds and needs. Sometimes, the Relationship Approach can be applied to a niche market as well (particularly psychosocial and affinity-style niches). For example, if you decide you will work with golfers, the needs of those with an affinity for golfing are so varied, no specific expertise in golfer financial planning may be required. But you will network with and get referrals from other golfers based on your personal relationships.

Expertise Approach. The Expertise Approach requires you to select a niche market. To be an expert, you must achieve mastery with one specific type of client and their needs. The client type must be a narrow one. So, for example, pre-retirees, retirees, and women are not a niche; they are large segments of the population that most financial advisors serve. However, late-career Kaiser doctors, retiring Boeing executives, and people who recently experienced the death of a spouse and who are transitioning to widowhood are all niches.

The Expertise Approach is most effective if the entire company is focused on one niche, especially if it is a small firm with just a couple of advisors. However, some RIAs that have $1 billion+ in AUM and large teams will have multiple niches. The company, as a whole, does not have a niche, but each advisor does. While this is not the preferred way to execute the Expertise Approach, it is an alternative to the entire firm focusing on one niche. It can become a slippery slope, though, where a firm has so many niche segments, they essentially serve the mass market, defeating the purpose of the Expertise Approach. If you aren't willing to focus on a narrow set of clients, the Expertise Approach will not be an option, and you can cross it off your list.

What Type Of Company Culture Do You Foster?

Your company culture can also dictate your marketing approach, which can be loosely categorized into three types: sales, service, and education. If you would describe your culture in different terms (e.g., creative), choose the one that most closely resonates with your values.

Transaction Approach. Well-suited for those with a sales culture. Since the prospects who contact you do not have an existing connection to your firm, strong sales skills will help convert them to clients.

Relationship Approach. Best for firms that pride themselves on service—the firms that will bend over backward to help their clients. If you find yourself saying you serve clients better than other firms or call yourself the Ritz-Carlton of financial advisory firms, then the Relationship Approach may be a good match.

Expertise Approach. Good for firms with an education culture where they constantly learn about and perfect their craft and love to educate others freely. To maintain credibility as an expert, you must continuously learn all the ways to solve your clients' problems and educate your niche about your expertise.

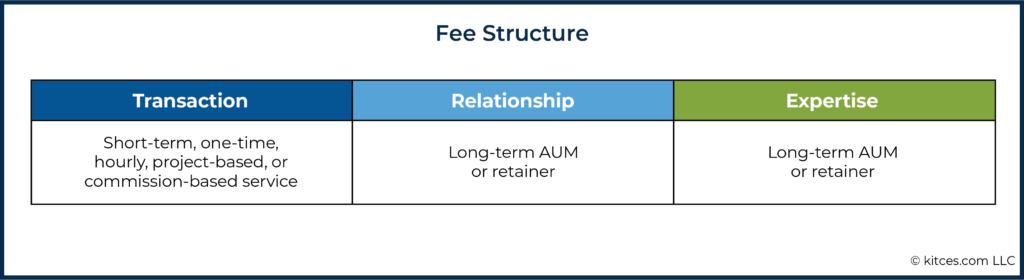

How Are You Compensated?

How you are compensated for your services can influence the approach you choose, though this is not a hard-and-fast rule.

Transaction Approach. Since there is no pre-established trust as with the Relationship and Expertise Approaches, the Transaction Approach works best with low-commitment fee structures such as commission-based, one-time, hourly, or project-based services. Advisors with strong sales skills can convert prospects into longer-term AUM or retainer relationships. Other firms may first have to offer a project-based service like a financial plan and then upsell to an AUM pricing model. Firms that provide services only on an AUM fee basis may find that their close rate is lower than their peers in the Relationship and Expertise Approaches.

Relationship and Expertise Approaches. Since credibility and trust are usually pre-established with a prospect under these approaches, it is easier to charge AUM fees or a retainer (a more ongoing-relationship-based pricing commitment for the client), though any fee model could work.

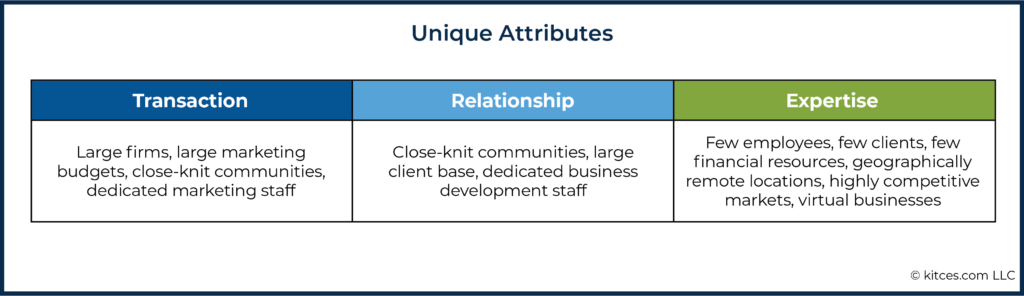

What Are Your Firm's Unique Attributes?

The attributes that are unique to your firm, such as size, location, and financial or staff resources, can dictate which approach might be best.

Transaction Approach. Generally expensive and time-consuming, so large firms with large marketing budgets have an advantage with the Transaction Approach. Firms in close-knit communities may also do well since their marketing dollars will have more impact than their counterparts in large metropolitan areas. Finally, firms with dedicated marketing staff with time to consistently focus on online strategies can succeed under this approach.

Relationship Approach. This can work well for firms in close-knit communities or with a large client base, though all firms can benefit from referrals. This approach can also be good for firms with dedicated business development staff tasked with networking.

Expertise Approach. Works well for all firms unless their growth goals are larger than the size of their niche market. Smaller firms with few employees, few clients, and few financial resources can prosper under this approach more so than they can under the other two approaches (as premium pricing means the firm can be very profitable with a relatively small number of clients). And firms located in geographically remote locations, in highly competitive markets, or who just want to be a virtual business are well-served by this approach.

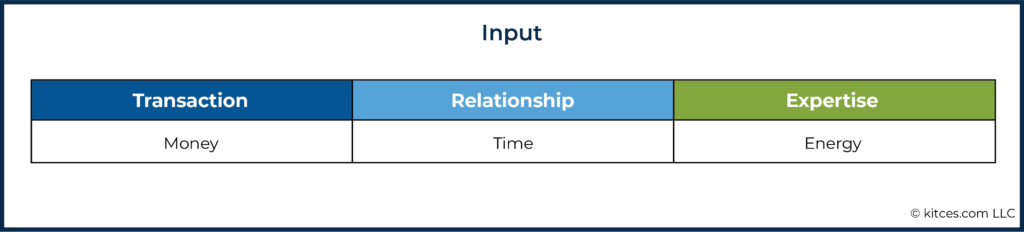

What Kind Of Input Are You Willing To Put In?

Different marketing approaches require different types of inputs to be successful. Historically, most advisory firms were relatively capital constrained (i.e., started without a war chest of dollars to spend on upfront marketing). They had a lack of dollars but an excess of time… which allowed them either to succeed with time-based marketing strategies or to substitute time and a brute force approach to make up for their lack of dollars.

Transaction Approach. Requires money (or substantial prospecting time in lieu of money) to keep campaigns funded.

Relationship approach. Requires time to keep relationships nurtured.

Expertise Approach. Requires mental energy to continuously learn and develop the thought leadership materials needed to build and maintain your standing as an expert.

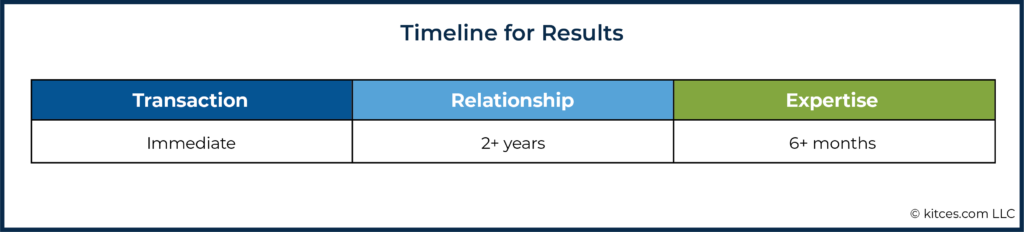

How Long Are You Willing To Wait To See Results?

"How long will it take for this to work?" is a common question in the realm of marketing. But the reality is that different marketing approaches have very different time horizons to begin to generate results. In part, this is a function of the inputs (money, time, or energy), and in part, it's simply a recognition of what it takes for the marketing strategy to gain traction with those it's aiming to serve.

Transaction Approach. Optimized campaigns can see results quickly. If you host a workshop, you can expect appointments the following week. If you have a radio show, you can usually expect to receive requests for appointments within days of the most recent show. Some online methods may take longer before you see results (such as local Search Engine Optimization), but when working, they can produce leads on a consistent basis. The fastest-growing firms I've worked with achieved their success by investing significant amounts of money toward the Transaction Approach.

Relationship and Expertise Approach. These approaches take much longer to see results since you must build momentum from your efforts. You can expect to spend at least six months, but more likely several years, nurturing relationships or establishing expertise before you see significant outcomes. The benefit of waiting is that once you have built momentum, your marketing will work with less effort and money (i.e., it is more scalable in the long term) than under the Transaction Approach.

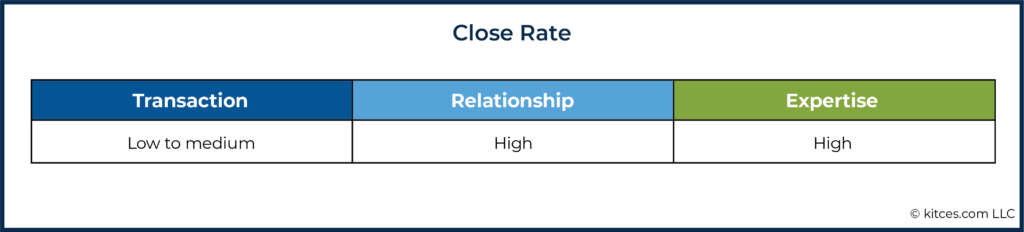

What Close Rate Is Acceptable To You?

A recent Kitces Research study on advisor marketing found that one of the biggest drivers of advisors' preferences for marketing strategies is their willingness to meet with and weed through 'low quality' leads to find the ones that are a good fit. This is important because some marketing strategies are more likely to produce a high volume of leads that the advisor must sift through, while others typically produce a lower-volume but higher-quality lead flow.

Transaction Approach. Your sales close rate will tend to be lower compared to the other two approaches. In our experience, this hovers around 50% or lower for qualified prospects. This is because trust and credibility have not been pre-established. In addition, you tend to attract more 'tire kickers' who are shopping around for options or looking for free advice. As a result, the Transaction Approach requires a higher volume of prospects than the other approaches to achieve the same outcomes. As mentioned, this approach, which produces a large volume of leads, is best suited for a sales culture.

Relationship and Expertise Approaches. Your close rate will be much higher for qualified prospects. Generally, in our experience, close rates are north of 75%. This is because you have already created trust through some sort of connection with the prospect, or you have gained credibility through your earned thought leader status.

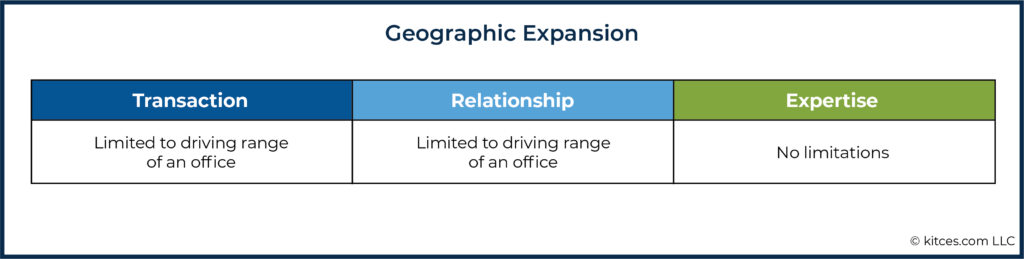

Do You Want To Expand Geographically?

Historically, the financial advice business was a local in-person business, almost by definition. But the reality is that the rise of the internet has made 'virtual relationships' increasingly feasible. For most advisory firms, this began with clients who would relocate away from the area but remain distant/virtual clients. Over time, it began to shift to non-local clients being referred to the firm. But today, some marketing approaches are built to generate new clients regardless of their geographic location.

Transaction and Relationship Approaches. With these approaches, you are generally limited to clients within the geographic region of an office. While you may get the occasional referral of a family member in a different state, or you may have clients who have moved after retirement, in general, it is difficult to direct enough resources to market to non-local prospects. To impactfully expand your reach to different cities and regions, you will need to establish new branch offices in your desired locations.

Expertise Approach. This approach generally has no geographic limitations. A prospect with a unique situation will work with an expert anywhere in the country who can solve their problem.

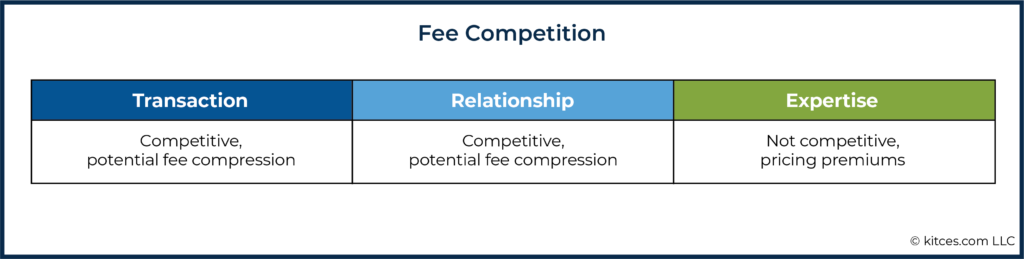

Are You Willing To Compete On Fees?

Transaction and Relationship Approaches. You are usually focused on a mass market, competing against similar firms for a similar audience with a similar message. Investors see you as replaceable and interchangeable with other firms they are researching (thus why they often search for a financial advisor by zip code or "financial advisor near me"… because advisors in their geographic area are viewed as interchangeable). As a result, you are playing in a highly competitive market and cannot carve out a defensible space in the marketplace. Widespread competition means that prospects can easily compare you against other firms, including making cost comparisons. This could potentially put pricing pressure on your firm in the long run, though for the Relationship Approach, ongoing client relationships tend to help support fees with existing clients (who rarely leave due to the ongoing relationship).

Expertise Approach. In contrast to the other approaches, marketing under an Expertise Approach will involve fewer (if any) competitors who can solve the problems for your niche like you do. Because you work in a niche, you will most likely create a proprietary process designed just for that niche that others won't offer. Prospects won't be able to compare what you do to other firms, and therefore can't compare your fees. The result is that you don't have to compete on price and can often charge a premium for your service.

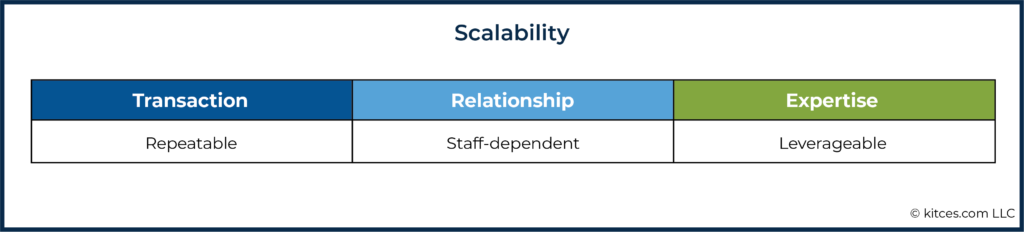

Do You Want A Scalable Marketing System?

Transaction Approach. One of the benefits of the Transaction Approach is that it is very repeatable. Once you find tactics that work, you can provide an input (usually money) and get an output (leads). Then you repeat this over and over… at least as long as the marketing environment remains consistent (for example, one set of tactics might have worked in the pre-COVID era, but a different set might need to be adopted in the COVID era). One caveat is that online marketing platforms are notorious for changing their algorithms without notice, and everything that was working for you in the past may no longer work going forward. As a result, transaction marketing is not only highly repeatable but also requires being constantly prepared to adapt to change quickly.

Relationship Approach. With this approach, you can gain momentum, but the input depends on staff time to keep the marketing going, whether it involves nurturing relationships or being involved in the community. This requirement makes it more difficult to scale this kind of marketing without adding staff. If you are satisfied with your firm's size and your growth goals are modest, then this staffing need becomes less of a concern.

Expertise Approach. Requires a significant amount of effort to position yourself as an expert—at least in the beginning. Over time, as you establish your reputation, the required effort decreases, and you can leverage your efforts as the reach of your expertise becomes more amplified over time. The input required is generally content-related, which you can eventually delegate or partially outsource.

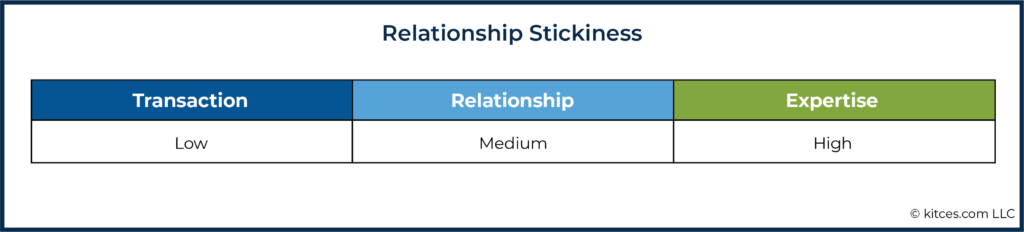

What Do You Want Your Client Retention Rate To Be?

Overall, RIAs I've worked with have very high retention rates (95%+). However, some approaches do have higher relationship stickiness factors than others.

Transaction Approach. Relationships with clients from the Transaction Approach will not be as sticky as with other approaches. It is not uncommon for firms attracting clients through public workshops to have those same clients switch to new advisors after the next chicken dinner workshop they attend.

Relationship Approach. Relationship stickiness is higher for this approach because there is usually an established relationship. Clients must be extremely dissatisfied to leave or must otherwise experience a disruption to the relationship (e.g., relocating, being transitioned to another advisor they don't feel as connected to, or experiencing a death or divorce of the client/spouse).

Expertise Approach. This approach will have the highest client retention rate since there will typically be few alternative options to what you offer; in other words, clients simply don't have many (or any) choices of where else to go to get a similar level of expertise. One big caveat is that, depending on your niche, clients may grow out of their need for your expertise. For example, if you work with the High Earners Not Rich Yet (HENRYs) market, clients may outgrow your expertise at some point and move to a new advisor who better understands their new situation.

Putting It All Together – Choosing The Right Marketing Approach

Now that you have reviewed the firm characteristics that are best suited for each approach and evaluated the pros and cons, it's time to choose your approach. Look back at your answers and determine which column—Transaction, Relationship, or Expertise—has the most boxes selected.

The column with the most checked boxes is probably the best match for your firm. If there is a tie, choose the one that you naturally gravitate toward—the one you mostly do now. After all, all three of these approaches can be successful when they receive the proper amount of focus. Remember, if you did not check the box for a niche market, the Expertise Approach will not be a viable option for you. Because the reality is that you can't be an expert in 'everything'… so if you can't decide who you will be an expert for, to learn how to address their particular problems with repeatable expertise, it's simply not feasible to scale an expertise marketing approach.

The graphic below offers a summary of the three marketing approaches, listing their focus, characteristics, and some commonly used marketing tactics used most effectively by each one.

Developing A Marketing Strategy Using Your Marketing Approach

Once advisors have selected the best marketing approach for their firm, the next step is to go deeper into that approach to fully capitalize on its effectiveness.

For example, let's say you identify that the Relationship Approach is the best match for your firm because you are in a close-knit community, have great relationships with clients and centers of influence, and have a reputation of generosity in your community.

To dive deeper into this strategy, you might decide to incorporate activities that aim to build and nurture relationships – the key focus of the Relationship Approach – and so you plan to have more client events and to ask clients who are prominent community members to provide video testimonials for your website under the new SEC rules. By choosing tactics that support the focus of the particular approach you select, you help gain more traction in your marketing.

Designing A Marketing Strategy Based On The Firm's Primary Marketing Approach

Looking back on the list of marketing tactics from the callouts at this article's beginning, you can start crafting a marketing strategy around those tactics without diving into tactics from the other categories.

Below are examples of strategies that can be used for each approach.

Sample Marketing Strategy: Transaction Approach

Direct Marketing

- Host two public workshops monthly and send direct mail invitations.

- Create a downloadable e-book and promote it using Facebook ads.

- Host a weekly radio show promoting workshops and free portfolio reviews.

Online Marketing

- Optimize your website for local Search Engine Optimization.

- Place Google Search ads.

- Place Google Local Services ads.

- Create profiles on all applicable "find an advisor" websites.

- Sign up for Zoe Financial and SmartAsset.

- Create a campaign to solicit reviews on sites such as Yelp and Google My Business to assist in the lead generation process.

Sample Marketing Strategy: Relationship Approach

Client Referrals

- Host monthly hybrid (online/in-person) Lunch & Learn workshops for clients.

- Host an annual holiday open house.

- Send biannual client surveys.

- Establish a client advisory board.

- Send a monthly newsletter with a market commentary, timely articles, and a variety of general topic articles to appeal to a diverse client base.

- Review the client experience for improvements.

COI Referrals

- Have each advisor meet with two COIs per month.

- Create marketing materials for COIs.

Community Involvement

- Have each advisor attend four in-person networking events per month (including volunteering, board meetings, chamber of commerce meetings, galas, etc.).

- Be the headliner sponsor for four local community events this year.

Online Marketing

- Create a process to solicit reviews or testimonials from clients for the website to help with the referral process.

- Send LinkedIn requests to all clients.

- Send LinkedIn requests to all existing and future COI relationships.

- Post general topic articles from the newsletter on social media.

- Post community involvement press releases and photos on your Facebook business page.

- Record and post video bios of all staff members on the website to create a connection with referrals researching the firm.

- Record and post a firm introductory video on the website to create a connection with referrals researching the firm.

Sample Marketing Strategy: Expertise Approach

Thought Leadership

- Write weekly blogs on the primary financial challenges the niche is facing and promote them on social media.

- Contribute one guest blog to an industry publication for the niche per quarter.

- Be a guest on one niche podcast per quarter.

- Send monthly newsletters to prospects, clients, and COIs featuring blog content.

- Develop a pre-recorded webinar on the most important topic facing the niche and make it available on-demand on your website.

- Spend 15 minutes each weekday reviewing your niche's community forums and social media groups and answering any questions.

- Speak at two niche conferences per year that your prospects attend.

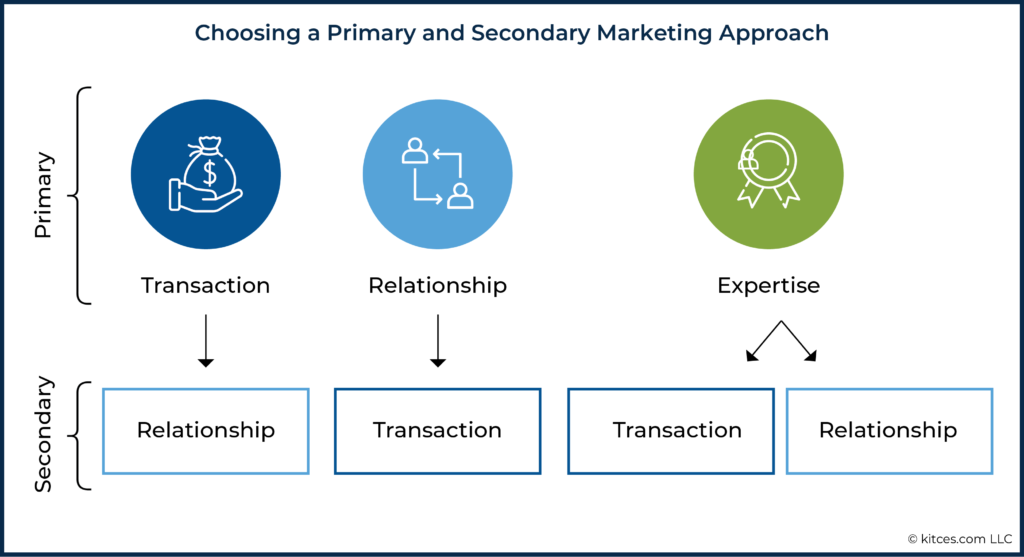

When Integrating A Secondary (Transaction Or Relationship) Marketing Approach Can Support Your Primary One

At this point, you may be thinking to yourself, "I do a little bit of all three approaches." It is not uncommon for firms to blend the different approaches into their marketing strategy, but usually, not all the tactics are producing results. Because the downfall with combining approaches is that you aren't putting enough time, money, or energy into the one approach that is best suited for your particular firm to make it truly successful.

In investment terms, your marketing portfolio may be "over-diversified" by dabbling in each, just hoping one of them will pay off… but not investing enough in any of them to grow to its maximum potential. That being said, there are times when you will want to integrate tactics from a secondary approach, particularly if the secondary approach still supports and complements the primary marketing strategy.

Let's look at an example. I work with an advisor who is implementing an Expertise Approach and has written a book for his niche market. However, since he is not yet well-known within his niche, he uses a direct-response LinkedIn campaign (Transaction Approach) to offer free copies of his book to his niche. Although he is pursuing an Expertise Approach, he supports it by implementing a Transaction Approach tactic to get in front of his niche market, while he builds his reputation as a thought leader in that community to the point that eventually, his niche may find its way to him (without the Transaction Approach outreach).

When choosing a primary and secondary approach, you should note that the Expertise Approach can never serve as a secondary. It can only be a primary. Its focus is just too different.

Consider it this way: With the Expertise Approach strategy, you are not an expert in all things to all people. Instead, you focus on a narrow set of clients and solve only their problems. That means expertise strategies won't support the other two approaches since they focus on a wide audience with a wide variety of problems.

If you believe a secondary approach will directly support your primary, start adding in the activities from your secondary that will enhance your primary approach.

Let's reference my example where you identified that the Relationship Approach is the best match for your firm. You are in a close-knit community, have great relationships with clients and centers of influence, and enjoy a reputation for generosity in your community. You have decided to dive deeper into this strategy by incorporating more client events and having clients who are prominent community members provide video testimonials for your website under the new SEC rules.

Now you feel that some tactics from the Transaction Approach could directly support your primary Relationship Approach. You want to spread the word about your excellent client service and stellar reputation, so you ask your clients to provide you with reviews on Google My Business and Yelp so that referrals who research you can see what other people have to say. In addition, your firm is highly visible in your town through your networking and community involvement, and you want to translate that dominant visibility to the online community through a local Search Engine Optimization strategy.

The goal for both the reviews and the local SEO is not to drive cold leads by using a Transaction Approach (though that might be a byproduct); instead, the goal is to reinforce your Relationship Approach. Similarly, with Transaction or Expertise Approaches, your secondary activities should reinforce your primary focus.

Transitioning To A New, Better-Fit Marketing Approach

If you are dabbling in two or three approaches and see the benefit of committing to a more focused marketing approach, you don't have to make the transition all at once. Instead, maintain what you are currently doing, but set the intention that all new marketing investments of time, money, and energy will be focused on your new primary approach—and stick to that intention. As you begin seeing more success from your new primary approach, you can start eliminating tactics that don't directly support your approach.

For example, let's say you have primarily focused on a Transaction Approach to build your business from the ground up and have successfully built a large client base using Transaction Approach strategies. However, you now want to transition from a Transaction Approach to a Relationship Approach to decrease the high percentage of your revenue spent on marketing.

As you plan the transition, you can continue to maintain your current marketing activities but focus all new marketing efforts on Relationship Approach tactics such as client referral programs. This will mean that, during the transition, you will need to spend additional time on marketing strategies to support multiple approaches. Since most RIAs have stable and recurring revenue, this transition is pretty low risk if the company is profitable and financially stable.

The hardest transition is for firms that shift to an Expertise Approach. Advisors usually fear that focusing on one niche market will alienate their existing clients who don't fall into the niche. They also feel alarmed by the idea of turning away business that does not fit the niche.

When making the transition to an Expertise Approach, consider following a similar process to that which large corporations use to bring a new product to the market. They start by first researching their target customer, then brainstorm product ideas, develop a prototype, and test and refine their product. Once they have a proven concept, only then do they fully invest in marketing the product.

Firms interested in shifting to an Expertise Approach should follow this same process:

- Research: Understand the primary financial concerns and pain points, as well as the goals and aspirations of your niche.

- Brainstorm: Write down key messages that would resonate with your niche and the services they may need.

- Prototype: Develop a double-sided, one-page brochure and/or a landing page on your website for your niche based on what you uncovered in the brainstorming step.

- Test: Present your brochure and/or landing page to your existing niche clients and centers of influence and get their feedback on whether you are on to something (or not).

- Implement: If you receive an overall positive response, apply the feedback you received to your brochure and landing page. Then start promoting your expertise to your niche using the Expertise Approach tactics mentioned above.

The first niche market you try may not be a winner. It may take two or three tries to find the niche that works for you. Even once you begin implementing, don't do anything that will alienate your current client base or stop you from taking on other profitable clients. Maintain what you are doing but focus your new efforts on building out an Expertise Approach for one niche market. Once the niche becomes wildly successful (which can take years), you can then address transitioning non-niche clients to other advisory firms if you wish.

Adopting an overall approach to your marketing strategy can help you narrow in on the appropriate marketing tactics for your firm. Advisors can follow these steps to ensure they are on the right track:

- Determine the marketing approach that is the best match for your firm after weighing the pros and cons for each of the three approaches.

- Focus your marketing strategy to dive deeper within this one approach.

- Use secondary approach tactics only when they directly support your primary approach.

- Maintain your current marketing activities while you commit all future marketing investments of time, money, and energy to your new approach.

- Shift your marketing to a single approach once you have gained traction.

No matter which approach you use, the concentrated focus will provide you greater clarity around your strategy and tactics, and will also help you achieve greater results from your marketing efforts!

Great article. Thanks for the information. As Advisors assess marketing options, there are a few other considerations to take into account as you suggest. What is the objective of the marketing? Is it to generate leads? engage clients? Build awareness? The objective should drive the decision. If its leads, the target audience is critical. Advisors seeking HNW vs. Retirement vs. Young Professionals, all differ in approach. Also, the type of spend requires different ROM (Return on Marketing). For example, a commission based advisor will have more to subsidize than fee-based. In all, if looking to generate leads, it all comes down to cost per appointment held. Don’t get fooled by social, email, content and flashy tools called “Marketing Automation”. It’s outcomes that matter. At White Glove, we decided to do marketing for advisors (Done For You) as to better manage these outcomes and not get caught up in the tool. In then end, as you mention, many approaches and tactics to consider.

When I talk to financial advisors who struggle with marketing and growth, I often start with one or more of these questions: So, what kind of investment portfolio do you think a marketing professional recommends? What type of financial planning software does a social media marketing expert use? Silly, right? They don’t know anything about financial advice and wealth management. So why does a financial advisor who has little to no background in marketing and sales think they can, or should, build a business around something they have no real knowledge of or expertise in?!

Basic marketing skills (webinars, mass mailings, phone books, country clubs, etc.) for a sole proprietor are one thing – building a business with a staff/payroll, an office lease, maybe next generation owners, and 300+ clients who depend on your business for the lifetime of their wealth is another. Like financial advice, marketing is an important and unique skill set – something I learned as a business owner the hard way!

Our consulting teams have a simple saying: let advisors advise; let sales sell; let marketing market; let leaders lead. At some point, and the sooner the better, turn the marketing functions over to a professional with an appropriate budget to do that job right and grow your business in a sustainable manner year over year. That’s one of the key differences we see in book builders and business builders.

Isn’t soliciting client reviews against the regulatory rules?

Brad – On May 4th, the new SEC Marketing rule became effective, opening the door for SEC Registered Investment Advisers to solicit client reviews – once they are fully compliant with the rule.

State registered investment advisers generally cannot yet solicit reviews pending individual state regulatory determination if they will align to the new SEC rule (Rumor is Missouri may be relatively quick to align to the new SEC rule, so you may be in luck. Chris Stanley is a securities attorney based in MO knowledgeable in this area if helpful to you).

FINRA registered representatives have had the ability to solicit reviews subject to conditions.

My company, Wealthtender, launched Certified Advisor Reviews on May 4th as the first financial advisor review platform designed to be fully compliant with the new SEC rule. You can learn more about our offering by visiting this page. I’d also be happy to jump on a Zoom call with you if you’re interested in finding time on my calendar when convenient for you. It’s an exciting opportunity for advisors to begin using online reviews to grow their business, and combined with the other very thoughtful marketing ideas suggested in this article, will help increase conversion rates from cold prospects to warm leads, especially for advisors focused on a niche and looking to attract clients nationwide.

Very helpful. Thank you Brian.