Executive Summary

In 2014, the Affordable Care Act (also known as “Obamacare”) established state health insurance programs with the intent to make health insurance accessible to all individuals and families – including the self-employed – without needing to obtain coverage through a (larger) group employer. For those with lower income who may not be able to afford coverage from the state marketplaces, the Affordable Care Act also established the Premium Tax Credit (PTC; also known as the Premium Assistance Tax Credit, or PATC), a fully refundable Federal income tax credit meant to subsidize the cost of insurance premiums for individuals who purchase insurance through the Health Insurance Marketplaces. The PTC provides support by effectively capping health insurance premiums (for the second-lowest-cost Silver health plan available in their state) to a certain percentage of the individual’s household income, calculated on a sliding scale for those earning up to 400% of the Federal Poverty Level (which amounts to $104,800 for a family of 4). Though because of the unique control that self-employed individuals have over the income and expenses of their businesses, they have a unique opportunity to make business decisions that can also help maximize their ability to receive Premium Tax Credits.

In this guest post, Vinicius Hiratuka, founder of Elevated Retirement Financial Services, examines planning strategies that self-employed individuals can use to manage their reportable income levels in order to qualify for the Premium Tax Credit, and maximize the amount of the PTC they receive.

Maintaining income levels within the allowed threshold to qualify for the PTC in the first place - between 100% and 400% of the Federal Poverty Limit (FPL) - is crucial because as little as a single dollar of income over the 400% FPL will result in the complete loss of the PTC.

Maximizing the PTC (once meeting the FPL-qualifying threshold) is largely influenced by managing above-the-line tax deductions (that affect the calculation of an individual’s AGI used to determine the PTC in the first place). As such, self-employed individuals often have greater flexibility to employ tax-savings strategies through business expense and retirement contribution planning, such as accelerating business expenses (e.g., at the end of the year) to reduce income and contributing to Health Savings Accounts (HSAs) and/or tax-deferred retirement accounts, which can be used to increase above-the-line deductions, and thus reduce their income for purposes of calculating the PTC itself, thereby increasing the amount of the PTC benefit being received.

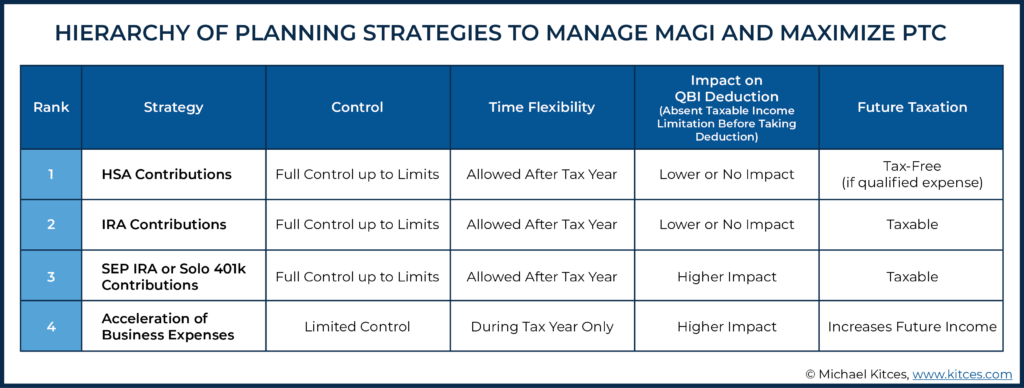

However, financial advisors should assess if and how their planning strategy will affect both their self-employed clients’ PTC benefit and also their Qualified Business Income (QBI) deduction. For example, while a Solo 401(k) contribution may decrease income (which both improves the PTC and reduces the Federal tax liability), the reduced income may also make the QBI deduction lower. As a result, making contributions to a Traditional IRA account instead of a Solo 401(k) could be even more beneficial, as the result would still reduce MAGI to increase the PTC, but would not reduce the QBI deduction for the self-employed individual (as IRA contributions are considered personal and, technically, not business-related contributions).

Ultimately, financial advisors can help clients by simply clarifying what health insurance options and potential Premium Tax Credit assistance is available to them. This can help the client understand how the PTC benefits their tax situation, and at the same time alleviate the fears that many clients who are considering self-employment have about the high cost of health insurance for self-employed business owners. Advisors can also add value for their clients by walking them through detailed tax projections that illustrate how the PTC (and other deductions and credits) play into their overall tax liability. Not only does this provide potential opportunities to strengthen the relationship with clients’ tax professionals, but at the end of the day, the collaborative efforts will ensure that the client has a more holistically prepared financial plan, and health insurance they can afford to keep!

Because health insurance for those of working age has historically been tied to employment, obtaining health insurance can be a significant challenge for those who are self-employed (particularly if they’re not able to access coverage through a spouse’s employer). The Affordable Care Act (also colloquially known as “Obamacare”) took effect in 2014 and was intended to help make health insurance more accessible by allowing anyone, including the unemployed and the self-employed, to access health insurance directly through the state-based Health Insurance Marketplaces (also known as “insurance exchanges”). And to help ensure that the health insurance remained affordable, the Affordable Care Act also provided a tax credit to subsidize the cost of insurance premiums for lower-income individuals who purchase insurance through the Health Insurance Marketplaces.

The reality, however, is that the Premium Tax Credit (PTC), created by the Affordable Care Act, is available even to families with a relatively ‘good’ income. The self-employed, especially, have many tools at their disposal to control their income levels for purposes of qualifying for and determining the amount of the PTC. Therefore, many self-employed clients of financial advisors (and in practice, many advisors themselves) can reap the benefits of the PTC and take it into account in their tax planning.

What is the Premium (Assistance) Tax Credit (PTC/PATC)?

The Premium Tax Credit (PTC), also known as the Premium Assistance Tax Credit (PATC), is a Federal income tax credit provided specifically to help offset the premium cost of health insurance purchased through state insurance exchanges. Furthermore, the PTC is generally paid in advance – as health insurance premiums themselves are paid – rather than simply receiving it at the time of tax filing like may other tax credits.

The PTC is unlike many other income tax credits, though, in that it is usually not received directly by the taxpayer; instead, the credit is usually paid directly to the health insurance provider on behalf of the taxpayer. The health insurance company then bills the individual only for the remaining portion of the insurance premiums not already covered by the PTC.

To receive the Premium Tax Credit, health insurance must be acquired through the Health Insurance Marketplace. In addition, the covered individual (and/or their spouse) cannot have access to affordable health insurance through an employer (i.e., PTCs are only available for those who must buy health insurance through a state insurance exchange, not those who could obtain coverage through an employer and simply choose to do so via the Marketplace).

Individuals can calculate their PTC based on estimated household income levels and determine what their share of the premium obligation will be. Each month, the credit is automatically applied to their health insurance premiums.

At the end of the year, after all of the annual premium has been paid, the taxpayer will receive Form 1095-A, Health Insurance Marketplace Statement, issued by the Marketplace. This form includes information regarding the premiums paid and PTC used, which is needed to complete Form 8962 (Premium Tax Credit) to be filed with the annual Federal tax return (Form 1040). This Form 8962 calculates exactly how much the taxpayer’s PTC will be, based on final income numbers for the year, and effectively 'trues up' the estimated PTC received throughout the year.

If the taxpayer received more in PTC advances than the final calculated credit, the overpaid credit is added to the individual’s tax bill (i.e., the excess credit received must be repaid at the end of the year). Similarly, if the taxpayer received less than the final credit amount, then any unused credit will offset the individual’s tax liability, or be added to the refund amount (if their tax bill is already reduced to zero), making the PTC a fully refundable credit.

How is the PTC Calculated Using Household Income?

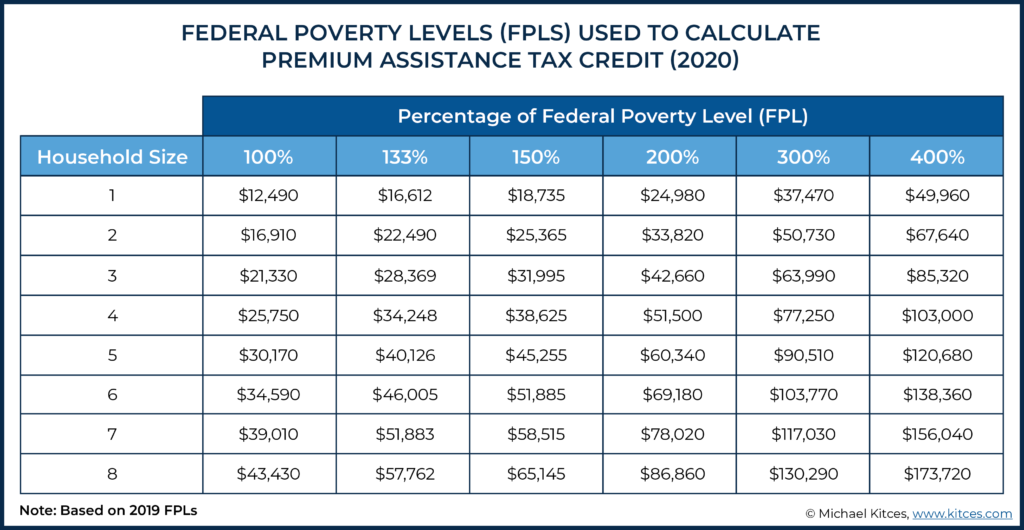

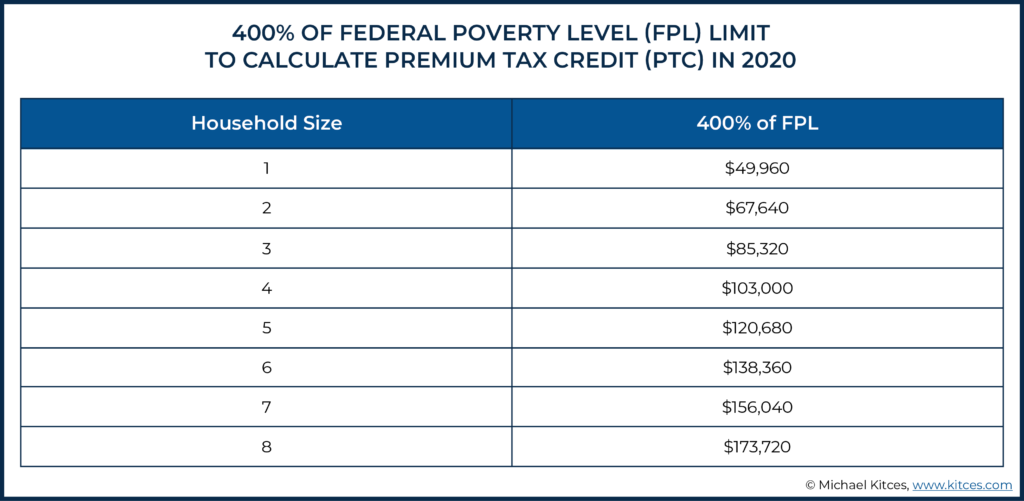

The PTC is calculated based on a household’s income levels relative to the previous year’s Federal Poverty Level (FPL), which is adjusted for inflation and issued each year by the U.S. Department of Health and Human Services. The FPL increases with the number of people in the individual’s household.

Instructions to Form 8962 provides three different FPL tables. The one used throughout this article, and to calculate the table above, represents the FPL table for the 48 contiguous states and the District of Columbia. The two other tables are for Alaska and Hawaii, which have their own threshold amounts due to their unique local cost of living dynamics.

Income must be between 100% to 400% of the FPL to qualify to receive the Premium Tax Credit, which effectively limits health insurance premium expenses to a certain percentage of the individual’s household income.

Notably, the Premium Tax Credit is only available for those between 100% and 400% of FPL, which means a single dollar of income above the 400% of FPL threshold would result in someone losing the entire PTC (and/or having to pay back all advanced credits previously received (even if they were already paid to the insurance provider), costing potentially thousands of dollars for just one extra dollar of income!

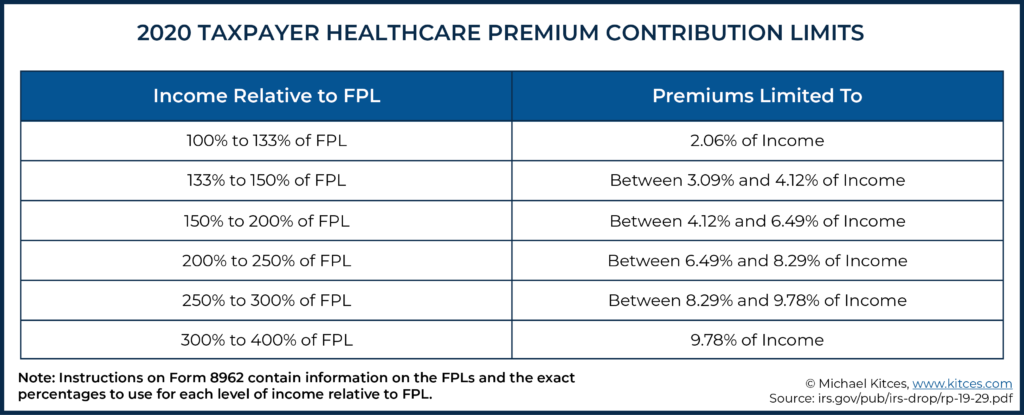

The amount of the Premium Tax Credit is generally equal to the excess of the premium for the second-lowest-cost Silver Health Plan available through the state insurance exchange over a certain percentage of household income (effectively capping the premium at that percentage of household income, with the PTC covering all premium obligations above that threshold). In turn, the applicable income thresholds themselves are calculated on a sliding scale as a percentage of the household’s income relative to the FPL.

Nerd Note:

Instructions on Form 8962 contain information on the FPL’s and the exact percentages to use for each level of income relative to FPL.

Example 1: Luke and Isabella are married and have two kids. They own and operate their own family business, and their household has estimated income for PTC purposes of $90,000 per year. The 2019 FPL (which is the figure used to calculate the 2020 PTC) for a family of 4 is $25,750. Thus, their income is 350% of the FPL.

If the premium for the second-lowest Silver health plan in their state is $1,200 per month (or $14,400 per year) for a family of 4, their premiums wil be capped at 9.78% (based on the contribution limit sliding scale for the PTC) x $90,000 (household income) = $8,802. As a result, their PTC will be $14,400 (annual premium) – $8,802 (cap based on household income)) = $5,598.

Notably, if Luke and Isabella actually selected the high-deductible health plan option, also available through the Exchange, at $1,000 per month (or $12,000 per year), their PTC remains $5,598 (based on the second-lowest-cost Silver Plan, even if they actually bought a cheaper plan). As a result, the credit of $5,598 ÷ 12 = $466.50 per month will automatically be applied to the premium of their actual (high-deductible) health insurance plan each month. Accordingly, they will pay $1,000 – 466.50 = $533.50 per month ($6,402 per year).

When they file their tax return for 2020, if their household income for PTC purposes ends up being $85,000, or 330% of the FPL, their PTC would be re-calculated at $14,400 – ($85,000 x 9.78%) = $6,087 and they would receive an additional $6,087 – $5,598 = $489 in tax credit to offset their tax liability.

If their income was $95,000 instead (higher than originally projected, and 369% of the FPL), their PTC would have only been $5,109 ($14,400 – [$95,000 x 9.78%]), and $489 would be added to their tax liability as a mechanism for them to repay the amount of credit they received in advance above their actual credit amount.

The Household Income Definition for Determining PTC

The key to planning for PTCs is understanding the definition of income used in the calculation, which is slightly different from the traditional (Modified) Adjusted Gross Income (MAGI or AGI) definition used for other tax credit and deduction thresholds.

For purposes of calculating the PTC and FPL, “income” is Adjusted Gross Income (AGI) on the tax return, plus certain income items not subject to tax (specifically, any foreign earned income or tax-exempt interest, and any non-taxable portion of Social Security benefits).

Example 2: Continuing with the earlier example of Luke and Isabella in a household of 4, let’s assume that business revenue this year was higher than expected, and their income estimate for PTC purposes was $103,000, which is right at the maximum FPL threshold for a family of 4. At this income level, their PTC will be $14,400 – ($103,000 x 9.78%) = $4,327.

For their high deductible plan at $1,000 per month, they would only pay $1,000 – $360.58 = $639.42 each month ($7,673.04 per year). The credit of $360.58 per month would be applied automatically towards their monthly premium.

If their MAGI for PTC purposes for the year was $103,001 (or more) when they file their return, though, they would exceed the 400%-of-FPL threshold, and thus would lose the full $4,327 in PTC!

Notably, the one extra dollar of income has cost the couple $4,327 in lost tax credits in this situation. Making things worse, the couple would likely have already received and used the money throughout the year to subsidize health insurance premiums. Therefore, they will actually have to pay the government out of pocket (or reduce their refund) an additional $4,327! Not a great feeling for any client and small business owner!

Premium Tax Credit (PTC) Planning for the Self-Employed

Because the PTC is based on (and disappears as a result of too much) income, strategies that change income can avoid the cliff phase-out of the PTC, and/or increase the amount of PTC received upon reconciliation from tax reporting.

Notably, though, because of the MAGI formula used for income in the calculation of the PTC, below-the-line deductions such as charitable donations and home mortgage interest, which are subtracted from Adjusted Gross Income (after it’s already calculated) will have no impact on planning for the Premium Tax Credit itself. Rather, above-the-line deductions, such as business expenses and also retirement contributions, are what will impact the PTC calculation, and should be the focus for PTC planning.

Interestingly, self-employed clients who must often buy expensive health insurance coverage on their own, are the ones that have the most variable (and difficult to estimate) income, but also have more planning strategies and control available to them to reduce such income because of the flexibility that self-employed individuals have to employ tax-savings strategies (e.g., control over whether to implement a small business retirement plan or not).

Example 3: Back to Luke and Isabella’s household, let’s assume the business does exceptionally well, and their AGI for purposes of the PTC ends up being $120,000, well above the estimated $103,000 they used as an estimate to receive the PTC (and above the 400%-of-FPL threshold to be eligible for the PTC at all).

The couple uses the $24,800 standard deduction and has taxable income of $95,200. This would put them in the 22% tax bracket, with a Federal income tax liability of $12,524. If they previously claimed advanced Premium Tax Credits of $360.58 per month (anticipating their income would be at the $103,000 threshold), they would have to pay back the $4,327 they received for the full year.

However, let’s also assume there are additional business expenses that can be claimed as above-the-line deductions of $17,000. This would bring their MAGI right below the cut-off for PTC at $103,000. By taking $17,000 of additional business deductions, not only would they receive the direct tax benefit of $3,535 (a marginal tax benefit of roughly 21% on that deduction [$3,535/$17,000], which mostly reduces the amount of income within the 22% tax bracket and a little into the 12% tax bracket), but they would also be entitled to the $4,327 PTC, not having to pay any of it back.

In total, the federal tax benefit of the $17,000 worth of deductions would be $7,862, a whopping 46% marginal tax benefit for the tax deduction (even though the couple is only in the 22% tax bracket)!

Importantly, when accounting for PTCs, above-the-line tax deductions not only generate the usual tax deduction benefits but also decrease income for calculation of PTC itself, potentially increasing the amount of credit received (as lower income levels also have a lower percentage-of-income cap when calculating how much in health insurance premiums must be paid out of pocket before the PTC kicks in). This means the marginal value of an above-the-line deduction for someone already in the income zone to claim PTCs could also be significantly higher than usual.

Example 4: Judah and Margaret are married and have one child. Their MAGI for PTC purposes is $70,000, the same as they had estimated when applying for health insurance through the exchange, and is 328% of the $21,330 FPL for a family of 3.

The couple takes the standard deduction of $24,800 and thus has taxable income of $45,200, resulting in a Federal income tax liability of $5,029. The premium for the second-lowest Silver health plan in their state was $1,200 per month (or $14,400 per year), and this was the plan they chose. Their PTC was $14,400 – ($70,000 x 9.78%) = $7,554.

If they were able to take an additional $10,000 above-the-line deduction, their MAGI would decrease to $60,000, and their federal income tax liability would be reduced by $1,200 (12%). However, their lower MAGI would now be 281% of the FPL, which would also favorably impact their PTC calculation!

The new calculation shows that their PTC would now be $14,400 – ($60,000 x 9.21%) = $8,874, an increase of $1,320 of additional tax credits. (Table 2 in the instructions for Form 8962, once updated for 2020, would indicate that an applicable figure of 9.21% should be used at this MAGI relative to the FPL level. Alternatively, it is possible to manually calculate the applicable percentage based on the ranges in the contribution limits table.)

In total, the couple receives a $2,520 tax benefit for the $10,000 deduction, a 25.2% marginal benefit for a tax deduction of a taxpayer who was “just” in the 12% tax bracket!

Straightforward Tax Strategies to Manage Income for PTC Purposes

With the potential for outsized marginal benefits from above-the-line tax deductions, advisors should be ready to help clients who claim the PTC, especially if they are near the ‘cliff’ at 400% of the FPL, and/or have highly variable income.

Self-employed individuals have a great set of straightforward tax strategies that can be easy to use and give a lot of control over their income for PTC, many of which will also help accomplish their other financial goals. These strategies may be used by themselves or in combination to achieve the desired outcome.

Accelerating Business Expenses (Especially Near The End Of The Year) To Reduce Income For PTC Purposes

Self-employed individuals have the ability to claim business expenses on Schedule C of their tax return, and most utilize the cash basis tax method. If they needed (or wanted) additional deductions to decrease their MAGI for the PTC, one of the ways to reduce income is simply by accelerating business expenses that otherwise might not have been paid until the following year.

The downside of this strategy, in comparison to other methods, is that it must be completed during the tax year itself (i.e., before December 31st, to count as a cash-basis expense for the current year), and before final income numbers are available (i.e., before it’s fully known if or how much benefit will really come from accelerating such expenses into the current year). In addition, by accelerating expenses, the client could have increased income in future years (where the deduction no longer occurs because it was taken in the current year instead). Which means, to say the least, self-employed clients and advisors should wait until late in the year to assess the benefits of accelerating future business expenses and take into account the possible impact on future years.

Example 5: Ross is self-employed and provides consulting work to companies in various industries.

If Ross is looking to buy a computer early next year for $2,000, and his projected MAGI for PTC is just slightly above 400% of the FPL, Ross could purchase the computer in December of the current year, to claim the deduction this year and get his income under the 400% FPL threshold.

Depending on his income level and health insurance premiums, the difference between receiving and not receiving the credit could pay for the whole computer itself!

This decision can make a lot of sense, especially if his income is expected to be lower for next year (less value to the deduction and he is probably still able to claim PTC), or significantly higher (to a point where he may not be taking the credit anyway). Many times, these factors may not be predictable, but it’s still important to consider the potential impact any accelerated expenses may have on future years. Though either way, an immediate tax credit that could be more than the entire cost of the computer in the first place is a hard deal to beat!

Self-Employed Contributions To Health Savings Accounts (HSAs) To Reduce Income For PTC Purposes

For many families and individuals, especially ones taking advantage of the PTC, a High-Deductible Health Plan (HDHP) could make a lot of sense, depending on the insured’s goals, preferences, health, and financial situation. Being on an HDHP would allow the family or individual to contribute to a Health Savings Account (HSA), and get an above-the-line deduction for those contributions.

Given the triple tax benefit of HSA’s, it can be one of the best places for clients to put their savings. It provides the desired deduction upfront, along with tax-deferred growth and tax-free distributions (if spent on qualified medical expenses).

The HSA provides the most flexibility as it can be used tax-free at any time for qualified medical expenses. After age 65, the account can be used for anything without penalties, but only distributions for qualified medical expenses will be tax-free. In addition, unlike business expenses, clients have until April 15th after the tax year to make contributions to their HSA’s, giving them the opportunity to see exactly what their MAGI will be and the benefit of getting the deduction for purposes of the PTC, before actually deciding whether to make the contribution.

HSA contributions can be up to $3,550 (2020) for individuals and $7,100 (2020), for families with a $1,000 catch-up contribution available for those who are 55 or older.

Tax-Deferred Retirement Accounts (IRA’s, SEP IRA’s, And Solo 401k’s) For Above-The-Line Deductions To Reduce PTC Income

Last but not least, self-employed individuals can utilize tax-deferred retirement accounts to lower their MAGI for purposes of the PTC. As with HSAs, contributions to retirement accounts can be made after the year is already over – by April 15th for IRAs and by the due date of the tax return (including extensions) for employer plans such as SEP IRAs and Solo 401(k)s.

In addition, these tax-deferred retirement plan accounts allow for much larger pre-tax deductions if the money is available to make a contribution. For example, with a SEP IRA or Solo 401(k), a self-employed person could contribute up to $57,000, depending on their income, with an additional $6,500 catch-up contribution available for those who are 50 or older. For IRAs, each individual can contribute up to $6,000 and an additional $1,000 in catch-up if 50 or older.

Deductibility of IRA contributions for those who are active participants in an employer retirement plan, including their own SEP IRA or Solo 401(k), will depend on income levels; however, many households that could take advantage of PTC may also be able to take a deduction on their IRA contributions. Because of the flexibility and high contribution limits, these retirement accounts can also be a great tool for clients that may have higher income, but still want to take advantage of the PTC, and again will receive a ‘magnified’ deduction thanks to both the tax deduction itself, and the higher PTC that results from a lower AGI.

Example 6: Jordan is 44 years old, single, and has two children. She is a high-powered swim instructor, receiving all of her pay through 1099 income.

She purchases the second-lowest Silver health plan in her state for premiums of $1,200 per month (or $14,400 per year) through the Marketplace. Because she is a high earner, she does not qualify for advanced PTC based on her estimate of income.

Jordan’s 1099 shows $130,000 in earnings for the year, her only income, and she did not claim any expenses. Her MAGI for PTC at the end of the year is $120,000. A SEP IRA would only allow Jordan to contribute $24,163; however, a Solo 401k would allow her to contribute up to $43,663.

400% of FLP for a household of 3 is $85,320. Jordan could contribute $34,680 towards her retirement goals through a solo 401(k), and it would qualify her to receive $14,400 – ($85,320 x 9.78%) = $6,056 in PTCs, in addition to normal tax deduction benefits of contributing to the retirement plan!

Interactions Between The Premium Assistance Tax Credit and The Qualified Business Income (QBI) Deduction

In addition to the advantages and disadvantages of each of the planning strategies mentioned above, advisors and their self-employed clients should be aware of how these PTC strategies may or may not reduce the QBI deduction for the self-employed.

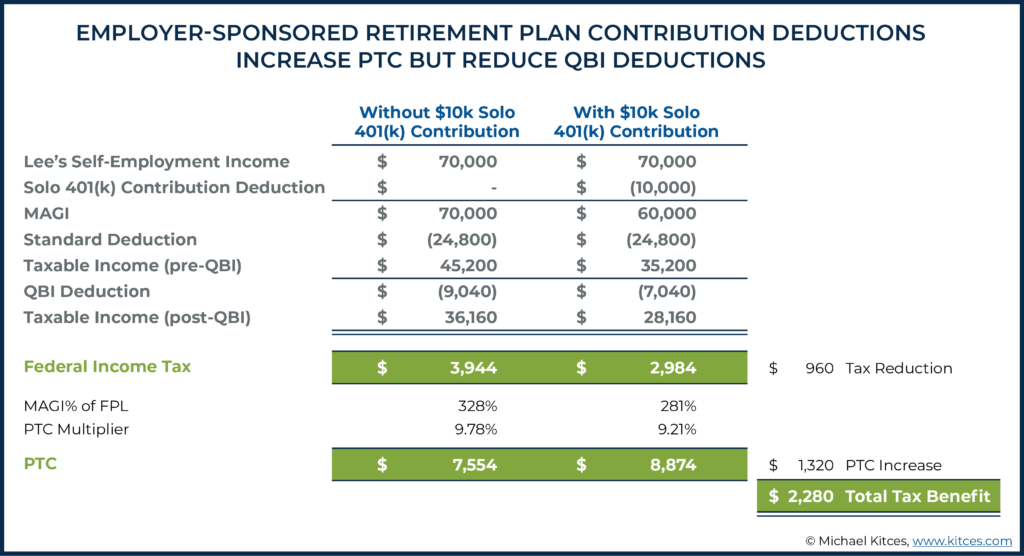

Notably, reducing the QBI deduction will have no impact on the PTC, as the QBI deduction itself does not affect the MAGI calculation (since it is calculated as a ‘below-the-line’ deduction after AGI is already determined). However, deductions that increase the PTC may still have their marginal benefits lowered as a result of reduced QBI deduction.

Example 7: Lee and Caroline are married and have one child. Their MAGI for PTC purposes is $75,322 (Lee’s gross self-employment income) – $5,322 (deduction for one-half of Lee’s self-employment taxes) = $70,000, the same as they had estimated when applying for health insurance through the Exchange.

The FPL for a family of 3 is $21,330, which means the 400%-of-FPL threshold is $85,320. The couple takes the standard deduction of $24,800, and has taxable income, before they take the QBI deduction, of $45,200. Their QBI deduction will be $9,040, (the lesser of 20% of their self-employment income, or 20% of their taxable income before QBI deduction), bringing their taxable income down to $36,160. They have a federal income tax liability of $3,944.

The premium for the second-lowest Silver health plan in their state is $1,200 per month (or $14,400 per year). They choose a High-Deductible Health Plan instead at $1,000 per month ($12,000 per year). Their MAGI of $70,000 is 328% of their $21,330 FPL, so their PTC is $14,400 – ($70,000 x 9.78%) = $7,554.

If they were able to take an additional $10,000 above-the-line deduction via Lee’s Solo 401(k) plan, they would bring their MAGI down to $60,000, which would be 281% of the FPL. At this MAGI, and relative to the FPL level, their PTC would be $14,400 – ($60,000 x 9.21%) = $8,874, an increased credit of $1,320. (Again, Table 2 in the instructions for Form 8962, once updated for 2020, would indicate that an applicable figure of 9.21% should be used at this MAGI relative to the FPL level.)

The contribution of $10,000 to Lee’s Solo 401(k) would, however, also decrease their QBI deduction to $7,040 (down from the original $9,040), which means that, for Federal income tax purposes, the $10,000 solo 401(k) contribution and deduction were effectively only worth $8,000 (a $10,000 retirement contribution deduction offset by $2,000 of foregone QBI deduction). An $8,000 reduction in taxable income puts them at $28,160, and their federal income tax liability at $2,984. Thus, the $10,000 contribution to the Solo 401(k) only reduces federal income tax liability by $960, which is a 9.6% marginal tax benefit on the contribution for a taxpayer otherwise in the 12% tax bracket.

However, when taking into account the increase in PTC of $1,320, the total tax benefit is really $2,280, a 22.8% marginal tax benefit on a $10,000 deduction for a taxpayer in the 12% tax bracket!

Notably, in this specific scenario, due to the taxable income limitation on the QBI deduction, any of the above-mentioned planning strategies would yield the same reduction to QBI and, ultimately, the same tax benefit.

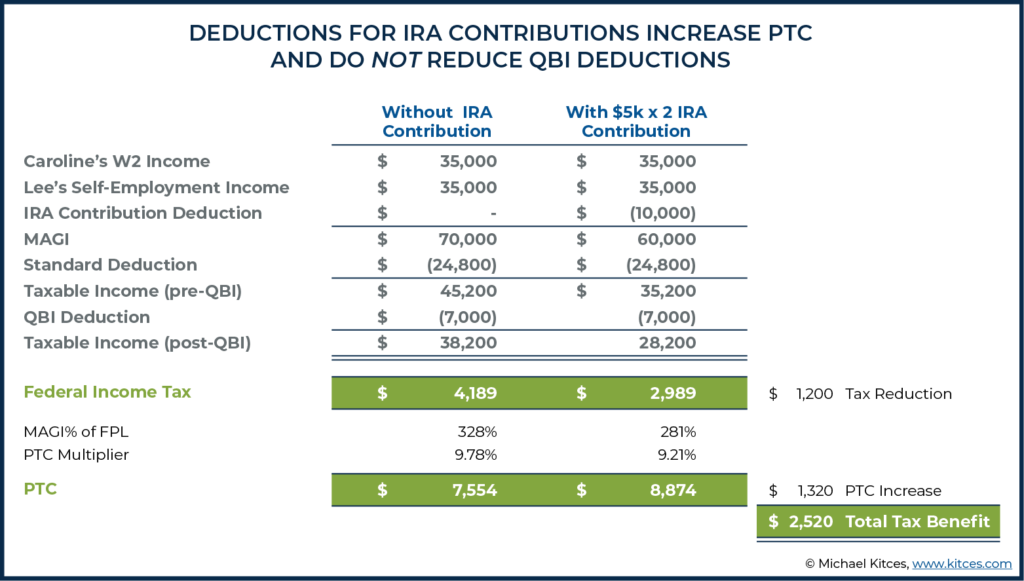

Depending on where contributions are made can also have a substantial impact on overall tax savings. Since the QBI deduction is based on net income for the business, tax-deductible employer-sponsored retirement plan contributions decrease the profits on which the QBI deduction is based, while contributions made to an IRA account instead of a Solo 401(k) account do not (since they are personal and, technically, not business-related).

As a result, substituting IRA contributions for employer retirement plan contributions can prevent the QBI deduction from being reduced, while still obtaining the benefits of the deduction for retirement plan contributions in the PTC calculation.

Example 8: Again using Lee and Caroline’s family from the prior example, let’s assume instead that their $70,000 in MAGI is composed of $35,000 in income from Caroline’s part-time W-2 job and $35,000 from Lee’s self-employment ($37,661 before half of the self-employment tax deduction).

Their QBI deduction will be $7,000 (20% of $35,000), bringing their taxable income to $38,200. They have a federal income tax liability of $4,189. Their PTC is still $14,400 – ($70,000 x 9.78%) = $7,554. In this scenario, a $10,000 contribution to Lee’s Solo 401(k) would still present an increase of $1,320 in the couple’s PTC, and at the same time, it would also decrease their QBI deduction to $5,000, reducing their taxable income to $30,200 and federal tax liability to $3,229.

The $10,000 contribution to the Solo 401k thus only reduces federal income tax liability by $960, which is a 9.6% marginal tax benefit on the contribution. When taking into account the increase in PTC of $1,320, the total tax benefit is $2,280, the same 22.8% marginal tax benefit as in the previous example.

If Lee and Caroline had contributed $5,000 to each of their IRAs in lieu of the $10,000 to Lee’s Solo 401(k), their QBI deduction would not be reduced at all! The total tax benefit would be $2,520 instead of $2,280, a 25.2% marginal tax benefit on the $10,000 contribution, improved simply by changing which type of retirement account their dollars went to!

For simplicity, the examples in this article ignore the circular formula between the self-employed health insurance deduction and the PTC. The key, however, is to realize that while the calculations can be complex, these planning strategies are relatively simple for the self-employed to execute with the advisor’s assistance and can provide a relatively large tax benefit.

In addition, not all planning strategies will impact the QBI deduction the same if the client is not, at least initially, subject to the 20%-of-taxable-income limitation on QBI deduction. All things equal, in such situations where QBI deduction matters, HSA and IRA contributions are more beneficial because they do not have any impact on QBI, unlike business expenses or SEP IRA and Solo 401(k) contributions.

Hierarchy of Planning Strategies to Manage MAGI for PTC

Based on the benefits and implications of each strategy, it’s possible to come up with a general hierarchy for which planning strategies self-employed owners can benefit most from maxing out first, all other things being equal. Of course, we should always consider clients’ other goals in addition to saving taxes, but this can serve as a good guide.

Practical Considerations For Advisors To Help Their Self-Employed Clients Optimize Their PTC

While there are tax-planning strategies that advisors can use to help clients reduce their tax liability through optimizing the PTC, there are also practical considerations for advisors to help their clients understand their options and follow through on maximizing potential benefits that may be available to them.

Explain The PTC And Create Awareness Around Health Insurance Options For Self-Employed Individuals

The first step is simply to make clients aware of their health insurance options and potential subsidization benefits via the PTC. Explaining how the credit works, and how clients may qualify even when they may not think they would, could provide tremendous dollar value to a client.

Perhaps even more importantly, if the fear of health insurance expenses is the only factor preventing a client from pursuing self-employment, the advisor can help clarify the client’s options and help them pursue their goals with less fear.

Advisors can spark these conversations with clients who have expressed an interest in self-employment. In addition, they can go through their client lists and identify any clients who are self-employed and who may not have access to a health plan through Medicare or a spouse’s employer.

The advisor can also look at the client’s tax return to see if they currently claim the credit and to check their current MAGI for PTC calculation purposes. If the client is currently taking the credits (or is not taking them, but is within the 400% of the FPL for the client’s household size –or at least within range by using some of the available strategies), the advisor can reach out to the client to bring up the PTC and decide if further analysis can be beneficial.

Help Clients Sign Up For Coverage And Claim The PTC

The process of getting coverage with PTC subsidies may sound intimidating to a client, but it’s actually a pretty straightforward process that can be completed through the Healthcare.gov website (or the state’s Marketplace website for the few states that have chosen not to use the Federal platform). Advisors who are already familiar with the process can walk their clients through enrollment, and help the client estimate their MAGI to determine their PTC in order to claim their advanced credits towards their health insurance premiums.

Advisors with clients insured or planning to be insured by a Marketplace plan should keep track of open enrollment dates when clients can sign up or change plans each year. Open enrollment may vary in some states, but for the vast majority, it will be from November 1st through December 15th.

Advisors should also be aware of qualifying events that trigger a Special Enrollment Period. If a client goes through one such event (e.g., losing existing health coverage, getting married or divorced, changing place of residence, etc.), it would be beneficial to re-evaluate the situation and see if coverage needs have changed or better options are available.

Create Tax Projections For Clients Who Are (Or Could Be) Taking Advantage Of PTC

Creating a tax projection to show the impact of the PTC on overall tax liability is perhaps the most important part for advisors helping clients with the PTC.

As we have covered, many of the calculations can be complex and can trigger consequences beyond just the PTC itself, and thus precision is key. An effective way to communicate to the client how the relative benefits of specific strategies stack up is to show how much each proposed strategy (or combination of strategies) would save in real dollars by creating tax projections with side-by-side numbers.

My recommendation is to create a tax projection near year-end with estimated numbers, as many advisors may already do, and one before filing, but after the tax year is over, with the final numbers. This is especially important in situations where a client is close to the 400% threshold in particular, and preparing a pro forma tax return can help to identify if any self-employed clients are anywhere near the threshold numbers.

The tax projection at year-end helps the client gauge where their approximate MAGI is and can kickstart thinking about what strategies should be used. It will also help the client prepare for what may need to be done around tax time and accelerate any business expenses if needed.

Once all the client’s tax information is available and final, the advisor and client can plug exact numbers into planning software and review the results. A good software tool is essential for this type of planning, such as Holistiplan, which may be helpful in creating the projections, however, more robust planning software, such as BNA Tax Planner, may be a better fit for complex side-by-side calculations related to PTC.

Help Clients Execute On Tax Strategies

Of course, once a client decides they would like to make a $10,000 contribution to a SEP IRA or Solo 401(k), they have to actually do it. Many advisors will be able to directly help clients set up accounts and fund those strategies if they manage their assets.

However, even if assets aren’t managed, I believe advisors should provide guidance and serve as accountability partners to make sure clients execute on planning strategies by the appropriate deadlines.

Communicate With Clients’ CPAs

Lastly, I believe an advisor can add value and strengthen relationships with their clients’ CPAs by giving the proper heads up communication on what the client has done that will affect tax reporting. Ensure that the client receives and delivers to the CPA their Form 1095-A, which is sent by the Health Insurance Marketplace and lays out premium costs and advanced PTCs received by the client.

The advisor can also ensure communication with the CPA about implemented strategies such as HSA or retirement account contributions. In addition, advisors can review Form 8962 to understand how the PTC is calculated in precise detail.

The bottom line is that the PTC presents significant planning opportunities with straightforward tax strategies that advisors can help self-employed clients implement, potentially saving clients thousands of dollars in addition to normal tax deduction savings.

While tax strategies are straightforward, the calculations can be complex, and advisors will more than likely need to use robust tax planning software to help properly plan for clients and demonstrate the potential savings to them. When done effectively, PTC tax planning will help clients feel like they’ve received tremendous value from their advisor. In addition, tax planning efforts are a good way to strengthen the relationship with clients’ CPAs, who can serve as potential referral sources in the future.