Executive Summary

According to the latest 2021 Genworth Cost of Care study, a private room in a nursing home costs almost $300/day, or nearly $9,000 per month. Fortunately, individuals in need of such institutional health care, who don’t have the means to pay for such care themselves, can generally rely on Medicaid to cover at least most of those long-term institutional care costs. However, as a means-tested program operated as a Federal-state partnership, Medicaid places extremely low limits not just on an individual’s income, but also on their “Countable Assets” that they are entitled to keep before they can qualify for coverage. Accordingly, those who will eventually rely on Medicaid to cover their cost of care must ‘spend down’ their own income and assets first… which can have a significant impact on the individual’s (and their families’) standard of living. Which raises the question of what planning can be done to help protect at least the other members of the family in situations where a Medicaid spend-down must occur.

While the limits on Countable Assets (including most of an individual’s assets such as cash, investments, bank accounts, and real estate) vary by state, the most commonly observed is a mere $2,000 in 2021. However, to allow a healthy spouse (with an ill partner applying for Medicaid) to maintain at least a minimal level of the couple’s assets and income to live on, the Medicaid rules include standards that set the amount of income and assets that can be maintained from the couple’s assets (and the institutionalized individual’s income) to maintain the healthy spouse’s standard of living without an obligation to spend them down for the ill spouse’s care.

To prevent couples from simply trying to ‘impoverish’ themselves to qualify for Medicaid, though, Medicaid rules include a five-year “Look-Back Period” (2½ years for California), which prevents recipients from simply giving away assets to (non-spouse) family members to meet Medicaid’s asset limits. Notably, though, when it comes to spousal income, the treatment is different, with the healthy spouse’s income generally being left out of the eligibility calculation altogether.

As a result, one strategy for married couples to preserve assets in light of the Look-Back Period for asset transfers, but the exclusion of the healthy spouse’s income, is to purchase a “Medicaid Annuity”. Essentially, assets in excess of the Countable Asset limit are used to purchase a Medicaid Annuity (such that the couple’s assets are within their allowed Countable Asset limit); then, annuity payments are made payable only to the healthy spouse. In doing so, the Countable Assets that would have otherwise been required to have been spent down to pay for the care of the institutionalized spouse are removed – but not as a gift, avoiding a look-back penalty period – and instead become income of the healthy spouse (which are effectively ignored for purposes of Medicaid eligibility).

Notably, though, not all states currently permit the use of Medicaid Annuities. And in states that do, to be Medicaid-compliant, the Medicaid Annuity must name the State (in those states that permit their use) as the remainder beneficiary for no less than the amount of Medicaid benefits it paid on behalf of the institutionalized individual. Which doesn’t limit the healthy spouse’s ability to leverage the Medicaid annuity for their own standard of living… but does mean that at least if both spouses do not survive the Medicaid annuity payout period, the State can recover Medicaid benefits it paid before those assets are bequeathed to subsequent heirs.

Ultimately, the key point is that for seniors or chronically disabled individuals who may need Medicaid benefits for their long-term care but fear the impact that spending down assets will have on their healthy spouse’s own standard of living, the Medicaid Annuity is a useful tool (at least in the states that permit them) to help the couple preserve assets by converting them into an annuity income stream. Which can be a valuable option to consider, especially in light of the last-minute ‘crisis’ nature that is often characteristic of Medicaid planning, when it’s too late to simply gift assets to family members by the time it’s necessary!

Many individuals falsely believe that their potential future long-term care and medical costs will be covered by Medicare, which is available to individuals once they reach age 65. While Medicare is widely considered to be quality, cost-efficient health coverage (in large part due to its cost-sharing component with taxpayers) and does cover a robust variety and amount of medical expenses, it does not cover all medical expenses.

One notable medical expense for which Medicare provides only (very) limited coverage is Institutional care, which involves services provided by a nursing home and which can be incredibly expensive. Specifically, the median cost of a semi-private room in a nursing home was more than $93,000 per year in 2020, while the median cost of a private room in a similar facility was nearly $106,000 per year. And in many higher-cost-of-living areas, the annual cost of care can approach nearly double those amounts!

Nerd Note:

Many individuals think of Medicaid as a single program. The reality, however, is that there are several different 'flavors' of Medicaid, such as Institutional (nursing home) Medicaid, Home and Community Based Services (HCBSs), and 'regular' Medicaid. There are often different eligibility requirements for different programs offered through the same state, and in some situations, there may be multiple paths towards eligibility. This article focuses on the requirements to be eligible for Institutional Medicaid.

In order to qualify for Medicare, an individual must have a Qualified Hospital Stay, which requires being formally admitted to a hospital for three or more consecutive days. If they do not meet this requirement, Medicare will generally not cover the cost of Institutional care (e.g., a nursing home, rehabilitation center, etc.). But even in situations where an individual does have a Qualified Hospital Stay, Medicare will only help cover Institutional care costs for up to 100 days.

To the extent that an individual requires continuing care in an Institutional setting after a Qualified Hospital Stay, the first 20 days of that care are essentially 'on the house' – or, at least, on the taxpayer – as Medicare will pick up the full cost. For the next 80 days, patients are responsible for daily coinsurance ($185.50 per day for 2021), with Medicare picking up the balance. But after that, Medicare is done, and the patient is responsible for picking up the entire tab personally unless long-term care or similar insurance is covering the expense. However, in situations where the patient has limited resources (income and assets), Medicaid will generally foot the bill.

Medicaid Provides Health Insurance To Those With Limited Resources

Created in 1965 (at the same time as Medicare) by the Social Security Act Amendments of 1965, Medicaid is a partnership between the Federal government and the states to provide medical care to individuals and families who cannot afford such care on their own. Despite a number of changes to the program since its creation, the Federal-state partnership aspect of Medicaid continues to this day.

As noted above, Medicaid is generally only available to those with limited resources. Accordingly, in order to qualify for Medicaid, individuals must meet certain means-tested eligibility requirements that require them to have both income and assets below certain thresholds.

Notably, while there is an extensive array of Federal laws, regulations, and other forms of Federal guidance that dictate how Medicaid must be administered, states have significant flexibility to operate Medicaid within their state in accordance with those guidelines. As a result, there exists a patchwork of available benefits – and eligibility requirements to receive those benefits – between different states (and sometimes between locations within a state as well!).

Nevertheless (and despite the need for individuals to verify the precise Medicaid eligibility requirements within their own state), it's possible to make some meaningful generalizations for overall planning purposes. For instance, regardless of the state in which an individual is applying for Institutional Medicaid, the maximum amount of "Countable Assets" they are allowed to keep before Medicaid will begin paying for care is extremely limited. Countable Assets are assets that Medicaid considers as an individual's available resources when an application is submitted and include cash, investments, bank accounts, and real estate (subject to a limited exception for equity in a primary residence).

Nerd Note:

Certain assets, such as one car, a primary residence (up to a specified threshold), pre-paid funeral plans, and household furnishings, are not considered Countable Assets.

Institutional Medicaid Eligibility Rules For Single Individuals

For 2021, a significant majority of states have a maximum Countable Asset limit of $2,000 for single individuals applying for Institutional Medicaid. A handful of states, meanwhile, have modestly higher maximum Countable Asset limits of between $5,000 and $10,000. New York is the most generous state in this regard, but even New York has a maximum Countable Asset limit of just under $16,000 for single individuals applying for Institutional Medicaid.

Assets, though, are only half of the equation. In order to qualify for Medicaid, an individual must also meet income eligibility requirements. More specifically, Medicaid enrollees must have either limited income or, in some states, medical expenses that 'eat up' most of their (higher) income.

In 2021, to qualify for Institutional Medicaid under the 'regular' rules in most states, an individual must have a monthly income of $2,382 or less. Some states, on the other hand, have income limits closer to $1,000. In the end, though, for individuals who will be receiving Institutional care, it's largely a matter of semantics because these income limits are not the amount of monthly income an individual can keep, but rather, simply the income levels at which point they can become eligible for Medicaid. If enrolled in Medicaid, the vast majority of that income (save for a maximum of about $150 per month – and in some states, less than one quarter of that!) must be used to pay for care.

In more than 30 states, individuals with higher income can also qualify for Medicaid through what are known as "Medically Needy Income Limits." In short, these limits look at an individual's total income and their total medical bills. If, after subtracting an individual's total medical bills, their net income is less than their specified threshold (which range from about $100 to about $1,100 per month, depending on their state of residence or, in limited cases, their specific location within a state), they will be eligible for Medicaid, regardless of how high their initial income (before medical expenses) was.

Any way you slice it, the point is that in order to qualify for Medicare, an individual must have extremely limited assets, and they must be using most of their income for medical expenses.

Medicaid Eligibility For Married Couples With One Spouse Requiring Institutional Care

When it comes to married couples, the possibility of one spouse needing extended Institutional care can present additional challenges, such as when the cost of an ill spouse's care significantly impacts a healthy spouse's standard of living.

In an effort to prevent an ill spouse's healthcare costs from completely impoverishing their healthy spouse, the Medicaid rules were amended in the late 1980s to create "Spousal Impoverishment Standards". These standards allow a healthy spouse to maintain certain assets, and potentially certain income of the ill spouse, that might have otherwise been required to be spent on the Institutionalized spouse's care.

Community Spouse Resource Allowance

For many couples, the most critical Spousal Impoverishment Standard is the Community Spouse Resource Allowance (CSRA), which specifies the amount of the couple's assets that the Community Spouse (i.e., the healthy spouse) is able to keep while still allowing the ill spouse to qualify for Medicaid benefits. This standard is particularly important because when Medicaid reviews a married individual's application, they will generally consider the combined Countable Assets of the couple to determine whether the ill spouse is eligible for Medicaid. In other words, regardless of which spouse actually owns an asset, it is considered available for either spouse's care (assuming it's a Countable Asset).

In 2021, the minimum Community Spouse Resource Allowance that is permissible under Federal law is $26,076, while the maximum Community Spouse Resource Allowance, adopted by a majority of states, is $130,380. Countable Assets over the Community Spouse Resource Allowance are generally considered available for use for the ill spouse's care.

Nerd Note:

With regard to Community Spouse Resource Allowances, there are two types of states; 50% states and 100% states. In 50% states, the healthy Community spouse gets to keep 50% of the couple's combined assets, up to the Community Spouse Resource Allowance. In 100% states, the Community spouse is able to keep the first 100% of the couple's combined assets, up to the Community Spouse Resource Allowance.

Example 1: George and Georgina are married taxpayers. George is ill and is in need of nursing home care. He has $70,000 in a bank account in his name only, while Georgina has $50,000 in a bank account in her name only. They also have a joint brokerage account with $150,000. Accordingly, their combined Countable Assets total $270,000.

The couple lives in a state that has a Community Spouse Resource Allowance of $130,380 and allows George to retain $2,000 of Countable Assets.

If George applies for enrollment in Medicaid, in addition to the $2,000 of Countable Assets that he is allowed to retain, Georgina will be able to keep $130,380 of their combined Countable Assets as a Community Spouse Resource Allowance.

The remaining $270,000 (total Countable Assets) – $2,000 (George's Allowed Countable Assets) – $130,380 (Georgina's Community Spouse Resource Allowance) = $137,620 of the couple's Countable Assets will need to be used before Medicaid will begin to cover George's nursing home costs.

When it comes to applications for Institutional Medicaid, one important difference between assets and income is that while the combined assets of a couple are generally used to determine Medicaid eligibility, only the income of the ill spouse is considered for the same purpose. The healthy spouse's own income, meanwhile, is ignored.

Specifically, per Title 42 U.S. Code Section 1396r-5(b)(2)(A)(i),

If payment of income is made solely in the name of the institutionalized spouse or the community spouse, the income shall be considered available only to that respective spouse.

This rule, commonly referred to as the "Name On The Check Rule", means that any income paid to the healthy spouse is not considered for the purposes of an ill spouse's Medicaid application and generally does not have to be used to pay for the ill spouse's institutional care.

Nerd Note:

Although a healthy spouse's own income is ignored for purposes of qualifying an ill spouse for Institutional Medicaid, in a small number of states, if the healthy spouse's income is high enough, they will be required to contribute some of their income towards the ill spouse's Institutional care.

Example 2: Recall George and Georgina, from the previous example, who are married taxpayers, and who are applying for Institutional Medicaid for George. In addition to their assets (discussed in the above example), George receives monthly Social Security benefits of $2,000, while Georgina, who is still working, has a monthly income of $6,000.

If an Institutional Medicaid application is submitted for George, only George's monthly income of $2,000 will be considered as part of the Medicaid application. Georgina's $6,000 monthly income, on the other hand, will be excluded.

Minimum Monthly Maintenance Needs Allowance

In scenarios where the healthy spouse's own income is below a certain threshold, a separate Spousal Impoverishment Standard, known as the Minimum Monthly Maintenance Needs Allowance (MMMNA), can allow the ill spouse to 'transfer' a portion of their income to the healthy spouse.

As of July 1, 2021, the Minimum Monthly Maintenance Needs Allowance that can be established by a state is $2,177.50 for all states except Alaska and Hawaii. The Maximum Monthly Maintenance Needs Allowance that can be authorized by a state is $3,269.50. To the extent that a healthy spouse's own income is below the Minimum Monthly Maintenance Needs Allowance established by their state, they can retain the income of the ill spouse until the combined income reaches that minimum amount.

The Medicaid Look-Back And Penalty Periods

If an individual believes that they are likely to require Institutional Medicaid in the future, one planning strategy to preserve their assets is simply to give their Countable Assets away to others (such as children), who will (hopefully) use those assets later for the ill spouse's benefit. This way, when they submit their application to Medicaid, their Countable Assets will be below the required asset limit for eligibility, giving them access to Medicaid, all while preserving assets for themselves (via transferees using those assets for their benefit) as well as for future generations. Such transfers cannot be made to a spouse since (as discussed above) Institutional Medicaid eligibility takes into consideration the combined Countable Assets of a couple.

But transfers (gifts) to persons other than a spouse are not a foolproof planning strategy either, thanks in large part to the Medicaid Look-Back Period. In short, the Medicaid Look-Back Period is a five-year period (30 months, or 2 ½ years, in California only) before an individual applies for Medicaid, during which if an individual transfers Countable Assets, or otherwise disposes of them for less than fair market value, they will be subject to a Penalty Period.

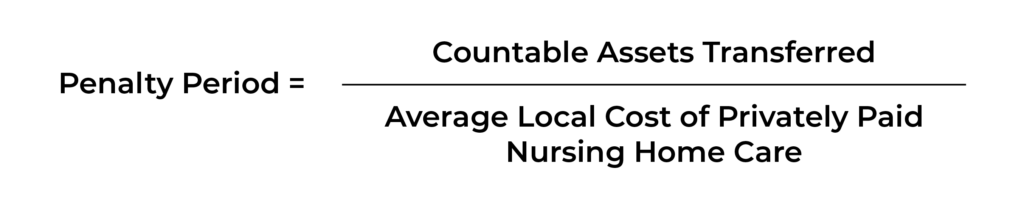

This Penalty Period is the length of time during which an individual will not be eligible for Medicaid due to transfers of Countable Assets during the Look-Back Period. The actual length of the Penalty Period varies and is calculated by dividing the value of Countable Assets that were transferred during the Look-Back Period by the average local cost of privately paid nursing home care.

Example 3: Violet and Mike are a married couple living in Georgia. An unfortunate accident has recently left Mike in need of ongoing Institutional care. In a panicked attempt to protect their assets, the couple transferred all of their Countable Assets, totaling $400,000, to their daughter shortly before applying for Medicaid.

The current cost of private-paid nursing home care in Georgia is $8,517 per month. Accordingly, even though Violet and Mike currently have no Countable Assets, Medicaid will not pay for Mike's Institutional care for $400,000 ÷ $8,517 = 46.96 months – nearly 4 years!

Given the Medicaid Look-Back and Penalty Periods, one 'obvious' Medicaid planning strategy would be "Give away your assets five or more years before you need care." Indeed, that is an effective strategy… at least in theory.

In reality, though, it's not as effective a strategy as one might think.

In many circumstances, for instance, the health event that precipitates the need for Institutional care, such as a fall or accident, is unforeseen (or at least does not leave five or more years between the health event and the need for extended skilled care).

And even when such an event is reasonably foreseeable, individuals may not feel comfortable transferring assets out of their name for fear of losing control. In still other situations, individuals simply choose to ignore the reality of the potential need for Institutional care because, frankly, it's not much 'fun' to think about oneself in that (lack of) capacity.

Due to these reasons, along with others, individuals often only engage in Medicaid 'crisis-planning', when the need for Institutional care is imminent. And, unfortunately, by that time, the Look-Back Period severely limits the ability of the affected individual or couple to transfer Countable Assets to others.

'Medicaid Annuities' As Medicaid Crisis-Planning Tools

Simply put, crisis Medicaid Planning is the attempt to retain as many assets and as much income as possible in the face of a likely near-term (or immediate) need for Institutional care. There aren't a ton of planning options, and frankly, many of the options that are available aren't really what one might consider 'good' options. They're just 'less bad' than the alternative of having those resources consumed by the cost of Institutional Care.

One option that can be explored in Medicaid crisis-planning scenarios is the Medicaid-compliant annuity (a.k.a., a Medicaid Annuity). This tool is often particularly valuable for married couples who have Countable Assets that exceed the amount of assets they'll be able to retain under state law while still qualifying the ill spouse for Institutional Medicaid.

At a high level, a Medicaid Annuity is a tool that can allow a married couple to convert Countable Assets of the couple into the 'ignored' income of a healthy spouse. More specifically, when a married couple's assets exceed the amount of Countable Assets they will be allowed to keep, they can 'spend' the excess assets by purchasing an annuity that pays income only to the healthy spouse. And since the healthy spouse's income doesn't prevent the Institutional spouse from being eligible for Medicaid (thanks to the "Name on the Check" rule, discussed earlier), the Medicaid annuity can be an effective way to help preserve the assets and maintain the healthy spouse's future standard of living.

Example 4: Recall George and Georgina, married taxpayers from Examples 1 and 2, who had $270,000 of Countable Assets, exceeding the total amount of Countable Assets that they could retain for Medicaid to cover the cost of George's care by a total of $270,000 (total Countable Assets) – $2,000 (George's allowance) – $130,380 Georgina's Community Spouse Resource Allowance) = $137,620.

If the couple does no planning, they will have to spend down their own assets to pay for George's care until their assets drop below the combined $132,380 they are allowed to retain.

By contrast, the $137,620 of Countable Assets over the combined asset limit for the couple could be used to purchase a Medicaid-compliant annuity payable to Georgina only. That Medicaid-compliant annuity could then pay Georgina an income stream for the rest of her life expectancy (more on this in a bit).

The purchase of the annuity, even though it was made using the assets in excess of a couple's combined allowance, is not considered a prohibited transfer during the Look-Back Period. Instead, it will be treated as though the couple simply 'spent' the money. Furthermore, since the annuity payments will be made payable only to the healthy spouse (Georgina, in the example above), the healthy spouse will be able to keep those funds, thanks to the "Name on the Check" rule.

Timing Of The Medicaid Annuity Purchase

Although individuals and planners should always check to verify local Medicaid rules, the steps involved in purchasing a Medicaid Annuity tend to be fairly similar. Notably, the annuity should generally be purchased only after Institutionalization.

Accordingly, the first 'step' in the process (once all assets and incomes have been reviewed, and it's been determined that a Medicaid Annuity is an appropriate planning strategy) is actually Institutionalization itself. The reason for this is that the date of Institutionalization (the day the ill spouse enters a hospital and/or nursing home for a period of at least 30 days) is the day that will be used to create a 'snapshot' of their assets.

Once this snapshot is taken, the amount of assets that the couple can keep can then be calculated, and the excess used to purchase the Medicaid Annuity.

Then, with assets reduced to levels sufficient to qualify for Medicaid, the couple can apply for Medicaid with a level of income/assets eligible for approval. It is worth noting that while the Medicaid Annuity's income that will be paid to the healthy spouse will not prevent the ill spouse from qualifying for Medicaid, it does need to be disclosed on the Medicaid application.

Requirements For Medicaid-Compliant Annuities

One important planning consideration for those thinking about using annuities as a way to preserve a couple's 'excess' resources is that not all annuities can be used for this purpose. Rather, an annuity must meet several requirements to avoid being considered a transfer for less than fair value and resulting in a Medicaid Penalty Period.

Naming The State As Remainder Beneficiary

First, under U.S. Code Section 1396p(c)(1)(F), the State must generally be named as the remainder beneficiary for no less than the amount of medical assistance it paid (via Medicaid) on behalf of the institutionalized spouse.

An exception to this general rule exists when in the less common situations where there is a minor child or a disabled child. In such instances, that minor and/or disabled child can be named as the primary beneficiary, provided the State is named as the contingent beneficiary. If, however, the representative of such a minor and/or disabled child disposes of the annuity for less than fair market value, the State must be elevated to the primary beneficiary (which would put the state in line as a beneficiary ahead of that minor/disabled child).

Nerd Note:

There is also an exception that allows the healthy Community Spouse to be named as the contingent beneficiary of a Medicaid Annuity. When using such an annuity as a crisis planning tool for couples, however, the Community Spouse is the annuitant and the recipient of the ongoing annuity income during their lifetime. Thus, the Community Spouse exception is irrelevant for this purpose (because the beneficiary of the contract won't receive anything until the Community Spouse dies in the first place!).

Annuities Must Be Irrevocable, Nonassignable, Immediate, And "Actuarily Sound"

In addition to the beneficiary requirement above, Title 42 U.S. Code Section 1396p(c)(1)(G) states that the annuity must be:

- Irrevocable

- Nonassignable

- One that provides equal payments during the term of the annuity with no deferral (it must be an immediate annuity) of payments or balloon payments

- Actuarily sound

The first three requirements above are relatively straightforward. But what does it mean to be "actuarily sound"?

From a Medicaid planning/Medicaid Annuity perspective, the term "actuarily sound" means that the payments from the annuity cannot extend longer than the actuarial life expectancy (generally, as estimated by the Social Security Administration, although some states use a state-specific table) of the healthy spouse, and that the payments from the annuity during that time must be equal to or greater than the initial investment in the contract.

Example 5: Recall, once more, George and Georgina, who, together, have $270,000 of Countable Assets, with $137,620 over the combined asset limit allowed in their state.

When we last 'checked in' on the couple, they were in the process of using the $137,620 to purchase a Medicaid-compliant annuity.

Suppose that Georgina's actuarial life expectancy, as determined by the Social Security Administration, is 8.33 years (100 months).

In order for the couple's annuity to be considered a Medicaid-compliant annuity, the payments from the annuity must be made over a period of 100 months or less.

If a 100-month term is selected, monthly payments from the annuity must be no less than $137,620 (the initial investment in the contract) ÷ 100 = $1,376.20, which would theoretically result in the entire amount invested being paid out before the end of Georgina's life expectancy.

In the example above, the 100-month term is one option for the couple, but a shorter selected term that produces larger payments may be a better option.

Selecting The 'Best' Term For A Medicaid Annuity

As discussed above, Medicaid Annuities must have guaranteed payment periods equal to or less than the healthy Community Spouse's life expectancy, and the initial investment must be returned during that time as well. That, effectively, places a maximum on the length of the term of the annuity, but it does not set a minimum term length. Indeed, for married couples looking to use Medicaid Annuities as tools to help preserve resources for the healthy spouse and future heirs, a shorter guarantee period is often preferable.

Recall that in order for the purchase of an annuity not to be deemed a transfer for less than fair value, the State must generally be named as the primary beneficiary of the annuity. Naturally, the longer the term of the annuity (up to life expectancy of the healthy spouse), the lower ongoing payments will be, and the longer it will take the healthy spouse to 'recoup' their investment. And if they die prior to doing so (or at any point prior to the end of the term of the annuity), the remaining payments will generally be 'lost' to the state to repay the cost of the Institutionalized spouse's care.

A fairly simple way of reducing the chance that the healthy spouse fails to recoup their investment before their death is to shorten the term of the annuity. By doing so, the healthy spouse will have their 'asset' returned more quickly (in the form of larger income payments), reducing the chance that resources are lost to the State.

Example 6: Recall – you guessed it – George and Georgina from the examples above. In Example #5, we saw that due to Georgina's life expectancy of 100 months, the term of her annuity would have to be 100 months or less.

Further, we determined that if payments were to be made over Georgina's 100-month life expectancy (the annuity term selected), then monthly payments would have to equal no less than $137,620 ÷ 100 = $1,376.20 (in reality, they would probably be slightly higher, as the insurance company would apply some level of interest to the payments).

Suppose, now, that George and Georgina have a healthy adult child for whom they would like to try and preserve assets. If this is a significant concern, even though Georgina may appreciate the appeal of ongoing income over her life expectancy, she may wish to instead opt for a shorter annuity term to increase the chances that she outlives the term of her annuity and gets as much possible.

For instance, if Georgina opted for a 5-year annuity term (60 months), then by the end of that 5-year term, Georgina will have received back (via larger monthly payments) at least her initial investment in the contract (or else it wouldn't be a Medicaid Annuity!).

Accordingly, if she were to die after 6 years (72 months), none of her income – which is essentially just a delayed return of her previous assets – would be lost to the State in the form of Medicaid recapture for George's care.

By contrast, had she stuck with the original 100-month term she had originally contemplated, at least 100 (original life expectancy) – 72 (actual life expectancy) = 28 payments of $1,376.20, or more than $38,500, would have been lost to Medicaid.

As the example above illustrates, with the 'right' structure, Medicaid annuities can help certain couples dramatically reduce the amount of assets that are required to be spent on Institutional care.

That said, they are far from a 'perfect' planning solution.

Downsides Of Medicaid Annuities

Clearly, one of the biggest downsides to using a Medicaid Annuity as part of Medicaid planning for couples is that the healthy spouse may die 'too soon,' before the term of the annuity has been completed, and assets (income at that point) may end up getting lost to Medicaid anyway.

But there may be a number of other complications and reasons to avoid using a Medicaid Annuity for planning as well.

Not All States Play Nicely With Medicaid Annuities

Despite the fact that the Federal government has provided guidance with respect to Medicaid Annuities, and there appear to be clear requirements for them provided by the Deficit Reduction Act, some states have effectively 'gone rogue' and don't allow the use of such annuities for planning purposes.

In some of these (minority of) states, the annuity may be treated as an asset that must be spent down, while in others, the annuity may be considered an impermissible transfer, resulting in a Medicaid Penalty Period. Accordingly, individuals must always be cognizant of state rules.

Medicaid Annuities Are Irrevocable, But Laws Can Be Changed

In their award-winning advertising campaign, De Beers famously states, "A diamond is forever." The same is also true of a Medicaid Annuity. By law, a Medicaid Annuity must be irrevocable. No changes can be made.

The same, however, is not true of Medicaid law. While the income of a healthy spouse can generally be retained today, perhaps at some point, a future Congress will decide that such income should be used to a greater extent to provide for the care of an ill spouse. Maybe a state will change its interpretation of the rules to join the ranks of those who don't allow such annuities.

The bottom line is that while the rules of the game may change in the future, once the Medicaid Annuity is purchased, it is effectively the hand that must be played.

Better Options May Be Available

Ultimately, the most compelling reason to avoid the use of a Medicaid Annuity for most people is simply that a better Medicaid planning option may exist. For instance, a healthy spouse may be able to petition their state (or a court) to try and retain more than the Community Spouse Resource Allowance. In a small number of states, a healthy spouse can use a Spousal Refusal to deny the ill spouse the use of the healthy spouse's assets, at which point, Medicaid will mercifully pick up the cost of care.

Assets may also be able to be spent down in other, more preferable ways, such as home improvements or personal automobiles. In the end, the Medicaid Annuity may simply not be the best option for a couple.

Institutional care throughout the United States is extremely expensive. When the need for such care is foreseen well in advance, there is a wide range of potential strategies that can be considered. Unfortunately, though, individuals often don't engage in Medicaid planning until the need for Institutionalization or other care is imminent.

While such a scenario can wreak havoc on a single individual's financial plan, it can raise even more challenges for a married couple, where the ill spouse's need for care can substantially impact a healthy spouse's standard of living. In situations where an ill spouse is expected to need care in the near future, while reduced in number (and potentially effectiveness), there remain a number of strategies that can be used to try and preserve assets and income for the healthy spouse.

One such strategy is the use of a Medicaid Annuity. Notably, the use of such annuities can help married couples 'transform' Countable Assets in excess of the amount they are permitted to keep before Medicaid will begin to cover the cost of Institutional Care to 'ignored' income of the healthy spouse. In order for this strategy to work, the annuity must comply with a host of rules, including that it be irrevocable, nonassignable, actuarily sound (i.e., payable in level payments over no longer than the healthy spouse's life expectancy, such that the invested amount is returned within that period), and a requirement that the State be named a beneficiary of the contract.

Ultimately, the key point is that, in a perfect world, individuals in need of Institutionalized care at some point in the future would transfer assets to others at least five years prior to requiring such care. However, that's just not the world we live in. And either because individuals don't foresee a future need for Institutionalization, or they're just not yet willing to transfer assets until it's a last-minute near-certainty, Medicaid crisis-planning is not uncommon.

In such situations, when Institutional care is imminent, Medicaid annuities can be a useful tool, particularly for married couples, to help preserve wealth for a healthy spouse and to protect assets for future heirs.

Another great Kitces.com resource! Having done Medicaid planning/qualification a time or two in Washington State, it is certainly it’s own area of expertise. Not sure the limit in other states, but here home equity is allowed up to some $550,000 making it a pretty substantial piece of the Medicaid qualification discussion. “Medicaid” Trust planning is also an often discussed/sold strategy, but similar to gifting funds to kids, not without serious risks/costs.

Great points Matt. For some folks in high-home-price areas, part of that equity can be at risk. Meanwhile, for others with lower home values, making improvements to the home can be an effective way of preserving wealth. Never easy, never simple. But hey, that’s why we do what we do!

This is great, thanks, Jeff! I literally sat down to write this out for a client today and found this article just published. I’m impressed, as always, at how you two are in my brain hearing article pitches, LOL.

Thanks for the incredibly nice feedback Wendy. Appreciate it!

If the community spouse receives his/her annuity payments over a short period of time, it’s plausible he/she would start to accumulate assets that would put him/her above the Community Spouse Resource Allowance again. Could the ill spouse then be disqualified from Medicaid until the community spouse spends down her assets again?

Great question Nathan. In general, assets accumulated due to income earned after the snapshot date would not be at risk. That said, always best to check local rules and regulations to make sure they view things the same way. Best!

Thank you Jeff. This is a very helpful article.

In the closing letter I send to clients after completing their estate planning documents, I’ll always include a sentence something like “we discussed in detail the need for Medicaid Planning, and you decided not to implement the suggested course of action,” or something like that. Because a few years ago the children came back at me hard “why didn’t you tell our parents about Medicaid Planning as part of their estate planning?” That was not fun.

Great idea to include that Rick. I’m sure your E&O carrier appreciates it as well😜

Jeff, are you familiar with how common it is/isn’t for states/localities to look at IRAs owned by the healthy spouse as income (that doesn’t need to be spent down for the CSRA, similar to Medicaid-qualified annuities) versus an asset (which does)? In Ohio, where I live, it varies from one county to the next as the state has not yet issued guidance as to whether an IRA owned by the healthy spouse should be treated as an asset or income, particularly if the healthy spouse is taking RMDs or regular distributions from the IRA.

For more information on the Name on the Check Strategy and its Impact on Countable IRAs in the Name of the Institutionalized Spouse’s name, please read my article: Fixing the Leak: Avoiding IRA Liquidation in Crisis Medicaid Planning (naela.org)

Dale Krause

medicaidannuity.com

May be small point here but Medicaid annuities are different than other higher commission and high cost annuity products. Commission based annuity advisors avoid them, because the time spent on them is not worth it. Most of the time, Medicaid annuities are pitched by an estate attorney who has a broker’s business card on their desk and when you call they always sell the same annuity package to everyone. Fiduciary advisors should fill in the gap more often when it comes to true planning. Not every annuity is a bad product and it probably is not a great idea to have an estate lawyer do the planning for pros and cons of annuities with clients. A fiduciary advisor can add more value here. Its too bad the word annuity scares most of them.