Executive Summary

The typical financial advisor meets with clients year-round, both because clients vary as to when they want and feel the need to see their advisor, and simply to ‘even out’ the workload involved in preparing materials for and actually spending time seeing clients during those meetings. The end result is that, according to the latest Kitces Research study, the average advisor spends nearly 27 hours per week on client service, which includes meeting preparation, planning, and the meeting itself. However, adopting an alternative client meeting strategy – the ‘surge’ method – can dramatically boost advisor productivity, systematizing the client review meeting in a manner that delivers the same level of quality service (if not better) to their clients, while freeing up as many as several months of the year to focus on other aspects of their businesses (or personal lives!)!

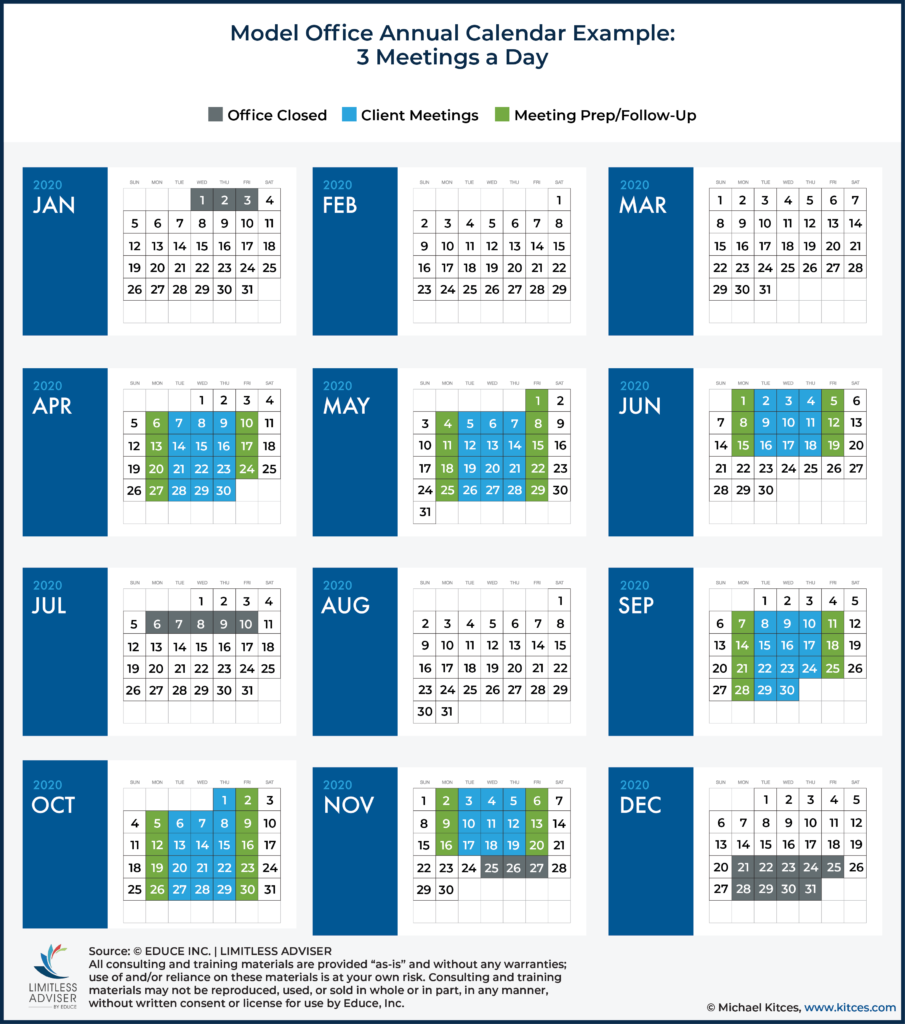

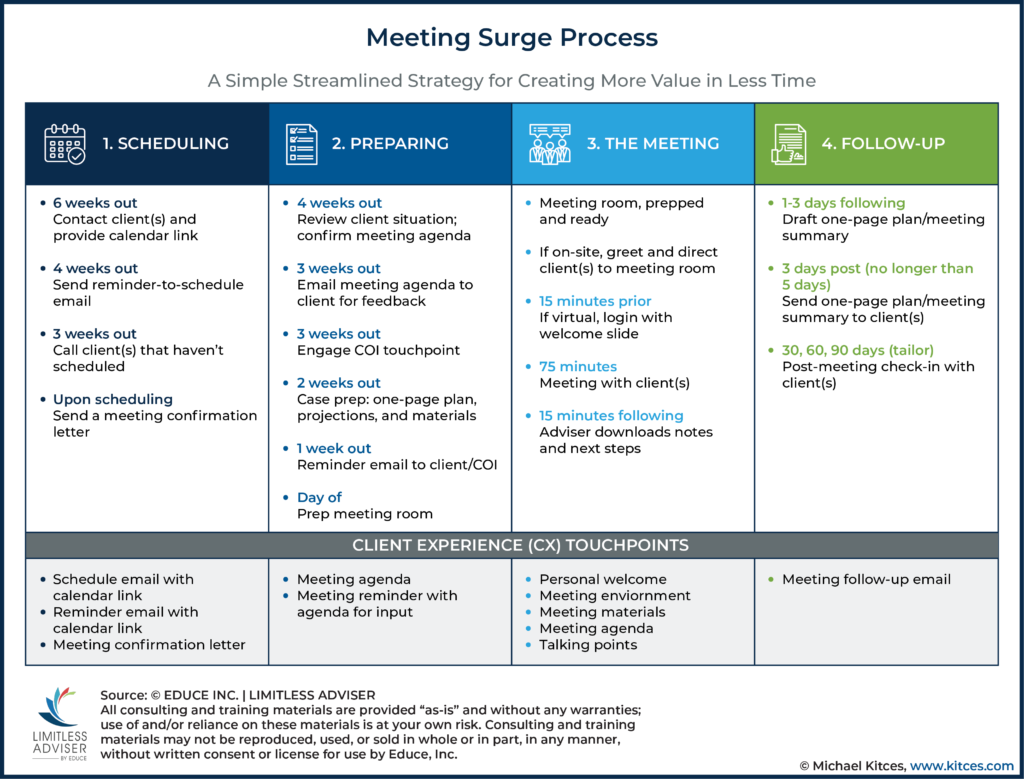

In this guest post, practice management consultant and coach Stephanie Bogan explores the client meeting surge approach, which involves developing a highly systematized method to conduct client meetings by separating the ‘factory work’ (e.g., the rote tasks and routines, such as preparing forms, confirming appointments, updating client information, etc.) from the ‘focus work’ (e.g., the intellectual work such as detailed financial planning analyses that rely on the advisor’s knowledge and understanding of their client’s situation). The meeting process itself is organized into four steps: 1) scheduling meetings (where a typical surge schedule would accommodate 3 client meetings per day, 3 days a week – generally Tuesday through Thursday, typically scheduled over 4- to 8-week periods, and only during set months of the year); 2) preparing the client deliverables, giving the advisor an opportunity to review client files in advance of the meeting (typically, Mondays are set aside for advisors to review client meeting files); 3) the actual meetings themselves; and 4) following up with the clients, providing them meeting summaries and (automated) personal check-ins at regular intervals after the meeting such as every 30-, 60-, and/or 90-days afterward (usually tasks that are completed on Fridays during surge weeks).

While the main concern of the surge approach is that it might seem to compromise the advisor’s ability to provide specialized, tailored attention to each client, in reality, the process of systematizing the ‘factory work’ actually enhances the meeting experience by creating more time for the advisor’s ‘focus work’ that needs thoughtful discussion and analysis, empowering the advisor to delve more deeply into these topics with the client during their meeting. Not only does this afford the advisor the opportunity to closely examine complex issues facing their clients, but it also helps them more easily identify other potential problems that might go unnoticed without the ability for a deeper analysis, and at the same time, even strengthens the relationship with the client.

Ultimately, the key point is that the meeting surge process can offer financial advisors more flexibility to balance their client meetings with other aspects of their businesses by systematizing and streamlining the client meeting process, freeing up more time throughout the year. And while the meeting surge process may involve a dramatic mindset shift for advisors in considering how business is actually done in their firms, the systematized approach can increase meeting efficiency and give the advisor the opportunity to focus more on complex planning issues, which not only enhances the meeting experience itself but also increases the actual value delivered to the client, all over a few months during the year. Which frees up the remaining off-meeting-surge months of the year for the advisor to consider other important issues, like how to grow their business and enhance their service offering even more!

The odds are high you’ve been peeling your banana the wrong way.

The common technique is to grab the stem at the top and pull. If too ripe, only one leaf pulls away, leaving the rest to be awkwardly peeled back. If not yet ripe, the unyielding stem meets with a knife or fingernail, revealing the assaulted banana inside. In both cases, still more work must be done to remove those pesky strings.

There is a simpler, better way to peel your banana. Do it like a monkey. Skip the handle-like stem and opt instead for the nubby tip at the banana’s bottom. Pinch the base between your thumb and forefinger, split with a twist and peel back two sets of intact banana skins, pesky strings conveniently tucked inside. With this technique, you can also use the top stem as a handle, making banana peeling clean and convenient.

The banana-peeling lesson isn’t included here to improve your breakfast experience. It is here to invite you to rethink everything.

If you’re like most financial advisors, you are good at what you do, you want to do good work for your clients, and you want to lead a good life in the process. You want to deliver great service and high-quality advice to people who listen to and appreciate you. You would like to enjoy this work and be paid well for your value. And you’d also like this greater success to include the freedom to enjoy some time away from the office.

Despite the best of intentions, most advisory practices aren’t there yet. If you’re among the advisors seeking a simpler, more satisfying way to help clients achieve their goals without sacrificing your own, consider peeling your practice ‘banana’ in a different way. Consider implementing client meeting surges.

Meeting surges are simply a shift from meeting with 2-5 clients a week all year long to holding 3-6 client meetings per day just a few months each year. These “surges” allow you to fully focus on client reviews in highly concentrated and organized blocks of time, offering a major productivity hack and the opportunity to deliver more personalized advice and deeper value while freeing up large swaths of time in your schedule.

The Meeting Surge Model, Simplified

Meeting surges are typically held over 4- to 8-week periods, during set months of the year, but they can be held during any period and for as many months as you like. Client meetings are held in tight formation during surge periods. Meetings are prepared for, held, and followed up on with a disciplined, systematic process each week.

During surge weeks, Mondays are reserved for meeting prep. Client meetings are held on Tuesdays, Wednesdays, and Thursdays, while Fridays are reserved for follow-up work, or free days when your system is fully operational.

The length of your surge will depend on your schedule intensity. In a typical 100-client practice, with two client meetings per year, your client meeting count is 200. At 3 meetings each day, client meetings can be covered in 22 very comfortable surge weeks, freeing up 7 months per year to focus on client service, investment and analytical work, continuing education, practice management, growth, and leaving ample amounts of free time. At 4 meetings per day, 50 meeting days or 16 surge weeks are needed, freeing up 36 weeks, or 75% of the year.

The fewer number of surges you hold each year, the greater the productivity gains. Below are samples of two model surge schedules we use in Limitless Adviser coaching. The first, more aggressive schedule maximizes free time, with meetings surges held in two months. The lighter schedule spreads surges over multiple months, allowing for a lighter, more comfortable meeting load. There is some loss of efficiency for each surge period added, but extending surges allows for fewer meetings per day, offering advisors a trade-off they can tailor to their preferences.

Can this work? Using the surge strategy taught in Limitless Adviser coaching, Adam Cmejla CFP of Integrated Planning & Wealth Management reduced his work hours from 40-45 hours a week to 25 hours per week, all while doubling his revenue – in only 15 months.

“Meeting surges allowed me to get hyper-efficient, very much refocused my time and gave me the time to ramp up my revenue. Total game-changer.” In Financial Advisor Success Podcast #140, Adam tells the story of how he stopped staying stuck and traded his frustration for coaching that led him to rethink everything, including why he’d settled for so long.

Meeting Surges: An Old Idea Offers New Possibilities

There are few practice management strategies that afford you the opportunity to boost your own personal productivity and enhance client value at the same time, at essentially no cost, while simultaneously gifting you with greater ease, satisfaction, and success.

My first experience with meeting surges came after my husband and I hired our financial advisor 20 years ago. Each May, we jumped on a conference call with our advisors, and each November, we flew up to Northern California for our annual review meeting. The meeting process and presentation were consistent each time. I recall being impressed by the professionalism, polish, and predictability of their process, and I always felt that the conversations were personalized around what was happening in our lives – financially and otherwise. This process was not exclusive to us, but consistent across all the firm’s clientele.

How did this save my advisors’ time? Each meeting’s standard agenda items, market commentary, and special subject matter were prepared at one time for use by all advisors with all clients during the meeting cycle. This affords ample time to focus and be thoughtful in the very specialized task of considering, meeting with, and advising clients. The more specialized your clients, the more systematized the process can be and the greater value you can deliver.

Like most affluent clients, we didn’t often speak to our advisors outside of these meetings, though a quick phone call was always warmly received and the wisdom we needed readily dispensed. I noted then the efficiency and effectiveness of it, but what struck me most was that our advisors were so present and prepared for our meetings. And as a client, I always knew what to expect every May and November, and I learned to trust the process.

Cathy Curtis CFP of Curtis Financial Planning went from stressed and sleepless at night to taking off 60 days to travel to 6 countries in her first year implementing meeting surges. Cathy shared her experience in Financial Advisor Success Podcast #143, saying “I have so much less anxiety taking time off. I can plan my travel in advance and work my work surges around my dates. It’s been so life-enhancing.”

Why then, don’t more advisors implement meeting surges? There is a persistent fear across the profession that delivering services in a systematized way will dilute the quality of service and advice delivered.

Quite the opposite.

Scaling Up Does Not Mean Watering Down

The most common rebuttal I get when talking to advisors about meeting surges is the argument, “What I do is special, I can’t water down my service like that!” My only issue with this argument is that it simply isn’t true.

Last year I delivered a keynote at FPA National, asking an audience of thousands how many were giving the “5-star” level of service they wanted their top clients to have? I didn’t need the fingers from one hand to tally the total. This is not a function of intention, but rather the toll of keeping up with the constant demands of running a practice. Demands that keep you from delivering the service that advisors want and that steal the free time they seek.

Meeting surges inherently increase productivity delivered by harnessing three of the 7 Mindsets of Success I shared in my Financial Advisor Success Podcast #24: leverage, time, and value.

You leverage your productivity by re-organizing your people, process, and platforms into a defined surge system. You maximize your Advisor Return on Time (ROT) by refocusing advisor time on the energy-creating, revenue-producing activities. And, you deliver deeper value to client relationships by giving clients more of what creates that value in the first place: your time, focus, and attention.

Meeting surges allow you to standardize the delivery of a specialized service by acknowledging that there are two fundamentally different types of work to be accounted for: factory work and focus work.

Factory work is fairly obvious, representing the rote tasks and routines required when planning and preparing for, holding, and following up on client meetings. Just as Henry Ford systematized the making of the Model T with an assembly line, advisors can streamline the process of client meetings with systematic execution. Meeting surges remove all productivity waste from the process, helping you deliver the product (in this case, service) in the least amount of time and at the lowest possible cost while meeting tight quality control standards.

Focus work, by contrast, is intellectual work. In the case of client relationships, it is the intangible culmination of an advisor’s knowledge, experience, and understanding of a client’s situation directed to the delivery of personalized advice on their behalf.

By isolating and separating the factory from the focus work, you can experience the same productivity gains leveraged by the industrial revolution, without sacrificing the personal approach that has become the hallmark of trusted advisors everywhere.

In other words, you’re only systematizing the parts that are meant to be systematized – the rote repetitive tasks of meetings – while allowing the real focus time of the meeting itself and the conversation with clients to be as Adviser customized and personalized as ever.

Tanya Nichols CFP of Align Financial, a Limitless Adviser coaching alumnus who shared her story on Financial Advisor Success Podcast, #150, started meeting surges so that she could take back control of her time and “spend an abundance of time laughing with my kids.” In one year, Tanya left her firm, started her own practice, and started taking every Friday off. In her first year, she grew 12% while cutting her working hours in half – all while growing 30% her first 2 ½ years in private practice.

Where other advisors would have sacrificed their life the first few years after opening a practice, Tanya got hers back. And, her now 25- to 30-hour workweek has her spending a lot more time laughing with her kids!

Systematize The Factory, Specialize The Focus

By decoupling the factory and focus work, you not only gain factory efficiencies; you harness your greatest revenue-producing and value-delivering asset, advisor time.

One day, in a fit of frustration, Benjamin Brandt CFP of Capital City Wealth Management, another Limitless Adviser alumnus – and father of six – concluded that if I could run a seven-figure firm working 20 hours a week from a beach in Costa Rica, surely he could run his practice in 25 hours a week from his office. Ben implemented the meeting surge strategy, resulting in a 17-hour-per-week summer schedule that first year. Ben now runs his practice in 25 hours a week, giving him ample free time with his young family.

Ben shared how he implemented meeting surges in Financial Advisor Success Podcast #181, allowing him to go from constantly frustrated to focused with plenty of free time, “It was life-changing. I couldn’t have a podcast, 6 kids, and a growing practice without the surge strategies.

Ben’s attitude about meeting surges is performance-driven. “Athletes are expected to be in peak performance for game time, and most play only a few hours a year. The other half of their time is dedicated to honing their skills and to recovery. As financial advisors, why do we feel our work should be any different?”

Ben, Adam, Cathy, and Tanya all got serious about their surge strategy when they realized their schedules weren’t serving clients, their practices, or their lives.

The Sausage-Making of Meeting Surges

The meeting surge process isn’t particularly difficult, though the devil is in the details. The strategy can be broken down into four simple, but non-negotiable steps:

Some advisors make the transition to surges over a period of time, while others implement the transition swiftly. Adam Cmejla made the full transition in a year. Benjamin Brandt made an intentional decision to ease into fewer months over two years, now surging for five weeks each May and October.

Step 1: Confirm Schedules And Meeting Agendas; Launch Process

The first step is to decide what months you will meet with clients. The best practice is to offer client review meetings twice per year, typically in May and again in the fall, usually October or November.

Meetings in May allow for you to have a copy of your clients' latest tax return. Fall meetings allow for end-of-year tax planning and client-specific conversations around Roths, RMDs, Medicare exemptions, estate planning, and the like. This provides solid planning reasons for these meeting times while also freeing up traditionally busy times of the year around the winter holidays, tax time, summer and spring break – for you, your team, and your clients. Though you can choose to set client meetings in any months that work for you.

The list of clients with upcoming meetings is reviewed 4-6 weeks in advance of the surge. The meeting agenda is reviewed, value-added content is confirmed, and the process of personally preparing each client file begins.

Value-added content is specialized content provided in each meeting cycle focused on a selected topic, personalized to the client. This includes educational pieces, planning topics such as estate planning reviews, CARES Act and PPP loan implications, unique market insights, or other special topics that rotate with each meeting cycle. This helps ensure that meetings add deliver ongoing value and don’t get stale.

Additionally, the client file has been reviewed to note the client's goals, key information, and any client-specific situations or needs.

Step 2: Preparing for the Meeting

Next, the client file and Agenda are prepared for the advisor’s review, following a tightly defined preparation process reflecting your firm’s process and deliverables.

Meeting files are delivered to the advisor each Monday, where the advisor reviews each file and makes any final changes, though few will be needed. At 9 meetings per week, an advisor can easily spend 30 minutes of focused, dedicated time reviewing each file to be fully prepared for the client meeting. This still leaves hours on Mondays for ongoing file review and more complex clients.

The advisor also reviews the client’s agenda and can make note of any special issues or talking points to be added. Then, a calendar scheduling link (using apps like Acuity or Calendly) is sent to the client in an email with the proposed agenda, requesting clients to schedule a time and share feedback on the agenda.

This step displays professionalism and credibility, builds critical trust equity, eliminates surprises, and promotes efficiency.

Step 3: Meeting Surge Weeks

Meeting weeks run on a disciplined schedule. Each Monday, advisors do client meeting prep. On Tuesdays, Wednesdays, and Thursdays the advisor meets with clients at set meeting times. The client meeting is either 45 minutes for virtual meetings or 75 minutes in-person. All meetings allow for 15-minutes of buffer time when detailed notes and next steps are captured in a consistent process. A 60- to 90-minute meeting cycle comfortably allows for at least 4 meetings per day, with time remaining and an hour for lunch.

An advisor’s first few surges will require far more physical stamina and mental energy than they will over time. In the beginning, advisors will expend a lot of mental energy designing and refining their systems, and physical stamina will be taxed engaging in highly focused thought activity multiple times per day, multiple times per week. As with any fitness routine, discipline and training yield the best results over time.

I recommend that advisors ease into their surge strategies at a challenging but not crushing pace. You can comfortably begin with 2-3 meetings per day and build up your meeting stamina to the surge schedule that’s right for you over time.

One firm’s advisor turns surge weeks into special weeks for herself and her staff. She orders an in-house masseuse on Fridays, brings in fresh flowers, covers an open tab for breakfast and lunch at the restaurant downstairs, and sends the team members gift cards for family meals during surge weeks. Given how critical her team is to successful surges, she knows it’s just as important to take care of her team as her clients!

Step 4: Meeting Follow Up

This step in the process provides a summary of the client meeting to the client, noting key discussion points, decisions, action items, and timelines.

This is followed by automated and personal check-ins at 30-, 60- and/or 90-day intervals to convey purpose, progress, and professionalism. The Limitless Adviser model meeting incorporates the Carl Richards’ One Page Financial Plan concept, which advisors can supplement with planning software or documentation used in support.

Done well, this approach and format not only makes delivering value easier, it also helps turns the meeting follow-up process from rote work into really meaningful action steps toward the goal, but that’s for another column.

Time Can’t Be Created But It Can Be Recaptured

The March 2019 Kitces Research study on how financial advisors spend their time reported that advisors spend, in the average week, 8.8 hours meeting with clients, 5.3 hours in meeting preparation, and 6.6 hours per week doing the supporting planning, investment, and analytical work. Add in 6 hours per week for follow-up service work, and you total 26.7 advisor hours spent on client service each week.

Assuming an average of 100 clients per firm, that is 1,282 advisor hours on client services or a heavy 12.8 hours per client. If you assume 200 clients per firm, which is certainly high, the average is 6.4 hours per client. However many hours are spent, they are usually served via a time consuming, constant churn of client meetings that consumes the year. This 'always-on’ model can be highly dilutive to the value delivered to clients, and it most definitely does not allow for freedom from the office.

With the surge strategy, advisor service time predictably averages 6 hours per client. Yet, almost magically, this is served up in four thoughtful hours for client meetings, two hours of dedicated advisor service focused on the client’s situation and specialized needs, and the core planning and investment work done in conjunction with client reviews.

A $500,000 practice can comfortably support 100 days off using meeting surges, and a $1,000,000+ firm would be far more profitable under this approach while giving up some of the stress that success brings, while gaining back some of the time that it tends to strip away.

Rather than spend hours of unproductive time being distracted by the non-revenue producing task of managing the process and doing prep work, advisor time is refocused on delivering tangible value to the client and growing the firm, with far greater ease and enjoyment.

Changing Your Mind Changes Everything

At this point, the voices in your head may be objecting that your clients would never accept the surge process, or that it simply won’t work for you. So, let me leave you with the most convincing argument I can. If you want to make meeting surges work for you the way they have for Ben, Tiffany, Adam, Cathy, and countless others, take the time to rethink everything about your business.

Michael Kitces recently joined me with Limitless Adviser coaches Adam Cmejla and Tiffany Charles in our free Open for Opportunity series where we talked about how much an advisor’s thinking becomes the secret weapon that can help them accelerate their success with greater ease than they ever thought possible.

In this same session, Michael shared how our coaching work together helped him to apply this same rethinking strategy in his own life.

In one of our calls, Michael shared that he had once received a letter of resignation from a key team member – a significant event that came with some not-so-insignificant stressors.

“Michael,” I asked, “What would it take to make this the best thing that could have happened to your business?”

He met this question with an uncharacteristic pause. Within such questions, you play a well-intentioned trick on your brain, re-directing your hard-wired survival response to focus on new, more empowering problems from which to save you.

When you ask better questions, you get better answers.

By our next call, Michael had clarity on how he could not only address the staffing shift but also use this inflection point to advance his strategy in ways that turned far-off goals into near-term possibilities.

As Michael tells the story, that first question and those that followed helped him make his “biggest shifts ever” including meaningful pivots to his business strategy, record revenue growth, and, perhaps most important, being more fulfilled and excited than ever about his work.

Michael’s results are a direct reflection of his willingness to rethink everything and step, often uncomfortably, into better questions.

With that, I offer you a similarly powerful question, “What would it take for you to deliver two times the value to your own clients in half the time with greater ease, and still be able to take 100 days a year away from the office without worry?”

You now have the mindset and the methods to make meeting surges a move-the-needle event that elevates your service while supporting a wildly successful practice and life that you love.

Now, rethink how you peel that banana… and everything else in your practice!

In response to the overwhelming feedback to the “Open for Opportunity: How to Succeed in Any Market” series with Stephanie Bogan, Michael Kitces, Adam Cmejla, and Tiffany Charles, Limitless Adviser will be offering a complimentary course on client meeting surges later this year.

To join the waiting list, simply visit https://limitlessadviser.com/client-surge-kitces

Stephanie,

Great article! I was thinking this week about our meeting process and thought their was a better way to do it. This gives some practical tips on how to make that happen.

Thanks John. This approach offers the best of all worlds, and it’s completely customizable to your preference so any concerns can be addressed by tweaking to fit your comfort and style. What matters most is that you (and others) know what is possible, so that you can decide what you want for your own business and life and work backwards from there. While it might seem complex, and I note there are several moving parts, it’s actually quite simple and thus elegant. Now, get clear, get focused and get to work! Good luck.

I ALMOST FORGOT – we’ll be working with Michael to share information on our FREE upcoming course on client surges and other success strategies later this summer. Stay tuned!

The author makes some good points about systematizing processes which I am in full agreement with. In general financial advisors tend to still have many manual processes that need to be automated and repeated-through a CRM or other method to reduce the brain drain of things that don’t need to be thought about (this should be done in the base case). I think the surge method could work for advisors who have clients that don’t have complicated situations (i.e. clients with <$3 million-retiree with 401k plan/younger individual who is still working). However, once you increase the complexity of ultra-high net worth clients between $5M-$25 million this process is much harder to replicate given the tax planning/estate planning needs of these clients (however if there are any firms out there that do this I would be curious to learn more about them and their process). Don't get me wrong even within ultra-high net worth you can repeat similar processes however each client usually has one off situations that have to be dealt with. Also, I would question if advisors are meeting with 3 clients a day how detailed are their agendas? (I would be curious to see samples as general bullet points of topics seems generic). In addition to this, usually after a meeting there are additional follow ups and having this many meetings would require plenty of time necessary to handle additional items-however some of these items can be delegated to some degree. The other issue is working on the agendas 4-6 weeks in advance has it's own issues (aged data provided by client/if performing any type of tax planning the wages/income provided by clients could change which may alter the tax estimate). The last issue I potentially see if being in a routine of meetings usually gets you into a mental groove of being prepared mentally for a meeting and accustomed to meeting with clients and going months without that may dull that client meeting muscle. Given all of this don’t get me wrong if this method works for advisors more power to them and I think it is great if it helps them reach their goals and objectives. However, my overall view would be that the surge method would work for advisors that don’t have clients with complicated situations and as the complexity level increases the chances of this system working would decrease-however I would be open to seeing any evidence to the contrary.

The author (me) genuinely appreciates the considerable thought her article provoked, and is happy to share some further insights in reply.

– We’re in agreement re the complexity of UHNW clients. I’ve worked w/many over the years and when your planning work includes NIMCRUTS, funding private jets, managing endowments, international lending (etc.) your process is more robust than traditional surging allows. That said, we have advisers in Limitless Advisor coaching right now using surges with $20M, $40M and $80M clients. Yes, of course, these clients gets more time and attention in surges, but the process accounts for that while remaining the same.

You are standardizing the process, the agenda and follow up. You DO NOT standardize the application of the agenda. This is where most people get hung up. They feel that scaling up the process means watering down the personal attention. But if you do it right the client’s gain far more time, focus and intellectual energy. Yes, there will be a small % of issues that fall outside the lines. But with this highly organized system, you have the methods and mental space to deal with those without issue. The “things that come up” that now fill your days with background noise find a new home (clients become trained to the new process, so much more to go into) and such interruptions truly become “special circumstances”.

– What about the follow up? We have a process for that too. You have the meeting, share the notes and next steps and your team handles the follow up, which you have time in your schedule to account for during and after surges.

– How detailed are your Agendas with 3 meetings a day? The detail on the agenda has nothing to do with the # of meetings. The prep is organized in advance so the meeting is focused on the topics selected as relevant. Some agenda items will be consistent (e.g., goals) and others will change (status of, issues re planning work, investments by client). Remember, each client’s situation is personally tended to, you’re just following the agenda structure custom designed for that meeting set. The more similar your clients the more efficient it can become. For generalized practices, you can specialize within your generality. For example, you can segment independent women, business owners and retirees. You can’t have the same topics for all clients, but you can have an agenda with goals, standard planning topics and then a section personal to each client’s situation. You then “sub-standardize” this set of agenda items. In Spring meetings, for example, you might review the January changes to retirement plans and the insight you share may be different for each of those clients, with different insights for business owners (which are reflected on all their agendas universally and still personally discussed). Without taking space for a deeper discussion of this strategy, the idea can be summed best this way:

MORE ISN’T BETTER, BETTER IS BETTER.

Do not get distracted about the value you deliver. You can have, reference and show the deep documentation but it is not where your value lies. Your value is advice, not information. It is bringing clarity, defining options and acting as a lifelong problem solving partner.

I’m a fan of keeping things simple for clients, so are most clients, especially the wealthier ones. One of my favorite best practices is Carl Richards One Page Plan. Like surges this may seem counter intuitive to those of you who reference inches of paper during your review meetings, but it can add incredible depth to your dialogue and value delivered. We work closely with Carl Richards at Limitless and the one page plan with surges is another way we deliver deeper value to clients while giving you back your time and freedom.

– Will my meeting skills get dull between meetings? I sure hope not, but that’s entirely up to you. You play how you practice, so if you don’t practice and spend no time marketing or meeting with prospects during the extended periods between meetings your skills could certainly grow dull. But I invite you to consider a different story.

What if… you took every Friday off, plus a month off in the summer, had 4 weeks for CE/conferences, and still had months of time to deepen your value-delivery. You could be refining your meeting structure (75 mins allows for an exceptional meeting), honing your advice giving skills, deepening your expertise, doing client research, connecting with client COIs, and other activities that make you a better advisor that delivers deeper value.

Surges give you back the majority of the year, so instead of spinning your wheels trying to keep up you have ample time to hone your craft. That’s what we do at Limitless Adviser anyway 🙂

It’s hard to get ahead when you’re struggling to keep up.

For your larger clients, define the services/planning topics that are standard to every client, then segment your clients into sub-specialties (inherited wealth, business owners, suddenly single women, etc.) and create versions of your meeting agendas for each segment, while keeping the agenda as consistent as possible across segments. Now, during your prep process, you and your team use the blocking model again – this time doing meeting prep for clients by sub-segment. Once you get the routine down, regardless of client size, meeting prep becomes routine. Again, the personal application to the client does not, ever.

You won’t have quite the same efficiency as a niche practice (the efficiency and value here is ridiculously compelling) but you can still glean many of the benefits…

Which is more than enough to deliver deeper value to clients while gaining back your time and freedom.

One final note, when considering a significant change, your brain loves to magnify the threat that poses significant risk to discourage change. Upsetting client relationships poses unnecessary risks, the very kind of risk that your brain is hard wired to avoid.

Except that when you take a closer look you see that surging isn’t about taking advantage of clients, but rather contributing to their lives in ways that don’t require you to sacrifice yours.

I hope this offers some additional clarity. ~Stephanie

Prior to Kitces.com/7 I’d only met a handful of advisors (starting with Tom Gau) who were doing surge meetings. It’s exciting to see how many advisors are now implementing this strategy! For those interested, the most intense example of surge meetings I’ve seen was talked about in Kitces.com/110.

Thanks Stephanie for helping spread this strategy!

I vote for Tom Gau for the podcast! An article years ago from Think Advisor said “Tom was amazingly productive. He was always full of energy and upbeat even though he worked unbelievable hours. In a good week, Tom would have more client meetings than many financial planners have in an entire year. In one week that I know of, he had over 100 such meetings.” Some advisors don’t even have 100 meetings a year let alone in one week!

I voted to Gau/Unger on the podcast when it first started and I’ve always been surprised they haven’t been guests. Tom is hands down the most talented advisor I’ve ever met.

Ken Unger would be a GREAT podcast guest. Dynamic and knowledgeable coach and speaker.

Hi Matthew! Tom Gau, with his partner Ken Unger, taught this time blocking strategy starting back in the late 1980s. Ken still is successful teaching it to Academy of Preferred Financial Advisor members. “Surge” meetings is a rename for what they called “bunching” in the 1990s and “back-to-back” client meetings in the 2000s. No matter what you call it, this is a great strategy. For those who would like to see this and other proven efficiencies for advisors they can check out http://www.theapfa.com.

Hey Matt! Have used this high performance strategy for 20+ years with private clients with remarkable results. Was happy to share this success shift when Michael asked.

Gau does a great job of coaching on surges, helping transform your practice and many others. Great to see you sharing as well.

Anyone can hear how other Limitless advisers used surges and other success shifts with radical results:

Adam Cmejla: https://www.kitces.com/blog…

Cathy Curtis: https://www.kitces.com/blog…

Tanya Nichols: https://www.kitces.com/?s=t…

Benjamin Brandt: https://www.kitces.com/blog…

I loved this article and have already made my 2021 schedule using the Surge strategy! We pre-schedule our meetings and that’s what clients expect, so starting next year we’ll schedule them into the Surges with a bit of explanation. Question – I have a surge in April and another in November for all of my financial planning clients (that lasts 14 days) and a 7 day surge in the summer for my asset-management only clients. We worked these around all of the school vacation calendars to minimize issues. How is it best to handle it if someone can’t make it work in our surge? I was thinking of setting aside a time the next month (maybe 4 days) that only my staff can schedule me (rather than them being able to do it on their on in Acuity) so that they are only given reschedule options in the Surge unless none of those work. But I’m sure we’ll have on-off situations. Any advice?