Executive Summary

Financial advisors looking to improve their businesses have a wide range of “Best Practices” research to tap for new ideas, from industry benchmarking studies to specialized white papers. And of course, this Nerd’s Eye View blog. For those seeking methods to run their advisory business more efficiently and profitably, there are a lot of relatively simple tactics to try.

In fact, as highlighted in this guest post from Stephanie Bogan and Matthew Jarvis, arguably the greatest challenge in improving a financial advisor’s business is not actually figuring out the Best Practices methods at all… and instead is almost entirely about changing the mindset of the advisory firm owner. Because most business improvements to an advisory firm are fairly straightforward – from standardizing service offerings, to eliminating fee schedule exceptions. The blocking point is in our heads. Literally.

Because as Bogan and Jarvis discuss, the real reason that most advisors struggle to take their businesses to the next level is the limiting beliefs that we impose on ourselves as financial advisors and business owners. The idea that certain aspects of the business “must” be done a certain way, or the business will fail. When in reality, it’s simply that we don’t want to go through the awkwardness of change and the discomfort of feeling threatened and worried that a client might push back… even though at worst, making changes will probably just threaten to cause a few clients to leave (and usually it’s those clients who weren’t even the best fit in the first place!).

In other words, the key to financial advisor success isn’t really about implementing the right methods – the business tactics and best practices – but more about having the right mindset that makes it easier to implement those methods in the first place. Because once as advisors we have clarity and focus in the business, a confidence in our own worth and the value we provide, a focus on leveraging our time and relationships, and an abundance mentality that the money and business success will come by doing the right things… it becomes remarkably easy to make the changes necessary for that success to actually happen!

Receiving the secrets to building a successful practice has substantial value to a financial advisor—so much so that we are constantly contacted with questions from advisors about how we did it. More often than not, advisors are looking for a simple, succinct answer that reveals the secrets to our success in a sound bite.

Of course, there is no one secret that is the proverbial panacea to greater success, but we’re happy to share that the process doesn’t have to be nearly as challenging as many advisors make it.

After our respective appearances on the Financial Advisor Success podcast (Episode #7 with Matthew, Jarvis, and Episode #24 with Stephanie, Bogan) we each received dozens of inquiries from advisors asking how they too could achieve such financial success, while enjoying so much freedom.

For some, this might look like Matthew’s highly profitable lifestyle practice, with over $1M+ in revenue, a take home profit margin of 55%, and over 100 days off per year (and he’s only 35!). For others, it might be building a multi-million dollar firm by the age of 34 as Stephanie did – and helped many advisors to do before she sold to a Fortune 200 company - or focusing more on lifestyle as she has transitioning to living and working from the beach in Costa Rica.

For others, success looks like a better version of their current practice, and still more may wish for something different entirely.

Understanding how to experience greater success and satisfaction is a daunting task for most advisors. In this post, we want to explore this search for success from several vantage points, taking a more robust view than is typical to highlight for you the path we have taken to build limitless practices. We’re going to reveal insight into the hidden forces behind success, explore how mastering your mindset is an essential ingredient in a successful practice, share The 5 Freedoms of Limitless Advisors and the 7 Mindsets required to live them, and then highlight the methods Matthew used to create the stellar results he is enjoying.

Master your Mindset

It may be a shock but it should come as no surprise that the secrets to success are quite simple. Of course, while they are simple, that does not make them easy. The reason for this is that applying them requires a change in thinking and behavior. And therein lies the first secret to success.

I realize that prevailing conversations about success in the advisory profession aren’t littered with conversations about mindset, performance psychology and neuroscientific research. Having spent 20 years consulting with the industry’s best advisory firms to create elite practices and having spoken on every business topic imaginable at nearly every industry conference, I will be the first to admit this and to share how much of a disadvantage I have found this to be for the average advisor. I can also attest to what a powerful advantage it is for the advisors who learn the secret and put it to work.

To support this assertion, let me share some mind-blowing insights I gleaned doing extensive research on success, happiness and personal performance.

One of the more astounding thing I learned was that one famous study from the Carnegie Foundation estimated that 85% of success is psychology, or state of mind. The other 15% of success is methods, or how you run your business practically speaking.

So, for simplicity sake, it’s a combination of an advisor’s mindset and methods that determine their level of success. But what’s been so striking to me is that there is so little conversation about mindset, and so much about methods.

The importance of mindset cannot be understated. While there are many factors that go into developing a million-dollar mindset, there are some that tend to give advisors the greatest difficulty. Here’s are two practice examples that highlight these challenges.

The Fastest Way to Give Away $3M

An advisor client with an $800,000-revenue practice retained me to assess his practice and evaluate how he could best double while improving increasing his profitability and decreasing his days in the office.

As part of this assessment, I noted some “fee exceptions” – clients where he charged something different than his (current) standard fee schedule. When I inquired, the advisor shared that he “had made a few exceptions over the years.” I’ve been around long enough to know that “some exceptions” is code for “too many”, and warranted further exploration. And so I conducted a fee analysis to calculate the difference between his revenue were all clients billed at the rates in the fee schedule, and the actual revenue he was collecting (including exceptions).

The net difference was – insert drumroll for dramatic effect - $80,000 per year, or 10% of revenue. Now that’s a good sum of money when considering it would be all profit (since he was already servicing them for his current costs). But add to this the fact that the advisor was in his late 30s and had easily another 20 years of practice work, and that total grows to $1.6M of cumulative revenue. If you expand the math to include compounding growth on AUM fees at just 5% annually, the new total is $3M of cumulative fees (which in this case is also $3M of cumulative profits). I might add that I’m not even accounting for the value of that revenue upon sale, which is millions more.

In this not-so-rare case, a “few” exceptions was literally going to cost that advisor over $3M of lifetime profits. And that’s assuming he never made another exception along the way.

A New Kind of Client Service Anyone?

In another advisory firm where the advisors were overwhelmed with work and underwhelmed by their profitability, I did a different kind of exploring. In learning more about their client base, I noted that they had a range of client types and sizes.

As this often creates complexity for a practice, I asked some questions about their service levels: were they defined? Did everyone know who got what, when, from whom and how? Where did they spend most of their time? And, perhaps the most critical, do you spend as much time as you would like with your top clients? Now, in fairness, I ask this question at nearly every speaking event I present, and in a room of 300 or so, the average is 4 hands that raise in the affirmative, or roughly 1%. This number holds consistent over the 20 years I’ve been asking the question.

In this case, as I find about 99% of the time, the answer was “no”, they did not spend as much time as they would like with their top clients. So, I asked them to consider holding a new kind of client event, one that more accurately reflected the service they were delivering. The firm partners couldn’t wait to hear what I had to share.

“For your next client event,” I shared “I’d like you to identify your top clients and place a gold star on their nametag. On the night of the event, I want you to sit one top client at each table and allow each table to fill in with the rest of your clients. When you get up to the podium to thank everyone for coming, tell the attending clients that instead of thanking you for the event, they should find the person at their table with a gold star on their name badge, and thank them instead. Since, after all, they are the ones subsidizing your relationship with our firm.”

When I share this story when speaking, this is the point at which the room becomes eerily silent, jaws appear noticeable lower than they started, and there’s an awful lot of looking around the room to see if everyone else has the same reaction.

In the case of the firm I was consulting with, their response was “No, we wouldn’t say that, because that would be dreadful client service.” Insert dramatic pause here. “Oh wait, that’s the kind of service we’ve been giving. Wow, we don’t feel good about that.”

The Business of our Brains

These practice examples are so powerful because they are so common and because it’s so easy to see the error of their ways once I re-frame the situation. Yet, how many advisors have made these same mistakes? How many make these mistakes constantly – and others just like them – unnecessarily compromising on their success?

Let me use our practice examples to highlight what I mean. But first let me share some neuroscience that will help you go beyond the typical “what’s happening here?” and become more conscious of what’s happening, really, so that we can deconstruct the problem, find the source, and successfully solve for what matters.

Behind the Curtain

It’s been estimated that the average person has about 12,000 to 60,000 thoughts every day. Of those, 95% are exactly the same repetitive thoughts as the day before, and about 80% are negative.

Critical to mastering your mindset is that little-known fact that 80% of these subconscious thoughts are negative.

Yes, 80% of your thoughts are happening “behind the curtain” as I like to say. And 80% of what’s taking place behind the curtain is holding you back, hard. Your brain is hard wired to operate in certain ways, and when you understand those ways – and work around them – you can massively improve your performance, success, happiness, wealth and well-being.

I am not over-stating the point here.

In my first example, the firm lost $80,000 per year in revenue due to exceptions that were not even on the radar.

I asked the advisor if he knew why he made the exceptions, and his response was common, and critical to mastering your mindset: “I don’t know really, I guess I didn’t want to lose the client. I didn’t know what else to say.”

This advisor suffered from the 3 most common business blockers: can’t, don’t want to, and don’t know how.

Go back to the first time you can remember making a fee exception. Tell me about it, what happened? The advisor described having a good meeting, and then unexpectedly the prospect indicated they really liked what they had heard, but would he be willing to reduce his fees.

Stop the presses. In what world does it make sense that when someone feels good about the work you do, and the value that you will add, that their first response is to ask for a discount. And, in what common sense world does the professional respond by essentially saying, “I just told you all the value I can add to your life, and you just told me you agreed, so yes it makes perfect sense for you to ask for a discount and for me to say yes and for us to both feel great about this relationship as we begin on those terms.”

Which, if we’re being honest, is precisely what happened. If you’re like most people I share that example with, you cringed a little bit when you read that last part. Why? Because it intuitively makes no sense whatsoever. When I re-frame situations and issues like this for clients, I usually hear something like: “Well, when you put it like that…”

It may be helpful for me to share what happened here, really. What happened was that the advisor’s brain was running the show, as is the case for most of us most of the time.

Recall that 80% of our thoughts happen behind the curtain, in our subconscious. Which makes the ever-important question: what’s running those thoughts? Your beliefs.

To understand how this works, one needs to understand the business of our brains. Our brains are incredibly powerful, though rather efficient and/or lazy depending on how you look at things.

Your Beliefs Become Your Scripts

Our brains process 11,000,000 bits of information a second, and 40 bits are processed consciously.

The rest of the processing happens behind the curtain, in about 1/5th of a second. The brain simply cannot process that volume of data consciously, so it delegates to the subconscious to get the job done. The subconscious develops shortcuts early in life as a coping mechanism for the volume of information to be processed. These shortcuts are like scripts, or computer code. They are the instructions for how to intake, process, and respond to information about our world and what’s happening around us.

These scripts are referred to as beliefs, which in turn drive the majority of our behaviors. Now, if all our beliefs were positive, this wouldn’t be a concern. However, as I shared earlier, 80% of our subconscious thoughts are negative. Armed with that information, it’s hard to make a case that a good majority of our beliefs aren’t negative as well.

The point of great concern here is that this is a lot of negative thinking happening behind the scenes, without our knowledge or consent. In short, we’re running on auto pilot for a good majority of our decision-making process.

Add to this the underlying biology of our brains. The oldest part of our brain is the limbic system. The limbic system has one job: survival. In short, its job is to keep you from dying. This part of your mammalian brain is responsible for fight or flight. When this survival mechanism kicks in, blood flows from your pre-frontal cortex (the rational, logical part of your brain) to the limbic system. You’re fighting or fleeing without ever having a conscious rational thought about what or why.

And our advisor friend who lost $80,000 a year in revenue and well over $3 million in practice value was no exception. Let’s break down the business of his brain.

How Your Beliefs And Fears Create Advisory Business Problems

He was in a happy, comfortable place (a meeting that seemed to be going well) when unexpectedly a hungry saber-tooth tiger jumped out at him (seemingly satisfied prospect asks for a discount), and he took flight to get out of there as quickly as possible (said yes to avoid the discomfort of having to defend his fees and possibly losing the prospect).

Without a second thought his brain’s biology, via his limbic system, kicked him into survival mode. Our brains evolved in very different times, back when surviving was a daily accomplishment. If something was out of the ordinary or unexpected, it should be immediately avoided to minimize the risk of injury or death. This is why, by the way, we are hard wired to avoid change. Change in caveman times most likely meant death.

The problem with this strategy is its only aim is “not dying”. But, regretfully, not dying is not the same as truly living. In our more modern times, something new or unexpected most likely isn’t going to make us its dinner. But our primitive brains don’t recognize that times have changed, and often do not process the difference between a true threat, and a business (or life) circumstance that might ultimately be favorable to our success.

Simultaneously, the advisor’s brain defaulted to backup mode for behavioral guidance, as it can’t consciously process what to do while trying to stay alive.

His underlying belief was that he needed to get a yes, at any cost. Why? Well, for starters, our profession was founded in sales, and in the 20 years I’ve been consulting I’ve seen hundreds of sessions on how to get a prospect to say yes. I have never seen a session on how to say no. Add to this the fact that in the formative years of a practice, not retaining a prospect can have serious financial consequences that are threatening to the ongoing survival of the business.

On top of that, at some level, most advisors are afraid of rejection. Not surprising, because rejection by a prospect doesn’t feel good. It makes us question our personal worth, and the value of our work. Not exactly confidence-inspiring stuff. Unless you are in fact confident in your worth and value, and thus don’t give the “no” or request for a discount any meaning beyond the obvious one that the person asking the question doesn’t get your value and thus may not be a great fit. In this case, you wouldn’t react in survival mode, because with confidence in your worth and value, you know you don’t need that prospect to feel good, much less survive another day.

So it’s no mystery how or why these things happen, once you understand the neuroscience and psychology underlying the majority of our behavior.

When the advisor was challenged, he panicked, and said yes. That seemingly small decision, repeated over time, will cost him millions. Because his brain did what all our brains do: it noted the shortcut, and saved it for later. The next time a prospect asked for a discount, the default code was already scripted to say yes, as that was now the path of least resistance. Because the belief (the script) was operating behind the curtain, the advisor’s radar never went off suggesting that these exceptions might be cause for concern. His brain was focused on the wrong tiger the entire time.

Now, if the advisor was confident in his belief that he was worthy, that his fees were fair for the value he charged, and he had recognized the possibility for this circumstance in advance, he would never have said yes to the fee exception, or repeated that mistake to the tune of millions in lost revenue.

Reframing Business Problems To Understand The Real Issues

Let’s go back to our client service example and see if we can deconstruct that with the same understanding. First, we have to understand why this problem really exists. The firm’s response to this question was that they were too busy serving all their clients to spend more time with their best clients. Again, this response describes a symptom, but it fails to identify the real problems. In this case, that there are no rules of the road.

The firm says yes to client requests and needs – whether they are in scope or not – because the firm has never set a standard, and so does not know how to say no or charge for additional services. Add to this a mindset for managing priorities and time of “be available to clients, irrespective of other priorities”. The advisor’s focus is driven by whatever client call or email (or staff questions) happens to be in front of them at the time.

What’s happening really is that advisors are avoiding the possibility of confrontation, disapproval, or rejection by a client, by saying yes without boundaries. And, like many advisors, they respond to whatever comes their way (the ding of their email inbox, a client phone call with a question, a staffer looking for an answer) in ways that allow the issue at hand to be more important than their need to focus on the (sometimes more important) other client work. Sadly, not only do most advisors willingly allow for this transfer of power with no resistance whatsoever, they do so under the guise of superior client service.

Every advisor I’ve ever discussed this with explains to me how caring and right it is to take the call, check the email, or allow the interruption. Not once in 20 years has even one advisor acknowledged one client’s work is being set aside in order to serve the next.

Here is where the old adage, “the squeaky wheel gets the grease” comes in. When a prospect says yes, have you ever then said to them, “I am so glad you’re becoming a client. For the first year or so, I’ll be on top of your every need. After that, I’m going to ease off a bit and within a few years I’ll be here if you really need us, or it’s time for a meeting, but outside of that I won’t be able to think or work proactively on your behalf because I’ll be too busy working on the newer clients who really need me.”

What’s happening here is that the advisors are being run by the practice, they’re not running it. And what’s really happening is that they lack the self-worth, self-perceived value, and confidence to take back control of their time.

In one client firm facing this situation recently, we decided to redefine the firm’s client service model. We segmented clients into different service types (financial planning, investment management, or collaborators) and then service tiers (Tiers 1-6). We then defined the services that each segment and tier would receive, resulting in a matrix of service models. Next, we estimated the time for each task, and calculated the profitability of each segment/tier to ensure each and every one was profitable in its own right. Where this didn’t work, we modified the services to ensure profitability at every level. Once the service model was designed and profitability confirmed, we developed a model for communicating the changes in services – including the important and well-founded reasons why – and what that would mean to them in the form of changes in service level, options to upgrade, and fees for services they may not have experienced before.

Now I will share that I’ve done this work dozens if not hundreds of times, and on average the firm will lose a client, maybe two, in this process. But often it is none. In this case, with over 500 clients, none was lost. Yes, there were some questions that needed to be answered, which we are always well prepared for. Yes, it takes some time and effort to communicate with all the clients. But yes, the results are more than worth it.

(Michael’s Note: For advisors who would like a copy of Stephanie’s “Client Service 1-pager” shared with clients during the firm’s transition, it’s available via the www.limitlessadviser.com website.)

The reasons the situation started are easy enough to identify here. The real question becomes why was it allowed to go on so long, with such discomfort, while costing so much in terms of productivity and profitability, not to mention personal satisfaction.

I won’t take you through the business of the brain as I did above, as the standard rules apply. As in the fee exception example, it happened subconsciously because beliefs that create autopilot scripts were driving the car, while the advisors sat behind the wheel looking out the window. And auto pilot was engaged for the better part of 10 years before they realized they didn’t really like the view and would like to be on a different route.

Understand The Business Of Your Brain To Master Your Mindset

Once you understand the business of your brain, you are far better able to understand the power of mastering your mindset. Better yet, you’re able to hack your mindset and create a wildly successful business and life that you love.

The challenge, however, is your beliefs. If you are human you have beliefs, and if you have beliefs, some - and often many - are limiting. This is not to suggest we are all bad, or broken, or flawed. On the contrary, that’s not the case, as most of us are getting by pretty well. It just also happens to be true that most advisors (at least the thousands I’ve spoken with) aren’t living up to their potential, and know it.

Which means if you aren’t living, being, having, earning and experiencing all that you want in your business and life, then I assure you that you too are suffering from limiting beliefs. It’s unavoidable as the diagnostic cause is: “human”.

Yet we too often just accept this, with what I like to call being “uncomfortably comfortable.” In other words, things are good enough that while we’d like them to be better, or perhaps even really dislike them and feel discomfort or difficulty often, we settle for things as they are because changing them would, well, require change.

But what if more, much more, were not only possible but readily available for any advisor willing to expand their thinking and behavior?

The 5 Freedoms of Limitless Advisors

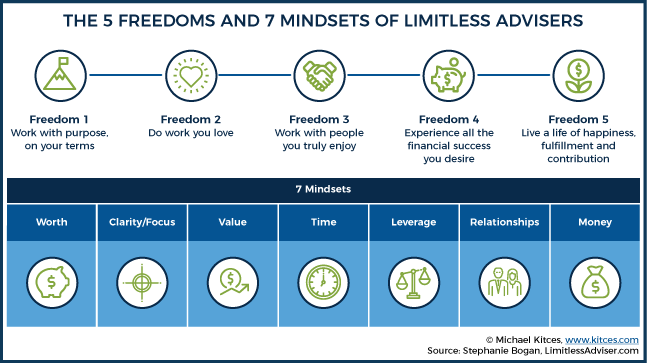

Stephanie always starts by asking her coaching clients what they aspire to, and for most it’s some form of what I’ve come to call The 5 Freedoms of Limitless Advisers, which are:

The 5 Freedoms Of Limitless Advisers

Freedom 1: work with purpose, on your terms

Freedom 2: do work you love

Freedom 3: work with people you truly enjoy

Freedom 4: experience all the financial success you desire

Freedom 5: live a life of happiness, fulfillment and contribution

For most advisors, the idea of living The 5 Freedoms sounds wildly attractive, yet is quickly followed by the question, “How do I get there?”

As we’ve shared, methods do matter, but we’ve also learned – and Matthew can attest from his own experiences – that the methods only produce real, sustainable results when you shift your mindset in ways that allow the methods to work their magic.

The 7 Mindsets of Success

Through our respective experiences, we’ve noted 7 mindsets that are essential for building an advisory practice that allows you to experience greater success, satisfaction, and freedom:

Worth: Knowing your worth, and the worth of the value you add through your work, is what allows you to face business and life with confidence. When we look to external factors for worth and validation, we compromise our standards when challenging circumstances arise, stripping away our success and satisfaction in the process. The advisor who discounted his fees by $80,000 (to ultimately lose millions in the process) didn’t have a thoughtful business response to the challenge on his fee. It was a reaction driven by his lack of confidence in his worth. When you know your worth, you don’t compromise your value, and you won’t let others do it either. Limitless advisors know their worth, and act with that knowledge front and center.

Clarity & Focus: Being clear in where you want to go is critical to charting a course for getting there. Too often advisors take action in response to daily challenges and circumstances, rather than being driven by a sense of vision and clarity around what they’re striving to achieve. When advisors decide to create massive shifts in their success, it starts with clarity about what they want, particularly if it’s a practice that would be very different than the one they are currently experiencing. And it’s the clarity of vision of what the advisor wants from his/her practice and life that helps to reveal the contrast of what changes need to occur. In a world with so much information, so many options, and so much happening at any given time, focus is a mindset that can be hard to maintain. We often joke that advisors are easily distracted and love to chase “shiny things” (we do it, too). We also know that focus is an essential ingredient in your success. There are many paths you can take to experience greater success. However, selecting a path and pursuing it with focus is far more effective than going down every possible path. Staying keenly focused on the strategies that pave the road to success is essential to a swift, smooth ride to that coveted destination. Limitless advisors have a clear sense of what experience, outcome and results they are striving to create, and know where to focus their energies for maximum results.

Value: An important compliment to knowing your own worth is knowing the value of the work you do, and the outcomes you deliver to clients. When you have a strong sense of the value you provide, you approach situations with greater ease and confidence. A strong sense of your value proposition is immensely helpful to articulating that value to potential clients and referral sources. We would argue that financial planning and investment management are not your value, but rather the mechanisms by which you deliver that value. Advisors with a strong value mindset know that their value is delivering advice, not information. Learning your value and how to articulate it in sales and marketing situations is a valuable leap-frog to success that advisors too often overlook. Limitless advisors know their value, and articulate it in ways that easily attract clients that are motivated, able to see their value and willing to pay for it.

Time: Advisors don’t suffer from a lack of time, they suffer from a lack of knowing how to make the most of it. The pace of your progress will be driven by what you choose not to spend your time on, as much as by what you do choose to spend your time on. Matthew is adamant about avoid time-wasting distractions in his practice, and Stephanie helps advisors make the most of their greatest revenue producing asset: time. When you possess a strong sense of worth, clarity and focus, you become quite clear on the priorities that will deliver results, and focus your time on these revenue-producing activities. Everything else you delegate to people, process, and/or platform solutions. Managing your time isn’t your greatest obstacle, but rather your greatest opportunity. Limitless advisors focus their time on energy-creating, revenue producing activities.

Leverage: Leverage is using the resources you have to your maximum advantage, and accordingly is an important mindset to fully living The 5 Freedoms. Many advisors struggle to extract the level of leverage possible from their people, process, and platforms. There are many reasons for this, but often this symptom is a result of difficulty delegating, control issues, a feeling no one can do it as well as you, and/or the perceived need to personally individualized solutions for every situation (regardless of the actual beneficial impact). Any advisor who has relied on these strategies because, well, they just “have to”, knows too well the discomfort of this dilemma. We know it feels like the right thing to do, but we also know this approach just doesn’t yield the results most advisors are looking for. We promise you each of us has struggled with this mindset, learning that letting go and leaning into a leverage mindset yields far greater performance and results than running a “1-man wonder” show. One feels righteous and validating, but the other produces results worth letting go for. The interesting insight here is that once you learn to use leverage to your advantage, you will never want to go back to the old, you-centric way of doing things. Limitless advisors use people, process, and platform to achieve maximum leverage, creating a magnifying affect and accelerating their success.

Relationships: Our relationships with people are a key contributor to our success and happiness at work. Advisors work with people, and for people, and too often don’t truly enjoy the people with whom they are working. You spend a significant portion of your time at work, and we feel strongly that you should enjoy the people you share that time with. Compromising on your staff in terms of quality, capability, or fit undermines performance, productivity and profitability. And, let’s be honest, it’s just not fun to work with people that aren’t performing or that aren’t a cultural fit, and it causes a great deal of avoidable stress and angst. Add to this that many advisors have client relationships they don’t enjoy, working with clients that are difficult, don’t follow their advice or aren’t a personality fit. Limitless advisors work with people they truly enjoy, making work an enjoyable experience.

Money: A positive money mindset is a major contributor to an advisor’s level of financial success. Advisors who approach money with an abundance mindset often fare better than those who operate from a scarcity mindset. A strong money mindset recognizes that you invest in success, you expect a good return on that investment and that money is an exchange of value between two parties that should be fair and reciprocal. A successful practice, and surely a limitless one, is built on a strong financial foundation. This includes profitability at both the client and firm level, as both are key components in a firm’s financial success, and ultimately the income of the advisor. We don’t know many advisors that would tell their clients to stay in an under-performing investment, yet advisors will stay in un-profitable endeavors and engage in un-profitable relationships when there is no business case for doing so. You will be far more ready and able to tap into a greater level of financial success when you master your money mindset. Limitless advisors know that money isn’t the point of success, while being able to appreciate their right to enjoy all the financial success they desire.

To be clear, you can be “successful” without mastering these 7 Mindsets; we’ve just found that that path is far more stressful, frustrating and difficult. Any advisor who feels more success, time, enjoyment and financial success is possible and isn’t experiencing it can be infinitely more successful once they master these 7 mindsets.

Methods Make the Magic Happen

Once you’ve mastered your mindset and learned to leverage the 7 Mindsets of Success, only then should you focus on the methods by which you build, manage and grow your business.

Of course, this is ultimately where the rubber meets the road, whether it’s defining your strategy, developing specialized systems or creating a sales process that makes it easy for prospects to say yes (to name just a few of the methods that multiply your success). You have to take the ideas you conceive with your newly expanded mindset and implement solutions that create improvements in your practice.

In Matthew’s practice, his shift occurred when he decided he no longer wanted to work so hard for such mediocre and disappointing results. By changing and refining his methods, Matthew was able to re-conceive his practice in ways that dramatically improved the results he achieved.

Today, Matthew enjoys extraordinary success, has a sales process that has a 90% close rate, and more often than not prospects ask him to become a client before he’s even completed the process with them.

Matthew will tell you that a large part of his success came from applying his desire for something more and better directly to his practice – using what Stephanie calls The Multiplier Methods. These represent the best practice business methods that improve performance and multiply success.

These methods deserve a conversation of their own, and our next Nerd’s Eye View guest post will cover them thoroughly.

Curious About What You Can Do?

Matthew and I have had the pleasure of living these insights, and are not only enjoying the rewards in our own advisory and consulting businesses, but are excitedly opening up all we know to anyone willing to join us in our quest to live The 5 Freedoms through our new Limitless Adviser Coaching Program.

If you’re curious, you can visit www.limitlessadviser.com to receive the Client Service 1-pager and some other samples referenced in this post, along with an invitation to our upcoming webinar “Mastering the Mindsets & Methods of a Limitless Practice: How to Build a $1M practice and take off 100 days per year” on December 6.

We believe that any advisor can achieve the kind of success we have enjoyed, and challenge you to apply the insights we’ve shared to stop settling for less than you really want and step into your possibility.

After all, if you’re going to help clients live the best version of their life through your work, shouldn’t you challenge yourself to do the same?

We certainly think so.

(Michael's Note: For further information on the Limitless Adviser coaching program, and their upcoming introductory webinar on December 6th, go to www.limitlessadviser.com.)

Leave a Reply