Executive Summary

In many large (publicly traded) businesses, it’s common to reward employees with employer stock, often granted directly in/through a profit-sharing or ESOP plan, or at least by allowing employees to purchase shares themselves inside of their 401(k) plan. The advantage of this strategy is that it helps to encourage an “ownership mentality” of the employees – who literally become (small) shareholders of the business. The disadvantage, however, is that when employer stock is purchased/owned inside of a retirement account, it is ultimately taxed as ordinary income when withdrawn (as is the case for any distribution from a retirement account), and loses the opportunity to take advantage of favorable long-term capital gains rates.

To help resolve the situation, though, the Internal Revenue Code allows employees a special election to distribute appreciated employer stock out of an employer retirement plan, and have the “Net Unrealized Appreciation” (i.e., the embedded capital gain) taxed at favorable capital gains rates outside of the account. However, to take advantage of these special NUA rules, there are specific requirements – that the stock must be distributed in-kind, as part of a lump sum distribution, after a specific triggering event.

The good news of the NUA strategy is that it creates an opportunity to convert unrealized gains from ordinary income rates into lower tax rates on long-term capital gains instead. However, the caveat is that in order to use the NUA rules, the account owner must report the cost basis of the stock immediately in income for tax purposes, and pay taxes at ordinary income rates. In addition, if the NUA stock is quickly sold, that long-term capital gains bill immediately comes due, too.

Which means in reality, the NUA rules don’t merely allow for the gains to be taxed at lower rates. They cause the gains to be taxed at lower rates immediately (at least if the stock is sold immediately), in addition to triggering ordinary income taxation of the cost basis immediately, when all of those tax liabilities might otherwise have been deferred for years or even decades. Which means deciding whether to take advantage of the NUA strategy or not is really more of a trade-off, than a guaranteed tax savings success.

As a result, the best practice for NUA distributions is to really scrutinize the cost basis of the employer stock inside the qualified plan, and if necessary cherry pick only the lowest-basis shares for the NUA distribution to ensure the most favorable tax consequences. Fortunately, the NUA rules do allow such flexibility – to take some shares in-kind, and roll over the rest – but that still means it’s necessary to actually do the analysis to determine whether or how many of the NUA-eligible shares should actually be distributed to take advantage of the strategy (or not)!

IRS Rules For Capital Gains Treatment Of Net Unrealized Appreciation (NUA)

Internal Revenue Code Section 402(e)(4) defines the rules for getting favorable tax treatment of the “Net Unrealized Appreciation” (NUA) of employer stock held in an employer retirement plan, ultimately allowing gains that occurred inside the plan to be taxed outside the plan at preferential long-term capital gains rates.

The NUA rules originated decades ago, in a world where employees of (typically large) corporations sometimes had both a pension plan and a profit-sharing or employee stock ownership plan (ESOP) that gave employees “profit-sharing" bonuses in the form of company stock.

The upside of this approach was that the corporation could make a deductible contribution to the employer retirement plan, and by contributing shares the employer could obtain that tax deduction without any cash outlay. The bad news from the employee perspective is that stock which would have been taxed favorably (at long-term capital gains rates) if it had just been purchased and grown in the hands of the employee directly, would instead be taxed as ordinary income when coming out of the plan.

Thus, as a relief provision and tax-preference for employees (to further encourage the strategy for employers), the NUA rules provided a means for employers to still obtain their favorable tax treatment, and for employees to obtain theirs as well.

Example 1. Over the years, Jenny has received annual bonuses of employer stock inside her company profit sharing plan. The total contributions have been $105,000, and thanks to the good performance of the company stock itself, the cumulative value is now $235,000. If Jenny had simply owned the stock directly, the $130,000 of cumulative gains would have been taxed at long-term capital gains rates. However, as a standard distribution from an employer retirement plan, the entire $235,000 account balance is taxable as ordinary income (regardless of the fact it happens to be a highly appreciated stock).

Under the NUA rules, though, Jenny can still be taxed on the $130,000 gain at long-term capital gains rates, even though the stock was originally purchased on her behalf inside the employer retirement plan.

Requirements To Qualify For NUA Tax Treatment

Specifically, the NUA rules under IRC Section 402(e)(4) stipulate that if employer stock in an employer retirement plan is distributed in-kind as a lump sum distribution after a triggering event, then the cost basis of the shares will be (immediately) taxable as ordinary income, but the gains on the stock – the “net unrealized appreciation” that had previously occurred inside the plan – will be taxable at long-term capital gains rates. And under IRS Notice 98-24, the net unrealized appreciation will always be taxed at long-term capital gains rates, regardless of the actual holding period of the stock inside the plan.

Notably, to meet the requirements for the NUA rules, there are three very specific requirements that must be met:

1) The employer stock must be distributed in-kind. This means it must actually be true employer stock, that is able to be transferred in-kind. Selling the stock shares, transferring cash, and repurchasing the shares outside the account doesn’t count, and TAM 200841042 similarly declared that an ESOP must actually transfer shares (or share certificates) out of the account, not merely liquidate them at termination and roll over the cash proceeds. Similarly, “phantom” stock or stock options aren't eligible for NUA tax treatment either, although an employer stock fund does qualify, as long as it holds only cash and shares of company stock and can be converted into individual shares of employer stock that can be transferred in-kind. To complete the in-kind distribution, the employer stock should be transferred directly to a taxable investment (i.e., brokerage) account.

2) The employer retirement plan must make a “lump sum distribution”. In this context, a “lump sum distribution” means the entire account balance of the employer retirement plan must be distributed in a single tax year. It’s important to recognize that this doesn’t just mean all the stock must be taken out of the plan; it means the entire account must be distributed. Although ultimately, it’s up to the plan participant to choose where the dollars end up; it is permissible to do an NUA distribution for just some of the account, and roll over the rest directly to an IRA (or even convert to a Roth). However, none of the money can stay in the plan past the end of that year.

3) The lump-sum distribution must be made after a “triggering event”. In order to be eligible for NUA treatment of an in-kind distribution of employer stock, the lump-sum distribution must be made after a triggering event. The triggering events are (a) Death, (b) Disability, (c) Separation from Service, or (d) Reaching age 59 ½. Notably, this means that an in-service distribution generally does not qualify for NUA treatment, unless it is a distribution that also happens to occur after a triggering event (e.g., upon reaching age 59 ½).

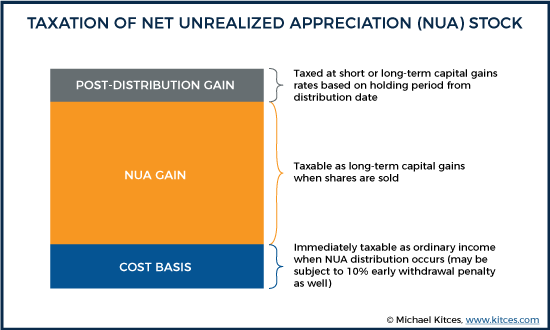

NUA Tax Treatment At Distribution And Subsequent Sale

As noted earlier, when the NUA distribution occurs, the cost basis of the shares (from inside the plan) are immediately taxable as ordinary income (and if not otherwise eligible for an exception, the 10% early withdrawal penalty may apply as well). The actual Net Unrealized Appreciation (i.e., unrealized gain above that cost basis) of the shares are taxable as long-term capital gains, but the capital gains tax event doesn’t occur until the shares are actually sold (although in many cases, due to a desire to diversify, the shares are sold as soon as they are distributed anyway). If the shares are held past the distribution, any subsequent gains will be taxed at short-term or long-term capital gains rates, based on the holding period from the distribution date until the subsequent sale. If shares are held past the distribution date and losses occur, it will simply reduce the amount of net unrealized appreciation gain reported on the sale (although if losses cause the price to fall all the way down below the original cost basis, a capital loss can be claimed).

Because there’s no particular requirement that the NUA stock be sold immediately (though it often is, for diversification purposes, but could be held for months, years, or even decades thereafter), the NUA gains may be deferred for an extended period of time. Only the original cost basis of the shares (inside the plan) is taxable at the time of distribution. Although notably, the NUA gain will eventually be taxed, as it is not eligible for a step-up in basis at death (under Revenue Ruling 75-125). On the other hand, under Treasury Regulation 1.411-8(b)(4)(ii), the NUA gain is also not subject to the 3.8% Medicare surtax on net investment income (just the standard long-term capital gains tax rates of 0%, 15%, or 20%, plus state income taxes where applicable).

A key point of the NUA rules is that while the lump sum distribution requirement necessitates that the entire account be emptied, there is no requirement that it all be distributed in a taxable event. It’s entirely permissible to take just the NUA stock as an (in-kind) distribution, and roll over the rest to an IRA.

Example 2. Continuing the prior example, Jenny decides to take advantage of the NUA rules, which includes both the $235,000 of employer stock (with a cost basis of $105,000), and also some mutual funds worth $80,000. In order to comply with the NUA rules, Jenny must distribute the entire $315,000 from the plan in a single tax year after a triggering event has occurred – which in Jenny’s case, is the year she retires (and therefore separates from service). Since Jenny only wants to do an NUA distribution of employer stock – and doesn’t want to liquidate her entire employer retirement plan in a taxable event – she can choose to take the $235,000 of employer stock in kind and roll over the other $80,000 to an IRA. In doing so, the $105,000 cost basis will be taxable immediately as ordinary income, the $130,000 of gain on the stock will be taxable at long-term capital gains rates when sold, and the $80,000 IRA rollover will simply be taxed whenever distributions are made from that IRA under the standard rules for IRA distributions.

Furthermore, it’s also permissible to “cherry pick” which shares of stock to distribute in kind, and roll over the rest (as long as the individual stock shares were earmarked for a particular employee’s account in the first place, under Treasury Regulation 1.402(a)-1(b)(2)(ii)(A)).

Example 3. Continuing the prior example, it turns out that amongst Jenny’s $235,000 of employer stock shares, the first $100,000 of shares purchased in the early years have a cost basis of only $10,000 (gain of $90,000), while the other $135,000 of shares purchased more recently and had a cost basis of $95,000 (gain of only $40,000, as the company hadn't performed as well recently). As a result, Jenny decides to do an NUA distribution for just the first $100,000 of shares with a cost basis of $10,000, and rolls over to her IRA both the other $135,000 of employer stock and the other $80,000 of IRA assets. (Because, again, everything must leave the employer retirement plan to meet the lump sum distribution requirement.)

The end result is that Jenny reports only $10,000 (cost basis of the NUA shares distributed in-kind) in ordinary income, will have a $90,000 long-term capital gain when the NUA shares are sold, and finishes with $80,000 + $135,000 = $215,000 in a rollover IRA.

Given the favorable treatment available for an NUA distribution – turning a gain that would have been taxed as ordinary income from an employer retirement plan or IRA into a long-term capital gain taxed at preferential rates – it might seem odd to ever cherry-pick taking some lower-cost-basis shares for an in-kind NUA distribution, but not the rest of the higher-cost-basis shares. However, as it turns out, the relative amount of cost basis to gain for employer stock shares inside an employer retirement plan is actually crucial to determining whether an NUA distribution is actually a winning strategy or not!

The Problem With The (High-Basis) NUA Distribution

The fundamental challenge to the NUA distribution is that it immediately triggers ordinary income taxation on the cost basis of the employer stock, which means the decision to distribute stock in-kind immediately forfeits to Uncle Sam a portion of the account that otherwise could have remained tax-deferred.

In addition, the subsequent liquidation of the employer stock itself triggers a second tax event, on the NUA gain. While the benefit of the NUA rules is that the gain is at least taxed at preferable long-term capital gains rates, it is again a tax event that, if rolled over, might not have occurred until many years (or even decades) into the future. Which means the faster the stock is sold – i.e., the more quickly the owner wants to sell and diversify – the more long-term tax-deferral that is forfeited. And of course, from that point forward, any future dividends, interest, and capital gains generated by the reinvested proceeds will also be fully taxable!

By contrast, simply rolling over the entire employer retirement plan to an IRA and diversifying is not a taxable event. And in a world where retirees often take no more than 4% to 5% of the annual account balance in distributions – and even RMDs begin at only 3.6% of the account balance at age 70 ½ – the value of the stock might have remained growing tax-deferred for, literally, decades. Or even longer if left as a stretch IRA for the next generation!

In other words, the NUA strategy is not merely an opportunity for “free” tax savings, by turning what would be an ordinary income distribution from a retirement account into capital gains treatment on the NUA gain. Instead, it’s more of a trade-off – a decision to pay taxes sooner, at a blend of ordinary income rates on the cost basis immediately and long-term capital gains on the NUA gain when liquidated, rather than pay all ordinary income at what might have been a much later point in time.

As a result, it’s especially important to look carefully at how much net unrealized appreciation there really is in the first place.

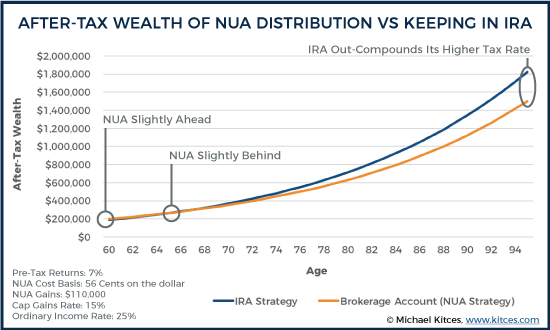

Example 4. Jeremy is 60 and has $250,000 of employer stock that was bought inside the plan for $140,000, which means it is cumulatively up about 78%, and the cost basis is effectively 56 cents on the dollar. The $110,000 gain being taxed at 15% instead of an assumed ordinary income rate of 25% in the future produces a prospective $11,000 tax savings. However, a rollover allows all $250,000 to remain invested, while an NUA distribution triggers 25% gains now on the $140,000 cost basis, plus the 15% tax liability on the $110,000 gain, for a total tax impact of $51,500. Thus, the trade-off is really $250,000 in a tax-deferred account subject to ordinary income in the future, or just $198,500 to reinvest in a taxable account (having lopped off just over 20% for immediate taxes).

Of course, if the $250,000 IRA were liquidated at ordinary income tax rates, it would be worth only $187,500, and the taxable account is still “ahead” by $11,000, thanks to the tax savings on the NUA distribution. However, until it’s actually liquidated, the $250,000 IRA can continue to grow tax-deferred, while the $198,500 has already been taxed, and going forward will continue to be annually taxable in the future!

Accordingly, we can analyze the long-term impact and after-tax value of each strategy in the above example over time. Assuming a moderate 7% growth rate and that the IRA will be taxed at 25% in the future (with RMDs beginning at age 70 ½), compared to a 5.95% after-tax growth rate in the brokerage account (assuming a 15% rate on qualified dividends and long-term capital gains), we find that it only takes about 6 years for the NUA strategy to fall slightly behind... and after several decades the NUA strategy lags dramatically!

Notably, this example “generously” assumes that the lump sum income from the NUA distribution stays in the 25% tax bracket (when in reality if all $140,000 of cost basis is taxable at once, some of it would at least bleed into the 28% bracket), and that the brokerage account has NO short-term capital gains or bonds yielding ordinary interest at higher tax rates (which would make the blended rate a bit higher than 15% and cause the NUA strategy to lag even further in the later years).

Nonetheless, as the results show, while the NUA strategy is appealing in the near term, over the long run the lost growth opportunity on the taxes paid sooner rather than later (both on the cost basis of the NUA stock, and the capital gains taxes on the actual NUA gain) is quite damaging. Even for a stock that was up 78%, the NUA distribution quickly falls behind, and dramatically so by the end. And of course, if there was actually money left over at the end, that IRA could have been stretched even further to the next generation (allowing the compounding to continue even further), or alternatively could have been opportunistically turned into a Roth IRA along the way via partial Roth conversions (which is impossible once the NUA stock is already fully distributed).

Finding The Balancing Point On An NUA Distribution

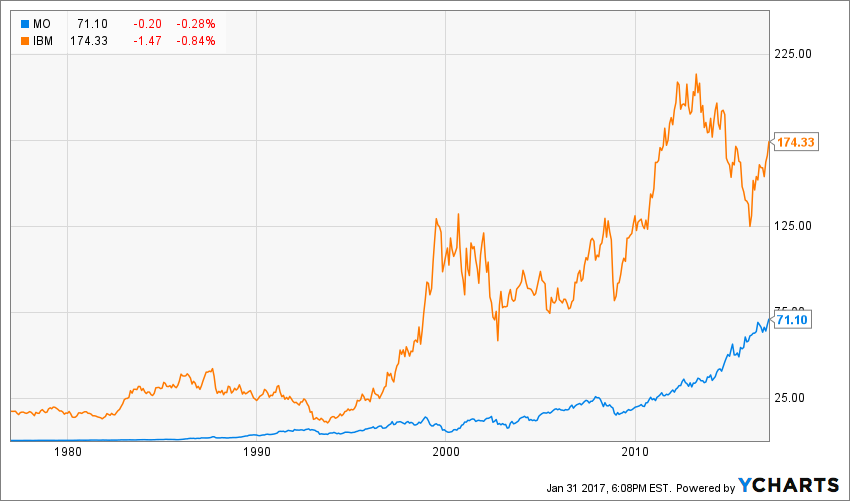

For very long-term employees, the reality is that employer stock shares might not “just” be up 78% (as was the case in Example 4 above), but several hundred percent, or even 1,000%.

For instance, a long-term employee at IBM for the past 40 years would have split-adjusted shares with a cost basis of just 10 cents on the dollar (a split-adjusted share price of about $17/share in 1977, versus over $170/share today), for a gain of about 900%. And an investor at Altria (formerly known as Phillip Morris, and now also the owner of Kraft and Nabisco Foods) since 1977 has a split-adjusted cost basis of about $0.30, which means with the stock now around $71/share, it is up a more than 23,500% in 40 years. Or viewed another way, the cost basis is less than half a penny per $1 of share price!

In the case of Altria, this means that even $1,000,000 of stock (at current value) eligible for NUA would face ordinary income of only about $4,000 (and a tax bill of just $1,000 at a 25% tax rate), with the entire $996,000 remainder taxed at long-term capital gains rates (likely at a blended rate of 15% and 20% given a gain of that size). And less of a tax hit upon NUA liquidation means more dollars that can be reinvested, which in turn means it would take longer for a mere IRA rollover to be more appealing.

In other words, the size of the cost basis (relative to the total value of the stock) is a key determining in the NUA trade-off, as a lower cost basis means a lower ordinary income tax hit, which in turn reduces the overall upfront tax impact, and makes the NUA strategy more appealing.

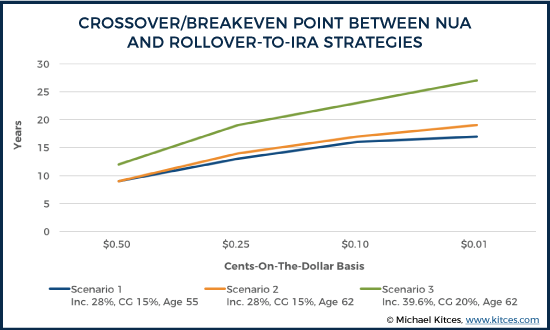

For instance, the chart below examines how long it takes for the IRA rollover (and its tax-deferred compounding growth) to overtake the NUA distribution, at various levels of appreciation and assuming different tax/age scenarios. Notably, amongst the tax and age scenarios considered, the crossover point between NUA and rollover-to-IRA strategies with a cost basis of 50 cents on the dollar ranged from 9 to 12 years (depending on assumptions), while at "just" 25 cents on the dollar and down to only 1 cent on the dollar, the crossover point ranged from 13 to 19 years and 17 to 27 years, respectively.

As the results reveal, the NUA distribution really does work better as the cost basis of the NUA distribution decreases (with the breakeven point approaching or reaching past normal life expectancy in the lower cost basis scenarios). NUA strategies are also more appealing as a retiree's age increases, which both reduces the deferral time available until RMDs need to be taken (as RMDs reduce the value of the rollover), and reduces the likelihood of living long enough for the IRA to overtake the NUA distribution (i.e., the time horizon is more limited, where the more immediate tax savings of the NUA rules are favorable).

Of course, it’s still important to recognize that for especially large NUA positions, the gain may be so large that the capital gains rate is higher than 15% (e.g., if some of the gain pops up into the 20% bracket), which makes the NUA less valuable. Similarly, even with “small” cost basis, a very sizable stock position could drive up the ordinary income tax rate on the cost basis. For instance, even at 10 cents on the dollar of cost basis, a $1,000,000 employer stock position would generate $100,000 of ordinary income, which is potentially enough to drive a married couple from the 15% bracket to 28%, or from the 25% tax bracket all the way to the lower end of the 33% tax bracket.

And it’s also notable that because the trade-off is the upfront tax hit (at lower rates) in exchange for tax deferral, the higher the overall tax impact up front, the harder it is to recover. And this can include the impact of state taxes, which apply equally to ordinary income AND capital gains. In fact, even though the IRA is ultimately taxed at higher rates later, the higher upfront tax burden can still be enough to bring the breakeven point even closer (where it's better to simply roll over to the IRA and skip the NUA strategy).

By contrast, though, if the individual can actually hold the stock, rather than sell it – for instance, if there’s not a pressing need to liquidate and diversify after the NUA distribution – the decision to hold onto the stock defers the NUA capital gain, and can greatly improve the long-term outcome. Though as a study by David Blanchett from Morningstar found, whether the decision to hold is appealing (or not) for an extended period of time should still be driven primarily by the investment risk and return of the employer stock compared to a diversified portfolio, rather than the tax deferral alone.

Best Practices In NUA Distributions

Fortunately, the reality is that the NUA distribution strategy is a choice, not an ‘obligation’ or a requirement. In other words, the investor doesn’t have to do it, and even if he/she does, the NUA strategy doesn’t have to be executed with all of the stock. As long as there are records to identify the share lots in the first place (and those lots were assigned to an individual employee’s account), it’s permissible to cherry pick them, whether from a profit-sharing plan or ESOP. Which means it often will be worthwhile to delve through the historical purchase transactions, just to identify which lot(s) may be appealing for NUA.

One straightforward approach is simply to set a cost basis threshold – for instance, don’t do NUA for any stock with basis more than 20 cents on the dollar. So if the company currently trades for $80/share, only do NUA on the shares with cost basis of $16 or less, and roll over the remaining shares to an IRA (along with anything else in the employer retirement plan, per the lump sum distribution requirement). And for those who want to liquidate the stock after distribution, but spread out the tax impact, it may be feasible to do the NUA distribution (triggering taxes on the cost basis) late in one tax year, and then complete the subsequent sale (with long-term capital gains rates on the NUA gain) early in the subsequent tax year (and even hedge the risk during the intervening period with a short-term put option). And notably, the NUA gain may even be eligible for the 0% Federal rate on long-term capital gains, especially if there is little other ordinary income to fill the bottom tax brackets.

However, it is still important to ensure full compliance with the rules. Which means don’t forget that the NUA distribution has to be a full lump sum distribution in that year, where the end-of-year account balance must read zero! The retiree can roll what he/she doesn’t want to NUA distribute, but it all must leave the account! In addition, an NUA distribution can only occur after a triggering event, which means it’s necessary to wait until a triggering event occurs, and it’s important that when any distribution occurs after the triggering event, that must be the year for the NUA distribution (or the opportunity is lost until the next triggering event).

Example 5. Sheila retired from her employer at age 56 in early 2016, after spending 30 years with the company. She has a 401(k) plan with profit-sharing with a total account balance of $1.2M, including $400,000 of employer stock with a cost basis of $45,000. During the summer of 2016 after she retired, Sheila took a $10,000 distribution for an around-the-world trip to celebrate her retirement, which she was able to do without any early withdrawal penalties thanks to the rule allowing retirees who separate from service after age 55 to take a distribution from their employer retirement plan. Now, in early 2017, she sits down with a financial advisor to plan her retirement, and explore the NUA distribution strategy for the $400,000 of employer stock.

However, Sheila’s retirement was her triggering event, and her distribution in the summer of 2016 meant that was her first distribution year after a triggering event. And she did not do a lump sum distribution (or any in-kind distribution of employer stock) that year. As a result, any attempt to do an NUA distribution in 2017 will not qualify, as it will no longer be a lump sum distribution after a triggering event (since a non-lump-sum distribution already occurred after the triggering event). Thus, Sheila will not be eligible for an NUA distribution.

Fortunately, though, because the triggering events include death, disability, separation from service, and reaching age 59 ½, Sheila will have a second chance for an NUA distribution in 2019, once she actually turns 59 ½, and can take advantage of the NUA rules then. As long as she makes certain that once she does take a distribution after age 59 ½, that is the year she does a full lump sum distribution, and takes the employer stock in kind!

Notably, if Sheila had separated from service after age 59 ½ – which means the separation from service and age 59 ½ triggering events would have passed, and the disability trigger is a moot point once retired – then the NUA strategy would be totally lost to her, and the only opportunity would be for her heirs to do an NUA distribution from the inherited employer retirement plan (as death is a triggering event, too!), though that would require her to keep the employer retirement plan, and hold the stock, without using it, until the day she dies (which may not be feasible due to both investment risk, and her retirement income needs!).

It’s also notable that the NUA strategy may be appealing for those who separate from service prior to age 59 ½, even if they’re not eligible for the age-55 exception to the early withdrawal penalty. For instance, a 52-year-old who separates from service can still do an NUA distribution. The cost basis of the shares will be subject to ordinary income taxes, plus the 10% early withdrawal penalty. However, if the cost basis is low enough, the penalty may be so small that the NUA strategy is still worthwhile for the overall tax savings. And once the shares are distributed from the account, they're freely available to use - unlike with an IRA rollover, where all of the retirement account would still face the early withdrawal penalty (with only more limited exceptions, such as 72(t) substantially equal periodic payments).

Example 6. Charlie retired from his company at age 52, with an ESOP holding nearly $650,000 of employer stock, which had an internal cost basis of just $45,000. Charlie decides to do an NUA distribution of his ESOP shares, even though the distribution will subject him to the early withdrawal penalty, because he doesn't want to wait until age 59 1/2 to diversify his concentrated stock position. However, since the cost basis is only $45,000, the early withdrawal penalty will only be 10% of that amount, or $4,500, which is a mere 0.7% of the value of the stock - a "cost" that Charlie decides is quite worthwhile, in order to diversify and still otherwise take advantage of the NUA rules! And going forward, Charlie has access to the entire $650,000 of employer stock, without needing to worry about further early withdrawal penalties!

On the other hand, it’s also important to recognize that it is an option to do the NUA distribution and keep the employer stock. Doing so allows the NUA gain to be deferred, and if the cost basis is low enough, the immediate tax impact (on just the cost basis) may be small or negligible. Clearly, holding a concentrated stock position just to defer taxes can be risky from an investment perspective, and also may not be feasible simply due to a need to use the asset for retirement income purposes. Nonetheless, in scenarios where the employer stock actually is a small portion of the retiree’s total net worth, or where the risk of the stock can be reasonably hedged (e.g., with put options), continuing to hold the stock may be both economically feasible and still reasonable from an investment perspective (as a modest portion of the overall portfolio), while also allowing the retiree to enjoy the tax benefits of the NUA strategy (by still enjoying the preferential capital gains tax rate on the NUA gain in the future, but being able to defer it to the future!). In addition, stock held in a brokerage account can also be margined (unlike in an IRA, which cannot be loaned against), providing a securities-based lending option for further liquidity (without actually selling the stock). Conversely, for those who “need” to diversify, don't need the liquidity outside of a retirement account, and truly don’t want to absorb the immediate tax impact, it’s always an option to simply roll over the employer stock to an IRA, and sell and diversify there without any immediate tax consequences while continuing to enjoy subsequent tax-deferred growth.

Overall, though, one of the biggest caveats of the NUA strategy is simply to recognize that cost basis inside an employer retirement plan actually matters. Given that employer retirement plans – and rollover IRAs – are simply taxable on all distributions as ordinary income, “basis” of stock inside the accounts are normally ignored. But in the case of a potential NUA distribution in the future, it matters, and can have substantial consequences for those who don’t bear it in mind while managing their employer retirement plan.

Example 7. Johnny had worked at his company for almost 40 years, and collectively had $900,000 of employer stock with an original cost basis of just $120,000. In the financial crisis, though, the price of the company crashed by 40%, and rumors abounded that the company could even go under, despite its decades of success. To avoid the risk, Johnny had sold the stock back then at $550,000. Once the rumors passed, he had bought back in at $600,000, only causing “limited” damage due to bad market timing (and allowing his shares to recover to their current $900,000 value).

However, because Johnny sold the stock inside the plan and bought it back, the transaction reset his cost basis on all the shares to $600,000, the value on the day he re-purchased. As a result, his “old” cost basis of $120,000 was completely overwritten, eliminating the value and potential benefit of the NUA strategy now that he is preparing for retirement!

Ultimately, it remains to be seen how long the NUA strategy will remain available. President Obama’s budget proposals in 2015 and 2016 characterized it as a “tax loophole” to be closed (though it would have grandfathered anyone who was already age 50 at the time), although President Trump’s tax plans still haven’t taken a position either way.

Nonetheless, as long as it’s still around, it does remain an appealing strategy. Though still, it’s important not to be overly exuberant about pursuing the NUA rules, as there’s still a real trade-off to consider, given the upfront tax impact versus being able to defer taxes until later, tempered by how quickly the investor does (or doesn’t) want to keep the stock in the first place!

So what do you think? Are the downsides of NUA distribution strategies often overlooked? How do you help clients evaluate NUA strategies? Are NUA strategies a "tax loophole" that will be closed in the future? Please share your thoughts in the comments below!