Executive Summary

Over the past decade, the financial advisory industry had continued to shift away from being primarily sales-based (where every new year starts off with little to no income, and there’s immense pressure to always be finding the next new client) and towards a recurring revenue model (typically based on AUM fees). The good news is that, after a few years of building such a recurring revenue business, advisors can spend more time providing more and better service to their existing clients, without needing to worry as much about finding the next new one (since just keeping those recurring-revenue clients itself becomes very lucrative over time!). The bad news, however, is that advisors must also learn a whole new set of interpersonal and management skills to ensure they really establish and keep that ongoing relationship… skills that often have very little to do with the formulation and delivery of financial recommendations themselves. In other words, in the ongoing advisory business, one of the key challenges is learning how to manage and nurture those evolving client relationships (in the face of the clients’ own changing needs and expectations).

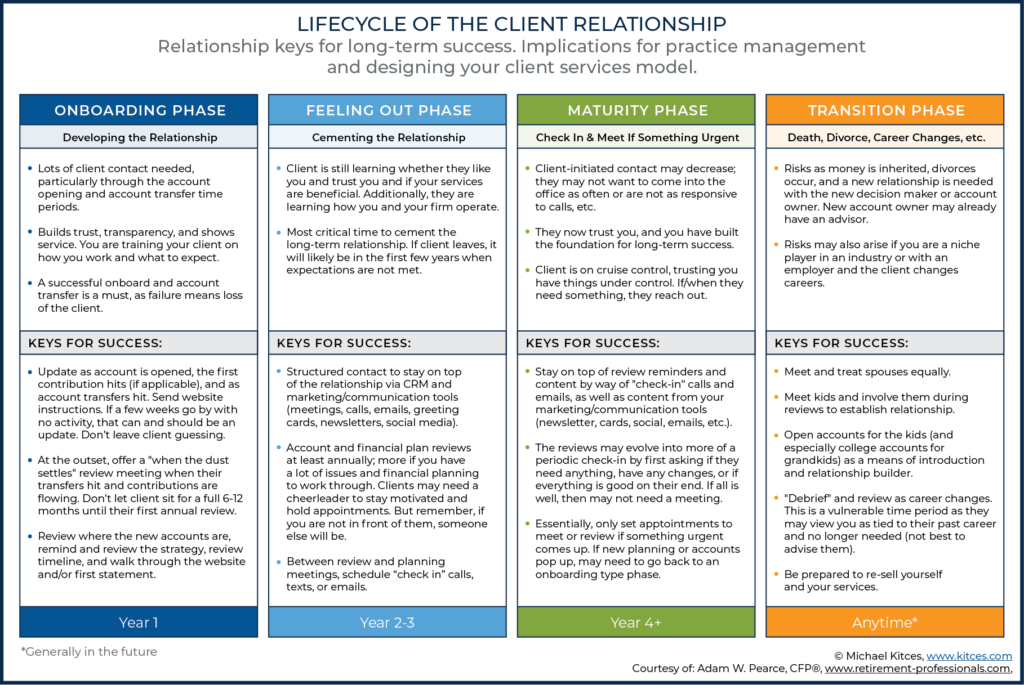

Accordingly, in this guest post, financial advisor Adam Pearce explains how client relationships can be viewed as developing across four distinct phases, potential pitfalls that an advisor may encounter through those stages, and the potential impact of client needs in each stage may have for an advisor’s workflows and client service models.

For instance, in the Onboarding Phase, new clients closely watch to see if the expectations that were set while the advisor was selling themselves and their services are being met (i.e., does the advisor really follow through on the quality of service they promised upfront?). Accordingly, it’s particularly important for the advisor to be especially proactive as accounts get set up and paperwork gets processed, and to make sure that there is frequent communication so the new client sees that their advisor is working hard on their behalf… to allay about doubts they may otherwise have about whether they made the right decision (to hire the advisor) in the first place. In other words, it’s not just about the paperwork itself, but an opportunity for the advisor to demonstrate – in how they handle and communicate about the paperwork – the advisor’s own service standards and affirm that the client really made a good decision.

As the relationship moves into the Feeling Out phase - which can span over the first few years, and, statistically speaking, is the most likely time that a client will decide to leave - advisors should focus on “excelling at the basics”, which means continuing to meet expectations, maintaining frequent contact, and cementing a personal connection with the client… which could even include getting to know them socially as well.

After those first few years, though, the ongoing relationship enters the Maturity Phase, which is often characterized by a decline in the frequency of client-initiated communication… not because they don’t see as much value in the service they are receiving, but because their comfort level typically grows to the point where they trust that their advisor is doing their job and don’t feel such a need to check in as often. Yet, it’s still essential that the advisor continues to proactively engage with the client to make sure everyone is on the same page when it comes to such things as how often they should come in for in-person meetings. Even if clients aren’t asking for more meetings, the advisor still gets credit for offering them.

Eventually, a Transition Phase will emerge, where the client faces some major change in their life (e.g., divorce, career changes, retirement, or health issues). Which in turn has the potential to put new strains on the advisor-client relationship. Which means it’s more important during this phase that the advisor once again is being effective at handling the little details, but making sure they’re adapting and changing along with their clients’ new needs and preferences, and are again actively reaching out to stress the importance of proactive planning during these major transitions.

Ultimately, though, the key point is simply that advisors need to be aware of the changing stages that client relationships will go through over time, so they can take advantage of the various opportunities they have to deepen the relationships they have with their clients (which do, in fact, vary by stage). And the best way to make that happen is by having processes and workflows in place to ensure a consistent level of service… because if advisors can’t even handle the basics smoothly, it creates doubt in the mind of the client, while those advisors who can deliver reliably on the fundamentals help assure clients that they can know what to expect… and will trust that their advisor is taking care of them!

The client relationship is not always a linear experience, but rather one that goes through cycles. More time and attention are required during some periods, whereas others feel like the relationship is on cruise control.

The risk is that an advisor can lose the client, even right after they say yes, if the advisor is not paying attention to the cycles, and ramping up the attention during key times. On the other hand, it’s important for business purposes not to “over-service” client in a way that adds cost but delivers little incremental value. Conversely, though, it’s important not to ever get too complacent during the lulls, because life events happen when it’s imperative to ramp things back up.

Ultimately, I’ve found that there are four key cycles of the client relationship:

- Onboarding phase

- Feeling out phase

- Maturity phase

- Transition phase

In this article, I will define these key cycles of the client relationship and explore some examples of when and how things can go wrong. Additionally, I will discuss the practice management implications for your onboarding workflows and client service models. Notably, while there is certainly relationship management during the prospecting phase before someone becomes a client as well, I am only focusing on the relationship moving forward from when someone actually signs on the line to become a client.

The Onboarding Phase Of The (New) Client Relationship

During the onboarding phase, the advisor is likely still developing a relationship with the client. The client is observing the advisor in action, and probably after having made a lot of promises and representations about how great the service and relationship will be. In essence, clients are now taking note and seeing if the advisor is fulfilling these promises.

The best defense is a good offense, so it’s critical for an advisor to properly set expectations for this time period. How long will it take to set up their accounts and transfer assets over? Will the relinquishing custodian try to conserve the client or otherwise notify them? Is there additional paperwork they should be on the lookout for from their old firm, or a call they need to make? What are the next steps they need to take? What will they see next? And what are some cues that things are going according to plan (or not)? When should they contact you, or when will you contact them throughout this process? And how do you communicate all of this in the first place (e.g., verbally, or send some notes or checklist, etc.)?

When I first started in the business as an insurance agent, I found it very difficult for people to say “yes” and sign on the line. In fact, when I did get someone to say yes, I literally couldn’t rush out of that meeting fast enough with the signed paperwork, fearing they would have second thoughts and change their mind to no. Picture me running away with a signed application in hand! Afterward, I would keep contact at a minimum, again fearing any contact with the client was an opportunity for them to change their mind, or bring up a new objection I could not handle. Unfortunately, this was a very bad habit that stuck with me.

Furthermore, during the onboarding phase, I would try to shelter my clients from seeing “how the sausage is made." The sausage being all the normal back and forth that occurs during onboarding and account opening. I feared that letting the client see too much of the process, or going back with additional questions, would be perceived as me not knowing what I was doing, or that my firm didn’t have their act together.

Many years ago, I had a new client I will call “Suzie”, who said yes to rolling over her 401(k) to me. The 401(k) was with a large provider, who is known to have a conservation program (i.e., a team that makes an effort to reach out when 401(k) rollover paperwork shows up to try and convince the client to stay with them after all). I set no expectations of this with Suzie, though, and instead simply had her sign the paperwork… and I guess I literally just hoped the assets would appear. But a few months passed, and no money hit. I finally made the phone call, and she explained the 401(k) rep told her it was a “bad time” to do a rollover. It was a bogus excuse. But they planted a seed of doubt, and without me being in front of her to refute it, that seed of doubt grew. By the time I got to her, that seed was in full bloom and gelled into her decision to not do the rollover. She had long since mentally moved on with her decision without me.

That was a painful lesson, and it wasn’t the only one. I had several similar several experiences.

During the onboarding process, clients may still be wondering if they made the right decision. They may see something they don’t understand on a confirmation or communique that casts some doubt. The old firm or a friend may make a comment that plants a seed. Left to their own devices, clients can, and usually do, think and imagine the worst. And if they don’t see you leading them, they can and will change their mind on a dime. Maybe that leads them to not sign that one last form you need and use it as an out. Or they walk into the bank and fall for a sales pitch.

As I matured in my practice, I realized a couple of things. The need to build a relationship. The need to closely monitor and manage onboarding. I found some confidence in myself by realizing that, hey, if they just said “yes” to me and agreed to move a large sum of money (maybe even the bulk of their life savings), well then, they must like me and have confidence in me. And because I am handling their money, they do want to hear from me. And I hope the relationship will be a long one, so I better develop some rapport and get used to spending time with them now, instead of being shy to call.

I broke those bad habits I developed and became very proactive during the onboarding. I integrated these principles into my workflows and a CRM to manage it all. I now let the clients see some of the sausage-making process. They need to see how hard you are working for them. And these extra touchpoints give you opportunities to build rapport, build trust, and cement the relationship. It’s not just getting information or another form from the client, but a chance to ask about their grandkids or a health concern they are working through. (Tip: I do “bundle” these extra touchpoints. In other words, if something comes up that we need to ask the client about, but we expect other things to likely come up, we may wait until we have two or three things to go back to them with, to limit the back and forth. Some extra touches to reveal how the sausage made is a plus, but we’re still here to make our clients’ lives easier, not to be a constant nuisance and barrage of information and paperwork requests.).

When I bring on a new client, I first introduce my client services manager and talk up her credentials (she IS awesome, by the way), and advise that she will be the one coordinating the onboarding process. I also set expectations that the transfers typically take 6-8 weeks, and coach them through what to expect from their old firm, and if they get any forms or calls to let us know so we can assist. I also hedge a little, and let them know often one more form is needed, and we will be in touch to coordinate, and either way will update them along the way. Finally, I let them know as soon as “the dust settles” and accounts are open and funded, my assistant will loop me back in and I will do a quick review to show them where everything is.

The “when the dust settles” review is critical because the advisor doesn’t want to leave a new client twisting in the wind until the next annual or semi-annual review comes up… that is too long to allow the seeds of doubt to potentially grow. Put a little extra time in, especially since it is usually just a quick review to show where the money is now (particularly important if you just consolidated a bunch of accounts and they want to know if its “all there”). Also, the “when the dust settles” review meeting is an opportunity for a quick review of any financial planning already done as well, and to revisit if more planning still needs to be done (and if so, what the next steps are).

I now use a 2-week rule during the account opening process. In our CRM, we track all contacts in this stage of the process, and we don’t let 2 weeks go by without checking in (even if it’s just a quick email to say “so far so good on this end”, did anything come up on your end?). I chose two weeks based on experience, and in my own behaviors, I think that is the amount of time when brand new clients can start to feel disconnected. They may lose interest. It’s a fence that bends, not a glass window that breaks if you bump up against it. So, if it drags into a third week, it's probably ok, but I always shoot for 2 weeks.

Remember, this is your time to shine, so get excited! You just made a bunch of promises, and now it’s time to show the clients how good you (and staff) are at following through, how good the service is, and make them believers! It is almost like you are still auditioning for the job.

Now, this is much more work up front, I realize. But you will reap the benefits down the road when you have a well-trained client, that becomes very low maintenance during other cycles.

The important thing to not miss here is that, by following through on your promises, having good processes in place to keep them updated in a timely manner, and making that dust settles review, you are building trust. Trust is tough to earn. This is how you earn it… by putting the extra work in up front.

The “Feeling Out” Phase With A New Client

After the onboarding process – if the accounts are in order, and the upfront planning is done – you are off to a good start. But don’t let your guard now. Even over the span of the first few years, clients are still deciding if they really trust you and are watching to see if you make good on your promises as the relationship unfolds. They are still feeling you out.

There’s an industry statistic that most clients, if they are going to leave, do so in the first ~1-3 years. I believe this is true because the relationship isn’t cemented yet. Even though clients said “yes”, signed the paperwork, transferred accounts, and did some financial planning, during this time period, all it could take is one slip up, one missed call not returned, one review not scheduled, or a service issue, and they could bounce. Even worse, you could do everything right, but if you don’t make that personal connection with the client, they still won’t feel attached or loyal, and could still leave for another advisor who they do feel (more) connected to.

The good news, though, is that to cement the relationship in the “Feeling Out” phase, you only need to excel at the basics. Promptly return calls and emails. Contact them at whatever frequency you promised. Hold your review meetings (even if they are tough to schedule). Finish or follow up on any outstanding financial planning. Blocking and tackling. The CRM is indispensable for tracking all this activity.

I once had a multi-million-dollar client tell me the reason he likes me and sticks with me is that he knows I am on top of everything. He doesn’t have to worry something will slip through the cracks.

The blocking and tackling can get you far. But to really cement relationships, it really helps to be detail-oriented. We keep a list of every little thing that comes up during a meeting that needs follow-up and follow through no matter how long or how tough some of the items become. We then report back to the client when it’s done, or the status if it’s not done yet. It can get to be a lot for the clients (especially early on when there’s still a lot going on), so often we end up tabling items if they choose to not keep drilling down. But it’s their choice, and they know we didn’t get lazy and let it slip.

If there is a lot of financial planning to be done (i.e., retirement, income, and an estate plan), it’s very helpful to prioritize the workload, and spread it out over 1-2 years. I call it “breaking it down into bite-sized chunks.” It’s easier for both you and the clients to manage the work, and gives you a nice long runway of showing progress incrementally achieving goals to cement that relationship.

Another thing that solidifies a client relationship in the “Feeling Out” phase is seeing them socially. I know advisors have differing perspectives on this, and some like to keep relationships on a professional-only level. But you can at least take them to lunch or dinner when doing a review to mix it up. I think some clients like it when you mix up the reviews; it keeps the process more fun, or at least interesting for them.

I once went on a trip to the outdoors with a client. He lost the trail and became lost and couldn’t find his way back to camp. I found him and got him back safely. Do you think that the client is ever leaving? That is a whole other level to get to with clients… when they truly become your friends and family.

One more concept to unpack during the Feeling Out phase. During this stage of the cycle, I believe clients are also evaluating not just you personally, but your firm and overall practice management as well. Your processes and how you conduct business. They can tell when you are flying by the seat of your pants and just making it up as you go along. I think we have all had an experience with a professional service or restaurant, where you can just tell there are no systems in place. You don’t know what to expect each time you go. Every time it’s different. Which makes it stressful and untrustworthy in a way (meaning you don’t trust what the experience will be each time, not necessarily that you don’t trust the people, although one lends itself to the other).

They can also tell when you have good processes in place to follow up, get things done, and it shines through making you look professional and efficient. They know you’ve got this!

But here is the key you don’t want to miss. You may have no processes and are flying by the seat of your pants, and still get your clients to stick with you because they like you or are loyal for one reason or another (maybe you saved their life on a hiking trip!). But… will they refer you to friends and family? Especially if they know that what their friends and family will get may not be what they’re getting themselves (because that’s what happens if you have no processes to standardize the services you offer).

The tire-and-auto service shop I patronize is a total disaster. It’s a different experience every time. I will call for an appointment and they say I don’t need it to come in, but when we come in it’s crowded, and they ask, “well didn’t you schedule an appointment?” Other times we schedule an appointment, and it doesn’t matter, we still end up waiting. Nothing on their website ever matches up with the store itself. I continue to go because they will work even after hours to get my car done. Also, one time I was having car trouble that was dangerous, and they gave me some free advice and figured it out. Literally may have saved my life. But… I would never refer anyone there because I don’t know what experience they will get, because when I go it's different every time. I don’t know if it will be good or bad. And if it is bad, it will reflect poorly on me. Remember a big part of why we refer people is to make us look good, and how smart and good we are because we have the best accountant or the best advisor or know the best restaurant to get Osso Bucco. You want to look good when you refer, and your client wants to look good when they refer, and if your client isn’t sure what experience a referral will get… they may not refer at all.

When you have processes and workflows in place, not only do you stay on top of things and get everything done, but it breeds consistency. Consistency reassures clients they know what to expect. It’s the same process every time they call in, email, or when its time for their annual review. Consistency breeds trust. See, we don’t sell tangibles, so they can’t place their confidence in a widget they hold in their hand. But they can place confidence in the intangibles when there’s a process, professionalism, and consistent service they can count on.

The Maturity Phase Of The (Ongoing) Client Relationship

After the Feeling Out phase, don't be alarmed if client-initiated contact drops, they don’t want to come into the office as often, and are suddenly not as responsive to calls. It’s not that the client is losing interest in the relationship; instead, there’s a good chance that they now trust you so much they don’t need to feel you out anymore because you have built the foundation for long term success. In other words, they don’t feel the need to “keep an eye” on you and monitor things as closely. Though it could also be as simple as they just don’t want to fight traffic across town to come into your office. Or that they hate your parking lot. (I had no idea how bad our parking was until I moved offices, and everyone then told me how much they love the new parking and hated the old place!).

You may have done some solid financial planning with them that got their life in order, and things are cruising along just fine. Maybe they are getting a monthly check from their investments, it’s enough to live on, and life is good. The client is now on cruise control, trusting you have things under control. Things will come up, and if/when they need something, they will reach out.

But... this does not mean you change the service you are providing them. Or at the most, it may warrant a conversation, that goes something like this:

“Suzie, when we first started working together, you wanted quarterly meetings. But things are under control now, and we don’t have as much work and planning to do as when we first started. The last couple times you seemed OK with skipping a meeting. Do you want to change to semi-annual or annual meetings? I can still call to check in quarterly if you like, but it seems like you may prefer to just meet once per year in person?”

Your review meetings may change in nature as well. But you still need to follow up on them. It might evolve into more of what I call a “check-in”. Calling to see how they are doing, and if they need anything… versus requiring them to come into the office to see if there’s anything changed in their life worth meeting about.

For example, maybe you don’t want to drag them into the office just to determine, “Hey, it looks like we have nothing to talk about, nothing to review, but thanks for coming in and see you next time!” Instead, call and ask if anything has changed, or if they need anything. And if not, and you don’t have anything to recommend on your end, let them know it's okay to skip a meeting, and you will check back in another 3 or 6 months. This may also be a great time to invite them for a more causal meeting over lunch (as a way to reinforce the social relationship) instead of a trip into the office for a business meeting that doesn’t actually need to happen.

Adapting to the changing dynamics of the client relationship is not only good for the client, but it's good for your practice, too. It will free up your valuable resources to focus on onboarding new clients and cementing new relationships, essentially giving your attention to the clients who need it now in the Onboarding and Feeling Out phases (in favor of those who don’t because they’re already in the Maturity phase). However, this can and will cycle back and forth.

When A Client Transition Phase Emerges

Clients may go through extended periods of time with no major life changes or drama, but inevitably, something will eventually come up. Retirement, career changes, health, divorce, and deaths are the many things we see our clients go through over time.

As these transitions occur, there are risks to the advisor-client relationship, because the question inevitably arises: as the client's needs change, will you able to adapt and change with them?

I specialize in the 403(b) market, and many of my clients are from employer-sponsored plans. I essentially built my practice on the back of employer plans. Early in my career, I had a client we will call Julie, whom I met in the K-12 schools, signed her up for her 403(b), and she invested a good chuck of change with me over the years. Several years later I got a phone call from her thanking me for helping her while she worked at the schools, and advising me she was moving her money to her “financial advisor.” "Wait, that is what I do," (is what I wanted to say)!

Aside from my apparently horrible job of communicating my services, I think early on I suffered from a perception problem too. I was perceived as a rep connected to the employer to help them during their working years, but not the one who could also help them retire when they made a transition, which instead fell to the domain of a “real” financial advisor. (I know this to be a thing because many other advisors in our office shared the same experience.)

This story illustrates how a client’s situation can change, and you could also suffer from a perception problem that you are viewed as the advisor that helped to solve the client’s last problem, but not the one they’re transitioning to next. I think this applies to any niche where that client could fall out of the niche, for example, if your practice is based on an employer or industry and the client retires or changes careers.

Divorces happen as well, and I am always surprised by how many times I keep both clients. But if you don’t have any relationship with the other spouse, will you keep both? Giving the proper care and attention to both spouses throughout the relationship is just good practice anyway. I recently attended a conference that had an enlightening breakout on including both spouses. There are many good resources out there to get better at advising couples.

We have seen the research and statistics that reveal when a client passes a way and leaves their money to the kids, those kids generally don’t stay with their parents’ advisor. As in the case of divorce, if you don’t have a relationship with the surviving spouse (or the next-generation heirs), they may not stick around either. You are faced with new account owners and decision makers, and you might not be “their guy” (guy meant in a gender-neutral way), or otherwise perceived as not the right one to help them. Worse yet, after the fact, it may be too late to start any kind of relationship, as they have already made up their mind on a new advisor. The lesson here is you need to start building these relationships with the kids and spouses before the transitions hit. Be prepared for Transition phases in advance.

The irony, of course, is that as parents, we talk about our kids a lot already. And if we don’t, just ask us, because we like to talk about our kids! Which is important, because any time you are talking about the client’s children, it is an opportunity to open up that dialogue and invite the kids to a meeting as well. Maybe they should attend an estate planning session or discussion about long term care. Or even just a quick introduction to break the ice, so they know who to call if something “ever happens”. I also have learned to love my secret, which is facilitating new 529 account openings.

I used to hate opening 529 accounts. Small accounts, a pain to open, and way more complex than they need to be given the typical amounts of money involved. But then I discovered the secret. It took me a while to catch on, and first I had to learn this lesson. If what is important to your clients is not important to you, then you aren’t going to have that client long. Furthermore, at a base level, if we are taking care of what is important to them, then what are we doing? Our clients’ kids and grandkids are important to them, and that $5,000 going into a 529 doesn’t seem like a big deal to an advisor with millions of dollars under management, but it is to your client. And it’s a golden opportunity to get an introduction to their kids, by working with them to set up a 529 for their newborn!

A newer trend I caught on to in recent years is clients helping their millennial kids open investment accounts, and even help initially funding them. We now have several clients whom we open IRA or non-qualified investment accounts for their kids (which the parents help fund), and occasionally assist in a rollover, even if it's small and wouldn’t otherwise meet our minimums. Because it’s all relationship building. You may see service and a waste of time, but I see opportunity to prepare for a future Transition phase.

Other life events may require new financial planning, or your client may be finally getting around to getting their estate plan in order. This should require a ramp back up in service and attention. In fact, we often will run an existing client back through a modified onboarding process all over again when they hit a Transition phase.

Take the example of someone retiring, who perhaps had $500k in non-qualified investments with you, and the other $500k in a 401(k) plan. Now they need some help with a rollover as they prepare to start generating ongoing retirement income. We treat them as a sort of new client all over again, and use our modified onboarding process (i.e., save the need for introductions and walk through of the website for example, but still pay attention to all the little things in what becomes a new version of the Feeling Out phase after a transition). This ramps back up the attention when it's needed.

As these life transitions occur, you need to be in front of your client. If they are stuck in cruise control, you may need to nudge them to get that meeting, stressing the importance of some planning during this time because now it really matters to do so (unlike the Maturity phase where missing some meetings was okay). In this case, you do have something burning up on your end to schedule a meeting. With the relationship in place, they will listen to you. Believe me, if you aren’t talking to your client during these times, someone else will be.

Building a flexible client service model that reflects the realities of the changing client relationship is not only client-friendly but will set you up to shine during the key moments in their life. Being flexible allows you to focus your resources, staff, and limited time on the clients who need it most at that moment. Finally, a well-run machine will help with referrals and scaling up as you grow.

One last story. While I was out of the office recovering from surgery, I got an unexpected call from my client services manager, too nervous to tell me we were losing a client. A retired engineer, I will call Sam, that I originally picked up through a CPA referral with whom I have a tight relationship. We did lots of good planning work as Sam made a transition from an employee at Raytheon to starting a new business. We did well growing his 401(k) from $700k to well north of $1M. We helped Sam navigate pensions, health care, and took care of some of his kid’s needs for life insurance. Everything was right. We did great work. He left anyway for family. Blood is thicker than water, I get it. Point being, we sometimes do everything right, but still lose. So be sure to show yourself some grace!

I am confident if you embrace the principles of the client relationship lifecycle you will find much success and save yourself from some pitfalls along the way.

Great read and advice. I could not agree more…..Thanks for sharing. My entire entire team is reading and will modify our workflows accordingly