Executive Summary

In the delivery of “the financial plan,” advisors have traditionally presented the thick, leather-bound, firm logo-embossed, three-inch binder to clients. On top of being a tool to present “the plan” to clients, this also was an outward demonstration of the sheer depth of analysis the advisor completed to compile this plan; a physical manifestation of the advisor’s “value”. Yet while that depth of meticulously compiled information can be helpful, it also comes with drawbacks. As, in practice, the especially thorough financial plan can be overwhelming to clients, if they open it at all. And at the end of the day, in-depth financial planning analyses can also quickly become out-of-date. To address this challenge, several years ago financial advisor and client communication guru Carl Richards made the alternative case – in his book The One-Page Financial Plan – that all of a client’s “need to know” information ought to be distilled into just a single page instead. In other words, the advisor would simply deliver a One-Page Financial Plan.

It’s worth noting that a One-Page Financial Plan (OPFP) doesn’t mean that the three-inch binder’s worth of information doesn’t exist; the OPFP is an alternative for a deliverable, not an alternative to the work itself. It’s about making a distinction between what advisors could share with a client, versus what a client needs (and really wants?) to know. Which means the creation of an OPFP is all about focusing that limited space to hone in on what each client truly needs to see and wants to talk about.

Beyond the sheer time savings of not producing such a lengthy physical financial plan deliverable, one of the major advantages of the OPFP is its ability to be a “living plan”. Because the traditional financial plan is often so long and time-consuming to produce, most firms only update it once every several years. By contrast, the OPFP can easily be updated on an ongoing basis every year, or even at every check-in meeting with the client throughout the year – which makes it easier for an advisor to pivot in unforeseen circumstances and disruptions (such as, for example, a pandemic!). Rather than reacting to a few years’ worth of changes, advisors can proactively adjust and update the plan as life happens.

Because the OPFP is a living document, a first draft can be constructed as soon as an advisor begins meeting with a new client, simply using standard Document and Spreadsheet tools (e.g., Word and Excel in Microsoft, or Docs and Sheets in Google). As while the Plan will shift a lot over the first few weeks, it nonetheless provides a framework that advisors and clients can work through together to reach mutual clarity. And once an OPFP has been refined and has buy-in from both an advisor and client, it can even become the centerpiece of meetings, because both parties agree that the OPFP has the most important information in order to make informed decisions.

Simmering down a financial plan to one page may be a hard adjustment at first, but it is certainly worth pursuing as a time- and information-efficient option to show clients what they need to know. Many advisors also refine their OPFP strategies over time, opting for more graphics (built from templates to ensure they’re easy to update), or building in automations to make the Plan even easier to compile and comprehend. But ultimately, the OPFP is useful as a tool to drill down to a client’s two biggest questions: “Am I doing OK?” and “What should I do next?” Providing a one-stop-shop to answer these two questions nudges clients (and advisors!) to stay focused on the right things—and work together to keep heading in the right direction!

After reading Carl Richards’ aptly named book - The One-Page Financial Plan - in 2016, I decided that I wanted to put it into action, and promptly started doing so when I launched my own firm in 2017. Since then, I’ve talked with hundreds of other advisors experimenting with the idea, or just curious to know more, about the One-Page Financial Plan (OPFP).

After reading Carl Richards’ aptly named book - The One-Page Financial Plan - in 2016, I decided that I wanted to put it into action, and promptly started doing so when I launched my own firm in 2017. Since then, I’ve talked with hundreds of other advisors experimenting with the idea, or just curious to know more, about the One-Page Financial Plan (OPFP).

The financial planning industry has evolved over the years – from selling products, to selling information, to selling advice. And with that evolution has come an evolution in the “deliverable” that we give to the client at the end of the financial planning process. When we think of “the financial plan” as that deliverable, we often envision a thick, leather-bound, firm logo-embossed, three-inch binder that’s produced, because that’s what we used to either validate the sale of a product or to demonstrate the depth of the information that we were selling.

But the reality is, however nice that binder looks, it’s going to be outdated very quickly… which is problematic for advisors now in the business of selling advice. A myriad of events, assumptions, and even client goals will change and render “The Plan” almost useless. And this is why the process of planning is actually more important than the plan. Or as my friend Roger Whitney wrote about and practices, real financial planning is AGILE in nature.

Moreover, our clients (at least the vast majority of them), don’t care about all the details – the standard deviations and Monte Carlo simulations and Sharpe Ratios and withdrawal strategies. They hire us as financial advisors precisely because they expect us to know all of and analyze those details. But in the end, they just want to know “Am I going to be okay?” and “What do I need to do next?”

Enter the One-Page Financial Plan.

The idea of the One-Page Financial Plan is to help clients (and advisors!) focus on the right things by distilling the incredibly complex into the elegantly simple, and stressing the value of ongoing planning over the one-time creation of The Financial Plan.

What Is A One-Page Financial Plan (OPFP)?

The One-Page Financial Plan (OPFP) is, in essence, an Executive Summary of a larger/longer financial plan. It could, in theory, exist entirely alone, though in practice I’ve found it best used in conjunction with other financial planning and FinTech software.

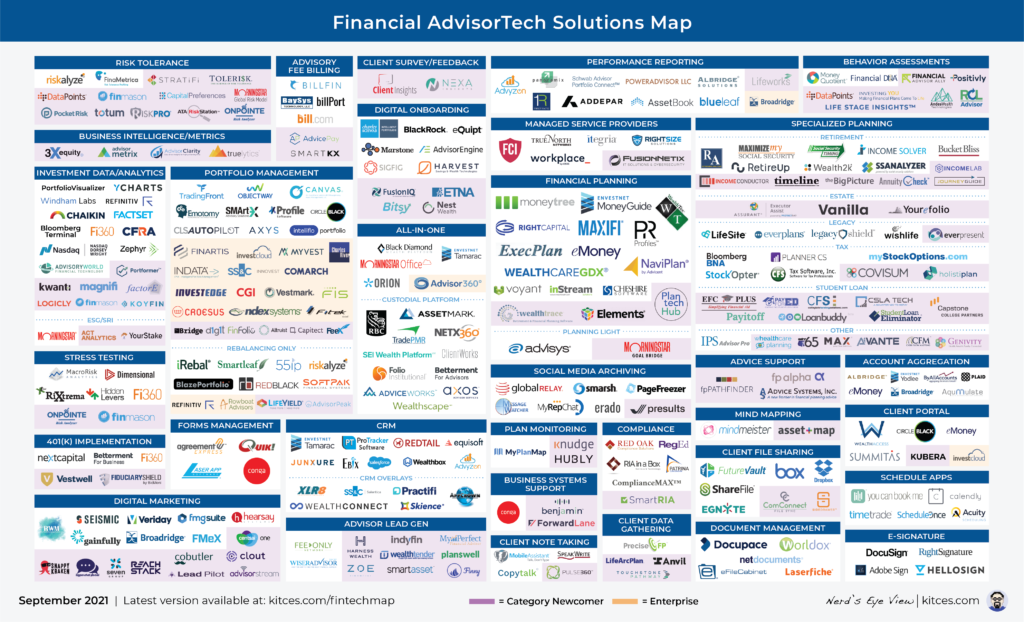

Still, though, the challenge with financial planning software today – especially when including the 46 ‘supplemental’ planning tools for specialized analyses from tax planning to Social Security timing on the Kitces AdvisorTech Solutions Map – is that even software that aims to simplify the process can still become overwhelming in quantity. Accordingly, the OPFP summarizes these, custom-tailored to how an advisor works best with his or her clients. In other words, rather than printing (or linking or screen-sharing) to 20 or 30 or 50 or 250 pages of information with 4 different log-ins, the OPFP puts it all together on one simple page.

Notably, because the OPFP is meant to bring together all the key points across various financial planning software tools and analyses, it may indeed still be helpful at times to log into the different platforms with the client – or provide them access to it without the advisor present – to verify or to dig deeper into certain areas at times. Nonetheless, the key concepts themselves are all consolidated in the One-Page Financial Plan.

Sample One-Page Financial Plan From Fident Financial

Ultimately, each advisor’s one-page financial plan can look a bit different – and arguably should look different – based on who they are serving, what they’re providing, and the particular needs of their niche/ideal client. In other words, the Plan should be tailored to what the client needs to see and wants to talk about (which from an efficiency standpoint makes all the stronger of a case to work with a consistent niche of clients, because it means a more consistent standardized OPFP can be used with all of them!).

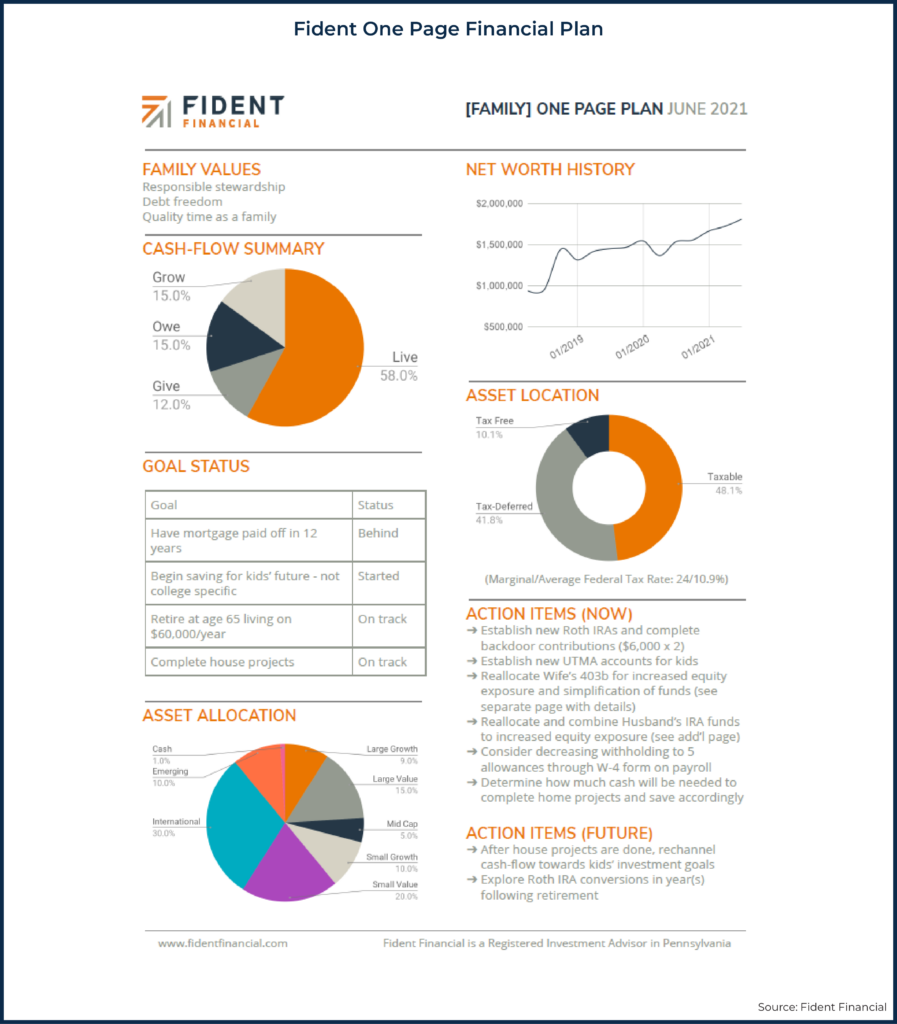

Below is an image of my OPFP at Fident Financial, with a description of what I include in it, and it is pretty consistent with each client that I work with.

I start with Family Values. Or if I’m working with an individual, Personal Values. The reason I start here is because I have a strong belief that good financial decisions have their genesis in values, as Bill Bachrach recently talked about with Kitces. These values take longer in the discovery process to really drill down and discover, but they are the least likely to change over time (and really form the foundation on which the rest of the plan is built), compared to the rest of the content on the OPFP itself which may be more fluid as life progresses.

Once I felt I understood what was really important to a client, we’d move onto the next section: cash flow. For me, I borrowed an idea from Kingdom Advisors in summarizing cash flow into four broad categories: Live, Give, Owe, and Grow.

"Live" is just that – our true living expenses. "Give" is any type of charitable giving, including both tax-deductible and any other (non-deductible) gifting to others. (I try to have clients create a personal Generosity Philosophy that would determine what’s included here.) "Owe" would include any obligations to pay – including both debt payments and taxes. For simplicity's sake on taxes, I just look at Federal, state, local, and property taxes, and generally pull it from their tax return when looking backward, and then make an estimate when looking forward. And "Grow" is what the client is allocating to grow net worth – investments into retirement accounts, kids’ savings vehicles, taxable investments, business purchases, etc.

This can be either forward- or backward-looking. If it’s forward and we’re planning on what the client is going to spend, then I'll try to stay with high-level summaries as we’re dealing with estimates (i.e., I’m not estimating utility bills or gasoline prices). If it’s backward-looking, then I’ll take some large items that I can find on documents (such as investment statements, tax returns, or mortgage statements) to calculate the Give, Owe, and Grow components, and leave the remainder as Live. In fact, this Live/Give/Owe/Grow tool is another tool I utilize for my clients, as it’s a great way of capturing cash flow over the years.

The intention behind placing cash flow directly underneath Values on the OPFP is that we can see if there’s a disconnect between what a client says is important, and how they’re actually allocating their income as it comes in and goes out.

Next on the OPFP is Goals. This can be a tricky area, as it requires a degree of creative constraint, given that you can only list so many goals here in a limited space. I try to help the client determine which are the most important objectives to them, on which we can take action now or shortly… and then summarize those particular short-to-intermediate-term goals alongside their current status. By tracking goals that have action steps to be taken in the foreseeable future – as opposed to a very-long-term goal like “retire in 20 years with $XX of savings” – seeing the OPFP and its ongoing status updates also becomes a form of accountability for clients to reflect on whether they’re taking the actions they committed to taking in order to achieve their goals.

Below the Goals, I include Asset Allocation – a pie-chart of what they’re currently invested in. As a believer in an evidence-based-investing approach to wealth management, I like to show a client how we’re positioned, and then be able to visually connect why we’re invested that way based on their goals above. Which can be especially helpful when markets become volatile, and we need to connect their portfolio decisions back to the original goals that allocation was intended to achieve.

At the top of the right column, I include a Historical Net Worth chart. If I’m just starting to work with a client, this might take the form of a Current Net Worth, with a simple table showing their current assets and liabilities as we begin working together. But once there is some level of historical data in the ongoing advisory relationship, I’ll plot a chart that shows the net worth over time. It shows that – in general – if we are doing the right things like paying down debt and increasing savings, the client’s net worth increases over time, and they gain a sense of positive progression over the span of their relationship with the firm.

Next, I include an Asset Location chart. This shows in a quick snapshot where our tax liabilities lie in our investments (i.e., the portion of the portfolio in tax-deferred, future-taxable accounts, versus tax-free Roth accounts, or ongoing-taxable investment accounts). Generally I exclude cash or money in the bank here, and focus only on actual investments. In characterizing their current tax situation, this section also typically includes the client’s marginal tax rate and their current average tax rate.

And finally, at the bottom right of the OPFP, I include the client’s outstanding Action Items. These are divided into Action Items NOW, and Action Items FUTURE – or things we need to get accomplished in the near term, and things we fully acknowledge we’re not working on right now, but want to openly recognize that we are keeping on the back burner.

Notably, while the ideal is to capture all of this on a single page, sometimes for an initial plan I’ll make an addendum here, such as “Reallocate employer 401k – see separate page” where I’ll list specific securities with allocation weightings, which wouldn’t neatly fit into this area by itself. Or if there is a flowchart to depict an estate planning strategy, I might reference that with the action step of “Update estate documents – see separate page”. Recognizing that even the OPFP may still need to have “supplemental information” attached.

And that’s it. That’s the One-Page Financial Plan. Or at least my version of it. The document that I utilize to produce the OPFP resides entirely outside any software itself – it’s a good old-fashioned Google Doc, with a supporting Google Sheet. An advisor could (almost) as easily do this within Microsoft Office. In turn, I currently have two main exterior providers that feed the primary data into the Plan: RightCapital and Holistiplan.

Benefits Of Using A One-Page Financial Plan

There are a number of reasons why a One-Page Financial Plan is beneficial for advisors to use with their clients, but arguably the most compelling reason is simply that many (or for some advisors, the majority of) clients rarely even go through the comprehensive financial plan document that we have traditionally produced. Even during the “presentation” meeting, we advisors can often notice clients’ eyes begin to gloss over with the sheer amount of data in front of them. And once that binder leaves our office, clients may never crack the spine of it again. Sometimes they even “accidentally” forget to take it with them.

The OPFP simply recognizes this fact and distills the larger plan as a whole into the parts that clients actually care about, that they pay attention to… and that they have the bandwidth to absorb in the meeting itself.

Will Clients Really Pay For Just One Page?

I’ll admit a bit of imposter syndrome lingered here the first few times I presented the One-Page Financial Plan to a new client. They had paid me thousands of dollars to create a financial plan for them – and I was giving them a single document to walk away with? How on earth could I justify myself in this?

But I recognized that I was deeply rooted in the false notion that my value came from the volume of information – which just isn’t true. I don’t think I’m entirely alone in this false sense of our value as advisors. Sometimes we feel the need to provide more “concrete” evidence of the work we did, to justify the fee we charged! But if we truly did the hard work of distilling the complex (even the chaotic) down to the elegantly simple, I’d argue that we have provided far more value than what we charge.

After all, if clients just wanted the volume of information alone, they could have done a Google search and surfed the internet themselves. There’s no lack of information available to read. The client comes to us not for the information, but for someone to distill it for them into the key takeaways they need to glean to move forward.

After I launched my firm, I had a small handful of clients transition with me from my previous firm. All of which had received both the full-blown, multi-section, leather-binder type of plan, as well as my new OPFP. And a majority of them – without solicitation – voluntarily told me how much more they appreciated the simplicity of the one-pager. One even said they felt guilty telling me previously that they never looked at the old plan, because they realized how many hours of labor were probably involved in just the assembly of it alone.

The OPFP Is About Focusing Clients On What Matters Most

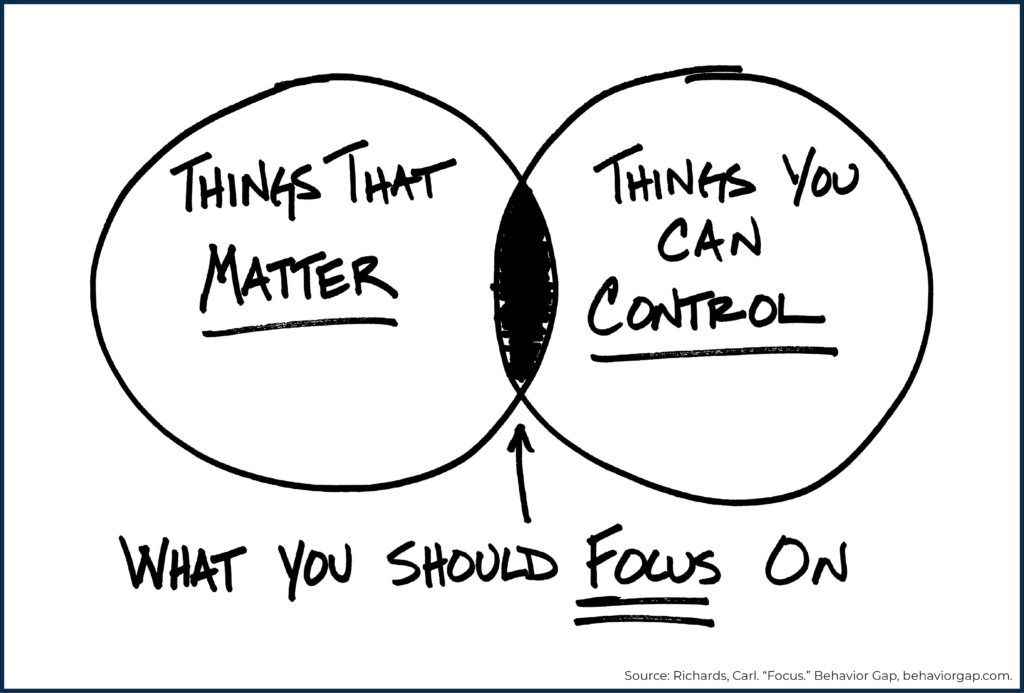

A second reason why I think more advisors should use the OPFP is that it helps clients – and ourselves – focus on the right things. It is short and simple enough that we are more clearly able to distinguish what is Noise, and what is Signal, in the whirling winds of information bombarding us every day.

Carl Richards has a great sketch that shows what we should focus on – the overlap of things that are both actually important, and actually controllable. A One-Page Financial Plan helps distinguish these things.

Additionally, the OPFP also helps demonstrate how the value of financial planning doesn’t lie in the one-time creation. As one side-effect of the traditional financial plan being so long – and time-consuming to produce – is that most firms only update it once every several years. While the OPFP, being much shorter and easier to produce, can be updated on a more ongoing basis every year or even at every check-in meeting with the client. Which makes the OPFP much more of a ‘living plan’.

As Carl Richards puts it, “we financial planners don’t want to have to be the defenders of an outdated map; we want to be guides in an ever-changing landscape”. However subconsciously it’s communicated, an OPFP – that can easily be and is regularly updated – shows clients how the plan is fluid, and that our value as advisors isn’t in predicting the future and estimating things far beyond our control that we document in a lengthy plan… instead, our value is continuously updating clients on where they stand now, and what step they need to take next to keep their forward momentum.

We don’t have to strain too hard to remember how COVID-19 drastically changed financial plans, and is still doing so. Nicely documented estimates that included assumptions on income, working careers, and returns on assets were all blown up for many clients in the past 18 months. While this might have been an extreme example, it’s nonetheless true that the only thing certain about the future is it will be uncertain.

What is less subject to drastic change – at least in the shorter term – are client values and goals. And having a document that reminds clients of this – and even anchors them back to it – is immensely helpful.

I can remember several years ago, shortly after implementing an OPFP with a client, receiving a call from them regarding an opportunity they had to purchase a rental property that wasn’t on our radar when we went through the initial planning process. I listened to the client describe the opportunity, and before we got into the real number crunching, I looked up his OPFP. On the top of the page under Family Values was “debt avoidance”, and so I simply asked him if that value was still true – and if so, would taking on another mortgage infringe on that to a degree that he felt comfortable with. He paused, and simply said, “Yes – yes, I guess it would. I kind of forgot about that in the moment. But yes, that’s still important to us.” This isn’t to say the rental property was or wasn’t a good idea. But the decision wasn’t actually about doing an analysis on the ROI of their potential real estate investment opportunity. It was about connecting the investment question back to his and his wife’s value set, as manifested on their OPFP, and seeing if the opportunity fit in… or if it was something we perhaps could and should decline because it didn’t really fit in after all.

The Comprehensive Financial Plan As A Technical Appendix

There will be times when clients have more detailed questions, or want more nuanced information about their plan, than what is shown on the OPFP. Advisors can still always print out the financial planning software reports (or even better, teach the client how to navigate the planning software interactively!?) to show the specific calculations. After all, we will still typically have to use comprehensive financial planning software to craft the right recommendations in the first place – the OPFP is an alternative for the output or deliverable for the client, not a substitute for doing the analytical work itself – and while most clients will trust us in the process of building and maintaining the financial plan, it can still be beneficial to show them where they can go to get more information.

For instance, when completing a new financial plan, I typically make sure that the client is logged in and actively involved with RightCapital – showing them the different inputs and outputs, and even making a joke that I could print several hundreds of pages, if they’d like, showing them their projected cash flow and events for the next 40 years! I’d encourage them to play around with the different assumptions and toggle the projection options, so they get an idea of how small changes over long periods of time really compound to massive changes.

I also encourage ongoing clients to occasionally log into RightCapital outside of our meetings. This way, they not only gain some understanding of how the plumbing works behind the plan when we first built it, but also they get more comfortable with seeing how dynamic the current projections really can be on an ongoing basis.

And lastly, at times during client meetings, we’ll pull up RightCapital or Holistiplan to show how various planning strategies may impact them. I won’t typically put all of that into printed information for them, but I do show them on a screen when it makes sense to do so during a client meeting.

The key point, though, is simply to understand that the OPFP isn’t necessarily done to the exclusion of a rigorous analysis in traditional planning software. And there may well be times that the software and its output are necessary to supplement the OPFP – either as a form of ‘technical appendix’ to validate where the numbers came from, or even to delve deeper if the client has further questions. But in practice, when the OPFP is clear in providing clients with the information they actually want and need, the truth is that they ask to delve deeper far less often than you might expect.

How To Construct, Implement, And Maintain A One-Page Financial Plan

Because financial planning software is still largely focused on producing “comprehensive” financial plans – with all their gory pages of details – in practice, the one-page financial plan is typically created (and maintained) outside any planning software. I happen to use Google’s Workplace ecosystem, because I believe the different programs interact better with each other, but you can create a similar template within Microsoft Office.

The Doc (or Word) document is where the Plan is actually constructed, and where it can be edited, updated, refined, archived, etc. And the Sheet (or Excel) is a spreadsheet where data gets scraped into (in my case, from RightCapital and Holistiplan), and is used to formulate any charts that are then live-linked into the Doc itself. (More on this in a bit.)

When designing my own template, I didn’t want a lot of text. As the saying goes, “a picture is worth 1,000 words”, and so I wanted visuals to communicate the richness of the message. When creating my OPFP template, I tried to strategically place the charts and images so that when there is longer text, it’s still easily read and understood without any eye-glossing.

In my example, the Cash-Flow Summary, Asset Allocation, Historical Net Worth, and Investment Tax Allocation (Asset Location) charts are all created in the Sheet, but are displayed in the Doc. Most clients never see the actual Sheet doing the data work in the background – the only document they see (typically either printed or in a PDF) is the One-Page Financial Plan that is produced in the Doc.

For each client, I create a template (well, technically Google does from a super-efficient Google Scripts program) of both the Google Doc and the Google Sheet. The two documents are saved in the client’s folder, and are then used by me to individually update as we continue the planning relationship.

Although this use of standalone Doc and Sheet tools might seem like a weakness of the OPFP construction, I actually view it as a positive as it still grants me (and other advisors) the autonomy to be platform- and provider-agnostic when creating financial plans. As living outside of any one planning software or other industry tool means we have the ability to choose which providers we use, and simply pull in their outputs as our inputs into the final OPFP document.

Using our own standalone document also gives us full control over the branding and visual look of the OPFP, not to mention what specific components of the plan we want to include.

Maintaining The OPFP As A ‘Living Plan’ Document

Once the initial One-Page Financial Plan is built out, it becomes a living document. In fact, the first iteration of the OPFP for a client is created after my initial meeting. A lot is going to change on it, but I use it to produce the framework that we subsequently use to work through together. As we clarify their Goals, we update or reprioritize them. As we build out their full net worth statement, it’s updated, too. As we get more clarity on their tax situation, we’ll quantify it. As we have our initial To Do list to do, we’ll write it. And once those To Do’s are done, we’ll write new ones.

Once the initial planning process is completed, I will also communicate that this document will continue to evolve and change – which is a natural and expected thing. And it’s at this point that I will begin to archive each one for each client as a way of showing the progress that we’ve made over time. Typically, how I do this is just print-to-PDF the current One-Page Financial Plan – with the date on the upper-righthand corner – to save in a file for the client before I make any changes or updates to the revised OPFP.

In fact, my client relationships are so centered around the OPFP that generally they’re the only document I bring to our ongoing Progress (also known as “Review”) Meetings with existing clients. I print two copies – one for me to take notes on, and one for the client to have – and it serves as the agenda for the entire meeting.

I may have my computer with me, with which we can dig deeper into a financial planning question in RightCapital, or a tax strategy in Holistiplan, or an investment analysis if need be. But the One-Pager serves as the primary means of communication and talking points.

Integrating And Automating Updates To The OPFP

Because the One-Page Financial Plan itself is simply a culmination of the output from other tools and analyses, it is supported by other planning software tools and components. Which means it is important to structure the One-Page Financial Plan to be easily updated, as life, circumstances, goals, and external events invariably and inevitably change the numbers and other outputs shown on the OPFP.

Whichever peripheral planning systems are being used (in my case, primarily RightCapital and Holistiplan), the OPFP should be updated as these systems are updated and revised with new information. In the Google Sheet (or MS Excel), I can data scrape resources from the original source into the Sheet. Using my current OPFP, these changes to the underlying Sheet are then reflected in the OPFP Doc output in the Cash-Flow Summary, Asset Allocation, Net Worth History, and the Tax Allocation chart.

All of these charts are populated within the Sheet. And so I’ll go into the software to find the updated account balances that I need, update the figures in the Sheet, and the charts will automatically update. Within the Google Doc (where the actual OPFP plan resides), I’ll then get a prompt to “Update chart” when Google sees that the underlying data has changed. There is a similar feature within Microsoft, although it’s not quite as intuitive (at least the last time I checked!).

Depending on the timing of the client meeting, if a new tax return has been filed, I’ll also cross-check the latest return to further report on their current Effective Tax Rate, and make any changes accordingly on the OPFP document.

Once the data and the corresponding Charts are updated, I’ll then look over the client Goals, and see if we need to make any updates to that text information. And then the same with any Action Items. As I mentioned before, I’ll then make sure I’m archiving the old OPFP (usually in the form of a PDF) so that any updates or changes are shown as current, and we can look back on progress made from previous editions.

I actually timed how long this takes recently. I started a stopwatch the moment I opened up the Google Doc and Sheet for the client, proceeded to log into RightCapital and Holistiplan, updated the data within the Sheets, and refreshed the charts within the Doc. It took 2 minutes and 37 seconds.

Now, granted, depending on how many other planning topics may need to be covered in the client progress meeting, the total meeting preparation time may be far longer than this. But for the sake of simply updating the financial plan, it is pretty efficient once the OPFP template has been built in the first place.

According to Kitces Research, the average financial plan takes nearly 10 hours to produce, and 2 hours to deliver to the client. Which means, not surprisingly, that financial advisors don’t update them very often.

The approach of using a One-Page Financial Plan changes this dynamic, by curtailing how long it takes to produce “The Plan”, while simultaneously turning it into something that more readily speaks to the issues that clients really want to know: “Am I doing OK?” and “What should I do next?”. In other words, the OPFP helps simplify the complex, nudges clients (and advisors!) to stay focused on the right things, is by its very construct showing that the Process of Planning is more important than The Plan itself, and by abbreviating the depth and volume of the plan output and physical deliverable, is far more efficient to produce (and update on an ongoing basis) than the traditional financial planning tomes our industry historically has utilized.

I have talked with enough advisors curious about the idea of an OPFP to know there is a lot of interest, and I have talked with enough clients to know it is what they desire as well. I hope that this article is helpful in encouraging more advisors to consider implementing it in their own firms – which may just include your own.

Jeremy also recently created a Course made for financial advisors in conjunction with Carl Richards on the topic of this article – The One-Page Financial Plan. The course has three tiers – template only, full video course along with templates, and customized coaching. You can find out more information on the OPFP Course website.

For more information on how real advisors are communicating their value to clients, join Jeremy and other guest speakers at the Kitces Financial Planning Value Summit 2021.

Thanks for sharing your template!

I’ve presented more than 100 OPFPs since Tom Gau taught me the strategy back in 2009. Other than Tom (and myself) you might be the first person I’ve ever seen to share their OPFP publicly.

Love to compare notes sometime. I like the idea of adding images, but I always had so many recommendations it was already a challenge to fit it on one page.

I was interested to see what you thought about this when I saw the title. In comparing the two of your “styles” I immediately noticed the pictures as well. Happy to see your perspective.

Matt we were glad you learned this strategy during your 7+ years in the Academy of Preferred Financial Advisors Exclusive Coaching Program.

You are clearly one of the many success stories that we are proud of.

Thanks, Matthew – would love to talk shop. I’ll send you a message and we’ll find a time to do so!

In my days working for an institutional money management firm, we always had a one-pager for stocks. I’ve tried from time to time to do this for financial planning but never got to the point where I rolled it out to clients. This concept is wonderful and thank you for sharing!

Thanks for sharing this information!

This is great, Jeremy. I really like the layout.

We’ve been using a simplified version OPFP for prospective clients at our firm that helps us communicate the ongoing value of our advice.

I just recorded a video on what ours looks like and how it’s helping convert prospects into clients. https://youtu.be/lVS-8EDdvAY

https://uploads.disquscdn.com/images/de534be2c9cd662827c71b3948ad7cce4faeb72c96725f46d7b2d0c24cb20ee8.jpg Great initiative Jeremy. Given the fact clients probably never read of full financial plan, giving them a snapshot, especially for micro-advice makes really good sense. We trialled a similar one-pager in the highly regulated Australian market where satisfying best interest duties are legal obligations when preparing a statement of advice (SOA)

Thanks for the article.

https://startupindias.com/

I love the OPFP, so simple and easily communicated to the client. Are there any suggestions for compatible software for us folks up in Canada?

As a DIY investor and DIY financial planner, this template is also extremely helpful! For me, it keeps me out of the weeds and help me focus on the big-picture questions. For my spouse, it is an effective communication tool. She usually rolls here eyes when she sees my spreadsheets. I gave her a one-page financial plan. She keeps it out to review as we reflect on our plans for our next stage of life.