Executive Summary

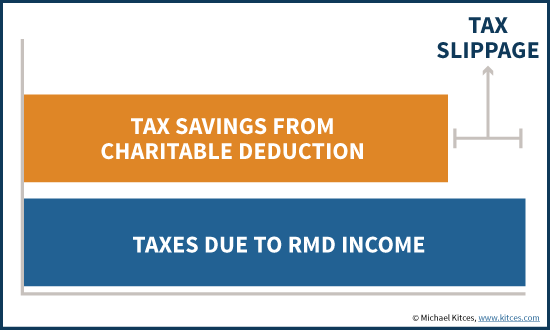

While the Internal Revenue Code does allow those who donate funds to charity to receive an income tax deduction to offset a portion of their income, in practice the two rarely offset perfectly. Income is counted “above the line”, increasing Adjusted Gross Income and impacting a wide range of tax credits and deductions, while charitable contributions only apply for those who itemized deductions in the first place (and face further charitable contribution deduction limits as well). As a result, there is often some “tax slippage” between the two.

In recent years, retirees who have “more than they need” in their IRA have been able to utilize the “Qualified Charitable Distribution” (QCD) rules to donate directly from an IRA to a charity, achieving a “perfect” pre-tax contribution and avoiding any tax slippage. Unfortunately, though, the QCD rules have come and gone several times since they were created in 2006, and after being briefly reinstated at the end of last 2014, the rules for QCDs have lapsed once again for 2015, raising doubt for those who want to do QCDs this year about how to proceed.

However, as it turns out, the best strategy to handle the uncertainty of whether QCDs will be extended or not is just to do them anyway! At worst, if the rules are not reinstated, the outcome will be no worse than just being forced to take an RMD and making a charitable contribution anyway (with the not-perfectly-offsetting tax deduction). However, if the rules are brought back once again, those who make direct charitable distributions from their IRAs will enjoy all the benefits of QCDs… even if the rules are only “fixed” after the fact!

(Michael's Note: The rules for Qualified Charitable Distributions from IRAs have been reinstated and made permanent under the Protecting Americans from Tax Hikes (PATH) Act of 2015.)

Standard Rules For Charitable Contributions And Required Minimum Distributions (RMDs)

Under the tax code, those who reach age 70 ½ must generally begin to take Required Minimum Distributions (RMDs) from their retirement accounts, reporting the taxable distributions as income and incurring a tax liability. In fact, given that growth in retirement accounts is normally tax-deferred, the whole purpose of those required distributions is for the Federal government to ensure that, eventually, that tax-deferred growth is subject to income taxation by forcing the money out of the account in later years.

Separately, the tax code allows those who make a donation to charity to receive an itemized tax deduction in the amount of the contribution (albeit subject to some limitations on the size of the deduction relative to income). To the extent that the individual has income to be offset, the net result of the charitable contribution is a reduction of taxes; it’s as though the income was contributed directly to the charity on a pre-tax basis.

Of course, the caveat is that given how tax liabilities are actually calculated, gross income (e.g., from an RMD) and below-the-line itemized deductions (e.g., from a charitable contribution) rarely net out perfectly. The income is included in the calculation of Adjusted Gross Income (AGI), which in turn can limit a number of other tax deductions (e.g., medical and miscellaneous itemized deductions) and tax credits that phase out based on AGI. In addition, the income is included when calculating the taxability of Social Security benefits, and at higher dollar levels can impact Medicare Part B and Part D premiums as well. And charitable contributions themselves can be limited in their deductibility in any particular year (with the excess carried forward up to 5 years into the future). Not to mention the fact that a large portion of taxpayers don’t actually itemize their tax deductions at all (and therefore receive no tax benefit from a charitable contribution).

Nonetheless, the reality is that for most who are subject to RMDs and plan to make charitable contributions, the income of the former is at least mostly offset by the deduction from the latter. Or technically, the taxes from a $5,000 RMD are almost fully offset by the tax savings from a similar $5,000 charitable deduction. While there may be some “tax slippage” in applying the deduction against the income, for most it will be relatively slight.

Qualified Charitable Distributions (QCDs) From IRAs – On Again, Off Again

The Pension Protection Act of 2006 was the first to create the concept of a “Qualified Charitable Distribution” from an IRA. Initially taking effect in that year (2006), the rules stipulated that those over age 70 ½ could make a donation of up to $100,000 directly from an IRA to a charity, and avoid any taxation on the income at all. The donation would not be claimed as a charitable deduction, but only because the IRA withdrawal would not be reported in income in the first place. With $100,000 leaving the IRA and $100,000 going to the charity – but nothing showing up on the tax return at all – it would be a perfect offset. And as an added benefit, the contribution would apply towards satisfying the individual’s RMD for that year (and since the rules only applied to those over age 70 ½, there generally would be an RMD obligation!). In other words, the Qualified Charitable Distribution (QCD) rules allowed someone to donate their RMD (and then some) directly to charity without any tax slippage.

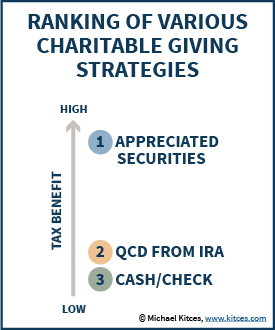

While technically the tax benefits of QCDs are still inferior to donating appreciated securities (at least for those who itemized deductions, have appreciated securities to donate, and have not already capped out their charitable deductions plus carryforward), doing a QCD is superior to simply donating cash or writing a check. As a result, QCDs have been popular as a tax-savings-strategy to consider for those who are subject to RMDs and planning to donate to a charity anyway.

While technically the tax benefits of QCDs are still inferior to donating appreciated securities (at least for those who itemized deductions, have appreciated securities to donate, and have not already capped out their charitable deductions plus carryforward), doing a QCD is superior to simply donating cash or writing a check. As a result, QCDs have been popular as a tax-savings-strategy to consider for those who are subject to RMDs and planning to donate to a charity anyway.

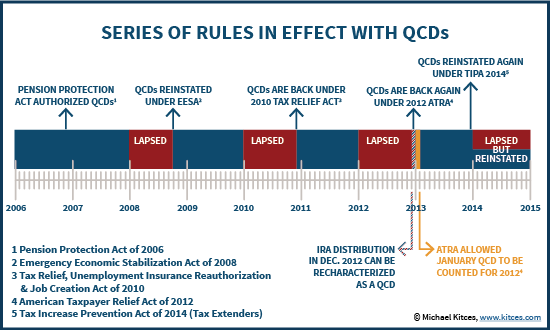

Unfortunately, though, the challenge of the QCD rules is that they keep disappearing. The original legislation under the Pension Protection Act authorized QCDs for only two years (2006 and 2007), after which they lapsed. In 2008, the QCD rules were reinstated and extended through 2009 (under the Emergency Economic Stabilization Act of 2008, also known as the TARP legislation signed into law during the financial crisis), only to lapse again after 2009. QCDs were in turn brought back again for 2010 and 2011 under the fiscal cliff legislation at the end of 2010, though they were reinstated only 2 weeks before the end of the year, leaving little time for anyone to actually make a QCD (necessitating Congress to provide taxpayers a one-month extension into January of 2011 to make their 2010 QCDs!). And sadly, this pattern was repeated again 2012, when QCDs were lapsed for the entire year and then retroactively reinstated for 2012 (and extended into 2013) with the second fiscal cliff legislation, once again prompting Congress to provide a temporary extension for 2012 QCDs into early 2013.

And sure enough, continuing the pattern once more, Qualified Charitable Distributions from IRAs were lapsed for the majority of 2014 as well, only to be retroactively reinstated in mid-December after it was already too late for many who had grown impatient and already taken their RMDs and/or done their charitable giving for the year! And this time, the QCD rules were not even extended forward a single year. As a result, they have lapsed once again for 2015, with uncertainty once again about whether they will be reinstated (retroactively or just going forward, in a timely manner or at all!)!

Planning For QCDs In Light Of Lapsed Tax Extenders In 2015

So what should taxpayers do, given that they find themselves once again find themselves in the situation where they may be considering whether to do Qualified Charitable Distributions from an IRA for their 2015 RMD, but are wondering whether the rules will be reinstated, and/or whether it’s worth waiting until the very end of the year to find out. The short answer: just do it anyway, now if desired, as though the rules have already been reinstated and extended.

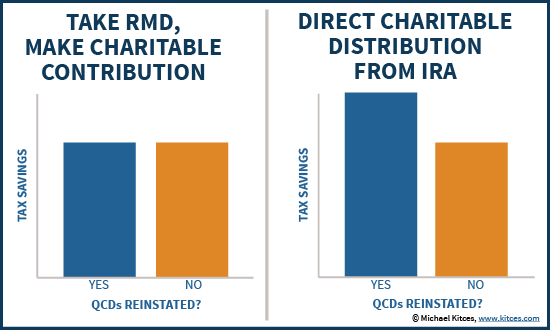

The reasoning is simply this: without the QCD rules, the tax consequences of making a charitable distribution directly from an IRA is simply that the distribution will be reported in income for tax purposes (coded as a normal distribution on Form 1099-R), the donation will be reported as an itemized deduction (which is permitted since the contribution isn't being claimed under the QCD rules), and the RMD income and charitable contribution deduction will mostly offset one another. In other words, making a direct charitable distribution from an IRA without the QCD rules has the exact same tax consequences as simply taking the RMD and separately donating it to charity anyway, which is what would happen anyway without the QCD rules! There’s no difference between withdrawing and donating, and making an "impermissible" QCD contribution under the lapsed rules. Without the QCD rules, the tax code does not recognize the direct charitable contribution, and simply taxes it as two individual steps anyway (a taxable IRA withdrawal and subsequent charitable contribution)!

On the other hand, the benefit of contributing RMDs directly to a charity as though the QCD rules still existed is that, if they are retroactively reinstated again for 2015 (as they have been in 2008, 2010, 2012, and 2014) then the direct charitable contribution will retroactively qualify, because the rules were otherwise complied with! And notably, in all prior scenarios, the QCD rules were not just reinstated, but reinstated retroactively in a manner that would have qualified prior QCDs as well. By contrast, if RMDs are simply withdrawn and charitable contributions are made separately, and then the QCD rules are reinstated, it’s too late to go back and fix it after the fact, because the rules weren't followed in the first place.

In other words, not making a direct distribution to the charity will never benefit from the QCD rules (reinstated or not) and always have some tax slippage, but making a direct distribution from the IRA to the charity will at least avoid the tax slippage if the rules are reinstated and have the greater tax savings benefit (and if the rules are not reinstated, the outcome is no worse anyway) .

Notably, there are a few important caveats to consider before employing this strategy:

- As discussed earlier, it may still be better in many situations to donate appreciated securities (and using that charitable deduction to offset the RMD income, while also avoiding capital gains taxes) than pursuing these QCD rules at all. In other words, this is a way to implement QCDs that may be recognized after the fact, but it still needs to be determined if a QCD is the right/best strategy in the first place!

- To qualify, the charitable distribution must otherwise comply with the QCD rules. This means the distribution must be made after age 70 ½ (not just in the year you turn 70 ½, but beyond the exact date that milestone is reached), and the distribution check must be made payable directly to the receiving charity, and it must be a permissible charity (donor-advised funds, private non-operating foundations, and split-interest trusts like CRTs and CLTs do not qualify!). And of course, bear in mind the $100,000 limit on QCDs, and the fact that they can only be made from IRAs themselves (and not employer retirement plans like a 401(k) or 403(b)).

- For those not charitably inclined, remember that taking an RMD, paying some taxes, and keeping the rest, is still worth more than donating the money just for a partial tax deduction. In other words, the QCD rules reduce the tax cost for those otherwise charitable inclined, but are not a net positive to wealth. You’re still donating money and reducing your wealth (albeit partially subsidized by a tax deduction), so be certain you wish to do so!

- For those who do plan to donate anyway, and face an RMD anyway, there’s little harm to making a direct charitable contribution up to the amount of the RMD amount and waiting to see if the QCD rules are reinstated. However, any charitable contributions above-and-beyond the RMD should wait until later in the year when there is more clarity about whether the rules will be reinstated. For those “excess” charitable contributions, it may still be better to use other sources (and allow the IRA to stay intact and tax-deferred) if the QCD rules are not reinstated.

The bottom line, though, is simply this: for those struggling with the uncertainty of whether the Qualified Charitable Distribution rules will be reinstated again – or not – the reality is that there’s little harm to “pretending” they’ve already been reinstated anyway, and proceeding accordingly. At worst, the outcome is equivalent to what would have occurred by ignoring the rules in the first place. And if QCDs are retroactively reinstated again – for the 5th time! – using QCDs to avoid the tax slippage of RMD-income-vs-itemized-charitable-deductions will turn out to have worked, albeit after the fact!

So what do you think? Will you be guiding clients to do Qualified Charitable Distributions from their IRA in anticipation of the rules being reinstated anyway (given the limited downside even if they're not?)? Or is the rule and its potential reinstatement a moot point, because your clients actually do other charitable giving strategies anyway?

I’m confused. It would appear to me that a couple with let’s say 20K income and maybe 12k SS income with a 10K RMD who file with a standard deduction, would be way far ahead with a direct 10k contribution vs the payout then contribute. Am I missing something?

Planner B,

I’m not sure how this disagrees with the article. I’ve said here that QCDs are better than payout-then-contribute already?

The issue of the article is that a direct $10k contribution isn’t actually PERMITTED under law right now. The QCD rules have lapsed. They don’t exist. So the issue is what you do in their ABSENCE. And the recommendation here is DO IT ANYWAY, because if the QCD rules ARE reinstated, you’ll be better off, including in the exact situation you’re citing here.

– Michael

One advantage of contributing appreciated securities is that they can be contributed to a donor advised fund. My understanding is that the QCD rules do not permit this.

Name the donor advised fund beneficiary.

I should be more specific. While a client is alive the effect of contributing QCD to charity vs. QCD to donor advised fund to charity (not legal) is the same. Also you can mimic a very similar result of QCD to donor advised fund (not legal) by allowing the IRA to build up more and taking a larger QCD in the future to the charity when your donor advised fund would be making the grant. (Only minor caveat is that additional RMD amounts in the interim would have to be QCDed in an IRA, but don’t have to be in a charitable trust).

So if I can mimic the effect of QCD to donor advised fund by keeping more assets in the IRA than the only real difference is the post death issue. That problem is solved by naming the donor advised fund as a x% beneficiary of your IRA.

You don’t need QCD to donor advised fund to be legal since you can basically the accomplish the same exact result via planning with the IRA.

Michael,

The sets of circumstances where donating appreciated securities is superior to QCD are actually far lower than you think.

1) Anyone who hasn’t maxed out SSI surtax should absolutely take a QCD over any appreciated securities. You’re talking about likely half their marginal in just federal surtax by having income taken “super” above the line instead of below the line.

2) State income tax systems often are less friendly towards deductions than Federal and getting deduction before it hits the 1040 will have a larger impact than getting one itemized.

3) AGI floors (as you mentioned) have a pretty decent sized impact as well

4) People that actually managed their finances correctly should be mostly qualified assets and should be spending out of non qualified assets.

5) For people with substantial non qualified assets, cap gains assets receive a step up in basis and IRA’s don’t.

6) 70+ individuals typically have paid off mortgages and primary tax deduction is state income (or state sales) taxes. This often will not produce a large enough bill to cross standard deduction limits. It’s also not correct to take itemized total after charitable contributions to make this decision as invariably that means that only some of the charitable deduction exceeded the standard threshold.

7) For high income individuals they get hit with the 3.8% Obamacare Surtax which you correctly pointed out in a different piece, is not a tax on investment assets, but instead a tax on MAGI (itemized deductions don’t reduce MAGI)

8) Let’s also not forget Pease limitations which also act as a surtax.

9) And then there is also AMT liability considerations

QCDs are better 80%+ of the time.

I do not consider myself a tax expert by any means, however, my thoughts also went to the Step-up in cost basis for estate planning considerations that was mentioned above. Also, it seems to me that someone with a large IRA (ordinary income) vs taxable brokerage account (long-term cap gains on most Dividends and capital appreciation, not to mention Muni’s) would be better off getting rid of the IRA Assets due to the ordinary income tax and lack of step-up in basis. For most investments in a taxable account they would be subject to the long-term capital gains rate which would be 0%, 15%, 20%, or 23.8% including the Obamacare Tax. Max ordinary income tax rate is 39.6%.

A typical saver (who actually saved what they were supposed to) may have a $2MM IRA (which is where the bulk of their assets would likely be, saved as they were told to – $18k per year for 35-Years, assuming they delayed saving until 30-YO and continued until 65-YO, at a 6% Return- Which is basically both spouses maxing out their IRAs at $5,500, plus their contribution and their employers contributions adding up to $3,500 each on 401ks), which would have a $72k RMD their first year. By the time that you add in Social Security and other income, for most married couples they would easily be in a 25% tax bracket.

The gifting of highly appreciated securities also seems to assume that they would need to sell investments.

Plus pre-tax dollars are worth less than after tax dollars, and so not only do you miss the step-up in cost basis, but your estate may pay a higher estate tax.

I realize AMT etc are factors, but it seems to me as though the IRA (tax deferred) assets are the greater liability.

I can find nothing in the literature or your article that says whether QCDs are subject to the “benefit” rules of the 2015 Pub 526 such as the 80%/20% rule for “Athletic events”, p. 3. It is possible that they are via the one statement in the 2015 Pub 590B (p. 13, QCDs) that says the donor must have “same type of acknowledgment of your contribution that you would need to claim a deduction for charitable contribution, ” i.e., deduction on Schedule A , Form 1040. The referenced “acknowledgment” is in 2015 Pub 526, p. 18, Acknowledgment, 2.b, is possibly the fly in the ointment. Pub 526 deals with Charitable contributions as itemized deductions on Schedule A whereas Pub 590B deals with Distributions from IRAs.

What do you think about the “benefits” issue?

I should add that the direct distribution from my IRA is intended to be a QCD and not for the purchase of tickets. In my situation, the most I would get for the QCD is the right, to purchase for full value a ticket, if available, in a certain section of the football stadium and a parking pass, if available, for full value.