Executive Summary

Over the last few decades, divorces among couples over age 50 have been increasing dramatically, even though the overall US divorce rate has decreased, giving rise to the phenomenon known as “grey divorce.” Which means that, given the fact that older couples have had decades to accumulate shared assets, splitting those assets between divorcees can be a thorny situation, and one that has become a common issue that financial planners have to address. As while splitting IRA accounts is relatively straightforward, ERISA-qualified plans, which include defined contribution 401(k) and defined benefit pension plans, can be much more complicated to divide.

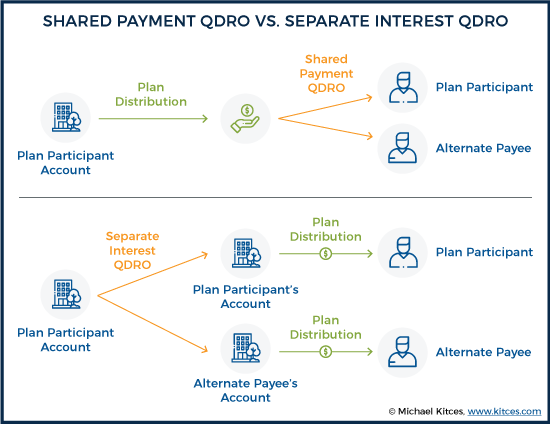

For instance, when ERISA-qualified plans are split, they require a formal document, known as a Qualified Domestic Relations Order (QDRO), in order to be divided. A QDRO identifies the Plan Participant and Alternate Payee (the former spouse receiving a benefit via the QDRO), how the benefit will be divided, and the amount of time or number of payments for which the QDRO will be in effect. For defined benefit plans, in particular, the QDRO also determines whether the plan will be divided using either the “Shared Payment” or “Separate Interest” method. For defined benefit pension plans, both forms of QDRO methods address the question, “How much will I get/give?”, but the “Separate Interest” method gives the Alternate Payee additional flexibility in terms of “How?” the benefits they receive under the plan will be paid.

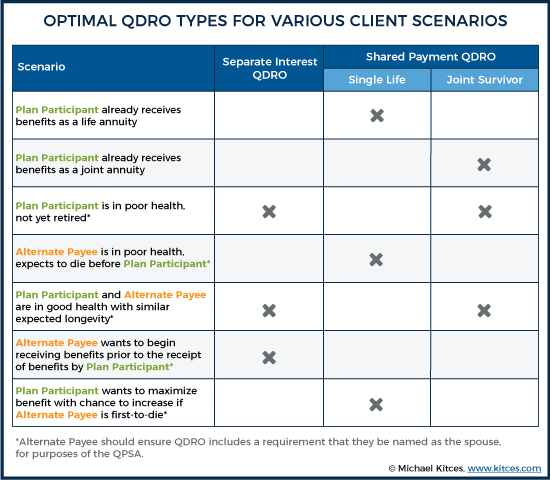

Specifically, the Shared Payment QDRO is based on the Participant’s retirement date and life expectancy, and the ex-spouse Alternate Payee’s benefits will generally begin and end at the same time they do for the Participant. Furthermore, in the event the Participant dies before beginning to receive benefits under the plan, the Alternate Payee won’t receive any benefits unless a Qualified Pre-Retirement Survivor Annuity (QPSA), guaranteeing survivorship benefits, is created by the QDRO. Thus, the Shared Payment QDRO can lead to some serious planning challenges for the Alternate Payee, should the Participant die first. However, if the Alternate Payee dies first after pension benefits begin, their share of the benefit will often shift back to the Participant.

On the other hand, a Separate Interest QDRO splits the plan balance between the Participant and Alternate Payee, before payments have begun. This gives both the Participant and the Alternate Payee control over how their share of plan benefits will be paid and eliminates the Alternate Payee’s risk of payments ending upon the Participant’s death.

Ultimately, the key point is that a QDRO offers some flexibility in planning strategies for both the Participant and the Alternate Payee. While the Shared Payment method must be used if the Participant has already begun payments when the QDRO is implemented, either the Shared Payment or Separate Interest strategy can be chosen if the QDRO is implemented before pension benefits begin. These choices allow for more flexible planning for both parties, possibly lowering at least one hurdle for older couples who choose to divorce.

When a marriage is good, it is one of the greatest blessings in life. Unfortunately, though, while the divorce rate has been declining in recent decades (at 0.69% of the entire US population in 2017, down from 0.82% in 2000), many marriages still end in divorce. In fact, one study estimated the number of couples getting divorced in 2017 at roughly 1 million!

Unfortunately, some divorces are more contentious than others, especially when spouses disagree on how assets (and custody of dependents) should be split. But even in amicable separations, and situations in which spouses largely agree conceptually on how assets should be divided, it’s not uncommon for there to be an innocent misunderstanding at the time that, once more thoroughly understood in the future, creates animosity or financial hardship. And in some cases, both.

Perhaps one of the best examples of this “we agree, but we don’t really understand what we’ve just agreed upon” scenario is when a defined benefit pension plan is split in a divorce. Unlike the splitting of a 401(k) or other defined contribution plan, which is generally straightforward and is often just a matter of asking, “How much of the account value will I receive/give up?”, the splitting of a defined benefit pension plan is often more nuanced as it also involves the question of “How (and when) will the division occur?”

The answer to this second, less frequently discussed (and certainly less understood) question of how a defined benefit pension plan’s assets will be divided pursuant to a divorce can have a huge impact on a divorcee’s long-term planning, impacting when they are actually able to receive a benefit from the plan, how much that benefit will be (even if the percentage of plan benefits to be received has already been decided), and perhaps most importantly, when benefits will cease altogether!

Qualified Retirement Plans Must Be Split Pursuant To A Qualified Domestic Relations Order (QDRO)

Property settlements pursuant to a divorce are primarily a matter of state law. And while those laws can have meaningful variations from state to state (especially in the context of separate property versus community property states), absent a prenuptial agreement to the contrary, soon-to-be ex-spouses are generally entitled to receive an equitable distribution of marital assets in a divorce (which is not necessarily the same as an “equal” distribution of assets), or, as in the case of community property states, an equal distribution of the community property.

Given the ubiquity of retirement accounts, such distributions regularly include the splitting of IRAs, as well as 401(k)s, pension plans, and other employer-sponsored retirement plan assets. But while IRAs can be split with relative ease using only a ‘simple’ divorce decree or Marital Separation Agreement (MSA), ERISA-qualified plans (including both defined contribution plans like 401(k) plans, and defined benefit pension plans), are more complex.

Notably, ERISA Section 206(d)(1) provides that, in general, the benefits accrued under an ERISA-covered plan cannot be assigned or alienated. Similar language can be found in IRC Section 401(a)(13). Together, these rules give ERISA-covered assets their strong creditor protection, making it nearly impossible for anyone other than the account owner to receive benefits accrued under an ERISA-covered plan. And more specifically, ERISA Section 206(d)(3) and IRC Section 414(p) provide a relatively narrow exception to the anti-assignment and alienation rules.

In fact, these provisions would make it nearly impossible for even a soon-to-be-ex-spouse to receive any benefits accrued under the plan… if not for the subsequent language regarding QDROs in both ERISA and the Internal Revenue Code. Under these sections of the law, a QDRO can be used to assign all or a portion of a Plan Participant’s benefits to an “Alternate Payee”, most commonly, the Participant’s ex-spouse (though it may also be the Participant’s current spouse, child, or other dependent to satisfy family support or marital property obligations).

Rules For Qualified Domestic Relations Orders (QDROs)

Qualified Domestic Relations Orders (QDROs) begin their life as Domestic Relations Orders (DROs)… the “Qualified” part comes later on in the process. Such DROs are generally issued by state courts, but may, in fact, be issued by any state agency or instrumentality with the authority to issue judgments, decrees, or orders, or to approve property settlement agreements, pursuant to state domestic relations law.

According to the requirements outlined in ERISA Section 206(d)(3)(C)(i)-(iv), as well as in IRC Section 414(p)(2)(A)-(D), QDROs must include certain information in order to become “qualified” (i.e., applicable to actually split an ERISA plan), including the following:

- Name and last known mailing address for the plan Participant and the Alternate Payee

- Name of each plan to which the order applies

- Dollar amount or percentage of benefits to be paid to the Alternate Payee, or a description of how such amounts should be calculated (i.e., 50% of the account balance as of a certain specified date)

- Time period or number of payments to which the order applies

ERISA and the Internal Revenue Code further outline provisions that are not allowed as part of a QDRO. Such prohibited provisions include those that would require the plan to:

- Provide the Alternate Payee with a benefit not otherwise available under the plan

- Increase the actuarial value of plan-provided benefits

- Pay an Alternate Payee benefits that have previously been awarded to another Alternate Payee via an earlier QDRO

- Pay a benefit in the form of a Qualified Joint and Survivor Annuity (QJSA) over the lives of the Alternate Payee and their (potential) future new spouse

Once a DRO has been drafted in accordance with the above terms, it can be sent to the plan administrator. Upon receipt of the DRO, the administrator must review the document within a reasonable period of time, and in accordance with its own procedures (which a plan must establish in writing), determine whether the DRO meets the conditions set forth in ERISA and the Internal Revenue Code to be deemed “qualified”. Notably, it is that plan administrator’s ‘blessing’ that the DRO meets the guidelines set forth in Federal law that ultimately turns it into a Qualified Domestic Relations Order (QDRO).

It’s important to note though, that while all QDROs must meet certain requirements and share some commonalities, there remains a significant amount of flexibility in the way such documents can be drafted. In particular, when it comes to determining how defined benefit pension plan assets will be split, one critical decision is whether the QDRO should be drafted using language that creates a “Shared Payment” or a “Separate Interest”.

The “Shared Payment” Method Of Splitting Defined Benefit Pension Plan Assets

One method of splitting defined benefit pension plans with a QDRO pursuant to a divorce is known as the “Shared Payment” method (sometimes referred to as the “Shared Interest” method).

In situations where the Shared Payment method is used, the Alternate Payee is just entitled to a portion of the benefits that would otherwise be paid to the Participant (e.g., “the Alternate Payee shall receive 50% of all benefits paid by the plan” or “the Alternate Payee shall receive $500 per month of what would otherwise be the Participant’s benefit once payment under the plan begins”). Notably, the Shared Payment QDRO does not affect whose life on which the pension is actuarially based. It follows then, that when defined benefit pension plan assets are split using the Shared Payment method, the benefits paid to both the original Participant and the Alternate Payee begin when that original Participant retires and starts to collect benefits (or at the time the QDRO is finalized by the plan administrator if the Participant has already started receiving benefits).

Conceptually, one might think of QDROs using the Shared Payment method as a “Who?” type of QDRO, in the sense that its primary function is only to determine “who” will receive benefits from the plan (on whatever payout schedule and terms applied in the first place). From the plan’s perspective, however, the “How?” with respect to timing and calculated benefit payments doesn’t change. Everything continues to revolve around the Participant.

In other words, there are no actuarial adjustments in the Participant’s balance. The Participant retains total control and continues to select the form of the benefit to be paid, such as a life annuity, joint and survivor annuity, or lump-sum benefit (though in certain circumstances, a QDRO may obligate the Participant to select a certain option).

Accordingly, it’s only when payments to the Participant have begun that the Shared Payment QDRO really takes effect and provides a benefit for the Alternate Payee. And in a sense, the Shared Payment QDRO is simply turned into a gatekeeper responsible for ensuring that the Alternate Payee actually receives the amount to which they are entitled and that the tax liability of such payments is properly reported to the Alternate Payee. Simply put, the QDRO makes sure that the right individuals (i.e., the “Who?”) receive their portions of the regularly calculated (i.e., based on the original Participant) benefit amount.

The Shared Payment Method Must Be Used For “Grey Divorces” Where Payments Have Already Started

Over the past several decades, the median age at which couples divorce has steadily risen. Yet in 2015, the median age for a first divorce for men was roughly 41, and roughly 40 for women. Thus, in the overwhelming majority of instances, couples divorce long before payments from a defined benefit pension begin.

But while that may be the case for most couples, there are certainly situations where divorce occurs after pension benefits begin. Such situations may become more common over the next few decades if the recent trend of increasing average ages for divorce continues. Because even though divorce rates for younger couples have steadily declined since 1990, a Pew Research study shows that over the same time period, divorce rates for individuals 50 and over have more than doubled!

In these so-called "grey divorces", it becomes more likely that pension plan benefits have already started at the time the divorce is finalized. In such situations, the form of benefit (e.g., life annuity, joint life annuity, etc.) has already been irrevocably selected. Thus, the only way to provide an Alternate Payee directly with benefits that the Participant has already started receiving from the plan is to split the already-being-received amount via a Shared Payment QDRO.

Example 1: Tim and Samantha are married and are each 62 years old. At age 57, Tim retired from the local police department, having completed 35 years of service. He was eligible to begin receiving pension benefits immediately, and chose to do so in the form of a life-only annuity with monthly payments of $5,000 (i.e., $5,000/month payments until Tim dies).

Unfortunately, during the initial years of retirement, Tim and Samantha have found that they’ve grown apart. As such, they have recently decided to seek a divorce.

As determined by the divorce proceedings, Samantha will receive some of the benefit from Tim’s pension. But Tim has already begun to receive benefits under the plan as a life-only annuity (a decision that is irrevocable), which means from the plan’s perspective, the “how” is locked in. In other words, payments of $5,000, based upon Tim’s actuarial life expectancy, will be distributed from the plan monthly until Tim’s death.

Since Tim has already started receiving payments, the divorce decree calls for a Shared Payment QDRO, which provides for the only way Samantha can receive any benefit from the plan. It awards Samantha 50% of the benefits paid under the plan to begin immediately, and Samantha starts receiving $5,000 x 50% = $2,500 monthly payments (with the remaining $5,000 – $2,500 payment to Samantha = $2,500 of the original payment amount continuing to be paid to Tim).

The “Shared Payment” Method Can Leave An Alternate Payee In Limbo… Indefinitely!

One of the biggest problems with defined benefit pension plans split with a Shared Payment QDRO is that the ex-spouse Alternate Payee is largely at the mercy of the Participant as to when (and in some cases, even if) benefits from the plan will be received. Because benefits to the ex-spouse Alternate Payee can’t begin until the Participant begins to receive their benefits under the plan.

As one can imagine, this can become both a major source of future conflict and a planning challenge for the Alternate Payee. For instance, an Alternate Payee may want to retire sooner than the Participant, but what if a 50-year-old Participant just really likes their job and doesn’t intend to retire until they’re 80? That would mean the Alternate Payee would also have to wait until that time to receive a benefit under the plan. Similarly, what if the Participant has already retired, but simply wants to delay beginning receiving benefits under their pension plan in order to allow their monthly benefit to grow, especially if they know they have to make up for part of it going to someone else in the first place… and in the process, leaves the Alternate Payee just stuck and waiting!

Example 2: Norman and Christie are each 50 years old, and are in the process of getting divorced. As part of the divorce proceedings, a QDRO using the Shared Payment method has been drafted, which will grant Christie 50% of the benefits accrued to Norman under the plan during their marriage. However, because the QDRO was drafted using the Shared Payment method, payments to Christie under the plan will not begin until Norman elects to begin receiving benefits.

Fast forward 15 years... Norman, now 65, is still working for the employer sponsoring the defined benefit plan that was split via the QDRO, and absolutely loves it. He doesn’t give retirement much thought, and when asked about it, says he still thinks he has at least another 10 or so good years in him. As such, Norman doesn’t plan on beginning to receive any pension benefits for about another decade, at which point he (and Christie) will be 75.

Christie, on the other hand, has had enough. She no longer enjoys work as much as she used to, and would like to retire to spend more time with her children and grandchildren. The problem, though, is that Christie can only afford to make the leap into retirement if she has that additional income from her portion of Norman’s pension benefits. Which won’t begin anytime soon, because Christie can’t control the start of Norman’s pension payments and Norman doesn’t plan to start them himself anytime soon!

Can you see where this might cause some tension? Can you imagine how it would feel for Christie to have her ability to retire rest in the palm of another person? And her ex-husband, no less?!

From a planning perspective for the Alternate Payee, things aren’t much better. In fact, in this regard, the best-case scenario for Christie might be remaining on good-enough terms with Norman so that she can ask him about his own retirement plans and receive a genuine answer. Given Norman’s plans, she may not like his answer, but at least she’d be able to plan accordingly.

Unfortunately, though, for some couples, the pain and trauma of a divorce produce so much resentment that having such a conversation would be next to impossible. In such situations, retirement planning can be even more challenging than normal thanks to the ambiguous nature of the start date of the pension benefits. In other words, Christie can’t control when her payments begin, and may not even be on good enough speaking terms with Norman to ask him about his plans, either.

But wait… it can get even worse!

“Shared Payment” QDROs May Result In The Termination Of Benefits For The Alternate Payee At The Participant’s Death

Not only is the ex-spouse Alternate Payee potentially left in limbo, waiting for the Participant to begin receiving benefits, there is also the risk that, after ‘finally’ beginning to receive benefits, the Participant dies before the Alternate Payee. And unless a joint-survivorship annuity option is elected, this could ultimately terminate the Alternate Payee’s benefit quite unexpectedly.

Because without a joint-survivorship election, the fear alone of even potentially losing all future plan benefits might force an Alternate Payee to reduce their standard of living (by lowering expenses) in an effort to save more should that possibility materialize.

And in some situations, the Alternate Payee may be entirely reliant on the Participant outliving them in order to make it through retirement. In the worst of circumstances, this can lead to a very unfortunate outcome for the Alternate Payee.

Example 3: Recall Tim and Samantha, from Example 1, who were recently divorced. Further recall that as part of the divorce, Samantha was awarded 50% of the $5,000 monthly benefit paid by Tim’s defined benefit pension plan as a life-only annuity. Thus, she received $2,500 per month and would continue to do so until Tim’s death.

That $2,500 monthly amount, plus Samantha’s Social Security benefit are enough for her to comfortably enjoy retirement and to remain in the home in which she’s lived for the past 40 years. Without the pension money, however, she would have to make major changes to her lifestyle, including a change in residence.

A few years after their divorce was finalized, when Samantha is 70 years old, Tim dies unexpectedly of a heart attack, and Samantha suddenly loses her monthly benefit from Tim’s pension. Samantha now finds herself in a difficult financial situation with few options.

Had Tim elected a joint survivorship annuity option, the monthly benefit would have been reduced, but Samantha would still have been guaranteed pension payments for her life as well, and may have had fewer financial concerns.

Tim, however, chose to receive benefits from the plan as a life-only annuity, and the fact that Samantha was subsequently awarded half of the amount paid by the plan via a Shared Payment QDRO did not, in any way, change that election. Thus, once Tim was gone, so too were Samantha’s monthly pension checks!

Accordingly, if a Shared Payment QDRO is drafted to split not-yet-started pension benefits, the Alternate Payee should almost always ensure that language is included within the QDRO document requiring the Participant to elect (at least some form of) a joint annuity. This way, if the Participant predeceases the Alternate Payee after benefits begin, the Alternate Payee will continue to receive benefits for the balance of their own life.

While this may work from the Alternate Payee’s perspective, it’s not likely to sit very well with the Participant. Consider that the Shared Payment QDRO is already going to be cutting the Participant’s pension benefits down. Electing to take a joint life option for pension payments (or being required to do so) will further reduce the starting amount of the payment, which was reduced from the split in accordance with the QDRO to begin with! It’s easy to imagine how, what at one point could have been a substantial pension, can quickly be whittled down into an amount that is no longer enough to support the Participant’s retirement goals. In such situations, the Participant spouse may be resistant to the use of a QDRO that required them to elect a joint-survivorship pension option.

The strong desire of a Participant to have a pension based only on their own life expectancy is bolstered by the fact that, in general, Shared Payment QDROs are drafted such that if the Alternate Payee predeceases the Participant, the benefits that were being paid to the Alternate Payee revert back to the surviving Participant (though it’s possible to require such amounts to be paid to the Alternate Payee’s estate). Thus, such amounts become a veritable windfall for the Participant and, at least in their own mind, often makes them feel as though their benefit is whole again.

The Life-Only Annuity Option (Paid Over The Participant’s Life) May Be Mutually Desirable When The Alternate Payee Has A Short Life Expectancy

A possible, albeit limited, exception to the desire of an Alternate Payee to ‘force’ the Participant to elect a joint annuity form of benefit exists when the Alternate Payee is in poor health and/or is otherwise highly likely to predecease the Participant anyway. In such cases, the Alternate Payee and the Participant may both want the Participant to select a life-only annuity. This way, gross payments from the plan are as high as possible, allowing the Participant and Alternate Payee each to receive the biggest possible benefit. And if the Alternate Payee is confident that they will be the first to die, there is minimal value in requiring the Participant to elect a joint pension that would lower their monthly benefit as well.

Example 4: Felix and Rochelle, both age 63, are married, but are in the process of getting divorced. Felix, who expects to retire and begin collecting pension benefits in two years, is a Participant in a defined benefit pension plan. He is in excellent health, and both of his parents, who are in their mid-80’s, are also in excellent health.

Rochelle, on the other hand, has been diagnosed with a terminal illness and has been given 5 to 6 years to live.

Given the facts of circumstances, Rochelle would likely benefit from having Felix elect a life-only annuity as a form of benefit once he retires. The life-only annuity will produce the largest possible payment from the plan, which in turn will make Rochelle’s share of that payment as large as possible. And while those payments will cease when Felix dies (even if that happens to be before Rochelle dies), the overwhelming likelihood of him outliving Rochelle in this situation may make that a palatable risk.

An Alternate Payee May Never Receive Benefits Through a Shared Payment QDRO If The Plan Participant Dies Before Payments Begin Unless A Qualified Pre-Retirement Survivor Annuity (QPSA) Is Elected

Oftentimes, couples will divorce many years (and in some cases, many decades!) before any benefits are ever to be paid from the pension plan. What happens though, if the Participant dies after a divorce and Shared Payment QDRO are finalized, but before benefits from the plan have begun to be paid?

The short answer? In many cases it can mean the Alternate Payee will never receive any benefits from the plan! Because, again, the payments for the Alternate Payee are tied to the original Participant… and if the original Participant dies without triggering benefits, then there are no benefits triggered to be paid! This can result in a potentially lower standard of living for the Alternate Payee.

The only way to solve this problem under a Shared Payment QDRO, and to make sure that the Alternate Payee won’t completely lose out on benefits if the Participant predeceases the commencement of payments from the plan in the first place, is to make sure that the Shared Payment QDRO includes some very specific language. More precisely, the QDRO must designate the Alternate Payee as the surviving spouse for purposes of the “Qualified Pre-Retirement Survivor Annuity” (QPSA), which is required to be offered by all qualified plans.

Example 5: Alexandra and Paul are both age 50 and married, but are in the process of getting divorced. Alexandra is a Participant in a defined benefit pension plan, but has not yet begun to receive benefits.

Alexandra is in excellent health and is likely to outlive Paul, who has a number of health issues, by a substantial number of years. Nevertheless, Paul has a knowledgeable QDRO preparer who is not taking any chances. As such, he drafts the QDRO with language requiring Alexandra to designate Paul as her spouse for purposes of a QPSA.

Sadly, Alexandra is involved in a car accident shortly after the divorce, and dies. Thanks to the QPSA-requirement drafted into Paul’s QDRO, he will still be able to receive benefits from Alexandra’s plan, even though Alexandra had not yet started to receive any benefits. If, however, the QPSA language had been omitted from the document, Paul would not have received anything.

Using A “Separate Interest” QDRO To Reduce Conflict And Increase Personal Choice

“There has to be a better way”, right? Thankfully, so long as payments from the pension plan have not already begun (in which case, as noted earlier, a Shared Payment QDRO must be used), the pension plan can be split via a QDRO that uses something called the “Separate Interest” method.

In essence, the Separate Interest QDRO takes the Participant’s accrued plan balance and divides it into two separate and distinct accounts; one that belongs to the Participant, and one that belongs to the Alternate Payee. The Alternative Payee gets their own separate account that is then actuarially adjusted (for the amount assigned) to account for the Alternate Payee’s life expectancy. More simply put, it basically turns the Alternate Payee into another Participant, themselves, which means that when the Separate Interest QDRO is executed, both the Participant and the Alternate Payee are given control over their own share of the plan benefits, along with the ability to make decisions in their own best interest accordingly… specifically with respect to when and how payments will be made in the future.

Furthermore, the decisions made by the Participant and the Alternate Payee have no impact on one another. To that end, the death of either also has no impact on the benefits of the other.

The Alternate Payee could, for instance, decide to begin receiving benefits earlier (or later) than the Participant. Similarly, the Participant might get remarried and decide to have their benefits paid as a joint and survivor annuity over their own lifetime as well as that of their new spouse, all while the Alternate Payee elects to receive his/her portion of the benefits as a single life annuity in order to receive the maximum monthly payment.

Thus, in contrast to the “Who?”-only nature of a Shared Payment QDRO, a Separate Interest QDRO is both a “Who?” and a “How?” QDRO. It changes both who is going to receive benefits from the plan, and it also allows both the Participant and the Alternate Payee to decide how they want to receive those benefits.

Example 5: Erin and Victor are in the process of getting divorced. Victor is 60 years old and would like to retire in 2 years. Erin is 58 years old and plans to retire at 65.

Currently, Victor’s pension benefit is estimated at $5,000 per month if he takes his pension as a single life annuity at age 62. Now suppose that, as part of their divorce proceedings, Erin is awarded half (50%) of Victor’s pension benefit via a Separate Interest QDRO. As a result, Victor’s estimated pension benefit, as a life annuity to begin in two years (when he is 62), will be reduced by 50% to $2,500.

Erin, on the other hand, would not receive $2,500 as a monthly benefit if she decided to take a life annuity in two years because upon receiving her share of Victor’s pension, the benefit would be actuarially adjusted downward to account for her younger age. So, for instance, if she did elect to begin receiving benefits as a life annuity at that time, she might only receive $2,320 per month instead (just an example).

But remember, the beauty of the Separate Interest QDRO is that Erin and Victor’s benefits are no longer intertwined. Thus, Victor can retire at 62 and collect his $2,500 life-only annuity monthly benefit as planned. Erin, on the other hand, can wait until she is 65 and retires to begin receiving her portion of the pension benefits. And by that time, her monthly life-only payments may have grown to $2,650 (as an example)… even higher than Victor’s own monthly benefit!

Under A Separate Interest QDRO, Benefits Do Not Increase Upon The Death Of The Participant Or Alternate Payee

People tend to naturally prefer having some level of control over their own future. Thus, QDROs using the Separate Interest method are generally a more workable and palatable option when it comes to splitting defined benefit pension plans (as well as for some defined contribution plans, for that matter).

However, with the Separate Interest QDRO, when the Participant or Alternate Payee dies, the surviving individual (regardless of which ex-spouse that happens to be) will not see any increase in their ongoing benefits. Thus, Participants often prefer the Shared Payment QDRO, because there is a possibility (depending upon the precise way in which the QDRO is drafted) that if the Alternate Payee dies first, the Participant may see a significant increase in their ongoing benefits, due to the Alternate Payee’s payments being shifted back to them. And this increase can be meaningful, especially if there is a substantial difference in the ultimate longevity of the ex-spouses.

For many individuals, the decision to seek a divorce is only reached after painstaking evaluation, often over many years. Unfortunately, once the decision has been made, the process has only just begun. It’s not an easy process in the best of situations… and rarely is it the best of situations.

Arriving at a division of assets that each party can live with is frequently difficult, but dividing pensions often poses even greater challenges. At least with pure assets once the split it made, the two spouses can mostly go their own way, and make decisions for themselves.

The same is not always true when defined benefit pension assets are split. If a Shared Payment QDRO is used, the ex-spouse Alternate Payee’s benefit is often largely contingent on when the Participant decides to retire. Benefits to the Alternate Payee won’t be paid until the Participant, themselves, begins to receive benefits. And worse yet for the Alternate Payee, if the Participant predeceased the Alternate Payee and a QPSA was not elected, there may be no future benefits at all! Of course, the Participant, themselves, will often prefer the Shared Payment method because they know payments will last at least as long as they live and they at least have a chance for those benefits to increase (via the return of the Alternate Payee’s share of benefits) should their ex-spouse Alternate Payee predecease them.

Nevertheless, for both practical and financial reasons, when possible, the Separate Interest method of splitting defined benefit pension plan is generally used. This way, each ex-spouse can truly have their own portion of the pension, and can make decisions without regard to how it will impact the other. Simply put, by using the Separate Interest QDRO to split benefits, couples can take a critical step towards accompanying their legal divorce with a financial ‘divorce’!