Executive Summary

As advisory firms grow and accumulate clients, they inevitably reach the point where it’s necessary to either stop growing, or start hiring staff members to expand the capacity of the firm. Initially, the first hire or two is usually administrative support staff, who are responsible for completely relatively well-defined, standardized, and repeatable tasks – key tasks for a financial advisor to delegate, but ones that are relatively straightforward to train on, and even re-train in the event of staff turnover.

However, when it comes to the next stage – hiring associate advisors and paraplanners who may someday take over client relationships (or even the entire firm) – the process of training and even hiring itself is far more difficult. Not only because the stakes are higher – as it’s more costly to the firm to have a financial advisor turn over, especially once they’ve begun to develop direct relationships with clients – but also because the development curve of a financial advisor is so long (taking years or even a decade to fully develop), that it’s difficult to be certain who will end out being a good advisor in the first place.

In the guest post, New Planner Recruiting co-founder Caleb Brown shares his perspective on what it takes to find, attract, and retain top next generation advisor talent, based on his own experience on the front of lines of recruiting young talent for the past 10 years. From what really is most predictive of candidate success (the effort they put into getting the job in the first place, and their “why” for becoming a financial planner), to the reasons that certain firms have more trouble than others in attracting and retaining talent to begin with (the unfortunate reality: your firm may not really be as "great" of a career opportunity as you think, relative to the other options available for top talent!).

The good news, though, is that the rise of financial planning in undergraduate degree programs means that today’s rising talent is, truly, the best trained and capable young talent the profession has ever produced. Which doesn’t mean every hire will be perfect, or even that everyone will work out (for any number of other life transitions that happen to people in their 20s and 30s), but for those who are willing to put in the time and effort, the rewards of hiring next-generation talent have never been better!

As we celebrate the 10-year anniversary of New Planner Recruiting, I thought it would be helpful to share what I have learned in the last decade about recruiting talent for the financial planning profession.

The most interesting and fun part has been to observe people’s behaviors, and some of the wacky and brilliant things people are capable of while hiring new talent (or trying to get hired).

The most rewarding, though, is the fact that we get to help people find a great career and further build out the ranks of the financial planning profession, which is desperate for new talent.

Here are some of the top things worth noting from interactions with thousands of career seekers and hundreds of financial planning firms trying to source, screen, and integrate new talent into their firms.

Effort To Get The Job Is Most Predictive Of Success On The Job

People searching for a financial planning job really want to get the job, especially at a good firm. Which, unfortunately, often leads to candidates who will say almost anything they think the firm wants to hear in order to get hired.

To combat this, we utilize a rigorous candidate screening process made up of a combination of interviews, activities, and assessments to reduce the firm’s risk of a stud-to-dud hire (a candidate who looks impressive during the interview phase but fails to impress once they actually get the job).

Simply having job applicants go through one small exercise, to demonstrate they can read and follow directions, is remarkably effective at eliminating most of the non-serious candidates.

More broadly, though, we find that having a rigorous screening process gives candidates the opportunity to demonstrate a number of key characteristics that we find are also predictive of long-term success in the financial planning profession, including:

- Sense of urgency: Candidates that are diligent and proactive in their application process tend to show a similar sense of urgency and proactivity with clients after they get the job. It’s also worth noting that candidates coming from the retail sales, hospitality, and restaurant industries usually have this, because if they didn’t, they would not have lasted very long. When interviewing, always pay attention to what type of work experience the individual possesses, and don’t discount these “non-industry” backgrounds just because they don’t fall under the typical “office” job that many hiring firms prefer to see.

- Grit: To thrive in client-facing situations, financial advisors need to be able to face rejection and setbacks, especially as they begin their careers. Candidates who have demonstrated the ability to survive under hardship, whether it’s working for a boss that only provides negative criticisms, or getting through a lengthy job application and screening process without just giving up and moving on to an easier job, will be much less sensitive to being rejected by prospective clients, too.

- Coachability: The best candidates tend to have an equal balance of confidence in their abilities, and humbleness that they don’t know what they don’t know yet. Candidates who show this attitude even during the application process – who show they are willing to seek out constructive criticisms and strive for improvement – tend to be coachable and good learners after they’re hired, too. One of the ways we screen for this is to ask candidates what participation, if any, they have had in organized sports. Based on these experiences, they are usually better prepared to work on a team, receive criticisms, and are likely not taking the path of least resistance, since these activities require extra time and effort.

- Awareness: The Psychology and HR communities often cite emotional intelligence as a key indicator of success in business and life in general, and we see this too amongst financial planners. Since financial planning is heavily relationship based, people who know how to recognize their feelings as well as others’ feelings and show sensitivity, are better positioned for gaining client trust and ultimately having the client follow their advice. We have an exercise that we put candidates through where they must respond to a client who has had a recent traumatic event, to gauge how much awareness is present, or if they even acknowledge the emotional turmoil that the client would likely be facing in such a situation (even if the client doesn’t bring it up themselves).

Notably, though, there is a balance, and firms should not have an overly onerous screening process which places an undue burden on the interviewers and candidates. Because there is enough competition for top talent that, if the interview process is too hard, very solid candidates will simply pursue and accept another job offer (that had a more "reasonable" screening process) instead. In addition, interviewers for firms themselves are usually performing double duty (evaluating candidates on top of the rest of their job duties) and can feel stretched to complete their core financial planning client-service-related tasks while conducting a search for a new hire.

Why Someone Wants To Become A Financial Planner Matters

As Simon Sinek shared in his popular Ted talk and book, “Start With Why”, learning someone’s Why is crucial to understanding their underlying motivations that impact what they ultimately do and how they do it.

Finding out someone’s Why is an equally important part of the candidate screening and selection process. Candidates with a strong Why have spent significant time contemplating the reasons that financial planning is the best fit for them, and should stand out accordingly.

Realize that virtually all candidates are going to state that they “want to help people,” so be certain to dig a little deeper when interviewing. For example, candidates that have negative first memories of money are emotionally charged to educate and protect others, which can be a very strong bond that lowers the probability they up and leave the profession because they are bored or hit a rough stint in their career.

Also, look for candidates who leave other more glamorous fields to make a switch to financial planning, and are willing to take steps back in terms of title, seniority, and compensation, as it signals that they have more intrinsic motivators for making the switch that can ultimately sustain their career and focus longer.

Of course, there is nothing wrong with candidates who are also simply drawn to the unlimited income potential financial planning can provide them and are willing to take one step back to take two steps forward… but financial compensation shouldn’t be the sole reason for someone to pursue a career in financial planning.

This is the reason we ask each candidate we encounter why they desire to enter the financial planning profession. The answers we receive are insightful, and range from “this is my calling ever since I can remember,” to “honestly I am not sure what financial planning is exactly, can you tell me?” and everywhere in between.

Consider starting here if you don’t find yourself interviewing frequently because it is a treasure trove of perspective about the candidate’s motivators. Some of the most successful candidates we have placed had the most passionate, clear and articulate Why, many stemming from financial difficulties they experienced during their formative years, which was a powerful catalyst to push them into a career in financial planning.

The Industry Is Changing And Not All Firms Are Changing With It

When I first started helping advisor firms recruit new talent as a full-time recruiting business, I was a total bleeding heart… bright-eyed and wanting to help anyone and everyone! (I am sure some of you can relate to that sentiment when you started your firms.)

The problem is that people must want to be helped before you can help them, which is true both for advisors working with clients and as a recruiter helping advisory firms implement better hiring practices. And it’s not the norm, because humans are naturally resistant to change.

In the context of advisory firms, the challenge is that the “old” way of hiring advisors – to try to find extroverted young people who can sell and get clients from day 1 – just doesn’t work anymore. While it may have worked in the past, firms that take this approach today are at a disadvantage when it comes to recruiting new talent. The better approach is to hire paraplanners and associate advisors to take on a support role so the lead advisor (or partner, or firm owner) can expand their business development time and efforts instead.

Similarly, when we first started, like any startup business, we were not as selective with who we recruited for and took on firms who had an established problematic track record of hiring and retaining people. I, naively, thought I could remedy their turnover problems. In practice, I simply found that a lot of firms really need to change the ways they manage and develop their team, and that if a firm isn’t willing to be introspective about how to improve their ability to retain talent, throwing more young talent at the problem will just lead to more turnover and heartache.

In the end, I discovered that what was the most telling was the mindset of the leadership of the firms we worked with. Leaders who are constantly thinking about how their businesses fit into the ever-evolving profession are in a better position to navigate the financial planning profession’s changing landscape.

Today, I encourage firms to spend significant time thinking about their business through the lends of "what needs to be changed to make us better" – even when things are going well – to better position themselves for success in attracting and retaining talent.

The Capabilities Of Newly Minted CFP Professionals Have Increased

The education that aspiring planners receive in the CFP programs has increased exponentially over the past 20 years, which is a great benefit to the profession… and one that often goes unrecognized, because it is easy to forget where entry-level candidates skills were just a few years ago.

Today, new graduates are coming out of CFP undergraduate degree programs are more prepared to handle various types of industry software, from portfolio management to financial planning and client relationship management (CRM) programs, are more thoroughly trained in client communications, and possess a solid understanding of practice management.

In addition, at some schools we visit, students are graduating having already passed the Series 65, and sometimes even having completed the CFP certification exam.

Of course, candidates may still be inexperienced in applying all these skills in a real-world business setting and still have much to learn. Still, though, these skillsets are lightyears ahead of where candidates were just a few years ago and should make them even more enticing to firm owners. As a result, we’ve found that it’s necessary to take a fresh look at what really constitutes an “average” vs. a truly exceptional and compelling candidate in today’s market:

- Average candidate – Has completed the minimum requirements it takes to graduate from a CFP Board-registered program, secured an internship/job, and succeeded in a job. If someone lays out the path for them and tells them what to do, they do it. Many firms would love to have this type of person at their firms. Though, over time, these candidates don’t always fully develop further up the line. After a few years work experience, they may not have pursued additional education, credentialing, or training, beyond what it took to secure their original position, which eventually leads them to “top out” and hit the ceiling at the firm.

- Compelling candidate – Pays close attention to the minimum requirements, and then sets a plan to exceed them. For a student, this could mean completing two internships when only one is required. Learning RightCapital in addition to MoneyGuidePro, even though they will only be tested on MGP in their classes. For someone with a few years of work experience, it might be the associate advisor who notices that the firm works with a fair number of divorcees and secures the CDFA credential without management telling them to do so. Or someone in a firm that sees the need for a new hiring process due to poor results from the existing one, and takes the initiative to research solutions, implements, and develop necessary skills to fully utilize new hiring process.

Keep in mind, often these candidates are equal in terms of raw capabilities; it’s actually the mindset of the compelling candidates who aggressively seek out challenges and are constantly putting forth the additional effort that is the true differentiator. In fact, that’s the whole point; as the average capabilities of candidates rise, it’s the other intangible aspects – like mindset – that really differentiate the average from the exceptional.

Notably, this also means – at least based on what I have experienced personally and seen over my career thus far – that everyone who can get a degree in financial planning (or anything for that matter) can become a compelling candidate if they so desire. If the mindset and effort are there, it is usually within reach. But it’s more about mindset and effort than raw capabilities alone (even though, as noted, they are better than ever from candidates today).

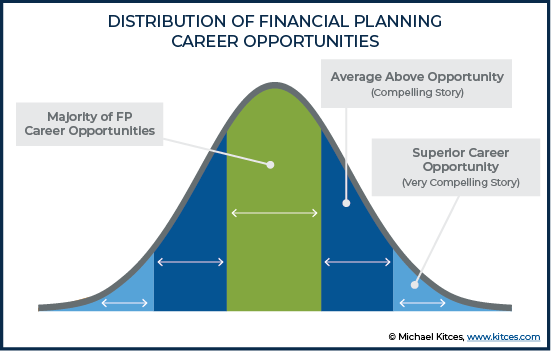

Few Advisory Firms Really Offer A Compelling Opportunity

As a firm that spends most of our time each day speaking to firm owners who are seeking talent, and candidates seeking career opportunities, we have noticed there is often a misalignment of expectations.

Each firm that calls us wants the “unicorn” candidate: someone who is hardworking, very smart, self-starter, detail-oriented, process driven, and the list goes on and on. And when we ask what they are offering to attract this type of candidate, the usual response is that "we are providing a great opportunity" for someone, often highlighting benefits like a stable salary (because the firm is successful enough that new advisors will not have to market for their own new clients).

Yet while offering a stable salary is a positive – and far better than just sending new young advisors out to hunt for millionaire retirees from scratch – offering a stable and well-paying job is not the same thing as a compelling career opportunity. And unfortunately, based on my experience, most firms are merely offering a(n admittedly good) job, but not a compelling career opportunity.

What’s the difference? Here is an overview of both:

- Job Opportunity – A role where someone fulfills the needs (or relieves an acute pain point) of the business by completing a list of tasks specified in a job description. Standard characteristics typically associated with a job include:

- Paid via salary and incentive bonus, plus access to health and retirement plans

- Firm revenue is growing, or at least stable enough to offer reasonable job security

- Role often includes multiple key but repetitive tasks, with little variation in terms of tasks to be accomplished

- Limited decision-making authority as a low-to-mid-level employee

- Little to no autonomy outside the specified job description

- Managed as a “cost” from the business owner’s perspective

- Doesn’t necessarily have a formal career track or clear path forward for increased responsibility and additional financial rewards

- Lack of ongoing committed professional development resources to grow skills

- Little to no input sought on client service issues and firm-level decisions

- Expected to work standard 40 hours per week, and not think about the business (or their own career) much outside of that.

- Compelling career opportunity – A position for someone to join a team of high performing professionals committed to both the growth of the firm and the career growth of its team members, aiming to use their skills and abilities to the fullest potential to add value to clients' lives and the firm overall. Standard characteristics of a career opportunity typically include:

- Paid via salary and incentive bonus, plus access to health and retirement plans

- Equity ownership potential

- Firm revenue is growing at least 10%-15% per year

- Usually located in a major metropolitan area (or otherwise has a target market capable of sustainable 10%-15% compounding growth)

- Regularly upgrading/replace technology to keep the firm moving forward

- Working on multiple projects simultaneously, and has a wide variety of work assignments and experiences

- Substantial decision-making authority and input on firm issues

- High degree of autonomy

- Seen as a human capital asset that the firm invests in to, in order to increase long-term growth and revenue potential

- Clear path for increased responsibility and financial rewards, and a dedicated career track with the flexibility to choose amongst multiple paths, from technical (e.g., Director of Financial Planning), client relationship management (e.g., Senior Advisor), or management (CEO, CFO, COO, CCO, CIO, etc.).

- Firm management commitment to professional development resources to grow skills and groom for future roles

- Expected to “think like an owner” even if not one officially (though it is an unrealistic expectation for firm owners to expect non-firm owners to devote as much time to the firm owner’s business when the employee doesn’t participate in the equity of the business… yet)

Notably, there’s nothing necessarily “wrong” with a good solid job opportunity in a reputable financial planning firm. There are many people seeking such opportunities, and the appropriate candidate will be very appreciative of it.

However, when it comes to the top tier candidates (that most firms seek), they are not going to be interested in a job alone, because they are typically seeking a longer-term career opportunity, and firms that will offer it to them.

So if you can not/do not want to offer what is a compelling career opportunity described above, you may need to adjust your expectations on what type of candidate you will attract and ultimately hire.

Advisory Firms Have High Expectations Of Candidates But Rarely Meet Candidates’ High Expectations For Formal Training

As the owner of a small business myself, I can relate to having high expectations for the team of colleagues that I work with. And it is reasonable to have high expectations if the appropriate training and timeframes for mastering that training are realistic. However, the combination of lofty expectations, and little to no training does not set new hires up for success, which in turn frustrates them, and the firms they work for.

We do see a fair number of firms that would prefer another firm “do their training for them”, so they get a new hire who has prior experience and is “ready on day one” to obviate the need for training. Yet the reality is that anyone you hire is still going to need at least some training in your firm’s processes and procedures, the technology you utilize, etc. And if the new hire is experienced, and has previously been trained in working with clients elsewhere, he/she will need to be trained on your firm’s policies and approach in working with clients. This is why we let firms know that hiring an experienced team member is not necessarily the training-avoidance panacea they might think it is.

Similarly, notwithstanding the fact that CFP Board-registered programs are training future talent with a level of capabilities never seen before in the industry, it too doesn’t mean that the CFP programs will have fully “trained” your next new planner. Although the education programs do a terrific job, the role of the CFP programs is to teach aspiring planners what financial planning is, and cover the technical subject matter to pass for the CFP exam after graduation. Furthermore, depending on the program type (certificate vs degree), and the size of the program, students in some cases will still have very little exposure to what a financial planner actually spends the majority of their time on, which is interacting with clients.

Consider other established professions such as medicine. Medical students learn how to fix people hands-on while logging many hours over a 3-4 year residency period, which occurs after medical school. Medical school provides a solid educational foundation for their craft, which is subsequently practiced and refined in residency and fellowship.

In fact, to combat the lack of formalized training in the financial planning profession, several financial planning firms have implemented a financial planning residency program to try and replicate the medical model. These residency programs have been rolled out with mixed success, though, as ironically they actually further emphasize the need for even more structured training (for a high volume of rotating residents over time).

As the competition for talent and the desire for training continues to rise, the largest advisory firms – with dozens of employees and billions in assets under management - are beginning creating their own in-house universities to bridge the gap between learning about financial planning and delivering it to clients successfully. These in-house academies are essentially a formalized way for the partners of the firm and other experienced people to provide training, mentorship, and coaching, to all new hires, through a structured curriculum. In addition to a scalable platform for firm leadership to convey their experience, wisdom, and insight, to the next generation, these programs are also a way for firms to attract top talent, since Generation Y career seekers consistently cite training and continuous learning very high on their career wish list.

My hope is that within the next 10 years the independent advisor channel will be known for the training and learning opportunities that were once only reserved for the large wirehouses! If only because it’s what the leading firms will have to do to attract and retain the top talent.

Most New Career Entrants Should Not Start Their Own Firm

It is simpler now, more than ever in the past, to start your own independent financial planning firm, with the rise of platforms like ACP, XYPN, and the Garrett Planning Network offer a turnkey solution for as little as a few hundred dollars per month. They help to lift the technology, compliance, and other practice management burdens, while providing marketing support to help you obtain clients. What they don’t do, at least not yet fully, is get all the clients for you, and teach you how to properly serve clients that you do manage to land.

Most people are drawn to start their own firm for the control, and ultimately the financial rewards. But I would caution those thinking of going down this route to contemplate if this is really what they want. We often see candidates who are ill-prepared still trying to take the plunge, for reasons such as, ‘someone else did it’, ‘it is a cool community to be a part of’, ‘I want to make more money’, ‘I want to work with clients who don’t have very much money’, and ‘I want a flexible schedule’. Which are all well and good if they are truly entrepreneurs ready to take on the burdens of business ownership.

The problem is that many people think they are entrepreneurs when in reality they simply want to be a self-employed small business owner instead. Entrepreneurs are almost always a small business owner, but being self-employed doesn’t necessarily make you an entrepreneur.

We see non-entrepreneurial advisors who want to be self-employed fail frequently while trying to start their own firms, either because they don’t have enough runway for their personal cash burn rate while trying to acquire enough clients to break even, or simply because they just don’t really know what they are doing with clients, and consequently the few clients they do land end out leaving after bad advice and/or poor service.

There is nothing wrong with not having your own firm, and being a solid contributing team member at a great firm. Starting your career in an established firm gives you a chance to build up some reserves, and develop your client acquisition and relationship management skills. There is always an opportunity to launch your own firm later if that is what you truly want. And in the meantime, you might even find you prefer the path to partnership if your current firm (which has a high probability of happening if you’re really that entrepreneurial and adding to the value of the business already).

In fact, we frequently have conversations with candidates who state they want to own their own firm in the future, and then quickly pull back once we go into detail about what owning your own firm really means, because often times they have only heard the good things.

The point here is not to stifle anyone’s start-up aspirations. The point is simply that there’s a lot to learn when you start your career and are simply suggesting that advisors take the plunge only after their skills are well developed, and they have the financial wherewithal to go without a paycheck for a while, to give themselves the most likely chance at success.

You Can Do Everything Right And Still Have People Leave

Firms that have a clear vision of where they are going and whom they want to hire provide a compelling opportunity to offer someone and are positioned well to attract and retain high performers. However, there is always a risk in hiring someone new into your business and having it not work out, even if it was otherwise the “perfect” fit. This is simply the risk that comes with being a business owner.

In fact, the reality is that with the transient nature of the younger planner workforce, if someone stays at your firm more than 5 years in their first job, you are ahead of the curve. (A time window that extends slightly if your firm is set up to accommodate remote employees, since many firm departures are due to employees simply progressing through life, where the "split" is due to getting married and relocating, wanting to try a new area, having to take care of a family member in another location, etc.)

Similarly, if someone has been at your firm for more than 10 years and has expressed an interest in being an owner but still isn’t – perhaps simply because the firm isn’t growing enough for it to make sense to add another partner – the firm is going to lose the employee to another firm, or an organization such as XYPN that will support them to launch their own firm (now that they’re finally prepared and experienced enough).

Of course, there’s a limit to how much you can alter or restructure your own advisory firm to try to fit the situations and needs of your employees. Which simply means that, just as you might tell your clients, it’s time to worry about what you can control and recognize that the stuff outside of your control is going to happen or not happen but you can’t do anything about it.

In other words, all you can do is craft a compelling opportunity, implement a solid screening process, hire the best candidate you can find in good faith, continuously develop them… and time will tell about whether your paths really stay aligned. Implementing multiple interviews, assessments, and other thorough screening measures will help you find a good hire, but just does not guarantee that even the “right” hire will stay at your firm forever.

Let Your Presence Source Candidates

While New Planner Recruiting does have a rigorous process to find and source talent, the reality is that word-of-mouth networking through your personal contacts as an advisor is still by far the best avenue to find qualified candidates in your area for your firm.

Consequently, we find that, at least anecdotally (but across a large number of firms we’ve worked with over the years), those who are active at a national, regional, and/or local level via professional organizations such as FPA and NAPFA are viewed as more successful firms and have more success finding and attracting good talent. From a practical perspective, candidates also place these firms’ career opportunities ahead of those firms who may have otherwise similar opportunities but simply are not as visible in the profession.

Firms that also make it a priority to visit and support local CFP programs financially also have an advantage, because having boots-on-the-ground does matter in local recruiting. Students are much more likely to be engaged and apply for an opportunity from someone that is familiar over a standard job posting from an advisor or firm they have never heard of and have not met. Ironically, the only problem with this approach in today’s market is that, due to the sheer volume of organizations now recruiting out of the college programs, it’s harder for local firms to stand out than it once was. Which in turn is leading to an increasing number of firms to get even more active integrating their people into leadership positions within the professional associations where new talent first appears, such as FPA Career Development Committee, FPA NexGen, NAPFA Genesis, and the FPA Career Day Committee, where they are well positioned to capture students and career changers (as well as those already employed in the profession). Firms we represent that have visible volunteers on the national stage, such as past FPA Presidents, have no shortage of people reaching out to them for job opportunities, career advice, mentoring, etc.

Of course advisors should ideally be engaged in these organization because they want to help shape and advance the profession; nonetheless, the potential for securing top talent is a great added benefit. The higher the profile of the position you or someone in your firm holds exponentially increases your national reach, so if you want to go big, consider the FPA National Board, the FPA Executive Committee, the Board of Directors for the CFP Board, etc.

Having an active presence on social media helps as well, as does being frequently quoted in the major financial planning profession publications. One of the things we tell individuals seeking a career in financial planning who aren’t certain where to look is to reach out to the planners and firms they see featured in the publications to ask about possible opportunities.

Notably, though, even if your firm has a strong local (or even National) presence to attract prospective talent to the firm, it’s still crucial to have a system and process to interview and screen candidates to ensure the right ones that are the best fit for your particular firm are hired. Ironically, one of the biggest challenges we have observed amongst certain high-profile firms is that they get a high volume of inquiries about career opportunities, but end out with a high level of turnover because they don’t have a rigorous structure to establishing job descriptions and roles and properly vetting their candidates, which leads to an ongoing series of promising-but-ultimately-unsatisfying hires which we are then brought in to solve.

Financial Planning Is The Best Profession

I believe in this profession, and still do not think there is any comparison for the unique combination of career satisfaction, earning potential, flexibility, and overall opportunity to engage in rewarding work. I draw these conclusions from several areas.

First, my own work earlier in my career as a full-time financial planner was spent mostly helping my clients in very reputable high-earning fields (mostly medicine), and developing a plan to help them transition out of those professions into something they could enjoy more thoroughly and be more passionate about than practicing medicine! For my physician clients, the thrill was gone due to the heavy regulations and changing of their profession, and it was my job to make sure the numbers would work out for them to resign and transition to usually a lower-paying-but-hopefully-more-personally-fulfilling position.

Second, from the thousands of conversations we have had with career seekers from other industries such as accounting, law, medicine, and banking who are looking for something better and have zeroed in on financial planning as their ideal professional opportunity. In fact, this category of career changers from other less-fulfilling professions is where a large percentage of the growth in the number of CFP exam test takers is coming from. When these professionals describe their unhappiness in what are well-respected and highly-compensated fields, it reiterates to me that the financial planning profession is a premium career choice. (Though I realize that I may be biased since this is all I have ever done!)

It is sad that I still must explain what financial planning really is to parents of high-schoolers and college-aged students who associate our financial planning profession with the likes of Bud Fox from Wall Street, Jordan Belfort from The Wolf of Wall Street, and Bernie Madoff. And so my hope is that this voracious passion exhibited by individuals changing careers will find its way into the minds of the young people in secondary and post-secondary educational institutions around the country. We do have several high-profile champions of the profession, telling the story of what true financial planning is to Generations Y and Z, but we need many more.

And so I challenge you to spread the word about how rewarding your career is to others. Even though I know I am not alone, sometimes I feel that I am on a one-man mission to change the entire country’s perception of who we are and what we do. Will you step up to assist me and tell people that this is the premier profession for those wanting to help others?

I hope these perspectives were helpful as you think about your own advisory business and how to approach your talent recruitment and retention strategies.

Bear in mind that the competition for talented individuals will remain fierce for the foreseeable future and that you very well may need to change some of the things you are doing to stay on top (or especially to get to the top).

Thanks for letting me and our New Planner Recruiting team serve the profession we care so deeply about for the past 10 years. I cannot describe the tremendous amount of joy and satisfaction that comes from finding a good fit for the job seeker and firm owner, watching careers develop and businesses succeed. As well as the immense sense of pride we feel knowing that, for every new planner we place, on average 100 additional Americans can gain access to financial planning services, further ensuring their own financial future will be bright and the world a better place.

Disclosure: Michael Kitces is a co-founder of New Planner Recruiting and XY Planning Network, which were both mentioned in this article.