Executive Summary

An important truism about marketing is that to be effective, the marketer’s message needs to connect with the audience it intends to reach. Traditional forms of marketing used by financial advisors – including networking with one’s friends and family members, cold-calling, and paid advertising – have been effective at reaching a ‘typical’ client base of older, wealthy retirees. However, for advisors looking to reach a different type of client – such as those in younger generations like Millennials, who often have an aversion to such straightforward sales tactics – finding a message that resonates often requires a more tailored approach that speaks to the specific audience and what they are going through.

One way to provide such a message is to create educational content, in the form of a blog, podcast, or social media posts (or a combination of the three), on topics that are relevant to the financial lives of the types of clients the advisor is trying to reach.

In this guest post, Thomas Kopelman, financial planner and co-founder of AllStreet Wealth, writes about the keys to becoming an effective content marketer, including building skills at creating multiple forms of content, repurposing content to use in multiple ways, and tracking progress to gauge the performance of content over time.

While good educational content can be a powerful way to generate interest from potential clients, it comes with its own challenges. Because not only does the advisor need to keep up a steady stream of content to engage with their audience, but the content also needs to be good – that is, to be relevant and interesting enough for the audience to want to come back for more. Furthermore, with the sheer number of available outlets for content marketing, it can also be easy for advisors starting out with content marketing to try producing content in too many places at once, ultimately spreading their resources too thin and failing to hone their skills with any one form of content.

A better approach may be to introduce each form of content one at a time – in other words, to initially focus solely on one form of content long enough to build up skill and confidence in that medium, then add another form and learn to do that one well, and so on. Not only does this approach help advisors ensure they have a solid grasp of each form of content before moving on to the next one, but it can also build up a sizeable foundation of content that can be repurposed in the future (e.g., reposted or reshared on social media). This can maximize the potential return on the time and effort it takes to create each blog post, podcast, or newsletter.

Ultimately, what’s important to remember is that it often takes time for the effects of quality content marketing to come to fruition, meaning the most important lesson is to stick with it. A good piece of content, whatever its form, might not immediately convince someone to become a client... but what it can do is cause the advisor’s name (and expertise) to stick in their head so that when they do come to a pain point that requires an advisor’s expertise, they know who to reach out to.

When I first started out as a financial advisor in 2018, I knew I wanted to attract a client base of millennials. But there was one issue: the broker/dealer I was with didn't allow me to do any real digital marketing. I was not allowed to have a blog or podcast, and posting social media content took weeks to be approved. I even got a post denied for the sarcastic tone I used once; crazy, I know.

Instead, I was told the best way to build my client base was to hit the pavement and frequent networking events, weddings (yes, even weddings!), volunteer opportunities, etc. I gave it the old college try, but it felt slimy and didn't yield the kind of results I wanted. I knew there had to be a better way. So I left my broker/dealer to join an RIA where I had more freedom to market to my specific target audience in the ways that worked best for me.

And since I made the move during the summer of 2020, I’ve executed a solid social media marketing plan by setting up a blog, podcast, and newsletter, which has allowed me to gain well over 15,000 followers and build a clientele of 50 millennial households with a monthly income of over $16,000.

Why Content Marketing As A Financial Advisor?

As a millennial myself, I knew that the financial services industry’s traditional sales and marketing tactics would leave my generation with a bad taste in their mouth. I thought that if financial planning is so valuable, shouldn’t I be able to attract the people who need me without having to aggressively sell to people ambivalent about the value of a financial advisor?

I realized that instead of selling like many advisors, I had to try attracting my client base so they would find their way to me when they were ready to engage. And I wanted to do this by generating natural interest in the content I produced, instead of relying on cold-calling, networking, or paid advertising.

Starting A Blog To Build My Client Base

The first step in figuring out how to connect with prospects to build my client base was to identify what type of millennials truly needed my help… and were willing and able to pay for it. Targeting millennials, in general, was far too broad, as creating content that resonated with every single millennial out there would have been nearly impossible. And not all of them can afford to pay me for my services anyway. For content to work, it has to be relevant and speak to the specific audience and what they are going through, which is why I decided it would be crucial for me to pick a niche early on in my process.

After much trial and error, I landed on my dual niche of millennial business owners and millennials with equity compensation. Some might say this is still too broad of a demographic, and I can see why. But even though business owners and salaried employees with equity compensation are unique clients with different needs, many millennials in these groups often share several issues common to their particular life stage and what they are planning for. And to be honest, I just love both markets. (While I might narrow my niche even further as my client base continues to grow, these are the clients who I want to stick with for now.)

After I determined who my ideal audience was, I decided the best way to attract this niche was to put out free, high-quality content that educated them on topics that were relevant to their lives. I would listen to every question my clients, friends, and family would ask me and create content on those topics. I knew that if 1 person was asking it, hundreds of others were thinking about that very same topic. I know this wouldn’t work for everyone, but luckily for me, all my friends, siblings, and cousins are in their mid-20s to early 40s: my exact target market. Listening to them, the questions they had, the mistakes they made, etc., was a great way for me to come up with new content ideas.

Here are a few examples of the early posts I created to answer their top questions:

- “Where do I even get started with my finances? Do I build an emergency fund first or pay off debt first? Do I invest or pay off debt?” To answer this and offer some steps that could be considered, I wrote 8 Steps To Set Up Your Family For Success.

- “What are the biggest mistakes you see people our age making?” To answer that question, I wrote 9 Biggest Mistakes Millennials Make Financially.

- “When should I start working with a financial advisor?” To answer this, I wrote 6 Signs It Is Time To Hire An Advisor.

The key was to start with the top questions I was asked and then to continue noting the questions that came up in client meetings, family gatherings, etc. I now have a ‘notion dashboard’ with over 100 ideas I still have not written about. The goal should be to create content based on what your audience needs to hear, not just what you want to talk about.

Once I developed my strategy as outlined above, I had to figure out the best way to market to this group. I decided a blog was my first best step, even though writing was never my strong suit, because I knew early on that to be successful on social media, it’s critical to write well and make complex topics simple to understand.

In the beginning, I focused solely on the blog for 1 specific reason: to learn and focus on improving my skills without having to manage too many projects all at once. Many advisors who focus on social media content as their main marketing strategy tend to start with a blog, podcast, and newsletter all at the same time, but they often find themselves spreading their resources too thin, trying to manage all of the different forms of content. And what often ends up happening is that by juggling so much content across different modes of communication, these advisors never get the deep practice they need in order to get great at any of them.

I was not going to let myself fall into that same trap, so I created a process around my writing that would take about 8–10 hours a week at first. Here’s how it went.

- Day 1 – Research the topic and write all the body paragraphs

- Day 2 – Re-read what I wrote on Day 1 and create an introductory paragraph. I spent a lot of time here knowing that getting people’s attention early on is crucial.

- Day 3 – Do an edit of the entire blog. If I get stuck on sentences and don’t like the structure, I use software like Quillbot to help me develop new sentence wording. This was a game-changer for me.

- Day 4 – Do another full edit with my fiancée (as she is a great writer!)

- Day 5 – One last edit and read-through on my own. Then I would post it.

After about 3 months of consistent blogging, I got better at writing and was able to cut down my editing process. I only needed 1 day to write and 1 day to edit before getting a blog out. This reduced the time spent from 8–10 hours to 3–5 hours a week. I used this extra time to allocate my energy to other marketing efforts. And with a better grip on my blogging skills, I knew it made sense to add another element to my marketing strategy, so I started a podcast.

Using Podcasts To Expand My Marketing Efforts

I love talking (just ask my fiancée!) and listening to podcasts, so starting a podcast felt like a natural progression. And with all the blog posts I had created, I had tons of topics to talk about! Because podcasts demand more time to consume and require video editing to market, I considered this to be more of a long-term play for me. Fortunately, I was able to maintain my blogging efforts, which sustained my original audience base as my podcasting efforts came to fruition over time.

In the first season of my podcast, I made a mistake. I decided not to make the podcast about finances and to instead focus more on stories about successful millennials who paved their own successful paths. I learned a lot from this, but it wasn’t exactly the way to push more people toward working with me.

After 1 season of doing that, I made a pivot to focus on financial topics and use popular blog posts to get started. Most of our episodes include a guest, but some just have me and Treyton Devore (my AllStreet Wealth co-founder).

Here are our top 3 podcast episodes thus far:

- Just Keep Buying With Nick Maggiulli

- Crypto 101: Intro To Blockchain, Bitcoin, Ethereum

- How To Win At Airbnbs With Taylor Jones

This pivot toward financial-related content helped me make huge progress. I went from about 30 listeners an episode to 100. We now have just under 10,000 downloads, not including the first season.

Producing Newsletters To Hedge Against Social Media Changes

After putting my focus on the podcast for a few months, my confidence and efficiency in creating it grew, and more hours opened up again. This allowed me to expand my marketing efforts even further, which is when I decided to move on to creating a newsletter. I currently have 2 newsletters: 1 personal and 1 for AllStreet Wealth. I started with the personal one, so let's walk through that first.

I created my personal newsletter primarily as a hedge against social media changes over time. You never know when a platform could change (people are especially scared of this right now with Twitter), so getting people's email addresses and owning the distribution is huge. But… people protect their emails, so a newsletter has to be really good for people to sign up. This is why I created a very in-depth, education-based newsletter that has 5 key parts:

- An original blog post for that month;

- Financial term of the month;

- Best content I consumed that month;

- Exclusive job opportunities from a partnership with Purpose Jobs; and

- Links to all the content I posted that month.

This is a big newsletter, so it only goes out once per month. But between my subscriber list and the one I build through LinkedIn, I have almost 2,500 people who get it every month. Could I cut out some parts of the newsletter? Maybe. I am working on deciding what is needed and what is not right now.

Now onto the AllStreet Wealth newsletter. When we looked across the industry, we saw that most financial newsletters were basic blog posts with few takeaways. And because we wanted to stand out, we created a newsletter that includes a brand new "How-To Guide" every month. We create the how-to guide and let people download it by subscribing to our newsletter (which helps to drive new subscribers), and then we send that guide as the monthly newsletter to existing subscribers. This way, we get to kill 2 birds with 1 stone.

A few of the How-To topics we have offered so far are:

- Your Guide To Estate Planning

- Your Guide To Understanding Taxes As A Millennial

- Your Guide To Maximizing Your Company Benefits

- Your Guide To Creating An Automated Financial System

Engaging With Social Media To Get More Eyes On Content And Build My Client Base

Once I established a regular newsletter cadence and got good at that, I then decided to begin engaging with social media platforms more regularly. The goal: get more eyes on what I was creating. I figured the more people that see my stuff, the more clients I would get.

Initially, I started posting content every day on LinkedIn. I would use the podcast and blog to include in posts 2 of the 5 days a week of posting. Then I would try and come up with a new original idea for the other 3 days to prevent my content from feeling stale. I did not want to be the person who would create a blog on life insurance and then post about life insurance every day, 5 days each week. I know themes can work, but to me, they are boring… and I want to be anything but boring! (When I started out, I didn't yet understand the value of repurposing, which I will get to later on.)

To ensure I stuck with my posting schedule, my focus was on social media every morning. I would start work, and for the first 30 minutes each morning, I would focus on getting a social media post out. I cannot recommend this enough. The best thing I ever did was require myself to create social media content for the first 30 minutes of every day. The next best thing was to never allow myself to have an excuse for not doing it. I didn't even let it be an option.

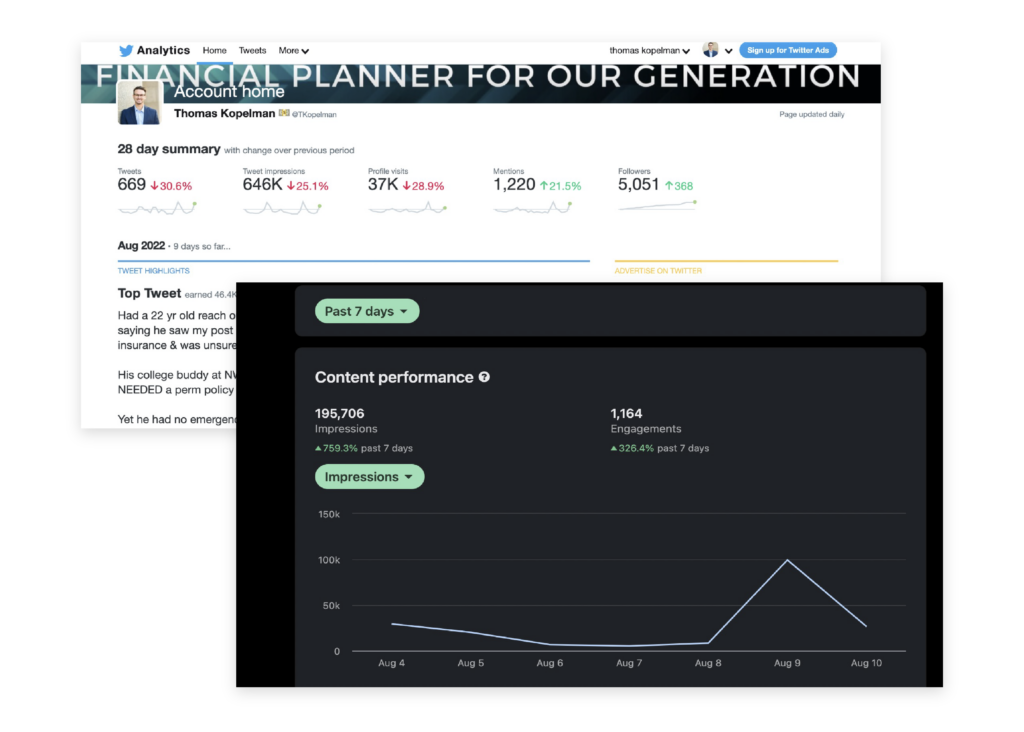

Once LinkedIn started feeling natural, I then turned my focus to Twitter. I've found the most sustainable way to build out a marketing strategy is to start with a single initiative, stick with it until getting good at it, and only then gradually add more to the mix.

Repurposing Content As A Social Media Strategy

We're all told that social media is a great way to grow a client base, but most people fail to realize how long it actually takes to start seeing results. For me, it took 6 months before I got a single lead from content. But by month 9, I had 7 prospects in a single month. Now, I average around 7 new prospects every month and have been able to onboard 1 new client a week almost every single week.

The best part about it is that this growth came with raising my minimum fee from $150 per month to $450 per month. Which means that even though I may be getting a similar number of prospects per month as I was before, they are willing to pay 3 times as much on average. Which also means their net worth (and complexity of problems and wherewithal to pay for advice) is generally much higher than the prospects I was previously attracting thanks to my content marketing approach.

People always ask me how I continue to post so much content. The name of the game is repurposing. For those who don't know, repurposing is all about reusing existing content created in the past versus reinventing the wheel and posting something new every time. The latter requires 10x the time and is often a wasted effort. Instead, you should repurpose by reusing, editing, and reposting the great content you have already created.

In the past 8 months, I went from 1,200 Twitter followers to over 7,000. I'm not saying this to flex on myself but to show that a large portion of my audience is new. They haven't seen any of my old content, so it only makes sense to repurpose and repost my best stuff. The key is to do both. Reposting is posting the same thing multiple times. Repurposing is taking good, existing content and posting it in a different way. These are both so important because there is no reason to create content and only use it once. That would have been a huge waste for me, and a lost opportunity for my audience.

A common fear I hear other advisors share is that people will remember they posted the same thing a few months back. But let's be real; most people see thousands of daily posts. It's extremely unlikely they'll remember what someone posted months ago. And even if they did, I would consider that a win in my book. That shows that the content stuck in their mind, and that's a great sign – it means it resonated with them that much!

To consistently repurpose, I use Hypefury to look back at my top posts and schedule new posts in the future. The platform allows me to see what has done well in the past, since most times, that will continue to do well. It also allows me to check other creators’ top posts to get inspiration from them. And lastly, it allows me to automatically retweet old tweets that have performed well, so more eyes get on those older posts.

Another trick is to repurpose from one platform to another. After I write a blog post, I turn it into a thread on Twitter since threads generally perform better than blog links. I do this by simply creating a compelling hook, changing the formatting, and making the entire blog post into a thread.

On top of that, I repurpose any post that does well on Twitter and use it again on LinkedIn. This allows me not to have to reinvent the wheel every week and still consistently post quality content. However, repurposing is not always as easy as just posting the same thing. It's critical to understand what performs well on each social platform and change posts to align with that.

Often, I will grab a tweet and then expand on it by going deeper on LinkedIn since it allows for more characters in each post. The key is to test out what does and doesn't do well on each platform. Here are some of the takeaways I have learned.

- Links to other sites do not perform well on any social platform. If you have to include a link, go ahead, but when you can, avoid using links whenever possible.

- Spacing matters. Do not write long paragraphs, use tons of punctuation, etc.

- Use basic terms, not acronyms or technical jargon. No one will bother looking up the word and come back to your posts.

- If you are posting long videos, create a short highlight clip to get people interested. And make sure you add subtitles!

- Repost or retweet old posts that have done well. Once you have new followers, they deserve to see your best stuff!

Creating A Content Schedule And Tracking Progress

From the beginning, I knew creating a content schedule would be crucial. Too many advisors bypass this step, and what tends to happen every time they aren't feeling motivated or get too busy is that they stop creating content. I knew I didn't want to fall into this trap and wanted to keep the momentum going at all times. Content compounds!

My current weekly schedule starts on Mondays when I write and edit my blog post for the week, so it is ready to go live every Wednesday. At this point, I do it all in 1 day on my own. I have learned that spending a ton of time seeking perfection is not worth it. Most of my audience just skims, so it's more about getting the content out there for them to learn from. Then, on Mondays or Tuesdays, my business partner and I record our podcast so it will be ready to go out that Friday. He edits the video, I edit the podcast, and then we post it. We keep it very simple.

From a monthly standpoint, my personal newsletter goes out on the 15th of every month, so I work on that from the 5th through the 10th, as it takes quite a bit of time. The AllStreet Wealth prospect newsletter also goes out on the 1st of every month, so I will work on that the last week of the month.

I also have a consistent social media schedule. The first thing I do every morning is to hop on LinkedIn and post one of the tweets that did well over the days prior. I do not post a screenshot; instead, I take the content and expand on it since LinkedIn allows for more characters. I figure if it did well on Twitter, it will do well on Linkedin. Then, for me to stay consistent on Twitter, I spend 1 Friday afternoon per month scheduling out 4 weeks' worth of 3 tweets per day.

For me, having a cadence and a set time to work on content has been a huge game-changer. I fully believe that this schedule has allowed me to do this consistently for 26 months in a row, all while running my business.

How We Track Progress

It can be challenging to track how effective content is based solely on the new prospects and clients that it may attract. Some months there will be a ton, and in others, there may only be 1 or 2. Plus, most new clients do not cite 1 piece of content as the reason they decided to engage. They come from following you and learning from you for a while. This is why I primarily track my progress based on new newsletter subscribers and impressions on Twitter and LinkedIn.

Twitter and LinkedIn each have analytics tools that are completely free to use, and I urge advisors to use them. For Twitter, just click on "More" (right under the user profile), click "Creator Studio", and then click "Analytics" to find an analytics summary. For LinkedIn, on the user profile page, scroll down to the “Analytics” section, then click on the “Post Impressions” area. Individual posts will include a link where analytics specific to that post can be viewed. I pay attention to impressions (how many people see my posts), engagement rate (how many clicked and engaged with a post, e.g., by reacting, commenting, or reposting it), and new followers, tracking this data month over month.

There is no good answer to how many impressions, engagements, or followers anyone should be getting. My focus has always been on my own progress, not what my numbers are in relation to someone else. I recommend reviewing the numbers from last month, then focusing on tracking the numbers every month after. The goal is to ensure growth in most months, with the understanding that some months will have lower numbers. In those months, see if anything was done differently. Did you post less? Did you do more long-form or short-form content? Analyze it and see why that could have happened.

I don't get too into the weeds with these analyses; I just want to ensure I continue to grow and create content that resonates with people. The hard part about these analytics is often in interpreting the results, as there are some months when my impressions will be way down, but I still get a ton of prospects. That's why I don't make drastic changes based on fewer impressions for a month here or there. I really just check these analytics periodically to make sure nothing drastic has changed.

The 1 statistic I always track is the number of new prospects per month and where they came from. When clients book a meeting with us, we have a form where they can indicate whether they found us through a referral, Google, social media, etc. 98% of the time, the answer is social media and we track that. However, we choose not to simplify it to 1 social media platform; most say they follow us on many platforms and consume our podcast content, so just citing "Social" is good enough for us.

One thing for advisors to consider is that they are not going to convince someone that they need an advisor. A more tractable objective would be to educate and stay in front of potential prospects so that when they do hit a pain point in their life and are ready to hire an advisor, they will deliberately choose to work with you!

My main goal is not to grow a huge audience. If it happens from good content creation, that's an added bonus. But, more often than not, advisors will be better off having a smaller engaged audience than a larger passive one.

While I believe there isn't any one right way to grow a client base, relying on content creation has been the best approach for me and AllStreet Wealth. And this is something that other advisors can do, too. It will take time, hard work, and a lot of iterating… but it is doable!

Leave a Reply