Executive Summary

Monte Carlo simulations have become a central method of conducting financial planning analyses for clients and are a feature of most comprehensive financial planning software programs. By distilling hundreds of pieces of information into a single number that purports to show the percentage chance that a portfolio will not be depleted over the course of a client's life, advisors often place special emphasis on this data point when they present a financial plan. However, the results of these simulations generally don't account for potential adjustments that could be made along the way (e.g., decreasing withdrawals if market returns are weak and the probability of success falls, or vice versa), making them somewhat less useful for ongoing planning engagements where an advisor could recommend spending changes if they become necessary.

With this in mind, retirement income guardrails, which provide strategies that pre-determine when spending retirement adjustments would be made and the spending adjustments themselves – have become increasingly popular. Nonetheless, while these thresholds and the dollar amount of potential spending changes might be clear in the advisor's mind, they often go unspoken to the client. Which can lead to tremendous stress for clients, as they might see their Monte Carlo probability of success gradually decline but not know what level of downward spending adjustment would be necessary to bring the probability of success back to an acceptable level.

But by communicating the guardrails withdrawal strategy (and not necessarily the underlying Monte Carlo probability of success changes) to clients, advisors offer them both the portfolio value that would trigger spending changes and the magnitude that would be prescribed for such changes. Notably, while advisors have the power to determine these guardrails using traditional Monte Carlo software, doing so can be cumbersome and can involve calculating initial spending levels that are reasonable for a client's portfolio size, solving for the portfolio values that would hit the guardrail thresholds, and determining the spending changes corresponding to the desired adjustment once a guardrail is hit (though there are specialized retirement income software programs available that can make these calculations easier).

Even with the knowledge of potential short-run changes that a guardrails strategy might call for, a client may be concerned about additional income adjustments amidst an extended market downturn. One way advisors can give clients more confidence regarding this long-term outlook is to 'stress test' the plan with hypothetical scenario tests modeling some of the worst historical sequences of returns (e.g., the Great Depression or the Global Financial Crisis), showing clients when and to what degree spending cuts would have been necessary. This exercise can also give advisors and clients the opportunity to adjust the guardrail parameters depending on the client’s risk tolerance (e.g., a client who really wanted to guard against downward-spending-adjustment-risk might forgo income increases entirely).

Ultimately, the key point is that the probability-of-success results of Monte Carlo simulations can be highly stressful for clients, worrying them about the impact on their spending from a future market downturn. But by calculating guardrails and communicating the requisite spending adjustments that would protect the client's overall outlook, and how the approach would have fared in some of the worst historical market environments, advisors can help clients mentally prepare for potential adjustments while bolstering their confidence in their financial plan!

Retirement income guardrails – i.e., strategies that pre-determine when spending retirement adjustments would be made and the spending adjustments themselves – have become increasingly popular in recent years.

While the Guyton-Klinger model is arguably the most well-known guardrails framework, there are other strategies advisors could use, such as Kitces' Ratcheting Safe Withdrawal Rate and risk-based guardrails. However, the reality is that most advisors do use some sort of dynamic spending strategy that effectively serves as guardrails, too – just without all of the communication benefits that come from actually articulating guardrails (in dollar terms) in advance.

What do I mean? Consider the following strategy that may be common among advisors using Monte Carlo simulations:

- Set an initial spending at a 95% probability of success.

- If the probability of success falls to 70% (or lower), recommend decreasing spending to raise the probability of success.

- If the probability of success rises to 99% (or above), recommend increasing spending to lower the probability of success.

Oftentimes, these internal thresholds that advisors target are left unspoken, but the reality is that advisors generally will recommend increasing or decreasing spending based on changes in the client's probability of success. We might refer to this as an "uncommunicated guardrail". It's a guardrail in practice that will help a client keep their spending on track, but it is never articulated (or calculated), so it just lingers in an advisor's mind, waiting for the advisor to take action if/when the need arises.

However, this is a big missed opportunity. There's a tremendous amount of stress that guardrails can help alleviate when properly communicated, and uncommunicated guardrails could be – at least in the client's eyes – quite similar to having no plan at all.

How Guardrails Can Help Alleviate Stress

Perhaps the greatest benefit of guardrails is helping clients answer the question, in advance, of what would happen during a significant market downturn. Consider the following guardrails:

Portfolio: $2 million

Initial Spending: $100k/year

- If the portfolio rises to $2.5 million, increase spending to 110k/year.

- If the portfolio falls to $1.6 million, decrease spending to $90k/year.

Suppose, in the example above, the probability of success at a $100k/year spending level was 90%. Suppose further than an advisor communicated this probability of success to a client and didn't take it any further.

Now, suppose the client is watching their portfolio fall during a downturn… $1.9 million, $1.8 million, $1.7 million, etc.

In even the best circumstances, it is hard to imagine retirees feeling good about seeing a portfolio decline. Portfolio declines aren't fun. But they are made even worse when we don't know (a) when we need to take action, and (b) what action we'll take.

While clients with a trusted advisor looking out for them would hopefully offer some peace of mind, advisors can likely provide even more peace of mind by helping clients understand what will happen if/when declines occur.

Moreover, assume a client has view-only access to their Monte Carlo plan and is also watching their Probability of Success (PoS) decline with time –90% PoS, 80% PoS, 70% PoS, 60% PoS… – this might end up being a double whammy to a client. Not only are they seeing their portfolio decline, but they are also watching a (often vastly misunderstood) metric trend in a negative direction. This can stress a client out further during an already trying time.

What if, instead, a retiree had only seen the withdrawal strategy part of the guardrails plan – and not the probability-of-success changes – mentioned above? Certainly, watching their portfolio decline still isn't going to be fun, but at least they are armed with the knowledge that (a) no change is recommended until their portfolio reaches $1.6 million, and (b) that change would be a reduction of $10k reduction in annual spending.

While a $10k cut will differ in how painful it is depending on a client's unique circumstances, let's say that this particular retiree is a big traveler and usually spends about $20k annually in travel. If they are looking at their $1.8 million portfolio and are aware of the withdrawal changes triggered by the $1.6M guardrail threshold, they know they would still need to face significant declines before that guardrail would be triggered. Furthermore, perhaps they also know that they could cut their travel back from $20k to $10k if they had to, so they already know exactly what adjustment they would make if/when the time comes.

If we are comparing these 2 retirees – the first flying in the dark with just some vague notion that their advisor is watching things (perhaps while also seeing that their probability of success is dropping) versus the second with a clear guardrails plan in place – we can see how guardrails provide an opportunity to significantly enhance a client's experience working with an advisor (and the general financial anxiety they may face beyond that).

How Advisors Can Communicate Guardrails

If most advisors using Monte Carlo are effectively using "uncommunicated guardrails", then the next step in articulating guardrails is calculating the guardrails themselves. While this process has been covered in greater depth previously on Nerd's Eye View, the process effectively comes down to 'solving for' each of the guardrails components in dollar terms.

This process can admittedly be a bit cumbersome in traditional Monte Carlo software, but it can be done nonetheless. For instance, an advisor trying to solve for a set of guardrails would do the following:

- Calculate the initial spending level that is reasonable given a client's portfolio size. For the sake of illustration, let's continue the examples above and assume that the client has a $2 million portfolio and their advisor would like to target an initial 95% probability of success. The advisor puts the client's plan into their software and calculates that an initial spending level of $100k would provide a 95% probability of success. We now have the initial portfolio value and initial spending level.

- Initial Portfolio: $2 million

- Initial Spending: $100k/year

- Solve for the portfolio values that would hit our guardrail thresholds. Let's continue the example of using 70% (lower guardrail) and 99% (upper guardrail) as our probability thresholds. An advisor could use a guess-and-check approach to change portfolio values in their Monte Carlo software until they arrive at their threshold probability-of-success levels. Let's suppose that these levels are $1.6 million for the lower guardrail and $2.5 million for the upper guardrail. The advisor has now solved for their portfolio guardrail triggers (in dollars).

- Increase spending if portfolio rises to $2.5 million

- Decrease spending if portfolio falls to $1.6 million

- Calculate spending changes corresponding to the desired adjustment once a guardrail is hit. There are several ways an advisor could define these adjustments. For instance, a flat percentage adjustment could be used (e.g., increase or decrease by 10%). This would be consistent with methodologies like Guyton-Klinger. However, if we're using a more sophisticated tool like Monte Carlo, we might as well take advantage of better controlling our risk levels, so let's say that in this example, we want to adjust back to a 95% probability-of-success level if increasing spending, and up to an 80% probability-of-success level if decreasing spending. The advisor would now guess and check their client's spending levels (at the higher/lower guardrail portfolio balances) using their Monte Carlo software. For the sake of illustration, let's just assume that those values are $110k in annual spending at the upper guardrail and $90k in annual spending at the lower guardrail. We've now calculated the adjustments to be made in a manner that rounds out our guardrails.

- Increase spending by $10k if portfolio rises to $2.5 million

- Decrease spending by $10k if portfolio falls to $1.6 million

As noted above, this is a very cumbersome process to do manually. While it may work to calculate these guardrails by hand as a one-time illustration to help understand how risk-based guardrails work, it is hard to imagine an advisor (or their team) realistically wanting to devote the amount of time it would take to not just build initial plans for 50–150 clients this way, but also keep those plans up to date and on track. The guess-and-check iterations for determining guardrails don't happen just once when setting a plan, but would need to be carried out every time a plan is updated.

Is it theoretically possible to do this? Yes. But it's impossible in a more practical sense: the amount of guessing and checking (and several phases of guessing and checking!) needed just for one client, one time, is onerous enough to likely deter most advisors. However, to scale it across 50–150 clients while keeping things updated over time would be overwhelming. Circumstances change. Plans get shorter. Balances change. Inflation happens. You don't just set guardrails once and leave them until you hit them. Guardrails need to be updated over time, and if an advisor is going to manually calculate guardrails, that is just not a great way to run a business.

Arguably, this may be one reason why distribution-rate driven guardrails have been more commonly implemented by advisors. However, distribution-rate driven guardrails have numerous issues of their own, perhaps most notably their inability to account for real-world spending patterns of retirees such as taking more from a portfolio in the early years of retirement while deferring Social Security and then reducing one’s distribution rate once Social Security kicks in.

Helping Clients Set The 'Right' Guardrails

While the peace of mind that can come from the short-term spending plan established by guardrails like those shown in the last section can be tremendous on its own, there is arguably some uncertainty that could remain for clients. Perhaps a client thinks, "Okay, I understand what this guardrail adjustment looks like, but what comes after that? Could this whole plan quickly spiral out of control on me?"

Admittedly, this is a reasonable fear. We know what is around the 1st corner, but what's around the second corner? A client may fear that while the 1st adjustment is palatable, the 2nd, 3rd, 4th (or beyond) is much more uncomfortable.

For this reason, finding a way to communicate the long-term income experience of a given guardrails plan can help further provide peace of mind. While there are a number of ways advisors could do that, one consideration is to 'stress test' a plan through some of the worst historical sequences we've seen. While there's no guarantee that future market sequences couldn't be even worse, clients may gain some peace of mind by seeing how going through known bad markets would have looked.

For instance, the advisor could show a client what adjustments they would have faced when encountering the worst sequences in U.S. history, such as the Great Depression, the Stagflation Era, the Dot-Com Bubble, or the Global Financial Crisis.

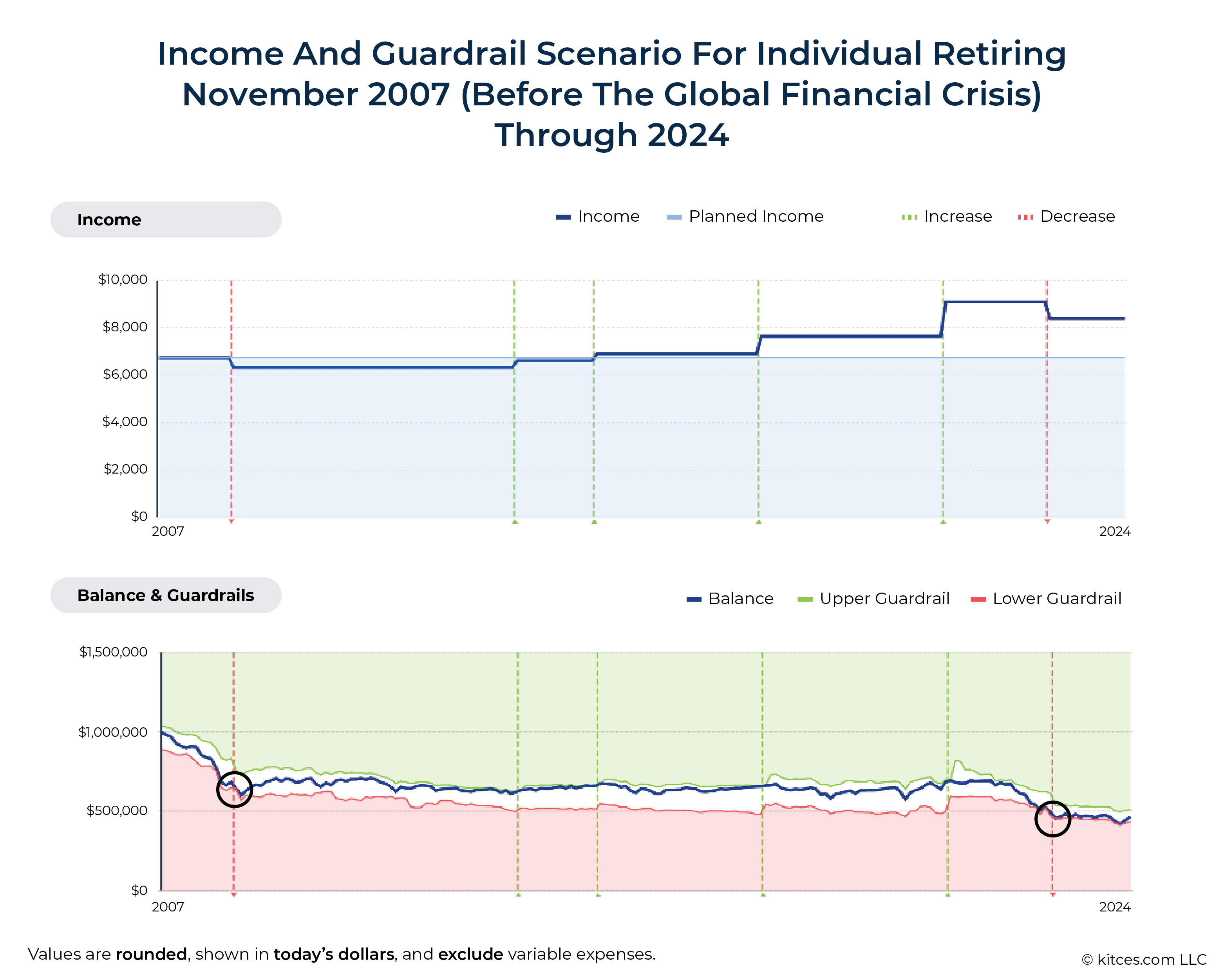

Perhaps such an exercise could show a client how their spending (shown in the first image in the graphic below), as well as their portfolio balance and guardrails thresholds (shown in the second image), would be impacted if they retired just before the Global Financial Crisis hit, providing an illustration that looks like the following:

The chart above shows both downward spending adjustments (red dotted lines) and upward spending adjustments (green dotted lines). As the second image shows, once the portfolio balance actually hits the lower guardrail, then we trigger a decrease in spending.

As we can see, if a retiree had used this particular guardrails strategy while retiring just before the Global Financial Crisis, they would have faced a spending cut of about 6% relative to their planned income near the onset of retirement.

While some retirees might be comfortable with this level of retirement income risk, others may feel like they would like less risk of a potential spending reduction and/or they would like to preserve more of a retirement portfolio balance going through a similar downturn.

One major advantage of risk-based guardrails over distribution-rate guardrails frameworks like Guyton-Klinger's model is that advisors can have a tremendous amount of control over the adjustment parameters. We can adjust the upper guardrails, lower guardrails, actions triggered at the guardrails, etc. For some who want to really guard against downward-spending-adjustment risk, it might even be prudent to forego income increases entirely, allowing a plan to effectively build up more of a reserve. Alternatively, strategies such as annuitization could play a role in providing a more significant income floor.

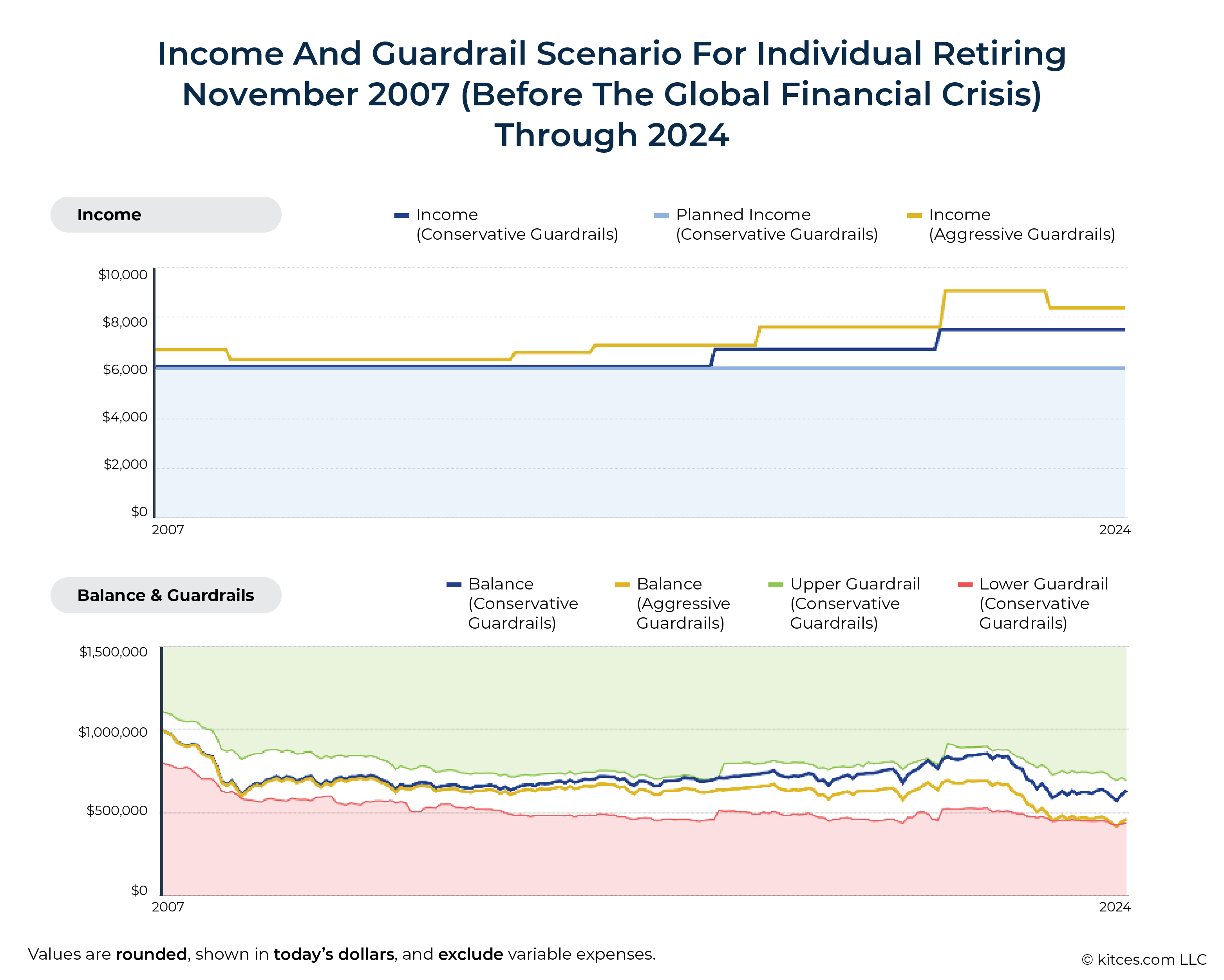

So let's assume a retiree looked at the chart above and felt they wanted to choose a more conservative guardrails strategy. Perhaps the advisor could adjust the initial targeted probability of success to be higher and raise the threshold for upward adjustments, resulting in a stress test that looked like the following (which includes a comparison to the "aggressive" income levels and portfolio balance shown in yellow below, identical to the scenario illustrated in the previous graphic):

Now, as we can see, the decline during the Global Financial Crisis was not significant enough to result in a client ever hitting their more conservative lower guardrail (in contrast to the lower guardrail being crossed twice in the more aggressive example illustrated earlier). Looking at their portfolio values, we can see that the portfolio did experience a similar decline, but the upper and lower guardrails also move around as total risk factors change in a client's plan, and, in this case, the lower guardrail was narrowly missed in 2009. From this point forward, we see that the retiree was able to maintain spending at their planned level until the prolonged bull market coming out of the Global Financial Crisis led to several increases in spending as the client's upper guardrail was hit.

To further continue the stress test, perhaps the advisor can also show the client how their guardrails strategy would have fared during the Great Depression, the Stagflation Era, and the Dot-Com Bubble. If the client is comfortable with the downward risk seen historically for their particular set of guardrails parameters, then the advisor can determine that this is a good guardrails plan and proceed accordingly for the client.

With this extra step in place of not just establishing the short-term income plan but also helping the client understand the long-term prospects of the strategy they have in place, advisors can further reduce the potential anxiety associated with navigating bear markets.

Going back to the initial example, our retiree with $1.8 million in their portfolio knows that their spending won't need to be reduced until their portfolio reaches $1.6 million, but they'll also know that the spending reductions they would have faced during the worst times in U.S. market history would have been tolerable. In other words, there are no monsters lurking behind the second or third adjustments, at least to the extent that a bear market isn't worse than the worst periods we've seen in U.S. history.

Unfortunately, there is no real way to carry out this exercise in typical financial planning software and have it checked using most standard planning software, the analytics are much different for testing the long-term outcomes of a given guardrails strategy, and traditional Monte Carlo tools aren't set up to provide that type of information. Hopefully, more tools will have such capabilities in the future. Currently, we're only seeing these types of capabilities in specialized retirement income planning software.

Ultimately, the key point is that how advisors present plan results to clients can have a significant impact on a client's experience and the stress they feel going through a market downturn. Monte Carlo simulation alone, even if guided by "uncommunicated guardrails", leaves a lot of uncertainty that can result in stress among clients. Furthermore, since watching a portfolio balance decline is already stressful, a client who is simply watching probability-of-success levels decline concurrently might only be more stressed seeing those probability-of-success numbers.

However, by using guardrails to express potential short-term adjustments in dollar terms, clients can gain some peace of mind with respect to when a first cut would be called for and what that cut would be. Particularly if a client is comfortable with that cut, the ability to plan ahead for it can provide a tremendous amount of confidence during a downturn. Additionally, the ability to communicate long-term income experiences of a given plan and make modifications to ensure that a given strategy is tolerable for a given client can further reduce anxiety clients may feel during downturns. At least to the extent that downturns are no worse than the most painful bear markets we've seen in the U.S. to date, clients may be able to have greater peace of mind that they can stomach not just an initial cut but also subsequent cuts that could come their way!

Disclosure: Derek Tharp is a Senior Advisor at Income Lab, which carries out analyses like those advocated for in this article and was used to produce the graphics included in the examples in this article.