Executive Summary

Since 2011, when one member of a married couple passes away, the surviving spouse is eligible to carry over any unused portion of the deceased spouse’s estate tax exemption amount. This rule, allowing “portability” of the deceased spouse’s unused exemption (DSUE) amount, provides a substantial reduction in estate tax exposure for couples whose combined net worth is more than $5 million (or is expected to grow above that amount in the future), and reduces or eliminates the need for many couples to utilize a bypass trust in their estate plan.

However, the caveat to portability of the estate tax exemption at the death of the first spouse is that it only applies if a Form 706 estate tax return is filed in a timely manner to claim portability – even, or especially, if the estate under the filing threshold and otherwise wouldn’t even need to file an estate tax return.

Unfortunately, though, many executors don’t even realize that there is a requirement to file an estate tax return for those who are not subject to an estate tax, and the oversight often isn’t discovered until the surviving spouse subsequently passes way. And by that time, it’s too late to go back and file for portability. At least, not without submitting a potentially costly request to the IRS for a private letter ruling to be granted an extension.

To help ameliorate this common oversight of executors – and the high volume of PLRs the IRS was receiving – in 2014 the IRS granted executors the opportunity to retroactively claim portability by filing an estate tax return for anyone who had passed away since 2011, under Rev. Proc. 2014-18. Yet since those rules lapsed (at the end of 2014), it has once again become increasingly common for executors to submit PLR requests to the IRS to receive an extension for an accidentally missed Federal estate tax return deadline.

Thus, the IRS has now issued Rev. Proc. 2017-34, which grants a permanent automatic extension for the time to file an estate tax return just to claim portability, beyond the original 9 months requirement. In order to utilize the extension, the executor merely needs to file a not-otherwise-required-to-be-filed Form 706 estate tax return within 2 years of the decedent’s date of death, and note on the return that it is being filed as a permissible extension under Rev. Proc. 2017-34.

In addition, the IRS has granted prior estates yet another opportunity for retroactive portability as well. For any member of a married couple who died after 2010, there is once again an opportunity to file a (now very late) Form 706 estate tax return to claim portability, with a deadline of January 2nd of 2018. Which allows surviving spouses (including same-sex married couples) to claim a carryover of the DSUE amount for any spouse who passed away in 2011 or later. And in situations where the then-surviving spouse also passed away and owed an estate tax, there’s even an opportunity to retroactively claim portability, and then file an amended estate tax return, and receive an estate tax refund of up to $2 million!

For most, though, the new rules simply provide an extended time window for executors to realize the need to file a Form 706 estate tax return to claim portability in the first place. Nonetheless, in situations where at least one member of a married couple passed away in 2011 or later, there is a limited time window to claim retroactive portability through the end of the year as well!

What Is Estate Portability Of The DSUE Amount?

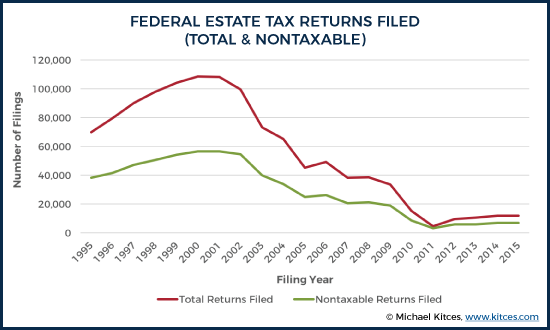

To shelter most people from exposure to the Federal estate tax, US citizens are eligible for a Federal estate tax exemption – which is currently $5.49 million per person (annually indexed for inflation). Thus, for anyone whose total estate is less than $5.49M, the Federal estate tax exemption effectively reduces their estate tax liability to zero (and current IRS data shows that there are only a few thousand estates per year, in total, that exceed this threshold!).

While the Federal estate tax exemption easily protects most individuals from the scope of the Federal estate tax, the situation is more problematic when it comes to married couples. The reason is that while each member of a couple has an estate tax exemption, if the first spouse passes away and leaves assets to the surviving spouse, then when the surviving spouse passes away, he/she will have the couple’s joint total of assets but only the one (surviving) individual estate tax exemption, potentially triggering an estate tax.

Example 1. Andrew passes away, leaving his wife Molly an inheritance of $3,000,000. Molly already has a personal net worth of $5,000,000. While each of their individual estates are below the $5,490,000 estate tax exemption, after Andrew’s death, Molly’s total combined estate is up to $8,000,000, which, if she died, would be subject to a 40% estate tax above the $5.49M exemption amount, resulting in nearly $1,000,000 of estate taxes!

To avoid this outcome, for years couples would use a “bypass trust” estate plan, where the first spouse to pass away wouldn’t leave assets directly to a surviving spouse in the first place; instead, the assets would go to a trust for the surviving spouse’s benefit, typically allowing access to cover any necessary expenses for the surviving spouse’s 'health, education, maintenance, and support', but restricting any further access (which allowed the bypass trust to be excluded from, and not taxed in, the surviving spouse’s estate).

Example 2. Continuing the prior example… instead of leaving his assets to his wife, Andrew instead leaves his $3M estate to a bypass trust for Molly’s benefit. Molly may use the bypass trust to help maintain her standard of living, but because her access to the trust is limited, its value is not included in her estate. Thus, Molly’s estate remains under the $5.49M estate tax exemption threshold. And Andrew is not subject to estate taxes when he leaves $3M to a bypass trust, because his $3M is sheltered by his own $5.49M estate tax exemption.

However, this all changed under the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (also known as TRUIRJCA, or “the first fiscal cliff legislation”), which, for the first time, introduced the concept of “portability”. The new rules, as defined under IRC Section 2010(c)(4), declared that if one member of a married couple didn’t use all of his/her own estate tax exemption – most commonly, because assets are left to a surviving spouse, which is eligible for an unlimited marital deduction that already reduces the tentative estate tax to zero – then the surviving spouse could inherit the deceased spouse’s unused exemption amount. In other words, the deceased spouse’s unused exemption (DSUE) amount became “portable” to the surviving spouse, obviating the need for a bypass trust in most situations.

Example 3. Continuing the prior example further… with portability, Andrew can simply leave his $3M of assets directly to Molly after all. Andrew’s estate will receive a $3M marital deduction, reducing his taxable estate to zero, and preserving all of his $5.49M estate tax exemption for Molly. Thus, Molly will end up with a total of $8M of assets (including Andrew’s and her own), but will have $10.98M of estate tax exemption to shelter those assets (including Andrew’s $5.49M and her own), avoiding any estate tax exposure (and without the need for a bypass trust).

Unfortunately, the new portability rules only applied to decedents who passed away after December 31st of 2010, and, at the time, were further limited by the fact that portability itself was temporary, since TRUIRJCA merely extended the sunset provisions that were causing the “fiscal cliff” of 2010 by 2 years, turning it into the fiscal cliff of 2012 (which meant portability itself would lapse at the end of 2012). However, the American Taxpayer Relief Act of 2012 – passed by Congress just hours before midnight on New Year’s Eve that year – ultimately resolved the fiscal cliff of 2012, and in the process, ATRA made portability of the estate tax exemption permanent.

Requirements To Claim Portability And Filing Form 706

While portability is now permanent, there is still a key requirement to claim it: the executor of the decedent’s estate must actually file a Form 706 Federal estate tax return.

In other words, portability doesn’t happen automatically; it takes an affirmative action to ensure the deceased spouse’s unused exemption (DSUE) amount is actually carried over to the surviving spouse. And the requirement applies even if the decedent’s estate otherwise had no obligation to file an estate tax return. In fact, in most situations where portability applies, there will be no obligation to file a Federal estate tax return… because filing isn’t even required until the gross estate is more than $5.49M in the first place (which is why the exemption amount is so often unused and available to carry over!)!

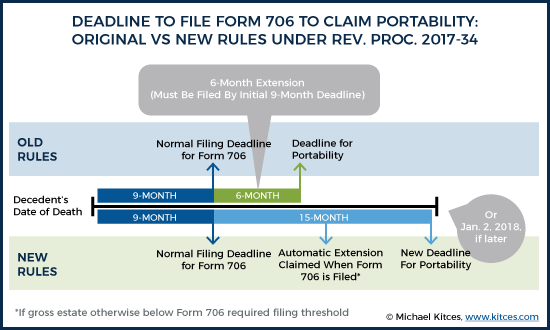

Yet regardless of whether a Form 706 will be filed because the estate actually exceeds the filing threshold, or simply because of a desire to claim portability, the deadline remains the same: to file a timely estate tax return, Form 706 must be filed by 9 months after the decedent’s date of death (with the option for a 6-month extension via Form 4768). In other words, under IRC Section 2010(c)(5)(A), even estates that would otherwise have no reason or obligation to file an estate tax return within 9 months of the decedent’s date of death, are obligated to do so in order to claim portability.

And unfortunately, in recent years it has become increasingly apparent that many people who wish to claim portability of the estate tax exemption are missing this deadline, including and especially in situations where the estate was under the filing threshold and the executor would otherwise have had no reason to file an estate tax return at all. In other words, executors often don’t even realize there’s a reason to file an estate tax return, for an estate with no estate tax exposure, until after the filing deadline has passed. The problem was especially severe in the early years after portability was established – in 2011 and 2012 – where many executors didn’t even know the portability rules existed and that there was a reason to file the estate tax return. They often didn’t find out until years later, when the surviving spouse passed away with a taxable estate, and it was discovered that portability was never claimed at the death of the first spouse.

For those who missed the Form 706 filing deadline, Section 301.9100-3 does allow executors to request an extension for a missed estate tax return deadline, if the executor can establish that he/she “acted reasonably and in good faith”, but doing so still requires submitting for a Private Letter Ruling (PLR) and paying a non-trivial User Fee (plus, usually, the cost of an accountant or attorney to aid in the process).

And in fact, so many executors began to submit PLRs to request extensions to the estate tax return filing deadline that in 2014, the IRS published Revenue Procedure 2014-18, which temporarily offered a “simplified method” of requesting automatically-approved extensions (effectively allowing “retroactive” portability) for anyone who had died since the portability rules first took effect after 2010 and missed the original filing deadline.

However, the automatic-extension relief of Rev. Proc. 2014-18 ended at the end of 2014, and since then, the IRS has once again seen a substantial increase in the volume of private letter ruling requests for extensions from executors who failed to file the Form 706 estate tax return in a timely manner (usually because they didn’t even realize they needed to until it was too late).

IRS Grants Permanent Extension For Form 706 Portability Filing Deadline Under Rev Proc 2017-34

In the newly issued Revenue Procedure 2017-34, the IRS has once again granted automatic relief provisions for those who failed to file a timely estate tax return in order to claim portability. However, this time around, the extension will remain available indefinitely in the future, as well.

Specifically, under Section 4.01(1) of Rev. Proc. 2017-34, any estate of a decedent who passed away after December 31st of 2010 is automatically granted an extension until January 2nd of 2018 to file the Form 706 estate tax return to claim portability. In addition, going forward, any executor will automatically have until the second anniversary of the decedent’s date of death to file an estate tax return for the purposes of claiming portability. (In the event that the decedent passed away in 2016 or 2017, where both options apply, the up-to-2-years option will supersede the January 2nd deadline, allowing the 2-year window to extend into 2018 or 2019.) In other words, in situations where the normal 9-month deadline (and 6-month extension) has passed for filing an estate tax return to claim portability, executors can automatically get an extension to the later of January 2nd of 2018, or 2 years after the decedent’s date of death.

In order to claim the extension – for executors who are filing past the normal 9-month deadline – Section 4.01(2) of the guidance stipulates that the executor should simply write “FILED PURSUANT TO REV. PROC. 2017-34 TO ELECT PORTABILTIY UNDER 2010(c)(5)(A)” at the top of Form 706. There is no user fee or other cost to making and being granted the request for extension (beyond the cost of assistance in filing a Form 706 in the first place).

Notably, though, these rules for getting an automatic extension only apply where the decedent was:

1) Survived by a spouse,

2) Died after December 31st of 2010,

3) Was a US citizen (or resident) on the date of death,

4) Not required to file an estate tax return in the first place (i.e., was under the filing threshold); and,

5) Did not already file an estate tax return (as if Form 706 was already filed, portability either was or wasn’t already claimed!)

A key point of the requirements is the determination that the estate was not already required to file an estate tax return under IRC Section 6018(a). In cases where the gross estate (plus prior adjusted taxable gifts) exceeds $5.49M, but there was no estate tax due (e.g., thanks to the marital, charitable, or other deduction), the standard 9-month-deadline-plus-6-month-extension rules still apply. In fact, Section 4.03 of Rev. Proc. 2017-34 explicitly notes that if the executor begins the process of filing for an extension, and then discovers that the original estate was over the filing threshold (and would have been required to file in the first place), this automatic extension is no longer available.

For those who are not eligible for an extension under the new rules – e.g., by being beyond even the 2-year time extended window – it is still possible to submit a private letter ruling under Section 301.9100-3 to request a further extension, subject to the usual User Fee and filing requirements for a PLR. On the other hand, for those who had already been in the process of requesting a PLR, Section 7.02 of Rev. Proc. 2017-34 states that the PLR request will be closed out, user fees will be refunded, and executors should simply proceed under the new automatic extension rules. In fact, the IRS has stated that no new PLRs will be considered at all after June 9th (the effective date for Rev. Proc. 2017-34), for those who fit the above requirements and can/should simply follow the new automatic extension process noted here.

Estate Planning Opportunities For The “Recently” Deceased (Since 2010) Under Rev. Proc. 2017-34

Notably, in the case of married couples where at least one spouse passed away since 2010 (i.e., on January 1st of 2011, or later), Rev. Proc 2017-34 provides a substantial additional planning opportunity: retroactive portability for anyone who died in the past 6.5 years, as the new deadline for portability is the later of 2 years from the date of death or January 2nd of 2018. Which means, even if one member of the couple passed away back in 2011, shortly after the portability rules came into existence, and never filed an estate tax return, there’s now once again an opportunity to file a Form 706 (by January 2nd of 2018) to claim portability for a surviving spouse, who may have only now realized he/she wants or needs it.

The planning opportunity is even more significant in the case of couples where both spouses have passed away since 2010, no portability was claimed at the first spouse’s death, and an estate tax was due at the death of the second spouse. Because the new portability deadline means it is now possible to retroactively claim portability from the first spouse’s death, to carry over the DSUE amount to the then-surviving spouse, and then claim the higher exemption thanks to portability on the second deceased spouse’s estate tax return, and receive what could be a 7-figure estate tax refund!

Example 4. Charlie died back on February 17th of 2011, leaving approximately $2,000,000 of assets to his wife Sheila. Charlie never filed an estate tax return at the time, and thus Sheila never inherited his unused estate tax exemption (which thanks to the marital deduction, would have been the entire $5,000,000 exemption at the time). Last year, on March 11th of 2016, Sheila passed away, with a then-combined estate of $8,000,000 (including Charlie’s $2M), leaving her assets to her two children. Since Sheila’s estate tax exemption was “only” $5.45M, and Charlie never filed a return for portability, Sheila owed a 40% estate tax on the excess of her estate above the exemption amount, and last year paid an estate tax liability of $1,020,000.

Under Rev. Proc. 2017-34, though, it’s now possible to retroactively file an estate tax return for Charlie, to “claim” his estate tax liability of $0, and port over his unused $5,000,000 exemption to Sheila. Then, Sheila’s executor can file an amended Form 706 estate tax return to claim a total exemption of her $5.45M plus Charlie’s $5M DSUE amount, for a total exemption of $10.45M. Since this exemption would have been more than enough to shelter the entire estate, Sheila will then receive a $1,020,000 estate tax refund!

Notably, in order for the second spouse’s estate to file an amended return and claim the refund, the amended return itself must be filed by within 3 years of when the second spouse’s Form 706 was filed under the requirements of IRC Section 6511(a). Thus, if both spouses passed away more than 3 years ago, and the second spouse’s Form 706 was already filed more than 3 years ago, the opportunity for retroactive portability is a moot point. And if neither spouse had an estate tax liability, the point is also moot.

Nonetheless, as long as the second spouse died and filed a Form 706 within the past 3 years and there was an estate tax paid (or alternatively if a gift was made, and there was a gift tax paid along with filing Form 709), the opportunity remains available. In situations where the second spouse’s estate (or prior gift) is close to the 3-year deadline, the executor should file a Form 843 to establish a protective claim for the refund (by the 3-year deadline), then file Form 706 for the first spouse’s estate for retroactive portability, and then file the amended Form 706 for the second spouse’s estate (which is permissible past the 3-year deadline, as long as Form 843 itself was filed by the 3-year deadline).

It’s also important to bear in mind that since the United States v. Windsor Supreme Court ruling in 2013, and the subsequent IRS Revenue Ruling 2013-17, the IRS recognizes a same-sex married couple as being “married” for the purposes of Federal income and estate tax rules, including portability, as long as the same-sex marriage was legal where it was performed at the time. Which means the surviving spouse of a same-sex married couple, where one spouse passed away in 2011 or 2012, could now retroactively claim portability of the estate tax exemption, even though the marriage wasn’t recognized as legal for Federal estate tax purposes at the original time of death!

Ultimately, advisors should review any/all situations where at least one member of a couple passed away since 2011, to determine whether a Form 706 was filed to claim portability, and, if not, whether it makes sense to do so by January 2nd of 2018, either to carry over the DSUE amount to the surviving spouse’s estate tax return, or to apply towards the then-surviving spouse’s estate and file for a refund in situations where the second spouse passed away as well (and owed an estate tax).

Planning Implications And Opportunities Of The New Portability Filing Deadline Extension

Beyond the unique opportunity that Revenue Procedure 2017-34 creates for couples where one spouse already passed away, the good news of the new rules is that it effectively turns what is normally a 9-month deadline to file a Form 706 estate tax return just to claim portability, into a 2-year deadline instead. As unlike the normal option for a 6-month extension (which itself must be requested by the 9-month deadline), the new extension is automatic for those who qualify, simply by writing “FILED PURSUANT TO REV. PROC. 2017-34 TO ELECT PORTABILITY UNDER 2010(c)(5)(A)” at the top of Form 706 when filed. At least, for those who were otherwise under the filing threshold and didn’t realize they “needed” to file in the first place just to get portability. (For those who are over the filing threshold and are required to file a Form 706 in the first place, though, the normal 9-month deadline remains.)

For most, this extension will simply be a welcome additional time window to ensure that Form 706 is filed, and portability is claimed. Two years from the decedent’s date of death gives a surviving spouse more time to make the decision whether the (usually modest) cost of filing is worthwhile just to carry over the deceased spouse’s DSUE amount. And for those who may not realize at first that it’s necessary to file an estate tax return just to claim portability for someone who does not have any Federal estate tax exposure – because their assets are well under the $5.49M exemption amount – now the surviving spouse gets more time to realize the opportunity.

In the meantime, from the IRS’ perspective, this will reduce the what are now a “considerable number” of surviving spouses submitting Private Letter Ruling requests just to obtain the same extension, without extending the time window so far that it becomes impossible to get an accurate picture of (and accurate appraisals for) decedents who passed away long ago. Though those who wait beyond 2 years, and prior estates that wait beyond the January 2nd, 2018 deadline, will still have to rely on the existing PLR process.

But the bottom line is that going forward, couples where one spouse passes away will have more time to make the decision whether to file Form 706 to claim portability – and/or have more time to realize they need to do so in the first place. Nonetheless, the deadline is still “just” a 2-year deadline (from the date the decedent passed away), which means it is still possible to wait too long, or forget altogether, the requirement to claim portability. And for those who already missed the opportunity to file for portability after the first spouse’s death years ago (but since 2010), a unique second-chance window remains open through the end of the year to file for retroactive portability, and reclaim the unused exemption amount!

So what do you think? Will you be reviewing instances of clients who were widowed since 2010 for planning opportunities? Does Rev Proc 2017-34 create any other planning opportunities for your clients? Please share your thoughts in the comments below!