Executive Summary

Financial planning, and the process of creating a financial plan, has changed extensively over the nearly 50 years since the first class of CFP certificants. As while in the early years, the “financial plan” was primarily used as a way to demonstrate a prospective client’s gaps and establish a need (for which the advisor could sell a solution to implement), financial planning then evolved into being a ‘value-add’ to support an ongoing client relationship, and now increasingly is becoming the purpose of (and primarily value proposition in) the client relationship in the first place.

To better understand these trends, in 2018 we released the first Kitces Research study on “How Financial Advisors Actually Do Financial Planning”, which examined how financial planners today are actually executing their financial planning processes, delivering their financial plans, what technology tools they are using, and how they are compensated.

Our 2018 report revealed several key findings, including how many meetings it takes to create and deliver a financial plan, how advisors are collecting the requisite data from clients, the tools they use to conduct their financial planning analyses and plan creation, the way technology is used to deliver the plan itself (where the majority of planners use planning software interactively, but also still use Word and Excel to supplement their financial planning software), and the time it takes for the whole planning process to come together. In fact, our research found that overall, financial planners spend only 19% of their time meeting with clients at all, while they spend 26% of their time preparing financial plans and other meeting preparation for their client meetings (along with almost 17% of their time on business development!).

A lot has changed since 2018, though, and as the financial planning industry, tools, business models, and regulations have changed, so too has the financial planning process itself. New technology tools have come, major financial planning software releases have occurred, new regulations have been proposed, and the industry continues to evolve.w

Accordingly, we’re excited to announce the second Kitces Research study, which will once again examine the process that financial advisors go through to create and deliver a financial plan. Similar to the study we conducted in 2018, this research will not only seek to identify current benchmark data for creating the financial plan itself (as well as best practices most effective for financial advisors), but will also specifically explore how the delivery of plans is changing in response to the rapidly evolving landscape of the financial planning industry itself.

So whether you’re frustrated that your financial planning software doesn’t “do” what you need it to in order to demonstrate its value, or are simply looking for ideas to refine your financial planning process to be more time-efficient or cost-effective (or valuable and able to command a higher price!), I hope you’ll take a few minutes to participate in this year’s Financial Planning Process survey and help the world better understand what real financial planners actually do!

What We Learned From The Kitces 2018 Research Study On How Financial Planners Actually Do Financial Planning

In 2018, the Kitces Research team launched its first research study, “How Financial Advisors Actually Do Financial Planning”, with a primary focus on the four areas: how financial planners actually execute their financial planning process, what they deliver as a “financial plan” to their clients (and how), what tools they use along the way (e.g., financial planning software and specialized software), and of course, how financial planners get compensated for their financial plans!

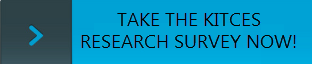

Our results showed that for most advisors (37%), financial planning is at least initially a 3-meeting process, where advisors collect data in an initial meeting, then spend time analyzing and crafting a plan to deliver in a second meeting, and then have a third meeting for implementation. Although notably, 11% of advisors conduct their entire planning process in a single meeting, and 31% of advisors have a 2-meeting process. On the other hand, 13% of advisors conduct 4 meetings (typically by adding a ‘draft’ plan meeting between initial data gathering and final presentation), and nearly 5% of advisors have an even more involved and specialized 5-meeting process.

While almost 20% of advisors have a more involved ‘multi-meeting’ process of plan analysis, recommendations, delivery, and implementation, for most advisors the biggest variability in the cadence of their financial planning meetings is how they handle data gathering.

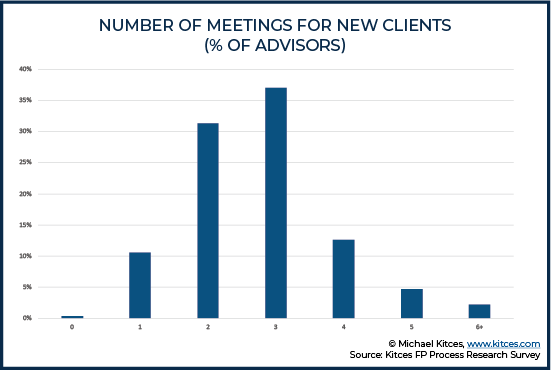

Because of not only the importance of gathering numerical data from new clients, but also the ‘softer’ more qualitative discussions about hopes, dreams, goals, and wishes, financial advisors do a lot of in-person data gathering – either in an in-person meeting where clients bring in statements (79%) and sometimes even having another meeting to confirm the data that has already been collected and potentially add more to it (58%). And notably, this is true despite the fact that 28% of advisors gather at least some of the data upfront via a paper data gathering form, another 29% do so with a fillable PDF, and 22% use some kind of software (e.g., PreciseFP) to gather that data in advance; in total, 73% of advisors reported using some kind of in-advance data gathering process… and despite that, of that 73%, 96% still reported using in-person meetings or video or phone calls to gather further data as well.

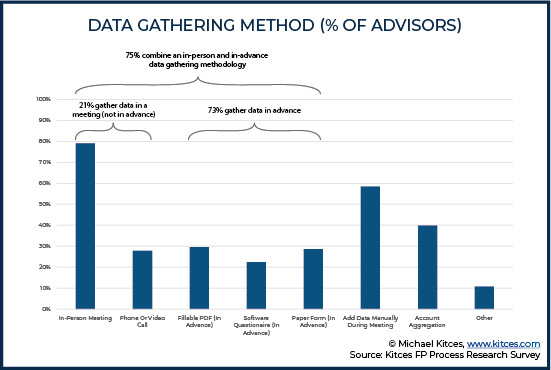

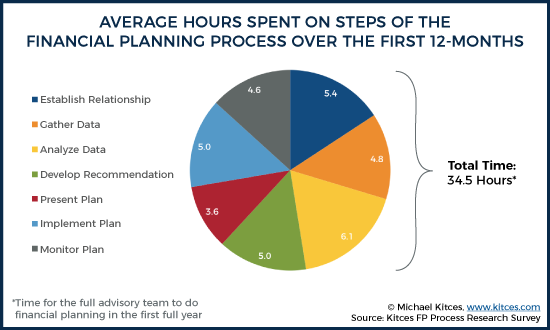

Notably, though, the financial planning process itself is far more time-consuming than ‘just’ the typical 3-meeting process itself. As engaging in the entire 6- (now 7-) step financial planning process takes up a lot of time between meetings, as well. In fact, the average time to create and deliver a financial plan was 15 hours!

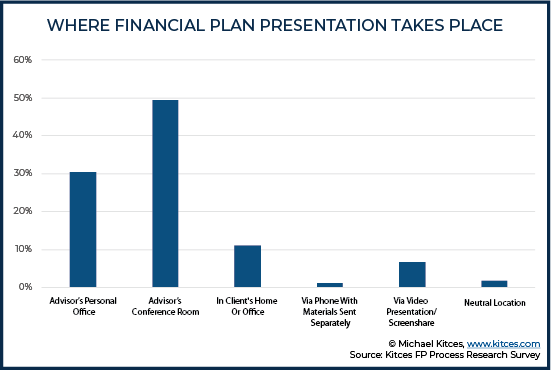

On the other hand, notwithstanding the rise of various technology tools to support the delivery of financial planning, our research showed that almost 90% of advisors still deliver their financial plans in person, either in thei advisor’s conference room (49%), in the advisor’s office (31%), or at the client’s home or office (11%), while only 7% deliver their financial plans via video presentation (though notably, video presentation of a financial plan outpaced the conference call delivery of a financial plan by 7%, with only 1% of advisors delivering a financial plan via conference call).

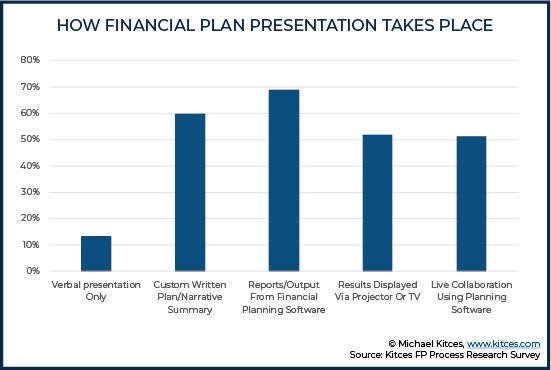

Notably, though, technology adoption to support the in-person delivery of financial planning is occurring at a much more rapid pace. While historically financial plans were delivered as physical print-outs of the output of financial planning software, today only 69% of advisors are delivering the reports and output from their planning software while 52% are customizing that output with their own custom written plan or narrative summary. More to the point about technology adoption, 52% of advisors reported that they are delivering the plans via projector or TV and 51% are delivering financial plans collaboratively and interactively using planning software.

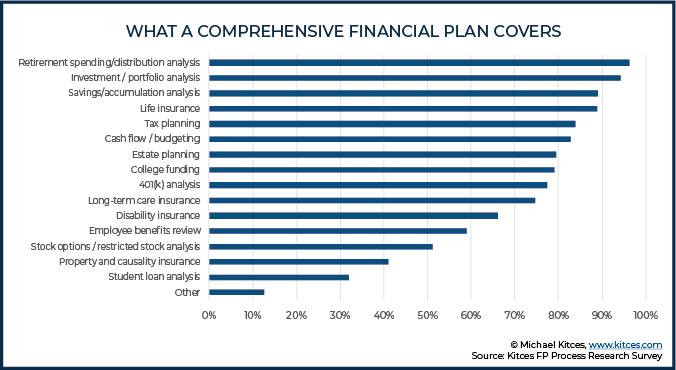

In terms of what was included in the plans, a wide variety of financial concerns is covered in most plans, which simply underscores why the data gathering stage is so crucial and explains why it takes a lot of time to gather financial data across so many financial planning topics. Not surprisingly, retirement planning and portfolios continue to reign supreme as the focus of financial planning (given the current dominance of the AUM model), and in fact decumulation planning (i.e., retirement spending/distribution analysis) outpaces accumulation planning (savings/accumulation analysis and/or cash flow/budgeting)!

Of course, financial planning itself doesn’t just end after the initial plan is delivered, and instead transitions into implementation and ongoing monitoring as well.

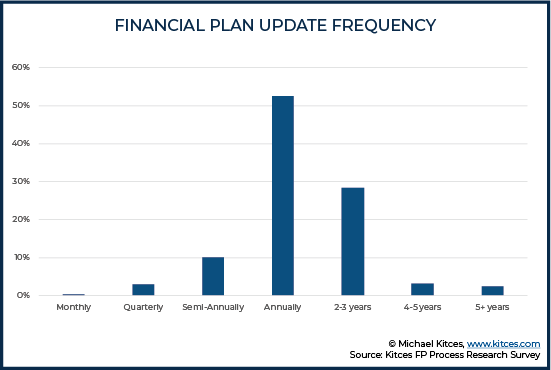

When it comes to ongoing clients, most financial advisors update their financial plans at least annually (53%), and most of the rest do so every 2-3 years (another 28%).

Still, though, the time to do financial planning, and cover everything in the upfront and ongoing relationship, is time-intensive. In fact, our Kitces Research study shows an average of 35 hours spent across all team members over the entire first-year client relationship!

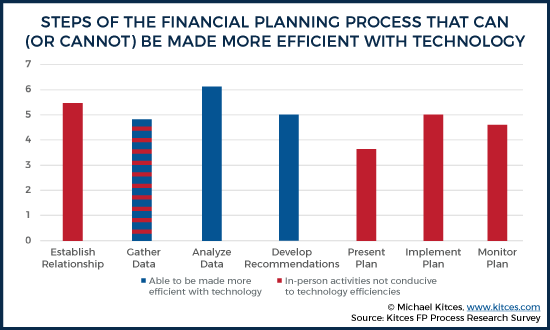

The time-consuming nature of planning has created a growing focus in recent years on how to make it more efficient… although notably, our Kitces Research data shows that planning is surprisingly ‘resistant’ to time savings!

Though this isn’t necessarily surprising, given that many of the steps of the financial planning process involve in-person meetings with the client to gather data, deliver a plan, and implement recommendations (which isn’t conducive to technology efficiency anyway).

However, even amongst advisors who do actively use financial planning software, our Kitces Research study doesn’t show that advisors are any faster using planning software. For instance, as shown earlier, most advisors using technology in advance to gather data are still having in-person data gathering meetings with clients as well, allowing them to conduct a deeper and more qualitative data gathering meeting, but actually increasing the total time to produce a financial plan (given both the data gathering meeting and the separate process to collect data from the client upfront!).

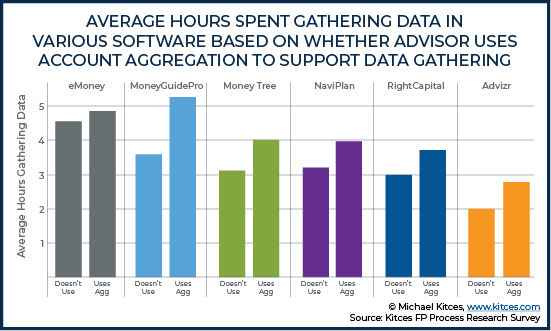

Similarly, leveraging account aggregation to feed data into financial planning software, in theory, saves time for advisors. Still, in practice, those using account aggregation tools spent more time in their planning process… ostensibly leveraging the additional data to go deeper into delivering better planning advice (rather than just doing it faster). Which isn’t entirely surprising, given our Kitces Research also shows that financial planners are more driven by the intrinsic desire to help and serve clients (than to just maximize profits by minimizing the time spent serving their clients through technology efficiencies).

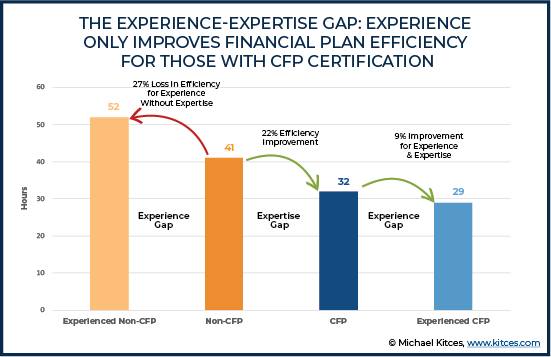

On the other hand, our research did discover that there are time-saving opportunities for firms in the financial planning process… but by investing into the financial planner, rather than the financial planning software.

For instance, our study showed that CFP professionals average only 32 hours in the first-year process, while non-CFPs average 41 hours. In addition, amongst the most experienced advisors – who tend to have the most affluent and complex clients – average planning time for non-CFPs increases to 52 hours in the first year, while experienced CFP professionals get more time-efficient (cutting their average time down to just 29 hours!).

Nonetheless, our Kitces Research data suggests that there are still many gaps and opportunities for financial planning software to get a lot better!

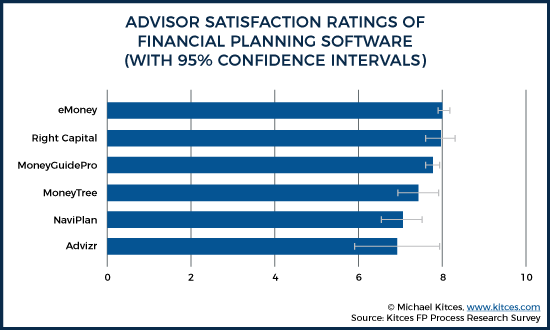

On the plus side, advisor ratings for the leading financial planning software solutions were all relatively strong.

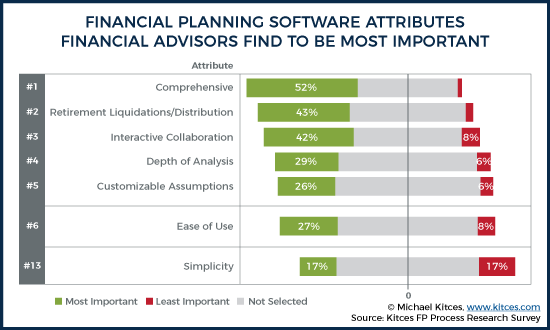

However, despite the recent industry focus on making planning software faster and easier to use, the biggest drivers of Advisor Satisfaction with software was not actually tied to the latest trends of “Ease Of Use” and “Simplicity” in planning software (which ranked #6 and #13 most important, respectively), and instead were most related to the flexibility of the software’s planning methodology, its comprehensiveness and customizability, and its interactivity to use live with clients!

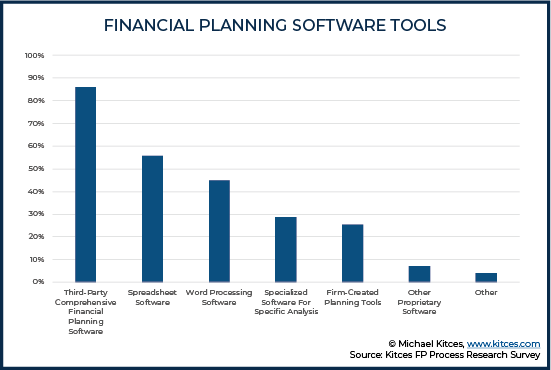

More generally, financial planners still reported significant gaps in the functionality of today’s financial planning software as well. While 86% of advisors use third-party financial planning software, 56% also use spreadsheets for supplemental analyses, 29% use other specialized planning software tools (e.g., Social Security analysis or tax planning software), and 45% also use Word or a similar tool to actually produce their financial plans (because planning software alone doesn’t allow for sufficient customization of the report itself).

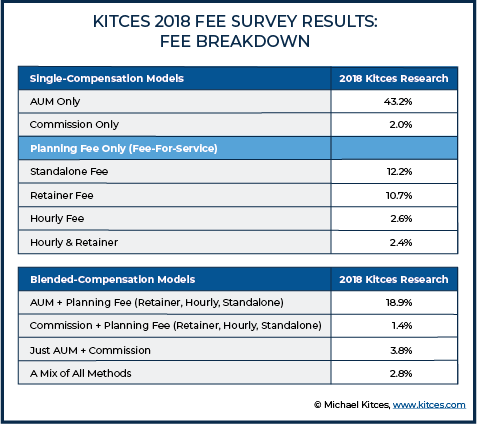

Also notable in the Kitces Research Study on Financial Planning is that, despite widespread fears of “fee compression”, amongst those delivering financial planning the trend appears to be a slow and steady rise in the fees that advisors are charging (as they obtain CFP certification and leverage financial planning software to do deeper and more comprehensive analyses). In part, this is driven through an expanding number of ways that advisors get paid for the planning itself – with our research finding that amongst planning-centric advisors, only about 40% were using an AUM-only model, nearly 30% are operating under “fee-for-service” (planning-fee-only) models, and nearly 25% are using ‘blended’ fee models – leading to an average fee of $2,361 to produce a written financial plan (and an average hourly rate of $233/hour), which is higher than recent industry studies in recent years on what financial planners charge for their financial plans.

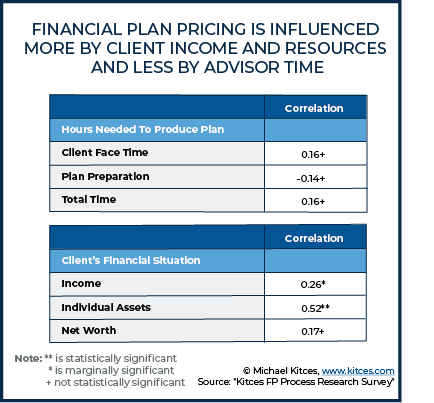

Yet even with rising fees (or at least less ‘fee compression’, the Kitces Research data suggests that advisors do not necessarily tie their planning fees and business model to the actual time and cost to produce the plan in the first place! Instead, planning fees may partially be related to “face time” and the number of available client meetings (as those aspects of the financial planning process, although statistically insignificant, had a positive relationship with the price of the plan). Furthermore, the time for plan preparation actually had a negative relationship to the fees that advisors are charging!

On the other hand, what did matter in the pricing of financial planning services was the affluence and complexity-needs of the client. In other words, financial plans are being priced on tthe value of what the planning is worth “to the client” given their own financial needs and situation – not the time it takes to actually make the plan. Or stated more simply, it appears that financial advisors price financial planning primarily using a value-based pricing approach (i.e., what is value to the client), and not cost-plus pricing models (i.e., pricing based on the cost to produce the plan plus a profit margin).

Identifying New And Emerging Trends In The Delivery Of Financial Planning

The ongoing evolution of financial planning – driven by improvements in advisor technology (and industry technology more broadly), shifts to the financial advisor business model, and the winds of regulatory change – is evidence that the service of financial planning itself is dynamic and continues to change over time. Accordingly, we’re excited to announce the new second edition of the Kitces Research Study on How Financial Planners Really Do Financial Planning, specifically to explore how the delivery of financial planning is changing in these turbulent times.

Our new 2020 survey will continue to focus on how financial planning itself is being done, including the actual process advisors use with their clients, how (and what) is delivered to clients at the end of the planning process, what advisors do to support clients on an ongoing basis (and not just in the initial stages of the process), and the tools being used along the way. In addition to, once again, trends in how advisors are being compensated for their work.

We have also tightened up the survey process, reducing and refining the questions asked to make it easier to complete the survey, though we will also be asking a few new questions related to financial advisors’ vocational psychology (i.e., are the personalities of financial planners congruent with the environments in which they work?).

Last but not least, we will be delving into a few new areas (e.g., how advisors leverage social media in the ongoing financial planning relationship with clients between check-in meetings).

Ultimately, it’s our goal not only to understand how financial planners are currently delivering financial planning to their clients, but also to identify how financial planning changes over time and the tools that the industry needs to create (or improve) to make it easier, more efficient, and more valuable to do so.

Participate In The Latest 2020 Kitces Research Survey On What Real Financial Planners Actually Do!

We hope you are as excited as we are about this new research and can support us by participating in our Financial Planning Process survey. Whether you completed the 2018 survey (we want to know if your process has changed… or if it actually has not and all the naysayers are wrong), and also from those who may be participating in the research for the first time!

This year’s survey is shorter and should take about 25-30 minutes to complete. All participants will receive a free copy of the final Kitces Research Report that we produce, providing relevant information you can use to compare your financial planning process to others, and best practices you can potentially implement for yourself.

The survey will remain open until Thursday, April 30th, with the full Research Report due out in July.

Thank you in advance for taking a a little time to participate in this important financial planning research study!