Executive Summary

The traditional approach to portfolio design involves diversifying the portfolio with low-correlation investments to help maximize the portfolio’s return for a given level of risk (or alternatively to minimize risk for a given level of return).

Yet from the holistic financial planning perspective, the reality is that the portfolio – or more generally, an investor’s “financial capital” – is only one asset on the household/personal balance sheet. And for accumulators who are still working, it’s not even the biggest asset, often trumped by the individual’s human capital that may be 2X, 5X, or 10X the value of his/her financial capital!

The significance of this distinction is that to truly maximize the risk/return characteristics of an individual’s total balance sheet, and all types of capital, it’s crucial to not just view the portfolio on a standalone basis, but to invest the portfolio to diversify around the often-much-larger human capital instead. Which means workers in conservative “bond-like” jobs might have even more equity-heavy portfolios, while those in more aggressive “stock-like” jobs should invest even more conservatively!

And even for those who are otherwise comfortable with their overall level of risk and equity exposure, arguably the future of designing portfolios for accumulators in particular – where human capital is really the dominant asset – is that the asset class and sector exposures of the portfolio should be adjusted around the risk/return characteristics of the worker’s job. For instance, those who work in the tech industry might really want to own less of the Technology sector in their portfolio! And ironically, the approach is especially relevant for financial advisors themselves, who are inherently so exposed to the economic and stock market cycle by virtue of their job, that they should own less in stocks themselves… or at least, far less in Financials!

The Correlations Between Financial And Human Capital On The Household Balance Sheet

While it is perhaps not surprising that most portfolio managers focus primarily on a client’s portfolio, the reality from the holistic financial planning perspective is that the household balance sheet includes more than “just” the portfolio of similarly liquid financial assets. Real estate holdings are often also material, whether it’s the primary residence or other directly owned investment real estate. Also material is the (albeit illiquid) asset value of future Social Security payments, or the lump sum value of a pension (which is still an asset, even if not actually converted to a lump sum). And of course, for younger workers their greatest asset is simply their ability to work and generate income in the future (i.e., their “human capital”).

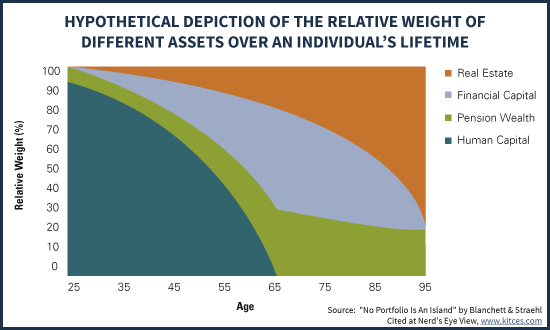

In fact, as David Blanchett and Philip Straehl of Morningstar point out in their recent paper, “No Portfolio Is An Island”, the reality is that for most of our lifetimes, our financial capital is actually a minority share of the household’s total balance sheet, which is dominated in the early years by human capital (measured as the present value of our future earnings), and in the later years by the remaining values of pension and Social Security wealth along with real estate (e.g., the primary residence). Ironically, the only moment at which financial capital briefly comprises the majority of total household assets is right at the transition into retirement!

A key implicit point made by Blanchett and Straehl of this entire household balance sheet is that not only is financial capital a minority share for most of one’s lifetime, but the factors that impact the value of your financial capital can impact the value of your other assets as well.

For instance, while an individual’s human capital is a significant asset throughout the working years, its value is not always stable – not merely because of idiosyncratic issues like whether the person can successfully get a raise or not get fired, but also because of the broader economic environment, too. At varying points in the economic cycle, industries may benefit from more or less wage growth (e.g., the manufacturing sector gives raises during economic growth environments but cuts raises and may engage in layoffs during a recession!). And there’s the risk that companies in the industry will go out of business altogether (as measured by their investment grade bond yields and their risk spread over government bonds).

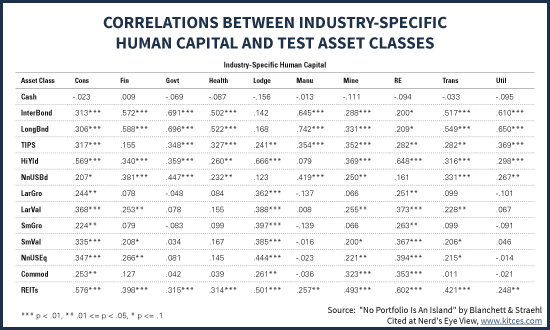

Since these factors – from the economic growth cycle to wage growth to interest rates and corporate spreads – impact the value of financial as well as human capital, Blanchett and Straehl analyzed the correlations between investments in the major asset classes, and the human capital value for various industries between in which someone might work (based on the 12 industries reported on in Kenneth French’s data library).

As the results reveal below, the correlations between the two can be quite significant, and quite varied from one industry to the next. For instance, high-yield bonds have a .65 correlation to the real estate industry, but no statistically significant relationship to manufacturing; the manufacturing industry shows the strongest relationship to long-term government bonds, though that asset class has no relationship to the lodging industry; yet human capital in the lodging industry actually has the strongest correlation of any industry to all the equity asset classes (including large cap growth and value, small cap growth and value, and non-US equities).

Adjusting Your Portfolio Asset Allocation Based On Your Job

From the portfolio construction perspective, diversification is achieved by including asset classes that have a low (or ideally, negative) correlation to one another. And conversely, including asset classes that have a high correlation to each other can amplify the overall risk of the portfolio. In fact, the whole process of mean-variance optimization in portfolios is to maximize risk-adjusted return by blending together assets with appealing return characteristics in a manner that minimizes the portfolio’s volatility for a given level of return.

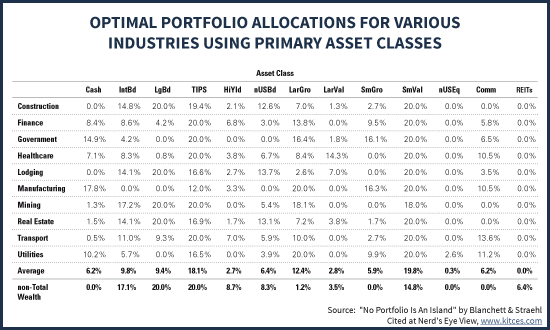

And while mean-variance optimization of portfolios was built primarily to optimize around the available investments in the portfolio, there’s no reason it can’t be applied more broadly across both financial and human capital. As shown above, the value of human capital has different risk-return characteristics, and different correlations to other portfolio asset classes, depending on the industry in which the person works. Which means for a job in a given industry, it’s possible to determine what the optimal allocation would/should be to various asset classes, where the asset allocation is designed to diversify around the existing human capital asset.

As the chart reveals, once the risks and volatility of human capital are considered, the “optimal” portfolio looks remarkably different than the traditional portfolio construction! For instance, given that REITs are already sensitive to both interest rates and the economic cycle, they add no unique diversification value around a worker’s existing human capital; similarly, in perhaps a nod to the international/global nature of most businesses today, international diversification into non-US equities shows almost no value in the human-capital-diversified portfolio. On the other hand, small cap value is an especially appealing diversifier, though this result may be at least partially an artifact of Blanchett and Straehl optimizing with cap-weighted industry indexes (which will naturally have a large-cap bias to them, implying that if a worker knowingly was already employed by a smaller capitalization company, owning more small cap stocks may not be as valuable after all, and the portfolio would tilt even more large cap instead!).

In some cases, the optimal exposure and relevance of a particular asset class is very sensitive to the particular industry. For instance, high yield bonds are most relevant as a diversifier for those working in financial services or the transportation industry, but not for government workers, or those in mining or utilities. Long-term government bonds (and also non-US international bonds) are especially good diversifiers for construction, lodging, mining, and real estate industries, but quite poor for government, healthcare, manufacturing, and utilities workers.

Overall, the study finds that the average allocations of a human-capital-adjusted portfolio change by 37.6% when the role of human capital is considered (versus just designing a standalone portfolio), and the allocation change is more than 50% for the most ‘extreme’ industries of government, manufacturing, and utilities (i.e., those industries have the most materially different risk/return and correlation characteristics that lead to materially different optimal portfolio outcomes).

Allocating Sector/Industry Exposure Around The Job Industry

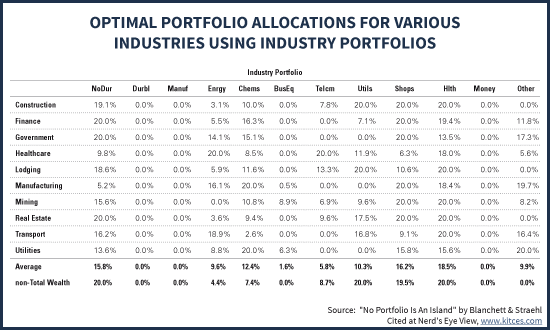

Drilling down to a level deeper, the reality is that portfolios may not only be allocated on an asset class basis around a worker’s existing human capital (and job industry exposure), but the sector/industry allocations within US equities in particular can also be allocated around sector exposure. For instance, owning Utilities stocks probably isn’t very helpful for someone already working in the utilities sector, but could be a very good diversifier for someone working in the construction industry.

Accordingly, the chart below shows the optimal industry percentage allocations of the portfolio for various workers, depending on what industry they’re working in (again based on French’s 12 industry classifications). As with the asset class allocations, the chart reveals that the optimal industry allocations of portfolios can vary significantly depending on the worker’s industry, with manufacturing, utilities, government, and healthcare showing the most significant differences from a neutral (job-agnostic) portfolio design.

Notably, the results suggest that certain industries have no useful portfolio diversification value at all, relative to the risk already contained in the worker’s industry employment. The optimal allocation to the Money (financial services), Durable, and Manufacturing industries is 0% across the board for workers in all industries, and the optimal allocation for the business equipment sector is 0% for most industries as well.

On the other hand, notably these industries also had optimal allocations of 0% when ignoring the worker’s industry altogether (shown in the last line of the chart labeled “non-Total Wealth” allocations), suggesting that these sectors aren’t ‘uniquely’ bad for workers but simply not additive to portfolios in the first place (and don’t become additive to most portfolios even after the risks introduced by accounting for human capital exposure).

Is The Future Of Portfolio Construction A Job/Industry-Specific Endeavor?

While historically most financial advisors have not even shown a client’s human capital on his/her personal balance sheet, the reality is that for most accumulators, human capital really is their biggest asset, often trumping the size of the financial portfolio by a factor of 2X, 5X, or 10X or more! Which implies that effective asset allocation of the entire household balance sheet really should take that enormous asset into account, and adjust the portfolio accordingly, at least for workers still in the accumulation phase (for retirees, whose human capital has declined to zero, a portfolio-only allocation is more appropriate, although perhaps could still be adjusted to account for the significant asset value of illiquid income streams like Social Security benefits).

Thus, while some might argue with the particular selection of industries and data used in the Morningstar paper (which relied on the Kenneth French 12-industry data series, rather than the more-commonly-used-for-portfolios 10 sectors classification), or the nature of how the Morningstar authors optimized portfolios (which excluded some sectors like Financials and Durables that are commonly held as a baseline in most portfolios), the fundamental point remains that human capital really does have significant value, significant risk, and a significant relationship to the risk/return characteristics of the rest of the portfolio. Which represents an opportunity to diversify against those risks.

So how might this approach look in practice? A starting point would be to reduce a client’s U.S. sector/industry exposure based on the industry in which he/she works (e.g., less in Utilities for someone who works in the utilities sector, less in Technology for someone who works in the tech sector, less in REITs for someone who already works in real estate), along with adjusting cap-weighted exposures as well (e.g., more in small-cap for someone who works for a large-cap company, and less in small-cap for someone who already works in a small business environment). The point here is not that working for a small business means you are already capturing the “small cap premium” for stocks, but simply that the factors that impact small cap stocks (most notably, the economic cycle, to which small cap stocks have a higher beta) are also more likely to impact the job, too. In other words, a growth cycle is more likely to benefit both at the same time, and severe recession is likely to hit both, hard, at the same time, which is the antithesis of good diversification!

Diversifying As A Financial Advisor

Notably, this approach to portfolio construction is ironic, as it is especially relevant for financial advisors themselves, whose job outcomes are especially exposed to, and correlated with, the economy and the stock market. In other words, when a recession occurs and a bear market emerges, it’s a hit to everything from your job prospects as a financial advisor to the profits of your advisory firm. And of course, for advisory firm owners, the situation is even more extreme, as the value of the firm itself – valued as a multiple of profits or free cash flow – is correlated to the markets as well, but is even more volatile!

In turn, this implies that advisors who are still working and own an advisory firm should be especially conservative with their own portfolios, dialing down equity exposure (and especially the Financial sector exposure), maintaining a larger cash allocation and/or emergency reserves, and more aggressively paying down any debt on the personal balance sheet that creates personal financial leverage. (In point of fact, this is actually how I manage my own personal financial planning for retirement!)

Risk Tolerance, Behavioral Finance, And Other Psychological Barriers

One important caveat to the approach of investing and diversifying financial capital around human capital is that it can lead to portfolio allocations that, when viewed in isolation, may feel ‘extreme’ or ‘distorted’ to the investor.

For instance, a government employee who has an extremely conservative “bond-like” human capital, and is young (such that his/her human capital might comprise over 90% of net worth) might well invest his/her portfolio to be 100% in equities. Even after making that portfolio allocation, the investor’s total household net worth would be allocated to a 10/90 portfolio (10% in equities all in the portfolio, 90% in bonds all in human capital).

However, on a standalone basis, the portfolio is still 100% in equities, which might be reasonable from the perspective of the overall balance sheet and the investor’s risk capacity, but may still feel like a breach of the client’s conservative risk tolerance. In other words, ‘academically’ we might observe that the investor’s entire household is a 10/90 allocation, but to the extent we compartmentalize assets into discrete segments, the investor may feel like he/she is bearing an uncomfortable 100% equity portfolio (and fail to recognize the role his/her ‘invisible’ human capital is playing). Notably, a similar problem occurs when retirees try to allocate a portfolio around the bond-like asset value of their Social Security, which again can result in allocations that are “reasonable” for the household overall but appear concentrated and risky when looking just at the portfolio itself.

At the opposite extreme, an aggressive entrepreneur whose human capital is extremely stock-like would ideally allocate his/her entire portfolio to bonds and cash, just trying to tone down and diversify what otherwise may be a nearly-100%-equities household balance sheet. From the financial planning perspective and the investor’s risk capacity, this may seem entirely reasonable – a stock-like job plus the volatile value of a business really is risky, and should be dampened down with a significant bond/cash holding and a large emergency reserve. However, in reality an aggressive entrepreneur who has a high tolerance for risk in his/her job and business probably also has a high tolerance for portfolio risk, too. In other words, if the entrepreneur is so risk tolerant that he/she really is ok with 100% equity exposure, then both the job/business, and the portfolio itself, would all be fully invested in stocks, rather than using the latter to diversify against the former.

Of course, even in a situation where the entrepreneur is content to be the equivalent of 100% in equities, through a combination of the job/business and also the portfolio, arguably it’s still relevant to diversify by sector/industry even if not based on asset classes on total equity exposure. In other words, the entrepreneur may be comfortable with 100% equity exposure across the board, but it still makes sense to own less in Financials in the portfolio if the entrepreneur’s job is running a financial advisory firm (which is already the equivalent of a concentrated investment in just the financial sector). This won’t run contrary to the investor’s overall risk tolerance (and/or desire for risk); at this point, it’s just a prudent diversification within equities, just as any highly-risk-tolerant client is still encouraged not to hold concentrated equity positions but a diversified 100% equity portfolio instead!

Investment Tools To Create Industry-Based Portfolio Allocations For Accumulators?

Ultimately, my gut is that the Blanchett and Straehl “No Portfolio Is An Island” paper may be setting the groundwork for what could someday become a new standard in how we invest the portfolios of accumulators, where asset classes and equity exposure are adjusted for a worker’s human capital, and/or at a minimum the sector/industry exposures of the portfolio are adjusted to diversify against human capital risks.

Unfortunately, at this point we lack tools to actually execute on the strategy, beyond operating at a conceptual level with strategies like “own more/less risk based on the lower/higher volatility of the worker’s job and career trajectory” or “own less in financials or tech for those who already work in those industries.” That’s is perhaps a good starting point, but alas it’s difficult to apply consistently across a broad base of clients with a wide range of situations.

In the future, though, it wouldn’t be surprising to see new set of investment tools evolve – perhaps technology/software designed to take information about an investor’s human capital, and come up with a more precise series of portfolio allocations that allow for better household diversification. Such an approach could be a significant value-add for “personalized” portfolio design. And notably, because the interrelationship between assets can change, and because over time a worker’s human capital may decline (as he/she progresses through working years) and the financial capital should increase (as savings occurs), the portfolio will need monitoring and ongoing management to be reallocated as the balance of human and financial capital changes over time (not to mention the impact of job/industry changes, raises and job promotions, etc.).

Fortunately, though, the strategy would at least be feasible for most advisors to implement in today’s marketplace, given the proliferation of sector-specific ETFs (e.g., the Select Sector SPDRs), which allows the advisor to recreate the total equity exposure of U.S. stocks but with more/less of certain industries that are duplicative or diversifying given the investor’s human capital. In other words, in the future it may become less common to own single “core” investment positions like the S&P 500 ETF or a Total Stock Market index ETF, substituted instead for a series of sector ETFs that re-create the broad market sector weightings and then adjust for human capital diversification opportunities. (And notably, this may also be an opportunity for a Turnkey Asset Management Platform, or even a ‘robo-advisor’, to develop an automated technology solution for advisors to help with implementation!?)

On the other hand, it is ironic that as an investment strategy that pertains primarily to workers, the greatest blocking point for most workers to implement may simply be that traditional employer retirement plans rarely hold a breadth of sector funds for investors to allocate amongst. And even if they could, the complexity of the portfolio design may be difficult for most investors to execute on their own (after all, in 401(k) plans we still see that many investors have trouble even implementing basic asset allocation!). So for the time being, diversifying around human capital may be far easier within an IRA than within a 401(k) or other employer retirement plan. At least, until asset managers perhaps create “target industry funds”, a new form of “target date funds” allocated not based on the worker’s planned retirement date, but allocated around the industry of the company that is sponsoring the 401(k) plan!?

So what do you think? Would you consider allocating a worker’s portfolio around his/her human capital? Do you currently adjust a client’s equity exposure higher or lower based on his/her job? Would you consider adjusting industry/sector exposure in this manner as well?

We have been accounting for Canada’s over exposure to mining , energy and financials as we index by sector and also when people work in these sectors , so yes I agree! Its a way to reduce risk . Kathy Waite Fee Only Planner Saskatchewan http://www.yournwm.ca

Very interesting and thought provoking. I have forwarded this to my colleagues in the office for a discussion. We do address this somewhat when working with Real Estate professionals but not really for any other industry. Another interesting twist is the correlation between multiple earner households and how to determine a correlation for them. For example, I have a friend from my CFP program who works with her husband, both financial planners. They would obviously need to be more careful than say a FP who is married to a doctor. Disparity of incomes between spouses should be a focus as well in the analysis.

Don’t we already adjust people’s portfolios based on their job stability and overall risk tolerance? Bond-like Jobs vs. Stock-like Jobs are already accounted for when we go through life insurance and emergency fund structuring. I think wages should still be separate from the investment portfolio. Just because I work in the tech industry/manufacturing/financial/etc. doesn’t mean I should be overweight/underweight in that sector from an investment standpoint. That risk is already “hedged” with my insurance and liability planning. Did I miss the point of the article?

Stan,

Life insurance protects against the economic loss of death. It doesn’t help much for the economic impact of unemployment, layoffs, diminished wage growth in your industry, etc. If you were a travel agent in 2000 or a taxi driver in 2015, there are broad industry impacts hitting you now and severely impacting your earnings potential that go far beyond just having life insurance or a 6-month emergency reserve. Ditto if you worked for a tech company in 1999, or a real estate or financial services firm in 2008.

– Michael

As a starting point wouldn’t you first do an analysis about how much portfolio returns, deviation, and drawdowns would differ with broad allocation A vs. broad allocation A minus 1 sector?

Because I’m just guessing here that you probably wouldn’t get statistically significant differences in any objective measure of risk. If true, most of this endeavor would result in wasted effort and possibly cost (if not HNW where it becomes economical to build their own index funds for tax reasons) in a theoretical wild goose chase.

Now volatility of chosen career is a different story because that impacts the possible need for liquidity. A federal employee is far less likely to require significant liquidity in a recession than business owner in a cyclical industry. The risk of needing to sell assets and/or lever in a recession necessitates sufficient allocation to assets not likely to be severely depressed at the same time.