Executive Summary

As the case of Camarda vs CFP Board winds closer towards a potential trial date, estimated legal costs for the organization continue to mount, and what started out as a dispute regarding a disciplinary action for one certificant may end out being a multi-million dollar expense for the CFP Board by the end.

Yet what’s really at stake for the CFP Board is not just the expense of pursuing a lawsuit – and potentially paying additional damages if found guilty, and more damages if others who have been disciplined by the DEC return to challenge their outcome, too – but the risk of a legal stigma against it for being found guilty in a court of law of breaching its contract with CFP certificants by failing to promulgate clear rules and enforce them consistently. Such a stigma that could haunt the organization for the foreseeable future as it attempts to establish the CFP marks as the minimum standard for a financial planning professional in the eyes of regulators, legislators, and the public.

Of course, if the CFP Board had an unequivocally clear case for defending itself and its actions, it would be only natural for the organization to protect its interests by pursuing the case to its bitter end. Yet with a litany of embarrassments for the organization in trying to enforce its compensation disclosure rules over the past 2 years – culminating most recently in the resignation of its own Managing Director of Professional Standards (a concerning vote of no-confidence from its own key employee?) – the CFP Board may be at more risk of losing than it is willing to publicly admit.

Unfortunately, the Camarda case has progressed so far that at this point, even settling will still be a very potentially expensive proposition for the CFP Board, and with so much in sunk costs it may seem like proceeding to trial is the inevitable conclusion. Yet with the benefits of winning so outweighed by the adverse consequences of a loss, and the CFP Board’s compensation disclosure challenges over the past year raising the concern that the CFP Board might not prevail in its defense, the question arises: should the CFP Board really be taking the risk, or will its Board of Directors intervene to protect the organization’s long-term interests?

You can view the CFP Board's official response to this post at the end of this article.

The Stakes Of The CFP Board’s Camarda case

Having perhaps underestimated the persistence of the Camarda’s in their lawsuit, the stakes in the CFP Board’s case have risen dramatically over the past year, with both financial and legal ramifications for the organization.

Legal Fees And Staffing Costs

Earlier this year, Financial Planning reported that as a part of its ongoing court filings in the Camarda case, the CFP Board acknowledged that it had already logged more than 2,000 hours of legal work just to comply with the Camarda discovery request… which, at a “conservative” $300/hour for Washington DC lawyers, would imply a cost of more than $600,000 for the discovery phase of the case. And of course, that doesn’t include the long series of legal motions that have gone back and forth as a part of the discovery process, and all the other legal work that has been underway behind the scenes since the Camardas were first notified of the adverse decision for their appeal in early 2013 and decided to file suit. Not to mention CFP Board staff compensation costs for the time that Michael Shaw (Managing Director of Professional Standards and Legal, at a Form-990-disclosed annual salary and other compensation of $326,000) and his staff have put in for this case instead of attending to their other CFP Board duties over the past 2 years. In total, it’s seems reasonable to suggest that the CFP Board was already into the case for upwards of $1,000,000 by the end of the discovery phase.

Of course, even these costs may still pale in comparison to the total legal bills the CFP Board may face by the end of the case. The above-mentioned costs were just for the CFP Board to gather its own documents and prepare for discovery, not including the analysis of the similar reams of documents the Camardas have provided, and the true cost of a case can become dramatically more expensive once the deposition phase begins, including the hiring expert witnesses (and counter witnesses) to evaluate the facts and details of the case, and the hours of lawyers involved to depose each and every witness. And with the depositions phase reportedly just wrapped up in recent weeks, now the CFP Board will just begin to prepare for the next phase, the actual trial (which will include more time with lawyers and expert witnesses pouring over the details of all the depositions). All in, with outright legal costs and the indirect costs of staff time (for both supporting legal work, and the time to be deposed and pursue the case), it’s not hard to imagine that the CFP Board could be in for $1,500,000 to $2,000,000 or more to pursue the Camarda case to the bitter end.

Granted, this cost isn’t necessarily destructive to the CFP Board, which according to its Form 990 for 2012 has annual revenue of approximately $26M. Though notably, because $145 of its annual dues are explicitly earmarked for the organization’s ongoing public awareness campaign (adding up to almost $10M across 70,000+ CFP certificants), the true “core” operating budget for the organization is probably closer to $16M, which would put the cost of the Camarda case at close to 12% of annual operating expenses! Or viewed another way, with 70,000 CFP certificants, the costs of the legal battle could be as much as about $30 per certificant by its conclusion next year.

Yet to truly consider what’s at stake financially for the CFP Board, it’s necessary to consider not just the CFP Board’s costs, but also what the CFP Board could be on the hook for if they lose. At a minimum, if the Camardas prevail, the CFP Board could potentially be assessed the Camardas legal costs for having pursued the case to defend themselves – which, if they’re anything like the CFP Board’s own efforts, could amount to another $1,000,000 or more in legal fees. And then there’s the reality that the Camardas are suing not only to block the CFP Board’s public letter of admonition and also their legal costs, but at this point are suing for business damages caused to the Camarda’s business and reputation as a result of the publicity of the case and the CFP Board’s allegations against them. What if the courts also decide that the near- and long-term damages to the Camardas’ business amounts to several million dollars more? Could the CFP Board be facing the possibility of a $5,000,000, or $7,000,000, or even $10,000,000 tab if it loses and the Camardas can substantiate significant business damage?

At these levels, the issue is no longer just the potential for a small dent in the CFP Board’s annual profit-and-loss and a little spend-down from its balance sheet due to some “extra” legal costs. According to the CFP Board’s Form 990, its total reserves and long-term assets are almost $24M, which means a significant loss for the CFP Board would put a significant dent in the reserves it has accumulated cumulatively over its decades of existence. While still not a threat to the near-term financial viability of the organization, such a loss would be felt financially for many years to come if the organization is forced to rebuild its reserve capacity.

Non-Financial Concerns In Losing The Camarda Case

Beyond just the financial issues, it’s also crucial to recognize the equally-important non-financial stakes for the CFP Board as well. Ultimately, the case of Camarda vs CFP Board is not actually about whether the Camardas were in violation of the compensation disclosure rules or not; it’s about whether the CFP Board breached its contract with CFP certificants, failed to give due process to the Camardas by not promulgating clear and consistent rules, and failed to enforce those rules fairly and consistently.

As a result, if the CFP Board loses, the door is open for virtually every other CFP certificant the CFP Board has ever brought before the DEC to question whether they, too, got a fair hearing with fair enforcement or not. Which means if the CFP Board loses, Camarda may just be the first of many (expensive) legal cases that could follow… and that in turn could lead to not only subsequent embarrassment for the organization, but a series of lawsuits for damages (from Alan Goldfarb, and anyone else ever publicly admonished who could claim similar business damages to the Camardas) that could actually become an even-more-material threat to the CFP Board’s financial viability.

Even if/after surviving all the legal costs, though, the true consequence of a loss in the Camarda case is that it would enter into the permanent record a judgment against the CFP Board for failing to issue clear rules and standards and not providing due process in enforcing them fairly and consistently. This kind of adverse ruling will be thrown in the CFP Board’s face in every political and lobbying effort it engages in for the next decade or two. CFP Board as a potential regulator or overseer for financial planners? Not when they don’t enforce rules effectively and fail to provide due process to those who appear before the DEC, as shown in the case of Camarda vs CFP Board! Use the CFP marks as a minimum standard for financial planners for Federal or state regulation? Not when they can’t issue clear rules and enforce them effectively, as shown in the case of Camarda vs CFP Board! Even if the CFP Board wishes to someday forget the outcome of an adverse ruling, its political enemies will never allow the CFP Board – or the regulators and politicians they lobby – to forget. Losing Camarda vs CFP Board could impair the CFP Board’s ability to be an effective part of rulemaking for the future of the profession, which opens the door for an alternative mark or state-based license to arise instead, permanently knocking the CFP Board and its marks out of the running to become the minimum competency standard for the financial planning profession.

In addition, the risk to the CFP Board goes even beyond its potential political damage with legislators and regulators. A part of the Camarda allegations are that the CFP Board has misrepresented the CFP marks to the public by claiming that the standard is higher than what is actually being effectively enforced. The legal charge – technically claiming a violation of the Lanham Act – effectively amounts to a claim that the CFP Board has been engaging in false advertising, even as it is in the midst of its ongoing $10M/year public awareness campaign that the CFP marks are the “gold standard” of financial planning. Which means that beyond what could be millions of dollars of damages and legal settlements if the CFP Board loses, there’s also the possibility of having flushed a significant chunk of its $30M of public awareness advertising dollars over the past 3 years down the drain by being found guilty of false advertising about its standards… or “compel” it to an even more costly subsequent public awareness campaign to repair the damage of losing the Camarda case (though CFP certificants may not be as supportive of additional fees for the next public awareness campaign!)!

What If The CFP Board Wins?

To be fair, there certainly are some benefits if the CFP Board prevails in its case against the Camardas. A victory would be legal validation of the organization’s ability to set its own practice standards and the associated enforcement process. In an environment where many designations and certifications claim high standards but few do anything at all to enforce them, a victory for the CFP Board would help to put it even further ahead of competing marks as being a valid basis to be the minimum standard for the financial planning profession. Just as a loss would be a court precedent that opponents to the CFP Board could throw at it to block the adoption of the CFP marks by regulators or legislators in the future, a victory by the CFP Board would give it a positive precedent of its own to cite on its behalf in advancing the role of the CFP marks as a true professional standard.

In addition, a resounding victory by the CFP Board also introduces at least the possibility of trying to counter-sue and recover its own legal costs from the Camardas, though it’s not entirely clear if the Camardas would even have the financial wherewithal to pay such damages if they lose (on top of their own legal fees). Realistically, it seems probable the CFP Board will pay at least its own raw legal costs (perhaps as much as $2M all-in by the end?), even if it wins. Although given the positive publicity the organization could generate if it wins on all counts, the legal fees for the case may actually be a modest cost for the benefit.

Nonetheless, arguably the CFP Board is already on its way to advancing itself as a recognized professional standard, and has been increasingly successful in this regard even without having a Camarda victory. In other words, a “win” might not even be necessary for the CFP Board to advance its agenda, but a loss would certainly damage it… raising the significant concern that the organization has much more at stake if it loses (both financially and in pursuit of its mission), than what it stands to gain by winning.

Is The CFP Board Really In Danger Of Losing The Camarda Case?

So given that there are a few clear benefits of winning (that the CFP Board couldn’t achieve anyway), balanced against a potentially long list of ramifications for losing, the question arises: is the CFP Board really in danger of losing?

First and foremost, it’s important to define what a “loss” would be. The Camardas have put forth a relatively long list of legal complaints, some of which carry more significant ramifications (both financially and legally) than others. However, while a victory on some of the charges might not necessarily bring the Camardas the full scope of injunctions and damages that they have requested, arguably being found guilty on any charge would be a substantive loss for the CFP Board, not just financially but especially in its efforts to elevate the CFP marks in the eyes of the public, regulators, and legislators. In other words, even a “small” victory for the Camardas – on any portion of the complaint – would be a very big loss for the CFP Board. The CFP Board would have to prevail on all counts to stamp the case a victory.

So given that context, what is the “risk” that the CFP Board will lose on at least one count of the complaint from the Camardas? As noted earlier, the crux of the case centers on whether the CFP Board is in breach of contract with its certificants (the Camardas) by failing to put forth clear rules to follow and/or failing to enforce those rules with a reasonable process, along with whether the rules are being enforced unfairly or in an uneven or capricious manner. In other words, it’s not actually about whether the Camardas were in violation of the compensation disclosure rules, but about how clearly the CFP Board defined those rules and its process for enforcing them.

While the discovery documents and subsequent depositions have been sealed under an order of confidentiality – so we don’t know, and may never know, the full and intimate details of how the CFP Board engaged in its enforcement process – the information that has become public, along with the subsequent actions the CFP Board has taken (and not taken) in other disciplinary actions since the Camarda case become public, do raise significant concerns about whether the CFP Board has created clear rules and whether it is enforcing them fairly and evenly. And the recent departure of Michael Shaw, the CFP Board’s Managing Director of Professional Standards and Legal, raises the concern of whether even the CFP Board’s chief attorney for enforcing the rules is having doubts about whether the CFP Board will prevail. After all, if Shaw were supremely confident about the CFP Board’s success, why resign just weeks after depositions ended and shortly before a trial date may be set, when a victory would be a tremendous plus mark on his professional career? Or is the reality that Shaw sees a potential for the CFP Board to lose, and felt the need to resign so he wouldn’t be the scapegoat when the time comes?

As discussed previously on this blog, while the CFP Board continues to insist that there have been no changes to their interpretations of the rules and that everything is “clear”, if that were the case, then the CFP Board would not over the past 2 years have had to:

- Ask for the resignation of, and then publicly sanction, its own board chair (Goldfarb) for failing to comply with the compensation definitions, despite the fact that he played an instrumental role in writing the current rules, thought he was in compliance, and has therefore suggested they are not being enforced as originally intended

- Remove two members of its own Disciplinary and Ethics Commission for also failing to following the compensation disclosure definitions when they thought they were as well

- Eliminate its own compensation definition of salary from its "Find a CFP Professional" search engine after acknowledging it doesn't reflect what clients actually pay, which was a critique first raised on this blog, yet refusing to hold the other compensation definitions to the same standard

- Issue a standalone notice to members specifically to explain the “not new” rules again

- Produce a new 1-hour webinar further explaining the “already clear” rules again

- Reset compensation definitions for all "fee-only" advisors on its website and issue yet another notice to "clarify" the rules after facing an article in Financial Planning magazine and WSJ about 468 wirehouse brokers - and apparently thousands of others at independent broker-dealers not studied by the media - who even after all of the above, including the educational outreach, were still not applying the compensation disclosure rules appropriately and had to be granted retroactive amnesty (and even though the issue had been pointed out months in advance on this blog as well)

- Put NAPFA in the position where the current rules are so unusual that as many as 5% of their own membership didn’t qualify, and forced them to redefine their rules to match the CFP Board, despite the role NAPFA has played in defining this very term for 30 years

More recently, the CFP Board’s struggles to consistently enforce its “clear” rules have only become more problematic. For instance, high-profile advisor Rick Kahler has been in the midst of a year-long ‘public debate’ with the CFP Board about how to resolve the ownership of his commission-based “related party” real estate firm while maintaining fee-only status for his financial planning firm, and the agreement reached between Kahler and the CFP Board was that the real estate commissions could be ignored by transferring the real estate company to his wife, implying that a spouse is not deemed to be a related party. In other words, a CFP certificant who owns a fee business and a commission business is commission-and-fee, a CFP certificant who does fee-only business with clients but works at a broker-dealer is commission-and-fee because the broker-dealer and other advisors there are a related party, but a CFP certificant who owns a fee business and transfers the commission business to his spouse can still be fee-only because a spouse is not a related party? (Notably, the agreement with the CFP Board did also stipulate that Kahler committed to not referring clients to his spouse’s real estate business, which arguably should be an acceptable remedy itself; however, the CFP Board has previously insisted that it doesn’t matter if an advisor claims they will not refer clients to a related party, the mere fact that the related party exists [e.g., a broker-dealer] and clients could do business with the related party is enough to taint a fee-only relationship!)

In another recent case, a complaint was filed against CFP certificant (and noted CFP Board watchdog) Nigel Taylor regarding the claim that his RIA firm is fee-only but Taylor also owns a commission-based insurance agency. Taylor disputed the claim, insisting that while he personally is a fee-and-commission CFP certificant (and discloses accordingly with clients), his RIA firm does not receive any commissions, to state otherwise would be a material misstatement of the RIA entity, and that the CFP Board has no jurisdiction over an RIA firm, only CFP certificants themselves. In protest, Taylor also dropped his CFP marks… and the CFP Board suspended the probe, despite the fact that the CFP Board’s own Terms And Conditions Of Certification state that a voluntary relinquishment of CFP certification “shall not take effect until… any complaint or action pending under CFP Board’s Standards of Professional Conduct is resolved.” Although the CFP Board does reserve the right to declare a relinquishment effective at any time, the purpose of the provision is precisely for situations like this (to prevent CFP certificants from avoiding public discipline by relinquishing their marks), and raises serious questions about why the CFP Board would choose to selectively enforce – or rather, not enforce – its rules against Taylor. The CFP Board’s decision to stop pursuing the matter was so surprising, even Taylor himself pointed out that ending the investigation without rendering a decision suggests the CFP Board lacks confidence in its own rules and enforcement process. Taylor has also openly published all of the documents and correspondence relating to his investigation, highlighting the CFP Board’s inconsistencies and lack of clarity regarding its own rules.

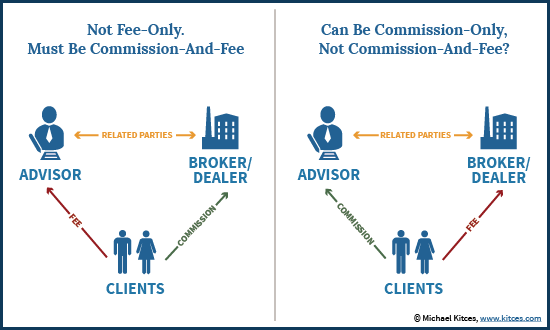

Beyond all of these issues, the next shoe to drop for the CFP Board may be its refusal to acknowledge the inconsistent enforcement of its own rules against commission-only advisors as well. While the focus for the past year has been on fee-only advisors, particularly those who have a relationship to a broker-dealer that could generate a commission – such that the advisor cannot claim to be fee-only and must be commission-and-fee – the reality is that any commission-only advisor working at a broker-dealer that could generate a fee is equally in violation of the rules (and what broker-dealer couldn’t at least possibly charge a fee!?)! Why is it that the CFP Board has publicly disciplined, and/or been compelled to grant amnesty, to all fee-only advisors with a broker-dealer relationship for not disclosing that clients could pay the broker-dealer a commission, but not required commission-only advisors with a broker-dealer relationship to disclose that clients could pay the broker-dealer a fee? While some would reasonably suggest that there’s “greater consumer risk” in the failure of a fee-only advisor to disclose a commission than a commission-only advisor failing to disclose a fee, in an era where the CFP Board insists that it has no favoritism and is enforcing all rules consistently, why is there not a consistent and even enforcement of such rules?

Perhaps most damning of all is the fact that in the Camarda’s original complaint, they point out that the crux of the case made against their improper compensation disclosures was that the existence of their fee-only firm and insurance agency together made them “functionally one entity” such that compensation should have been disclosed as commission-and-fee. Yet for all the publicity of the case since then, all of the follow-up “clarifications” that have been issued by the CFP Board, all of the subsequent rulings that have occurred, not once has the CFP Board ever publicly disclosed the “functionally one entity” precedent as a rule that all CFP certificants must follow. In other words, despite the proclaimed clarity of the rules, and the CFP Board’s insistence that nothing has been changed, the key precedent in the Camarda case hinged on a term that is not included in the CFP Board’s terminology, has never been defined or explained publicly for other certificants to be aware of, and has not been applied in any public ruling since then.

In an environment where the CFP Board’s case with the Camardas relies on it demonstrating the consistent and even enforcement of clear rules, and it must win regarding all of the Camarda complaints to be successful, the CFP Board’s problems of the past 2 years paint a very troubling picture of the risks that the CFP Board may not unanimously prevail.

Where Does The CFP Board Go From Here?

So given all these concerns about the risk that the CFP Board could lose on at least some counts of the Camarda complaint, and the highly asymmetric potential outcome of the Camarda case – where a loss would be highly damaging but a victory may only be modest benefit – what should the CFP Board do?

If there really, truly, is absolute certainly that the CFP Board will win, it clearly makes sense to proceed, especially given that with depositions complete, most of the legal costs are already in now, and the court case may be over (for better or for worse!) in the first half of 2015. At that point – whatever the outcome – the CFP Board can begin the normal process of updating its rules through a period of proposed changes and public comments.

However, if the CFP Board acknowledges there is a risk of loss – certainly a concern to this commentator, and apparently to CFP Board’s own disciplinary chief given his decision to exit the organization just months before the trial! – it raises the question of whether the CFP Board should aim to settle the case, as the public embarrassment of a settlement is still far less damaging than a recorded loss in court. A settlement is something that time can forget; a legal precedent the CFP Board loses will remain etched into every regulatory and legislative effort it makes forever.

Settling the Camarda case will not be inexpensive, given that the CFP Board has allowed it to advance as far as it has, though settling may still be less financially expensive (and certainly less damaging from a PR perspective) than losing. In addition, settling the Camarda case also allows the CFP Board to accelerate the process of updating its rules, and moving past the issue, along with considering whether to re-open and settle regarding prior public disciplinary actions (e.g., Goldfarb) as well. Another benefit of settling is that it reduces the risk that other parties will get involved if/when the Camarda case goes to trial (what if other parties, adverse to the CFP Board’s interests, suddenly appear to support the Camardas and file an amicus brief on their behalf, in an effort to put a nail in the CFP Board’s coffin?).

All public evidence from the CFP Board staff indicates that they fully intends to pursue the Camarda case to the bitter end, and that it fully expects to prevail. Yet this is the perspective from the same CFP Board that has also insisted its rules are clear and the enforcement process is consistent all along, despite the embarrassingly long list to the contrary. While it does appear that the CFP Board staff seems to have driven this case in good faith, acting with integrity about trying to remain consistent, if the organization really has been utterly failing to recognize the changes that were made to its interpretations of the rules, the ramifications of its decisions, and along the way has grossly mismanaged its legal strategy – putting it into the current position where a highly costly public settlement or a highly risky legal outcome are its only choices – is it really a good idea to let the CFP Board staff make the final call about whether to proceed from here?

Or is the reality that now is the moment when the CFP Board’s board of directors needs to act to protect the long-term strength and mission of the organization, by swallowing its pride with a confident move to settle the case, acknowledge the organization’s mistakes, hold someone accountable (though with Shaw’s resignation, that ship may have already sailed!), pay the costs of settlement while they’re not too destructive, re-engage the stakeholders of the organization to update and improve the rules, and move on with this embarrassment. Fortunately, the reality is that the organization has survived an astonishing array of blunders over the years, and it can certainly survive the embarrassment of a settlement. But losing in court is something the organization can never move past, never outlive, and is a citable legal precedent its enemies will NEVER forget. Is that really worth the risk?

So what do you think? Should the CFP Board continue to pursue the Camarda case to the end? Are the benefits of winning worth the risk of loss? Is this court case a good investment of the dollars that CFP certificants pay to use the CFP marks? Or do you believe the CFP Board should settle the case and move on?

The CFP Board Leadership Response Letter:

While I certainly appreciate Michael Kitces’ valuable comments and views on how CFP® professionals can help clients and his observations on how to improve the profession, he lacks the legal expertise and full knowledge of the facts to opine on the lawsuit Jeffrey and Kimberly Camarda brought against CFP Board.

Indeed, the blog seems to have overlooked a fundamental principle of both the legal and financial planning professions: know all the facts before making any recommendations.

Kitces is simply wrong when he says that the case is not about whether the Camardas are in violation of CFP Board’s clearly defined compensation disclosure rules and definitions. Rather, that is the heart of the case. Kitces is also wrong in pre-judging the merits and costs of the case without knowing the facts or how the pertinent legal standards apply to those facts.

CFP Board is steadfastly committed to its professional standards and disciplinary processes. As I noted in my op-ed in Investment News last May, “[t]he lawsuit fundamentally threatens the CFP Board's mission to benefit the public by challenging our ability to enforce these standards. . . . The very integrity of the CFP® certification would be undermined if the CFP Board backed down from enforcing a disciplinary decision that was imposed in accordance with its rules and procedures.”

CFP Board does not initiate disciplinary actions against CFP® professionals lightly. We also maintain the confidential nature of all disciplinary proceedings. Therefore we must exercise restraint in commenting publically on the lawsuit until the litigation is concluded. That said, we believe that the facts and the law are on our side, that we will prevail, and that ultimately CFP® professionals and, most importantly, the public will benefit from our vigorous defense.

The Board of Directors is fully engaged to protect the long-term strength and mission of the organization. We understand the facts, we understand the law, and we understand what’s at stake – the integrity of the CFP® certification and CFP Board’s enforcement process.

Ray Ferrara, CFP®, Chair, CFP Board’s Board of Directors