Executive Summary

Financial advisory firms can find themselves struggling to grow their businesses for a wide range of reasons. While some firms have difficulty developing a seamless client service experience, others may find business development strategies difficult to implement (or scale across additional new advisors) to increase their client base, and others yet may feel their executive leadership team is unable to connect with the firm as a whole. Regardless of where the difficulty lies, though, the root problem for most firms struggling with growth often lies in the lack of a well-developed training program.

For many busy firms seeking growth, investing time in establishing an effective training program is not often a top priority, and it can be difficult to even find the time to develop training protocols. However, a well-defined training program is critical not only for providing employees with a solid foundation of specific procedural requirements on how to run a firm that can grow, but also in establishing a unified firm culture that provides the vision required by employees to attract the right clients to the firm and to develop an implicit understanding of the expectations for servicing those clients. And the good news is that a good training program doesn’t have to be built all at once; instead, it can be developed iteratively, often in conjunction with fleshing out an advisory firm’s Operations Manual of processes and procedures.

Through an extensive study of employee training programs across many fast-growing financial advisory firms that were expanding their reach across the country, Herbers & Co. identified certain key characteristics that were consistent across successful training programs. From the research, they optimized an effective six-week program that can be adapted by firms to create a defined and repeatable training program for their new employees.

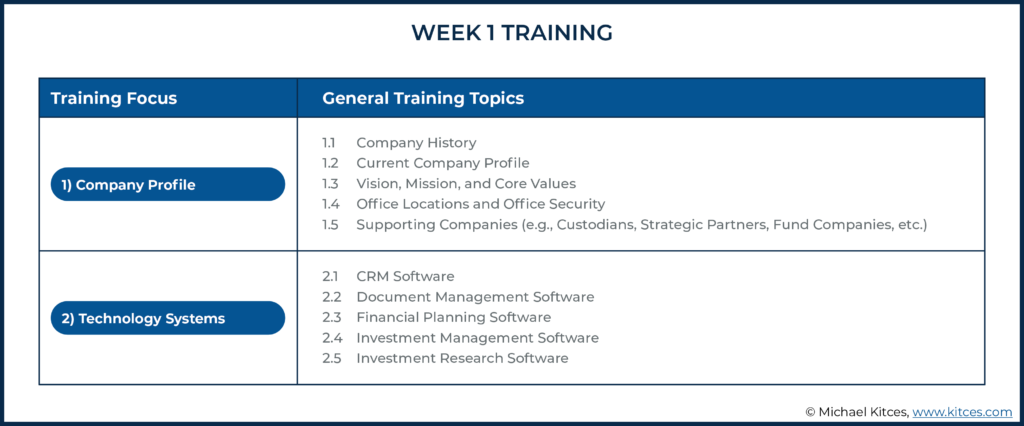

The weekly focus of the six-week onboarding training program for new employees is as follows:

Week 1. Understanding the company profile and its technology systems;

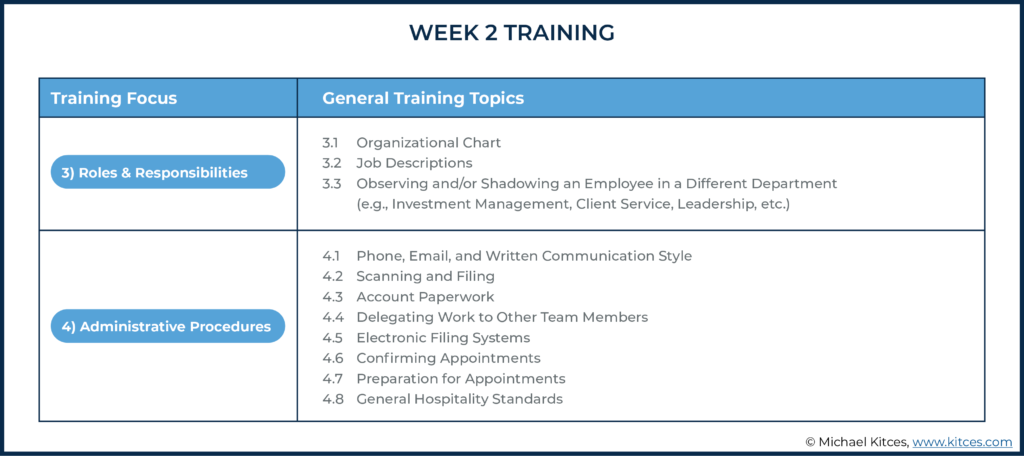

Week 2. Roles and responsibilities of employees across the firm and administrative procedures;

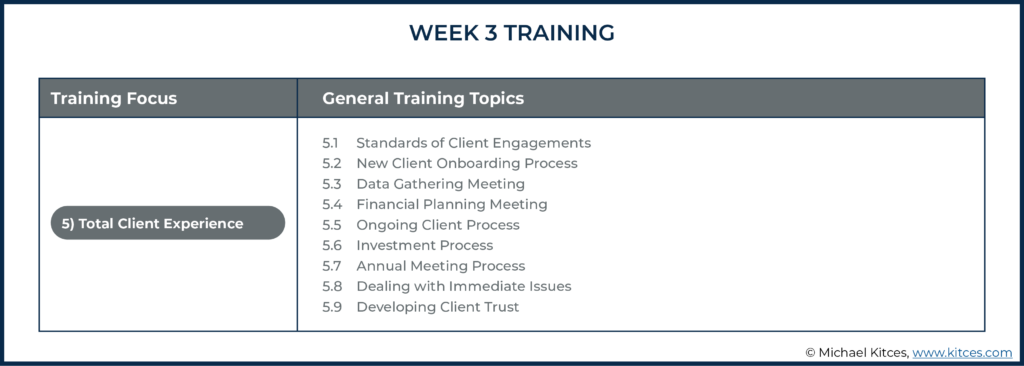

Week 3. Total client experience;

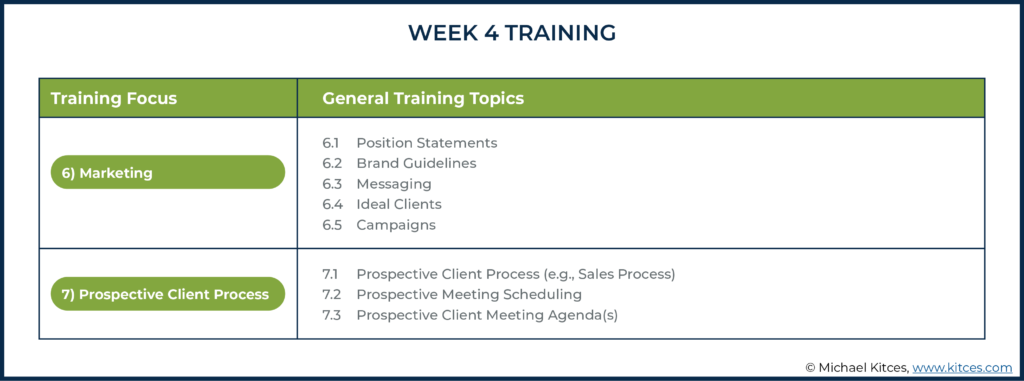

Week 4. Marketing and the prospective client process;

Week 5. Understanding the Client meeting process and client communications; and

Week 6. Compliance.

The easiest way for a firm to build a training program based on the six-week program is to develop an Operations Manual that encompasses all of the firm’s protocols and values on which training will be based. For firms that don’t already have an Operations Manual in place, it can in turn also be created one topic at a time, and over the span of several months. In fact, firms that aim to address each of the areas outlined in the weekly training topics may need up to 9 – 12 months to establish their training programs (though of course, it will still be updated over time to reflect how the firm’s processes evolve).

In today’s work environment, given our current pandemic state, it is important for remote training to be an available option for new employees. Strategies for an effective remote training program include timing the training sessions in short bursts, mixing in self-paced instructional videos, and assigning ‘homework’ exercises to be completed in between training sessions. Once the instruction and assignments have been completed, the trainer should review the assignment and offer feedback to the new employee.

Ultimately, the key point is that firms who want long-term, sustainable growth of their business need to have a well-developed training program in place. A consistent and thorough training program will ensure that all employees have a clear understanding of the firm culture and its goals, as well as being able to execute within the systems the firm uses. And while establishing a good training program can be a long-term process that may require a significant investment in time and resources, the end result will be a well-trained firm that not only knows how to operate consistently and in accordance with the firm’s culture and values to promote growth, but also is able to delegate training to more employees across the firm, which in turn frees up firm leadership from much of the training responsibilities so that their focus can be on developing and implementing growth strategies!

Most growth problems that occur within an advisory firm can be traced back to a common root cause. Regardless of whether the problem is with a firm’s service delivery to clients, the ability to attract new clients, or leadership capability among the executive team, these seemingly different issues are often much more alike than they may seem.

The root cause of most of these problems is a lack of training – for both employees and leaders within the firm. Without a well-defined training program within your advisory firm, employees and future leaders do not have a solid foundation on growing a firm, delivering a consistent client experience, and marketing the firm to attract the right type of client.

Without that baseline knowledge, employees and leaders will create their own methods, and a disjointed firm will be the result.

Yet, most firm owners look at the issues they have and pinpoint deficiencies that have nothing to do with training. They look at unmotivated employees and suggest that they need better compensation. They look at a lack of quality referrals or incoming leads and think they need better marketing. They see unsatisfied clients and think they need to change their services, segment their clients, and/or add more service to their business to improve their client experience.

Some firms may even go so far as suggesting that they need better leadership, and so they look for someone to hire onto the executive team to provide new ideas and innovation for the company.

While there will be times when these approaches are the answer, it is more commonly the case that the advisory firm leaders simply need better training programs.

The art of growing an advisory firm begins with training and continues with ongoing improvement. In this article, we are going to look at how advisory firms can structure training programs and continually improve those programs and processes over time to speed up the rate that knowledge is attained and to expedite their advisory firm growth.

How Training Programs Affect Firm Growth

Before we look at the details of a firm’s training process, it is best to back up for a brief story.

In the early 2010s, Herbers & Co. began to take a long and detailed look at how employee training programs were structured by advisory firms. In our research, we began to identify key structures that the fastest-growing firms deployed, and which were the most effective for training advisory firm employees and leaders.

It was during this time in the early 2010s that we began to see many advisory firms looking to grow a wider geographical footprint and expand their reach across the country. Naturally, the question that began to crop up was this: “How do we balance and create a culture that is spread out all over the country and still provide consistent training to all employees and leaders in different geographical areas?”

Firms were opening offices hundreds of miles away from their home office as they expanded. Mergers and acquisitions saw massive increases, and firms were rapidly growing nationally. As advisory firms began to expand outside regional domination, we were challenged to figure out a way for these firms to create a cohesive culture and get all their employees, in every office across the country, trained in the same way and with the same philosophy.

Without a defined, repeatable training process, firms risked their reputation and encountered costly turnover; at the same time, M&A failure rates created a risk to their ongoing success. In a service-based business such as an advisory firm, having different or inconsistent training programs across offices generally created ‘micro-cultures’ instead of one cohesive culture.

And incohesive micro-cultures pose a risk to the firm because no matter where the office and employees are located, a firm must deliver a consistent brand, culture, and ultimately service to its clients. The best way to achieve that is through training.

Notably, the same risks that we saw develop from inconsistent training programs in our initial research remain particularly relevant concerns today as advisors have been forced to conduct all their business remotely because of the coronavirus pandemic.

In the studies and interviews Herbers & Co. conducted of successful advisory firms across the United States, we found that a few key determinants made for great training programs. The top three findings were founder/executive leadership prioritizing training in strategic goals, an employee feedback loop to give suggestions for improvement and ideas for what they wanted to learn, and finally, consistency. We’ve learned the number one factor was consistency.

The consistency factor was easy to recognize because training was offered to staff through a regular set of meetings each month that employees came to depend on – and training programs followed a process. In other words, all employees were trained in the beginning of their employment in the same way with the same content, and then were continually trained when the content was updated, through regular meetings, throughout their employment experience as the firm evolved and developed.

With this research and knowledge, Herbers & Co. began to design and implement training programs in our client firms in the same consistent manner. In the process, we learned that firms who had training programs but that delivered them in inconsistent ways, such as with more ad hoc methods only training when needed, immediately saw changes within their growth rates when they changed their delivery to a more consistent, proactive training approach.

Over the past decade, we have taken the initial data to improve and implement countless training programs within advisory firms. And what we have discovered through this experience is a process to best train advisory firm employees and leaders.

Our experience has clearly shown that training programs can be conducted over a six-week period and can evolve over time by consistently training and retraining in six-week increments on a schedule as the firm evolves. Which means that training never ends. But also that it can be administered in ‘bite-sized’ manageable six-week stints, that all firms, no matter the size, can easily implement. In other words, you can do it!

The Six-Week Training System For Financial Advisory Firms

Before we get into the details of the Six-Week System, you need to understand that training has to be broken into two categories:

- The first six weeks an employee works at your firm; and

- Every week after that, during which an employee stays with your company.

Let us begin with new-employee onboarding in the first six weeks.

Employees make a critical decision within the first six weeks at your organization. They decide, subconsciously or consciously, whether the company would be one where they would stay long-term. The first weeks of the employment relationship set the framework for the remainder of the employee’s time at that advisory firm. First impressions don’t just matter in personal relationships; they also inform how well your employees will perform during their tenure with your firm.

Unfortunately, most advisory firms treat the first several weeks of training as a kind of 'sink-or-swim' initiation. The major issue with the sink-or-swim approach is that it is inherently illogical. It asks people to show that they are successful before they’ve received adequate and comprehensive training necessary to be successful at your firm. While some people thrive on this type of learning, many do not.

An employee can only truly deliver service in a way that is congruent with a company’s brand and systems when they understand what a firm does and how that translates to the clients it serves. Therefore, before a new employee is given any tasks of their own to do, they should first go through a six-week program that has them talking with people throughout the firm, interacting with every department, understanding what everyone in the firm does, and how it all works together.

This baseline big-picture view gives the employee the foundation on how to work within your culture, sets expectations of their performance, and helps them see how they fit within the overall success of the organization.

By providing the space to see the whole firm and its systems, you integrate new employees within your culture before you ever ask them to perform individual tasks within it. It may seem like six weeks is a long time for a new hire to be inside your organization without doing any ‘real work’, but this foundation-setting time will influence the work that they do for an advisory firm for the rest of their time with the company.

Over the course of the past decade, we have perfected the system within advisory firms to find the right learning progression of those six weeks. While every firm is different, here is a high-level overview of the training that is conducted each week, in a logical order to give all employees a baseline overview of the firm within those six weeks.

Week 1

In Week 1, we begin with an overview of the company profile and technology systems. This includes the company history, vision, mission, and core values, as well as an understanding of key partners such as custodians and fund companies, and learning about all technology, hardware, and software.

The goal of Week 1 is to understand where the company has been in the past and where it is going in the future while learning and experimenting with the firm’s technology tools.

Week 2

The second week connects the dots between everyone else in the firm by focusing on the company’s organizational chart, job descriptions, firm roles, and administrative procedures. A new employee cannot do their best work if they do not know what everyone else does to help each other and where to go for help.

During Week 2, they interact with many people throughout the company. If it is a small firm, the new employee spends time with the firm owner to understand and learn about all the different hats a firm owner wears to gain a full understanding of the work the owner carries out each day.

Week 3

Week three is a big week and delves into the total client experience process and how the firm delivers its service, the supporting materials used, and the standards of client care. This includes the new client process, meeting agendas and processes, investment management philosophy, and how your firm develops client trust.

Week 4

Once the employee understands the client experience, they spend Week 4 learning about external marketing and prospective clients.

This week, they learn how to talk about the firm, gain an understanding of the prospective meeting process, ideal clients the firm is focusing on generating, and marketing programs the firm is conducting.

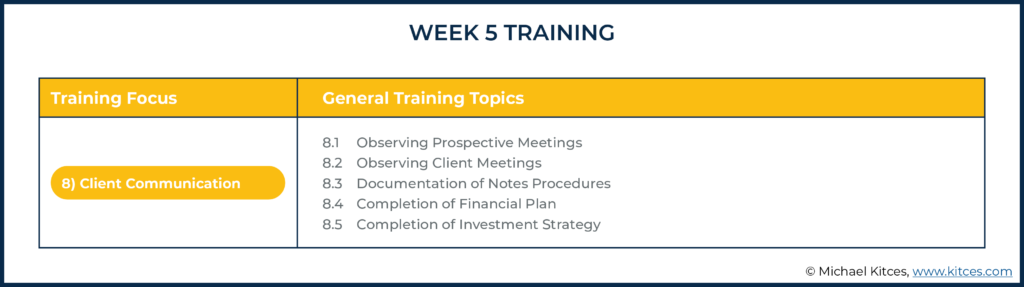

Week 5

Week 5 is a critical week for understanding growth in the firm. It takes Week 3 and Week 4 deeper, allowing much space for the employee’s questions to be answered about the client experience and the marketing processes. It allows them to complete a financial plan and create an investment strategy. In some firms, the employee will be asked to write a blog post for marketing and/or observe client and prospective meetings to understand how communication is delivered to clients.

Week 5 sets the communication standards by allowing space for observation and participation.

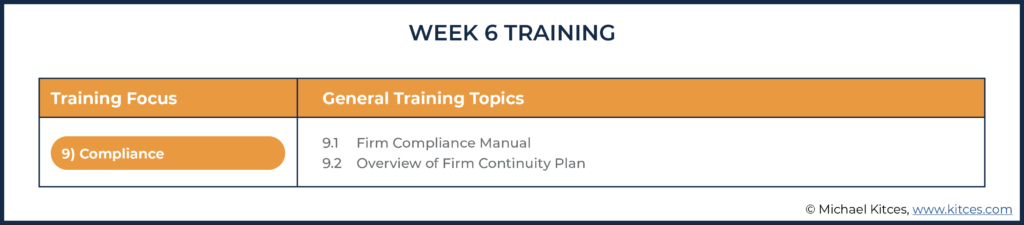

Week 6

And finally, Week 6 is about compliance requirements. During this week, the employee will go through all the compliance-related tasks and requirements to gain a full understanding of the responsibility, boundaries, and limitations they have in their position to help protect the firm.

In Week 6, the employee will also learn about disaster recovery protocols and how the firm prepares for and protects clients in the event of a crisis.

In larger firms, the entire training program is often written down in a training manual. In the modern advisory firm, there is usually an internal learning system with many videos to help the employee review and navigate what they are learning.

By documenting the program in a shared firm-wide document and/or training site, the training can be consistent and repeatable for every new employee joining the firm.

Building the Training Program

I know what you are thinking – and you are right. Building a training program for your organization is no small task. However, it does not have to be hard!

Generally, advisory firm leaders do not think about training until they are in the hiring process, and then they rush to get a training program developed, develop a training program specifically for the position they are hiring, or simply opt for the ‘sink-or-swim’ method.

But, as illustrated in the above charts, your training manual and program are simply your Operations Manual table of contents! For the firms we consult, we make this easy by focusing on one core area of the business each month to get it built.

For example, in January, the firm would build out Sections 1.1 – 1.5 as outlined in Week 1 training. Then in February, they would move to Sections 2.1 – 2.5, and so on. Generally, it takes between nine and twelve months to build the frameworks for a great training program.

Once it is built, the firm simply reviews, updates, and enhances the training program every six weeks afterward for the benefit of operating an efficient firm and training employees to be great. Think of the process like this: you update a section of the Operations Manual in month one (four weeks); two weeks later, you train the staff on the updates made. Then you repeat the process over and over in six-week periods. With time, updates are few, yet training continues each six-week period as a reminder of how the firm is designed to operate.

And here is the cool part: When the central training system is your Operations Manual, each time there is a change in the firm, or improvement or enhancement in client service, marketing, sales, etc. the Operations Manual is updated too.

Which means that your firm conducts training and development in the first six weeks of an employee’s employment – and then training never ends. And, drum roll, please… where everyone is trained, everyone can train. This means not all training has to be done by one person in the firm. It can be done by everyone, and everyone can help each other!

How a firm develops its Operations Manual (and their training program) can differ for every business. Small firms who are just hiring their first employee will create the program as they go. The business owner won’t have a training manual written out yet, but they can record a video, for example, for each session they cover with the new employee. Many of our client firms will record a video on Loom.com for training purposes, and then upload it in Rev.com to get an editable transcript for the Operations Manual.

When a second employee is added, they can go back and enhance their materials by recording more sessions that they didn’t get to the first time and/or update the initial sessions. As more employees are added, the process repeats until a firm has a solid and cohesive training program that needs only minor updates as the firm grows. The important part of developing a training program is not that it’s all done at once; it’s that it gets done over time through repeated actions.

A large firm, unlike a small firm, has the ability to build out a complete training program much more easily due to the sheer number of people in its organization. While a small firm of only a few employees may not need or want to spend the resources to map out a program, a large firm would have no problem doing so. Where the small firm will build out its program one video/page at a time as the new hire is trained, a large firm will likely designate someone on the Operations team to map out the entire training program at once and then start recording videos, even before adding any trainee subjects.

If you’re unsure about where to begin your training program and you already have employees, then you have your answer. Ask them. This is where the art of asking for help becomes vitally important for a firm owner to master.

Your employees have the experience of having gone through training in your firm, and they know what they would have liked to know and what would have helped them. Allow them to give you insights and build out your training program alongside you. When you work collaboratively like this, you can identify and avoid the problems that they encountered when you hire new employees.

How to Implement Training in a Remote Work Environment

In today’s environment, most advisory firms are working remotely. Even before the pandemic, though, many firms had a need to think about remote training – and the trend to add remote employees, whether working entirely virtually or simply at a new/different location than the firm’s original home office, will likely only increase as time goes on. Therefore, it’s important for all advisory firms to understand how to create a training program that works for remote employees.

The most important issue is that remote training requires space. No one wants to stare at another person through a Zoom meeting all day long. Instead, remote training should be done in short bursts and include exercises (you might even call it homework) for the new employee to complete between training sessions.

Here’s how a day in the life of a remotely-trained new employee might be structured:

Example 1. The trainer begins the day with an hour-long overview of your firm’s planning philosophy and the process you follow when creating financial plans. This part of the training is conducted using the scripts and content in your Operations Manual.

After the in-person time is completed, the new employee watches a video that covers more details of the session on their own.

Once that session is over, it’s homework time. The trainer gives the new hire a financial plan and mock client to practice on, with a few hours (or the rest of the day, depending on the complexity of the plan) to work on it and put together recommendations.

Once they’ve completed the assignment, the trainer comes back together with the new employee to review their work and to give feedback.

All remote training should follow this simple process. Train the process, give an assignment, and then come back together to review. This format allows you to get a baseline understanding of how well the new employee retains and applies the information provided to them. Very quickly, you’ll be able to see if they are able to do the minimum of what you need them to do once their six-week onboarding plan has been completed.

As time goes on, your ongoing training process should look similar to this. However, you won’t need to retrain your employees on the information they’ve already learned. You should only need to conduct ongoing training when you change processes or adopt a new philosophy.

A Good Training Program Is The Teacher

Often, advisory firm owners object to training their new employees because, as one put it, he “is not a teacher.” And of course, that is true on the surface. You likely started your business to be an advisor, not to be (an employee) teacher. However, if you take that attitude toward your business, then you will never get around to building a real training program that teaches consistent culture, correct processes, and philosophies for you, over and over.

If you never create a training program, you are the teacher every time! And, in not doing so, you are effectively saying that you don’t want your firm to grow bigger and you want teaching to continually depend on you.

Training people in your firm’s ways is a necessity for growth. The good news is, when you build the training program you only need to be the teacher once. Every year after, the teacher becomes the training program itself. Ignoring training, or only doing it halfway, simply creates more teaching problems and makes life harder because you end up with everyone doing things their own way.

A lackluster training program also creates the ‘sink-or-swim’ approach, which can be far more detrimental to your business than just losing an employee here and there who doesn’t feel respected in your company. You can run into major issues, like a compliance or regulatory failing, due to a lack of training. If that happens, much more will be at stake than spending the time to find a replacement for a lost employee and the productivity loss that goes along with that process.

Firms who are serious about their growth and who want to create a great employee experience are also serious about how they approach training. While it may look different for different firms, establishing a comprehensive six-week program that is guided by an Operations Manual gives your firm the opportunity to create a culture and experience that fosters growth and productivity … endlessly.