Executive Summary

Under Social Security and Medicare rules, the “Hold Harmless” provision is a special rule intended to protect most Social Security recipients from experiencing a decrease in their (net) benefit payments, by limiting the (dollar) amount of the annual Medicare Part B premium increase to the (dollar amount) of Social Security’s cost-of-living adjustment. And due to negative inflation from the recent fall in energy prices, the 2016 Social Security COLA is on tracked to be “floored’ at the minimum 0.0%, which in turn means that Medicare Part B premiums will be locked in for a 0.0% increase in 2016.

However, the "Hold Harmless" provisions only apply to approximately 70% of currently Medicare enrollees for the protection. Which means that the entire magnitude of Medicare's rising costs must be borne by just the other 30% of Medicare enrollees, as well as any who planned to enroll in 2016, resulting in a project 52% spike in Part B premiums next year!

Given the looming Medicare Part B premium increase, those who are not eligible for the Hold Harmless provision - for instance, those enrolled in Medicare but delaying Social Security benefits, or those who haven't yet enrolled in either but could - should carefully consider whether it is really still worth delaying Social Security benefits (and/or delaying enrollment in Medicare), given that those who begin the process by October of this year still have the potential to get started in time to be eligible for Hold Harmless and shelter themselves from the 2016 increase.

And in practice, it appears that slightly accelerating claiming may in fact be appealing, especially for those who otherwise anticipated starting Social Security and Medicare Part B in 2016. On the other hand, higher-income taxpayers who are subject to the Medicare Part B premium surcharge cannot protect themselves (or do anything else about it, since the calculation would be based on income from 2014 and that tax year is long since closed). And for those who still plan to delay Social Security benefits for many years to come, the reality is that delaying Social Security benefits is still so valuable, that even the projected Medicare Part B premium spike is still not nearly enough to deter the long-term value of generating Social Security’s Delayed Retirement Credits for those who anticipate living well past the breakeven period.

(Michael's Note: Some Social Security claiming strategies discussed in this article have been materially impacted by the Bipartisan Budget Act of 2015, which has eliminated most forms of the File-and-Suspend strategy. See "Congress Is Killing The File-And-Suspend And Restricted Application Social Security Strategies" for further details.)

How The “Hold Harmless” Rules Impact Medicare Part B Premiums

Every year, Social Security benefits receive a Cost-Of-Living Adjustment (COLA). At the same time, there is also an annual process to adjust Medicare Part B premiums higher every year, to account for the current (and rising) costs to administer the Medicare health insurance system.

However, a special provision dubbed the “Hold Harmless” rule stipulates that the dollar amount increase of Medicare Part B premiums can never be greater than the dollar amount increase of the Social Security COLA – effectively ensuring that retirees who receive Social Security benefits and have Medicare Part B premiums subtracted from their benefits will never see the size of their monthly checks decrease. At worst, payments will simply remain flat (although higher Medicare Part D premiums subtracted from Social Security benefits can still cause the final amount of the monthly check to decline slightly).

Notably, though, the Hold Harmless provision only applies to those who have actually enrolled in Medicare Part B, and who actually receive Social Security benefits (with Medicare Part B premiums subtracted) in the first place; those who have delayed Social Security, delayed enrolling in Medicare, or both, are not protected by the rule. In addition, the Hold Harmless rule also doesn’t apply to anyone who is subject to the “high-income surcharge” on Medicare premiums (formally known as the Monthly Income-Related Adjustment Amount to Medicare Part B premiums). In total, it’s estimated that these limitations mean the Hold Harmless provision only actually protects about 70% of Medicare enrollees.

Yet with the Social Security COLA projected to be flat at 0.0% for 2016 (due primarily to the crash in oil and other energies prices in late 2014 and early 2015), these rules mean that nearly 70% of Medicare enrollees cannot experience a Part B premium increase next year. Instead, the other roughly-30% of Medicare enrollees that are subject to the Medicare Part B premium increase must bear the burden for the entire premium increase due to Medicare's rising costs. Yet as noted recently in the WSJ, squeezing 100% of the premium increase into only 30% of the enrollees is projected to trigger as much as a 52% spike in Medicare Part B premiums (an increase of about $55/month, or over $650/year)!

Planning Around The Potential 52% Spike In Medicare Part B Premiums For 2016

The “good” news for planning purposes is that because the Hold Harmless provision is determined based on whether the retiree is getting Social Security benefits (and is a Medicare Part B enrollee) for the last two months of the year, it appears that there is still time for retirees to consider whether to take action on claiming Social Security or Medicare Part B now, before it is too late.

However, in practice whether it is effective to engage in such claiming strategies will depend heavily on the exact details of the retiree’s situation, as discussed through the various scenarios below.

Currently On Medicare Part B And Receiving Social Security Benefits, Not Subject To IRMAA

For anyone who is currently on Medicare Part B, is receiving Social Security benefits, and will not be subject to the income-related monthly adjustment amount (IRMAA) for their Medicare Part B (and Part D) premiums in 2016 because their income was low enough on their 2014 tax return, there’s nothing to be done. The Hold Harmless provision will apply, and Medicare Part B premiums will remain “locked in” at the current $104.90/month rate.

Notably, the determination here is whether IRMAA will apply to the retiree next year in 2016 (based on the 2014 tax return), even if the retiree is not currently subject to IRMAA for his/her Medicare premiums this year (which was based on the 2013 tax return). Thus, even though the tax year is already closed, if 2014 income was up over the IRMAA threshold, the Hold Harmless provision will not apply to the looming Medicare Part B premium increase next year too (i.e., Medicare premiums will go up next year).

Currently On Medicare Part B And Receiving Social Security Benefits, And Subject To IRMAA

For those who do anticipate being subject to IRMAA for 2016 because their 2014 income was in fact too high (regardless of whether they’ve been subject to it already for 2015), unfortunately the coming Medicare Part B premium increase will apply. And in practice, there’s really very little that can be done; since IRMAA is calculated based on the 2014 tax return – a tax year that has already closed – even end-of-year tax planning for the current 2015 tax year won’t help. At best, it may help to avoid IRMAA and leave someone eligible for the Hold Harmless provision in 2017, but that will merely lock in the new already-increased 2016 rates!

On the other hand, there are some “life-changing events” that do qualify for an exception to IRMAA in 2016, even if modified AGI would have otherwise triggered it based on the 2014 tax return. For those who may be eligible for an IRMAA exception, it’s necessary to complete Form SSA-44 to request relief.

In the context of an IRMAA exception, though, it's important to recognize that ‘mere’ volatility of income from year to year, even including a one-time significant capital gain, is generally not an exception to the IRMAA rules; it means IRMAA may only apply for that one year and not subsequent years. Alas, if that one year was the 2014 tax year, there’s again little that can be done at this point.

Currently Below Age 65 And Not Eligible For Medicare

For those who are below age 65 and not eligible for Medicare, there’s nothing to be done about the looming Medicare premium increase. The Hold Harmless provision cannot apply if not already enrolled in Medicare (and if under age 65, there's no way to enroll at this point, unless disabled!). Of course, for those who are not yet age 65, the Hold Harmless provision may be a moot point anyway; if they won't be starting Medicare Part B in the near term, the looming Medicare Part B premium increase won't apply anytime soon, either. And by the time the retiree is eligible for Medicare, the Part B premium increase under the Hold Harmless provision may have normalized by then.

Notably, those who are younger than age 65 but are disabled and are on Medicare will generally not be eligible for Hold Harmless either, because they are not also receiving Social Security retirement benefits with Part B premiums subtracted from their monthly checks. However, this will generally be a moot point anyway, as younger disabled beneficiaries who are dual-eligible for Medicare and Medicaid will already have their premiums paid by the state (so the state may be impacted by the premium increase, but they won't be directly).

Unfortunately, though, for those who will turn age 65 soon and become eligible for Medicare in 2016, alas the new higher Medicare Part B premiums will already be in force by that time, and must be paid by a new enrollee.

Currently Over Age 65, Eligible For But Not Claiming Medicare Yet

For those who are over age 65 but not claiming Medicare yet (most commonly because they are still working and eligible for an employer retirement plan, or eligible for a working spouse’s employer health plan), the Hold Harmless provision will not apply because there is no ongoing Part B premium “base year” on which to limit a premium increase in the first place.

For those who do not anticipate beginning Medicare until many years in the future anyway, this may be a moot point, as again eventually the Medicare premium increase should normalize in several years once Social Security benefits begin to increase again and the Medicare premium increase can be re-distributed across the entire base of Medicare enrollees (as occurred in 2012). And starting Medicare "early" when already covered by an employer may be especially unappealing, simply because the benefits aren’t otherwise needed but will involve paying $104.90/month in current Medicare Part B premiums, just to avoid a $55/month increase (and paying $104.90/month to dodge a $55/month increase is an outright losing proposition!).

For those who do anticipate beginning Medicare in the next year or two, though, the situation is more acute, as such individuals will end out paying for Medicare Part B soon enough anyway, but starting now means more payments at a materially lower dollar amount. Fortunately, those covered under a group health plan based on current employment are eligible for a Special Enrollment Period to sign up anytime in Medicare as well (once already age 65), which means they can add themselves to Medicare now in time for the Hold Harmless measuring period that begins in November. Again, though, paying many years of $104.90/month premiums just to avoid a $55/month increase won’t necessarily pay off; this strategy will likely be most beneficial for those who were going to start Medicare within the next year or two anyway.

In addition, it’s crucial to recognize that starting Medicare Part B earlier to try to lock in premiums under Hold Harmless still will not matter unless the retiree also enrolls in Social Security in time for payments to begin in November as well. And it's also important to recognize that this remains a moot point if income will be high enough to be subject to IRMAA anyway. And further complicating the matter is that for those who are between age 65 and age 66 (old enough for Medicare, but not yet full retirement age), beginning Social Security benefits early will likely subject them to the Earnings Test, reducing Social Security benefits until they actually do reach full retirement age anyway. On the other hand, for those over the full retirement age of 66, the Earnings Test no longer applies, and it is simply a matter of signing up for Social Security benefits by October (so that payments can begin in November) and also getting enrolled into Medicare Part B by then as well.

Notably, though, the decision of whether to accelerate the onset of Social Security benefits just to avoid the Medicare Part B premium increase still requires a further evaluation of whether it’s really worthwhile to give up on the otherwise-significant longevity-hedging benefits of delaying Social Security in the first place, for “just” a $650/year Medicare Part B premium savings for a couple of years!

Accelerating Social Security Benefits To Apply Hold Harmless Vs The Benefit Of Delaying

Given that most retirees who start Medicare at age 65 but delay Social Security are doing so specifically to generate Delayed Retirement Credits (given their long-term value), the trade-off of continuing to delay versus accelerating benefits to lock in Medicare Part B premiums must be carefully considered. The issue applies for those who are eligible for a Special Enrollment Period (e.g., have ongoing employer coverage but are already age 65) and could start Medicare Part B and their Social Security benefits in time to get November payments. It also applies for those who already are on Medicare (i.e., over age 65, enrolled, and didn’t delay or opt out) but who have been delaying Social Security benefits already and may now be reconsidering.

For people in this situation, the decision effectively amounts to a trade-off between the benefits of starting Social Security earlier to lock in current Medicare Part B premiums.and the benefits of delaying Social Security to generate higher (inflation-adjusting) payments in the future at a "cost" of absorbing higher Medicare Part B premium in the meantime.

While the ultimate outcome and benefit of this situation will vary depending on how many years there may be higher Part B premiums before Social Security COLAs increase benefits enough to redistribute the increased-Part-B-premium to all enrollees, we can estimate the impact.

For instance, consider a 66-year-old retiree who was planning to continue to delay Social Security benefits for the next 4 years, and assume a “worst case” scenario that Medicare Part B premiums remain elevated by $55/month (or $650/year) for the next 4 years, effectively increasing the “cost” of delay by $2,600 cumulatively (plus the time value of money).

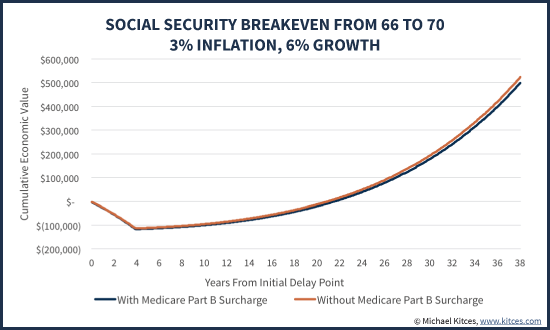

As the chart shows below, assuming the retiree’s baseline benefit is $2,000/month (such that delaying 4 years increases it by 4 x 8% = 32% to $2,640 at age 70, plus ongoing COLAs), the reality is that the projected long-term economic value of delaying Social Security experiences only a negligible impact when dragged down by the Medicare Part B premium spike (the Medicare Part B increase may cost thousands of dollars, but a good decision on delaying Social Security benefits for 4 years can amount to hundreds of thousands of dollars!). In other words, if delaying benefits was already appealing, even a multi-year impact from “losing out” on the Medicare Part B Hold Harmless provision doesn’t appear to be a deal-killer at all. The relative impact is barely visible in the early years (i.e., the value of delaying Social Security is virtually the same as the lines overlap), and while it does cause a slight decrease in long-term value to absorb a Medicare Part B surcharge, if the retiree anticipated living long enough to reach their 90s and beyond, the economic value of delaying Social Security is still hugely positive (rising as high as +$500,000 of economic value!), Part B premium spike or not.

Ultimately, this suggests that retirees who might have been considering whether to apply for Social Security benefits very soon anyway may wish to start benefits a few months earlier (and must be done by October) to ensure eligibility of the Hold Harmless provision for their Medicare Part B premiums (assuming they’re also eligible for and enrolled in Medicare Part B by then, too!). But those who otherwise had a plan for a multi-year delay in benefits and found delaying Social Security benefits to be economically appealing in the first place will likely want to continue to delay (it's not worth giving up hundreds of thousands of dollars of delayed Social Security benefits, just to avoid a few years of paying an extra $650 for Medicare Part B). Similarly, those who are engaging in file-and-suspend strategies (which don’t help for Hold Harmless because there are no actual payments being made to which the rule can be applied) will likely want to continue to keep their file-and-suspend in place (unless it within a month or few of winding down anyways).

In the end, though, it's still crucial to recognize that all of this may prove to be a moot point. Health and Human Services Secretary Sylvia Burwell can choose to set a lower premium to mitigate the 52% increase, and has already indicated that she is exploring other policy options. Either way, the “final” Medicare Part B rates for 2016 will be set in October... but those who aren't actually eligible for Hold Harmless, and are concerned about its potential Medicare Part B premium impact, may want to start planning now, just in case!

So what do you think? Are you engaging in any adjustments to your planning strategies for retired clients to contend with the potential Medicare Part B premium spike? Are you clients mostly already eligible for Hold Harmless? Or are they just planning to ride it out?

Hi Michael, could you address those of us who are using a file and restrict (ie I filed on my wife’s SS when she turned age 62 and now get 50% of her fra SS payment. I was age 68 at the time. I was planning to defer my SS until age 70 next April 2. ) Since I am getting SS payments on my wife’s SS account and having my medicare payments with held from that payment will I be held harmless when I switch to my own account at age 70. My will file file a spousal claim when she reaches her age 66 (fra). She will file for medicare at age 65 in two year so it sounds like she will see higher premiums at that time depending on what they are. I would appreciate your insight as too what I should do going forward. Should I file in Oct. 2015 for my SS (six months before age 70) and then in April 206 repay the funds and file a redo claim?

Or will I be fine with the current setup I am currently under as getting my medicare premiums paid via my (spousal) SS payments?

Richard,

If you’re receiving a Social Security retirement benefit and having Medicare Part B premiums subtracted from your monthly checks, you’re already eligible for Hold Harmless. It doesn’t matter whether it was YOUR retirement benefit or the spousal payment from your wife’s retirement benefits.

In fact, under 45 U.S.C. 1395r(f), the Hold Harmless rules explicitly apply if you’re receiving a monthly Social Security check under 45 USC 231b(a) (an individual retirement benefit), under 231c(a) (a spousal benefit), or under 231c(f) (a survivor benefit).

– Michael

Wow, Michael, that was a fast great answer. I am very much impressed.

I was concerned that when I switch to my SS benefits it might be considered starting medicare for the first time since it will be under my SS number and not under my wifes SS number so thank you for clariflying this for me. I was going to make an appointment with SS to check this and make changes as necessary but looks like you have taken care of this for me. Thank You Again !!

Richard, I saw you mention your wife was planning to file for spousal benefits for SS. Since you mentioned that you have already do that, she won’t be able. You can’t both file for spousal benefits.

Hi Brian, thanks for the comment on SS. My wife filed for her SS at age 62 and I filed a restricted claim on her SS. What I hope to do is to file for my SS benefits at age 70 and then when she reaches her age 66 (FRA) she can file for 50% of my benefits which as I understand will be her current reduced SS payment plus some additional SS payment to bring her to 50% of my age 66 FRA SS payment minus her discount (30%) for starting her SS at age 62 instead of her age 66 FRA. I may have this wrong but will she not be filing spousal on me as then I will not be on her SS as a restricted spouse but on my own SS record so only one of us would be on a spousal claim at that time. At least that is what I understood from discussing this with a SS representative. I may not have explained this clearly. Can you enlighten me further. Thanks Brian

Richard, thanks for the response. Filing restricted and spouses benefits are the same thing. Unless there is loop hole I haven’t read about you can’t switch from you filing from her check to the other way around. I have trained pretty extensively on this topic and give seminars on it. There is always an usual situation that comes up that makes me research each seminar. I hope for your sake there is but think it is highly doubtful. We do calculations for clients on filing strategies and you can find an entire section on our website if you wish. It’s Stephensandlaroche.com. If you would like to discuss this further, you can contact me from the Social Secuirty tab.

Sorry for any typos. On a long bumpy flight catch up on emails. Happy to help.

I believe Richard Ellingson and Michael Kitces are correct. Have checked into this with SS and various independent sources.

Richard,

Your strategy as articulated should work just fine.

The caveat that Brian is alluding to is that you can’t both claim spousal benefits yourself AND file-and-suspend to turn on your wife’s benefits. That kind of “criss-cross” spousal strategy doesn’t work.

However, that doesn’t appear to be what you’re doing here. You’re not going to file-and-suspend to activate your wife’s eligibility for spousal benefits. You’re actually going to FILE for benefits, which is fine. At that point, she becomes eligible for spousal. If her spousal (50% of yours) is HIGHER than her own, yes she can file for spousal, and she will step up, after adjusting for the early benefits election (as you note). If her own benefit is already higher than the spousal benefit she’d get from you, nothing happens.

– Michael

Michael , thanks for the clarification on this! I think what is confusing to most of SS claimants is the difference between file and suspend and file and restrict !

I sure appreciate both your response and Brian’s response!

SS is confusing especially when doing spousal claims so I appreciate all the feedback I can get!

Michael, do you see any issue with me filing for my age 70 SS claim, after coming off my restricted SS claim as a spouse on my wife SS and her either filing a spousal claim on me at my age 70 or waiting 2.5 years until she is FRA of 66?

My thought was for us to wait until she is FRA and that way increase her monthly SS ! Assuming a long life span she should receive more as long as I also stick around.

What are your thoughts on this line of thinking?

Again, thanks much too both you and Brian!!

Rich E

I have been investigating claiming strategies, and this is what I was advised to do also by SS and various advisors.

Oh Wow! I posted part of your initial article on “Rule Your Retirement” and indicated that this would be coming. As always, great analysis … especially since it agreed with my “back of the envelop” look [laugh]. But the $500,000 figure IS revealing. THANKS for ALL that you do!!!!

Michael, quick question: I will be 65 in Nov. 2016.. was planning on waiting one year, until my FRA of 66 in Nov. 2017 to start taking SS. Does that mean I would only pay the Medicare B increase for one year, until I file at my FRA, and once I’m taking SS and having Medicare B taking out of my SS, I would go back to $104/month?

Great stuff as usual, Michael.

I’ve had several questions on this very topic of late. My opinion was just like yours – it’s penny-wise and pound-foolish in many cases to pull out of a delay strategy to bypass this increase.

Thanks for fleshing it out, this will be helpful!

jb

What do you mean by “the Medicare premium increase will normalize”?

John,

If you click on the hyperlink with that text, the mechanism of premiums normalized is explained (towards the end) of the linked article.

Once Social Security COLAs do occur, the premium increase that couldn’t be applied to the 70% of Medicare enrolls eligible for Hold Harmless is ultimately redistributed amongst them. When it occurred last time, this caused Medicare premiums to drop back in line with original projections, after the Hold Harmless period ended.

– Michael

Not that it will happen again, but 2010 and 2011 both saw no COLA’s. Entirely possible that this isn’t a one year phenomena. I would guess the probability of that is fairly low.

Good but scary information relative to the following. My brother is a Federal CSRS retiree (did not pay Social Security) and currently 64, when he reaches 65 next year he has to enroll in Medicare. Does that mean that he is a part of the 30% and such are going to have very high medicare premiums??? He had about 7 years were he paid SS prior to joining the government. He has not filed because of the offset rule as it pertains to getting social security (vs. government annuity), but would this make a difference in his case, as it pertains to the high increase in medicare if he were to file to get SS now(although a very minimal amount)???

Lets do some math. (note: I do not factor in estimated annual Cost of living increases, as it would affect both alternatives about the same)

Person X will be 65 in December 2015 with his first Medicare enrollment eligibility being Sept 1. X was planning on delaying SS to age 70, but is now reconsidering. Waiting would grow his benefit by 6.7% from December 2015 to December 2016 and then 8% per year for the next 4 years. Lets say his PIA is $1,500/mo. Beginning next month (first payment in October) would be 1,500 reduced by 14 months at -5/9%/mo = 7.78% reduction or (1-.0778) X 1,500 = $1,383/mo. If he lives to life expectancy of 86, this would provide in nominal dollars not adjusted for CPI increases of (86-64) X 12 X 1,383 = $365,112 over life expectancy.

Now, assume X waits to age 70. His PIA is effectively reduced to $1,500 – $54.55 = $1,445/mo. Growing this at 8%/yr for 4 years = $1,966.52/mo or $23,598.23/yr for the next 86-70 = 16 years, for a nominal non-CPI adjusted life total of $377,572.

And if X doesn’t require the SS income up to age 70 (the original assumption), he could invest the after tax SS benefit from Oct 2015 up to age 70. I haven’t done this calculation, but I’d imagine it will put the two alternatives pretty close.

Bruce Miller

There is another wrinkle to the “hold harmless” percentage of recipients in that the threshhold for the lowest (and all) wealthy Medicare brackets is UNINDEXED through 2019 (Thank you ACA/Obamacare).

As more retirees than the current 30% reach the threshhold, the effect of any future zero inflation/ no COLA is at least a little less onerous

Attach

I’m 65 and not due for my full retirement until Aug 2016. What would happen if I signed up now before the end of Oct deadline. Took SS for 3-4 months, then opt out and paid the money back. Would I then be grandfathered in, or is this a loop hole they have thought of?

My husband will turn 66 in November. He did apply for Social Security

and should get it the month of November and December 2015. I started

taking SS in Sept 2015 when I turned 65. He will retire December 31st.

He and I are under his work insurance until Dec 31. We will be subject

to IRMAA. The question is should we apply for Medicare B in December or

January? We plan to file SSA 44 for life changing events due to

retirement.

> Notably, those who are younger than age 65 but are disabled and are on Medicare will generally not

> be eligible for Hold Harmless either, because they are not also receiving Social Security retirement

> benefits with Part B premiums subtracted from their monthly checks. However, this will generally be

> a moot point anyway, as younger disabled beneficiaries who are dual-eligible for Medicare and

> Medicaid will already have their premiums paid by the state (so the state may be impacted by the

> premium increase, but they won’t be directly).

Hold harmless applies to any SS benefits with Part B being deducted, not just retirement. Eligibility for Medicare as disabled is conditional on eligibility for SS disability benefits. And you’re being prejudiced in assuming that disabled SS beneficiaries are also simultaneously poor enough to qualify for Medicaid. The upper limit for Medicaid eligibility is only a measly $2K in countable resources (or up to $7.2K for the Medicare Savings Programs).