Executive Summary

Over the past several weeks, the major stock indices have experienced both the fastest crash and the most robust market bounce ever seen. In the process, financial advisors have watched their clients transition from abject panic to outright relief and have worked hard to keep their clients focused on their long-term goals… while sometimes questioning how they themselves will persevere through these difficult times because as previous crises have shown, many businesses fail to survive through severe economic downturns. Which, in turn, raises the question: what should advisory firm owners do now to ensure they survive the next crisis (or the next stage of this crisis, if the S&P 500 falls back near 2,000!)?

In this guest post, Stephanie Bogan – CEO of Educe, Inc., and Founder of Limitless Adviser Coaching – explains how financial advisors can address this difficult question and start to understand the steps they need to take to help them prepare for the potential bumps and potholes in the road ahead. More specifically, planning ahead can help avoid getting backed into a fight-or-flight reactionary corner in response to crisis situations; instead, advisors can take a proactive approach in preparing their firms, embracing an enthusiastic mindset, identifying where they provide the most value to their clients, developing efficient systems, and continuously driving growth.

Accordingly, the first step in preparing for a crisis involves contingency planning, a calm evaluation of all business expenses, and modeling various scenarios to identify which expenses can be reduced or eliminated without compromising client care.

Beyond that first step, the capability that will function as the main driver of a successful business is maintaining a positive mindset by categorizing all tasks that need to be done as either ‘above-the-line’ activities (those that empower and create energy and thus create a success-state frame of mind) or ‘below-the-line’ activities (those that stagnate energy and create a negative state of mind with feelings such as fear, uncertainty, doubt, and anxiety) and then to design a plan that will allow the advisor to delegate all below-the-line activities to someone else while keeping their time and energy focused on the above-the-line activities that ultimately are crucial to keep the business thriving and growing through a crisis.

An objective and fair assessment of an advisor’s own value is also a critical step to help home in on a specific client niche for which they are able to provide their best work. By narrowing the ideal client’s profile, advisors can focus on their clients’ specific and unique needs, elevating the value they provide. Efficiency is another core competency that will help advisors not just survive, but thrive, in the face of crisis as efficient systems will permit advisors to continue delivering their specialized services without interruption, even in the face of crises. Finally, a focus on growth – by investing in marketing strategies such as SEO, digital marketing, and podcasting – can help advisors maintain a successful practice even in times of crisis. And with a narrowly defined client niche, providing targeted, essential services addressing the unique and specific needs of the clients in and of itself can also foster growth!

Ultimately, the key point is that by asking the right, albeit difficult, questions about what it will take to maintain a successful mindset in the face of a future business crisis like watching the S&P 500 fall to 2,000, the specific value that can be most effectively offered to clients (and sustained through such a crisis), how operating systems can be systematized most efficiently (especially when facing the pressures of a crisis), and what measures can be taken to foster continued growth of the firm (despite an ongoing crisis), advisors can ensure their own continued success when the next crisis inevitably hits.

If the S&P 500 drops to 2,000, what will you do next?

This is more a question than a prediction, really. I ask it not to scare you, but to shock your brain into attention so that I can invite you to get off the task-list treadmill long enough to ask yourself the simple but significant question I posed to you.

Why? Because when you ask better questions, you get better answers.

This is my third major crisis in almost as many decades. Having weathered the downturns of 2000 and 2008, I’ve seen firsthand the relentless business tests that downturns prove to be – tests not everybody will pass. Tests like these, and the ones to come, have a tendency to thin the herd.

I’ve received more than a few calls dealing with the disruption from the COVID-19 pandemic. Facing a wildly uncertain future, solo advisors, national RIAs, fintech firms, and the CEOs of familiar names are all working to navigate this uncertainty with greater clarity and confidence. My advice to them was the same as my advice to you: start by answering my question.

Preparing for the worst of times is a potent strategy for creating a bigger, better business future at any time. Make no mistake, rising to these challenges is going to demand a new level of mental discipline and different modes of thinking than many forged in the comfort of an 11-year bull run.

If the hard-to-think-about were to come to pass, would you be a survivor? More importantly, would you focus your energy during the ensuing chaos and business challenges while your competitors waste their energy making the excuse that they did not see it coming? With some purposeful planning and the right perspective, in markets where others see fertilizer, you can find fuel for growth.

The real question my title poses is, “What would it take to be prepared for a 50% market decline and a sustained 30% downturn…and still have the time to serve clients well while investing in growth?”

Now is the time to run your business planning scenarios and financial contingency plans for the next disruption, before they arrive.

Crisis Contingency Plans Begin With (Calmly) Evaluating Expenses

The first instinct is to slash and burn expenses immediately upon a revenue decline. A less panicked option is to evaluate your expenses and how they will shift in various revenue scenarios, based on which expenses are essential to providing value, and the impact any changes will have to your clients and business.

Beyond the traditional dollar estimates, identify expenses in four broad categories:

- Mandatory for ongoing operations;

- Critical to doing business in your preferred way;

- Useful but optional; or

- Simply a luxury.

Next, note any expenses that could likely be reduced through negotiations, if needed.

Now, run various decline scenarios to determine how deeply into expenses you have to cut to stay level. If you knew you could withstand a protracted 30% decline in cash flow without impacting client care, or that you couldn’t, how might it change your strategy?

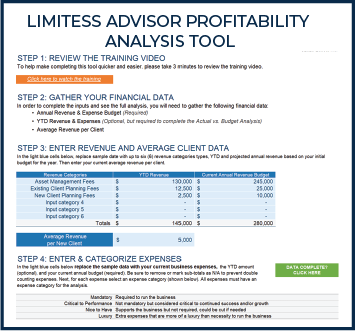

To help with your crisis contingency plans, I’ve shared a practice-analysis tool that you can use to run financial projections based on various revenue conditions. The tool will help you plan for different scenarios, helping you make informed decisions on how to best serve clients while succeeding as a practice.

Good contingency business planning can mean the difference between advisors cutting expenses in a panic, versus having the confidence to hire and make strategic investments. Where clients are holding steady, the business has stable cash flow and capital reserves, and the firm is continuously monitoring and upgrading its performance, professionally and personally.

One advisor I’ve worked through this process with is Adam Cmejla, CFP®, who did such a good job of answering my tough questions about the pain points and possibilities in his practice, he doubled his revenue in under 2 years while raising his fees, narrowly focusing his niche, specializing his podcast, hiring a service manager, and automating 30+ Redtail workflow templates to systemize his client lifecycle from prospect inquiry through ongoing service… all while having the newfound time to fulfilling his dream of getting his pilot’s license!

You can prepare for the worst-case scenario by following the same advice I gave Adam to create his best-case scenario, which was to focus on four core capabilities: mindset, value, efficiency, and growth.

Mindset Mojo Is The Main Driver Of Success

Capability one is mindset. Mindset is the set of attitudes and opinions we hold – our formed beliefs that shape our view of the world. According to a study published by the Carnegie Foundation, our mindset is responsible for 80% of our success.

Despite having more influence over our success than any other known factor, mindset is just now moving up to the adults’ table in terms of serious conversation. Still not well-understood, mindset is too often confused with sappy self-help strategies that invoke images of campfires and crystals.

You can listen to my story about how to master the 7 mindsets of success and read previous posts I’ve done for Nerd’s Eye View that examine how mindset trumps best practices for financial advisor success and the other factors that can help advisors find success as solo practitioners. The Cliffs Notes version is that a majority of Americans experience moderate to high levels of stress, operating from the fight-or-flight response driven by the most primitive part of the brain responsible for our survival.

Unfortunately, this stress mode directs us to panic and run away, helpful to survive the threat from the saber-toothed tiger – not a useful defense against market volatility, however. When a threat is perceived, blood is drawn from the pre-frontal cortex – the thinking, cognitive, reasoning center of the brain – and redirected to the heart and muscles to help you fight harder and run faster. In short, stress makes you stupid so that you can survive.

When advisors fail to master their mindset, there is the tendency to look through the limiting lens that your value is something other than advice. This often presents itself as no fees or low fees for planning, delivering services for free for fear of losing the client, and taking clients below your minimums. It did for Adam.

Achieving A Success-State Mindset By Minding your Line

As a business strategist and success coach, I regularly help advisors like Adam shift their thinking so that they can get clear, get focused, and get to work. If you’re looking for a practical tip to help you out-think, out-strategize, and out-execute your challenges and competition, you need only start by learning to mind your line.

What does this mean? Draw an imaginary horizontal line in your mind. Above the line, write a plus sign (+), and below the line, write a negative sign (-). This line reflects the state you are operating in, which directly impacts the quality of your thoughts, actions, and results.

Everything above the line is energy-creating and empowering. This is your success-state. In this state, you are empowered, confident, future-focused, and everything can be figured out. Abundance, confidence, and optimism live above the line. Clients you love and a smooth-flowing office are all above the line. A better body, booming business, bigger bank account? Above the line. Above the line is where inspiration strikes, and sudden insights are revealed.

Above the line is also where all your energy-creating, revenue-producing activities live. This is your genius zone. You love working in an above-the-line mindset. It feels effortless, and you can do it for extended periods with ease.

Below the line is another story. This is where fear, uncertainty, doubt, anxiety, stress, and overwhelm live. So, too, do their companions judgment, blame, and criticism. Below the line is where your energy-draining, revenue-dilutive activities reside.

You can quickly identify these activities as the ones that make you want to put a pencil in your ear after 10 minutes. The great tendency is to delay and distract ourselves from this work at all costs, often resulting in increased stress and a foreboding sense of overwhelm.

The important secret to understand is that this line is in your brain. And it represents a simplified version of how you can hack your brain for greater success, health, wealth, and well-being. Above the line, you are psychologically, biologically, and biochemically primed for greater mental performance and physical stamina, creating your “success state,” a positive, empowered, forward-focused, everything-can-be-figured-out state of mind. I’ve found no better state from which to evaluate the landscape (including the difficult ones we are experiencing now), assess your options, and chart a clear course of action aligned with the outcomes you want to create.

You are clearer, sharper, and smarter when you are above the line. The more time you spend here, the more successful you will be, with greater ease and enjoyment.

In stark contrast, life below the line is riddled with complexity, challenges, and compromise costs. Every discount you ever reluctantly agreed to, every too-small client you took because you couldn’t bring yourself to say “no,” and each referral you onboard knowing full well you were compromising your standards—all of these represent below-the-line thinking. That prospect you agreed to discount fees for, it’s not that he doesn’t see the value in working with you, he just doesn’t see as much value in it as you believe you’re worth. And without even realizing it, you told him that it was OK with you. Above-the-line or below-the-line decision?

Now perhaps you see how effective the line can be, precisely because it is so simple.

Just ask Adam. He’ll tell you that the foundation for his rapid ascent began with a simple exercise: take out a piece of paper and write down everything you do. If an activity is energy-creating, it goes above the line; if it is energy-draining, it goes below the line. Once done, take 15 minutes to create a timeline showing when and to whom you will direct or delegate all below the line tasks over the next 3-24 months. No exceptions.

Adam’s first big step was to hire a Service Manager. In the 2 years since he did so, he has grown enough to hire a second advisor to service all but his most complex, interesting, and thus energy-creating clients.

With his new success mindset, Adam was able to take his entire practice through this same exercise quickly. He then had the clarity he needed to re-imagine his practice, get focused with a one-page business plan, and get to work.

Deliver Differentiated Value To Thrive Through Uncertain Times

Once Adam adjusted his value mindset, he became clear that his value was advice and that the fee he was charging did not fairly compensate him for that value. Accordingly, he raised his fees by a factor of 4x. Upon sharing his first fee increase with a client, she turned to her husband and said, “$225 a month, that’s just a sh*tty car payment.”

Adam’s minimum fee has since doubled again with no resistance from prospects. If you’re wondering how Adam was able to advance his fees so swiftly, here’s the secret: price is only an issue in the absence of value.

Getting clear on the value you deliver to clients, as Adam did, allows you to focus on delivering deeper value to clients. Couple that with higher-quality thinking and better questions, compliments of your mindset makeover, and you can now go one step further and challenge yourself to do business differently.

As when subtle trends begin to accelerate in pace and velocity through the profession, advisors with future-focused plans would be wise to take note of these trends. We see an increasing appetite for advice, growing demand for specialized services, and shifts in fee and service models to meet changing consumer preferences. This now in tandem with a meteoric rise in consumer’s comfort with remote connectivity and virtual relationships thanks to the sweeping cultural change brought on en masse by social isolation.

Accordingly, competency two is value. Being a good advisor might help you earn a living in the future, but it won’t give you the kind of no-limits practice that will see you through when the S&P moves down to 2,000 and back. If you want to thrive through uncertain times, then delivering massive value to clients is mandatory.

The more specific your services and advice are to your client, the greater the value, efficiency, and impact. In Adam’s case, we rode the growing trend toward specialized advice by narrowing his niche from ‘white coats’ (medical professionals of various types) to ‘just’ serving optometrists, and then quickly to those within 5 years of retirement.

Most people would say Adam already had a niche with white coats, and I’d agree if you want ‘most people’ (i.e., ordinary!) results. Instead of keeping his focus on the broader white coat niche, Adam got more specific about who he wanted to work with. Adam and I agreed with Dennis Moseley-Williams on the value of a “niche, niche, weird” approach, where you can’t underestimate how impactful a very specific niche can be, and how ambiguity is a luxury of good times.

If you want to rebound strongly from a recession, you can take a note from Adam’s to-do list and build your practice around the answer to one profoundly powerful question: “Who do I do my best work with?”

Narrowing his niche enabled Adam to get hyper-specialized in his knowledge and advice, ensuring he would dominate in any Jeopardy round titled ‘Know your Exiting Optometrist’. With this newfound clarity, Adam was able to quickly re-imagine his prospect process, planning process, service models, client experience, staffing model, and marketing strategy around delivering value to this select group.

When the CARES Act was released in March, Adam spent a Saturday reading it and taking specific notes about its impact on his niche clientele in particular. His Monday communication to his clients provided clear and personalized insights on how the CARES Act applied to their specific situation, and what to expect next. Would a general communication have sufficed? Certainly. Does the fact that Adam’s clients know that they will receive highly specialized information, insights, and expert guidance to implement that is specifically relevant to just them help make Adam’s practice recession-proof? You betcha.

With big strides in thinking and small shifts in strategy, Adam was able to re-focus the services he provided to his clients and the strategies he used to deliver specialized advice, which ultimately resulted in deeper value delivered to his clients!

Stay Out of Survival Mode By Getting Serious About Efficient Systems

The trouble with delivering deeper value to clients is that it tends to take a lot of time… something in short supply in most advisory offices during good times and entirely absent during tougher times.

Thus, competency three is efficiency. One way to survive a protracted 30% revenue decline is to make sure you can deliver personalized information, service, and advice in a hyper-efficient way during market peaks and valleys. In short, you want to develop an efficient, systematized way to deliver your highly specialized services.

Start by making sure you have a crisis communication plan in place so that ‘next time’ you aren’t scrambling to return client phone calls and run reports highlighting whose situation needs attention in a frenzied rush at the very time your calm, reassuring presence is most needed.

By doing so, you won’t fall prey to survival mode should the market decline 10% suddenly, because you have a clear plan at the ready and the calm resolve to see it through. You send an instant email communicating to your most confident savers, telling them that you are monitoring the situation and reviewing plans and portfolios, and will reach out with a call request in the next 48 hours if specific action is warranted for their situation. Otherwise, they will continue to receive ongoing communications appropriate to the next circumstances, whatever they may be. You will call them within a few days, perhaps sooner, but now you can turn your attention to those clients immediately impacted by the situation.

You have already prepared general messaging points specific to the situation and the client profile. Your talking points might be very different with a business owner experiencing critical cash flow shortages than with a retiree who might have to cut back on distributions from the IRA.

Then, like Adam, you can quickly and easily communicate to groups of clients using apps like Loom for personal videos offering your insights and reassurance at scale, and forging deeper client connections with greater efficiency than traditional email.

Now, you are free to focus your phone and meeting time on those clients who need it most, with the presence of mind to do so.

But before this time comes, there is more you can do to get serious about systems. You can borrow another play from Adam’s raise-the-bar playbook: client review surges. By grouping client review meetings into batches held two to four times per year, you can streamline and automate the client review process to a level of extreme efficiency. This then frees you to focus on delivering personal, high-quality advice to each client. Such a surge system allows you to streamline the operational aspects so that you can specialize the more personal ones.

Now, if you want to kick your efficiency engine into even higher gear from here, you will squeeze every ounce of productivity out of your people, process, and platforms by making sure they are automated and integrated. Adam built out over 30 Redtail workflow templates to systematize his client lifecycle from prospect inquiry through ongoing service. This also gave him free time to fulfill his lifelong dream of earning his pilot’s license. During the downturn, his clients have been steady and his revenue stable.

As a result of these changes, Adam’s practice became hyper-efficient giving him ample free time to focus on the fourth, and last, core competency: growth.

Big Story, Small Audience: Distilling Your Focus To Grow Better – Not Just Bigger

Doubling down on his niche and remote technology, Adam was able to narrow his niche from white coat professionals to optometrists while expanding the virtual footprint of his growing practice. This allowed him to focus on telling a big story to a small audience.

Now clear on who he does his best work with, Adam was suddenly able to speak to the very specific pain points and possibilities of his prospects, fostering deeper trust and confidence more quickly.

With his more focused specialty, Adam quickly identified all the places his audience goes, the publications they read, and the best ways he could credibly and consistently tell his story within that community. In short, he built brand leadership in his niche community. As mentioned previously, when the CARES Act was passed, he tailored that knowledge to his clients – and simultaneously to his prospects. In nearly real-time Adam spent another Saturday converting his knowledge into a webinar for, you guessed it, Optometrists. Adam had over 700 Optometrists in attendance, over 400 questions, and more than a few prospective client inquiries!

As a result, I recently had to help Adam develop a waiting list strategy to slow the flow of qualified 7-figure prospects to ensure he didn’t compromise quality to keep up with demand.

Modern marketing strategies like SEO, digital marketing, and podcasts offer even small advisors a scalable way to drive steady growth in their practice before, during, and after during down markets.

If you’re not the front-man type, social media campaigns are coming into vogue as they yield increasingly reliable results. Firms like Snappy Kraken are shaking up the marketing space by showing that advisors with the right mindset and methods can drive steady, more satisfying growth if they’re willing to connect the dots between their story and their strategy.

Whether your go-to growth strategy is going to be personal, digital, or both, consider following the advice I gave Adam when he was ready to build his marketing muscles: more isn’t better, better is better.

As amazing as Adam’s story sounds, it is true and one of many more no-limits stories like it. I don’t share this to impress you, but rather to impress upon you an often-overlooked fact: the only limits you really have are the ones you place on yourself.

Open for Opportunity

I can’t predict when the scary markets of the not-so-distant past will return, but I can comfortably predict that there will be more than a few advisors re-thinking their approach when they do. I hope you are not among them.

Instead, I hope you are asking yourself more challenging questions than ever. The most successful advisors will frame these questions around the four core components of mindset, value, efficiency, and growth. Questions that will make you uncomfortable. Questions that force you to set down your conditioned thinking and pick up new possibilities. Questions that help you to see clearly through the background noise to the strategies that will set you apart. Questions like, “What would make this the turning point that led me to create a bigger, better future?” or “What would it take to deliver twice as much value to clients in half the time?”

Not because there is some magic voodoo in these questions that guarantees success, but because asking better questions is the way to better answers, ones that can help you stay open for opportunity in the days ahead!

Join Stephanie, Michael Kitces, Adam Cmejla, and Suzanne Siracuse for a free 4-part web series “Open For Opportunity: How To Deliver Value & Drive Growth In Any Market,” beginning May 20.

To learn more or register for the series visit: https://stephaniebogan.com/go/success-starts-now-kit

Leave a Reply