Executive Summary

The 2024 Technology Tools for Today (T3) Advisor Conference, held last month in Las Vegas, Nevada, featured a large gathering of financial advisors and representatives from across the fintech industry. Hosted by Joel Bruckenstein and his team from T3 Consulting, the conference focused heavily on the relationship between financial advice and its accompanying fintech, covering everything from how AI and other tech developments are changing the advisor landscape in unprecedented ways to the importance of stringent cybersecurity measures, tech-stack integrations that actually work together cohesively and seamlessly, and the value of retaining the human essence in a wealth management landscape that is constantly moving forward.

In this guest post, Craig Iskowitz – CEO and founder of Ezra Group, a financial technology consulting firm – highlights this year's conference with his signature Twitter-driven recap, featuring presentations on the compelling paradox of AI; as while AI has become increasingly associated with overcoming human limitations with its efficiency, accuracy, and convenience, its weakness actually lies in its lack of humanity and inability to establish human connections. For example, Snappy Kraken emphasized how delegating tasks to AI tools can increase efficiency beyond what advisors can do on their own, and TradePMR shared their own (surprising) experience that their highly skilled personal concierges were actually AI bots; however, both companies conceded that technology can only go so far without a human relationship acting as the 'engine' for all of these (automated) pieces.

A continual thread through the conference was the ongoing effort to build a truly cohesive tech stack. In the wake of an AdvisorTech boom over the last decade, many advisors have all the tools they need to build truly comprehensive solutions for their clients. However, as Pershing Wove's Ainslie Simmonds points out, 65% of affluent investors are willing to leave their advisors if they do not offer an integrated tech experience – and in fact, having interoperable tech was a key component to growth.

Other major highlights from the T3 Advisor Technology Conference included:

- Several speakers, such as Craig Ramsey and Rich Cancro of Advisor Engine, emphasized how processes are quickly changing in the new face of technology, and FP Alpha emphasized that right now presents a better opportunity than ever to reexamine old practices to see what can be simplified, automated, or altered.

- At the same time, Morningstar's CEO Kunal Kapoor highlighted that efficiency comes with a greater demand towards personalization, and Orion's new CEO Nataline Wolfsen also spoke of the importance of aligning technology with the human elements of trust, shared values, and personal understanding.

- Apex Fintech Solutions noted that the average advisor rings in at a cool 97% retention rate for acquired clients, suggesting that net new assets may provide a clearer lens for growth than the more traditional AUM metric. In the same vein, they also highlighted that hybrid firms (i.e., those that offer both digital robo-advice and human touch) are growing faster than almost everyone else, with 24% of net new cashflows despite the low aggregate number of firms with this business model.

- Of course, with digitalization, integration, and automation comes cybersecurity risks. Digital hygiene, encryption security, and good staff training can all be enormous factors in the overall safety of the company, as explained by Patrick Hennessy, Schwab's Director of Business Consulting.

Finally, the annual T3/Inside Information Software Survey, which assesses the software programs used by financial advisors, found that tax planning tools are on the rise – with adoption rates jumping from 30% to 43%. Likewise, while CRM usage has slipped by about 5%, the overall number of advisors who use a CRM still remains at a dominant 92%. And lastly, as data becomes more comprehensive in today's digital landscape, cybersecurity rises in importance – and cybersecurity tool adoption remains on a slow, but steady, rise.

Ultimately, the 2024 T3 Advisor Conference brought together advisors, leaders, vendors, and students from all across the financial advice industry to share insights on threats, changes, observations – and, of course, to examine new opportunities in a constantly shifting fintech landscape. As software providers grow in number and their offerings expand in complexity, automation and cybersecurity will be central themes as client preferences continue to change. Which means that there is plenty of space – and demand – for technology to evolve, continually helping more advisors to be better, and more successful, and also allowing for the definitions of 'better' and 'successful' to grow as our technology options do as well!

At this year's T3 technology conference in Las Vegas, the big 2-0 anniversary was more than just a number – it was a deep dive into the heartbeat of fintech and the future of financial advice.

What was clear from the conference start was that we're not just skating on the thin ice of innovation; we're carving out new paths on a solid lake of tech advancements. Across the board, from Apex Fintech to Envestnet to Morningstar to Orion to Pershing and many others, there's a shared buzz about how tech's not just changing the game in wealth management; it's rewriting the rulebook.

Here's the scoop: all the talk about how to blend technology with a personal touch. It's like everyone suddenly realized that while software is cool, it's the human connection that seals the deal with clients. Growth stories, challenges, you name it – the common thread is about making tech work harder to bring people closer, not push them away.

One trend that stood out alongside the whole tech-meets-touch theme was the massive emphasis on cybersecurity. It's like, as we're all diving deeper into digital, there's this growing chorus reminding us to keep our guard up. Cyber threats are getting sneakier, and the conference was a wake-up call to beef up our defenses without making everything feel like Fort Knox.

Then there was the continuing conversation about AI – how it's not just about crunching numbers faster but making the advice we give more personalized. It's like having a super-smart assistant who knows what your clients need before they even ask. I'm happy to report there wasn't a flood of AI sessions full of hype and marketing promises. The sessions they had were rational and kept the discussions down-to-earth and practical.

But here's a curveball from the conference: the rise of 'hybrid' advisory models. This isn't just tech talk; it's about finding the sweet spot where digital efficiency and human insight meet. Imagine giving clients the sleekness of tech-driven solutions without losing that personal advisor-client spark. It's about blending the best of both worlds to serve up advice that's not just smart but also feels right.

Founder, president, and @fintechie Joel Bruckenstein and his team outdid themselves with a stellar event, by far the best among the dozen or so that I've attended. Marketing partner Impact Communications, led by Marie Swift, came through with flying colors as we always had the latest announcements, press releases, daily summaries, and product information at our fingertips.

Of course, we got our hot little hands on this year's T3 Tech Survey, compiled by Joel and financial planning guru Bob Veres. And there were a few surprises once we dug into the data.

So, what's the biggest takeaway from T3 this year? It's that the future of advice will be more robot-assisted but will still feel distinctly human, at least for now. The tools are getting sharper, but being able to deliver advice with empathy is going to make all the difference in the world.

Apex Fintech: Reimagining RIA Custody

Olivia Eisinger, General Manager of Advisory at Apex Fintech Solutions, broke down the keys to their growth across the past decade and the issues that hold most of the industry back.

Apex's Rise To Power. Since 2012, Apex has seen steady growth, now holding over 21 million investor accounts and $120 billion in assets under custody, outpacing the rest of the second tier custodians but still far behind the Big 3. T3 is prime time for product launches and Apex took advantage by announcing a new onboarding platform called Apex Astra, which I’m assuming will replace their current system called Onboarding Edge.

Addressing Industry Stagnation. Eisinger called out RIAs clinging to their strong retention rates (the average is 97%), noting that keeping clients is not nearly as much of a challenge as acquiring them. In this sluggish market, net new assets should be considered a more accurate growth metric than total AUM. Many advisory firms are not keeping pace with the needs of prospective investors, particularly Gen Xers and Millennials, who now make up the majority of incoming clients and hold $17 trillion in investable assets.

The Power Of Hybrid Solutions. There are still some hot spots in our midst – 'hybrid' advisory firms are growing faster than almost anyone else. Jon Patullo, Chief Product Officer at Apex, noted that these firms are capturing 24% of net new flows despite representing just 1% of RIAs. The 'hybrid' model offers the best of both worlds – technological efficiency and a human touch – satisfying the digitally fluent but financially wary younger generations. (See Bridging the Advisor Technology Gap with Bill Capuzzi, Apex.)

Advisor Engine: Don't Let Success Hold You Back

Spotting The Sneaky Blind Spots. Craig Ramsey and Rich Cancro of Advisor Engine laid it out straight – the bigger your firm gets, the easier it is to miss the little things that can trip you up. Just like a huge truck has spots the driver can't see, successful advisory firms can have blind spots in client support, operations, and outreach to younger generations.

Championing Change. The pair made a solid case for the power of shaking things up. They shared their own story about shrugging off complacency and pushing for a company vibe where people get excited about new ideas, turning the usual fear of change into an office superpower.

Pushing The Tech Envelope. A core principle keeping Advisor Engine moving forward is their insistence on keeping their tech game fresh. Cancro and Ramsey were all in on helping advisors set up their clients with some slick self-service tools – because nobody likes to wait around when they could just do it themselves. If you want to keep up, you have to make sure your tech is as easy to use as ordering a pizza on your phone. (See #WinnersOfWealthTech: Rich Cancro, CEO of AdvisorEngine.)

Dispatch: The Secrets To Buying Advisor Software

Dispatch CEO Rob Nance delivered some valuable insights about selecting advisor software, which is a subject I speak about often as the CEO of a technology consulting firm. So, I appreciated Nance taking the opportunity at T3 to share some best practices.

Nance, drawing from his dual expertise as an advisor and tech CEO, confessed that his initial attempts at building a functional advisor tech stack were riddled with challenges. Only by first building a detailed framework for evaluating software could his team align their technology ambitions with their operational needs.

He emphasized the importance of specificity when assessing software, recommending a deep dive into the causes of operational inefficiencies. For example, a firm he worked at suffered from a 50% rate of client account documents considered 'Not In Good Order' (NIGO) due to data transcription errors. This enabled his team to agree to target a solution that addressed this issue.

Lastly, Nance advocated for quantifying the business impact of technology flaws. By calculating the hours a support team spends on managing NIGOs and the subsequent trust repair time for advisors, firms could measure the real cost to their business and, more importantly, the potential savings and revenue gains from investing in the right software.

The big takeaway? Success in software acquisition is not about bells and whistles but about a rigorous, ROI-driven approach that meticulously bridges the gap between the current and future state of your business operations. (See The Velocity of Technology Change is Increasing: What Can Advisors Do To Keep Up?)

Ed Slott: The Truth About IRAs

Tax- and retirement-planning expert Ed Slott, CPA, delivered straight-shooting insights on why IRAs are a lousy vehicle for transferring wealth and how to turn them into strategic gold for financial advisors.

The Only Constant Is Change. Slott emphasized that while tax laws and retirement vehicles like IRAs are subject to change, the critical constant is the need for strategic tax planning. New legislation creates planning opportunities, so staying nimble and informed is critical to provide real value to clients and create a future-proof legacy.

The Truth About IRAs. Slott sifted through the complexity of numerous retirement accounts to underline a stark reality – IRAs are far from ideal for wealth transfer. He highlighted the urgency of reevaluating beneficiary designations and the potential pitfalls of trusts as IRA beneficiaries under current laws. The #1 mistake retirees make is taking the minimum RMD from their IRA instead of taking the maximum if they're in a lower tax bracket, as they pay lower taxes on the RMD than other distributions.

The Value Of Advice. Advisors may have more value-adds and fancy gadgets than ever, but Slott kept coming back to underscore that genuine, forward-looking advice is where financial professionals earn their keep.

Envestnet: Bill Crager

Envestnet, Inc.'s outgoing CEO Bill Crager shared his vision for the future of the industry, focusing on how integrated and intelligent financial planning can scale and become more accessible.

Navigating Industry Evolution. Tech is becoming an eclipsing force, but Crager championed the foundational role of financial advisors amid the industry's digital metamorphosis. By leveraging robust platforms and infrastructure, advisors can provide better service to more clients.

This better service has resulted in outreach to more prospective clients as embodied by a 27% increase in the number of proposals created by advisors on the Envestnet platform last year, Crager reported.

Resilience In The Face Of Adversity. The essence of our industry lies not just in the technology we create but in the human spirit that drives us forward. Crager opened up about visionary leader Jud Bergman's death in 2019, around which the Envestnet team has rallied to fulfill his vision.

The Future Of Financial Advice. Crager painted a picture of a future where financial planning becomes less about isolated transactions and more about integrated, intelligent ecosystems. He described Envestnet's aim to connect various aspects of personal finance, to facilitate more streamlined advisor-client interactions. (See The Day Envestnet Became the King of Financial Planning Software.)

While this is encouraging, we would still like to see tighter and more robust integrations between MoneyGuide and the rest of the Envestnet ecosystem. Their platforms seem to act more like separate business units, in some respects, rather than a cohesive ecosystem.

Crager concluded by pointing to the potential for increased efficiency and integrationthrough advancements in technology. However, he stopped short of making predictions, focusing instead on current Envestnet initiatives that will enhance support for financial advisors. (See Envestnet is Transforming into The Alibaba of Wealth Management.)

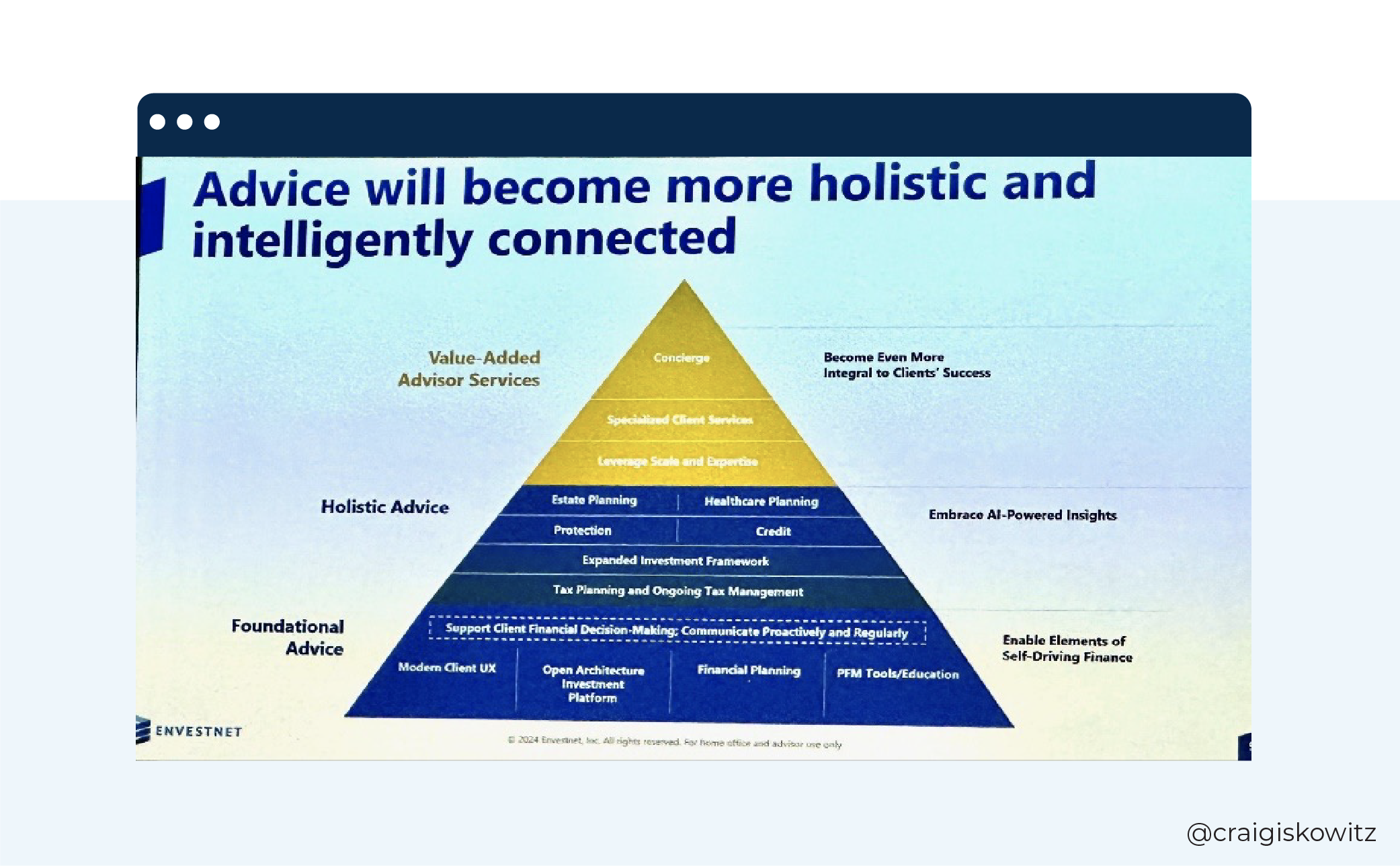

Envestnet: An Integrated Ecosystem

Anuj Gupta, Principal Director of Sales Engineering, and surprise guest Molly Weiss, Group President of Wealth Platforms, provided some useful insights into how Envestnet is bringing together its many acquisitions.

Adaptability Reigns. Weiss highlighted a shift towards more configurable software, reflecting a growing need for tools that cater to diverse advisor strategies and client profiles, pointing to a trend of personalization in financial services. Envestnet's Market Intelligence Research has identified that the most significant challenge facing advisors is the lack of integrated technology workflows.

Envestnet is one of the few platform vendors that have the breadth and depth of services that they can deliver at scale to the largest enterprise wealth management firms. Many other vendors have likewise attempted to grow their platforms from small RIAs up to enterprise firms, and discovered just how difficult it is.

Looking at the advice pyramid slide that Envestnet showed in their presentation, I could make a case that it should be flipped on its head. Modern Client U/X, Financial Planning, and Personal Financial Management (PFM) Tools are all primary entry points for clients into their financial lives.

Blurred Lines. Gupta pointed out the increasingly indistinct boundaries between various financial roles, suggesting that the future lies in unified platforms that can pivot as client situations change. An industry move towards holistic service models is very likely on the horizon.

Efficiency Is Key. Together, Gupta and Weiss stressed the importance of minimizing manual, repetitive tasks, directing us towards a future where advisors leverage integrated systems that streamline the client journey from planning through onboarding through implementation, indicative of a broader industry emphasis on operational efficiency. (See The 3 Biggest Pain Points of Platform Consolidation with Molly Weiss.)

Invent: Oleg Tishkevich

CEO Oleg Tishkevich's presentation offered a glimpse into the complexities of financial tech integration, where the industry's push for seamless experiences sometimes clashes with practical realities.

Demonstrated Adaptability. Tishkevich introduced the Super Hub concept, underscoring Invent's ability to integrate various applications and provide a tailored experience for a range of different user personas.

Promoted Efficiency. 'Swivel chair' workflows often have squeaky wheels – shifting to a unified platform streamlines operations and makes advisors' lives much easier.

Emphasized Customization. Across the fintech landscape, we're seeing modular, user-centric software becoming the dominant approach. Oleg detailed how Invent allows the creation of personalized 'micro apps', giving users the power to customize their digital ecosystem. Interoperability, user experience, and customization are the focus, and their approach is paying off.

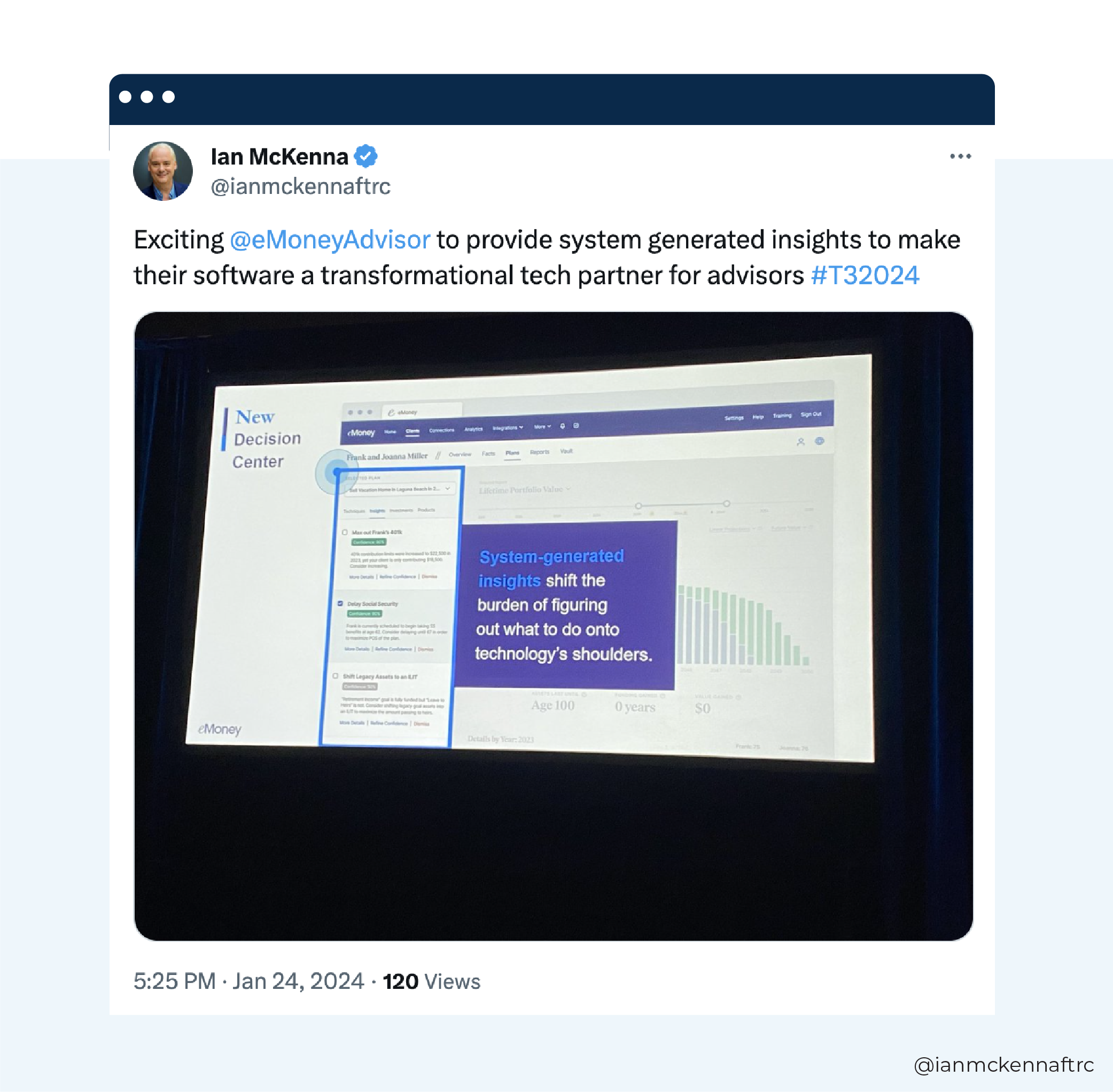

eMoney Advisor: Boosting The Power Of Planning

eMoney Advisor is stepping up its game with improvements to its industry-leading financial planning platform, with the presentation delivered by Josh Belfiore, Group Product Manager, Advisor Experience.

A Fresh Face For Client Portals. Scheduled for a 2024 rollout, eMoney's client portal is getting a makeover. Expect a sleeker design, enhanced user experience, and personalized engagement features that promise to strengthen the advisor-client bond. According to stats provided by Belfiore, clients who access their eMoney portal on a regular basis have better planning outcomes than those who do not, are happier with their advisors, and refer more clients.

Decision Center Upgrades. Say hello to a more efficient planning hub. eMoney's enhancements will save advisors time by consolidating multiple tools and reports into one space, making the planning process smoother and more collaborative.

Data-Driven Insights. The introduction of a feature that offers personalized recommendations based on client data could be a game-changer. Advisors can now provide tailored advice with the click of a button, showcasing the tangible impact of their expertise on client goals.

Across the board, eMoney Advisor's upcoming enhancements reveal a trend toward more interactive, personalized, and efficient financial planning experiences. These updates not only aim to boost client satisfaction but also empower advisors with tools to demonstrate the real value of their services. (See Can eMoney's Mobile App Deliver an Incentive for Clients?)

FCI Cyber: Brian Edelman

Navigating The Murky Waters Of Digital Threats. Brian Edelman, CEO of FCI Cyber, provided a stark yet informative briefing on the escalating arms race in cybersecurity. Based on his 27 years of experience, he highlighted a sobering statistic: More than 65% of businesses are unprepared for a cyberattack; he also suggested that the real figure could be even higher.

He pointed out that cybercriminals are not just becoming more sophisticated but also more prosperous, providing them with the resources to harness advanced tools like artificial intelligence to increase the effectiveness of their attacks.

The old jokes about emails from Nigerian princes seem antiquated when compared to the electronic weapons being deployed by today’s malicious actors, Edelman noted.

Zero Trust Is The Way to Go. He explained how government entities, recognizing the gravity of these threats, are disseminating critical information with unprecedented speed, producing guidelines such as phishing-proof MultiFactor Authentication (MFA) and the Zero Trust Security Model 2.0. Understanding these resources and implementing tools based on them are vital for organizations aiming to bolster their defenses against ever-evolving threats, Edelman warned.

Watch Out For Regulations. Regulatory bodies are not just issuing fines but striving to make a difference, Edelman insisted, pushing companies towards adopting stringent cybersecurity measures. The role of cyber insurance is also morphing; where once vague applications and low premiums were the norms, now, due to significant losses, insurers are tightening the screws – raising premiums, demanding detailed security measures, and using company risk scores in underwriting.

Edelman then shifted towards the practical with solid advice on preventing common cyber threats like ransomware and password hacking. He emphasized the necessity of robust antivirus software, multifactor authentication, and company-wide education. He also noted that password management should extend beyond the office to personal practices, underscoring the value of simple, proactive measures like starting each password with the name of the system it protects.

(See Wells Fargo Data Leak Shows Risk Goes Beyond Hackers.)

FP Alpha: Andrew Altfest

Andrew Altfest, founder & CEO at FP Alpha, shared some enhancements to their Estate Snapshot offering, which summarize and visualize elements of a client's estate plan, including fiduciaries, beneficiaries, and asset distribution provisions.

A Step Ahead. FP Alpha was one of the first applications to allow advisors to upload PDFs of clients' wills, trusts, and power-of-attorney documents, where the software would summarize them and generate a personalized deliverable, including a visualization of the client's distribution plan.

Reaching Complete Automation. Up until now, FP Alpha’s document analysis was performed through a combination of AI and human experts, taking an average of 3-5 days. Altfest explained that the performance of their AI has steadily improved as it has been trained on thousands of client documents to the point where they believe human oversight is not needed in cases of wills and simple revocable trusts, reducing processing time to mere minutes. 100% automation has also been achieved for Power of Attorney (POA), advance directives, and healthcare proxies, providing advisors with client deliverables in just a few minutes. Full automation for cases involving irrevocable trusts is slated to be rolled out later this year.

We're expecting these types of advancements in AI-powered assistants to dramatically increase client satisfaction as they will receive targeted advice and recommendations much quicker and more holistically. Without adding work or members to their team, RIAs will be able to deliver basic estate planning services to more clients. (See AI's Judgment Day: How ChatGPT-4 is Reshaping Wealth Management)

Morningstar: Kunal Kapoor

In a fireside chat with Joel, Kunal Kapoor, CEO of Morningstar, discussed the integration of AI in advisory services, acknowledging both the potential and the skepticism.

AI Fatigue. Kapoor acknowledged a certain weariness in the industry towards AI hype while emphasizing AI's potential to streamline advisor workflows and reduce friction, enhancing focus on client relationship building.

The Rise of Personalization. A significant shift towards tailored investment strategies is coming, with a new generation of investors demanding more control and personalized portfolios, leveraging technology for customization at scale.

Data Security. Cybersecurity is increasingly vital in the age of AI, and Kapoor urged advisors to establish clear communication protocols with clients to prevent data breaches and unauthorized transactions. (See Embracing External Trends in the TAMP Space with Daniel Needham, Morningstar.)

Nest Wealth: Mastering Digital Transformation

Redefining The Mundane. Over the past decade, CEO Randy Cass's journey with Nest Wealth has seen the firm pivot from a direct-to-consumer robo-advisor to becoming a central technology solution provider for Canada's largest financial institutions. Their focus? Streamlining tedious, cost-intensive processes that haven't seen innovation in years.

Globalization Goals. The regionalization of software solutions often leads to industry-leading products in one area being virtually unknown in another. Cass sees global cross-pollination in fintech solutions as a leading source of innovation in the coming years.

The Power Of Friendship. Perhaps the most important choice a business leader makes is who they align themselves with. Toronto-based Nest Wealth's was recently acquired by Italian banking and asset and wealth management software provider Objectway, which has set up the company to reach new heights if their strategic plans come to fruition.

Nest Wealth has built an impressive client portfolio, which includes wealth management firms Raymond James and Manulife Securities and 3 out of Canada's 6 largest banks, including National Bank of Canada and National Bank Independent Network.

Exploring a New Continent. This deal marks Objectway's first foothold in North America, and the 2 companies appear to be complimentary. Objectway has clients across Europe, the Middle East, and Africa (EMEA), and they will now be able to take Nest Wealth's digital client onboarding and planning solutions and combine them with their existing slate of advisory, discretionary portfolio management, and back-office software products.

Cass added that the deal with Objectway will "accelerate our expansion across the North American region, and open up additional market opportunities in EMEA".(See The Secret Sauce in the Top 6 Client Onboarding Vendors.)

Orion: Natalie Wolfsen

Orion's new CEO, Natalie Wolfsen, spotlighted a striking contradiction: Virtually all financial advisors acknowledge the need for technology to stay competitive, yet less than half find value in the tech they use.

Following Psychology. "We want our advisors' experience to be less Zeigarnik and more Gestalt", she announced – which is a phrase I never expected to hear at an industry conference. (Translation: fewer interruptions, more holistic experience.)

These terms are part of the psychological underpinnings of what makes an intuitive user experience. The Zeigarnik effect is when people become upset when they are interrupted and cannot finish a task, while Gestalt psychology emphasizes the processing of complete patterns and configurations.

Along these lines, Orion aims to create a seamless, integrated tech ecosystem where advisors have a unified platform offering a single source of truth.

Humanizing Financial Tech. Wolfsen underscored the importance of aligning technology with the human elements – trust, shared values, and personal understanding – to avoid it becoming a source of frustration. She hinted at upcoming Orion innovations that promise to enhance the advisor-investor relationship through planning experiences informed by behavioral science. (See Orion Advisor Buys Redtail Technology with Kristen Schmidt.)

Pershing Wove: Ainslie Simmonds

Ainslie Simmonds, President of Pershing Wove, highlighted some practical tips for how financial advisory firms can leverage technology to drive long-term growth.

The Shift Towards Comprehensive Platforms. Firms are increasingly seeking integrated platforms that can handle the diverse needs of broker-dealers, RIAs, and large trust platforms, Simmonds noted. They also regularly find themselves constrained by initial tech decisions that don't scale well with growth. These issues often require more comprehensive and wide-reaching solutions, and more one-stop-shop options (like Wove) are on their way to meet that demand.

These comments grabbed my attention since we at Ezra Group have a number of large clients that have all 3 components: a broker-dealer, a corporate RIA, and a bank/trust. This combination generates a geometric increase in complexity for their technology infrastructure since they have different needs and there are few vendors that support all 3.

The Emerging 'Amplification' Solution. Between full outsourcing and the 'assembler' approach, there is an emerging 'amplification' offering where wealth management firms piece together their tech stack from different providers, according to Simmonds. Amplification can theoretically provide a more configurable platform that enables tailoring tech without the need to handle every aspect in-house. However, this approach can greatly increase the stress on your internal tech resources who will have to manage data integrations between applications. She sees the middle ground as a strong contender for those desiring powerful solutions that are also affordable.

Interoperability As A Revenue Driver. Simmonds shared the stat that 65% of affluent investors are willing to leave their advisors if they do not offer an integrated tech experience, highlighting the dire need for both simplification and connectivity. Firms with highly interoperable tech were shown to grow revenue 6 times faster than those without, providing a compelling case for prioritizing interconnected systems and supporting Simmonds's pitch for the future capabilities of the Wove platform.

Simmonds's insights reveal that for advisors and tech providers, the path to dominance hinges on embracing interoperable, scalable technology solutions that can adapt to evolving business models and client demands. (See Pershing Wove Goes All In On Financial Planning, with Ainslie Simmonds.)

RBC: Navigating The Technology Horizon

Tara Wells, Director of Product Management, and Dillon Benz, Manager of Technology Consulting, provided a glimpse into RBC's strategic integration of user-friendly technology with client-centric services around their clearing and custody offerings.

User-Centric Tech Design. Wells put forward a compelling narrative for technologies that prioritize user choice and ease of use, mentioning RBC's principle that if a technology requires extensive training, it's not achieving its purpose. She highlighted the RBC Nexus as a central hub for advisors, designed with these principles in mind.

Streamlining Vendor Selection. Benz added depth to the discussion, revealing RBC's marketplace that simplifies the selection process from a daunting array of over 150 third-party vendors. He noted the marketplace's design for ease of navigation and its alignment with the firm's technology consulting services.

High Satisfaction Scores. Together, they painted a picture of RBC's commitment to empowering advisors through technology, underscored by a Net Promoter Score of 9.8, reflecting high satisfaction with RBC's technology consulting services. This score indicates strong approval from clients who have experienced RBC's approach to integrating technology into their service offering. (See RBC Tries to Jumpstart RIA Custody Business with New Platform.)

Ritholtz Wealth: Our First Acquisition

Amidst a backdrop of technological shifts and strategic moves in wealth management, Josh Brown and Michael Batnick from Ritholtz Wealth Management, along with Rich Cancro of AdvisorEngine, took the stage to discuss their acquisition of FutureAdvisor from BlackRock in a refreshingly honest conversation.

The Complications Of Acquisition. Ritholtz has historically held an organic-growth mindset but saw the strategic leap to acquire FutureAdvisor as a risk worth taking. Since FutureAdvisor was a pure robo-advisor, the conversion of client accounts required some extra care – for example, making sure clients were aware of the change despite Ritholtz not having any legal ability to speak with them until after the transaction was completed. To get around this, they sent out a negative consent letter, which did not require client approval.

Overcoming A Pile Of Roadblocks. The deal had to be done quickly, so Cancro and his team at AdvisorEngine – Ritholtz's core portfolio management platform provider – were given just a few months to build a brand-new portal to support the incoming FutureAdvisor retail clients. On top of that short turnaround, the whole process was extra complicated since it was scheduled for Labor Day weekend, which happened to be the same time as the Schwab-TD Ameritrade cutover!

Cancro was candid about the daunting technological challenges they faced, such as converting and recalculating performance history to align with Ritholtz's standards, which had to be done seamlessly or risk impacting the confidence of their new clients.

A Human Touch. The conversation highlighted the importance of a human touch in an era increasingly dominated by digital solutions. Despite the acquisition of a tech-driven platform, Ritholtz emphasized the ongoing necessity for human CFP professionals to guide clients through the digital maze, reinforcing the idea that technology, no matter how advanced, cannot replace the nuanced understanding and empathy provided by human advisors. (See Why Technology Cannot Replace Likability for Advisors: Josh Brown.)

RFG Advisory: Shannon Spotswood

Shannon Spotswood, President of RFG Advisory, highlighted some key trends of the moment across the wealth management industry.

Falling In The Talent Gap. Spotswood underscored the industry's imminent talent gap, with a projected shortfall of 10,000 advisors to manage over $10 trillion in client assets. She pointed out that next-gen advisors want to focus more on client relationships rather than being bogged down by administrative tasks, and firms must cater to that.

Beyond Financial Advice. The wealth management advisors of tomorrow are anticipated to take on a more holistic role, akin to life coaches, going beyond financial planning and investment management. Clients increasingly seek out advisors who resonate with their values and can offer a deeply personalized experience.

Innovation Is Here. The wealth management industry is brimming with innovation, thanks to the vibrant FinTech sector and an infusion of growth capital. These advancements span the entire spectrum of the industry, from AI to cybersecurity, and are crucial for propelling organic growth amidst the largest generational wealth transfer in history. (See Unleashing Potential: A Next-Gen Advisor Platform with Shannon Spotwood.)

Schwab: Fraud Prevention Best Practices

Patrick Hennessy, Director of Business Consulting for Charles Schwab, who stepped in as a last-minute replacement speaker, addressed the pressing issue of fraud prevention for advisory clients.

Cyber Threat Landscape. He began with a sobering overview of the cyber landscape, noting the 3.4 billion phishing emails that are sent daily and the alarming statistic that 41% of sensitive data in U.S. companies remains unprotected. He cited specific cases such as MGM's cyberattack, which resulted in a staggering $100 million in recovery costs, contrasting this with Caesar's approach to paying a ransom, which cost between $1 million and $10 million.

Building Human Firewalls. Hennessy advocated for internal vigilance, highlighting the value of employee training to build a 'human firewall'. He recommended utilizing frameworks like those developed by NIST for structured cyber defense and stressed the significance of multifactor authentication as a deterrent against unauthorized access.

Advocating for Encryption Security. The presentation also touched on the importance of encryption and secure credentials management, with Hennessy suggesting password managers as a tool for maintaining strong and unique passwords. He shared examples of both personal and corporate best practices for data protection.

Hennessy underscored the need for a comprehensive approach to cybersecurity, emphasizing that both technology and education are required to mitigate the risks and potential damages from cyberattacks. (See Top 5 Cybersecurity Failures in Financial Services.)

Smartleaf: You're Doing Portfolio Management All Wrong!

Amidst a backdrop of rapid industry evolution, Gerard Michael of Smartleaf provided a candid and data-driven analysis of the approach to portfolio management he has seen at many advisory firms.

Rebalancing Hygiene. Michael emphasized the necessity of year-round tax loss harvesting, underscoring its effectiveness, which he claims is 75% more beneficial than annually. He pointed out a common pitfall: inefficiencies in rebalancing at scale, which, according to Smartleaf’s data, can lead to excessive and unnecessary tax bills for clients.

Underrated Indexing. Direct indexing, a strategy that allows for personalized and tax-optimized portfolios, is an underappreciated option in its efficacy. Michael shared a compelling statistic: Transitioning legacy holdings to a direct index account could slash tax costs by over 95%, a staggering figure that suggests many advisory firms might be missing out on significant value for their clients.

Scale Through Automation. Embracing automation in rebalancing and tax management is the best way to provide true personalization at scale, and Michael argued that it's worth embracing. He challenged advisory firms to document and demonstrate that they save or defer more in taxes for their clients than the fees they charge, advocating for a value-driven approach. (See Trust the Process: Why Advisors Should Let Rebalancing Software Manage Client Portfolios.)

Snappy Kraken: Robert Sofia

Robert Sofia, CEO of digital marketing firm Snappy Kraken, offered a deep dive into effective marketing strategies for financial advisors, backed by a comprehensive data analysis of over 600,000 marketing campaigns, 60 million emails, and 39 million investor contacts.

Search Engine Optimization (SEO) Is King. Sofia underscored the importance of SEO for driving website traffic. Advisors focusing on SEO see 87% better performance in web traffic and 75% more pageviews. RIAs that invest in a well-maintained Google My Business page and focus on long-tail keywords can double their website's performance.

The Power Of Video. Utilizing video content significantly increases engagement, with open rates and click-through rates more than doubling when video is included in campaigns. Sofia emphasized the trust-building power of video, which is second only to in-person interactions, encouraging advisors to use video to connect with and expand their audience.

Delegation Elevation. Advisors who are consistent in their marketing efforts and delegate tasks effectively see a substantial boost in lead generation and appointment requests. Automation and delegating marketing to a dedicated team or service can lead to 6 times the website traffic and 3 times the lead generation compared to doing it all solo. (See Don't Wing It: 5 Tips for the Enterprise Market with Robert Sofia.)

Softpak Financial Systems: Driving Optimization At Scale

Christopher Stewart, Director of Client Relations at Softpak Financial Systems, and Joseph Smith, CIO at Parti Pris Investment Partners, delivered a discussion on the power of technology to drive optimization and personalization at scale.

UMAs Everywhere. The industry is clearly shifting gears towards Unified Managed Accounts (UMAs) that allow for the combination of different investment types under a single account structure. Centralized UMAs managed by the home office can deliver massive scale as well as personalized wealth management strategies.

Marrying Risk And Taxes. Smith traced the trajectory of personalized investment strategies, from mutual fund-centric approaches to the contemporary focus on individualized stock, bond, and ETF portfolios. He emphasized that this is not just about buzzwords; it's about marrying risk and taxes in a way that makes clients' money work smarter. Parti Pris has integrated advanced portfolio optimization tools such as Axioma, BARRA, and Northfield to provide additional firepower by combining risk management with tax optimization to deliver a more nuanced, client-centric service. (See How Predictive Health Data Drives Personalization in Financial Planning.)

Challenges Of Personalization. The industry is pivoting towards sophisticated portfolio optimization tools to cater to specific client needs, such as managing legacy positions and avoiding securities that don't align with a client's values. This approach requires meticulous attention to data quality and operational capabilities, as well as user-friendly workflows, to ever be achievable at scale. Smith proposed that with the right technology behind it, ESG could become a consistent and viable approach.

Summit Wealth: Reed Colley

The wealth management landscape is continuously morphing, and at the vanguard is Reed Colley, co-founder and CEO of Summit Wealth. His remarks shed light on the delicate balance between leveraging the latest technology and retaining the human essence, which should be at the core of wealth management.

Embracing Technological Choices And Challenges. Colley emphasized that while there is a burgeoning array of tech options available to advisors, it's wise to avoid the allure of novelty for its own sake. He stressed the importance of integration in ways that simplify processes and enhance client engagement, avoiding tasks that can devalue an advisor's work.

This approach appears to be paying off, as the week before T3, national RIA Brighton Jones announced they were moving their $20 billion in assets away from Envestnet Tamarac and onto the new Summit Wealth platform. Although, putting this in perspective, Summit still has only 20 RIA clients and declined to release their current AUA (which means it's most likely way less than they expected at this point). But portfolio management systems are some of the stickiest software in the RIA ecosystem, so I'm not surprised that it's taking longer for them to reach critical mass.

The Shift From Math To Humanity. Colley reflected on the industry's evolution from focusing on data and numbers to prioritizing human elements. Colley advocated for aligning wealth with values and leveraging technology to create deeper, more meaningful interactions with clients rather than being bogged down by manual processes that impede personal connection. Their $20 million Series A funding round back in March 2022 will be a big help in building more intuitive technology.

The Data Dilemma. According to Colley, the fragmentation of client data across various platforms remains a significant hurdle. He outlined the need for a central system that not only consolidates this information but also makes it actionable, paving the way for advisors to conduct richer, more client-centric conversations.

The Future Of Personalization In Wealth Management. Looking ahead, Colley envisioned a future where data and technology serve to enhance the advisor's humanity rather than replace it. He predicted that the next 2 decades would continue to see growth in the RIA space, driven by advisors who adeptly blend technological tools with an empathetic approach. (See How to Build an RIA Tech Stack That Gets Results.)

Syntax Data Direct Indexing: Patrick Shaddow

I had not heard of Syntax Data before this conference, so I was looking forward to hearing from their CEO Patrick Shaddow as he discussed his goal for the democratization of investment management.

Syntax Data was given the T3 Emerging Technology Award by Joel Bruckenstein on the conference's opening day. "Syntax Data allows advisors to differentiate themselves from others who offer name-brand indices and portfolios, while better matching the investment portfolios to the unique needs of each client, at scale," Bruckenstein said.

In his breakout session, Shaddow highlighted technological advancements that have progressively leveled the playing field for investors over the past century. He pointed out that technology's role has been pivotal in granting broader market access, ultimately empowering more individuals to invest.

A Growing Investment In Investment. As of the end of 2023, around 158 million (or 61% of) U.S. adults invest in equities, according to a recent Gallup survey. The 2008 financial crisis knocked many Americans out of the market, and the percentage who owned stock plummeted to 52% by 2016 but has steadily increased since then.

Keeping Up With The Times. The demographics of financial consumers are changing – a tech-savvy generation is emerging with different expectations and behaviors. Shaddow noted these new investors often seek financial advice through social media and digital platforms, necessitating a shift in how financial advisors engage and communicate. Time for advisors to get on FinTok!

Syntax Direct. Shaddow introduced Syntax Direct, a new tool for advisors to create customized investment strategies, including Direct Indexing (DI). He detailed its ability to modify traditional indexes to align with specific investment goals, suggesting this tool could be essential for advisors to efficiently service a growing and more diverse client base.

Syntax Direct will likely be facing an uphill battle for attention as it enters a crowded market – and excitement over direct indexing peaked over a year ago. There was a string of M&A activity as major players snapped up DI providers post-pandemic, with BlackRock acquiring Aperio in November 2020 and JP Morgan Asset Management picking up OpenInvest in June 2021. In a bid to provide more customizable ESG offerings, Vanguard made its first acquisition when it bought Just Invest in July 2021.

Fortunately (for Syntax Data, at least), according to the Financial Times, a 2022 survey by the CFA Institute found DI was the most popular customization tool among investors who had financial advisors, with 56% saying they were interested in utilizing them. In 2020, $3.5 billion was managed through DI, and that number is expected to grow an average of 34% per year for the next 5 years to $1.5 trillion from wealth manager demand alone. (See Implementing Tax-Smart Portfolios at Scale.)

T3 Tech Survey: Joel Bruckenstein And Bob Veres

In an in-depth conversation filled with industry insights, Joel Bruckenstein and Bob Veres shared valuable takeaways from their extensive tech survey among financial advisors. Here are the highlights:

CRM. The survey garnered 2,917 responses, a robust total, revealing trends and preferences in technology usage among advisors. Despite a slight dip in CRM software utilization, the data showed consistent year-over-year trends and a growing reliance on financial planning tools, with CRM usage surprisingly slipping from 97% to around 92%.

Tax Planning And Retirement. Veres noted the escalating adoption of tax planning tools, which soared from just under 30% to 43% in 2 years, likely driven by the uptake of software like Holistiplan and FP Alpha. Retirement distribution planning software had more modest growth, suggesting an area ripe for innovation and increased attention from advisors.

Cybersecurity. Despite a slow but steady increase in cybersecurity tool adoption, Bruckenstein urged advisors to prioritize this aspect more heavily, considering the critical nature of data security in today's digital landscape.

The data provided by this annual survey is helpful for anyone trying to understand which technology is most popular with advisors. Because the data isn't gathered using statistically sound principles, the results are skewed by voluntary response bias.

Advisors who had exceptionally positive or negative experiences with their software may be more motivated to participate in the survey, while advisors with neutral or average experiences may be less inclined to take the time to provide feedback, potentially leading to a slanted representation of satisfaction.

This doesn't mean the T3 survey isn't valuable, because it is! At Ezra Group Research, we reference it quite a bit. We believe that while individual percentages may be off (some way off), overall, the data is directionally accurate. Meaning that you shouldn't read too much into the data for a single product. But taken in aggregate, this survey is incredibly useful to gain a deeper understanding about the market for wealth management software.

TradePMR: Will Your Clients Turn To ChatGPT?

Bill Coppel, TradePMR's Chief Growth Officer, isn't here to chat about AI; instead, he's dishing out real talk on the human elements that power the future of wealth management.

Understated AI. Bill started his talk with an unexpected twist, sharing his discovery that his 'personal concierge' at the conference hotel was actually an AI bot. This anecdote led to a deeper conversation about how technology, especially AI, has permanently altered our expectations and relationships, even down to the way we communicate and make decisions.

Urgency Overload. Coppel highlighted how tech giants like Amazon and Apple have cranked up everyone’s sense of urgency. He encouraged the audience to consider a broader cultural shift away from immediate gratification, which everyone with an internet connection and a phone is currently struggling with – whether they acknowledge it or not.

Connection Over Convenience. In a world where we're trading trust for convenience, it's human relationships that still matter most. He emphasized that while AI might be able to manage data and patterns, it can't replicate the nuances of human emotion or replace the deep value of personal connections. (See Text and Chat: How AI is Reshaping Client-Advisor Communications.)

Startups At T3

One of the benefits of T3 is that it acts as a central clearinghouse for new ideas from some of the brightest industry minds. We ran into a bunch of new (and relatively new) companies that were attending T3 for the first time. Here's a brief rundown of each:

- Arqa – Looks like investment data analytics with some AI stuff on top. According to their website, they can import chartered financial documents and convert them into actionable data. They seem to focus on private fund documents, 10-Ks, and that kind of stuff. It looks like some combination of classic AI analytics and PDF-statement extraction like Canoe. I referred to them as "VRGL for Alts".

- Asset Sprout – Their website claims they're an "all-in-one" platform for advisors (too bad Michael Kitces and I retired the All-in-One category from the Advisortech map!), but to be blunt, their website is light on details, so I'm guessing they're a performance-reporting tool with a portal and a dashboard. Need to see more.

- Bequest Finance – A document vault for digital assets used for legacy planning. Good-looking website. I like the screenshots of their visualization of how digital assets would be distributed to heirs. Similar to some high-end estate planning tools. But why limit it to only digital?

- Dispatch – Looks like a client-data-gathering tool similar to PreciseFP but with the ability to automate via document import and extraction from tax forms. Claims to also handle account opening, but I'll believe it when I see it. Recently scored an $8M funding round and rebranded.

- Fiduciary Genius – A light financial planning tool focused solely on retirement. An interesting mix of portfolio risk, fee analysis, and budgeting.

- Sidedrawer – These guys aren't exactly new, but they're growing fast and have a complementary mix of features and functionality in the document vault and document management space. An enhanced client vault that offers data gathering, access rights, and file sharing – as well as workflows – all accessible via APIs.

- Syntax Data – An asset management play with some software support for their direct-indexing products. Not a pure technology provider but leverages technology to support their asset management products.

- Zocks – Another in the recent rush of products launching in the client-meeting-support category. Similar to leading application Pulse360 or trying to be the Fathom for advisors, they group information into categories rather than in chronological order.

A big shoutout to Ian McKenna from the Financial Technology Research Centre for sharing his videos of a few sessions that I missed. Thanks, mate!