Executive Summary

(Michael’s Note: In light of the breaking news of the long-awaited release of the House GOP tax reform legislation, we have pre-empted the usual Friday Weekend Reading with this special “In-Depth Review Of The Proposed Tax Reforms” edition of Weekend Reading! Hope it helps!)

(Note: For an updated discussion of the final 2017 GOP Tax Plan, see Individual Tax Planning Under The Tax Cuts And Jobs Act Of 2017.)

After more than a year of buzz from both House Republicans, and President Trump, and high-level proposals that were scant on crucial details, this week the House GOP finally unveiled the actual draft legislation of its proposed tax reform – kicking off the messy process of Congressional compromises that may still be necessary to actually pass the reforms into law, but providing a first real glimpse at exactly what is on the table.

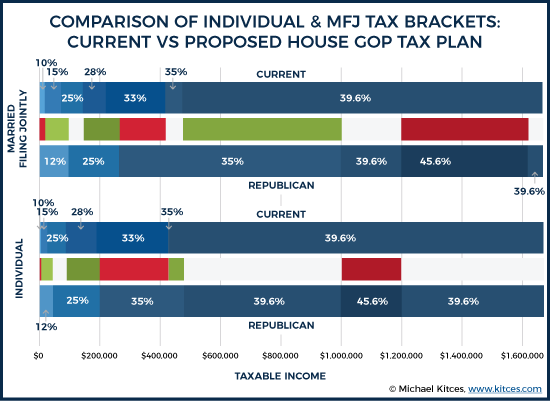

While the proposals of the “Tax Cuts and Jobs Act” are not quite the sweeping level of “file your tax return on a postcard” that Republicans had proposed early on – as the inevitable push for compromises eliminated the elegant simplicity of the original version – the House GOP proposal nonetheless represents some of the most significant tax reform in more than 30 years, with a reduction in the number of tax brackets from seven to four with the same top tax rate of 39.6% (albeit with a 6% surtax for a portion of income over $1M that effectively creates a new 5th tax bracket at 45.6% before reverting back to 39.6% again), the repeal of the AMT, and substantial simplification employee fringe benefits, college tax preferences, and itemized deductions… along with a near doubling of the standard deduction that will make itemizing a moot point for most individuals anyway.

On the other hand, the proposed changes also bring a whole host of crackdowns that will likely trigger complaints for many – but then again, sweeping tax reform virtually always means that everyone has at least some pet deduction or tax credit to lose. Though for many, the negatives will be made up for most of the middle class by the expanded standard deduction, an increased $1,600 child tax credit, and a new “Family Flexibility Credit” of $300, fewer (and for many, lower) tax brackets, while more affluent business owners will be attracted to the opportunity for many types of pass-through business income to be taxed at favorable 25% tax rates (though, alas, not the pass-through income for financial advisors!), as well as a (delayed) repeal of the estate tax (starting in 2024).

Ultimately, it remains to be seen whether or how much the Tax Cuts and Jobs Act will be altered from here, as the messy process of compromise begins in an effort to garner the necessary votes to actually pass the legislation. Nonetheless, the fact that so many compromises have been brought already, from the original House GOP framework, and the fact that the GOP already laid the groundwork to pass the legislation with an up-to-$1.5 trillion deficit projection under budget reconciliation rules (which only require 51 votes in the Senate and cannot be filibustered), suggests that legislators are truly positioning this proposed tax reform legislation as something that can garner enough votes to pass (as in current form, it is projected to cause a $1.487T revenue loss over 10 years, just under the budget reconciliation thershold). Which means that while some of the exact details may shift, the current proposal has a real chance of being passed in the coming month, setting a new foundation for the Internal Revenue Code (and individual tax planning) in the coming decade!

(For full details of the Tax Cuts and Jobs Act, the full legislative text can be viewed here, while a summary of the key points from the Ways and Means Committee is available here.)

Individual Tax Bracket Changes Under The Tax Cuts And Jobs Act (TJCA)

Under the Tax Cuts and Jobs Act (TJCA), the tax brackets for individuals would shift from the current 7-bracket system of 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%, down to a simpler 4-bracket system of just 12%, 25%, 35%, and 39.6%.

The new 12% bracket would go up to $45,000 for individuals and $90,000 for married couples – effectively capturing the “old” 10% and 15% brackets, as well as a small slice of the prior 25% bracket, resulting in an effective tax cut for most affected.

The new 25% bracket would extent to $200,000 for individuals and $260,000 for married couples, combining what was previously the 25% and 28% tax brackets (and a small slice of the 33% bracket), again resulting in a small tax cut for most affected.

The new 35% bracket would then extend all the way to $500,000 for individuals and a whopping $1,000,000 for married couples, combining the prior 33% and 35% brackets, and shifting a portion of the prior top 39.6% bracket down to 35%... triggering a 2% tax rate increase for those under $416,700 of income (the top of the “old” 33% bracket threshold), but providing a 4.6% tax rate savings for those who were previously in the 39.6% tax bracket (but below the $500,000 and $1,000,000 thresholds).

Notably, while the new system retains the old top tax rate of 39.6%, there is a special phase-out for upper income individuals that increases their income in the 12% bracket up to 39.6%. This phase-out of the 12% bracket begins at an AGI of $1,000,000 for individuals, and $1,200,000 for married couples. Once these income thresholds are reached, a 6% surtax applies (i.e., taxes are increased by 6% of the excess of AGI over the threshold) until the entire 39.6% - 12% = 27.6% tax savings of the first tax bracket has been phased out.

Example 1. Charlie is a high-income individual with AGI of $1.1M. Because he is $100,000 over the $1M threshold, his tax bill is increased by 6% of $100,000 = $6,000. As Charlie’s income continues to rise, he will be taxed at 39.6% (his tax bracket), plus another 6% for each additional dollar, until his 12%-bracket-phaseout surtax reaches $45,000 x 27.6% = $12,420. At that point, his entire $45,000 of income that was previously in the 12% tax bracket will have been surtaxed up to 39.6%, and the surtax no longer applies.

Given that the difference between the 12% bracket and the top 39.6% tax bracket is 27.6%, and the 12% tax bracket itself ends at $45,000 for individuals and $90,000 for married couples, the 12%-bracket-phaseout ends once individuals exceed the threshold by $207,000 (a total AGI of $1,207,000), while a married couple reaches the phaseout cap after $24,840 of surtax (which is $414,000 of additional income, or a total AGI of $1,614,000).

In other words, high-income individuals effective face a special 45.6% tax bracket that applies from $1,000,000 to $1,207,000 for individuals, and $1,200,000 to $1,614,000 for married couples. Additional income above these thresholds reverts back to the original 39.6% “top” tax bracket. But with the 45.6% bracket, the new tax plan would effectively have five tax brackets and not just four (where the 39.6% bracket appears twice, before and after the 45.6% bracket).

In the meantime, tax bracket thresholds themselves will be indexed for inflation going forward, albeit using the projected-to-be-slightly-lower chained CPI-U instead of headline CPI. On the other hand, AMT tax rates – and the entire AMT tax system – is fully repealed!

All of the newly proposed tax brackets would first apply for the 2018 tax year (not retroactively for the current 2017 tax year).

Alternative Minimum Tax (AMT) Repealed With Release For Minimum Tax Credit Carryforwards

In combination with the refinement of tax brackets and the elimination of various deductions, the Tax Cuts and Jobs Act would also repeal the existing Alternative Minimum Tax system - although in point of fact, this is being done in large part by making many of the typical adverse adjustments and preference items currently limited under the AMT, and simply making them unavailable for regular tax purposes as well - which, as discussed below, includes limitations on everything from deductions for state and local income taxes paid, to the tax-exemption on interest for private activity bonds.

Nonetheless, the "good" news is that the AMT is (finally) repealed under the TCJA legislation. For those who have been impacted by the AMT, it will no longer loom large - although ironically, for high-income individuals, harvesting additional income this year (e.g. via a partial Roth conversion) at top AMT rates (of "just" 28%) may actually be more appealing than facing the 35% and 39.6% tax brackets next year after AMT is repealed.

For those who have had Minimum Tax Credit (MTC) carryforwards - which are a dollar-for-dollar tax credit against regular tax liabilities, but only to the extent it does not reduce the individual's regular tax liability below his/her tentative minimum tax - the repeal of the AMT will finally release those AMT credit carryforwards. In fact, for some, the release of the MTCs may be so substantial as to actually create a negative tax liability, which would potentially waste them; accordingly, the TCJA legislation would allow 50% of any excess MTCs to be claimed as a refundable tax credit over the subsequent 3 years of 2019, 2020, and 2021, with any/all remaining MTCs still carrying forward to be claimed as refundable in 2022 (assuming the AMT credits are initially released with AMT repeal in 2018).

Capital Gains And Qualified Dividends Under The House GOP Proposal

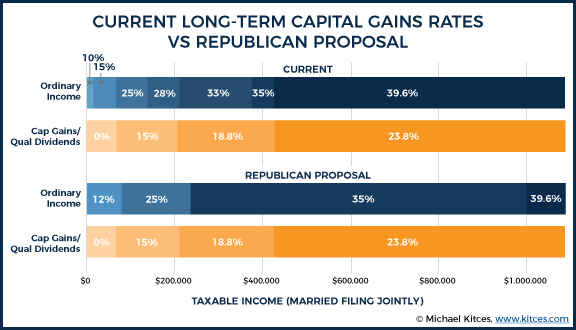

When it comes to capital gains and (qualified) dividends under the House GOP proposal, the Tax Cuts and Jobs Act would retain the current 3-bracket structure, where those in the bottom two tax (10% and 15%) brackets are eligible for 0% capital gains rates, those in the middle four tax brackets (25%, 28%, 33%, and 35%) get 15% capital gains rates, and those in the top (39.6%) tax bracket are eligible for 20% long-term capital gains and qualified dividend rates. In addition, the 3.8% Medicare surtax on net investment income (which includes capital gains and dividend income) remains as well, effectively creating four capital gains and qualified dividend tax brackets: 0%, 15%, 18.8%, and 23.8%.

However, even though TCJA would change the current seven tax bracket system to one with only four/fve tax brackets – and with slightly different thresholds – the long-term capital gains and qualified dividend thresholds will remain as they are under the old/current system.

Which means the 0% capital gains rate will apply up to $77,200 for married couples or half of that amount ($38,600) for individuals, even though the new 12% bracket goes to $90,000 and $45,000, respectively. In turn, the 15% capital gains rate will apply up to $425,800 for individuals and $479,000 for married couples, and the 20% capital gains rate will apply to any capital gains that fall above those thresholds (even though the 39.6% bracket won’t actually apply until $500,000 for individuals and $1,000,000 for married couples under the new law). In addition, the 3.8% Medicare surtax thresholds - $200,000 of AGI for individuals and $250,000 for married couples – remains unchanged.

Expanding The Standard Deduction And Family Flexibility And Child Tax Credits

A major aspect of the Tax Cuts and Jobs Act is a drastic winnowing and simplification of (itemized and other) deductions.

First and foremost, the existing standard deduction ($6,350 for individuals and $12,700 for couples) and the personal exemption ($4,050 per person) is combined into a single expanded standard deduction of $12,000 for individuals and $24,000 for married couples (rising to $12,200 and $24,400, respectively, in 2018 when it would first take effect). For an individual, this represents an increase of $1,600 over the existing combination of standard deduction and personal exemption, while couples will see a $3,200 increase (from $12,700 standard deduction plus two $4,050 exemptions to the new $24,000 standard deduction).

Notably, though, larger families – that previously would have benefitted from additional personal exemptions – will receive less under the new expanded standard deduction than they would have through a combination of the prior lower standard deduction and multiple personal exemptions. However, this is mitigated by an increase in the Child Tax Credit from its current $1,000 to $1,600 (though only $1,000 remains refundable for low-income individuals). In addition, the new rules provide for a new $300 credit for non-child dependents (e.g., college-aged children, or even elderly parents), and the taxpayer themselves (and his/her spouse) will each receive their own $300 “Family Flexibility Credit” as well (though both of these new $300 credits phase out after 5 years in 2023). Furthermore, the phaseout thresholds for the Child Tax Credit (and the new $300 credits) is favorably increased from an AGI of $75,000 for individuals up to $115,000 (and for married couples from $110,000 to $230,000).

The net impact of these changes is that most families with children will see a tax savings with the combination of the new standard deduction and child tax credits, over the old rules of standard deduction, personal exemptions, and smaller child tax credits.

Example 2. Richard and Lucy have a combined income of $70,000, and three dependents (two young children, and one in college). Under the existing rules, they would be eligible for a $12,700 standard deduction, 5 personal exemptions totaling $20,250 for the family of five, reducing their taxable income to $37,050, resulting in a tax liability of $4,625, which is reduced to $2,625 after their two child tax credits.

By contrast, under the new rules, their taxable income would be $46,000, for a tentative tax liability of $5,520 (in the 12% tax bracket), which would then be reduced by $3,200 (for the two Child Tax Credits) and another $900 for the three Family Flexibility credits, for a total tax liability of just $1,420, and a family tax savings of $1,205 (despite the loss of their personal exemptions).

Notably, the elimination of personal exemptions also means that the Personal Exemption Phaseout (PEP) is repealed. And with the curtailment of itemized deductions (as discussed below), the Pease limitation on itemized deductions – which phased out itemized deductions by 3% of the excess above an AGI of $261,500 for individuals and $318,800 for married couples, effectively resulting in a 1% income surtax – is also repealed. In fact, it is estimated that fewer than 10% of households will even itemize deductions under the new rules (down from approximately 33% of households today).

Curtailment Of Itemized Deductions Under House GOP Proposal

A key aspect of major tax reform is to “simplify” the tax code, which involves the curtailment of various tax preferences (i.e., deductions and credits). Ideally, any deductions lost can be more-than-offset by other benefits gained – which in this case, may include slightly lower tax brackets for most, and an expanded standard deduction that will make itemizing a moot point for the overwhelming majority of taxpayers anyway.

Nonetheless, for those who do itemized deductions – and hope to do so in the future – it is important to recognize the various deductions and credits that may be eliminated, some of which are quite material to certain households directly affected by them. All of the proposed eliminations and changes to itemized deductions and credits would apply going forward in 2018 (and not for the current 2017 tax year), except where specifically noted.

Limitations On Deducting State And Local Taxes Paid

Under Section 1303 of the TCJA, individuals would no longer be able to deduct any state and local income taxes paid (or for those in states without income taxes, the state and local sales tax paid). These deductions would be eliminated entirely.

However, a carve-out preserves the ability to deduct local real property taxes paid – e.g., on real estate, such as a primary residence and/or vacation home – up to a maximum of $10,000/year (and the limit applies equally to individuals and married couples). However, the limit applies only to “real” property taxes (i.e., for real estate), and not personal property taxes (e.g., automobile taxes in certain states). Notably, property taxes paid for investment real estate (and other business property) may still be separately claimed as business deductions, and not subject to the $10,000 limit, as they’re claimed on the business tax return.

Limiting Deductions For Casualty Losses And Gambling Losses

Under current law, taxpayers can claim an itemized deduction for “casualty losses” – i.e., personal losses that result from external events like a fire, storm, or theft. Under TCJA, though, casualty losses would no longer be deductible, unless specifically authorized with special disaster relief legislation from Congress (as occurs from time to time with very major hurricane or other natural disaster events).

In addition, TCJA also further curtails deductions associated with gambling. Under current law, gambling losses are only deductible to the extent of an individual’s gambling winnings. However, other gambling-related expenses may be deductible, even beyond an individual’s gambling winnings (producing a net loss deduction). Under the new rules of TCJA, all gambling-related deductions – including gambling losses, and related gambling expenses – are limited to the extent of gambling winnings.

Medical Expense Deductions Repealed

Under current law, medical expenses are deductible as itemized deductions, to the extent they exceed 10% of AGI (up from a 7.5%-of-AGI threshold in prior years, as increased by the Affordable Care Act). The 10%-of-AGI threshold, the fact that medical expenses were itemized (and thus had to, when combined with other deductions, exceed the standard deduction as well), and the limitations on the deductibility of certain expenses (e.g., long-term care insurance premiums have age-based limitations on deductibility), meant that relatively few taxpayers deducted medical expenses in the first place – although when medical expense deductions actually were claimed, they were often very significant.

Under TCJA, the medical expense deduction is eliminated (and in fact, the entirety of IRC Section 213 is repealed, with key definitions for medical care and related expenses for employer health insurance rules moved to the new IRC Section 105(f) instead).

While as noted, this repeal will not likely impact very many households, it may be especially impactful for a small subset of households that are experiencing significant medical expenses, particularly amongst the elderly who may have to liquidate their pre-tax retirement accounts to fund medical expenses (where in the past, at least the medical expense deductions largely offset the taxable income created by liquidating those accounts).

Limitations On Miscellaneous Itemized Deductions (Subject To The 2%-Of-AGI Floor) And Other Tax Credits

While the proposed TCJA legislation does not entirely eliminate the category of Miscellaneous Itemized Deductions subject to the 2%-of-AGI floor, it does curtail several common such deductions.

Specifically, Section 1303 eliminates the miscellaneous itemized deduction for any tax preparer (or tax prep software) expenses, and Section 1312 eliminates the deduction for unreimbursed business expenses for employees.

Fortunately for financial advisors, the miscellaneous itemized deduction for advisory fees is not eliminated under the new rules, although with the elimination of other miscellaneous itemized deductions, it may be more difficult to reach the 2%-of-AGI threshold for deductibility. And the higher standard deduction, combined with the elimination of state and local income taxes, may make it harder for many households to reach the threshold to itemize (and capture those in-excess-of-2%-of-AGI deductions) in the first place.

Notably, Section 1310 also repeals the deduction for moving expenses to a new job (as long as it is at least 50 miles further than the old workplace), though that deduction was previously permitted as an above-the-line deduction.

In addition, the proposed legislation would also eliminate several other popular nonrefundable tax credits, including:

- Plug-In Electric Drive Motor Vehicle Credit would be repealed (so buy your Tesla before the end of the year to get your $7,500 credit!).

- Adoption Tax Credit (up to $13,570 per eligible child, phased out at upper income levels) would be repealed.

Reversing Alimony Tax Treatment

Under standard tax law, alimony payments are deductible to the individual paying the alimony, and reported as taxable income to the alimony recipient (unless the divorce decree or separation agreement stipulated otherwise). In practice, this tax treatment often generated tax savings for a divorced couple, as the payor of the alimony (who received the deduction) was typically the higher income spouse (in a higher tax bracket), while the alimony recipient was typically the lower income spouse (in a lower tax bracket).

The TCJA legislation would eliminate the alimony tax deduction for the payor, and no longer make the alimony payments received taxable to the recipient, effectively eliminating the tax bracket arbitrage between the divorced spouse’s tax brackets.

Notably, this change in the treatment of alimony would only apply to new alimony agreements entered into after 2017; existing alimony agreements and payments would not be altered, unless the couple expressly modified an existing divorce decree or separation agreement to change the treatment.

Mortgage Interest Deductions Limited To $500,000 Of Acquisition Debt For One Primary Residence

The mortgage interest deduction is one of the more popular tax deductions under the Internal Revenue Code, which also makes it one of the most “expensive” for the Federal government, and therefore one of the biggest targets of tax reform. Ultimately, the proposed rules under the TCJA do not repeal the mortgage interest deduction – which was at one point rumored as a possibility – but it does substantially curtail the deduction.

Specifically, under Section 1302 of the TCJA, the mortgage interest deduction would only be permitted on the first $500,000 of mortgage debt (down from $1,000,000 today). In addition, only mortgage debt on an individual’s one primary residence would be considered (whereas under current law, interest on the mortgage debt on a second/vacation home may also be deducted). And only interest on “acquisition indebtedness” – debt borrowing to acquire, build, or substantially improve that primary residence – would be deductible, while so-called “home equity indebtedness” (mortgage debt used for any purpose besides acquiring, building, or substantially improving the primary residence) would no longer be deductible.

Notably, unlike many of the other proposed changes, which would only take effect starting in the 2018 tax year, Section 1302 of TCJA is proposed to be effective “immediately”, as of November 2nd of 2017, if it ultimately passes into law. As a result, any remaining interest payments made on home equity indebtedness through the end of the year would not be deductible (though payments earlier in the year would be), and any mortgage loan that is taken out on or after November 2nd would be subject to the new $500,000 limit (unless there was a written binding contract for the mortgage already in place prior to November 2nd).

Fortunately, though, existing acquisition indebtedness is grandfathered, such that ongoing interest payments on acquisition indebtedness up to $1,000,000 of debt principal remains deductible (even beyond the new $500,000 limit), and a refinance of pre-November-2nd acquisition indebtedness remains deductible (even above the $500,000 limit) as long as the refinance does not increase the debt balance above the remaining acquisition indebtedness balance at the time.

Limitations (And One Slight Improvement) On Charitable Deductions

While most itemized deduction changes under the TCJA proposal are “negative” and more limiting, a silver lining is that under Section 1306, the limitation that cash contributions to a public charity cannot exceed 50% of AGI (with a 5-year carryforward for unused amounts) would actually be increased to 60%-of-AGI instead (with the same 5-year period). In addition, the charitable mileage deduction limit – currently $0.14/mile – will finally be indexed for inflation going forward.

However, Section 1306 also proposes a number of “crackdowns”, including the ability to claim a charitable deduction for 80% of the cost of purchasing seating rights for college athletic events (entirely repealed), and the requirement that all charitable donations above $250 must have an accompanying contemporaneous written acknowledge will be expanded to all such charitable donations (regardless of whether the charity also maintains donation records and reports them in the organization’s own tax return).

Section 121 Exclusion On Primary Residence Capital Gains Becomes Far More Limited

One of the most substantive tax preferences that any household receives is the IRC Section 121 exclusion of up to $500,000 of capital gains (for married couples; up to $250,000 for individuals) on the sale of a primary residence, as long as the sellers owned and used the property as a primary residence for at least 2 of the last 5 years.

In practice, the rule originated in part because it was deemed “unfair” that the majority of the long-term gain in a primary residence is simply its increase in value due to inflation (and not a “real” inflation-adjusted return), but also because it’s often difficult for homeowners to actually produce years or even decades of records to substantial their true and exact cost basis in the residence (including all home improvements that may have added to basis over the years).

However, over the years, Congress has become concerned that the rule is being abused, particularly by “house flippers” who purchase a property, live it in for two years while they work on it to make improvements, and then “flip” it for a tax-free gain as a primary residence, only to then move into another investment-property-as-residence and do it again. Alternatively, investors would sometimes take a rental property, and then move into it and use it as a primary residence for 2 years, and then sell the property to absorb some or all of the gains under the primary residence exclusion, even though the bulk of the appreciation may have occurred while it was investment property (although this strategy was at least slightly curtailed under the Housing Assistance Act of 2008 by deeming investment use since 2009 as “nonqualified” use).

Nonetheless, Section 1402 of TCJA takes further steps to limit the “too-frequent” use of Section 121 for house flippers (or those repeatedly converting and moving into their rental properties to subsequently sell them as primary residences in 2 years) by changing the “owned and used for 2 out of the past 5 years” into a “5 out of the past 8 years” requirement instead (which is actually how the rules originally worked prior to 1978!), and further limiting that the Section 121 exclusion can only be used once every 5 years in the first place. As a result, owners must actually use the property as a primary residence for 5 full years, to be eligible for the capital gains exclusion, and can only use it once every 5 years regardless. (Though notably, the exception allowing for a partial use of the Section 121 exclusion is a sale occurs in less than 5 years still applies under IRC Section 121(c) is the residence is being sold due to a change in place of employment, health, or similar “unforeseen circumstances”.)

In addition, the Section 121 exclusion is further limited with an income test, which stipulates that the exclusion will phase out by $1 for every $2 above an AGI threshold of $500,000 (for married couples; $250,000 for individuals).

Example 3. Harry and Sally have lived in their primary residence for 25 years, which they originally bought for $175,000, though the property is now worth $750,000. This year, Harry sold his business, resulting in an adjusted gross income of $600,000, and upon retiring the couple decided to sell their house as well, generating an additional $575,000 of gain. Under the standard rules of Section 121, the couple could exclude $500,000 of their $575,000 gain, which increases the couple’s AGI to $675,000. However, because they are now $175,000 beyond the AGI threshold, they will lose $87,500 of their $500,000 exclusion, reducing it to only $412,500 of gains that are excluded, and increasing their AGI by another $87,500 of capital gains to $762,500.

The new Section 121 limitations would only begin to apply for primary residence sales that occur in 2018 or beyond.

Elimination Of Various Employee Fringe Benefits

Beyond the efforts at tax reform for individual tax credits and deductions, the TCJA legislation also tries to reform and “simplify” business tax returns as well, which includes the proposed reduction or elimination of numerous “fringe benefits” that firms often provide – on a tax-preferenced basis – to their employees, offset by other increases (including a dramatic expansion of Section 179 expensing, increasing the limit from $500,000 of property up to $5M!).

The new limitations on employee fringe benefits and related employee benefits include:

- Dependent Care Assistance programs (allowing employers to provide up to $5,000 per year tax-free to support care for children under the age of 13, or spouses or other dependents who are physically or mentally unable to care for themselves) are repealed.

- Qualified Moving Expense Reimbursements (where expenses that would be deductible as moving expenses by the individual can be received tax-free from the employer) are repealed.

- Adoption Assistance Programs (where employers can provide up to $13,570 of tax-free payments to support an employee’s expenses when adopting) are repealed.

- Employer-Provided Child Care Credit (where employers receive a 25% tax credit for qualified expenses for employee child care and a 10% tax credit for child care resource and referral services, up to a total of $150,000 of credits per year) is repealed.

- Employer-Provided Educational Assistance (permitting employers to pay up to $5,250/year for undergraduate or graduate courses for employees without being income to the employee) is repealed.

- Qualified Tuition Reductions For Employees Of Educational Institutions (where an educational institution can provide employees or their family members a discount on college tuition, or a cash equivalent to attend another college, without reporting the value as income) is repealed, causing any such tuition reductions in the future to be reportable as taxable income.

- Employer-Provided Housing Exclusions (where housing for employees and their families is excluded from their income if done for the convenience of the employer and the employee is required to live on premises as a condition of employment, including in certain educational institution situations) is curtailed, with a maximum value of just $50,000 that can be excluded, and a phaseout of the exclusion once income exceeds $120,000 of AGI.

- Meals And Entertainment Expenses will be limited to only a 50% deduction for food and beverage and business meals (but not other types of entertainment), and no deduction will be permitted for entertainment, amusement or recreation activities, even if related to the employer’s trade or business.

- Other Employer-Provided Fringe Benefits will be limited, including the elimination of any deduction for transportation fringe benefits, on-premises gyms, or similar amenities (unless they’re made taxable to employees, akin to a salary bonus to pay for those expenses).

On the other hand, certain provisions for employer retirement plans will be expanded to help rank-and-file employees, including allowing those who take a hardship distribution from a 401(k) plan to still be allowed to contribute to it (without the current 6-month waiting period), permitting employers to offer hardship distributions for both the employee’s original contributions and employer contributions and growth (as opposed to current law, where hardship distributions are only permitted for an employee’s own contributions), and an time extension allowing 401(k) participants with loans who terminate from the business (or where the plan itself is terminated) to repay the loan amount into an IRA by his/her tax filing deadline to avoid the loan being treated as a taxable distribution after termination (as opposed to the current requirement for repayment within 60 days).

Educational Planning Reforms And Simplification: 529 Plans And American Opportunity Tax Credit

Although not specifically anticipated but arguably long overdue, the TCJA provides a substantial series of reforms to simplify the painful web of education tax incentives, including both various tax credits and deductions, and tax-preferenced accounts.

First and foremost, the TCJA officially repeals the Hope Scholarship Credit, the Lifetime Learning Credit, and the above-the-line deduction for tuition and related expenses, consolidating them all into the American Opportunity Tax Credit – which (still) provides a 100% tax credit for the first $2,000 of educational expenses, and another 25% tax credit on the next $2,000 of expenses (for a maximum credit of $2,500/year). As a new addition, the AOTC is expanded from being available for the first four years of college, to being available for a 5th year of college (e.g., for graduate school) at a 50%-of-otherwise-eligible rate. In practice, because the AOTC was already a larger tax credit (at $2,500/year) than the Hope Scholarship Credit (up to $1,500) and the Lifetime Learning Credit (up to 20% credit on $10,000 of expenses, or $2,000) and the above-the-line tuition-and-related-expenses deduction (which at a 25% tax rate on up-to-$4,000 of expenses was worth $1,000), and had higher income phaseouts than the others, in practice virtually all taxpayers only claimed the American Opportunity Tax Credit anyway. But now the rest will no longer even be available, which may be adverse in some cases (particularly for graduate students who were still claiming the Lifetime Learning Credit for the later years of grad school).

In addition, Coverdell Education Savings Accounts will be wound down under the TCJA legislation as well. Technically, existing Coverdell ESAs won’t need to be eliminated, but no new contributions will be permitted after 2017, and the updated rules will permit Coverdell ESAs to be rolled into (i.e., consolidated into) 529 college savings plans. Notably, most parents already saved into 529 plans over Coverdell Education Savings Accounts, given that they had the same tax benefits for higher education, but 529 plans had far larger contribution limits. However, Coverdell Education Savings Accounts were unique in that they also permitted tax-free distributions for elementary and high school expenses; to resolve the disparity, the new rules will permit up to $10,000/year of tax-free distributions from 529 college savings plans for (private) elementary and high school expenses beginning in 2018 (in addition to certain apprenticeship programs).

In addition, the new TCJA legislation would adjust the 529 plan rules to allow a 529 plan to be created for an unborn child still in utero, allowing parents to establish 529 plans and begin contributions even before the baby is born. (And already kicking off an abortion rights debate about the implications of recognizing unborn children for tax purposes, especially since it was already feasible for parents to simply create the 529 plan and name themselves as the beneficiary and change to the child shortly after he/she is born and is assigned a Social Security number.)

On the other hand, while the aforementioned provisions will likely be welcomed for their tax simplification and overall improvements (relative to the status quo), the TCJA proposals would limit or eliminate several other population education-related tax benefits, including:

- Student loan interest deduction (permitting a deduction of up to $2,500 of loan interest, phasing out at upper income levels) is repealed.

- Savings Bond interest for higher education (which allowed parents to cash in Series EE or Series I savings bonds tax-free for college expenses, again phasing out at upper income levels) is repealed.

On a more positive note, TCJA also modifies the requirement that discharged student loans (on account of death or disability) be treated as taxable income, although the new rule allows discharged student loan debt to be excluded from income only on account of death or disability and not taxable discharged student loan debt that is forgiven under other Federal programs like Income-Based Repayment (IBR), PAYE, or REPAYE.

Preferential 25% Tax Rates For Business Income From Pass-Through Entities

For many small business owners – including both the clients of financial advisors, and even financial advisors themselves – one of the most buzzed-about changes proposed in the House Republican tax plan is a change that would allow income from a pass-through entity – e.g., a partnership, LLC, or S corporation – to be treated as special “business income of individuals” subject to a maximum rate of just 25% (i.e., taxed as ordinary income in the 12%, 25%, 35%, or 39.6% brackets, but with the tax rate capped at 25% for those in the upper two brackets). Notably, though, not all pass-through income will automatically be fully taxable at the preferential 25% rate.

Any pass-through business income that is from a passive activity will automatically be characterized as 25% income, where “passive” is determined under the existing IRC Section 469 rules based on whether the owner “materially participates” in the business for at least 500 hours per year (or certain other tests). Which means investors in real estate or other limited partnerships (where there is no material participation) will automatically be eligible for the 25% rate.

In the case of an “active” business owner – i.e., one who materially participates and does not meet the passive activity requirements – must split their income between income derived from their labor (taxable as ordinary income), and income derived from their capital contributions (eligible for the 25% rate). By default, active business owners will be able to elect to treat their “capital percentage” as 30% - i.e., that 30% their pass-through income is attributable to capital (taxed at up to 25%), and the other 70% taxed as labor (as ordinary income with rates up to 39.6%). Alternatively, capital-intensive businesses (e.g., manufacturing) may determine their capital percentage by multiplying their capital investments into the business at an assumed rate of return (which will be the Federal short-term rates plus 7%), with the remainder taken as labor income. Thus for instance, if the business owner put $1,000,000 into the business, and short-term rates were 1%, then the first 1% + 7% = 8% x $1,000,000 = $80,000 of pass-through income would be treated as 25% business income, and any remainder would be treated as labor income. Notably, any salary or guaranteed payments assigned to owners will automatically be treated as labor income (regardless of any other capital percentage formulas).

To prevent abuse, though, the capital percentage will automatically be set to 0% (i.e., all taxed as “labor” ordinary income) for any type of personal services business, which includes a long list of “specified service activities” including lawyers, accountants, consultants, engineers, performers, and those who work in the financial services industry. For all of those individuals, no income can be treated as 25% business income (instead, it will all be taxed as ordinary income) unless the business owner can demonstrate a greater-than-0% capital percentage based on their actual capital contributions into the business.

This limitation on personal service businesses is specifically intended to curtail the temptation for high-income employees to revert themselves to independent contracts that provide services back to their (now-former) employer... as consulting income from a pass-through entity would have a capital percentage of 0%, resulting it all the income being taxed as labor (at ordinary income tax rates) anyway. In addition, the fact that any "active" participation in a business will by default render most pass-through income to be only 30% capital and 70% labor - which results in a blended maximum tax rate of 30% x 25% + 70% x 39.6% = 35.22% - means that most actively engaged business owners of pass-through entities will still only see a moderate improvement to their 39.6% top tax rate without the new rules (a 4.38% tax rate savings).

Nonetheless, the temptation will remain for S corporations in particular to minimize salary in an effort to maximize the amount of 30%-of-profits distributions eligible for the preferential rate, and likely spurring a fresh round of "reasonable compensation" battles for S corp owners. Though ironically, the new rules may simply make business owners want to shift back to partnerships or LLCs (instead of S corps) where it would be easier to qualify 30% of all profits as "business income" (as by default, all business income will qualify for the 30% calculation, since there are no salaries in partnerships or LLCs, and only guaranteed payments would be excluded from the calculations). And while in the past, most business owners tried to avoid the passive income rules - because they allow for more limited deductions - now business owners may try to cut their hours to qualify as a passive business in order to receive the more favorable "business income" tax treatment.

On the other hand, the good news for already fully bona fide passive business owners/investors - e.g., those who invest in real estate, or passively invest in other pass-through business entities - all pass-through income will automatically be eligible for the 25% business income tax rate (although investment income that is passed through will still retain its original character, including ordinary income treatment where applicable, unless it is specifically interest income properly allocable to a business).

Roth Conversion Strategies Curtailed By Repeal Of Roth Recharacterization Rules

An unexpected provision in Section 1501 of the TCJA legislation was the announcement that the rules permitted a recharacterization of Roth contributions and Roth conversions would be repealed beginning in 2018.

The crackdown appears to be directly targeted at popular Roth conversion-and-recharacterization strategies where the account is initially converted and invested, and the account owner then waits to see whether the market performs well (or not) before deciding whether to keep the Roth conversion (or recharacterize it). At a minimum, Roth recharacterizations made it easy to always convert the “perfect” amount to fill up the lower tax brackets (by converting more than enough and then recharacterizing the excess), and in the extreme were used (or in Congress’ eyes, abused?) by doing multiple Roth conversions of different investments into different accounts with the sole intention of keeping the best performer and recharacterizing the rest (ensuring that Roth conversions “always” increase in value in the initial year).

Notably, though, the elimination of the Roth recharacterization rule effectively makes Roth conversions “irrevocable” in their amount (as recharacterizing to unwind a conversion for those who exceeded the Roth conversion income limits is a moot point since the $100,000 AGI limit was repealed effective in 2010), and thus merits more caution before determining the right Roth conversion amount. Those who make a new Roth contribution must also be cautious that once contributed, the Roth contribution cannot be recharacterized to a traditional IRA if he/she end out over the income limits (although the impermissible amount could still be withdrawn as an excess contribution, and a separate traditional IRA contribution might then still be made if time permits before the contribution deadline).

On the other hand, the so-called “backdoor Roth contribution” rules, and the ability to convert after-tax dollars into a Roth account, were not curtailed in the TCJA legislation, despite having been previously proposed repeatedly in the Treasury Greenbook in recent years.

Other Miscellaneous Income Tax Benefits Altered Or Repealed

Beyond the wide range of proposed individual tax reforms already discussion, TCJA also includes several other provisions to simplify certain parts of the tax code, and alter or crack down on others, including:

- Archer Medical Savings Accounts (Archer MSAs) are repealed, given that their benefits are now completely duplicated by Health Savings Accounts (HSAs) anyway. Existing Archer MSA dollars may be rolled into an HSA going forward.

- Private Activity Municipal Bonds issued after 2017 will be fully taxable as ordinary bonds, and no longer eligible as tax-free municipal bonds (akin to their current treatment for AMT purposes). Notably, only new private activity bonds (PABs) issued after 2017 will be taxable (which isn't much, with a CreditSights estimate of only $11B of total PAB issuance in 2017); existing private activity municipal bonds already issued and paying ongoing interest will remain tax-exempt. In fact, the change in rules and repeal of AMT means new private activity bonds will be disadvantaged - taxed at ordinary income rates - while existing private activity bonds are advantaged by now being tax-exempt for all individual investors (regardless of AMT constraints that previously applied).

- Nonqualified deferred compensation will be more restricted, and must truly remain subject to a substantial risk of forfeiture to defer income tax consequences (and not merely tied to a covenant not to compete or any other condition not related to the future performance of services).

- Limitations On Excessive Compensation Above $1M To Covered Employees will be expanded to include (i.e., limit tax deductions for) commission compensation and performance-based compensation (i.e., stock options or restricted stock) for the CEO, CFO, and the three other highest-paid employees (consistent with SEC disclosure rules).

Gift And Estate Tax Exemption Increased With Ultimate Estate Tax Repeal (In 2024)

The final proposal under the Republicans’ TCJA legislation is a substantial shift in the current estate tax regime.

First, beginning in 2018, the estate (and gift) tax exemption amount would be doubled, from the currently-projected $5.6M in 2018 to $11.2M (which would be $22.4M for a married couple). This increased basic exclusion amount would also become the amount eligible for portability to the surviving spouse.

Second, the estate tax would be repealed in 2024, along with the generation-skipping tax. However, even after estate tax and GST repeal in 2024, the gift tax would remain in place (at the $11.2M-adjusted-for-inflation level, along with the $15,000-in-2018-and-adjusted-for-inflation annual gift exclusion). However, the gift tax rate would be reduced to 35% in 2024 when the estate tax is repealed. And step-up in basis at death would remain, even after estate tax repeal.

Ultimately, it still remains to be seen whether the Tax Cuts and Jobs Act is actually passed into law in 2017 or early 2018, and to what extent the current proposal remains intact, or is further altered in the process of seeking the compromises necessary to pass it into law.

Nonetheless, the proposed framework provides a clearer-than-ever perspective on the key changes on the table in the tax reform discussion, and while the TCJA reforms would not quite achieve the “file your tax return on a postcard” goal of Speaker Ryan’s original “Better Way” proposal, it does achieve a substantial simplification of the current tax filing process.

Individual households would be reduced to just four tax brackets (albeit really five brackets, with the 45.6% surtax bracket surrounded by the 39.6% bracket on either side), and most would claim just a handful of itemized deductions, including property taxes, mortgage interest on acquisition indebtedness, charitable contributions, and a very limited number of miscellaneous itemized deductions (including advisory fees) – and with a higher standard deduction, more than 90% of households would not be expected to itemize at all. Along the way, a slew of miscellaneous tax credits – that were popular with certain small bases of constituents that were benefitted by them, but added to the overall complexity of the tax code – would be repealed as well. In addition to some long-overdue and bona fide reform in key areas like tax credits for college expenses (and tax preferences for educational savings in general).

And in a world where the Internal Revenue code has been “updated” in major tax reform every 20-30 years since the 16th amendment was adopted 104 years ago, arguably it’s “about time” for some kind of tax reform. Will the Tax Cuts and Jobs Act of 2017 prove to be the tax reform we’ve been waiting for?

So what do you think? Which provisions of the proposed tax reforms most impacts you and your clients? Which will provide the greatest benefit? Do you have any clients that will be harmed? Please share your thoughts in the comments below!

Re: In addition, the new TCJA legislation would adjust the 529 plan rules to allow a 529 plan to be created for an unborn child still in utero, allowing parents to establish 529 plans and begin contributions even before the baby is born.

Parents have always been able to establish 529 plans in anticipation of the birth of a child, naming themselves as the plan beneficiary and then changing the beneficiary after the child’s birth once a Social Security Number has been obtained.

I believe all 529 plan administrators require a Social Security Number for the plan’s named beneficiary. Today, it is not possible to apply for a Social Security Number for unborn children, so it is not possible to provide the 529 plan administrator with the SSN. This makes the language in this portion of the TCJA contradictory, unless TCJA allows 529 plan administrators to waive the requirement of providing a SSN for the named beneficiary.

Doesn’t your graphic have a mistake, with the first proposed tax bracket at 12% instead of 10%?

Eek, yes, thanks John. We’ll get it fixed ASAP. We’ve been scrambling to produce brackets this morning once I finished reading all the legislation last night. Sorry! 🙂

– Michael

Is the proposed Child & Family Tax Credit in some cases nonrefundable (such as the “Additional Child Tax Credit” is today?)

John,

The first $1,000 of the Child Tax Credit remains refundable (as it is today), and the underlying inflation formulas will actually increase the refundability portion for inflation, such that it will be $1,030 refundable next year (assuming 3% inflation), and continue to rise, until eventually all of the credit is refundable.

The new additional $300 credits for the individual and spouse, and non-child dependents, is not refundable.

– Michael

Michael as usual great post! I noticed AMT would be repealed. How would this affect AMT carryfoward credits (8801)? This would impact lots of people who had ISO stock options.

Good question. Offhand, I believe the AMT repeal would simply release the Minimum Tax Credit carryforwards (since they could only be used to the extent of NOT triggering AMT, which would be a moot point in 2018).

I’ll try to dig further just to clarify that they aren’t unwittingly lost in the process (though I doubt that would be the case, and if they are it’s an ‘easy’ technical corrections fix).

– Michael

I’ve dug in further on this. Minimum Tax Credit carryforwards are released over the next several years with AMT repeal. I’ve updated the article and added a full AMT section to discuss further!

– Michael

Thanks Michael for updating the article!!

Does either the House or Senate tax law proposals deal with the taxation of Incentive Stock Options (ISO) that have yet to been exercised? Currently the bargain element is subject to AMT if the options meet the grant and exercise requirements that don’t subject the bargain element to ordinary income. The AMT paid is then recovered over time.

Does either the House or Senate tax proposals deal with the AMT cost basis of stock that was exercised, subject to AMT and has both a regular and AMT cost basis? I think these are questions many advisors and tax planners will have.

Seems to me that upper middle income households on the coast will take tax hit. Is it something that your analysis says? My rudimentary analysis says that increased standard deduction will not offset the elimination of many deductions like mortgage over 500K, Home Equity, state taxes, dependent care etc. for many households in CA/NJ/NY/VA/WA etc.

Same thing I thought.

I ran my 2012 numbers against the new law (no 3.8%/ .09% taxes until 2013), and actually the new law only cost me $2,023 more. No AMT made the difference so small. Also my property tax was under $10k. Phase outs did not hit me that year.

thanks for simplifying the proposed tax changes! (as much as possible). Hopefully, middle class people retain or gain tax advantages in perpetuity as we struggle to balance the cost of living and build a future. Great article, although I will need to re-read several times to fully understand! /s/ mre

Yeah, sorry, there was a lot to cover! 🙂

– Michael

No doubt there will be some compromises and alterations, but there is a real chance of true tax reform.

I was planning to do so before this came out, but I am now even more compelled to fully fund our donor advised funds in this calendar year, as future donations may very well give me a lesser (or no) tax benefit.

Thank you for the detailed writeup — it will be featured in my Sunday Best.

Cheers!

-PoF

Thanks PoF! Hope it helps!

As for whether you see more or less tax benefit with a donor advised fund now versus in the future, it really depends on how your tax brackets line up. See the first graphic in particular – the green zones are tax cuts (which would be good for you to do the DAF now rather than later), while the red zones would be better to push DAF contributions into next year. 🙂

– Michael

Yes, I am solidly in the red zone, driving for the winning touchdown.

Additionally, I have just dropped to part time in the doctor job, so I expect to be in a lower tax bracket next year whether tax reform passes or not. The wild card is online income, which could make up for at least some of the income reduction.

Keep up the great work!

-PoF

Great post Michael, once again very thorough and helpful.

I am shocked & disappointed there is no repeal or adjustment to the 3.8% medicare surtax. Although this tax package is a step in the right direction, there are a plethora of improvements that still need to be made.

Great move in opening up 529 capabilities to help fund elementary and high school expenses.

That’s why they pushed so hard to repeal the 3.8% Medicare surtax in the health care reform. They wanted to do it there, so it wouldn’t be part of the baseline here. Trying to remove it as part of the tax reform legislation would put them over the deficit target they must stay under to pass as a budget reconciliation bill without a Senate filibuster by Democrats…

– Michael

Wow, the lobbyists and special interests were really working overtime to get this much “reform” done. There was more back-scratching than in most chiropractic offices!

I think if the small business provisions pass as is, it will create thousand of jobs for lawyers, CPA’s and financial advisors who are advising small businesses on how to structure and qualify for the lower rate.

In truth, there really aren’t a lot of structuring options. Either you put a lot of capital into the business to increase the capital percentage, or you don’t. And the list of personal service businesses that are prohibited from the new rules is pretty clear.

I suspect the biggest “games” to play will be in figuring out how business owners can scale down their involvement to the point of NOT being an active participant. Because in the past, being subjected to the passive business rules was “bad”, but now being subject to the passive income rules is “good”…

– Michael

You didn’t mention medical/dental providers in your personal services exemptions. Thoughts there? Also assuming a 7 figure practice purchase in the last two years, would that qualify one for the capital contribution provision?

The legislation references IRC Sec. 1202(e)(3)(A), which includes “any trade or business involving the performance of services in the fields of health, law, engineering, architecture, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, or any trade or business where the principal asset of such trade or business is the reputation or skill of 1 or more of its employees”.

Under this definition, doctors and other health services professionals would seem to fall into this category of business income that is not eligible, by default, for this 30% capital portion.

I would love an article on how figuring out that capital amount would work. I assume that capital contributions are reduced by distributions, but is it also reduced by losses? Does the inflation return add to the capital base? (For instance in your example where $80,000 of income is taxed at the max of 25%, is the capital contributions for the next year at $1,080,000, causing $86,400 to be at the preferential rates assuming the same 8%)

It almost seems that myself as a tax accountant would need to keep two sets of records now (Basis and capital contributions) in order to determine whether the 30% or build-up is the better method.

It also seems like NOL deductions got a large overhaul that you did not touch on. Elminiation of the carryback as well as somewhat indexing NOL’s to inflation.

Very good work Michael. This has been my favorite post ever. Way to simplify it!

Thanks Justin!

Always happy to provide 7,500 words of “Simplification”. 🙂

– Michael

Thanks for the insights and updates as usual Michael!

Great analysis, as usual. On the Roth recharacterization issue, does the document specify whether no recharacterizations would be allowed starting in 2018 period, or no recharacterizations on Roths converted in 2018? For example, if we have employed the multi-Roth conversion strategy for 2017 with the goal to recharacterize in 2018, do we need to examine that strategy if recharacterizations will not be allowed at all starting Jan 1?

I had the same thoughts and I don’t see how they will not allow for the recharacterization of 2017 Roth IRA conversions given that there have already been 2017 conversions made with the understanding that a recharacterization would be available at any time before 10/15/2018. I think there would be an overwhelming resistance to the bill if there is not an allowance for a calendar 2018 recharacteriization on a 2017 conversion. There would be too much pain.

Michael, any information regarding if the “Income in Respect of a Decedent” (IRD) deduction under Section 691(c). will still exist. (Deduction claimed by the beneficiary of an inherited IRA to the extent of any estate taxes paid by decedent.) And I assume that the IRD amount plus any other remaining deductions must exceed the standard deduction to be useful? If the IRD disappears or even with the new limited deductions, some may want to pull out more money out of an Inherited IRA this year to take advantage of IRD deduction. Thanks for your thoughts and the great article.

Brad,

I don’t see any changes or impact to the IRD deduction itself.

But you’re correct that with a higher standard deduction, there’s less value to the IRD deduction to the extent the individual wasn’t already clearing the new higher hurdle with their other itemized deductions!

– Michael

Michael

A couple of points…..

The ‘higher’ standard deduction isn’t really much different than what is available today for those taking the standard deduction who are age 65 and older, when you take into account the additional senior deduction and personal exemptions. For those filing MFJ in 2018, this totals to 13,000 + (2X4,150) + (2X1,250) = $23,800 as compared to the proposed $24,000.

You’ve pointed out 2 misc. itemized deductions that would be kept. But I (roughly) count 78 misc deductions subject to the 2% floor and about 20 misc deductions NOT subject to the 2% floor from Pub 529. Retention of deductibility of IA fees would be a big deal to high net worth clients even with the 2% floor and IRD a big deal to those who inherit IRAs from large estates. Might you know of any other of the misc deductions that will be kept?

https://www.irs.gov/publications/p529

Thanks much

At the expiration of the estate tax is the step up in basis lost? If so, then this could become a huge burden across the board for taxpayers. Establishing historic basis can be difficult. And many people who would have inherited tax free and enjoyed the step up will find themselves with a new tax burden!

DeDe,

Step-up in basis stays, even after estate tax repeal.

– Michael

Thanks. That’s good to know.

Curious: if this passes as written, does that mean there will be no recharacterizations for Roth conversions done in the 2017 tax year and performed in 2018? Or is it just for conversions/contributions made in 2018 and beyond?

It’s a bit murky in how the revision is worded. The legislation would apply to taxable years beginning after 12/31/2017 (i.e., in 2018). The recharacterization rules under IRC Section 408A(d)(6) technically pertain to recharacterizing before the due tax of a (prior) taxable year.

So I believe that means a conversion already done in 2017 would still be eligible for recharacterization in 2018 (because it is a recharacterization FOR 2017, and the new rules only apply for taxable years beginning AFTER 2017). Only new conversions in 2018 and beyond that wouldn’t be eligible for subsequent recharacterization.

We’ll see if this gets clarified or adjusted further with any technical corrections or further explanation.

– Michael

Nice summary Michael. I appreciate your hard work on this!

I noticed an oddity regarding long vs. short term capital gains, and maybe there is a correction somewhere for this.

It is not said in your analysis, but one presumes that the short-term capital gain rate would remain the same as the ordinary tax rate. However, this creates an odd conundrum for taxpayers with total taxable income between $77,200 and $90,000 (MFJ). Long-term capital gains would be taxed at 15%, but short-term capital gains would be taxed at only 12%. Is there something in the bill that addresses this?

That is a very interesting catch. The maintaining of different tax brackets for capital gains purposes is clearly one piece that is not tax simplification.

Indeed, that was a compromise to make the budget math work. 🙁

I was excited for the lower capital gains put in by GWB early in my career, believing it would motivate savings, but I’ve changed my view. The difference b/w capital gains and income rates allows us all to play games with how income is categorized, obviously to the greater benefit of the capital owning segment of the population. I now believe there should be no difference or very slight difference (5% max) between ordinary income and capital gains rates. This would reduce or eliminate carried interest games (other than just the deferral component) and allow top rates to come down further without reduction in overall revenue.

Tom,

Hrm, interesting question and point. I’ll dig around a bit to see what I can find. Not sure if there’s a conforming amendment buried somewhere in the bill that I missed, or if this really is a little gap in the short-term capital gains rate…

– Michael

The long-term capital gain rates are not the actual rates to which LTCGs are subject but rather the maximum rates to which the gains are subject. I believe that if a taxpayers ordinary income marginal tax rate is lower than the specified LTCG rate, the ordinary rate will trump the LTCG rate.

Looks like larger families like mine (4 kids) at the lower end of the current and future 25% tax bracket are likely to get a tax increase (depending on current Schedule A deductions). My rough estimate is that my fed tax liability would increase by $2,500. This is despite the fact that I would recover about $1K in currently phased out child tax credits with the higher phase out amounts. The bulk of the remaining impact is related to the fact that $600 increase in child tax credit only partially offsets the $1,012.50 increase in taxes due to loss of the $4,050 per child exemption while the $300 per adult credit (that also eventually phases out) clearly does not offset the same $1,012.50 increase. Charitable donations, mortgage interest, and property taxes slightly exceed the new $24K standard deduction.

In the same boat with four kids. My family does quite a bit of charitable giving, decent size mortgage, and has Texas size property taxes. It will really hurt not having the $24,000 of personal exemptions in addition to itemized deductions.

Agreed. Interesting that the bill discourages larger families, both in the repeal of per child exemptions, and in the repeal of adoption assistance credits. Wonder if that was a targeted objective or unintended consequence?

How does the proposed law affect taxable amount of Social Security benefits?

No change, beyond the fact that included benefits will likely all fall in the 12% tax bracket while phasing in, whereas in the past it was a blend of 10%, 15%, and 25% brackets.

-Michael

Just wanted to give you the feedback that I found this to be an excellent summary of proposed tax law changes. I’m sure it was a tremendous amount of work to scramble and take the time to put this together so quickly. I like the clear explanations and examples too. Thanks for all of your efforts!

Happy to help, Eric! Thanks!

It never ceases to amaze me how quickly you put out in-depth, quality articles!

Happy to be of service! 🙂

Repeal of the medical deduction would affect only a minority of those who itemize, although a pretty substantial minority, about 9 million filers.

Let’s be clear: it’s an unpopular deduction in the sense that no one wishes himself to be in a position to take it. But for those who do qualify it is often a lifesaver. To use my own family as an example: more than 60% of our annual budget goes for health aides for my wife, who suffers from Parkinson’s disease. We are retirees, living in a high tax state and burning through our savings a lot faster than we ever expected to.

You can choose to live in a smaller house or send your children to a public rather than a private college, but when it comes to chronic diseases, they choose you, Getting some tax relief lightens the burden somewhat.

Richard,

Indeed, the elimination of the medical expense deduction is particularly concerning to me from the financial planning perspective.

I can appreciate the need and desire from Congress to both simplify, and that SOME sacred cows have to be killed to do tax reform.

But in practice, catastrophic medical expenses can force people to liquidate taxable accounts and then spend their dollars on medical care. Which means they won’t be able to afford the end-of-year tax bill anyway. So the Federal government still won’t get its money; it will just force people into bankruptcy to prove the point, instead of just allowing it as a deduction in the first place, which is a loss for everyone.

I hope the medical expense deduction is reconsidered. We’ll see…

– Michael

The medical expense deduction is a big issue for me and I suspect many early retirees – most certainly for those of us without employer provided retiree health care coverage and therefore find themselves purchasing policies in the insurance marketplace.

FWIW, I am budgeting health care costs for my wife and I of $25,000 in 2018. Losing the ability to deduct a good portion of that large cost (the portion above the floor) is a big negative for me (in addition to losing personal exemptions and losing or limiting my RE tax deduction). This tax plan will cost me thousands of additional dollars each year.

Beyond just hoping this thing dies in our dysfunctional congress, it is hard to imagine this proposal survives in anything close to its current form. Just thinking about the large number of people (and special interest groups) that will come out against the loss of deductions for…

1. Medical costs,

2. State and local income taxes,

3. Charitable deductions (for at least a subset of those who won’t be itemizing deductions in the future)

4. Home mortgage interest

5. Personal exemptions

…it is hard to imagine their being enough support in congress to make changes of this magnitude.

It feels much like re-arranging chairs on deck of the titanic. So many better thinks to spend time on that this.

Michael, thank you, thank you, thank you so much for doing all this work — when do you sleep?

I especially appreciate the coverage of the AMT carry-forward credits — I’ve got a client with “money in the bank of AMT” and we’re working on unlocking it (by selling off the shares which resulted from the ISO exercise), but this would resolve it very nicely. I’d speculated that they’d either do this — or possibly just let folks use their AMT basis when computing capital gains. This is better. 🙂

I am disappointed that there is no proposal to raise the annual gift tax exclusion. Even under current law, it is unlikely that my wife and I will leave estates large enough to be subject to the estate tax, but we nevertheless have to pay accountants every year to file gift tax returns because our gifts to our children exceed the $15,000 threshold. A $25,000 or $50,000 exclusion would work better and would not cost the Treasury much lost revenue.

so they are not relaxing the rules to qualify for an HSA, correct? I had heard they would not require us to have an HDHP, or that maybe a medishare plan would qualify you… Or all of these issues should be included in the health law instead?

No changes to HSA qualifications that I’ve seen in the tax reform legislation. This may have been on the table for health care reform?

– Michael

thank you

Am I reading the brackets incorrectly?

The 25% individual bracket applies to incomes above $200k while the married bracket for those making over $260k jumps to 35%. Why get married if you’re combined income is between $260k and $400k?

Paul,

Indeed, this is called the “marriage penalty” tax. It exists under the current system now as well. A couple with combined incomes between $233k and $380k would pay 28% as individuals but 33% as a couple (assuming their income is split evenly). A couple making $800k would have almost half of it taxed at 39.6%, but as individuals each making $400k it would be taxed at a top rate of 35% (not to mention the second person’s income partially fills the lower brackets as well).

The new legislation would actually have LESS of a marriage penalty (where two high-income individuals face higher tax rates as a couple than two individuals) than the existing one already does.

– Michael

Michael,

Are there family attribution rules for the passive/active component of the pass through entity rules? If H and W are co-owners and only H is active, does W get all her dividend income at the 25% rate? Children, nieces and nephews, etc.?

Steve,

I believe all the existing family attribution rules are still fully intact as they always were. The “business income” rules simply piggy back on the existing passive/active business rules.

But I haven’t specifically researched whether there were any tweaks or conforming amendments that would impact this. Will try to dig in further.

– Michael

Any word on self employment health insurance premium deduction? I thought I’d heard elsewhere this had been removed which would be huge for these self employed who don’t qualify as passive as wel.

I didn’t see anything about this on my read through the legislation.

The medical expense deduction details formerly in IRC Section 213 (for individual deductions) were actually moved to IRC Section 105 (for employer deductions), in what appears to be an effort to preserve their application in business deduction contexts?

I’ll dig further to see if I can find anything else on this.

– Michael

Hands down the best (comprehensive but readable) summary of the TCJA I’ve seen. Thanks, Michael. Hope you will do it again when the dust settles (and there will be quite a bit of dust stirred up, I think, before then!) I really struggle with the rationale for and strong disincentives created by the 45.6% rate bubble at $1M-$1.6M for MFJ families. Hope that goes away.

David,

Yes, we’ll do some kind of update when the dust settles and there’s final legislation (if we get there). Or a separate standalone article, if enough changes by the time we get to the finish line! 🙂

– Michael

Here here!

I’d spent several hours plowing through others reading of the TCJA when I happened across MK’s analysis. Much, much easier to understand and follow..and NOT laced with the selective assessments of the popular media to meet their political agenda.

Typo?

IRC Section 121(c) is the residence is being sold due to a chance in place of employment, health, or similar “unforeseen circumstances”.)

Due to a CHANGE in place of employment…..

(Sorry OCD kicking in)

Fantastic article as alway!

Eek, sorry! Fixed now! ChanGe indeed! 🙂

– Michael

I was wondering if someone can weigh in on a question. We have an irrevocable trust that holds a partnership interest in commercial real estate (every year we get a K1 and file form 1041 for Trusts). Currently, the tax rate we pay is high at 39.6%. Under proposed rules would this income qualify at the 25% tax rate?

Thank you so much for a enormously helpful information. Will the new tax brackets be inflation adjusted? Will the old brackets for cap gains be inflation adjusted?

There are many references to Section 7706 of The Internal Revenue Code in the Tax Cuts and Jobs Act, but there is NO such section currently in the IRC. For example, the revisions to the Child Tax Credit in Section 1011 of the Act require “striking ‘152(c)’ in paragraph (2) (as so redesignated) and inserting ‘7706(c)’.” What am I missing?

IRC Section 152 (which defines dependents) is being renumbered as IRC Section 7706.

See Section 1003(b) of the legislation.

– Michael

Maximum $3,000 capital loss amount deducted from ordinary income with remaining loss amount carried forward: Based on no substantive changes to cap gain treatment my understanding is the treatment of cap losses also remains unchanged. Correct?

Proposed correction: “Which means the 0% capital gains rate will apply up to $77,200 for married couples or $51,700 for individuals”. See p. 18, (12) (A) (iii) in bill_text: The $51,700 amount is for head of household (12) (A) (ii). The amount for individuals is 1/2 of married or $38,600.

On passive real estate it appears from the summary report that passive business activity would be “treated entirely as business income and fully eligible for the 25% maximum rate”. You referenced that it allocates the 30%, but the way I read the document all the income is taxed at 25% if passive. The 30% default only applies to an active pass-through. Can you clarify your stance.

Thanks… excellent piece.

Brent,

I’m not sure I follow what you’re reading.

Per our discussion of passive income directly from the article:

“Any pass-through business income that is from a passive activity will automatically be characterized as 25% income, where “passive” is determined under the existing IRC Section 469 rules based on whether the owner “materially participates” in the business for at least 500 hours per year (or certain other tests). Which means investors in real estate or other limited partnerships (where there is no material participation) will automatically be eligible for the 25% rate.”

Where are you reading passive activity would have a 30% allocation?

– Michael

The end of you article was a bit confusing:

e.g., those who invest in real estate, or passively invest in other pass-through business entities – all pass-through income will automatically be eligible for the 30% capital percentage allocation (although investment income that is passed through will still retain its original character

My read of the bill was the 25% rate on a passive investor applied to all the income. The 30% allocation was only to active business.

Brent,

Ahh, sorry for the confusion.

Yes, that end-of-section statement is not accurate. That should have said all pass-through income is fully eligible for the 25% rate, for those who are invested in (passive) real estate or other passive businesses. That’s what I get for still writing at 1AM! :/

Corrected now! Thanks for clarifying and pointing this out so I could fix it!

– Michael

Great post Michael!! For S Corp Advisors, CPA’s, or Attorneys, starting at 0% on the 25% rate, I’d assume one could add up cost of any practices purchased, Office Build outs, Computers, Desks, etc. as part of that capital percentage to work up to the 30%. Or as you mention, it may just be easier to not deal with the hassle of adding those up (as applicable) and just convert to a LLC.

I cannot imagine the estate tax repeal happening and keeping the step-up-in-basis. That seems like too much of a tax advantage.