Executive Summary

For most retirees, the tax efficient liquidation of a retirement portfolio requires coordinating between both taxable brokerage accounts and pre-tax retirement accounts like an IRA or 401(k).

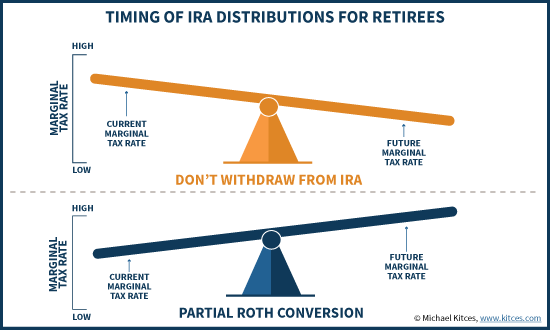

The conventional view is that taxable investment accounts should be liquidated first, while tax-deferred accounts are allowed to continue to compound. Except in practice, it’s possible to be “too good” at tax deferral, where the IRA grows so large that future withdrawals (or even just RMD obligations) actually drive the retiree into higher tax brackets!

As a result, a more tax-efficient liquidation strategy is to tap IRA accounts earlier rather than later. Not so much that the tax bracket is driven up now, but enough to reduce exposure to higher tax brackets in the future.

However, the optimal approach is actually to preserve the tax-preferenced value of retirement accounts and to fill the tax brackets early on, by funding retirement spending from taxable investment accounts but doing systematic partial Roth conversions of the pre-tax IRA to fill tax brackets in the early years.

The result is that the retiree will tap investment accounts for retirement cash flows in the early years, a combination of taxable IRA and tax-free Roth accounts in the later years, and in the process avoid ever being pushed into top tax brackets, now or in the future!

The Conventional View Of Retirement Liquidations - Let The IRA Compound!

The classic approach to liquidating investment accounts in retirement is fairly straightforward: after-tax “taxable” brokerage accounts should be liquidated first, while retirement accounts like IRAs and 401(k) plans receive preferential (tax-deferred) treatment and should be liquidated last. This allows the retiree to spend down the least tax efficient portion of the portfolio first – the brokerage account with annually taxable interest and dividends, and potential capital gains – while preserving tax-deferral (and the benefits of tax-deferred compounding growth) as long as possible.

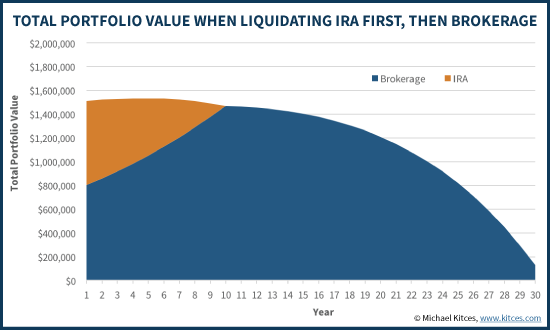

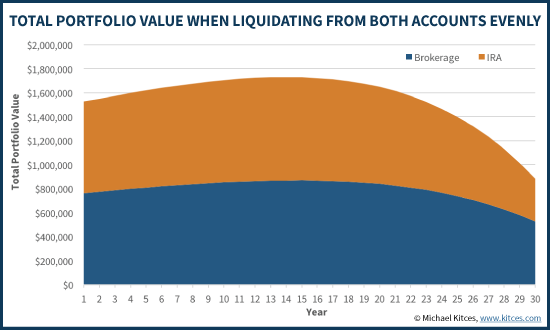

For instance, imagine a retiree who has $750,000 in a brokerage account and $750,000 in an IRA, and plans to withdraw $80,000/year from the portfolio (with spending adjusted annually for inflation) on top of other available income sources (e.g., Social Security).

If the IRA is liquidated first, even at an 8% growth rate the retiree quickly spends down the account (as at an average 20% tax rate, it actually takes close to $100,000/year of withdrawals to support $80,000/year of net spending). At that point, the retiree must rely on the brokerage account – which will never grow quite as quickly in the first place, as the annual drag of taxation on interest, dividends, and capital gains will reduce the ability of the account to compound. (The example below assumes a 7% net rate of return on the taxable account, assuming a combination of ordinary income interest and non-qualified dividends and short-term capital gains being taxed at 15%, and qualified dividends and long-term capital gains eligible for 0% rates.)

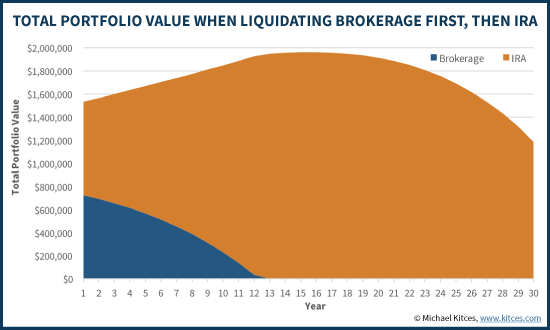

By contrast, if the retiree reverses the order, the results are more favorable. By drawing on the brokerage account first – which is growing in a less tax efficient manner anyway – and allowing the pre-tax IRA more time to compound, the strategy of spending the brokerage account first and the IRA second allows the portfolio to sustain withdrawals for a longer period of time, retaining a significant remaining balance even after 30 years (while the prior spenddown strategy was nearly depleted by the end of the 30th year).

Big IRA Distributions Drive Up Tax Brackets

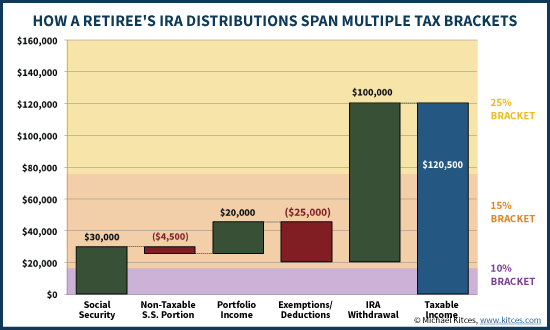

While the example above shows how deferring withdrawals from a pre-tax IRA can allow more wealth to compound, there is a significant caveat: the IRA is being subjected to a 20% average tax rate because the withdrawals are happening from the IRA all at once (either earlier or later) and driving a portion of the distributions into the 25% tax bracket.

For instance, continuing the prior example, the reality is that initially the couple would likely only be in the 15% ordinary income tax bracket. After all, if the couple is receiving $30,000/year of Social Security benefits (of which 85% would be taxable), and the taxable portfolio generates about $20,000/year of interest and dividends, and available exemptions/deductions are $25,000, their taxable income after all deductions would be barely over $20,000/year. This would put them at the bottom of the 15% tax bracket, and would actually mean any qualified dividends (and long-term capital gains) are eligible for a tax rate of 0%! It’s only by stacking a $100,000 gross withdrawal from the IRA on top that drives them into the 25% bracket, with technically about half of the withdrawal taxed in the 15% bracket, and the other half of the IRA distribution taxed at 25%. (Notably, this would also cause any of the qualified dividends or long-term capital gains to lose their 0% tax rate and be subject to 15% rates as well.)

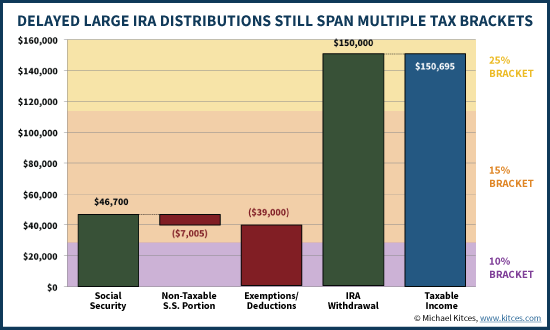

Similarly, if the retiree waits to tap the IRA until the later years, the tax bracket is driven up again as retirement cash flows must be almost fully funded from IRA distributions. For instance, after 15 years, the inflation-adjusted spending need would be nearly $125,000, and the requisite gross IRA withdrawal would be over $150,000. Of course, by definition at this point any passive portfolio income from interest, dividends, and capital gains would be eliminated (as the brokerage account was assumed to be spent down first), and the tax brackets (and standard deduction and personal exemptions) would be higher due to inflation adjustments as well. Still, while the portfolio withdrawals dip down to the bottom of the 10% bracket, they are mostly taxed at a blend of 15% and 25%.

Blending Withdrawals From IRA And Taxable Accounts

Given that taking full distributions from the IRA up front can drive the couple into higher tax brackets, and taking full distributions from the IRA in the later years will also drive the couple into higher tax brackets, the solution is actually remarkably simple: to take distributions from each account along the way.

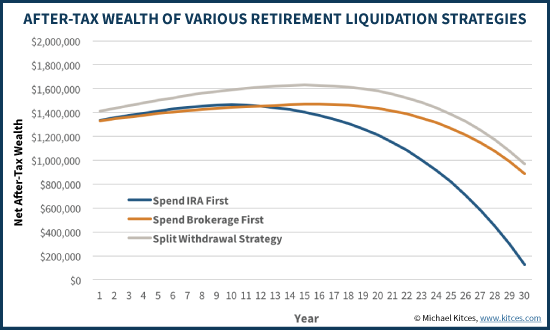

The benefit of this tactic is that by taking only partial distributions from the IRA each year, the distributions can occur at "only" the 15% bracket without ever reaching the 25% bracket. Yet by taking at least some withdrawals from the IRA every year, the brokerage account lasts longer before it is ever depleted (avoiding the point where the retiree must take all distributions from the IRA because there’s no other money left). For instance, the chart below shows the results when the retiree takes half the desired spending from each account every year, assuming their tax-savvy withdrawals keep them in the 15% tax bracket throughout.

By taking the blended-distribution approach, this portfolio lasts significantly longer than either of the preceding examples, driven by both the fact that “most” of the IRA still enjoys tax-deferred growth for an extended period of time, and more significantly because the annual distributions are modest enough to avoid ever hitting the 25% bracket!

Notably, the spend-brokerage-account-first scenario still had a higher final account balance, but this is due in large part to the fact that the IRA still has a significant looming tax liability that will have to be spent someday (i.e., the still-intact IRA will still be subject to taxes someday!). On a net after-tax basis, the split-strategy that allows the IRA withdrawals to be blended across the 10% and 15% brackets (assuming an average rate of just 13%) actually fares better than either of the alternatives!

Filling Lower Tax Brackets With Partial Roth Conversions

While the strategy of taking partial distributions from an IRA earlier rather than later can be an effective means to enhance the longevity of the portfolio by reducing the average tax rate paid on the IRA, the one caveat to the strategy is that it still depletes a tax-preferenced account earlier than may have been necessary. In other words, the strategy faces a fundamental tension between the desire to take withdrawals earlier (to avoid “wasting” unused low tax brackets in the early years) versus the desire to benefit from tax-deferred compounding growth (by leaving the money in the IRA to compound tax-efficiently over time).

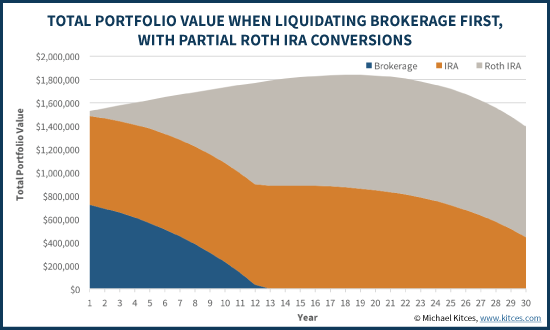

The resolution to this dilemma is to recognize that it’s possible to “fill up” the lower tax brackets in the early years from the IRA, without actually liquidating the tax-preferenced account. The solution is to engage in systematic partial Roth conversions in the early years, moving the dollars from the IRA to a Roth IRA, and generating the taxable income that fills the 15% tax bracket in the early years.

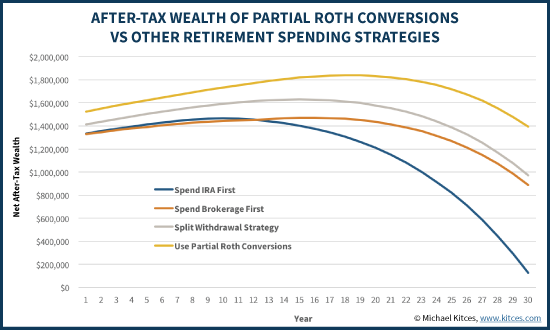

The end result of this approach is that the brokerage account will still be depleted throughout the first half of retirement, but the retiree's tax rate isn't driven up at that time because distributions can be partially supported from the newly-created Roth IRA. (In the example above, distributions are assumed to come 50/50 from the Roth and traditional IRAs, once the brokerage account is depleted, and all Roth conversions stop at that point.) In other words, by engaging in partial Roth conversions, the retiree can have the benefits of the "split" strategy to keep IRA distributions from ever reaching the 25% tax bracket, but done in a manner that still spends down the brokerage account first and allows tax-preferenced IRA and Roth IRA accounts to compound as long as possible.

Ultimately, the combination of taking advantage of lower tax brackets (and avoiding higher brackets) plus the additional tax-favored compounding in the traditional and Roth IRA accounts means that the partial Roth conversion strategy produces greater (net after-tax) wealth than any of the other scenarios.

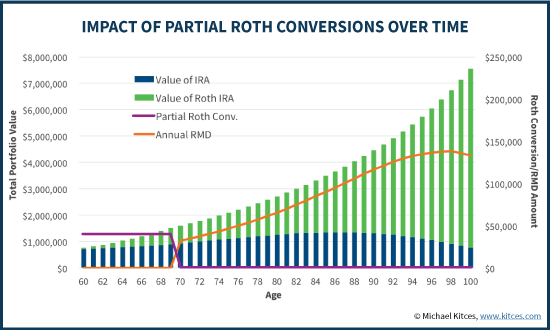

Maximizing Partial Roth Conversions To Minimize RMD Obligations

Another benefit of the approach of spending taxable/brokerage accounts first while doing partial Roth conversions is that if there’s enough funds in the brokerage accounts that the IRA may not be needed at all, doing partial Roth conversions still helps to maximize long-term wealth, by minimizing the future impact of Required Minimum Distribution (RMD) obligations.

After all, for the retiree who doesn’t need the IRA account, taking no distributions from the IRA and allowing the account to compound can actually create less wealth in the long run. The reason is that, as noted earlier, taking large IRA distributions all at once can drive up the retiree’s tax bracket. And this is equally true regardless of whether the “large” IRA distributions are because the retiree needed the withdrawal, or was simply forced to take it as a required minimum distribution.

By contrast, doing partial Roth conversions not only ensures that the distributions themselves occur at more favorable tax rates in the early years, but can whittle down the IRA to the point that by the time the RMDs actually kick in, the IRA has been reduced to the point that the RMDs aren’t actually very large. Which allows the retiree to remain in that lower tax bracket!

In addition, the fact that a Roth IRA does not have any RMD obligation also allows more dollars to stay in a tax-preferenced account for a longer period of time, which indirectly helps the Roth to enhance long-term wealth as well! (At least, until/unless Congress changes the rules and implements an RMD requirement for Roth accounts, too!)

Finding The Optimal Amount For Early Partial Roth Conversions And Avoiding Too Much Tax Deferral

Ultimately, the key concept to recognize in the tax-efficient liquidation of retirement accounts is that there really is such thing as “too much” tax deferral. An IRA (or 401(k), or other pre-tax retirement account) that is allowed to compound long enough will eventually be so large that the retiree is driven into even higher tax brackets just trying to tap the account, whether it’s to generate retirement spending or simply because the distributions are “forced” out when RMDs begin.

Accordingly, the fundamental goal to spend from the portfolio in a more tax-efficient manner is to find constructive ways to whittle down a pre-tax account and stop it from growing too large, either by taking distributions outright at an earlier phase, or by doing partial Roth conversions. Of course, if “too much” is withdrawn or converted in the early years, the retiree may drive up their tax rate now, which doesn’t help the situation either. In other words, the end goal is to find the balance point between the two.

Of course, where that balance point is will depend on the retiree’s overall income and wealth levels. For some, the balancing point may be to “just” fill up the 15% ordinary income tax bracket, and try to avoid any rates that are 25% or higher. For those with more significant retirement accumulations, the sheer size of the family balance sheet may make it impossible to avoid being in at least the 25% bracket, and the goal will just be to stay there and not drift up into the 28% or 33% brackets. For those with very significant wealth, any tax bracket that’s less than the top 39.6% bracket may be appealing to fill with partial Roth conversions!

Nonetheless, the strategy for the tax-efficient spend-down of a retirement portfolio remains the same – to allow for maximal tax-preferenced growth in retirement accounts by spending from taxable brokerage accounts first, but not letting low tax brackets “go to waste” by filling them with partial Roth conversions along the way!

So what do you think? How do you execute liquidations from retirement accounts and coordinate amongst taxable, tax-deferred, and tax-free accounts? Are partial Roth conversions part of your retirement spending strategy?

How would taxable gain harvesting fit in to this strategy?

If, for example. a retiree in the 15% tax bracket has a traditional IRA and also large unrealized capital gains in their taxable brokerage account should the retiree perform a partial Roth conversion or harvest gains and exploit the 0% capital gain tax bracket?

It seems as if paying 0% to step up the basis of appreciated assets is preferable to paying 15% to perform a Roth conversion but I’m curious what you’d recommend and why.

I’ve covered these separately, but never really set forth a clear rules framework about how to decide. Noted for a future article topic. 🙂

– Michael

Hi Michael – great post, but I agree with EverywhereOnce. If you could write a followup article that talks about systematic Roth Conversions in coordination with capital gains and a decision framework, that would be great. Overall, I’m just having trouble understanding the framework / coordination of Roth conversions with capital gains tax brackets and how to most efficiently spend down a portfolio. Example 3 in your post “Mechanics Of The 0% Long-Term Capital Gains” briefly discusses the topic, but something more in-depth would be good.

I have a client that harvested cap gains last year, and is doing partial Roth conversions this year. He is living on cash he has in the bank so either strategy is viable for him. I introduced both strategies to him (thanks Michael!) with no clear mandate on which we would prioritize.

He did like the idea of letting his kids inherit the taxable brokerage account and they could get the step-up in basis, so we will likely concentrate on Roth conversions to fill up the 15% tax bracket until he is 70 1/2 and has to start taking RMDs.

I’m currently knee deep in an analysis (for myself) to optimize the use of 0% Capital Gains, Partial Roth Conversions, and Social Security Benefit in he Low Income Valley (after Retirement, but before RMD’s begin). It gets complicated. Although it is easy to forecast future account balances (in Roth vs Traditional IRAs vs Taxable Accounts) it gets harder to value the residual tax liabilities that that children will inherit (in in Taxable and Traditional Accounts)– particularly in light of future withdrawal rate uncertainty (by children), possible future disclaiming strategies (which may step taxable cost basis sooner rather than later, potentially stretch out Traditinal RMDs still further, etc). So far it looks like doing some 0% Capital Gains first (to provide liquidity until RMDS begin, and before SS begins at FRA or later) makes sense, followed by some partial Roth Conversion). I’m don’t think deferring SS beyond FRA will make much sense (for me), despite that impact Roth Conversions can have on the Taxability of SS (and all SS Benefits beyond RMDs will be 85% Taxable anyway) — because I am not concerned with Long Term Income Security (just maximizing probably value), and I don’t have unlimited Liquid Assets in Taxable Accounts with which to fund Partial Roth Conversions. RMDs alone will fund living expenses once they begin, and account balances should continue to grow. Partial Conversions at a True 12% Marginal Rate (under TCJA) are the only “no” brainer, but opportunity is limited (considering SS Taxability) — but deferring SS Benefits to fund more “low cost” Roth Conversion doesn’t look good either (nor does Accelerating Traditional IRA withdrawals to fund Conversion Tax Payments). Filling Up the 12% Tax Bracket with Patial Conversions may also be worthshile, but the True Marginal Cost of that is over 20% (when SS impacts are considered), and even at 20-22% (let alone 24%) the Economics of Roth Conversions are starting to look questionable (to me). Taxes on RMDs could eventually reach maximum rates, but disclaiming inheritance when the first spouse passes (and letting the kids inherit then) may be the best way to avoid this (I don’t think I can do it with Roth Conversions alone). Also, since RMDs alone will fund expesnes in Retirment a step up in Taxable Cost Basis (for the kids) is possible. Does anyone have any guidance on the “best way” to do an integrated analysis of these issues? I’m slugging through it, but it aint easy!

The “conventional wisdom” of withdrawing one account at a time (i.e., Taxable, Tax Deferred, Tax Exempt) that is in eMoney, MGP and Advicent is always sub-optimal. This blog is similar to a paper Bill Reichenstein and I wrote (FAJ – Tax Efficient Withdrawal Strategies) and it spot on that you can find more portfolio longevity by withdrawing from multiple accounts to dedicated thresholds (effective marginal rates, MAGI for medicare, Provisional Income for SS, etc.). We just launched new software http://www.IncomeSolver.com that allows advisor to do this analysis and publsh plans for cleints. It is now easy to run these scenarios for your clients. Reichenstein and I created an optimize button that presents a list of withdrawal strategies at varying thresholds to help advisors see multiple withdrawal sequences that beat the conventional wisdom. The SSanalyzer is integrated into the software to help coordinate the Social Security optimization with the withdrawal strategy. Check it out or attend our next education session on this topic.

Hi Bill. Does your software consider partial roth conversions, as this article recommends? thx, Steve

Yes, we do partial Roth conversions! You can withdrawal from multiple account to thresholds you set (ex. tax brackets, or marginal rates) where the additional amount over spending goes into a Roth. The key to the application is that you can do the partial roth conversions over the plan horizon and see the result quickly…then, compare it and publish it to see how one withdrawal strategy compares to another.

Thanks Bill

We are active with surgical Roth conversions for clients and creating various buckets to create tax diversification when it comes to withdrawals. We begin 5-7 years from estimated retirement dates. We will have clients stop contributing to traditional 401k plans and consider Roth 401(k) options, if available. An increasing number of clients are seeking tax-efficient withdrawal strategies and ask the right questions. This is one of my favorite writings of yours so far this year.

This has been a scenario that I have been contemplating for awhile to reduce the overall taxable nature of the different income streams. There is also another tax factor to consider, taxes on SS after you reach the base amount (32k for married couple in 2015). So when one is going to take SS it would be beneficial to minimize taxable income.

Taxable Accounts: reduce to 0

Tax-deferred: 0 or to where the RMD + 1/2 of SS income is below the base for SS tax calcuations

Roth: Maximize

So between retirement and taking SS, maximize roth conversions to fill in the desired Tax Bracket bucket so the last conversion takes place right before collection of SS. So at age 70 1/2 the income streams would be reduced to SS plus Roth distributions (Could include minimal tax-deferred). At this point the tax rate is 0. As long as the starting point for the Tax-Deferred is not too high and the time period between retirement and SS collection is not too short, this should lower your lifetime tax bill.

The addition of ACA subsidies further complicate calculations for achieving a balanced withdrawal strategy. Are there calculators that provide for this input? For example, does IncomeSolver solve for ACA subsidies or does one just have to grind it out with their FP?

Indeed phasing out the Premium Assistance Tax Credits functions as a marginal tax rate surcharge – I’ve covered it separately here: https://www.kitces.com/blog/how-the-premium-assistance-tax-credit-for-health-insurance-impacts-the-marginal-tax-rate/

Certainly relevant in this context as well, with the caveat that most retirees will enroll in Medicare at age 65, which renders them ineligible for premium assistance tax credits. So the PATC phaseout is generally a limited-time “early retirement” issue. Though absolutely still a factor here.

– Michael

If you make over about 40k forget any significant help from the ACA. Been there done that.

Thanks for this article! Most of the material out there make reference the savings phase of financial planning or as I called it the entry plan. Few speaks or reference the spending or exit phase.

This is as important as the initial phase but rarely spoken about. This article was very helpful.

This should have been about 80% RMDs and 20% fancy strategy. If you have a job making good money 30yr career (is this the retiree you are talking about?) and saved your whole life in the 401k/IRA, when early social security eligibility comes around you start to think about retirement. Its really almost too late to do anything about future taxes. Your RMDS will defeat any ability to reduce your tax bill cause uncle sam says you gotta withdraw starting 70 1/2. Convert IRA to Roth is not a tax free event if you have any significant money at all, and 80% of your social security becomes taxable. The only way to save on taxes is to use the money you already paid tax on, which keeps your social security tax free, you can get an Obama subsidy for health care and a tax bill zero.

Saving significant money on taxes takes life long planning in your 40s, 50s. What can you do with your money in a 62 to 70 1/2 time stretch with money you cannot afford to lose, not much now days.

We did decide to convert some of our IRA to an FIA/lifetime rider annuity (we would rather have 6% CDs but) which pays out right at RMD time, and solves some RMD issues.

Good stuff! The IRS hates it, but still, good stuff!

Great article Michael; very helpful. Do you have any software that you like for evaluating these scenarios?

Robert Keebler and the AICPA has a great software product that provides high quality 15 year tax projections without the expense of the best of breed tax software. Tax Bracket Arbitrage is one of my most favorite planning tactics. As usual Great work Michael!

I am curious about the after-tax calculation for the IRA with a large corpus at the end of the plan. You stated that while spending the taxable brokerage account down first left a larger IRA account balance at the end, the IRA is then all taxable. Wouldn’t the tax ramifications of the inherited IRA distributions be largely dependent on who inherits the IRA, and which distribution strategy they go with? Or am I missing something?

For the purposes of these examples, we simply assumed that subsequent IRA withdrawals will be at the same rate. Leaving an IRA for the next generation that has a lower tax rate would fare better. If the next generation has a higher tax rate, it’s worse. Whether leaving the IRA is better at all depends on the magnitude of the gains in the taxable account and their prospective step-up in basis.

Though ultimately the point here was simply to look at retirement income sustainability in the first place (on a true after-tax basis), not estate planning. Though if the inferior strategy results in depletion during life, the post-death treatment of the IRA is a moot point, because there won’t be any IRA left…

– Michael

Thank you.

Have you thought about applying a sequence of return risk analysis to this as well?

I think you should cite as a reference to the prior publication in the Financial Analysts Journal from March/April 2015. (http://www.cfapubs.org/doi/abs/10.2469/faj.v71.n2.2?journalCode=faj)

Great article Michael. Makes complete sense to me. I plan to do exactly this beginning next year (first full year or retirement).

Great article, Michael. Intuitively, I’ve been using the strategy you suggest, so glad to see this confirmation. I spend up to the top of the 15% tax bracket, making Roth conversions from my traditional IRA if I have room in that bracket. More on this, please!

Wow, great article. I’ve been thinking something along these lines for myself, but have not had a chance to build any kind of plan – this analysis covers a lot of good territory and provides a great framework for exploring the topic!

Have you looked at variable asset allocation within some band based on some measure of market premium? I realize it could be considered a form of ex post market timing or rebalancing around risk, but I wonder how possible this might be.

Mr. Kitces states that “…the fundamental goal to spend from the portfolio in a more tax efficient manner is to find constructive ways to whittle down a pre-tax account and stop it from growing too large, either by taking distributions outright at an earlier phase, or by doing partial Roth

conversions.”

I argue that the “fundamental goal” is to maximize annual, after-tax spending, leaving behind no

estate. (By the time I arrive at end of my planning horizon, my heirs will be into their own retirements and my bequests will not be that important to them.) Achieving tax-efficiency is a necessary but not sufficient condition to maximizing spending.

I ran Mr. Kitces numbers through the linear programming optimizer available at http://www.i-orp.com which maximizes annual spending rather that the plan’s estate. The results of the various scenarios confirm Mr. Kitces’ conclusions, i.e.:

1. Parallel distributions from the two saving accounts gives optimal results. Taxes in the 15% bracket are enjoyed while the taxable account makes distributions. Taxes jump to the 25% bracket when Social Security benefits begin and then jump into the 28% bracket after the taxable account is depleted.

2. Adding IRA to Roth conversions produce different results. Contrary to Mr. Kitces ORP’s taxes are incurred in the 25% bracket in the beginning when the Roth is funded. Later Roth distributions pick up where the taxable account leaves off in supplementing IRA distributions keeping taxes in the 15% bracket. (Retirees may quake at the idea of drawing down their IRA to pay taxes on conversions but annual spending improves by 2% if they do.)

The results include delaying Social Security until age 70, which increases savings distributions early in retirement. and honoring the RMD, which may increase IRA distributions after age 70.

(In reply to the ACA question above: i-orp includes limiting MAGI before age 65 to be eligible for ACA tax subsidies.) ORP is available free of charge and with no registration.

How about adding ACA (ObamaCare) analysis in for those retiring before 65? The subsidies vary with income and phase out about $47,000 for a single taxpayer.

Yup, loss of the ACA PTC (premium tax credit) upon crossing 400% of FPL (federal poverty line) with your MAGI (look up the definition of the ACA MAGI, but note it includes preferential income like LTCG that otherwise might not be taxed) creates a new “tax bracket” that at least for MFJ (couples) is lower than the top of the 15% ordinary income bracket.

ACA MAGI also includes tax exempt (muni) Interest. That alone may push the income for many above the threshold.

I have $1 million client with 600 K nonqualified & $400k in a Roth; no traditional IRA. So I really like the split strategy, take enough from the non-qualified to fill up to the 15% tax bracket and then take everything else from the Roth. Just a little twist on your strategy. Good stuff Michael.

Michael. Very nice job breaking down all aspects of retirement income into the different tax brackets. I am 66 years old and been doing my best to reduce my taxes…especially keeping my dividends and LT gains at the zero tax bracket. I have been delaying taking any IRA money until I’m 70.5 when I must. However, now I know I will be pushed into the 25% bracket when I start my RMDs and any Roth conversion will be taxed at the 25% rate. So now I must analyze the advantage of taking my conversions in the three years before I turn 70.5 years old. Your charts have inspired me to consider a Roth conversion sooner vs later.

Analysis is great and talking about retirement strategies then I have the best page to share with you all.I am sure you all will be benefited.

Rolek Retirement Strategies

Nice piece

Kyle Rolek CFP®

Nice analysis. My complaint is that with all the research into withdrawl rates and portfolio design with asset allocation and the minimizing of expenses, the “math seems to be a one shot analysis.

One tool individuals and financial planners utilize

in most situations is a Monte Carlo simulations to consider the probabilities

your portfolio might experience under different market conditions. The financial industry, has provided many

freely available tools that primarily calculate the probability of running out

of money. The problem is a combination of Required Minimum Distributions and

the Marginal Tax Rates. Yes, we do not

know what future tax rates will be but to plan for a 30 year period and to ignore

these is going to lead to false conclusions and result in known defects that

are being brushed over, “consult your tax advisor”.

The underlying facts are most will have social security and tax deferred accounts.

Most Retirement Planning Models use “effective tax rate” estimates. RMD’s on any TDA amounts over $1,000,000 to $2,000,000 result in effective tax rates ranging from 20-30%. These tax liabilities completely destroy the reliability of the computations. Fidelity and Vanguard are two examples. I have not found one RIA or broker that will run computations without running the account for a small fee (1% per year). When a client reaches 80, the results will be much different even if every assumption on investments, inflation, and spending are exactly correct. The marginal tax rates are simply not computed under the various probablities.

I include the tax liability from drawing income in retirement in my “spending” and therefore it is specifically provided for in my SWR. This way I don’t have to rely on some computer model to get that part right.

My problem is that the calculation for each year would change each year because of the RMD. One “estimated rate” does not apply. The calculation impacts the Balance at the end of the year. Thus next years RMD and taxes again. When the effective tax rate goes from 14% to 28%, that has a big difference in a 30 year simulation. Yes, it is only probabilities. But the flaw in the computations significantly flaw the outcomes from a reliability standpoint. The computation is dynamic and needs to be internal to the model. Significantly Below, Below, and Average lose credibility over 30 years since taxes CAN exceed the IRA balance over 30 years. That is my point, estimating a tax rate will lead to false results due to the computational flaws with Monte Carlo simulations. Thank you MikeG. I simply built a spreadsheet to compute the mariginal rate taxes compared to the “estimated rate” and noted the significant over/(under) by year and was surprised that the numbers will be distorted so significantly due to the RMD’s and the marginal tax rates.

That is a fair comment. Would be good to see if Michael or one of the professional planners responds. In the meantime I’ll make a few more comments.

The annual change on then RMD (% of your IRA to be withdrawn each year) changes insignificantly from year year. In your 70’s, you get roughly 0.14% more each year. On a $1 million IRA this amounts to $1,400 more income per year. In your 80’s you 0.3% more per year or an incremental $3,000 each year (again for each $1 million in your IRA). It is hard to imagine that this little bit of extra income each year drives a meaningful increase in your tax liability.

More specifically, even if your “marginal tax rate” were 25% (which using current tax rates for a married couple means “taxable income” above $75,300, and given personal exemptions and standard deductions translates to well over $95,000 in adjusted gross income), the incremental tax on the $1,400 would be $350 per year ($750 on the $3,000). That won’t change your overall effective tax rate all that much.

when you talk about your effective tax rate going from 14% to 28%, you must mean your “marginal tax rate” as your income would have to increase by many times over for that to happen (you’d need taxable income of several hundred thousand dollars per year to have an overall effective Federal income tax rate of 28%). For example, the effective Federal tax rate for a couple with taxable income of $75,300 is 13.8%. For a couple with taxable income of $151,900, the effective tax rate is 20.9% (even though the margin rate between $75,300 and $151,900 is 25%). When you are talking about an extra $1,400 per year or $3,000 per year, it won’t drive by a small fraction of that 710bp increase in the effective tax rate year by year.

Keep in mind as well the published research (including a recent article by Michael himself here – https://www.kitces.com/blog/safe-withdrawal-rates-with-decreasing-retirement-spending/ and another one here https://www.kitces.com/blog/estimating-changes-in-retirement-expenditures-and-the-retirement-spending-smile/) suggests that expenses are highest in the 1st decade of retirement (go-go years), then lower in the 2nd decade (slow-go years) and lowest in the 3rd decade (no-go years) as discretionary spending falls fast enough to more than offset rising health care costs as you age. So with spending naturally declining over your retirement horizon, this may well offset any incremental taxes (or at least a portion of it).

It sounds like you may be using Fidelity’s retirement planner (which I think uses a flat tax rate for all years). What you can do is either zero out the tax rate and include all taxes in your spending (and provide for it to increase each year as a specific line item) or use a tax rate consistent with your first year of retirement and then include a specific line item in your spending for incremental taxes each year.

Does this help at all to allay any of your concerns?

Second time trying to send this response…hope this one goes through.

That is a fair comment. Would be good to see if Michael or one of the professional planners responds. In the meantime I’ll make a few more comments.

The annual change on then RMD (% of your IRA to be withdrawn each year) would be insignificantly from year year. In your 70’s, you get roughly 0.14% more each year. On a $1 million IRA this amounts to $1,400 more income per year. In your 80’s you 0.3% more per year or an incremental $3,000 each year (again for each $1 million in your IRA). It is hard to imagine that this little bit of extra income each year drives a meaningful increase in your tax liability.

More specifically, even if your “marginal tax rate” were 25% (which using current tax rates for a married couple means “taxable income” above $75,300, and given personal exemptions and standard deductions translates to well over $95,000 in adjusted gross income), the incremental tax on the $1,400 would be $350 per year ($750 on the $3,000). That won’t change your overall effective tax rate all that much.

When you talk about your effective tax rate going from 14% to 28%, you must mean your “marginal tax rate” as your income would have to increase many times over for that to happen (e.g., you’d need taxable income of several hundred thousand dollars per year to have an overall effective Federal income tax rate of 28%). For example, the effective Federal tax rate for a couple with taxable income of $75,300 is 13.8%. For a couple with taxable income of $151,900, the effective tax rate is 20.9% (even though the margin rate between $75,300 and $151,900 is 25%). When you are talking about an extra $1,400 per year or $3,000 per year, it won’t drive but a small fraction of that 710bp increase in the effective tax rate year by year.

Keep in mind as well the published research (including a recent article by Michael himself here – https://www.kitces.com/blog… and another one here https://www.kitces.com/blog…) suggests that expenses are highest in the 1st decade of retirement (go-go years), then lower in the 2nd decade (slow-go years) and lowest in the 3rd decade (no-go years) as discretionary spending falls fast enough to actually more than offset rising health care costs as you age. So with spending naturally declining over your retirement horizon, this may well offset any incremental taxes (or at least a portion of it).

It also sounds like you may be using Fidelity’s retirement planner (which I think uses a flat tax rate for all years). What you can do is either zero out the tax rate and include all taxes in your spending (and provide for it to increase each year as a specific line item) or use a tax rate consistent with your first year of retirement and then include a specific line item in your spending for incremental taxes each year.

Does this help at all to allay any of your concerns?

Not much mention of the real “effective” tax rates caused by the

tax-deferred IRA income pushing Social Security income into the taxable

realm. A significant part of that $100K turned 10% & 15% brackets

into “effective” brackets of 18.5% and 27.75% brackets. Not in this

example, but if there were a larger pool of Social Security income we’d

also be exposed to the “effective” 46.25%, as well. At least that’s what

I see when I run the (circa 2016) numbers.

Carnac,

Indeed, this is definitely an issue when evaluating marginal tax rates. We actually have a whole separate article just on this topic at https://www.kitces.com/blog/the-taxation-of-social-security-benefits-as-a-marginal-tax-rate-increase/

– Michael

Thanks for the response. And I apologize in advance for the volume below.

While this topic can be found discussed if one looks hard enough, I can’t help but believe that the financial advice community (of which, I am not) could do a better job of communicating this effect. Of course, that might deflate AUM (as people choose Roth over traditional) and thus likely inhibits a more broadly shared conversation … certainly not a motivator for Fidelity or Schwab (and all of the others) to inform their 30s & 40s clients during the accumulation years. Better to get to them in their 50s & 60s (if ever) with a later Roth conversion conversation.

In fact, I found a whitepaper (‘Older Taxpayers’ Response to Taxation of Social Security Benefits’ by Burman, Coe, Pierce, Tian) that concludes with ….. “The taxation of Social Security benefits creates high effective marginal tax rates, which gives older workers an incentive to reduce their labor and non-labor income below the taxable threshold. However, the tax rules are also quite complex” ….. and ….. “Overall, the findings suggest that older taxpayers have little understanding of the incentive effects of taxing Social Security”.

As well, the paper cites a Page & Conway study (“The Labor Supply Effects of Taxing Social Security Benefits”, 2011) that argues “… people above the threshold where 85 percent of benefits are subject to tax, even before including OASDI benefits, have less after-tax income, which increases hours of work. They do not attempt to measure the marginal effect of reduced after-tax income within the phase-in range.”

So what we very well may have is the elderly in retirement working longer hours while being severely effected by taxes which result in even more hours worked. All from ignorance.

I ask: Who should be making a better effort to erase this ignorance? Unfortunately, the masses are not getting financial input from Kitces.com ;-). With this ignorance erased, I can’t help but believe that Congress would be forced to take corrective action.

I was looking for some articles about tax strategies of retirement period hope i will get some help from your article.

Rolek Retirement Strategies

Is there anything you can do to help with taxes (even a little) for a client in the top tax bracket and who will be in the top tax bracket for the rest of their life? What would be the best distribution strategy?

Tax rates are historically low – one option is to use a Roth conversion strategy to lock it in (including beneficiaries). Back in the 40’s – 70’s, top rates were at times over 80%.

Then there’s the charity option if you don’t care to spend the money on yourself – donor-advised funds, trusts, private foundations and the like. Depends on priorities.

Anyone use Welch’s ORP wrt the above?

One huge defect of OPR is it doesn’t constrain optimization by a given AA. It does show the AA each year so you have a sense of how risky your portfolio is; but it optimizes independent of that so will e.g. always favor preserving stock heavy accounts over bond accounts. Ideally I’d want the optimization to be constrained by a risk parameter

What complicates this for me is that I’m retiring at 62 and waiting until I’m 70 to take social security (which, from both my wife and I who will very nearly max out the possible SS income, would fill most of our income needs.) Which means I have to be very careful about taxable income after 70 to avoid paying too much tax on my SS income. I like the partial Roth conversion – but I need to radically drop my taxible income at 70 so I should accelerate withdrawing my IRA before then, right?

Michael,

What if the person only has a Roth IRA? I am only 25, and my income is already too high to contribute to a regular IRA. Any suggestions in that case?

Non-deductable regular IRA contributions

Please consider updating this valuable guidance in light of the change in tax brackets effective 1/1/18. Is your approach still as successful? (Hope so!)

Michael, this is an excellent article that lays out the process and rationale. It would be terrific to update this to what we know in 2021 and the pending tax & retirement legislation.

One of the charts shows the optimal way for withdrawals is pulling equally from IRA and brokerage accounts.

But what if the brokerage assets are all in muni bonds and the IRA assets are the same value as the brokerage assets.

I would pull mostly from the tax free muni bonds or 75% muni and 25% IRA to stay in a low tax bracket. Thereby preserving the munis longer. Do you agree?

Presha Cleaning offers secure and efficient house cleaning services. They will restore the exterior of your home to its previous glory. Your property gains value immediately as a result of the pressure washing Milton service, which revitalises the exterior appeal without the need for repainting. We provide residential pressure cleaning services in Brisbane’s Northside, Southside, Bayside, and Western Suburbs, in addition to Milton.