Executive Summary

With the migration of advisor technology solutions over the past several years from local servers to existing in the cloud, the ability for software to be continuously digitally connected has led to a massive rise in software integrations, allowing an ever-increasing amount of data to flow through the "Big 3" technology hub for advisors, going more and more efficiently from one software platform to the next.

Yet as information and data flows more freely across the advisor technology stack, it is becoming increasingly frustrating for advisors to need to log into so many different software packages to manage their business, and for clients to have several different portals to access their document vault, their financial plan, their investment account information, and more. If the software is becoming more integrated, will there soon be a single centralized dashboard for advisors to manage their practices and monitor key performance indicators, and a single portal for clients to effectively manage their personal financial information?

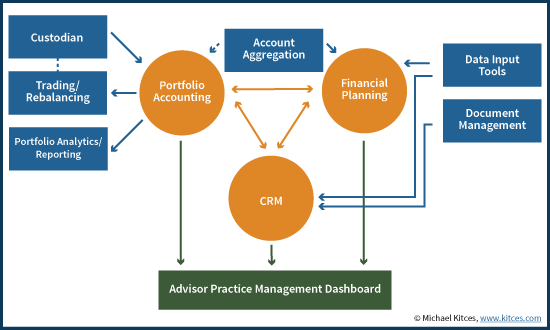

The convergence towards a single advisor practice management dashboard and a single client portal, though, raises the question of where exactly these software tools will be anchored. Should client portals be built around client vaults, or planning software, or portfolio reporting? Should advisor dashboards be built within financial planning or portfolio accounting software, or the advisor CRM instead? Ultimately, it remains to see where the winners will come from – or if an entire new software category for advisors may soon emerge – but for advisor technology companies, they may soon come to the crossroads about whether the purpose of the software is to be the engine that powers and manages the data, or the portal to interface with it.

The “Big 3” Technology Hub For Advisors – CRM, Financial Planning, And Portfolio Accounting Software

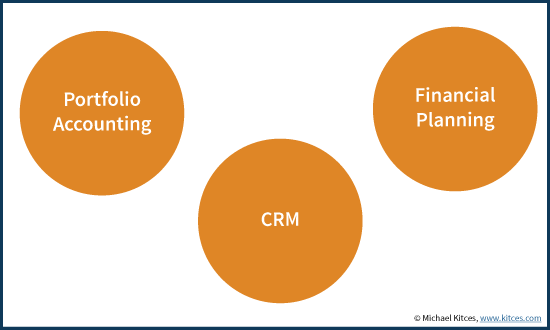

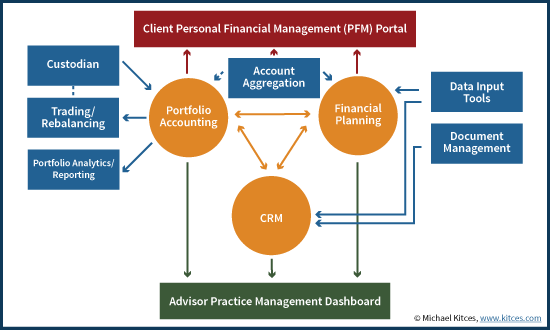

For financial advisors actually engaged in providing financial advice for clients – beyond just doing investment management alone – there are typically three core technology tools that drive the practice: CRM software to manage the client relationship (and the staff serving them); financial planning software to analyze the client’s financial situation; and portfolio accounting software to track (and manage, and report on) the client’s investment accounts (primarily those under management).

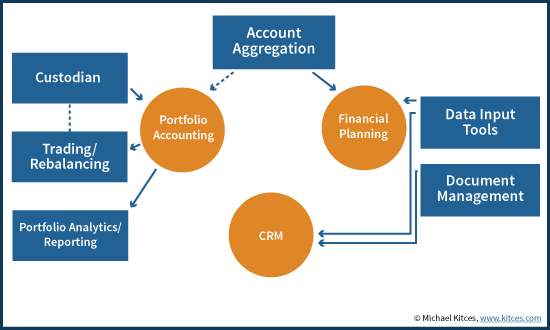

Around the big 3 are attached a wide series of additional software tools and supporting technologies that help the advisor to implement, from portfolio analytics/reporting and trading/rebalancing software tied in to the portfolio accounting software (along with a connection to the custodian themselves to download and reconcile data), to account aggregation and data input tools that push information into financial planning software, and a document management system (to both manage documents themselves, and tie them back to clients in the CRM).

For most of the past 20 years, though, the challenge of the Big 3 is that they have each run independently, with little if any data flowing in between them, forcing advisors to interact with each software platform independently – and often redundantly, such as entering client information separately into each. The situation was so problematic, that for years advisors have lamented the lack of a “Holy Grail” solution, packaging the big 3 together into a single unified system (though a few attempts have been made historically, they have ended out being mediocre in each category in a failed effort to try to develop them all simultaneously).

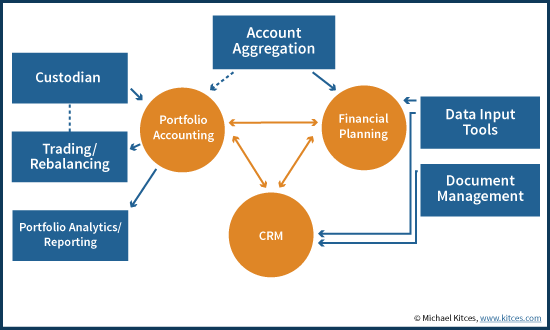

In recent years, though, the shift of software from local servers to the web, and the expansion of APIs, has kicked off a massive change in the world of advisor software, where suddenly it’s not relevant to seek out a single unified system, because integrations make it possible to simply obtain the best-in-class in each category, and allow the software platforms to push and pull information to/from one another. As these integrations continue to unfold, though, and data increasingly flows across the big 3, a new problem has begun to arise: which software should be the central dashboard for the advisor’s practice?

What’s The Central Dashboard To Manage An Advisor’s Practice?

When none of the big 3 software tools “talked to” each other much, advisors who needed information from each would log in to each. Want to know the client’s account balance? Log into the portfolio management software. Want to know the status of the client’s financial plan? Check out the planning software. Need to set up the next appointment for a client meeting? Go to the CRM.

Ultimately, though, the opportunity that comes from integrations is not merely to eliminate the redundant data entry across the platforms, but actually to reduce the necessity of logging directly into those platforms at all. For instance, if the current status of a client’s financial plan (e.g., the current Monte Carlo probability of success) was shown in their CRM record, there’s less need to log in to planning software (unless it’s actually to do a specific plan update). If the client’s account balances are pushed directly into the planning software, there’s less need to log into portfolio accounting platform to see where the client stands. If address updates entered into the CRM are pushing into the portfolio accounting software (which ideally then push all the way out to the investment custodian), it’s not necessary to log into the portfolio accounting platform to manage investment account information.

Yet when information can push all the way around the circle, it starts to become confusing about which platform is the “central dashboard” of the advisor’s practice. In other words, if the advisor was just going to log into one piece of software to “run” the business, which would/should the advisor use?

Thus far, the answer still seems to be “all of them”, as the software companies vie for dominance as the advisor’s central dashboard. CRM tools like Salesforce, including with middleware enhancements like AppCrown, have made the case that CRM can be the center, and pull in the relevant information from other locations. Investment custodians have tried hard to support advisors building their practice around their portfolio accounting software, and/or around the investment custodian’s own advisor portal that provides a connection and interface to the investments accounts held there. And now financial planning software companies like InStream Wealth are making the case that the financial planning software can/should be the central dashboard of the practice.

Yet ultimately, the effectiveness of software integrations will break down across the Big 3 if they all simultaneously vie to be the central portal for the advisor managing their clients and the practice. Not every part of the Big 3 can or should be the “portal” used to peer into the advisor’s practice. In the end, there must be one practice management dashboard, providing easy access to all the key performance indicators (KPIs) of the business – and ultimately there will be just one, either because one of the Big 3 becomes the dominant portal itself, or because a separate advisor portal solution comes along to draw information from them all.

What’s The Central Portal For Personal Financial Management For Clients?

Unfortunately, the confusion about which of the Big 3 should be the central dashboard for advisors is matched by a similar challenge when it comes to clients: what should be the information hub for clients to interface with their advisor?

When it comes to clients, there is arguably an even more dizzying array of choices to consider. There are “client portals” built around client information vault solutions like Sharefile (though many advisors seem to report that clients rarely use such vaults for storage, just for secure file transfer!); client portals built around financial planning software tools like eMoney Advisor or FinanceLogix; client portals built around portfolio accounting software platforms like Orion Advisor Services; and investment custodians (e.g., Schwab, TD Ameritrade, Fidelity, etc.) all have their own client portals to provide account/investment information as well. And unfortunately, not all client portals provide the same information for clients, as the content they offer clients in most situations depends heavily on the source software it’s attached to (FP software providers primarily financial planning information, custodian portals provide primarily investment account information, etc.).

In the ideal world, though, this too ultimately becomes a solution solved by integration, with a single centralized portal through which all other information flows. It is not a positive user experience for clients to have multiple disparate portals to interface with the advisor; in point of fact, arguably one of the things that the so-called “robo-advisors” have done quite well – along with highly-technology-leveraged human advisor solutions like Personal Capital – is the creation of a single centralized client portal that serves as the comprehensive interface for all of the client’s relevant financial and advisor relationship information.

Unfortunately, in practice this too is an area without a clear frontrunner solution yet. Nonetheless, as with an advisor dashboard, there must ultimately be one portal to rule them all!

The Crossroads For Advisor Technology Firms – The Engine Or The Interface (Or Both?)

Given how API-driven integrations across advisor technology solutions are growing, it seems that soon advisor technology companies themselves will face a crossroads: whether they wish to simply be the engine that performs some important action on/with data, or whether they actually want to be the interface to that data as well.

The key distinction is that as advisor technology firms begin to coalesce around a primary advisor dashboard and a primary client portal, the risk is that advisors will demand more and more integrations and that data be pushing into those portals, so that they need to log in less and less to the ancillary software that supports the hub of the advisor technology stack. For instance, if an advisor can pull investment information, performance reports, the status of a financial plan, and manage billing, all from the advisor CRM, how much need is there to even log into those other software programs. Obviously the answer will still be “sometimes” for specific needs, but over-investing into the user interface, reporting, and other capabilities may become “wasteful” development time if that software isn’t really going to be part of the hub or the central dashboard anyway.

Instead, the direction of advisory technology development may look more like the strategic direction of FinanceLogix, where all key outputs are “widgetized” into a form that can easily be pushed into any other software, dashboard, or portal. In such a world, most software will survive and thrive on its ability to do something useful and relevant with data (analyze a plan, report on performance, identify a client action, etc.) and then push it out in widget form to another platform, where the advisor actually interfaces with that data. It is the separation of providing value by being the engine that manages the data, even if the software website itself is not the direct way the advisor interfaces with it.

Of course, this still raises the question of what the actual central advisor dashboard and client portals will be in the long run. On the advisor side, it seems increasingly likely that CRM packages may become the advisor dashboard hub, and the trend is already underway with some of the most ‘flexible’ of CRM packages to build in this manner, like Salesforce and Microsoft Dynamics; it’s probably not a coincidence that Salesforce has the largest market share amongst the largest independent firms where using their CRM not just for client relationship management but firmwide practice management is key. On the other hand, it’s also possible that in the end, true “practice management software” may become the advisor dashboard (for any advisor technology entrepreneurs, here’s your business idea for 2015!), creating a software category of its own by integrating into the CRM, portfolio accounting software, and the rest of the hub (an early example would be ActiFi Analyst) to create a new way to interface with the data of an advisory firm (which means all the software of the advisor technology stack simply becomes a series of “engines” that power the data in a centralized third-party dashboard interface!).

In the client context, it’s not entirely clear what the central portal will be, either. Arguably, frontrunners right now are the most comprehensive of the client portals attached to financial planning software (like eMoneyAdvisor), or portfolio accounting software solutions that have opened up most generously to integrate with others (for instance, the Orion “open source” portal on Github). Yet even as the frontrunners here illustrate, it’s not clear whether the “center” of the client portal should be built around financial planning software, or portfolio accounting software. Arguably, the best solution perhaps would be neither, but something similar to what Personal Capital has done with their own proprietary solution – building around a Mint.com-style personal financial management (PFM) dashboard for clients (which may be part of financial planning software, but could be a standalone solution as well, though so far the PFM solutions for advisors have been very light!), which could then push its account-aggregated data out to all the other key software in the advisor technology hub.

The bottom line, though, is simply this: while advisors and their clients rely on information that is drawn from multiple sources, there are too many advisor technology tools competing to be at the center of the advisor technology stack and managing/controlling key information. And the “good news” of the increasing capabilities of API integrations is that advisors will soon no longer need to log into each and every piece of software to access its information. But for many advisor technology companies, it will soon be time to make a decision about where they really do – and do not – add value, and focus accordingly on whether they want to simply be the engine, or the interface as well (recognizing that there will be more engines than interfaces to work with them!). And in the meantime, the door remains open for new entrants to take control of the “interface” side of the landscape, becoming a leading client portal, or advisor practice management dashboard… and perhaps even becoming the de facto data standards that the world of advisor technology has struggled unsuccessfully to establish!

Nice post, Michael. For a highly relevant read, check out this post entitled “The Interface Layer: Where Design Commoditizes Tech.” > http://bit.ly/1vwvObH …Design-centric, UX-thinking tech companies are poised to win in their categories, and it’s conceivable that new entrants – who do nothing but provide high-design overlay interface “products” atop entrenched players’ services – will come to the fore.

Michael- are you saying there is a software where you can have 3 things open at once like Morningstar Office, Moneyguidepro & Junxure? If so let us know about it?

It is interesting that advisors directly engaged in rendering advice (utilizing a proprietary range of resources) rather than simply utilizing brokerage advice products render a far higher level of counsel at lower cost that those that simply flip mutual funds. TAMPs and one dimensional planning, CRM software alone without an expert authenticated prudent process can not fulfill the advisors aspiration to professional standing. The engine of advice requires an expert authenticated prudent process as required by statute. Ad hoc technology that only facilitates incremental considerations of continuous comprehensive counsel will never suffice for fiduciary standing.

Stephen Winks

If you’re looking for advisor technology that provides all 3, then consider AdvisorEngine. It’s a CRM that acts like an Advisor. With digital client onboarding, goals-based financial planning, data reporting, account aggregation, and a client portal that’s accessible from anywhere, you’ll have everything you need in one platform.