Executive Summary

Welcome to the February 2019 issue of the Latest News in Financial Advisor #FinTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors and wealth management!

This month's edition kicks off with the big news that eMoney Advisor founder Edmond Walters is back, with a new financial planning software competitor… but one targeting an entirely different (ultra-high-net-worth) clientele than traditional financial planning tools, such that MoneyGuidePro and Envestnet (owner of FinanceLogix) have actually partnered with Walters’ new Apprise Labs to develop the solution (aptly named “MoneyLogixPro”).

From there, the latest highlights also include a number of interesting advisor technology announcements, including:

- RightCapital raises a $3.7M Series A round to scale its competition with MoneyGuidePro, eMoney Advisor, and NaviPlan in the enterprise market

- AdvicePay raises a $2M seed extension round by crowdfunding within the advisor community itself to power a new enterprise solution for hybrid broker-dealers offering fee-for-service financial planning

- MoneyGuidePro rolls out its own new “downmarket” solution for non-CFPs dubbed MoneyGuideOne, and announces a new, more advanced financial planning software solution to be called MoneyGuideElite

- Plaid acquires Quovo to turn its account aggregation services into more actionable APIs that might actually move client assets (or manage them from afar)

Read the analysis about these announcements in this month's column, and a discussion of more trends in advisor technology, including Bridge Financial’s new portfolio performance reporting solution for small-to-mid-sized RIAs, Timeline’s new retirement distribution software to model the impact of dynamic spending rules and dynamic asset allocation on sustainable withdrawal rates, the rollout of two new client survey/feedback tools to better measure client engagement, and a look at how the latest T3 Advisor Technology Survey shows that what advisors state is their most important technology is not what they actually spend the most on (raising the question of whether there’s room for higher-priced CRM and financial planning software, and coming price pressure on portfolio performance reporting tools).

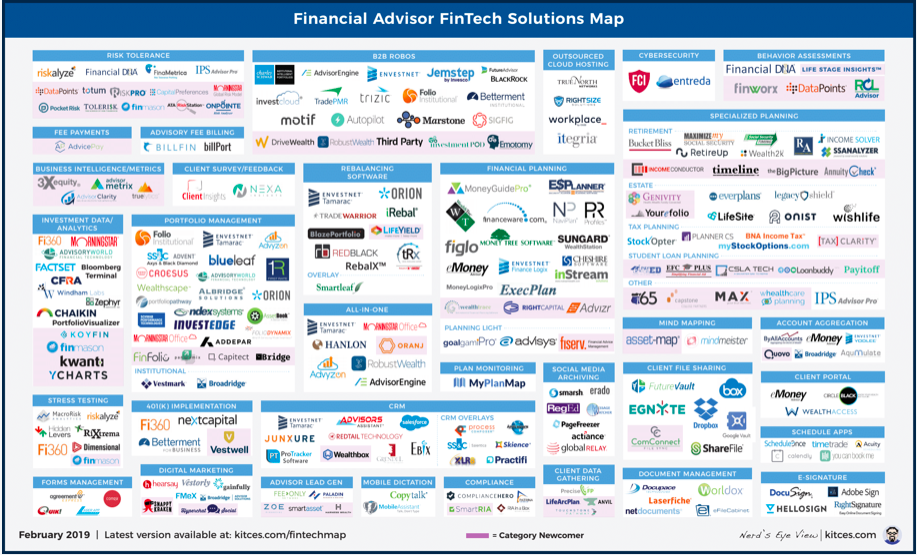

And be certain to read to the end, where we have provided an update to our popular new “Financial Advisor FinTech Solutions Map” as well!

I hope you're continuing to find this new column on financial advisor technology to be helpful! Please share your comments at the end and let me know what you think!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

Edmond Walters Returns At T3 With New Ultra-High-Net-Worth Financial Planning Software. At last week’s T3 Advisor Technology conference, the big buzz was the return of Edmond Walters, the financial-advisor-turned-FinTech-entrepreneur who founded eMoney Advisor, sold it to Fidelity 3 years ago for nearly $250M (announced at this very same T3 Advisor Tech conference), and now is back with a new version of financial planning software… to be distributed in partnership with Walters’ new company Apprise Labs and former competitors, MoneyGuidePro and Envestnet (owner of Logix financial planning software), who each reportedly own 1/3rd of the new software solution, aptly named “MoneyLogixPro”. The news that Walters was developing new financial planning software in partnership with the companies it would ostensibly compete with left many scratching their heads, but the reality is that Walters’ new creation is built to create a very different kind of advisor-client conversation with a substantively different target market: the ultra-high-net-worth client, who doesn’t need “retirement projections” to ensure they have enough to afford retirement, and instead wants to engage in more complex estate and tax planning strategies, and to understand their legacy (i.e., how the dollars will distribute out to future generations through trusts and other estate planning vehicles over time)… an area where MoneyGuidePro and Logix are especially weak, and thus why in practice MoneyLogixPro is more complementary than competitor. Similarly, while media coverage suggested that Walters is coming back to compete with his own eMoney solution, in reality, the new Apprise Labs solution will not realistically compete with eMoney either; in fact, arguably its closest (and only) true competitor is WealthTec, the only other financial planning software capable of illustrating GRATs, IDGTs, multi-generational estate cash flows, etc., that similarly serves ultra-HNW segments like bank trust departments, family offices and MFOs, high-end RIAs, etc. In fact, it’s not entirely clear how large the market for Walters’ new software really is, though serving ultra-HNW clients is so lucrative for those who do so, it wouldn’t be surprising to see MoneyLogixPro premier with a far-higher-than-average $5k-$10k/year software licensing fee (which is more-than-justified by the average fees advisors earn serving ultra-HNW clientele), and the potential to penetrate directly into the lucrative (and ultra-HNW-focused) wirehouse market. Though in the end, Walters fully acknowledged that – as with so many creations of entrepreneurs – the software was largely built to solve his own challenges, after having sold eMoney Advisor for $250M, and then discovered the lack of effective financial planning software to address ultra-HNW estate and legacy planning needs like his own (and thus decided to make a solution for himself that he’s now selling to others as well). In the meantime, though, all advisors (and financial planning software competitors) may be jealous of the modern UI/UX that MoneyLogixPro is being developed upon, where it’s assumed that clients will engage interactively with the software (Walters himself suggested the new 82” Microsoft Surface Hub 2 with dual stylus’ each for the husband and wife as an ideal interface!) and all interactions occur via a single anchor screen where any tap delves deeper into the details in that area. And while arguably MoneyLogixPro really is not a competitor to eMoney Advisor (nor MoneyGuidePro, Logix, or other financial planning software competitors besides WealthTec), the long-term question is whether Walters’ new creation will eventually expand beyond its initial ultra-HNW market and become more of a competitor to those other platforms in the future.

RightCapital Raises $3.7M Series A To Compete In Enterprise Financial Planning Software. While the advisor technology community was fixated last week on the return of Edmond Walters and the announcement of MoneyLogixPro from his new Apprise Labs venture, financial planning software upstart competitor RightCapital announced its own $3.7M Series A round of funding last week. The company has been the fastest growing new entrant in the financial planning software category in more than a decade (arguably since eMoney Advisor itself), with a healthy 10%+ market share in the fee-only advisor community since launching at the XYPN National Conference in 2015 and a near-top User Rating amongst advisors according to the latest 2019 T3 Advisor Tech Software Survey. Though with solid traction in the RIA community, RightCapital now appears to be making the pivot into the enterprise market, building on its head-turning deal last fall to back Commonwealth Financial’s latest financial planning efforts. In fact, RightCapital announced not only its latest funding round, but also the hire of Pietro La Greca – who formerly led Adicent’s Enterprise Sales of Naviplan – to lead RightCapital’s own Enterprise Sales efforts. And ironically, notwithstanding the buzz of Walters’ MoneyLogixPro as a potential competitor to eMoney Advisor, it’s actually RightCapital that has the most similar cash-flow-based capabilities to compete with eMoney, and has been building more advanced next-generation retirement distribution planning tools that eMoney lacks (e.g,. a module to actually show the impact of systematic partial Roth conversions over time!). With a major enterprise win from Commonwealth under its belt, fresh Series A capital, and a highly experienced Enterprise Sales lead, expect to see a lot of enterprise sales headlines from RightCapital in 2019 as it competes head-to-head with MoneyGuidePro and eMoney Advisor, building upmarket for the more advanced and comprehensive needs of growing base of CFP professionals while eMoney Advisor and MGP have been distracted going “downmarket” to non-CFP brokers with their recent MoneyGuideOne and eMoney Foundations tools instead.

MoneyGuidePro Forks Up, Down, And Sideways To Expand Market Opportunities With MoneyGuideOne and MoneyGuideElite. For over a decade, the market-share leader in financial planning software has been MoneyGuidePro, who in the early 2000s innovated a simpler “goals-based” approach to financial planning software that quickly took market share away from its cash-flow-based predecessors like NaviPlan. But today’s market leader to admire becomes tomorrow’s market leader to disrupt, and for nearly a decade competitors have been looking to unseat MoneyGuidePro’s dominance, with the most successful being eMoney Advisor and its client-portal-based approach to client engagement. And at the same time, the growth of the financial planning movement means that virtually every enterprise has an agreement with at least some leading financial planning software solution (or has built its own), which means the total available market of financial advisors today has largely been penetrated already. Accordingly, over the past year eMoney Advisor made a notable pivot “downmarket” with the launch of its new eMoney Foundations solution, designed for the large segment of brokers at the typical broker-dealer enterprise who are still not adopting any financial planning software today (complaining that financial planning is “too time-consuming” and stirring software providers to offer scaled-back simpler alternatives). And now, MoneyGuidePro has announced its own competing downmarket solution, dubbed “MoneyGuideOne”, which similarly will offer a “fast planning” feature to quickly construct basic financial plans. However, unlike eMoney Advisor, the MoneyGuidePro announcement also included the launch of a new more advanced “upmarket” solution as well, to be called “MoneyGuideElite”, that will delve deeper into income distribution planning, annuities, and other retirement income strategies that surprisingly still cannot be illustrated in financial planning software today. Notably, thus far only the MoneyGuideOne (simpler) solution is available today (as it is essentially just a full version of MoneyGuidePro with the less-commonly-used “Power User” features removed), while MoneyGuideElite and its more advanced features are still under development with a target release date of April. In the end, though, the real question is whether today’s non-financial-planning-adopting brokers will adopt MoneyGuideOne (or eMoney Foundations) at all, or if the reality is that they’re simply never going to become financial planners because it’s not the culture of their firms and the job they were hired into 10/20/30 years ago… and whether MoneyGuidePro’s real growth upside is in MoneyGuideElite, and charging more for a financial planning software solution that actually makes it easier for advisors to charge more for (and deliver more value with) their financial planning advice (at least, if RightCapital doesn’t take their upmarket opportunities first).

AdvicePay Raises $2M Seed Extension From Advisor Crowdfunding And Launches AdvicePay Enterprise For Hybrid B/D-RIAs Growing Fee-For-Service Planning. One of the most pronounced trends of the past decade has been the financial advisor shift from investment products to investment advice, and the concomitant shift from commissions to AUM fees, driving tremendous growth in the fee-based advice channel, to the point that in the latest Financial Planning survey of independent broker-dealers, the top-50 IBDs are now generating the majority of their revenue from fees and not commissions! Yet at the same time, the shift of broker-dealers into the fee-based model has driven the historically-fee-based RIA community to further innovate on their business models, driving a shift towards getting paid directly for financial advice via various “fee-for-service” approaches, including hourly fees, monthly subscription fees, retainers fees, or simply charging on a standalone financial planning fee, in search of new “blue oceans” of (non-AUM) clients to serve. For which there have been no solutions for financial advisors to actually bill clients a financial planning fee – and especially a recurring financial planning fee – directly from their bank account or credit card if they don’t actually have an investment account available to manage. Accordingly, AdvicePay launched in early 2018 to fill this void, offering fee-for-service advisors a way to charge one-time or recurring financial planning fees directly via ACH or credit card and without running afoul of SEC custody rules (that are otherwise triggered by most other “generic” payment processors). Except as it turns out, innovation of fee-for-service business models hasn’t been constrained to only the independent RIA market; instead, the shift of broker-dealers to hybrid B/D-RIAs means that fee-for-service models have begun to emerge in the hybrid broker-dealer community as well, who have unique challenges executing fee-for-service billing and collection processes at scale across hundreds or thousands of advisors. Accordingly, last summer AdvicePay announced that it was raising capital – uniquely through a direct-to-financial-advisors crowdfunding effort, rather than traditional Venture Capital – and after a successful capital round, has launched AdvicePay Enterprise specifically to serve large RIAs and the corporate RIAs attached to hybrid broker-dealers. Though ultimately, the broader question is not just how to execute fee-for-service financial planning fees at scale, but whether technology facilitating a new business model for financial advisors could accelerate the shift from investment advice to comprehensive financial planning advice and underserved segments of consumers, just as the early custodial platforms for RIAs (e.g., the launch of Schwab Advisor Services in 1993) that first facilitated AUM fee billing ended out unlocking the entire growth path for the RIA AUM model 20 years ago.

Bridge Financial Closes Series A Round To Compete As Portfolio Performance Reporting Solution For Small RIAs. The rise of the fee-based AUM model over the past decade has led to a concomitant rise in portfolio performance reporting tools, which in the late 2000s and early 2010s was the “hot” advisor technology category. Yet ultimately, the challenge of performance reporting tools is that it’s hard to differentiate on doing a “better” job reporting the same underlying data that everyone else has access to, and as a result while the portfolio performance reporting category has more players than most, the growth has still been concentrated in a subset of larger players like Albridge and Morningstar Office in the broker-dealer community, along with Tamarac and Orion and Black Diamond (and what are still a zillion legacy Schwab PortfolioCenter installations!) amongst RIAs. Nonetheless, Bridge Financial this month announced a new Series A round of capital to accelerate the growth of its new portfolio performance reporting platform, a pivot for what was previously an outsourced portfolio performance reporting servicing firm since the early 2000s (overlaying service-intensive solutions like PortfolioCenter and Advent that requires daily data downloads and reconciliations) that decided in 2015 to build its own portfolio performance reporting tool instead. Dubbed Atlas, the BridgeFT solution offers the usual suite of a client portal for performance reporting, advisor dashboard for tracking and reporting on client accounts, AUM billing tools (including held-away account aggregation to facilitate AUA billing), and an integration with Blaze Portfolio for portfolio trading and rebalancing, but seeks to gain market share on top of its existing 110 firms by simply pricing at a more compelling entry point for small-to-mid-sized RIAs that may not be able to afford the typically-$10,000-to-$15,000/year entry point for many of the more established tools. And arguably, as many of the more established portfolio performance reporting tools have become more and more capable, there is room for a simpler and more affordably priced performance-reporting-only solution for smaller more planning-centric firms. Though in the end, it’s still unclear whether BridgeFT, or any of their competing portfolio performance reporting start-up brethren, will be able to effectively build and scale their solutions by trying to compete primarily on price in the face of an increasingly commoditized feature set.

Plaid Acquires Quovo For $200M As Account Aggregation APIs Move From Data To (Authenticated) Action. The meteoric rise of Mint.com, which launched in the fall of 2007, quickly gained 1 million(!) users, and was sold just 2 years later to Intuit for $170M (who then multiplied Mint to 10 million users just a few years after that!), instantly made account aggregation a “hot category” in FinTech, and spawned a number of competitors that similarly tried to make competing PFM (Personal Financial Management) tools to capture consumer attention. The caveat, however, was that for a while, account aggregation and PFM portals seemed to be all sizzle and no steak, as consumers rapidly adopted the tools but providers struggled to figure out how to effectively monetize the value. The first generation of account aggregation tools aimed to monetize users’ attention, from Mint.com cross-selling ads for credit cards and savings accounts, to eMoney Advisor giving their financial advisor users a way to more deeply engage clients to retain their attention (and their assets), to Personal Capital giving away its free PFM tools and then upselling its investment management services. The second generation of account aggregation providers aimed to monetize the data itself, selling access to the data flows that other third-party solutions could then use for their own ends, including Intuit’s own Mint API and Yodlee. But in recent years, a third generation of account aggregation providers like Quovo appeared, that began to develop APIs not just to share the account-aggregated data, but to actually use them to take actions. For instance, the Betterment Smart Saver tool leveraged the Quovo APIs to not just aggregate information about outside bank accounts, but authenticate the connection to transfer money to/from the account, and proactively monitor the account balance to trigger transfers of “excess” saving (to Betterment) once cash balances reached certain targets. In other words, it wasn’t just about the account aggregation data, but taking actions using that data, building initially on its Authentication API and extending further. In this context, it’s entirely logical that Plaid, which similarly has leveraged financial APIs to not just connect data points but execute real-world actions (Plaid powers numerous bank account authentication and bank-transfer-related APIs), would acquire Quovo to extend its bank-centric reach into the world of wealth management as well. For instance, financial authentication and transfer APIs could someday make ACATS transfers nearly instantaneous (dramatically reducing friction for account transfers), provide a way to not just aggregate data from but actually trade held-away investment accounts or 401(k) plans (turning even held-away assets from AUA to AUM!), or further replicate services like Betterment’s Smart Saver to help consumers (and their advisors) automate various savings and investment strategies (which could materially impact the flow of assets from one account or provider or platform to another!). In other words, Plaid’s acquisition of Quovo signals that account aggregation and PFM solutions are making a significant shift, from just trying to gather and sell the account aggregation data, or monetize the attention of PFM portals that show the data, to the 6th level of account aggregation: actually leveraging the financial data to execute financial actions alongside it… for which a Plaid-plus-Quovo partnership provides access to nearly the entire financial services investment and banking spectrum!

Timeline 2.0 Launches To Illustrate Dynamic Spending Strategies And Produce Withdrawal Policy Statements. It was nearly 25 years ago that Bill Bengen first produced his so-called “4% rule” research, showing that even if long-term returns average out, retirees can still run out of money if an adverse sequence of returns draws down the portfolio too far before it has a chance to recover (and thus why even though a balanced portfolio generates 7% to 8% long-term returns, the “safe” withdrawal rate is only 4%). Over the years, retirement researchers have found numerous ways to better manage the safe withdrawal rate, though, from engaging in dynamic spending rules (e.g., small mid-course adjustments to avoid depleting retirement assets) to dynamic asset allocation strategies. Yet surprisingly, no financial planning software today is capable of actually illustrating such dynamic spending or dynamic asset allocation rules, much less help to codify them into a Withdrawal Policy Statement for clients. To fill the void, last year Timeline App launched a solution specifically to help model safe withdrawal rates – or more accurately, how various retirement strategies would have fared through rolling historical periods (and how the 4% rule “works” to manage those historical sequences). And now, the company has announced its latest 2.0 version, adding in additional tools to model the impact of rebalancing, asset allocation glidepath strategies, and income taxes, and automatically preparing a Withdrawal Policy Statement for clients based on the selected dynamic spending and asset allocation rules selected. Of course, many comprehensive financial advisors will prefer to model retirement projections in their existing financial planning software, and not “duplicate” the process in separate standalone tools, raising the question of whether Timeline’s tools will eventually become integrated or embedded into other financial planning solutions; in the meantime, though, Timeline’s success highlights the ongoing gap between today’s accumulation-centric financial planning software used primarily for asset gathering, and the kinds of conversation that advisors have (and have to model) with real-world retiring clients who can and do make adjustments along the way (and want to know the impact and consequences of those decisions to make a real plan up front).

Will Envestnet’s New Insurance Exchange Platform Become The Distribution Channel For Fee-Based Annuities? When it comes to investment solutions, the rise of the fee-based model has shifted financial advisors to become investment managers themselves, fueling the growth of ETFs as the fundamental building block of the RIA-as-portfolio-manager (or Rep-as-PM) who doesn’t have time to analyze and manage individual stocks and bonds. From the advisor’s perspective, the appeal of solutions like ETFs (and index funds, and some institutional-share-class mutual funds) is that it allows them to strip out the fund’s costs of distribution (e.g., commission payments) from the cost structure, leaving more room for the advisor to add their own AUM fee and still add up to a reasonable (or even lower all-in-cost) than the broker-sold competitor. In this context, the challenge of gaining adoption of annuities in the independent fee-based channel was that there were no fee-based annuity alternatives, and RIAs were reluctant to recommend a product that would charge a commission to the client on top of the advisor’s own fees… and stirring in recent years the rise of a new crop of fee-based annuity products with the underlying commission costs stripped out. Yet the reality is that it’s not enough to just offer a no-commission annuity to RIAs to gain adoption in the fee-based channel, as most annuity carriers don’t have any marketing or distribution infrastructure to reach and educate the fee-based channel on how to effectively use their new products. Nor are the new fee-based annuities necessarily able to connect to modern RIA portfolio reporting, trading, and other technology systems being used to run fee-based businesses. Consequently, it was notable that last year Envestnet launched a new “Insurance Exchange” platform, aiming to make its technology platform a distribution channel for fee-based annuity products, just as it became a powerhouse distributor of fee-based managed account solutions over the past two decades. And in recent months, the company has quietly added a number of key annuity players to the platform, from Jackson National last fall, to Brighthouse Financial and its new fee-based annuity contract this most recent month, along with major indexed annuity player Allianz Life. But what makes Envestnet’s Insurance Exchange different from other fee-based annuity distribution partners – e.g., DPL Financial Partners – is that as a technology platform that delivers the Tamarac portfolio performance reporting and trading solution to fee-based advisors, it is uniquely positioned to not just facilitate fee-based annuity distribution, but also to solve the real-world technology integration problems that still hinder their adoption in the RIA channel… yet another interesting example of how technology itself is becoming a key distribution channel not just for investments but also for the insurance and annuity products of the future as well (and for both advisor-intermediated and direct-to-consumer product distribution!).

Oleg Tishkevich Returns With Invent.us To Transition Legacy Broker-Dealer Systems To The Cloud. One of the notable themes of this year’s T3 Advisor Technology conference was a series of second-venture launches from successful advisor FinTech entrepreneurs. Jim Starcev and Mark Calhoun sold Etelligent Consulting to Schwab years ago and returned this year with Nexa Insights, Edmond Walters sold eMoney Advisor to Fidelity three years ago and returns to launch Apprise Labs’ MoneyLogixPro, and Oleg Tishkevich sold FinanceLogix to Envestnet three years ago and returned this year to launch Invent.us. Notably, though, while Starcev and Calhoun, and Walters, both launched new client-facing tools for advisors, Tishkevich is targeting an arguably even more important but less evident problem – the vast number of broker-dealers who still run on spreadsheets and legacy server-based software, who need to transition to the cloud and modern architecture but don’t actually know how to do so (because they’re broker-dealers, not technology companies). For many broker-dealers, the stop-gap for the past several years has been to try to build point-to-point solutions that connect their legacy technology to the endpoints of more modern solutions thanks to the rise of APIs, but the end result is still highly inefficient, prone to breakage, and lacks scalability. In other words, rather than just trying to transition parts of broker-dealer data and systems to be more cloud-based, Tishkevich’s new company is a bevy of developers (30 so far) whose job is to architect and deploy entirely new “cloud-native” systems (i.e., built for the cloud from the start). In essence, then, Invent.us is “simply” a financial services industry-specific enterprise development shop… solving the very targeted but remarkably still widespread challenge of transitioning the huge portions of the broker-dealer community from legacy server systems to the modern cloud.

Cetera Tests Whether nViso Facial Recognition Software Will Improve Financial Advisor EQ. In the ongoing debate of robo-advisors versus human advisors, and more generally the role of technology automation versus human workers, the “saving grace” for the humans has always been that we can uniquely understand emotions and connect with other human beings in a way that software cannot. Yet the reality is that the rise of facial recognition software means that computers can and are being taught to recognize and “understand” how to read human emotions from someone’s facial expressions… and those tools are now beginning to find their way into the world of advisor FinTech. The newest addition in this space is nViso, which recently launched a platform called Emotion Advisor that uses facial recognition software to monitor a client’s facial expressions while taking in or discussing financial information… used by the Bank of New Zealand to make improvements in its customer service and how it delivers financial information. Expanding on the platform further, at the T3 Advisor Tech conference, nViso announced their new Insights Advise solution, with the goal of providing that client facial expressions information as feedback to the financial advisor themselves, who might miss key client emotions that only flash by for a moment but can use the computer’s monitoring tools to be better aware of any issues. Now in a pilot program with independent broker-dealer Cetera Financial, it stills remains to be seen exactly when/where nViso’s tools are best used – for instance, is it better to have facial recognition tools to augment the advisor in a meeting, or will that be deemed “too creepy” by clients, such that it’s better to use nViso to see how clients react when they view information digitally (e.g., when the client logs in to see an update of their investment accounts or their financial plan, what is their emotional reaction, and does it signal that they make be about to make a rash decision?). Ultimately, as with other “augmented reality” tools like Google Glass, nViso will likely push the limits of how comfortable modern clients are with “intrusive” technology that looks closely (literally!) at what they’re doing… but as technology marches inexorably forward, first-use tools like nViso today will likely become industry standard in 20 years. To each their own about whether they want to be the first/early adopter, though.

New Product Watch: The Rise Of Client Engagement Surveys From Client Insights And Nexa Insights. The financial advice business is a service business, and one in which client satisfaction is everything, driving both the client retention rates and new client referral rates that are essential to sustain the growth of a recurring-revenue business. Yet surprisingly, despite the ubiquity of customer feedback systems like Net Promoter Score (NPS) in virtually every other industry, there are still virtually no tools available in the financial advisor landscape to conduct client surveys and gather feedback and whether the firm is performing well, and where it could improve… as advisors instead rely solely on the pace of client referrals and the firm’s client retention rate itself to determine its effectiveness (where problems are only evident after it’s far too late!). At least until now, as in the past month, two new client survey and feedback tools have been announced. The first is Client Insights (available in March), launched by industry consultant Julie Littlechild, who previously built and then sold Advisor Impact (a client survey/feedback system), and has now built a next-generation client feedback solution with the specific goal of not just gathering client feedback but mapping it to recommended practice management action steps that advisory firms can take to improve their scores. The second is Nexa Insights (launched at the T3 Advisor Tech conference and available now), which aims to delve even deeper into the client feedback data by aggregating in additional data points from the advisor’s CRM or portfolio reporting systems to create even more “big data” insights about client trends (e.g., are male clients more or less satisfied than female clients, are older clients more or less satisfied than younger clients, are high-fee/high-AUM clients more or less satisfied than lower-fee clients, etc.). And as with Littlechild’s Client Insights, Nexa Insights is also a “second tech” initiative, developed by Jim Starcev and Mark Calhoun, who previously built and sold Etelligent Consulting (an outsourced PortfolioCenter servicing and consulting firm) to Schwab back in 2008. Which means not only are these new client feedback tools quickly emerging into a new category of their own, but they’re being developed by very experienced advisor consultants and entrepreneurs who intimately understand exactly what financial advisors want and need… a promising sign for both solutions and their usefulness and relevance to the advisor community.

New Product Watch: The Rise Of Client Engagement Surveys From Client Insights And Nexa Insights. The financial advice business is a service business, and one in which client satisfaction is everything, driving both the client retention rates and new client referral rates that are essential to sustain the growth of a recurring-revenue business. Yet surprisingly, despite the ubiquity of customer feedback systems like Net Promoter Score (NPS) in virtually every other industry, there are still virtually no tools available in the financial advisor landscape to conduct client surveys and gather feedback and whether the firm is performing well, and where it could improve… as advisors instead rely solely on the pace of client referrals and the firm’s client retention rate itself to determine its effectiveness (where problems are only evident after it’s far too late!). At least until now, as in the past month, two new client survey and feedback tools have been announced. The first is Client Insights (available in March), launched by industry consultant Julie Littlechild, who previously built and then sold Advisor Impact (a client survey/feedback system), and has now built a next-generation client feedback solution with the specific goal of not just gathering client feedback but mapping it to recommended practice management action steps that advisory firms can take to improve their scores. The second is Nexa Insights (launched at the T3 Advisor Tech conference and available now), which aims to delve even deeper into the client feedback data by aggregating in additional data points from the advisor’s CRM or portfolio reporting systems to create even more “big data” insights about client trends (e.g., are male clients more or less satisfied than female clients, are older clients more or less satisfied than younger clients, are high-fee/high-AUM clients more or less satisfied than lower-fee clients, etc.). And as with Littlechild’s Client Insights, Nexa Insights is also a “second tech” initiative, developed by Jim Starcev and Mark Calhoun, who previously built and sold Etelligent Consulting (an outsourced PortfolioCenter servicing and consulting firm) to Schwab back in 2008. Which means not only are these new client feedback tools quickly emerging into a new category of their own, but they’re being developed by very experienced advisor consultants and entrepreneurs who intimately understand exactly what financial advisors want and need… a promising sign for both solutions and their usefulness and relevance to the advisor community.

Annual T3 Advisor Technology Survey Accentuates Mismatch Between Advisor Software Pricing And Value. Joel Bruckenstein’s T3 Advisor Technology survey is unique in the financial advisor landscape because it’s only software survey that asks not only what technology advisors use, but also what they think of the software (i.e., User Ratings), and what they actually value as being most important. Which is striking… because the latest survey shows that what advisors actually value is inversely proportional to what advisors typically pay for their software! Overall, the T3 tech survey shows that the majority of advisors spend between 1% and 5% of revenues on technology, consistent with other industry benchmarking surveys (e.g., the InvestmentNews Benchmarking studies) that show the average advisory firm spends about 3% of revenues on technology, spanning numerous categories, including the “big 3” of the advisor tech stack (CRM, portfolio management, and financial planning software) and the various supporting tools (e.g., risk tolerance, trading/rebalancing, investment analytics, and document management). And within these categories, it’s notable that portfolio management software tends to be much more expensive (i.e., portfolio management tools priced per-account often amount to $5,000 - $10,000/year/advisor) than the others (e.g., the average financial planning software costs about $100/month or $1,200/year/advisor, and CRM software is typically less than $40/month or about $500/year/advisor). Yet when the T3 survey asked advisors what is the most valuable software for their firms, the majority (52%) state that CRM software is most important, followed by financial planning software (23%), then portfolio management software (only 13%), and then trading/rebalancing tools (6%). Which raises the question: why do advisory firms typically spend 5X to 10X the fee on investment solutions than on financial planning or CRM solutions that they state are more valuable? To some extent, this may simply be because portfolio management tools are “essential” (given the ubiquity of the AUM model and the necessity of being able to manage and bill on those assets) but largely commoditized as table stakes (to the point that any one solution, in particular, isn’t the most valuable). Nonetheless, it raises interesting questions about the potential for pricing disruption in portfolio performance reporting tools for whatever firm can figure out how to more effectively scale their solution… and highlights what appears to be a notable gap in CRM and financial planning software deemed “high end” enough (and relevant enough to what advisors can charge for their services) to justify a materially higher (portfolio-reporting-like) price point.

In the meantime, we’ve updated the latest version of our Financial Advisor FinTech Solutions Map with several new companies, including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation!

So what do you think? Is there really a gap for financial planning software for ultra-high-net-worth clientele? Will MoneyLogixPro become a competitor for eMoney Advisor, or is RightCapital the greater threat? Can Plaid use Quovo to modernize ACATS transfers and facilitate the outside management of held-away accounts? Is there truly room for a “higher end” CRM solution given that most advisors report it is their single most valuable piece of software in the first place?

Disclosure: Michael Kitces is a co-founder of AdvicePay, which was mentioned in this article.

Leave a Reply