Executive Summary

Welcome to the February 2020 issue of the Latest News in Financial Advisor #FinTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors and wealth management!

This month's edition kicks off with the big announcement that Visa is acquiring Plaid for a whopping $5.3B (barely a year after Plaid itself acquired Quovo, a popular account aggregation solution for financial advisors), in a move that will help cement account aggregation as a standard fixture in the financial services landscape, and likely help to standardize (and reduce the frequency of breakages) account aggregation data gathering… though for the price that Visa paid to acquire Plaid, it doesn’t appear likely that serving financial advisors will be a priority, raising questions about what Visa’s commitment will be to Quovo in the long term and leaving the door open for Yodlee’s continued growth in the advisor community.

From there, the latest highlights also include a number of other interesting advisor technology announcements, including:

- Invesco’s Jemstep announces a major deal with Citigroup to power its new Citi Wealth Builder robo platform… to be funded exclusively with Invesco model portfolios comprised of Invesco ETFs

- Fidelity and Schwab announce a series of new enhancements to their own digital onboarding solutions and a long-term pledge to eliminate account application forms altogether

- WisdomTree announces that it intends to sell its robo-for-advisors platform AdvisorEngine for a significant loss that amounts to little more than what it originally paid for Junxure, raising questions of where Junxure itself will land when WisdomTree puts the company up for sale

- TA Associates announces that it is putting Orion Advisor Solutions up for sale for nearly $2B, in what may become the biggest yet private equity sale of an RIA technology solution

Read the analysis about these announcements in this month's column and a discussion of more trends in advisor technology, including the growing intertwining between risk tolerance assessment tools and rebalancing software, Act Analytics launching a new ESG research platform for advisors looking to more easily analyze and then customize ESG portfolios for individual clients, Whealthcare’s founder splitting off from the company despite recent industry awards as advisor growth appears to have been lagging, and a growing level of integrations and adoption of cash management solutions for financial advisors as the pressure grows for advisors to show value for clients beyond just the portfolio itself.

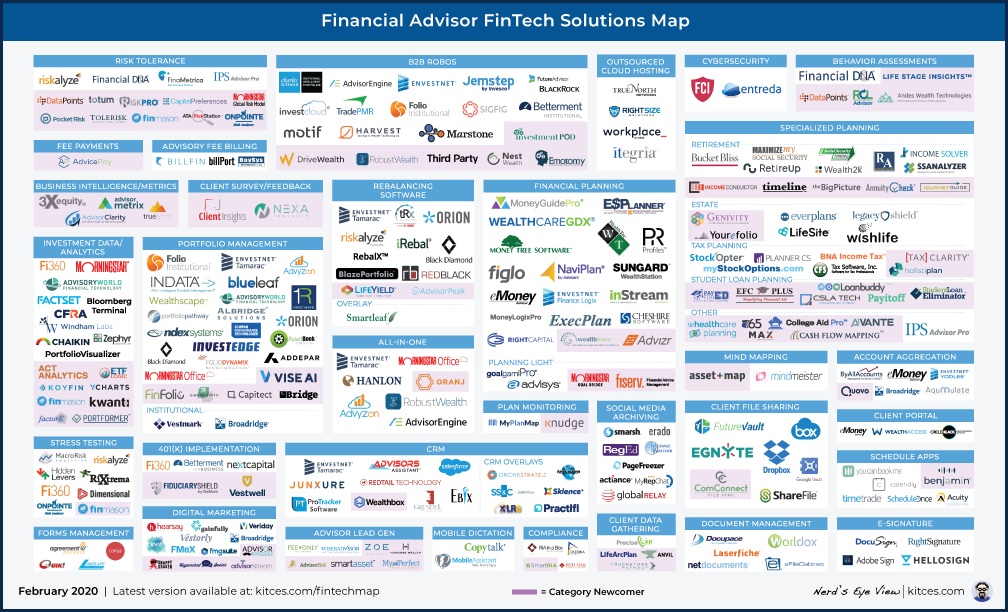

And be certain to read to the end, where we have provided an update to our popular new “Financial Advisor FinTech Solutions Map” as well.

I hope you're continuing to find this column on financial advisor technology to be helpful. Please share your comments at the end and let me know what you think!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

Visa Goes All-In On Account Aggregation With $5.3B Plaid Acquisition But Not For Financial Advisors? The blockbuster FinTech news this month was the announcement that Visa was acquiring account aggregator Plaid for a stunning $5.3B (estimated at 25X to 50X Plaid’s $100M to $200M revenues), barely a year past when Plaid itself bought financial advisor account aggregation provider Quovo for $200M, and suddenly making Envestnet’s decision to purchase competing account aggregator Yodlee in 2015 for $590M (estimated at ‘just’ 5X to 10X Yodlee’s revenues at the time) a stunning value deal by comparison. At a high level, the significance of the Visa deal is that, when a company the size of Visa (with a market cap of nearly $500 billion) makes such a massive bet on the business of financial data aggregation, it both increases the likelihood that regulators and legislators will continue to be supportive of data sharing (as Visa’s lobbyists now have 5.3 billion reasons to ensure the pipes stay open!), and brings to the table a firm large enough to actually be able to standardize what has historically been a problematically inconsistent stream of data to manage and report on. In point of fact, a slow and steady shift has already been underway to finally transition account aggregation away from third-party platforms that store login credentials to screen-scrape user data, and instead towards accessing API data flows directly (leveraging OAuth or other authentication standards to ensure the data sharing has been properly authorized)… which Visa will likely be able to accelerate (which ultimately should largely eliminate the all-too-common challenge of account aggregation links that routinely break and have to be reset). The caveat, however, is that Visa is so large that it may largely command the process of driving account aggregation standardization… and is not likely to be doing so with the use cases of financial advisors in mind. As the reality is that Quovo’s account-aggregation-for-advisors service was just a small portion of Plaid’s business, and Visa’s eye-popping valuation for Plaid suggests that it sees more new and different ways to monetize the data beyond ‘traditional’ account aggregation use cases. For instance, Plaid’s capabilities to not only share and aggregate data, but facilitate account openings, could be used to better facilitate consumers opening Visa credit cards (and in point of fact, Plaid already helps to power some of credit-card-comparison-site Credit Karma’s services). And a unified set of transactional payments data has long been viewed as the ‘holy grail’ in the world of advertising, creating the potential of not only serving ads to consumers but then being able to determine when and where they made a subsequent purchase, to fully validate which ads are working or not (thus why Amazon and Apple have been so eager to put their own credit cards in the hands of consumers). Which means it’s really not clear what Visa has in mind (or not) for Quovo’s service to financial advisors in particular, and whether or to what extent it even intends to compete against Envestnet’s Yodlee in the advisor channel when Visa clearly has other business objectives in mind. Still, though, the good news is that Visa’s acquisition of Plaid should mean that “account aggregation” is here to stay (after fears for years that financial institutions might try to assert more control over customer data and lock account aggregators out), and will likely become even more standardized, consistent, and secure in the future.

Three Lawmakers Call Federal Trade Commission To Investigate Envestnet Yodlee’s Sales Of Private Data. Following just four days after the announcement of Visa’s acquisition of account aggregator Plaid, three lawmakers sent a letter to the Federal Trade Commission calling for the FTC to investigate Envestnet Yodlee’s business practices with respect to selling personal financial data on up to 25 million consumers, and whether Yodlee is obtaining the proper consent before doing so. Notably, much of the data services that Yodlee sells is specifically at the request of consumers - for instance, when plugging into various account aggregation tools, including some used by financial advisors - but Yodlee also separately sells data about users' credit and debit card transactions. And while Envestnet does state that all such 'personal' data sales first scrub personally identifying details and anonymize the data, recent studies have found that having just a handful of 'anonymized' points of credit card metadata can sometimes be enough to de-anonymize and identify the underlying individual. Which is concerning, as ultimately spending data on an individual basis can then be used to identify private information about someone's health, sexuality, religion, political views, or other personal details. Accordingly, the concern is that while Yodlee's Terms of Service do note the ways that it uses data, lawmakers suggest that Yodlee "should not put the burden on consumers to locate a notice buried in small print", and that consumers may not be made aware enough of the personal privacy risks of Yodlee's data-sharing policies. On the other hand, it's not clear that Yodlee is even selling a level of transaction data or metadata detail (e.g., to hedge funds to identify investment opportunities) that could be de-anonymized. And the sharing of anonymized data to third parties isn't unique to only Yodlee's account aggregation services, raising questions of whether lawmakers simply aren't 'up with the times' on the ways data can (reasonably) be leveraged, and why Yodlee, in particular, was singled out for a broader industry practice and whether it could have even been spawned by the Visa acquisition of Plaid (though RIABiz notes that Visa doesn’t appear to have any financial contribution entanglements to the Congressmen involved)? Alternatively, some have suggested that in practice, Yodlee is simply being made the example, and that the call for investigation may simply be the first step for legislators or regulators to get involved in forcing greater standardization of both how personal financial data can be used, and the protocols for collecting and sharing it safely. Either way, though, the incident will assuredly draw more scrutiny from both regulators and legislators to how the growing business of collecting consumer personal financial data is being used and monetized to ensure that consumers are protected… which, arguably, is the way it should be anyway?

Invesco’s Jemstep Announces New Citigroup ‘Robo’ Platform Powered (And Funded) By Invesco ETF Models. When Blackrock first acquired early robo-advisor pioneer FutureAdvisor for $150M (estimated to be 50X FutureAdvisor’s revenue at the time), many wondered if Blackrock was making an ill-fated bet on the nascent direct-to-consumer robo-advisor movement. In practice, though, it turned out that Blackrock didn’t acquire FutureAdvisor for its own robo-advisor consumer business, but the potential to leverage the technology as a solution for financial advisors instead, where advisors using the software to create model portfolios for clients could be defaulted into (or required to use) Blackrock models that used Blackrock-owned iShares ETFs as their building blocks. In subsequent years, this shift of robo-software-for-advisors-as-an-ETF-distribution-channel spawned a number of ETF providers acquiring competing robo-for-advisors solutions, including WisdomTree buying AdvisorEngine (nee Vanare) and Invesco acquiring Jemstep. And now, Invesco’s Jemstep has announced one of its biggest deals yet, powering Citigroup’s new Citi Wealth Builder robo solution, which is rolling out with a 0.55% fee and a $1,500 account minimum, though fees are waived for Citi Priority customers who already maintain at least $50,000 in banking, retirement, or investment accounts (or for Citigold customers with $200,000+ balances). The Citi offering was quickly criticized by some as being ‘late to the game’, and expensive (at least for those under the Citi Priority $50,000 threshold) relative to competing robo solutions, though with more than 200 million customer accounts around the globe, Citi arguably has more than enough existing customer households already doing business with the bank to whom a new investment solution can be cross-sold. Notably, though, the model portfolios that Citi Wealth Builder will offer are a series of 6 strategies designed by Invesco and using exclusively Invesco ETFs… for which Citi’s Form ADV Part 2 reveals will include a revenue-sharing arrangement where 10% of the fees from Invesco’s ETFs (in non-retirement accounts) will be paid back to Citi. In other words, Citi purchased Invesco’s Jemstep technology to power its robo-advisor solution, but is then covering that cost (and ostensibly some profits on top) by indirectly receiving 10% of the ETF fees that Invesco generates when its ETFs are used in the models that Jemstep implements… somewhat akin to Schwab’s own Intelligent Portfolios robo business model of offering the robo-advisor for ‘free’ but profiting from the underlying ETFs (except in Citi’s case it isn’t using its own ETFs, but a third-party provider’s that share a portion of the revenue back to Citi). Of course, Citi is certainly entitled to be paid for the solution it provides to its customers… but in practice highlights the extent to which asset managers are seeking to leverage ‘robo’ software and model marketplaces as a distribution channel (even if it means sharing enough of the ETF fees clients pay to cover the cost of and fund the business of the software provider along the way).

Digital Onboarding Solutions Endangered As Fidelity Tightens Its Digital Onboarding Process And Schwab Pledges A Death To Onboarding Paperwork Altogether? When robo-advisors first arrived in the early 2010s claiming they could replace financial advisors at a fraction of the cost by facilitating a fully digitized account opening process directly from a smartphone, few financial advisors felt threatened by software that technically replaced work typically done by a client service administrator and not the financial advisor themselves. In fact, given how arduous account opening paperwork itself still was at the time – with many leading providers still requiring advisors to overnight paperwork with wet ink signatures or fax copies to receive a preliminary account number – many advisors simply wished that they too could have such a digitally-enabled account opening and onboarding process. Which led to the rise of various robo-advisor-for-advisors platforms that promised a fully digitized account opening and client onboarding process… with the caveat that there was still a limit to how much they could truly streamline when the underlying broker-dealer or RIA custody and clearing platform still couldn’t facilitate the digital process themselves. Over the past 5 years, though, a major reinvestment cycle from those broker-dealer and RIA custody platforms is now bearing fruit as the back-end platforms become increasingly capable of actually facilitating a truly digital onboarding experience, working towards the ideal of a ‘straight-through processing’ approach where applications completed by the advisor and client are immediately reflected in a newly created account. For instance, Fidelity this month announced a new onboarding workflow that cuts the required input fields by 40% and the total pages of the account application process from 9 down to just 2! And at the last November’s Schwab IMPACT conference, the company announced its long-term vision to eliminate account opening forms altogether as an unnecessary intermediate step to having advisors be able to create accounts directly in the Schwab system. On the plus side, these improved capabilities for digital onboarding are making it easier and easier for third-party solutions to truly facilitate a better onboarding experience. Yet ironically, the improved capabilities of broker-dealers and RIA custodians may end out cutting out more and more of those third-party ‘robo’ onboarding solutions altogether, as it becomes increasingly feasible for advisors to just use their platform’s core technology (and save on third-party software costs). In other words, the “robo” digital onboarding overlays that the original robo-advisors spawned as a solution to lagging advisor technology platforms now appear to be in danger of being made irrelevant as broker-dealer and RIA custodian platforms themselves are finally getting caught up?

Junxure CRM Fate Uncertain As WisdomTree Announces Intended Sale Of AdvisorEngine With Potential 50% Investment Loss. In the aftermath of FutureAdvisor’s acquisition by Blackrock in 2015 as a means to sell Blackrock’s iShares ETFs through robo-for-advisor technology, several other ETF providers sought to acquire their own robo-advisors as a technology distribution channel, including Invesco acquiring Jemstep and WisdomTree buying AdvisorEngine (Vanare | Nest Egg at the time). The challenge in the robo-for-advisors distribution strategy for asset managers, though, was figuring out how to actually reach advisors that would adopt the software. In the case of Blackrock, their FutureAdvisor solution was targeted primarily towards major broker-dealers (e.g., LPL’s Guided Wealth Portfolios) that were accustomed to distributing third-party strategists and needed better onboarding technology, and had the scale of thousands of brokers reaching tens of thousands of clients. When it came to Invesco’s Jemstep, the provider found some traction with banks that could interlace the solution with their exiting mobile banking apps and were eager to offer a packaged investment solution to cross-sell to tens of thousands (or more) of existing bank customers. WisdomTree’s AdvisorEngine, on the other hand, decided to stay focused on the rapidly expanding RIA channel. The challenge of ‘robo’ solutions for RIAs, though, is that they don’t necessarily have the base of tens of thousands of potential customers to immediately market to (and typically lack scaled marketing and especially digital marketing systems), which in turn can make it harder for a robo provider to rapidly scale in the RIA channel. Accordingly, in early 2018, in an apparent attempt to accelerate its penetration into RIAs, AdvisorEngine acquired advisor CRM provider Junxure to cross-sell their users on the AdvisorEngine platform. Yet the caveat even at the time was that Junxure’s existing user base was extremely financial-planning-centric while AdvisorEngine had only a ‘light’ financial planning offering (with its then-recently-acquired WealthMinder) and lacked integrations to more robust financial planning software like eMoney or MoneyGuidePro… a potential misfit for AdvisorEngine’s investment-centric platform. In addition, it wasn’t clear that the RIA community would be willing to pay AdvisorEngine’s basis point fee schedule when most advisor tech is priced in flat dollars (per firm, per advisor, per client, or per account), especially as RIA custodians increasingly offered their own digital onboarding capabilities. And now, two years after the Junxure acquisition, WisdomTree announced in its recent Q4 Earnings Report that it intends to exit its AdvisorEngine acquisition for an impairment of $22M to $30M on a $58M cumulative investment. Which is notable both for the sheer magnitude of the loss (as much as 50% of WisdomTree’s investment), but also because ostensibly at least $24M (or almost all of the remaining value?) is simply the value from the original purchase of Junxure itself (which still maintains a healthy base of advisors paying for the CRM solution). Raising the question of whether WisdomTree will sell AdvisorEngine coupled with Junxure, or spin Junxure CRM off separately (as strategic acquirers for a CRM solution with a healthy existing RIA market share may not be the same as those who would want to acquire AdvisorEngine to potentially not sell to RIAs and use for other purposes instead). Fortunately, as discussed on this blog when AdvisorEngine first acquired Junxure, the existing and loyal base of Junxure users means that Junxure should still have a positive future even if AdvisorEngine failed to convert its users to adopt AdvisorEngine (which now appears to be the case). Still, though, with an AdvisorEngine sale from WisdomTree now looming for a value that may be driven primarily by Junxure itself, the real question is not who may buy AdvisorEngine from WisdomTree, but whether a strategic acquirer will make a play for Junxure?

TA Associates To Legitimize Private Equity Investments Into AdvisorTech By Selling Orion Advisor Solutions For Nearly $2B? In 2015, private equity firm TA Associates turned heads by acquiring Northstar Financial Services, which owned Gemini Fund services, TAMP provider CLS Investments, and portfolio performance reporting provider Orion Advisor Services. At the time, private equity investors had made few inroads to the RIA channel, and had made virtually no steps towards advisor technology solution, which at the time were sold (if at all) primarily to other strategic acquirers in the industry (e.g., eMoney Advisor to Fidelity, Black Diamond to Advent, PortfolioCenter to Schwab, etc.). And while the terms of the original deal were not disclosed, Barron’s reports that TA Associates is now looking to sell its stake in Orion Advisor Services (which now includes Orion’s acquisition of FTJ Fundchoice along with CLS Investments as part of Orion’s newly unified brand and structure) for a whopping $1.875 billion, in what is widely viewed as a substantial appreciation in value and growth success for Orion. Ultimately, it remains to be seen who may acquire Orion, and whether it will be sold to another private equity firm for another 5-7 year growth cycle, or if a strategic player (e.g., an RIA custodian like Schwab, or a competitor looking to get deeper into the RIA channel like Fiserv) will make a bid; either way, the ongoing success of Orion’s growth suggests that any acquirer will simply look to further expand Orion’s services and market share. But from the broader industry perspective, a PE firm investment into an advisor-specific (and even more narrowly, RIA-specific) technology solution that results in a successful multi-billion-dollar exit is likely to attract further high-profile investments into advisor technology, a channel for historically was viewed as “too small” of a market for venture capital and private equity investors but is increasingly holding its own as a potential creator of FinTech unicorns?

Risk Tolerance And Rebalancing Software Increasingly Intersect As AdvisorPeak And Orion Integrate With Totum. For as long as there has been regulation of financial advisors, there has been a fundamental requirement to ensure that recommendations being made are appropriate for the client’s situation and consistent with the client’s tolerance for risk. Which led to the emergence of various risk tolerance questionnaires to assess the client’s risk capacity (i.e., time horizon and financial needs) and risk attitudes (i.e., willingness to allocate dollars to risky investments), delivered to the client once they came on board to document their risk preferences for the client file. Andthe 1990s spawned FinaMetrica as the first major software provider to turn risk tolerance questionnaires into a technology solution. In 2011, though, Riskalyze arrived on the scene, with a solution designed not only to assess the client’s tolerance for risk, but show the client how their risk tolerance aligned with their current portfolio, whether the advisor’s prospective portfolio was better (usually the case, as investors so commonly overconcentrate their portfolios resulting in unduly high levels of risk), and then help the client make the transition from their current portfolio to the advisor’s recommended solution (with the launch of Riskalyze’s Autopilot in 2015). From the business perspective, this shift – from risk tolerance software that helped with compliance due diligence after a client agreed to come on board, to what effectively became a form of risk-tolerance-based proposal generation software to get the prospective client in the first place – is what allowed Riskalyze to charge nearly double its competitors and still rapidly gain market share. But from a technology perspective, Riskalyze’s combination of risk tolerance software and trading implementation has spawned an ever-growing number of integrations between various risk tolerance software solutions and the available suite of rebalancing software providers, so advisors can ensure that the output of their risk tolerance software – either upfront with a prospect, or ongoing with a client – can be quickly and easily implemented in the client’s portfolio, and also so that the client’s portfolio can be monitored not only for its investment parameters but also when its allocations exceed the client’s stated risk tolerance thresholds. Most recently, this includes startup risk tolerance software provider Totum Risk integrating with both AdvisorPeak rebalancing software (from the original makers of TradeWarrior), and also with Orion Advisor Solutions (which makes the Eclipse rebalancing software). In theory, rebalancing software providers may soon just begin to develop their own risk tolerance questionnaire tools to provide a more ‘all-in-one’ solution (and a tighter integration between trading and risk tolerance assessment and monitoring), though arguably Riskalyze has set the bar high enough on risk tolerance assessments (going far beyond just answering a series of written questions) that third-party providers for whom interactive risk tolerance assessments are a core competency are more likely to prevail questionnaire. Which means it may be more likely in the coming year to see some trading and rebalancing software solutions begin to simply outright acquire risk tolerance software solutions instead?

Northwestern Mutual’s Venture Arm Invests Into Digital Onboarding ‘Robo’ U-Nest For 529 College Savings Plans. While the rise of robo-advisors has spurred both traditional brokerage firms and advisor platforms to improve their own digital onboarding capabilities, the world of 529 college savings plans still often entail a significant ‘paper’ component to the onboarding process. Yet the irony is that the target users of 529 college savings plans – generally young adults (i.e., new parents) in their 20s and 30s – are the ones being most targeted by the rest of the robo-advisor movement (e.g., Betterment) as well as other startup digital investment platforms (e.g., Robinhood and Acorns), where a lengthy paper application for a 529 plan is especially jarring relative to the seamless mobile account opening experience of non-529-plan alternatives. In this context, U-Nest (founded by Ksenia Yudina, herself a former employee of American Funds, which currently offers the largest 529 plan by assets) is seeking to create the ‘robo-onboarding-experience’ equivalent for 529 plans, for a flat fee of just $3/month to maintain the account (overlaid on top of Invesco’s Rhode Island 529 plan), and recently attracted an additional round of seed capital from Northwestern Mutual’s Future Ventures group (bringing its total up to $3.5M). Notably, U-Nest is currently a direct-to-consumer offering, largely seeking to serve less affluent segments of the population not traditionally served by financial advisors, but Northwestern Mutual itself acknowledges the U-Nest as a ‘strategic’ investment that could eventually become part of the firm’s reworked client experience (potentially following a similar path to LearnVest, which also received an early stake from Northwestern Mutual Ventures and eventually was acquired into the insurance company itself). As ultimately – just like the evolution of the robo-advisor movement as well – it may be helpful to facilitate a more digital onboarding experience for consumers, but in the end technology to expedite the account opening process is equally relevant for financial advisors, too (whether for traditional investment accounts, or 529 college savings plans!).

PreciseFP Expands Data Gathering Toolset With DocuSign Integration. The good news of an increasingly digitized onboarding experience directly from various broker-dealer and RIA custodial platforms is that it’s less and less necessary to utilize a third-party ‘robo’ solution to digitize the onboarding process for clients. The bad news, however, is that the digital onboarding experience of most investment platforms is still built first and foremost to facilitate the investment onboarding of a client… but not necessarily in service of a more holistic financial planning relationship. For instance, digital onboarding tools from broker-dealers and RIA custodians don’t necessarily port the relevant data from the investment platform to the advisor’s CRM, are even less likely to also transfer and map the key client data into financial planning software, and is virtually never capable of the customizations necessary to gather the rest of the client’s financial planning and advice data beyond whatever the investment provider requires to open the accounts themselves. Which means that while third-party digital ‘onboarding’ solutions are becoming less necessary as advisor platforms improve, third-party data gathering tools that capture the full breadth of information needed for a holistic financial planning relationship and then port it to the various advisor CRM, financial planning software, and investment platforms, remains as relevant as ever. In this context, it’s notable that PreciseFP, which has been an early leader in developing customizable data gathering forms that can be integrated to various advisor software solutions to map and transfer the relevant data, has now announced an integration with DocuSign, making it possible to transfer client data not just into a fillable PDF but then directly queue up the document for electronic signature. In other words, while digital onboarding experiences are becoming ubiquitous, there is still an underlying challenge of collecting a broad range of data about new clients and ensuring it gets to all the various systems that a financial advisor uses… which means it can still be painful to use an investment platform’s native onboarding experience but then still need to gather additional data or do double-data-entry to get it into the advisor’s other systems, as compared to just gathering all the data once centrally (e.g., via PreciseFP) and then sending it out to the various software and investment platforms to power the onboarding experience (facilitated by integrations into e-signature solutions like DocuSign).

Cash Management Solutions For Advisors Heat Up As Stonecastle Drops Minimums And Flourish Integrates With eMoney And Lands A Mega-RIA. In the realm of investing, it’s often said that “cash is trash” that is just eroded by inflation, a maxim that has been further validated over the past decade of near-zero money market and bank yields where virtually anything was capable of providing a better return. Yet at the same time, the reality is that some clients do have a need to hold a non-trivial amount of cash, whether as emergency reserves, to fund a shorter-term savings goal, or simply because (as research has shown) some people sleep better at night (and literally report more happiness) by having a significant amount of cash on hand. Which means, as yields over the past two years have at least slightly rebounded above 0%, it can be worthwhile to help clients get a better yield on whatever (sometimes material) cash they do hold, especially when it’s never been easier to move cash between institutions in an increasingly digitally enabled world. Leading to a recent growth in ‘cash management’ solutions for financial advisors, especially as RIA custodians and broker-dealers still disproportionately rely on their own cash sweep programs to proprietary money market funds or affiliated banks to generate the bulk of their own revenue. Some providers, like MaxMyInterest, facilitate the process by opening multiple bank accounts at various online banks and then automatically transfer the money to whichever has the highest yield, while other like Stonecastle and Flourish create a single centralized account and then sweep the cash to various Program Banks in their network that agree to offer compelling yields. And now, as cash management programs for advisors gain momentum, Stonecastle has announced that it is entirely eliminating what was previously a $250,000 minimum to open an account under its FICA for Advisors solution, and Flourish has built a third-party integration to eMoney Advisor to provide a direct data feed of client cash holdings for account aggregation purposes. In addition, Flourish announced a deal with mega-RIA Buckingham Strategic Wealth, a $15B RIA based in St Louis, to offer its cash solution directly to clients and be able to queue up the application process directly from the firm’s Salesforce CRM and then feed the data to Orion. From the advisor perspective, the good news of these emerging cash solutions is that they provide another value-add opportunity to clients in a world where it is increasingly difficult to differentiate on the advisor’s core investment offering. From the broader industry perspective, though, when broker-dealers and RIA custodians still rely so disproportionately on advisor cash holdings for their own revenue, it seems only a matter of time before advisor-driven cash management solutions become popular enough that they begin to materially conflict and clash with their platforms, potentially forcing a shift in the business model of advisor platforms as well?

When Advisors Won’t Change: Did Advisor Growth Challenges Cause Whealthcare Founders To Split? Most new startups in the world of advisor technology try to grow by establishing themselves in an existing software category and competing for market share by being incrementally better than the incumbents, from portfolio performance reporting tools with slightly better reports, financial planning software with slightly more flexibility, or advisor CRM with a slightly easier to use interface. Every now and then, though, a startup emerges in a new category, most commonly as a “homegrown” – an advisor software solution built by an advisor for their own firm and client needs, and then turned into a software company that sells to other advisors as well. Such was the case back in 2017 when Whealthcare was first launched as the brainchild of Dr. Carolyn McClanahan, a physician-turned-advisor (working in conjunction with software developer Chris Heye) who turned the advice she gave her own clients on their aging issues into a piece of software that any financial advisor could use to engage clients around the difficult conversations of advancing aging, from establishing a Financial Caretaker Plan when they can no longer care for themselves, to an assessment tool for financial decision-making that could help spot early cognitive decline, to a Proactive Aging Plan to address major retirement transitions around housing, driving, and health care services. Yet after being recognized as a finalist for several Wealth Management industry awards last fall, and announcing a planned $2M capital raise in October, the news broke this month that the Whealthcare founders were splitting and that McClanahan was leaving “due to disagreements in business management”. As while Whealthcare had been recognized positively in the industry press, its recent capital raise announcement noted it hadn’t even quite cross the mark of 100 advisory firms as users in its first two years, and Whealthcare had already separately developed and released a consumer version of the software last year as well, raising the question of whether the software was at a crossroads about whether to continue in the advisor channel or pivot more fully to focus on consumers instead. Which, unfortunately, is the fundamental challenge always present in trying to create a new category of software for advisors: the risk that what seems like a strong value proposition on paper, and a relevant value proposition for the advisor/founder’s own firm, turns out to be something that the majority of advisors just don’t want to do themselves with their own clients (in this case, have what are important but often very challenging conversations with clients about aging). Not that there’s any shame in trying, though, as nothing new is ever created without some attempts that don’t work out along the way; nonetheless, Whealthcare may also end out serving as an important reminder that just because technology can quickly add value in solving a new problem for advisors doesn’t mean advisors are ready to quickly change themselves and their own value proposition to incorporate it when they’re already comfortable with what they’re currently being compensated to do for their clients.

New Product Watch: Act Analytics Launches New ESG Analytics Platform To Facilitate Values-Based Portfolio Construction. While research on consumer preferences has shown a growing interest in socially responsible investing, it’s only in recent years that flows into various Environmental, Social, and Governance (ESG) funds have begun to accelerate, now up to $20B into ESG funds in 2019 (quadrupling from 2018). The relatively slow uptick appears to be driven in large part by the fact that ESG describes more of a philosophy of ‘values-based’ investing that emphasizes (or screens out) based on certain preferences… with the caveat that not all investors weigh those preferences the same, which means a perfectly acceptable ESG fund for one client that has a five-Globes rating from Morningstar still might not reflect the ESG preferences (and therefore not be acceptable) to the next. Which means when it comes to ESG investing, it’s not only a matter of being able to evaluate funds or ETFs based on third-party ESG scoring, but instead analyzing prospective holdings based on the advisor’s or client’s own relative weightings of the ESG factors most important to them. Accordingly, over the past year, a growing number of investment solutions are emerging that are built to allow advisors to do their own granular analysis of potential investments for various ESG factors, in order to construct either their own advisor-specific or more client-customized ESG portfolios. Yet in practice, there are still a variety of solutions to do so. On the one end are platforms like Ethic Investing, which facilitates advisors creating their own lens on sustainability and then helps advisors to actually implement the portfolio (by operating as a Separately Managed Account platform to execute the requisite trades). At the other end are new standalone ESG analytics platforms like this month’s newly launched Act Analytics, which pulls in data from Refinitiv and Lipper to allow advisors to do their own ESG analysis of stocks, mutual funds, and ETFs. Ultimately, though, it remains to be seen whether the advisor community shows a preference for “buy the analytics and implement it yourself” versus “platforms that support the analysis and help implement it”. As on the one hand, the potential for unique ESG preferences amongst each client, resulting in truly every portfolio being customized uniquely for every client, creates greater technology needs (e.g., Ethic Investing) to support it. On the other hand, given the challenges of scaling the client conversations when every client’s portfolio is customized differently (where it takes more time for the advisor to get up to speed on every unique portfolio before each portfolio review), advisors that wish to scale their ESG offerings to clients may still end out opting for research platforms like Act Analytics to create their own model ESG portfolios (and then convince clients why those ESG factors, in particular, were the most important). Either way, though, the fact that ESG portfolio design can reflect a far wider range of advisor and/or client preferences than a more standardized approach relying on Morningstar star or Analyst ratings (or even Morningstar’s Globe Ratings) means that some unique technology solutions to facilitate the rise of ESG investing seems inevitable in the coming years.

In the meantime, we’ve updated the latest version of our Financial Advisor FinTech Solutions Map with several new companies, including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation!

So what do you think? Should digital onboarding solutions be driven by third-party technology platforms, or do broker-dealers and RIA custodians need to step up themselves to fill the void? Is there still a need for greater third-party data gathering tools, even as onboarding becomes more digitized? Will advisors use more cash management solutions for clients in the coming years? What kind of technology would you want to facilitate ESG investing for individual client portfolios? Please share your thoughts in the comments below!

Disclosure: Michael Kitces is a co-founder of XY Planning Network, which was mentioned in this article.