Executive Summary

Welcome to the May 2018 issue of the Latest News in Financial Advisor #FinTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors and wealth management!

This month's edition kicks off with the big news that private equity firm Hellman & Friedman is purchasing Financial Engines for a whopping $3 billion in cash, and intends to pair what many call the “original robo-advisor” together with (also-Hellman-owned) Edelman Financial, in an effort to expand Financial Engines’ services to 401(k) plan participants to include human comprehensive financial planners. Which is notable both that major investors now see the upside of “robo” platforms as expanding them back into human advisors, and also because if it works it could dramatically alter the landscape for 401(k) rollovers by making those assets “advised” by a comprehensive financial planner before they ever become a rollover opportunity in the first place!

From there, the latest highlights also include a number of interesting advisor technology announcements, including:

- Personal Capital pairs up with Alight to distribute its PFM solution into the large firm employee channel as a means of getting financial advice prospects.

- Goldman Sachs buys the Clarity Money PFM solution as a way to cross-sell its Marcus bank products to nearly 1 million Clarity users.

- “Free” robo-advisor WiseBanyan raises $6.6M of venture capital to cross-sell more a-la-carte “premium” services to its existing 32,000 clients.

- Australian Salesforce CRM overlay PractiFI partners with Black Diamond to bring its “business management” advisor CRM solution to the U.S.

- Chalice Wealth Partners launches a new “technology network” that aims to charge advisors $249/month to integrate their technology (overlaid onto Chalice’s B/D-RIA platform).

Read the analysis about these announcements, and a discussion of more trends in advisor technology, in this month's column, including United Capital’s shift into providing a standalone FinLife Partners option (dubbed FinLife CX) for firms that want to continue using their existing CRM software, the launch of a “RoboWholesaler” that aims not to fully replace human wholesalers but make it easier for financial advisors to control the process by identifying the funds they’re interested in and then contacting the wholesalers they want to talk to, the rollout of a straight-thru insurance application process by Cetera that is integrated directly into MoneyGuidePro financial planning software, a look at whether the new ScratchWorks competition could be a new model for Advisor FinTech startups aiming to raise capital, and the opening of the application period for the third annual XYPN FinTech Competition for advisor fintech startups specifically aiming to support financial advisors serving next generation (i.e., Gen X and Gen Y) clientele.

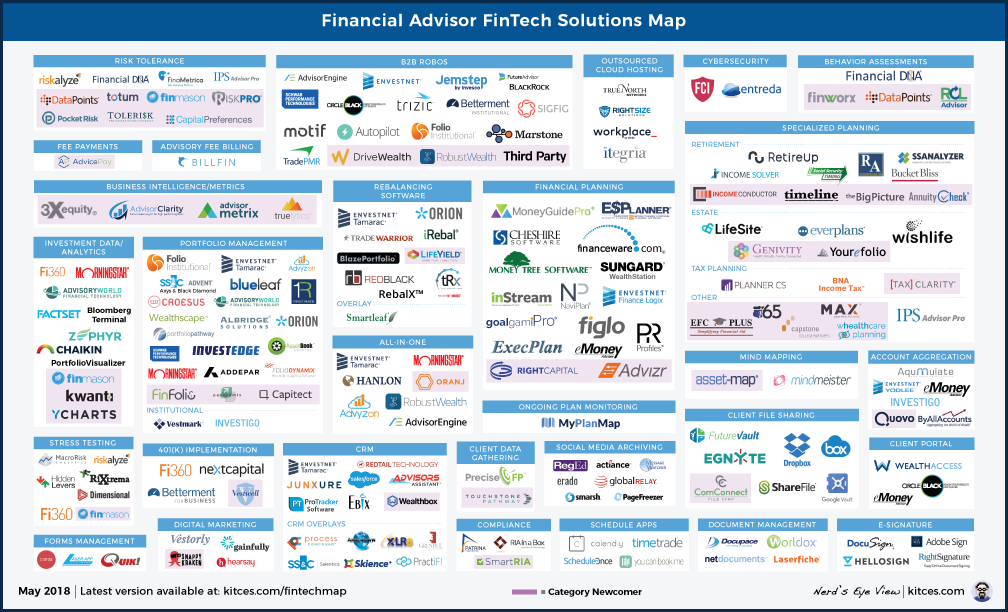

And be certain to read to the end, where we have provided an update to our popular new “Financial Advisor FinTech Solutions Map”, including a number of new companies and categories!

I hope you're continuing to find this new column on financial advisor technology to be helpful! Please share your comments at the end and let me know what you think!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

Private Equity Firm Acquires Financial Engines To Pivot From Robo To Human. The big news this past month was the announcement that private equity firm Hellman & Friedman was buying the “original robo-advisor” Financial Engines, and its whopping $169B of managed 401(k) accounts, for $3B in cash, and in the process would be merging in the (already-Hellman-majority-owned) $21B mega-RIA Edelman Financial into Financial Engines. The end result of the combined entity will be a managed 401(k) technology provider (Financial Engines) with a new human advice service offering (via Edelman Financial advisors) that can be delivered in person via any of Edelman’s branches nationwide, in what appears to be an extension of Financial Engines’ prior acquisition of the Mutual Fund Store and its 125 physical branch locations back in 2015. What’s unique about the deal with Edelman, though, is that his firm has a far deeper financial planning focus (at least relative to the Mutual Fund Store that was still more akin to retail brokerage than comprehensive financial advice), and has already successfully scaled a consistent financial planning process across its 100+ advisors. The deal also appears to be a good one for Edelman Financial itself, which will finally have a clear growth path ahead (the nearly 1,000,000 retirement plan participants that Financial Engines already serves!) that doesn’t have to rely on founder Ric Edelman’s books, radio show, and speaking engagements. From the broader industry perspective, the Financial Engines deal is significant because it signals the growing interest – including from “big money” private equity firms – in not focusing purely on “robo” advice, but instead layering in more human financial advice as well (as Betterment raised its fees with a new human advice offering last year, too). But perhaps the most lasting potential legacy of the deal is what happens if Financial Engines really can successfully “distribute” human financial planners into the 401(k) channel… as if real financial advisors are available directly to mass affluent (and higher net worth) 401(k) plan participants, then there may be a significant decline in the opportunity for independent advisors to get un-advised 401(k) rollovers in the future, as more and more prospective retirees will already be “advised” clients through their 401(k) plan long before they’re ever getting ready to retire (and rollover) in the first place! Stay tuned to see whether/how major 401(k) competitors like Fidelity and Empower choose to respond with a similar strategy (which Fidelity is arguably already well positioned with its 2015 eMoney Advisor acquisition and hundreds of CFP certificants in retail Fidelity branches nationwide!).

Personal Capital Expands Into Managed 401(k) Channel With WealthSpark Launch. Continuing the theme of financial advisors accessing the 401(k) channel, last month “cyborg” advisory firm Personal Capital announced a partnership with Alight Solutions (which provides employee benefits to more than 1,000 firms, including many in the Fortune 500) to provide its digital Personal Financial Management (PFM) tools to employees, along with a series of “customized” retirement portfolios (built in partnership with AllianceBernstein). The initiative, dubbed “WealthSpark” (but “powered by Personal Capital”), will be treated separate from Personal Capital itself though (and WealthSpark AUM will not be reported as part of Personal Capital’s AUM); instead, it appears that the move is not intended for Personal Capital to become a managed-401(k)-accounts provider (as that business is being handed to AllianceBernstein), but is simply about getting the Personal Capital PFM tools into the hands of those plan participants, in an effort to establish a relationship with them before they’re ready to retire. Which in point of fact is nothing more than an extension of Personal Capital’s current client acquisition strategy, which is all about getting its PFM software into the hands of consumers, identifying qualified prospects (based on the accounts they themselves aggregated into the portal), and then reaching out to them to offer financial advice. Accordingly, if Personal Capital can get the plan participants’ personal finances already tracked in their PFM tools, it’s similarly easy for the company to identify prospective clients who might work with Personal Capital after they do retire. Of course, Personal Capital may not be the only one to employ this strategy; at some point, it seems likely that Fidelity will also start offering its eMoney Advisor dashboard to its own 401(k) plan participants, and then will be similarly encouraging them to visit a CFP professional at a local Fidelity branch when they’re ready to retire and want more personalized financial advice. Which just further emphasizes the true monetization opportunity of PFM software that has been largely overlooked by the FinTech world thus far – not as a way to generate financial product leads (e.g., Mint.com), or to charge consumers a few dollars per month to track their finances, but instead as a means to start building a relationship with consumers by offering a valuable service that simultaneously allows financial advisory firms to pre-qualify prospects with whom they might expand into a deeper advice relationship.

Goldman Sachs Buys Clarity Money PFM For $100M To Cross-Sell Bank Products. Last month, Goldman Sachs closed on its acquisition of Clarity Money, a newcomer in the Personal Financial Management (PFM) space that in the span of barely two years had managed to grab nearly 1 million(!) users with tools that were built specifically to help people better manage their cash flow (including identifying and helping to cancel wasteful recurring subscriptions, tracking spending relative to budget, and assisting with savings goals). The massive $100M purchase (for a 2-year-old company that reportedly wasn’t even close to turning a profit yet) will tuck Clarity Money up under Goldman Sachs’ new retail consumer banking platform Marcus – an appealing opportunity for Goldman, which effectively bought a 1-million-user prospect list, plus a prospect-generating machine, at a price of “just” $100 per user, to which Marcus can cross-sell its various personal loans, high-yield savings accounts, and other banking products. From the Goldman Sachs perspective, the deal is an appealing opportunity to continue to build its consumer brand with a novel PFM platform, albeit while monetizing it in the rather “traditional” way of cross-selling bank products to expand wallet share. From the broader industry perspective, it’s yet another reminder that while it may “pay” to distribute products to consumers (in the case of Marcus, or cross-sell advice and managed accounts in the case of Personal Capital), that creating compelling PFM solutions with a great user experience is the hot new way to attract new clients in the first place.

“Free” Robo-Advisor WiseBanyan Raises $6.6M To Continue Growing Client Base. In the early days of the robo-advisor frenzy, early startups like Betterment, Wealthfront, and FutureAdvisor spawned numerous competitors anticipating that lower cost robo services would quickly gain market share from competitors, in an “inevitable” race to zero pricing. Accordingly, WiseBanyan launched in 2014 with the stated goal of being a truly “free” robo-advisor service, charging literally nothing as its base fee to provide a basic asset-allocated portfolio (comprised of low-cost ETFs with their own modest fee) and with no account minimums. Of course, eventually the company would have to charge for something, and in 2016 the company launches a paid tax-loss-harvesting solution, ultimately charging a 0.24%/year fee that is competitive with other robo-advisor fees for a similar service. Over time, the company has indicated an intention to continue to expand its range of “premium a la carte” services, while maintaining its free robo core, and the strategy has paid off to the tune of a solid 32,000 clients… albeit with “only” $153M of AUM (for an average account size of under $5,000/client). Which suggests either that WiseBanyan has attracted especially small consumers, or simply that a lot of consumers are just “testing” WiseBanyan with a modest initial dollar amount, for which the company may still be able to attract for more dollars by expanding its services. It appears that its investors are betting on the latter, though, as WiseBanyan has now raised another $6.6M of venture capital with the stated goal of continuing to grow its user base, while ostensibly trying to expand its suite of paid a la carte services to eventually become an economically viable business. At a minimum, though, the WiseBanyan tale is yet another example of the opportunities that lie in providing a valuable consumer service first and foremost, to attract users, recognizing that there are many ways in financial services to monetize a “good” user base in the future (not unlike Clarity Money’s own path with its sale to Goldman Sachs!).

Australian Salesforce CRM Overlay Provider PractiFI Expands Into U.S. With Black Diamond Integration. Salesforce has by far the largest CRM market share of any company, but when it comes to financial advisors in particular the adoption of Salesforce has been slower, and skewed primarily towards the mid-to-large-sized firms that can afford the consultants and developers that are necessary to adapt “out-of-the-box” Salesforce into something valuable for the advisory industry. Accordingly, in recent years, there have been a growing number of “Salesforce Overlay” providers, that aim to shortcut the time (and cost) for firms to get up and running quickly with Salesforce, starting with early players like XLR8 and continuing to Salesforce launching its own Financial Services Cloud solution. Now, a new Salesforce overlay competitor is entering the U.S. space, not as a start-up, but as an international expansion, as Australian-based PractiFI rolls out what it calls its “business management” Salesforce overlay to U.S. advisors via an integration to Black Diamond (which also recently re-tooled its own acquisition of Salentica Elements from a Microsoft Dynamics to a Salesforce overlay). The announcement is significant not only for the fact that there will be a new fresh provider (and competitor) in the Salesforce CRM overlay space, but also that it may mark the beginning of a new trend of advisor software solutions in other countries that have a smaller advisor base on other continents (e.g., Australia and the U.K.) using their success in their home country as a launchpad to expand into the ~10X-larger U.S. market (as opposed to companies that try to raise seed/venture capital and build from scratch in the U.S.). Of course, the caveat is that there’s a layer of “localization” that’s necessary to adapt Australian or U.K. financial advisor software to the U.S., but arguably when it comes to CRM and business management software in particular, the ability to overlay portfolio accounting software solutions (e.g., Black Diamond) will make the transition easier (as the software simply has to utilize and report on existing Black Diamond data, rather than fully standardize and convert the data itself). If PractiFI can gain any traction at all, expect to see more Australia and U.K. advisor software providers attempt to expand into the U.S. market in the coming years via similar partnerships to existing complementary software solutions that can help both facilitate the localization of the software, and ramp-up initial distribution to the financial advisor channels.

Chalice Wealth Partners Raises $4.6M Series A To Launch FinTech Network For Independent Advisors. For decades, the challenge of becoming an independent advisor was the lack of technology solutions and infrastructure support, in a world where it was only the largest of broker-dealers that could afford to (re-)invest into technology. Over the past 15 years, though, the rise of the internet and APIs suddenly made it possible for independent software providers to gain significant scale and create (relatively) efficient integrations, such that now the largest independent advisor software companies have far more users than even the largest proprietary software platforms of large broker-dealers. Except from the financial advisor’s perspective, the proliferation of choices has created a pain point of complexity in figuring out which software solutions to use, and whether/how each fits together with the other, necessitating the creation of FinTech Solutions Maps just to navigate the technology selection process! Yet the reality is that for any given financial advisor business model serving a particular target clientele, one particular set of software solutions usually rises to the top as a “best fit” for that particular model, which has led to the rise of the “Turnkey Advice and Planning Platform” (TAPP) that creates a particular suite of solutions for a particular type of advisor clientele, such as the Garrett Planning Network for hourly financial planners, or the XY Planning Network for advisors serving Gen X and Gen Y clientele, which provide a combination of technology tools and discounts to support their advisors. In this context, Chalice Wealth Partners has raised $4.6M of Series A funds to launch its own “FinTech Membership Network” with the stated goal of providing a unified suite of (third-party) technology, and the associated back office support, to help advisors who are going independent to run their own businesses. Functionally, the Chalice Network appears to be built on top of its own “RIA-friendly broker-dealer” Chalice Capital Partners, is aiming to monetize the valuable “technology solutions layer” by charging a flat membership fee of $249/month to use its technology suite (ostensibly in addition to any profits it can generate by owning the RIA and broker-dealer layers). To the extent that the Chalice Network is built on top of a hybrid broker-dealer and RIA platform, it’s not entirely clear if in the end, Chalice is all that different than any other broker-dealer that offers technology on top of its core B/D-RIA business model (and unlike the other TAPPs that are “pure” networks providing technology and back office but without requiring a proprietary B/D-RIA layer)… but at a minimum, it’s a notable shift in the positioning of a broker-dealer as being a “FinTech Network” first and foremost (and a hybrid B/D-RIA platform second), and with a $4.6M Series A, suggests it likely won’t be the last to try shifting the traditional broker-dealer/RIA model into a flat-fee-network approach instead.

United Capital’s FinLife Partners Expands FinLife CX To Additional CRM Partners. In order to achieve real economies of scale as a large independent advisory firm, it’s necessary to deeply systematize the firm’s processes into technology, which often entails the firm developing its own “proprietary” layer of technology; in point of fact, one of the reasons that Salesforce CRM, in particular, has been so popular amongst mid-to-large-sized rapidly-growing advisory firms is its ability to be customized to the individual needs of the firm. In the case of United Capital, the firm invested so much into its proprietary Salesforce CRM overlay on its path to the first ~$15B of AUM, that it decided in 2016 to “unbundle” its proprietary technology for its advisors from being a United Capital advisor directly with the launch of FinLife Partners – effectively allowing independent advisors to use the United Capital technology (as a “partner”) but without the firm itself actually selling to (and being acquired by) United Capital. The software is a combination of a financial-planning-oriented client portal (integrated to MoneyGuidePro and FinanceWare, with account aggregation powered by Yodlee and ByAllAccounts), advisor dashboard for business management, investment management tools, and CRM overlay to handle workflows and manage client relationships… but has found its adoption slowed by the fact that few advisors relish the idea of switching CRMs (as it was impossible to use the FinLife Partners’ Salesforce CRM overlay without actually switching to Salesforce). Accordingly, United Capital this month announced the release of “FinLife CX” (short for Client Experience), an alternative version of its FinLife Partners platform that can better integrate with an advisor’s existing Junxure, Redtail, or (non-FinLife Partners) Salesforce CRMs. Notably, the FinLife CX platform also has an alternative pricing model (relative to the core FinLife Partners platform that also charged firms a percentage of their growth and/or necessitated them outsourcing investment management to United Capital), and charges a flat annual fee of $600 per client (plus potential additional implementation and ongoing support fees based on the complexity of the advisory firm) while outsourcing investment management to United Capital as well remains optional (though United Capital likely hopes that FinLife CX users will still more fully adopt the rest of United Capital’s services over time).

RoboWholesaler Launches Catalogue Of Mutual Fund Fact Sheets Ranked By Performance. In recent years, financial advisors have increasingly struggled with a “crisis of differentiation”, as more and more shift away from product-based sales into client-centered advice (where it’s very difficult to differentiate one comprehensive financial planner from the next). And the shift from products to advice isn’t only impacting the competitive landscape for financial advisors themselves; it’s also impacting the world of mutual fund distribution and the role of the wholesaler, as less-product-centric advisors are also less interested in hearing the latest product pitches from wholesalers (as it’s no longer what advisors “sell”), and instead are adopting a “don’t call us, we’ll call you if we’re interested” attitude. The latest marker in this trend is the launch of “RoboWholesaler”, a new website that aggregates together mutual fund Fact Sheets for the top ten mutual funds (based on 1/3/5/10 year performance) in a wide range of various investment categories (from stock to bond to alternative funds, large to small and growth to value), so advisors can more easily look up the funds themselves to decide what they’re interested in learning more about. Notably, though, “RoboWholesaler” isn’t actually looking to totally replace the wholesaler; instead, its service actually does help to connect advisors with their local wholesalers… albeit not until the advisor has already identified the mutual fund he/she is interested in learning more about. Of course, financial advisors already typically buy even more robust mutual fund screening and analytics tools like Morningstar, which can help identify and rank funds on more robust criteria than “just” the top 1/3/5/10-year performance returns in each category. Yet if there’s one lesson learned from the “robo-advisor” movement in the first place, it’s that a subset of consumers (and perhaps, advisors) don’t want the complexity of traditional solutions, and find a simpler and more straightforward alternative appealing. And of course, Morningstar doesn’t connect advisors to their local wholesalers, while RoboWholesaler appears to be anticipating that advisors will want to eventually go deeper on their analysis (for which RoboWholesaler is just providing an initial round of screening). Which means once again, the future of “robo” isn’t really about technology tools fully replacing what human beings do, but simply to handle the simpler initial layer of tasks and information, allowing the end user to then move up the line to engage a human being if and when they need to, at the time they want to and are ready to.

Orion’s Parent Company Acquires FTJ FundChoice To Expand Competition For TAMP Business. Orion Advisor Services is a portfolio reporting system that has expanded over the years to include a broader suite of billing and trading tools, culminating in its recent rollout of the Eclipse rebalancing feature last year. However, Orion didn’t necessarily provide the depth of investment and back-office services that allowed it to facilitate investment managers that wanted to use Orion to run a TAMP (which instead necessitated a partnership between a TAMP support provider and Orion). Accordingly, Orion parent company Northstar announced this past month the acquisition of FTJ FundChoice, a $10B TAMP platform that will make it possible for Orion to better support investment managers that want to distribute their strategies as separately managed accounts with Orion’s now-all-in-one solution (competing more directly with the likes of Envestnet, AssetMark, and VestMark, who surprisingly didn’t buy FTJ FundChoice themselves). In addition, FTJ FundChoice’s proposal generation tools help to fill a gap in Orion’s offering. Ultimately, the synergistic goal is for Orion’s now-deeper capabilities to support TAMPs and separately managed accounts to facilitate broker-dealers and RIAs that are recruiting breakaways, as it means brokers who were previously using a TAMP at their former firm may potentially be able to continue using it with their new broker-dealer or RIA (facilitated by Orion’s new capabilities), which makes it easier for those firms to recruit and reduces the risk that client accounts don’t transfer and retain (by allowing clients to keep their existing managers and strategies). Not to mention the RIAs already using Orion that might want to distribute their strategies to other advisors, pushing out their strategies through Orion’s new Communities model marketplace and outsourcing the investment back-office implementation to FTJ FundChoice. All of which are positive trends for the new Orion Enterprise offering, especially as a growing number of financial advisors continue to look towards outsourcing their investment implementation.

Cetera Implements Straight-Thru Insurance Application Processing Directly Within MoneyGuidePro. One of the great ironies of financial planning software is that for decades, it has been used to illustrate and demonstrate the need for various insurance and investment products, but up until relatively recently, there was no way to actually implement a recommendation within the planning software. Instead, the planning software merely illustrated the need, and then the insurance agent or broker would implement the appropriate product using their usual product application process. This began to change 18 months ago, when MoneyGuidePro announced a partnership with Covr that would allow MGP users to immediately begin a life insurance application process from within MGP itself once the insurance recommendation was made. And now, broker-dealer Cetera has announced that the MGP/Covr integrated solution is actually being deployed, in its Cetera Financial Institutions channel (that serves banks and credit unions, where the depth of advice is more limited and is more conducive to transactional implementation), starting with life insurance, and anticipated to expand later this year to long-term care and disability insurance policies as well. On the one hand, this is arguably a substantial improvement in both the workflow experience for the advisor, and the application/implementation experience for the end client, in a world where technology itself is becoming a distribution channel for financial services products. On the other hand, as first the DoL fiduciary rule, then various state fiduciary rule proposals, and now the SEC’s advice rule, all apply a deeper level of scrutiny to the intersection between financial advice and product sales, arguably an uptick in financial planning software that directly facilitates product implementation will only exacerbate regulatory concerns about whether consumers clearly understand when the advice relationship is ending, and the product sales process begins.

Will ScratchWorks Success Set A New Model For Funding Advisor FinTech Startups? One of the biggest challenges in launching a technology startup is simply getting the funding to hire the team necessary to build the initial prototype of the software in the first place, and then actually be able to sell and market it to get initial customers/users… in a world where a huge number of these new businesses won’t actually succeed in the long run. The world of Venture Capital funding (and Angel Investors) exist to take these risks, recognizing that while many may fail, a few “big winners” can more than average out to strong overall investment returns. The caveat, though, is that the world of “financial advisor FinTech” in particular just isn’t large enough to make “big winners” by FinTech investor standards, where companies are often looking for the next big billion dollar company – or at least one that can be worth hundreds of millions of dollars – that provides a 30X return or more, while successful advisor tech startups are often worth no more than “just” a few tens of millions… in a space that has a lot of complexity and nuance (due to the dynamics of industry channels and long enterprise sales cycles) for which many investors just don’t have the domain expertise to judge which companies are likely to succeed (or not). In this context, it was notable that last fall, a series of advisor firm owners announced the launch of ScratchWorks, which would run a “Shark Tank style” advisor FinTech pitch competition at the Barron's Top Independent Advisor Summit, with the opportunity for the winning firms to receive a commitment of capital on the spot. The upside of the ScratchWorks model from the industry perspective is that, with advisors themselves as the primary funders, they will have the industry domain expertise to understand what really are good opportunities or not, and for the typical advisor – whose investment alternative is simply buying publicly traded stocks and bonds – a startup with “just” a 3X, 5X, or 10X return potential is still a great investment opportunity. And in fact, when the recent ScratchWorks competition ran, advisor marketing technology platform Snappy Kraken did successfully attract a round of capital from the ScratchWorks investors. Which raises the question of whether ScratchWorks itself will be back for another round in the future (hopefully!), and more generally of whether the best way to attract capital for more advisor FinTech startups is to facilitate more startup investment dollars directly from the advisory community itself?

Applications Open For Third Annual XYPN FinTech Competition. This month, applications opened for the third annual FinTech competition hosted by XY Planning Network at its XYPN LIVE national conference. Given the challenges of new advisor technology startups gaining visibility (to both attract capital, or simply to gather their first/initial advisor users), the XYPN FinTech Competition is intended specifically to support FinTech startups with greater visibility (in the form of both media coverage through the XYPNRadio podcast and Nerd’s Eye View blog, as well as a promotional video and feature of Bill Winterberg’s FPPad.com, and industry media coverage in partnership with advisory industry PR agency FiComm, and a free booth at the XYPN LIVE national conference in September). To be eligible, the technology firm must offer a solution relevant to financial advisors serving Gen X and Gen Y clientele, and is specifically intended for “start-ups”, defined as companies that either launched in the last 12 months, have less than $1 of revenue, or are an existing company launching an entirely new product offering (that is substantially different than what the parent company already offers). Prior winners include marketing technology platform Snappy Kraken (which raised its Series A round after its XYPN FinTech competition win in 2016), and retirement plan technology platform Vestwell (which also announced its Series A round shortly after its XYPN FinTech competition win in 2017). Applications are due by June 1st, with finalists announced on July 2nd, and the XYPN FinTech Competition itself will occur on Tuesday, September 25th at the XYPN LIVE conference in St Louis. Interested FinTech startups can apply directly here.

In the meantime, we’ve updated the latest version of our Financial Advisor FinTech Solutions Map with several new companies, including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation!

So what do you think? Will Financial Engines be able to successfully “upsell” comprehensive financial advice in the 401(k) channel? Will Personal Capital be able to convert 401(k) plan participants by handing out its PFM tools for free? Can Broker-Dealers differentiate themselves as “flat-fee technology networks” that throw in the broker-dealer services on the side? Will financial advisors adopt a “RoboWholesaler” solution that makes it easier for them to find the wholesalers they want (instead of trying to screen inbound calls and emails from the wholesalers they’re not interested in)? Please share your thoughts in the comments below!