Executive Summary

Welcome to the October 2018 issue of the Latest News in Financial Advisor #FinTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors and wealth management!

This month's edition kicks off with the big news that private equity firm Warburg Pincus is investing a whopping $33M into Facet Wealth, a new advisory firm upstart that aims not to build “robo” tools to compete with advisory firms, but a tech-savvy advisor platform to service “smaller” mass affluent clientele that they buy from existing advisory firms who may want to sell a portion of their book of clients to free up space (and/or to generate additional capital) to grow further upmarket. At least, if the clients will actually be willing to convert from an in-person advisor to one of Facet’s virtual CFP professionals, and from an industry-standard AUM fee to Facet’s complexity-based monthly retainer fee instead.

From there, the latest highlights also include a number of interesting advisor technology announcements, including:

- Zoe Financial raises a $2M seed round to create a new lead generation platform for (a subset of highly vetted) advisors to reach more affluent clients;

- SmartAsset reinvents the next generation of BrightScope’s controversial Advisor Pages as it aims to scale up interest in its SmartAdvisor lead generation service;

- Mineral Interactive wins the XYPN FinTech competition as one of three finalists all focused on making the holistic data-gathering and onboarding process for financial planners more efficient;

- ScratchWorks announces “Season 2” of its FinTech accelerator program replete with Shark-Tank-style pitch sessions to its founders (and funders).

Read the analysis about these announcements in this month's column and a discussion of more trends in advisor technology, including the launch of MoneyGuidePro’s new G5 platform (which goes even deeper into retirement income planning but conspicuously skips out on building its own PFM portal to compete with eMoney Advisor), Personal Capital’s launch of its own tax-savvy retirement income planning tool for its advisors and clients, the rise of student loan repayment planning software tools for advisors, and a look at whether Schwab’s recent launch of new Digital Account Opening tools may signal the beginning of the end of independent digital advice platforms as RIA custodians themselves finally upgrade their technology and expand to encompass more and more digital onboarding capabilities themselves.

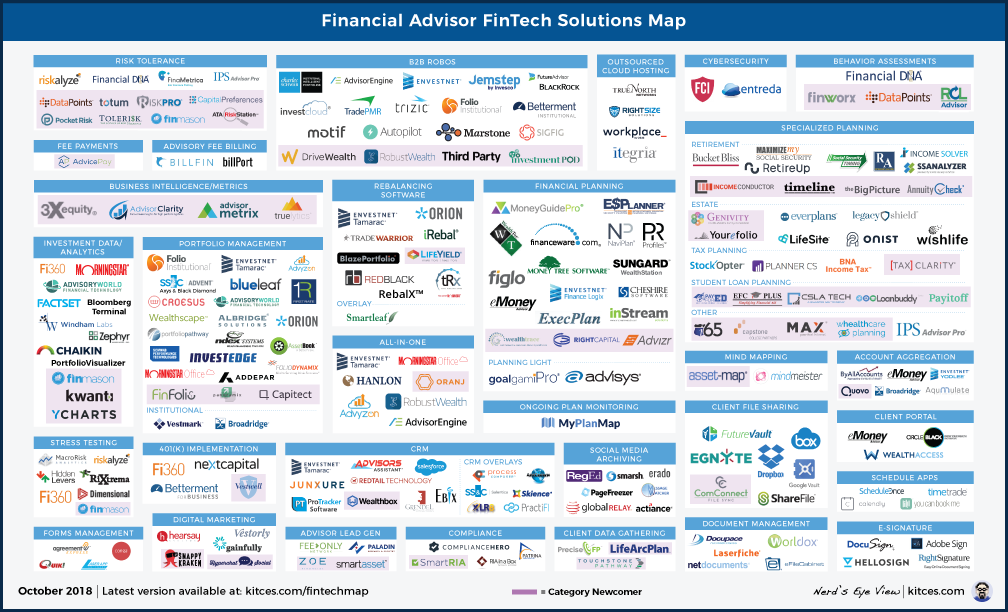

And be certain to read to the end, where we have provided an update to our popular new “Financial Advisor FinTech Solutions Map” as well!

I hope you're continuing to find this new column on financial advisor technology to be helpful! Please share your comments at the end and let me know what you think!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

Facet Wealth Lands $33M Series A Funding To Buy Advisory Firms’ Non-A-Level Clients. One of the most common pieces of practice management advice to capacity-constrained financial advisors is to fire (or at least “graduate”) your smallest clients out of your book every year in order to make room for more affluent clientele. After all, in a world where a financial advisor can just only handle “so many” clients before being completely overwhelmed, the only way for an advisory firm to keep growing once reaching that capacity threshold is either to hire more advisors (which many firm owners don’t want to do), or figure out how to free up capacity from the existing client base. The challenge, however, is that smaller clients are often also low maintenance, at least after the initial planning process has already been completed, which makes it hard to walk away from them. Not to mention that many advisory firms feel a certain reciprocal loyalty to their smallest clients, who were often their first clients that took a chance on and stuck with the firm in the first place. But the decision of whether or not to walk away from smaller clients takes on a new dimension when there’s an easy opportunity to sell that portion of the client base rather than to just walk away. Which is the business model bet being made by new upstart Facet Wealth, which this month raised a massive $33M Series A round to try to buy the smaller mass affluent (i.e., $100k to $1M of AUM) clients from existing advisory firms, to allow those advisors to free up personal capacity to move further upmarket (not to mention literally writing a check that gives the advisor more capital to invest into his/her firm to continue to grow). What’s unique about Facet, though, is not merely that its growth strategy is to engage in partial book purchases of the smaller clientele of existing advisory firms, but that they’re aiming to staff the solution with a base of “virtual” CFP certificants and develop their own financial planning software to support the model. In addition, the firm will not be charging AUM fees either, and instead is adopting a monthly-retainer-style business model, charging anywhere from $40/month ($480/year) to $417/month ($5,000/year) with the exact fee based on the complexity of the client’s situation – which makes sense both as a means to ensure the necessary revenue/client to maintain profitability when working with the mass affluent, but also because staffing the solution with human CFPs means time is the primary constraint to the service model (and thus why it makes sense to price the service with a time-based complexity fee). On the other hand, it’s not entirely clear how much opportunity Facet will find to acquire advisory firms’ “smaller” clients, given that most advisory firms are solos, and for most solo advisors the mass affluent aren’t their “small” clients but their primary clients instead. In addition, given that existing small clients often don’t take a lot of time to service after the hard upfront planning work is done, it’s not entirely clear how many advisory firms will be willing to sell what may be at the margin quite profitable clients for what is reportedly “just” a 1X revenue price that Facet Wealth is paying (or potentially less if clients don’t retain after a year). Nor is it clear how willing clients will be to transition, given that their sale from their original advisory firm means both switching from an in-person advisor to a virtual one (which may be fine for some clients, but isn’t what those particular clients first signed up for with their original advisor), and that clients will also be transitioning from an AUM to flat-fee payment model (which may be fine for the clients who will pay less than their original AUM fee, but a sticking point for those who will pay more). In fact, the model of buying existing advisory firms’ “smaller” clients has been tried before, most recently by Marty Bicknell’s FirstPoint solution several years ago, which was ultimately folded (ostensibly due to a failure to gain traction). Nonetheless, given the sheer frenzy of eye-popping venture capital investments into robo-advisors in recent years, it’s highly notable that a major private equity firm is making a major $33M investment not into another robo-advisor or pure technology play, but a tech-augmented human advisory firm instead, as private equity firms now eye more opportunities for the potential to get a Focus-Financial-style IPO exit from a highly scaled human advisory firm.

Zoe Financial Raises $2M Seed For “eHarmony For Advisors & Affluent Clients” Lead-Gen Platform. The biggest challenges for most financial advisors who launch their own firms is not the startup costs to get the firm off the ground, or figuring out the systems and processes to serve clients, but simply finding the clients in the first place (and convincing them to work with the firm and hire the advisor), as only a small subset of the (mostly) largest independent advisory firms have managed to systematize and scale their firm’s marketing and business development efforts. The ideal for many advisors would be to simply “outsource” the firm’s marketing efforts and lead generation… but firms that are actually successful at scaling lead generation (outside of non-profit membership associations) tend to find it more lucrative to simply be the advisory firm instead (and generate the more compelling profits for serving those clients, rather than just being paid to generate them as well). In this context, it is notable that Zoe Financial announced this month a $2M seed round to develop a new “eHarmony”-style advisor lead generation “matchmaking” system specifically targeting affluent clients in search of a financial advisor who can handle their potentially-more-complex situations. From the client perspective, Zoe states that it will rigorously vet advisors, including only “pure” fee-only RIAs (and not hybrid RIAs), with advisors who have advanced credentials (i.e., CFP, CFA, or a CPA license), and firms that must also have clean regulatory records and low client-to-advisor ratios. For advisors, Zoe brings in the client prospects, tries to match them to the “right” advisor based on the advisor’s background/expertise and the client’s needs, and facilitates the initial scheduling for an introductory meeting. And notably, unlike recent competing advisor lead generation services like SmartAsset’s SmartAdvisor, Zoe will not charge advisors for upfront leads, and instead will participate on the back end (receiving either a flat fee for 5 years for clients that hire the firm on a retainer basis, or a small slice of the AUM fee for advisors who are hired on an AUM basis). The good news of such arrangements is that Zoe “puts its money where its mouth is,” in that the firm won’t be paid at all if they cannot generate high-quality leads for advisors that actually close. On the other hand, in the long run, advisory firms would most likely be far more profitable by not paying indefinite revenue-sharing trails for one-time upfront marketing… although in practice, for advisory firms that don’t have the financial capital to spend on marketing, revenue-sharing with Zoe’s client leads may still be better than not getting any at all!

SmartAsset Reinvents BrightScope’s Advisor Pages 2.0 As New Matchmaking Directory. Back in 2011, FinTech startup, BrightScope, launched a service called “Advisor Pages,” which aimed to cull the disparate public information on financial advisors (e.g., from FINRA’s BrokerCheck, the SEC’s IAPD, and other regulatory filings and public data) into a single resource that consumers could reference to get all the information they needed (or at least, far more information than they can otherwise easily obtain) to choose an advisor. The hope was that by consolidating the relevant information to improve transparency for consumers – beyond the fractured resources available today – that BrightScope could help clean up the industry by making it easier for consumers to actually spot (and then avoid) advisors with problematic regulatory records. However, in practice, BrightScope struggled in the early years to collect and refine the available data in an effective manner and was then criticized for charging advisors to correct their own data, leading the firm to ultimately make AdvisorPages free… and never managing to fully monetize the opportunity before being sold to Strategic Insight last year (primarily for their 401(k) data business and not AdvisorPages). But now, SmartAsset, which earlier this year announced an advisor lead generation service called SmartAdvisor and then raised $28M of capital from Focus Financial, has announced a version of “Advisor Pages 2.0,” which, similar to BrightScope, will pull together public information from BrokerCheck, IAPD, LinkedIn, and more and provide consumers profiles of those advisors. The firm announced that it has already launched its first 10,000 profiles, with another 50,000 coming online shortly, and aiming for 100,000 by the end of the year, and eventually listing all 300,000+ financial advisors in the US. At this point, SmartAsset has announced that any advisor will be able to update their information (and won’t charge for advisors to take control of their pages as BrightScope did early on), and the pages will be free to consumers to view and access as well, with the company ostensibly hoping to monetize their offering by generating leads directly from its Advisor Pages and then selling them through its SmartAdvisor service. Though the question remains: will SmartAsset be able to capture the information and present it in ways that are meaningful for consumers and avoid accidentally misrepresenting individual advisors given the often spotty information that may be available in public regulatory records?

Shark-Tank-For-FinTech Platform ScratchWorks Announces 2nd “Season” For FinTech Applicants. While in recent years there has been a growing volume of new startups in the world of Advisor FinTech, the reality is that very little new investment dollars have been flowing to fund advisor technology. In large part this is simply due to the fact that even a “large” company by advisor tech standards is still “small” for most venture capital investors (who want to find companies that may someday be worth a billion dollars or more, not “just” tens of millions as a successful advisor fintech startup). And even for companies that have access to funding, it still takes intimate knowledge of the highly fractured financial advisor landscape to identify the potential business opportunities available amongst the various industry channels. As a result, most advisor technology startups over the years have been “homegrown” solutions – typically software that an advisor literally made for his/her own firm, and only subsequently began to sell to other advisors and form a standalone software company (from Junxure to Redtail, Orion and Tamarac, iRebal and TradeWarrior and Red/Black, as well as RiskPro and Tolerisk). In this context, it was notable when last year, a group of mega-RIA owners banded together to form “ScratchWorks,” a FinTech accelerator platform where the RIA owners involved would invest their own money – “Shark Tank-style” – into the winning companies that pitched their solutions as a part of the recent Barron's conference. And after its success in funding next-generation-digital-advice platform InvestmentPOD, ScratchWorks has announced its new “Season 2,” and is now accepting applications on the ScratchWorks website for consideration in the second pitch session that will once again occur in conjunction with the Barron's Top Independent Advisor Summit (scheduled for March 20-22 in Salt Lake City, Utah), with an opportunity to get funding directly from the cohort of RIA owners (who collectively manage more than $60B of AUM), and at worst, substantial visibility with all the advisory firms at the Barron's Advisor Summit. Though, with ScratchWorks ultimately choosing to fund InvestmentPOD in an already-very-crowded category of robo-advisor-for-advisors, the real question is whether ScratchWorks Season 2 will feature a wider range of actually new and innovative advisor software categories and tools?

Mineral Interactive’s “Approach” Wins Data-Gathering-Centric XYPN FinTech Competition. The rise of the “robo-advisor” movement, with their sleek account opening processes, have driven a growing awareness of the importance of improving the onboarding experience for clients, and spawned an entire subcategory of “robo-advisor-for-advisors” tools like Jemstep, AdvisorEngine, and Marstone to help with the process. However, the reality is that today’s “robo” tools are really only built to help with the investment account opening onboarding process, and not the rest of what it takes to gather more data for a comprehensive financial plan and then onboard clients into that holistic relationship, for which the only option in recent years was PreciseFP. But at the recent XYPN LIVE FinTech competition, a whopping 50% of the finalists were tools that in some way assist with the holistic data gathering and onboarding experience of an entire financial planning relationship, including Touchstone Pathway, Baxter Insights, and “Approach” from Mineral Interactive (which itself was just recently acquired by the Carson Group), along with competitor LifeArcPlan (which submitted for the competition but was not chosen as a finalist). And ultimately, Mineral’s “Approach” solution, which facilitates both an advisor’s customized onboarding experience for clients (leveraging integrations to third-party tools, from financial planning software to Riskalyze), and additional tools for digital marketing and customized/targeted prospecting with website visitors, was crowned the winner of the XYPN FinTech competition. Which is notable both for the sheer success of Mineral itself – and a nod to Carson’s well-timed purchase of Mineral, which will remain available under the Carson Group umbrella to any advisors who want to purchase it – and signals that tools for more holistic and customized client onboarding experiences, especially with respect to the needs for data gathering and onboarding beyond the mere process of opening and transferring investment accounts, or onboarding a client into just one provider’s software tools (rather than gathering integrated data across the advisor tech stack) remains a major gap (or at least, a major growth opportunity) in the advisor FinTech landscape.

Loan Buddy, Pay For ED, and PayItOff Debut Student Loan Repayment Tools. As the total volume of outstanding student loan debt crosses $1.5 trillion (far more than either credit cards or automobile loans!), there is a growing demand for advice and assistance with student loan planning… including and especially those who are starting their careers in various professional services careers (e.g., doctors, lawyers), who may quickly gain access to a 6-figure income upon entering the professional workforce, but carry with them 6-figure student loan debt. The problem, however, is that there are few software solutions available to financial advisors to help analyze student loan debt payoff strategies, as historically advisors focused more on the accumulation side of college planning (tying to our historical ability to be compensated for selling 529 college savings plans). In fact, it was only last month that RightCapital became the first financial planning software to offer a basic student loan planning module. However, at the recent XYPN LIVE national conference, with a base of advisors specifically focused on serving Gen X and Gen Y consumers (where such student loan issues are common), three different companies announced new student loan repayment tools for financial advisors. The first, PayItOff, was a finalist in the 2018 XYPN LIVE FinTech competition, having originally launched as a direct-to-consumer solution, but recently pivoted to become an advisor tool, and debuted its advisor platform (and a new scenario-planning solution to project the student loan impact of future raises, marriage, and children) at the conference. The second, Pay For ED, had originally premiered as “EFC Plus” to do financial aid planning at the time of applying for college (which itself was a finalist in the 2016 XYPN LIVE FinTech Competition), and now debuted a new post-college “Student Loan Repayer” tool for advisors at the conference. And the third, Loan Buddy, was also a former finalist in the 2017 XYPN FinTech competition (with a solution aimed at expediting the data collection process for student loans), but has now debuted a full student loan repayment tool for advisors, along with an entire platform to help advisors manage client student loans… focused not necessarily on building an advisors “assets under advisement,” but instead aiding in (and actually tracking on its advisor dashboard) the advisor’s “Student Loan Debt Under Advisement” instead!

SaleMove Debuts Next Generation Of Virtual Client Collaboration At Orion Fuse 2018. The ever-expanding access to faster and faster internet speeds over the past decade has turned the internet from what was once “just” a place to go and look up information into a rich medium of videos and streaming services, and in the process transformed internet-based community from emails and text messages into video chats and screen sharing services. As a result, a rising number of financial advisors are engaging with their clients using various video conference tools as an alternative to traditional face-to-face meetings (either for distance-based clients who can’t meet in person, or even the ones who could but simply don’t want to sit in traffic to go to their advisors’ offices). The caveat, however, is that video conferencing tools still require a certain level of set-up, “scheduling” a video call and circulating the necessary log-in link for clients to use, which makes it less helpful for quick and spontaneous client meetings, or situations where operations and other staff members need to work with a client through a problem (e.g., a question about a report in the client vault). In industries outside of financial services, the solution to this has been a rise in “co-browsing” services that make it possible for someone in tech support to directly “co-browse” with the end user, sharing their browser screen directly and being able engage in a text or video chat system alongside. And this easier-to-use version of screen-sharing and video chat tools helps to explain why SaleMove – a provider of such co-browsing and chat solutions in a wide range of industries – was able to win “Best In Show” at the recent Orion Fuse tech integration competition. Of course, the appeal of the SaleMove integration at Orion – making it possible to immediately open a connection to the client who is already authenticated via the Orion portal without creating a separate login requirement for chat – is really only appealing for advisors already using Orion, and may not necessarily fit a broader range of client meetings (that may cover a wider range of financial planning issues and don’t necessarily start with logging into Orion). Nonetheless, SaleMove itself has a wider range of uses than “just” its Orion integration, and for Orion users, it may still be more than enough to allow for quicker and easier client connections on a host of Orion-website-related client questions (especially for operations/administrative staff). More generally, though, the popularity of SaleMove at the Orion Fuse event – which also won the People’s Choice award as well – suggests that perhaps the next generation of advisor video conferencing tools isn’t about new fancy new features and capabilities, but simply making it easier to do the screen sharing and video chats that are already at the core of such tools.

Apex Clearing Announces Cryptocurrency Custody For Advisors But Will Any Advisors Care? While the rise of Bitcoin and other cryptocurrencies has created a media frenzy, which in turn has spawned the growth of a number of cryptocurrency trading platforms and even nudged more “traditional” next-generation investment platforms like Robinhood to offer cryptocurrency trading, the uptake of cryptocurrency in the financial advisor community has been decidedly quiet. In fact, the recent FPA Trends in Investing survey found that only 1% of financial advisors are currently using/recommending cryptocurrencies to clients, with only 2% of advisors stating that they intend to start doing so in the coming year. Notwithstanding this "headwind" to crypto investing in the advisor community, though, upstart RIA custodian Apex Clearing announced this month that it would soon be launching “Apex Crypto,” which would allow RIAs to open cryptocurrency accounts for clients alongside their “traditional” brokerage accounts to buy and trade various cryptocurrencies like Bitcoin, Bitcoin cash, Litecoin, and Ethereum. However, it’s not clear that Apex will necessarily win (m)any advisors with its new offering, given that so few advisors are using Bitcoin or other cryptocurrencies in client portfolios at all, and it’s doubtful that (m)any RIAs would switch to Apex with the bulk of their client portfolios just to invest what would still likely be only a small diversified slice of a client portfolio into cryptocurrencies (for firms that are willing to invest anything at all in the space). Instead, it seems more likely that advisors will simply hold out for the potential rollout of a Bitcoin ETF (that could be purchased on any traditional RIA custodial platform if the SEC ever approves one), or encourage clients to invest in the underlying cryptocurrency technology via various blockchain ETFs that are already available today. Of course, Apex also serves as the custody and clearing platform for a number of direct-to-consumer “robo-advisor” platforms that may find cryptocurrencies more compelling to offer (because the firms wouldn’t be selling/recommending/advising on cryptocurrencies, and would just be making them available for customers to buy directly). But at this point, it seems doubtful that Apex’s Crypto offering will help the company gain much of any traction in the more traditional advisor community (where non-traditional cryptocurrency-recommendations-gone-bad can have more challenging legal consequences for advisors themselves).

Is Salesforce Financial Services Cloud Growing Away From The RIA/IBD Community? In the early days of computers, “CRM software” was little more than an electronic version of a rolodex, holding the contact details of clients, prospects, and perhaps the company’s service providers and other key contacts, with some room to add notes to detail any recent communication with the individual. However, the transition of the advisory industry from commissions to AUM fees, and the scalability that comes from a recurring revenue model, has allowed advisory firms to grow much larger… which also makes them more complex, and more in need of process and workflow management tools. And for the largest enterprises, the key is not just being able to manage workflows and processes but to glean key business intelligence insights from that information – a capabilities requirement that goes far beyond what most advisor CRM solutions provide today (which at best are still just coming up to speed on workflow management). In this context, it is perhaps no surprise that Salesforce has been able to gain as much market share as it has, especially amongst larger advisory firms, despite not being built specifically for the financial services industry, simply because the platform is flexible and customizable enough to be adapted to the needs of large and scaling advisory firms. Except unfortunately, most advisory firms don’t have the financial and staff resources to customize Salesforce for their needs, which in turn had led to third-party middleware providers like XLR8 and AppCrown to help make Salesforce more usable “out of the box,” and eventually led Salesforce itself to launch its own “Financial Services Cloud.” The appeal of the Salesforce FSC solution was that it turned an otherwise-too-bare-bones CRM into a solution that was more immediately viable for advisory firms, pre-packaged with the most common fields and workflows and integrations that advisors use, with relatively little need (and cost) for customization (albeit still at a much higher cost than standalone advisor CRMs like Wealthbox or Redtail or Junxure). Except now, it appears that Salesforce’s Financial Services Cloud for wealth managers may have become “too” popular, as Salesforce announced it is expanding FSC to work more effectively across the advice, insurance, and banking channels of the largest of multi-channel financial services firms. The “good” news of this shift is that it helps to affirm for Salesforce the demand for a more integrated client-centric CRM platform that spans an entire financial services firm – which is key for end-to-end management of the client relationship – and further affirms the ongoing shift of large financial services firms into the wealth management/advice channel. The bad news, though, is that the needs and demands of mega financial services firms with banking, insurance, and advice channels are quite different than the needs of “just” the smaller independent RIA or independent broker-dealer. Which raises the question of whether Salesforce FSC has been so successful in the independent channels, that it may now be outgrowing (and no longer iterating as much) in the independent channel… and perhaps re-opening the door for more independent middleware providers to reassert themselves in serving the independent advisor community on the Salesforce platform?

MoneyGuidePro Announces New G5 Release And Doubles Down On (Only) Interactive Planning With Retirees. In surveys of advisor software adoption, MoneyGuidePro has long reigned as the #1 most popular financial planning software with advisors, still maintaining a lead over the growing market share of eMoney Advisor, and far ahead of any other financial planning software solutions. The caveat, however, is that other financial planning software solutions do appear to be gaining momentum, most notably eMoney Advisor, which retails for nearly 3X the price of MoneyGuidePro and is still winning away business from MGP, primarily on the basis of one key difference: eMoney Advisor has its own fully integrated Personal Financial Management (PFM) portal for clients, in addition to similar financial planning projection tools. Yet despite eMoney Advisor’s success at winning financial advisor users at MGP’s expense (at 3X the price), it is notable that MoneyGuidePro’s latest G5 (major version update) release did not include the development and rollout of a new client portal. Instead, MGP doubled down on its core competencies – supporting an interactive financial planning process with clients, especially retirees, with new modules on planning for health care expenses in retirement, illustrating cash reserve bucket strategies, and announced more capabilities to integrate annuities and other retirement income planning strategies into its projections. Notably, in a world where “retirement planning” software was historically focused primarily on accumulating for retirement, and not for illustrating actual liquidation strategies in retirement, the rollout of more sophisticated retirement income planning tools in MGP is rising to meet a recognized need in the marketplace. Nonetheless, as consumer adoption of various account aggregation tools continues to rise, and eMoney Advisor continues to gain market share on the back of its bundled planning-software-and-PFM-portal-solution, the question arises: how long can MoneyGuidePro continue to build software that “only” helps advisors the 2-3 days per year that a client is in the advisor’s office, while eMoney Advisor builds software that also helps advisors with their client relationships the other 363 days of the year?

Personal Capital Delves Deeper Into (Tax-Efficient) Retirement Liquidation Strategies. From their very early days, one of the leading features of “robo-advisors” was their ability to automate the process of tax loss harvesting, making the solution about more than just investment returns but also a layer of “tax alpha” on top. Yet the reality is that the real opportunities in generating tax alpha for a portfolio aren’t about tax loss harvesting, which actually has a relatively limited value, but the broader range of tax planning strategies that arise when a portfolio must actually be liquidated for/in retirement. In part, this is simply because upon retirement, it’s necessary to actually figure out which accounts to liquidate and when, in a world where retirees typically have to choose between taxable (i.e., brokerage), tax-deferred (i.e., IRAs and 401(k) plans), and tax-free (i.e., Roth-style) accounts. In addition, the valley of lower income that often occurs after retirement, and before the onset of RMDs, affords additional tax planning opportunities, from systematic partial Roth conversions, to capital gains harvesting (instead of capital loss harvesting in the earlier years). And illustrating such strategies can be complex – so much so, in fact, that few financial planning software solutions today even for advisors are effective at illustrating account sequencing, partial Roth conversion, and other “tax alpha” strategies. In this context, it is notable that Personal Capital announced this month a new “Retirement Paychecks” software solution, for both the firm’s clients and the advisors who work with them, specifically to illustrate such tax alpha strategies. Which is notable not just because a “digital advice” platform is creating new retirement planning solutions – as while digital advisory firms are often framed as being for Millennials, Personal Capital’s private client group is predominantly comprised of clients in their 50s with more than $1M of AUM who are approaching retirement – but also because it represents another situation where next-generation tech-centric firms creating client- and advice-centric software are outdoing the still-too-product-centric traditional financial planning software providers at their own game, especially when it comes to high-value (and hard-dollar-financial-savings) advice areas like tax planning.

Does Schwab Digital Account Opening Signal The Beginning Of The End Of Digital Advice Platforms? While direct-to-consumer robo-advisors have failed to “disrupt” the traditional financial advisor over the past 6 years, their arrival was nonetheless a wake-up call to traditional financial services firms about how far behind their technology had lagged, in a world where many RIA custodians and broker-dealers still required faxed paperwork that had to be manually processed at a time that Betterment was capable of opening and funding an investment account digitally from a smartphone in less than 30 minutes. As a result, the struggles of finding adoption in a B2C channel simply led many robo-advisors – from JemStep to FutureAdvisor to AdvisorEngine – to pivot and become B2B (or B2B2C) “digital advice” providers for advisors instead, helping to convert what was often still a very manual and paper-based account opening process of traditional incumbents into a more digitally-tech-savvy experience (for advisors and their clients). Except the fundamental challenge to being such “technology intermediaries” between a next-generation client experience and a legacy-generation incumbent is that, eventually, the incumbents can and would upgrade their own technology, if only to allow for better straight-through processing of key business processes… and eventually replace the digital advice provider overlays that were built on top of them. And now, that transition appears to be underway, as this month Schwab announced at the Orion Ascent conference the rollout of its new Digital Account Opening tools, which will integrate directly with both Orion and (separately announced) with Tamarac as well by pulling client information directly from those tools to pre-populate data and then review/edit/submit account applications directly. Perhaps not surprisingly, the Schwab tool itself was developed as a part of its robo-advisor-for-advisors Institutional Intelligent Portfolios platform, in what started out as a ‘niche’ robo solution but is now becoming the core of Schwab’s main platform as well. And TD Ameritrade indicated that it is working on similar digital account opening integrations to Tamarac… while Fidelity ostensibly has also learned much (and developed a great deal of the technology) from its own Fidelity Go “robo” solution as well. The good news of this for financial advisors is that digital account opening should continue to get easier and easier in the coming years, and without necessarily needing to buy a separate “robo” digital advice solution to make it happen. The bad news, though, is that it suddenly becomes less clear what the future will be for many of today’s digital advice platforms, that are quickly discovering that the lack of any “moat” to defend their B2C businesses from incumbents – which forced them to pivot to become B2B providers instead – may not fare any better as a moat in defending their B2B businesses from incumbents, either.

In the meantime, we’ve updated the latest version of our Financial Advisor FinTech Solutions Map with several new companies, including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation!

So what do you think? Will Schwab lose business by walking away from their multi-custodial PortfolioConnect solution, or win business by offering otherwise-expensive portfolio accounting software for free? Does the ability to get direct annuity data feeds increase your interest in using an annuity in a fee-based world? Would you have your retired clients set up a debit card to do their spending directly from their retirement accounts if it meant being able to stay fully invested without any cash drag? Please share your thoughts in the comments below!

Disclosure: Michael Kitces is a co-founder of XY Planning Network, which was mentioned in this article.

Leave a Reply