Executive Summary

Welcome to the September 2019 issue of the Latest News in Financial Advisor #FinTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors and wealth management!

This month's edition kicks off with the news that Wealthfront is acquiring financial planning monthly subscription startup Grove… but as part of the deal, is selling off all of Grove’s clients to Facet Wealth, leaving the industry wondering whether Wealthfront is about to pivot into the monthly subscription model to mimic their competitor Schwab Intelligent Portfolios, wanted Grove’s financial planning technology to expand Wealthfront’s own Path financial planning software, or simply wanted to “acquihire” the Grove technology and product talent to advance Wealthfront’s own mission. And raising concerns about why Grove, which just last year raised an $8M Series A round to begin to scale its monthly subscription fee financial planning solution, decided to walk away barely a year later.

From there, the latest highlights also include a number of other interesting advisor technology announcements, including:

- United Income’s virtual-CFP-for-Baby-Boomer-retirees model gets acquired by Capital One as digital advice expands beyond just serving Millennials

- Snappy Kraken raises a $2.5M seed round to begin ramping up its marketing technology built to both generate leads for advisors and convert them

- Aivante launches a new health care cost calculator for prospective retirees that helps to project out health care costs based on a client’s health and geographic location

- ScratchWorks announces the open of its third season of Shark-Tank-meets-FinTech-Accelerator for advisor technology

Read the analysis about these announcements in this month's column, and a discussion of more trends in advisor technology, including Ladenburg acquiring the NewDay impact investing robo-advisor to create more customized ESG portfolios for advisors instead, BrightPlan launches adds an artificial intelligence “financial coach” to its digital wellness platform as a way to upsell complex clients to its affiliated PlanCorp RIA, PreciseFP launches new data-gathering forms specifically to facilitate TD Ameritrade client onboarding with reduced NIGOs, both Envestnet and MoneyGuidePro launch expanded life insurance modules as interest grows from insurers in using financial planning software to facilitate life insurance sales, and Ric Edelman suggests that part of the challenge of advisor adoption of cryptocurrency may be a PR/perception problem and accordingly rebrands his Advisor Blockchain and Cryptocurrency Council into an “RIA Digital Assets Council” instead.

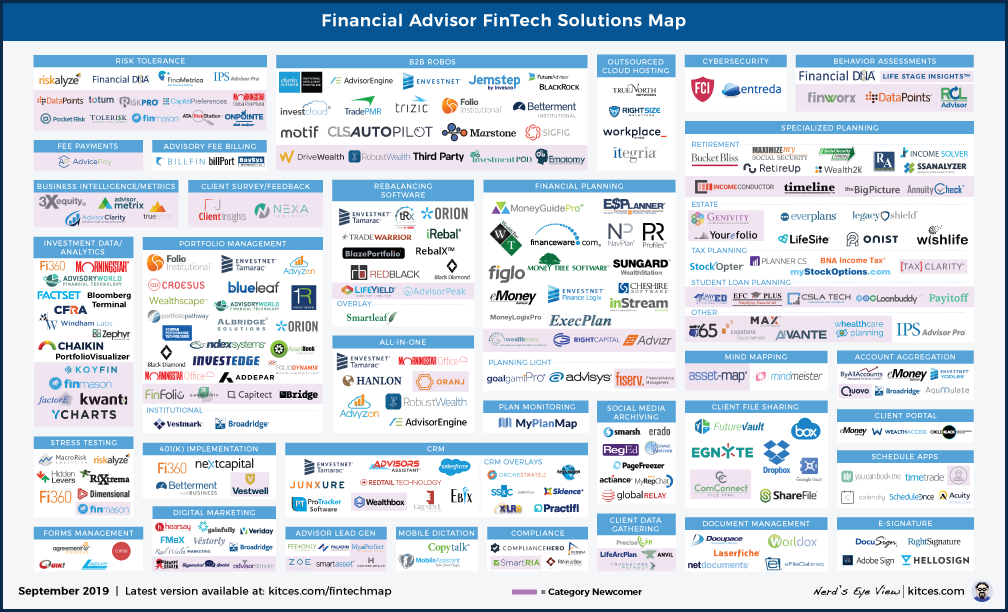

And be certain to read to the end, where we have provided an update to our popular new “Financial Advisor FinTech Solutions Map” as well!

I hope you're continuing to find this new column on financial advisor technology to be helpful! Please share your comments at the end and let me know what you think!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

Wealthfront Acquires Financial Planning Monthly Subscription Startup Grove Tech And Talent… But Not Clients? Last summer, a new “hybrid” financial planning startup named Grove announced an $8M Series A round to begin scaling up its platform that would offer virtual access to a human CFP professional for financial planning, plus supporting Grove financial planning technology, for a monthly subscription fee of $75. Co-founded by Chris Hutchins, formerly of mobile app incubator Milk (acquired by Google in 2012) and an Entrepreneur-In-Residence at Google Ventures, Grove had a vision of building a subscription financial planning solution at "Google levels" of national scale. But now, just a year later, the news came that digital-only-no-human-advisors robo-advisor Wealthfront was acquiring Grove… and in the process, selling off its existing roughly-500 clients to another virtual-CFP-professional startup Facet Wealth. The acquisition immediately raising the question of whether Wealthfront was about to pivot into the monthly subscription model (as Charles Schwab did with its robo solution earlier this year), and wonder about whether Grove’s proprietary financial planning technology tools might soon be incorporated into Wealthfront’s own Path financial planning solution. However, the rumor is that Wealthfront’s acquisition of Grove may have been an “acquihire” to bring Hutchins and his team under the Wealthfront umbrella simply to build Wealthfront’s technology (and not extend Grove’s model), which helps to explain why Wealthfront acquired Grove but not its clients (in addition to the fact that Grove sold access to a human CFP professional as a key tenet of its service, while Wealthfront unequivocally does not provide the same service, which suggests that Grove clients may not have transitioned smoothly to Wealthfront anyway). Nonetheless, even if Wealthfront acquired Grove for its talent and/or tech, and not its clients and business model, it still raises the question of why Grove would choose to sell and exit so soon after its Series A round, when it clearly would have still had money left in the bank, and was ostensibly gaining at least some traction with 500 clients already on board. On the other hand, when LearnVest engaged in a similar monthly subscription fee model – and at an even lower and more affordable price point – and still struggled to gain clients at scale before being sold to Northwestern Mutual for their tech and talent, it may be that the reality is simply that Grove couldn’t see a path to achieve the level of scale it wanted, as yet another startup discovers that the real blocking point to expanding the reach of financial planning to the masses isn’t necessarily the technology and cost to deliver the service, but the “hidden” cost of client acquisition to reach them at scale.

Virtual Advice Accelerates Past Millennials As Capital One Acquires United Income’s Retiree-Centric Digital Advice Platform. When robo-advisors first launched in the early 2010s, the industry’s mantra was that Baby Boomers who have the bulk of the investment wealth will never use an online digital platform and prefer in-person meetings with human advisors, such that robo-advisors would be relegated to only working with “digitally native” Millennials and wait for them to grow (or inherit) assets. However, the reality is that the conveniences of the digital world go beyond just Millennials, and there’s a subset of consumers across all age brackets who are comfortable with, or even prefer, to interact with human advisors through the internet. Which in turn has led to the rapid growth of tech-augmented-human advisory firms like Personal Capital with a growing number of baby boomers coming on board – to the point that the firm even launched a “Tax-Efficient Retirement Paycheck” solution for their (virtual) retiree clients. Accordingly, it was not entirely surprising that in 2016, former HelloWallet founder Matthew Fellowes launched “United Income”, a tech-plus-human-advisor solution specifically designed to assist baby boomers transitioning into retirement, with a series of tools from a(nother) tax-efficient retirement paycheck tool to a Social Security optimizer. And now, after just 3 years, United Income is being acquired by mega-bank Capital One, after showing a solid $750M+ of AUM growth just 3 years after launch, and the firm’s Form ADV showing that nearly 75% of its individual client assets are high-net-worth baby boomers as well (either $1M+ of investable assets or $2M+ of net worth). Notably, United Income also charges relatively “human advisor” fees for its service, with a fee schedule that starts at 0.8% and a $300,000 minimum for its “Private Wealth” solution with comprehensive financial planning and unlimited access to an advisor (or a scaled-down 0.50% fee and a $10,000 minimum for their initial “Premium” tier that is primarily United Income’s analytical tools with one-phone-call-per-year access to an advisor). For the broader industry, the significance of the United Income deal is that it validates the level of demand for virtually-based advisors even amongst baby boomers (though there is an option to pay an extra 0.08% AUM fee to get an in-person United Income advisor), and with United Income reportedly remaining a wholly-owned subsidiary that will continue “business as usual”, it appears that the Capital One acquisition is not the end of the company but merely a preparation to grow it further with its virtual retiree-centric advisory solution. Although when the long-term question for every such “robo” startup firm is how they will scale their new client growth in the face of challenging client acquisition costs, arguably the real appeal for United Income to be acquired, is the newfound opportunity for its service to be cross-marketed to Capital One’s $255B of total deposits, giving it the potential for even more rapid growth just as Schwab and Vanguard did by cross-selling their “robo” solutions to their existing clientele.

“Robo” Tools Finding Traction With Customized ESG Portfolios As Ladenburg Acquires NewDay Impact Investing Robo-Advisor? – One of the most long-standing challenges to customizing portfolios for individual investors is that managing a portfolio with a large volume of individual stocks is not very practical and is difficult to scale, while using mutual funds or ETFs as "building blocks" limits the granularity of the portfolio customization in the first place. Accordingly, one of the greatest potential breakthroughs of “Indexing 2.0” technology – that replaces index funds and ETFs with portfolios of the underlying stocks, managed directly with software – is that it allows for portfolio design to revert back to its roots of selecting individual stocks, in a manner that is still scalable. Which is beneficial not only because owning the stocks individually – instead of via funds – allows for more granular tax loss harvesting, but also because it facilitates the implementation of various rules-based overlay strategies to traditional index funds. For instance, advisors would no longer need to use smart beta funds, and instead could simply program their own smart beta rules to adjust which stocks are purchased (or not) directly into the software. And a wide range of ESG and impact investing strategies suddenly become feasible as well, where clients can easily request to purchase “the S&P 500, but excluding gun stocks and companies that score poorly on child labor” (as an arbitrary example). In this context, it is not surprising that major broker-dealer Ladenburg Thalmann announced this month that it was purchasing impact investing robo-advisor NewDay, with an eye towards deploying NewDay within its advisor network to create more customized ESG portfolios for interested clients. Notably, NewDay itself reports that its AUM is only $1M – a powerful reminder that even in the increasingly popular category of ESG and impact investing, robo-advisors are not an “if you build it they will come” solution – but can still have valuable application within the advisor industry as a tool to build more customized portfolios. With the caveat that while technology can increasingly systemize the scalability of creating more customized portfolios, there’s still a risk that the efficiencies of the technology to manage such portfolios may be more-than-lost with the inefficiency for advisors who will be challenged to remember and get up to speed for portfolio review meetings with clients when every client’s portfolio has different holdings and different performance. Though at a minimum, Ladenburg can simply use NewDay technology to create its own in-house proprietary ESG strategies, essentially leveraging the technology as a form of ESG portfolio management tool to distribute as an SMA offering to its own advisors.

ScratchWorks FinTech Accelerator Opens Its Third Season For Startup Submissions. The concept of the “FinTech Accelerator” has become increasingly popular in recent years, as a way to both support startups and facilitate entrepreneurship, for investors to find new companies to invest in to, and for startups themselves to get access to experts who can provide critical early-stage feedback on their endeavors. Yet the challenge is that most FinTech accelerators today are focused on the “hot” domains of blockchain and digital payments, and not necessarily the smaller world of AdvisorTech and WealthTech. Accordingly, it was notable that three years ago, a group of mega-RIAs owners assembled their own FinTech Accelerator, dubbed “ScratchWorks”, that would give advisor tech startups the opportunity to pitch their companies “Shark-Tank-style” to a group of advisor investors, who could then help incubate the startups and facilitate their subsequent growth. Early successes of the ScratchWorks program have included advisor marketing technology startup Snappy Kraken (Season 1), and a near-deal with financial planning fee-for-service platform AdvicePay (Season 2). And now, ScratchWorks has announced the opening of its new Season 3, where once again advisor technology startups can apply for the opportunity to pitch their companies at the ScratchWorks live event (to be held at the Barron’s Top Independent Advisor Summit on March 18th-20th in Louisville, Kentucky). Applications can be submitted directly via the ScratchWorks website for firms looking for early-stage funding, with the application period closing on November 29th.

Snappy Kraken Raises $2.5M Seed Round To Automate Advisors’ Digital Marketing For Them? The incredible success and popularity over the past 10 years of email marketing platforms like MailChimp, ExactTarget, and Marketo have spawned a number of copycats in the world of financial advisors, generally aiming to either provide a “better” list of curated articles and content for advisors to use in their email marketing newsletters, or better “matching” algorithms to try to identify which content prospective clients will be most likely to open, click, and read. The caveat, however, is that creating better email newsletter content for advisors only matters if advisors can attract prospects to sign up for their newsletters in the first place; in digital marketing parlance, email newsletter content is a “middle-of-funnel” solution that doesn’t help until the advisor generates enough “top-of-funnel” prospects to pour into the funnel (and receive the email newsletter). And unfortunately, when most advisory firms aren’t producing ongoing blog content, aren’t highly active on social media, don’t utilize pay-per-click advertising, and have done little or no Search Engine Optimization (SEO) for their websites, the reality is that most advisory firms aren’t generating any top-of-funnel traffic for that email newsletter content to engage in the first place. Which in turn has led several of the advisor marketing companies focused on middle-of-funnel engagement to struggle themselves, as the lack of top-of-funnel traffic means the middle-of-funnel tools don’t produce much in the way of tangible business growth results. In this context, it’s notable that recent newcomer Snappy Kraken has announced a new $2.5M seed round to grow its email marketing automation tools, but with a unique business model of also providing the top-of-funnel support (in the form of both blast emails and social media posts that drive prospects to landing pages to convert into email subscribers). In turn, to avoid creating conflicts amongst their users – as there’s a risk that Snappy Kraken’s top-of-funnel marketing for multiple advisors could clash – the company is carving up advisors into “exclusive” territories, where advisors pay for Snappy Kraken’s services in their specific area, such that the top-of-funnel marketing can then be geotargeted to avoid any overlap. Of course, the limitation of such a model is that there are only “so many” viable advisor territories that can be carved up where there’s a critical mass of consumers to market to in the first place. And Snappy Kraken must prove that it actually can generate top-of-funnel prospects, who then actually convert into clients by going through the firm’s email marketing funnel. On the other hand, if Snappy Kraken can fully vet out its end-to-end marketing funnel, it can always target its territorial marketing more tightly, and there’s an ample number of zip codes for the firm to grow at a reasonable price point of $189/month… or alternatively, get acquired by an advisory firm with a national reach that wants to leverage all of Snappy Kraken’s territories across the nation for its own national marketing funnel?

PlanCorp RIA Aims To Leverage BrightPlan “Robo” Financial Coach To Upsell 401(k) Financial Wellness Into Wealth Management Clients. Two years ago, the advisory industry was stunned by the news that an upstart robo-advisor platform known as BrightPlan was acquiring a 40% stake in a “traditional” multi-billion-dollar independent RIA (PlanCorp from St Louis), in a world where most robo-advisors either pitted themselves as competition to traditional advisors, or alternatively got bought by advisor platforms that wanted to leverage their technology. As with most combinations of traditional advisors and robo-advisors, the apparent goal was to both for PlanCorp to leverage the BrightPlan technology to become more efficient, and give BrightPlan a pathway to “upsell” more traditional high-net-worth clients to PlanCorp. In that context, it’s perhaps not surprising that BrightPlan, which has now focused itself into the 401(k) channel as a “financial wellness” provider that leverages its robo-advisor capabilities to automatically select and make recommendations about a plan participant’s 401(k) plan, is expanding into a coaching platform that will calculate financial wellness scores (on a 500-point scale) and provide feedback on how employees are progressing against their plans… with an opportunity to work with (i.e., be upsold into) PlanCorp advisors for those who have more complex needs. Of course, many advisory firms have long sought out doing business with 401(k) plans as a way to get access to their plan participants, in the hopes of engaging the more affluent employees into full-scale advisory services… a strategy that appears to be gaining momentum as even Financial Engines was merged with Edelman Financial last year to bring (i.e., upsell) Edelman’s financial advisors into the Financial Engines clientele. The caveat, however, is that this isn’t the first time a company has tried to treat a financial planning “scoring” system to gamify consumers around financial planning; FlexScore first debuted with a similar approach at Finovate in 2013, only to ultimately have its technology sold to United Capital a few years later to be monetized as a part of FinLife Partners instead. Which isn’t to say that a scoring-system-based financial coaching app isn’t useful, but that ultimately a tool to better engage plan participants into more comprehensive financial planning advice is only beneficial if the firm can get in front 401(k) plan sponsors in the first place, even as financial wellness apps themselves are becoming increasingly popular (and therefore competitive). In other words, BrightPlan’s new financial coaching tools may be a helpful value-add and a way to identify and steer a subset of affluent 401(k) participants to PlanCorp, but in the end, as with all “robo-advisor” solutions, it’s not an if-you-build-it-they-will-come world, and BrightPlan’s (and PlanCorp’s) success in this endeavor will still be driven by their ability to handle the distribution challenge of getting in the door with 401(k) plans in the first place.

Aivante Aims To Provide Personalized Health Care Cost Projections For Clients, But Will Advisors Use Them? According to a recent study from PwC, the top fear of prospective retirees isn’t “just” running out of money in retirement, but specifically in how they’re going to handle health care costs in retirement. Yet in practice, advisory firms often don’t delve into great detail in projecting health care costs in retirement, and instead to tend simply include an assumption that such costs will be covered as part of the retired client’s overall standard of living. To be fair, though, Medicare, including a Part D prescription drug plan and a Medigap supplemental policy, actually does largely stabilize retiree health care costs into a relatively narrow range, averaging a (sizable but very plannable) cost of about $500/month. But those costs can and do still vary by geography (and the local cost of living, including medical services), and those with greater health complications (already when heading into retirement) do face an outsized likelihood of above-average expenses (not to mention the risk and potential impact of long-term care expenses as well). Accordingly, newcomer Aivante – which currently provides health care expense estimates for health insurers and self-funded employee insurance plans themselves – has announced the rollout of a new service that will provide their health care cost analytics directly for advisors to use with their clients, based on the client's own reported health conditions and their zip code. The caveat, however, is that a number of other providers in recent years have tried and failed to get advisors to adopt similar client-specific health care cost projections, with little to no uptake. In some cases, it may simply be because advisors don’t actually want to open the door on such awkward conversations; in other cases it’s because clients are comfortable enough with a “rough” estimate (given that even “accurate” health care cost projections still rely on a large number of probabilistic assumptions). Though perhaps the biggest blocking point is simply the lack of a clear way to facilitate such conversations within financial planning software itself, where advisors would either have to “back out” a baseline health care cost assumption from their overall retirement projections just to import third-party data (like Aivante) back in, or otherwise create a more granular (and time-consuming, and not-easy-to-do-in-all-planning-software) projection of individual expenses in retirement (including health care costs) in the first place. Though arguably, even if Aivante’s tool just helps to facilitate a conversation about whether the client is likely to have “average”, “above-average”, or “below-average” health care costs (based on their current health and geography), it would be a constructive conversation. But it still raises the question how, exactly, advisors can easily get the health care cost data into their financial planning software projections, and whether Aivante would be better served to simply work with and license their data directly to financial planning software makers to create their own “health care expenses in retirement” module, rather than trying to work with advisors directly?

PreciseFP Launches Centralized Data Gathering Template To Receive NIGOs On TD Ameritrade Client Onboarding. One of the most frustrating parts of the investment account opening process is submitting paperwork only to receive back a NIGO (Not In Good Order) failure for some form that had a typo or was missing a field… which for some advisory firms, occurs as often as 20%+ of all the forms that are submitted. Ideally, of course, onboarding paperwork would be “smart” paperwork that could catch blank fields and flag them, or quickly identify invalid entries (e.g., a Social Security number with not enough digits, or a missing zip code). Yet in practice, not all RIA custodians have digital e-signature paperwork that knows how to “validate” such data when entered in real-time. To solve the problem, PreciseFP – which has created a wide range of data gathering forms for financial planning software – has developed a new data-gathering form specifically for TD Ameritrade client onboarding, that validates every field the client enters before processing the form. In other words, rather than just verify the data when the advisory firm enters it, PreciseFP effectively shifts the burden to the client in the initial data gathering process to ensure that all the key data is provided – and entered properly – before the advisor then submit the data into the TD Ameritrade Institutional Form Wizard. Arguably, such tools should ideally just be created within CRM systems themselves, as a centralized database of record for the typical advisor firm. But lacking such solutions from many of the leading providers, PreciseFP gives an appealing alternative to streamline the process for the client to only enter data once… and with its integrations to various CRM providers and financial planning software as well, and advisors can ideally automate mapping the data to all of its various end-point locations in various software tools (in addition to the investment account opening forms themselves).

MyRepChat Launches Rules-Based System To Facilitate Disclosures When Texting Clients… Because Compliance. One of the fundamental challenges in a highly regulated industry like financial services is the burden of compliance, which includes requirements to provide clients with a wide range of disclosures. When it comes to text messaging, the burdens are sometimes increased even further, because not only is text messaging a form of client communication and potential advertising (and therefore must be archived for future compliance review), but also because some states require additional disclosures and opportunities for consumers to opt out of receiving various business-related text messages. Which means engaging clients with text messages can require a number of different disclosures, potentially of different types depending on the state(s) involved, in turn creating substantial complexity for advisory firms (or especially broker-dealers) that have advisors spanning a large number of states. Accordingly, MyRepChat announced this month the rollout of a series of rules-based options to determine which clients receive which disclosures and when, with the ability to customize frequency based on the client situation, or even which disclosures they receive (or not) based on the state they’re in. A good example of what happens when an advisor tech solution is able to be solely focused on doing just one thing and is able to build enhancements for the very specific use cases that crop up when using their software. Even if the endpoint is to facilitate financial services disclosures via text message… which arguably no client really wants to receive via text message! (But as a highly regulated industry, advisory firms, unfortunately, have no choice!)

Envestnet Deepens Covr Integration To Turn MoneyGuideElite Into A Life Insurance Sales Illustrator. Nearly 3 years ago, MoneyGuidePro first announced an integration with Covr, that would take MoneyGuidePro financial planning data and port it directly into Covr’s “Insurance Solver” tool, to not only help illustrate a client’s potential life insurance needs but actually be able to follow through and begin the application process on the spot. On the one hand, the appeal of the integration was that it would be easier for advisors providing comprehensive advice on insurance matters to have deeper capabilities to model a client’s insurance needs (and then immediately begin to implement whatever was needed). On the other hand, as discussed previously on Nerd’s Eye View, the integration also raised the potential that financial planning software could effectively become the next distribution channel for life insurance itself, with the opportunity for MoneyGuidePro itself to participate in the economics of life insurance sales (i.e., take a piece of the commissions or an override thereon). And with this year’s acquisition of MoneyGuidePro by Envestnet, and the launch of Envestnet’s Insurance Exchange, that plan now appears to be coming fully to fruition, with Envestnet offering a growing range of fee-based annuities that can be illustrated directly through MoneyGuidePro, and now announcing an even deeper integration with Covr that will pull Covr’s analytics directly into MoneyGuidePro (instead of sending advisors “out” to Covr’s Insurance Solver)… and then helping to queue up any life insurance recommendations for immediate implementation. The good news of the deeper integration is that, for advisors who want to help clients implement life insurance as part of a holistic plan – or simply because it’s part of what they’re paid to do – the more tightly integrated life insurance needs analysis that helps project out a client’s changing needs over life should simply facilitate more and better conversations about life insurance. And arguably, given that financial planning software is supposed to illustrate a client’s overall plan and needs over their lifetime, such life insurance products should be illustrated directly within the client’s financial plan (and not separately). Nonetheless, the deepening integration of financial planning technology and life insurance and annuity implementation, effectively turning the financial plan once again into a point-of-sale tool, also raises concerns about the economics of such arrangements, how Covr and Envestnet will select which insurers participate or not (and whether it’s impacted by what the insurer is willing to pay to the technology companies to be listed), and whether at some point the business model of financial planning software could become so conflicted that the software no longer focuses on helping advisors give better advice, and just focuses on how to sell more product instead?

eMoney Advisor Expands Foundational Planning To Include Life Insurance Planning Module But To What End? With Envestnet pivoting the MoneyGuidePro business model to no longer rely solely on financial planning software fees but also have the opportunity to participate in the economics of the insurance and annuity products illustrated and implemented through the software, the growing question now is whether other financial planning software companies will follow suit and do the same, or instead try to differentiate themselves by remaining “fee-only” financial planning software instead. In this context, when eMoney Advisor announced this month that it was adding a Life Insurance Gap Analysis module to its Foundational Planning platform (i.e., simplified downscale planning, built for brokers and insurance agents that don’t necessarily want to do full comprehensive financial planning), the question immediately arose as to whether this was simply a feature expansion or a riff on the Envestnet/MoneyGuidePro trend of tying life insurance more and more directly to into financial planning software (as a way for the software to participate in the economics of life insurance sales). Of course, the reality is that for younger clients who don’t necessarily have substantial nest eggs yet, life insurance is a crucial planning conversation (as they literally don’t yet have enough net worth to self insure against the loss of a primary earner), and so a life insurance gap analysis tool is an entirely logical addition to Foundational Planning. Nonetheless, with so much buzz around MoneyGuidePro’s insurance pivot, the question now is whether eMoney is “just” expanding its life insurance planning capabilities in Foundation Planning, or setting the groundwork to get into the life insurance distribution business as well?

Edelman’s New Council Tries To Generate More Advisor Interest In Crypto By Renaming Them “Digital Assets” Instead. Financial advisors, in general, tend to be wary of the “next new thing” when it comes to hot investment ideas, and especially when they’re “non-traditional” investments that sit outside the traditional platforms that we use to work with clients. And between that wariness and the actual extreme volatility that various cryptocurrencies like Bitcoin have experienced, the latest FPA Trends In Investing study shows that advisor adoption of cryptocurrency remains at less than 1%. However, advisor Ric Edelman – who is known for pushing the envelope on futurist thinking and focusing on exponential technologies – is making the case that cryptocurrencies and blockchain technology are here to stay, and earlier this year formed a new Advisor Council, dubbed the Advisor Blockchain and Cryptoasset CounciL (ABCC), that would focus on providing education to the advisor community about cryptocurrencies and blockchain and their potential applications in our industry (either for investment purposes when it comes to cryptocurrencies like Bitcoin, or the platforms we use to run our businesses when it comes to blockchain technology). Now, 6 months into the effort, Edelman suggests that perhaps part of the challenge of low advisor adoption is simply that cryptocurrencies and blockchain have a PR/perception problem, as literally the word “crypto” tends to evoke mental images of crypts, death, and skullduggery, while the roots of the word “blockchain” are all about preventing, tying up, and restricting (literally, “blocking” and “chaining”). Accordingly, his Advisor Blockchain and Cryptoasset Council is being renamed into an “RIA Digital Assets Council” (RIADAC) instead, with an upcoming Digital Asset Strategy Summit on October 20-21 in Dallas for advisors who are interested in getting more educated on the topic, and plans to develop a Speakers Bureau and additional training and certification on the topic in the future. Ultimately, it remains to be seen whether cryptocurrency investing in particular really gains traction with advisors – and whether it even remains viable as an investment and becomes accepted as a distinct asset class or not – and arguably the primary concern of advisors is not the name but the actual risks of cryptocurrency itself. Nonetheless, as prior trends from the rise of “alternative investments” to “smart beta” have shown, the name itself and how it’s communicated to clients really can have an impact on the perception of risk, and arguably Edelman has a good point that the suggestion of investing into “crypto” sounds a lot darker and potentially nefarious than advisors simply discussing with their clients whether to buy “digital assets” or not?

In the meantime, we’ve updated the latest version of our Financial Advisor FinTech Solutions Map with several new companies, including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation!

So what do you think? Will Baby Boomers continue to adopt virtual CFPs and digital advice platforms as at least some Milllennials have? Will advisors actually do more detailed health care cost projections for retirees with access to better data? Would you recommend and implement more life insurance in clients’ financial plans if it could be done easily from directly in the financial planning software? And will calling cryptocurrencies a “digital asset” instead really improve their adoption? Please share your thoughts in the comments below!

(Disclosure: Michael Kitces is a co-founder and owner of AdvicePay, which was mentioned in this article.)