Executive Summary

Welcome to the August 2022 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This month's edition kicks off with the news that Envestnet has acquired Redi2, one of the most widely used ‘revenue management’ systems in broker-dealers that facilitates the flow of dollars coming in and being paid out to advisors in all the various increasingly complex ways they can get paid (from upfront commissions via various product types to trails to advisory fees to standalone planning fees), along with its BillFin solution for independent RIAs doing standalone AUM billing.

The deal is well timed to a recent Risk Alert from the SEC about advisors engaging in (unwittingly) incorrect billing due to a lack of strong billing systems and processes. But arguably, it also signals a broader trend, particularly amongst broker-dealers, towards increasingly complex revenue models (with various combinations of third-party products, in-house products, advisory fees through a wide range of SMAs and TAMPs, home office models, and Rep-as-PM portfolios, and fee-for-service financial planning) that necessitates increasingly sophisticated billing systems to handle the growing complexity, as the industry continues its evolution from product sales to advice fees (and the messy middle that comes in the midst of that transition).

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including:

- Catchlight offers up a new system that scans information about prospects online to determine which ones are ‘qualified’ and worth pursuing further

- AssetMark acquires Adhesion Wealth from Vestmark as TAMPs continue to seek scale for both technology development and distribution

- CapIntel raises an $11M Series A round to bring its proposal generation tools from Canada to the US

Read the analysis about these announcements in this month's column, and a discussion of more trends in advisor technology, including:

- Independent Advisor Alliance partners with ‘We Handle Tech: 4 Advisors’ as advisor demand grows for Managed IT Services providers to outsource IT support

- Income Lab and MoneyTree both launch new ‘One-Page Financial Plan’ summary reports as advisors continue to demand more tools to demonstrate the ongoing value of financial planning after the upfront planning process is complete!

In the meantime, we’ve also made several updates to the beta version of our new Kitces AdvisorTech Directory, to make it even easier for financial advisors to look through the available advisor technology options to choose what’s right for them!

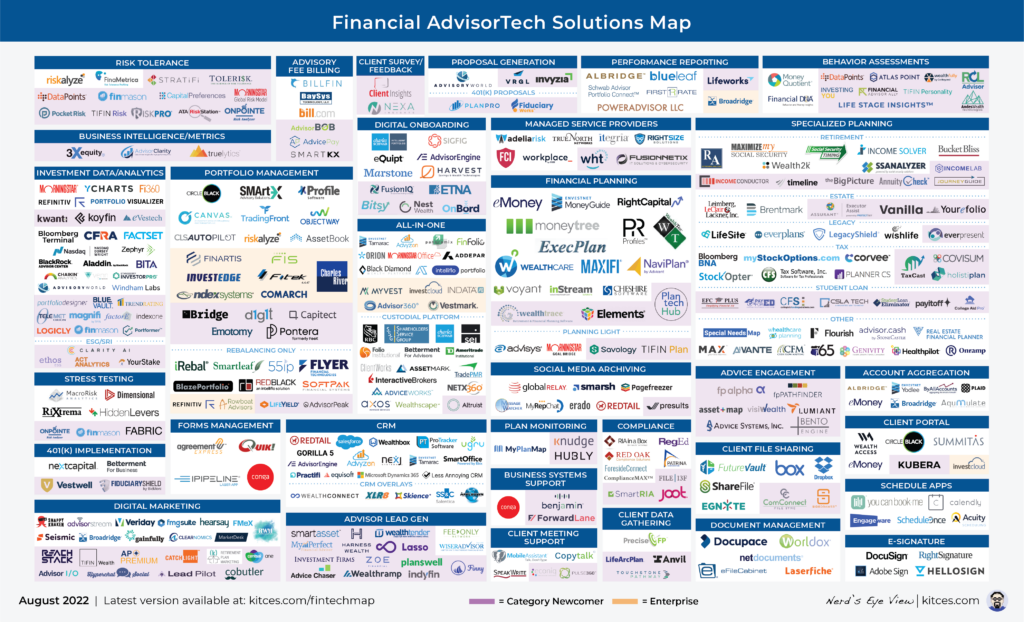

And be certain to read to the end, where we have provided an update to our popular “Financial AdvisorTech Solutions Map” as well!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

Envestnet Acquires Redi2 As ‘Revenue Diversification’ Of Advisors Makes Enterprise Billing More Complex

In the early days of financial-advisors-as-stockbrokers, managing broker compensation was relatively straightforward: brokers earned commissions for the stock and bond trades they placed directly for their customers, and broker-dealers had one set of standard commission rates (typically based on trade size/volume) to determine what the compensation would be.

In the 1980s and 1990s, with the rise of ‘discount brokerages’ like Schwab, and as stock-brokering became increasingly computerized, trading commissions began to fall, and brokerage firms increasingly shifted to the distribution of third-party mutual funds. Which allowed for the rise of ‘independent broker-dealers’ (independent because they were independent of any investment bank to underwrite the securities being sold) that facilitated the distribution of third-party investment products, particularly mutual funds.

By the late 1990s and into the 2000s, though, the sheer breadth of different products that independent broker-dealers offered (from mutual funds to variable annuities to private placements) – each of which would have their own commission rates and revenue-sharing agreements, and may have differing payouts to the brokers based on varying ‘grid’ incentives – led to the rise of “revenue management” systems that could help track all the different financial arrangements from various providers, the different ways the commissions were split between the broker-dealer home office and its reps, and tying the appropriate commissions to each of the various reps (including in situations where commissions were split across multiple reps).

Over the past decade, though, broker-dealer enterprises have further diversified their revenue streams – not just across the breadth of securities product types, but also with the rise of advisory accounts in the shift to dual B-D/RIA registration after the Merrill Lynch rule was vacated in 2007, and more recently the emergence of subscription and other fee-for-service financial planning models – which has made revenue management exponentially more complex and driven demand for increasingly sophisticated solutions.

In this context, it’s notable that this month, Envestnet announced the acquisition of Redi2, one of the early players and market share leaders in revenue management systems for advisor enterprises. Which includes both Redi2’s core offering – Wealth Manager – that handles the complexities of broker-dealer and TAMP tracking and payouts, along with Revenue Manager (a similar system that supports asset managers), and BillFin (which facilitates AUM fee invoicing and billing for RIAs, along with internal tracking of fee splitting and billing compliance).

Strategically, the deal is a good fit for Envestnet’s ever-expanding role in facilitating the back-end of large advisor enterprises – particularly broker-dealers – as Redi2 brings both sizable existing market share in the revenue management category to which Envestnet’s other services can be cross-sold, some upgrades over Envestnet’s existing revenue management systems (e.g., sleeve-level billing for SMAs), and the opportunity for Envestnet to then offer Redi2’s expanded capabilities to its immense base of enterprises.

The related acquisition of Redi2’s BillFin also gives Envestnet a deeper penetration into AUM billing capabilities for standalone RIAs, particularly amongst smaller up-and-coming RIAs (which tend to purchase standalone solutions like BillFin until they’re large enough to handle AUM billing within all-in-one platforms like Orion, Black Diamond, or Envestnet’s own Tamarac). And Envestnet signaled that it sees further opportunities for BillFin to begin facilitating more fee-for-service financial planning payments as well, by integrating it more directly into Envestnet’s MoneyGuide in the coming years (though given that many larger enterprises offer their advisors multiple planning software tools, it’s not clear how feasible directly-MoneyGuide-based financial planning fee payments will be).

Ultimately, though, the key point is simply that the ongoing growth of advice fees is driving a rising focus on billing systems to manage those fees, from the shift of IBDs into the hybrid model with a broad range of revenue streams (where tools like Redi2’s Wealth Manager aim to help), to the ongoing growth of RIAs into larger and more complex enterprises (which necessitates their own revenue management systems), and greater scrutiny from the SEC about advisory firms not always having cleanly executed billing processes in the first place (per the SEC’s Risk Alert on Investment Advisers’ Fee Calculations last November), is turning what historically was the relatively mundane domain of billing (and the associated revenue-sharing/fee payments to advisors) into a growth market for Financial/Operations technology solutions for advisor enterprises!

Fidelity’s Catchlight Launches To Make Prospecting More Efficient At Scale By Pre-Qualifying Which Prospects To Pursue

One of the key lessons that nearly every new financial advisor has to learn the hard way is that there’s a difference between a prospect and a qualified prospect. A prospect is anyone the advisor meets with to discuss potentially doing business with them. A qualified prospect is someone who actually has a need for the services the advisor provides (rather than simply pitching a solution in search of a problem), and the financial wherewithal to pay for the advisor’s (needed) services. Because one of the biggest potential losses in productivity for an advisor is spending a lot of time talking to ‘unqualified’ prospects who can’t or won’t ever actually do business with the advisor.

In the past, “qualifying” a prospect was often part of the initial meeting process itself, where either at the beginning of the meeting, or perhaps during the process of scheduling the meeting or via a brief intake form, it would be determined whether the prospect had enough assets or other financial wherewithal to work with the advisor, and an understanding of prospect’s needs to affirm that the advisor was a good fit. This, in itself, was still both a time-consuming process, and a more ‘reactive’ one as advisors often still had to initially engage with the prospect to determine if they were qualified, and the advisor wouldn’t know if they were qualified or not until the engagement process began.

But last month, a new platform called Catchlight was launched, that specifically aims to solve for these challenges by leveraging the plethora of data now available in the digital era to better pre-qualify prospects in advance.

Born from the Fidelity Labs incubator, Catchlight is not so much a prospecting or lead generation tool, per se, as a “lead evaluator” that takes in an existing list of potential prospects – e.g., a list of social media contacts, or an existing drip marketing email list – and then cross-references that individual’s identity on available social media platforms and marketing databases to try to identify the potential financial complexities they may face (e.g., based on their age, stage of life, neighborhood affluence, company affiliations, etc.) and ‘score’ the prospect to help the advisor understand how worthwhile it would be to pursue that prospect further.

From the advisor perspective, the potential benefits of Catchlight are clear – advisors can reduce the amount of time they spend with non-qualified prospects, or outright have an opportunity to amplify their efforts to reach more (pre-)qualified prospects, which can greatly improve the efficiency of the business development process. In turn, Catchlight itself built its system with an AI layer that can take feedback from advisors on which prospects actually do turn out to be qualified and close as clients (or not), and learn from the feedback to make its qualified-prospect identification process even better. (In fact, Catchlight was already in pilot with a handful of firms since the beginning of the year to ‘train’ its algorithm before release.)

Notably, because Catchlight operates as more of a lead-evaluator than a lead-generator, it won’t necessarily help advisory firms that haven’t figured out how to generate a list of leads (or at least a growing list of email or social media contacts) in the first place… a domain where marketing-tech competitors like SmartAsset and Zoe Financial are better suited. Nor is Catchlight necessarily the drip marketing system to those qualified prospects, where Snappy Kraken, AdvisorStream, and ReachStack have grown. Instead, Catchlight would help screen the leads from SmartAsset or Zoe, or the email list in Snappy Kraken, AdvisorStream, or ReachStack (or the social media contacts the advisor is building on Twitter, LinkedIn, or Facebook), to highlight which leads, in particular, the advisor should more proactively pursue (or which might be better to just screen out altogether).

In the end, Catchlight’s success will be driven first and foremost by the ability of its algorithm to actually spot which are the (most) qualified leads, and screen out those that truly aren’t qualified, while minimizing the number of false positives or false negatives. For which only time will tell about whether Catchlight’s algorithm does (or can learn to) execute effectively. But given the incredibly high client acquisition costs of the typical advisor – and in particular, how loathe advisors are to spend time with non-qualified prospects (at least, once they realize the prospect isn’t qualified) – Catchlight seems incredibly well positioned to execute on its opportunity to make the prospecting process for efficient, especially for advisory firms trying to scale up that must figure out how to focus their resources on the ‘right’ (most qualified) leads.

Adhesion Wealth’s TAMP Changes Hands As Vestmark Exits And AssetMark Bulks Up

In its earliest days, the Turnkey Asset Management Platform (TAMP) functioned as an alternative to ‘traditional’ investment products like mutual funds (or fund-of-funds); instead of the advisor engaging in the time-consuming process of setting individual stock and bond (or mutual fund) allocations for their clients and then doing the research and due diligence to manage those investments, the advisor could outsource the whole process to a ‘turnkey’ platform that could handle model design and investment due diligence on a centralized basis. TAMPs then competed in a similar manner to any other investment product: on the quality of their investment analysis and research, and their ability to manage client portfolios in a way that would outperform the available alternatives.

However, because many advisors have a wide range of clients that may have differing investment needs and differing investment preferences, it was not uncommon for advisors to choose multiple different TAMPs to work with, selecting the particular TAMP manager’s strategies that aligned to their particular clients. Which, unfortunately, deleveraged a lot of the operational efficiencies that TAMPs were supposed to bring, as advisors ended up managing within multiple TAMP systems. And eventually led to the rise of the ‘Platform TAMP’ – a kind of platform-of-platforms solution where advisors could manage all client accounts within one centralized TAMP system, but still have a choice of a range of 'product TAMPs' (and SMAs) within that platform.

Over the years, the two have continued to run largely in parallel – 'product TAMPs' tend to be more modest, with a focused proprietary investment management offering that they aim to distribute by offering outsourced services to advisors who invest their clients into those strategies. While Platform TAMPs are mostly technology companies that have access to a wide range of third-party strategies and products that they help distribute.

As Platform TAMPs have continued to evolve, though, the irony is that they too have begun to morph back into a form of ‘product TAMP’, except the product isn’t the investment offering, it’s the technology offering that powers the Platform, with different providers trying to build their own differentiated technology, and then find advisors (or find partners to reach advisors) who want to operate within their TAMP tech ecosystem.

It was in this context that several years ago, Adhesion Wealth – which has followed the Platform-TAMP-turned-technology-product-TAMP path – was acquired by Vestmark. At the time, Vestmark was (and remains) one of the larger back office systems to handle managed accounts for enterprises, and Adhesion had built its own proprietary layers of technology value-add on top of the VestmarkONE system, which Vestmark clearly hoped to cross-sell to other advisory firms (particularly other RIAs, where Adhesion had been concentrated up to that point).

But now ‘just’ 4 years later, Vestmark has decided to exit its Adhesion TAMP business and divested the offering to AssetMark, citing what was ultimately non-trivial growth – up from $3.5B in 2018 to $9.5B today. Though notably, nearly half of that growth may simply be attributable to market growth over the intervening time period. And in the end, Adhesion is reporting 180 advisory firms that it works with – up ‘only’ 30 firms from the 150 reported at the original acquisition (of which 17 apparently came in just the first 6 months of the deal), implying that growth may have been stalling at Adhesion despite the cross-selling opportunities within Vestmark and ongoing investments into the breadth of models available on its platform.

The end result is that Vestmark appears to be looking to focus back on its ‘core’ business of being a back-end technology provider to power managed accounts (rather than trying to grow the TAMP service layer that may have been challenging simply because so many of its users already are TAMPs or using other TAMP solutions?), while AssetMark – which has been a rapidly growing Platform TAMP in its own right – gains the opportunity to bulk up with both additional assets from Adhesion, and additional technology (e.g., Adhesion’s capabilities in Direct/Personalized Indexing that can be rolled out to AssetMark advisors).

From the broader industry perspective, arguably the real takeaway of the Adhesion-Vestmark-AssetMark deal is simply that the ongoing demand for TAMPs to gain scale (including and especially by acquiring other TAMPs) continues unabated (with the buzz that Adhesion didn’t take a valuation hit despite recent market volatility), both because differentiated technology itself is very hard and costly (and requires scale) to build and maintain, and also because the hyper-competitive nature of the current TAMP marketplace means it’s not an “if you build it they will come” environment, but instead also requires scale and reach just to distribute the solution and actually attract new advisors to grow!

Independent Advisor Alliance Launches ‘We Handle Tech 4 Advisors’ As Managed IT Service Adoption Accelerates

The financial services industry has long been a slow adopter of new technology trends. In part, that’s simply the reality of a highly regulated industry that tends to be wary of changes that can cause disruptions to key systems. Though it’s also driven by the fact that the overwhelming majority of advisors operate in at least some form of quasi-independence (either as a standalone RIA, or affiliated with a broker-dealer or hybrid RIA), and consequently lack the team and resources to adopt (and implement and roll out) new technology.

The slow-moving evolution of advisor technology is perhaps most evident in how advisor systems themselves are housed, as the financial services industry severely lagged most others in the transition to the cloud, and a non-trivial number of advisors are still running local desktop- or server-based software (“it’s safer if I can see and touch the computer!”), rather than fully utilizing available cloud-based systems.

However, the trend to the cloud is now (finally) fully underway and accelerating, driven by what is, finally, a near ubiquity of cloud-based solutions for all major advisor software systems, which, ultimately, is greatly simplifying the technology demands of advisory firms themselves. After all, when all systems run entirely on the cloud, the in-office/desktop computer simply becomes a kind of “dumb terminal” whose sole purpose is to provide an access conduit to the advisor’s systems, alleviating most of the prior burdens on maintaining local systems and software, and enabling advisors to leverage more centralized (remote-based) IT solutions.

As a result, one of the rapidly growing sections of the AdvisorTech Landscape Map is the category of “Managed IT Services”, which has seen both new launches (e.g., FusionNetix) and existing players focusing more into the advisor channel (e.g., AdeliaRisk), as well as mergers and acquisitions (RIA In A Box acquiring Itegria, True North and RightSize being acquired and merged into Visory, etc.). A trend that appears likely to accelerate further as the SEC increasingly scrutinizes how secure RIAs are operating their computer systems and has recently proposed new cybersecurity requirements… and advisors realize both that their existing in-house systems are not actually as secure as modern cloud systems, and that they don’t have the in-house expertise to be able to fully manage and maintain a secure environment.

This month, another new entrant arrived in the Managed IT Services segment, with hybrid-RIA Independent Advisor Alliance (IAA) announcing a new partnership with “We Handle Tech: 4 Advisors”, which, similar to other providers in the space, will help advisors set up their computers, provide centralized IT support for tech problems and new tech needs, oversee cybersecurity of all the advisor’s systems, and even includes cybersecurity insurance as an overlay to the relationship.

For advisor support platforms like Independent Advisor Alliance, the partnership (and its ostensibly IAA-favored pricing) forms an interesting differentiator in its “technology stack” to attract potential advisors to affiliate in an environment where differentiation of advisor networks and platforms has been increasingly difficult. Even as it solves for what is arguably a problem that ‘every’ independent advisory firm ultimately must address.

From the broader industry perspective, though, the real significance of IAA’s partnership with We Handle Tech is part of a broader trend underway towards the outsourcing of IT services by independent advisory firms, as the core systems that advisors use are finally all cloud-based enough, and advisor attitudes about the cloud have shifted enough, that advisors really can let go of managing their own IT (as the burden of cybersecurity increasingly pressures them to do so) and instead can re-focus themselves more directly on serving clients and growing the business.

CapIntel Raises $11M Series A To Bring An(other) Investment Proposal Generation Tool To Advisors

One of the most fundamental requirements of a financial advisor's sales process with a prospective client is that, in order to win the business, it’s necessary to convey how the client’s financial situation will be improved by the advisor. Which, in practice, is most commonly expressed in the form of a(n investment) proposal, where the advisor reflects back to the prospect their current situation, what the advisor recommends should be changed, and how the prospective client’s situation will be improved as a result.

Over the years, though, the nature of how advisors generate proposals has changed. In a product-based world, proposals were often product illustrations provided by the manufacturer (e.g., the life insurance company’s product illustration tools) that show how the impact of the product purchase on the client’s long-term future (versus the alternative of simply not buying the product) or a product comparison tool that shows how one product stands up against another (e.g., using Morningstar to show how the advisor’s funds have performed relative to whatever the prospective client already owns). And as advisors have increasingly shifted towards advisory accounts, the nature of proposal generation has shifted as well, towards increasingly more comprehensive “portfolio analytics” that compare the advisor’s proposed portfolio to the prospect’s existing investments on a wide range of metrics (from ‘modern portfolio theory’ statistics like alpha, to Riskalyze’s Risk-Number-based portfolio comparison).

Notably, though, most advisors ultimately generate their investment proposals not necessarily from “sales” tools that aim to present a compelling offer to prospects, per se, but from investment data/analytics tools that aim to conduct a robust analysis of the investments (and then generate some kind of output that can be presented to prospects). Which, on the one hand, means a lot of investment “proposals” don’t actually do a good job of presenting the information in a way that compels prospects to take action. But on the other hand, means that most advisors don’t have to (or at least aren’t used to) paying separately for investment proposal tools, as they’re typically part of the advisor’s existing investment analytics tools used to build portfolios in the first place (or are provided by a TAMP or home office for advisors that use pre-built/existing models).

In that context, this month CapIntel announced a new $11M Series A round to scale up its investment proposal generation (and supporting investment analytics) tool for financial advisors. With a particular focus on not just trying to create a compelling investment proposal for prospects, but the ability to do so more quickly and easily (i.e., saving advisors time in the proposal generation process).

For most financial advisors in the US, the CapIntel name is likely unfamiliar, as the company has been primarily focused in the Canadian marketplace, where it works with several of the ‘Big Banks’ where a large segment of Canadian advisors is affiliated. In fact, CapIntel’s Series A round is primarily to leverage its success in building out tools for Canadian advisors by funding an expansion of CapIntel into the (much larger) US marketplace… given that there are more than 5X the number of CFP professionals in the US than in Canada.

However, the reality is that the US marketplace is also drastically more competitive, in no small part because of the sheer size of the advisor opportunity in the US, and the number of technology firms it attracts. And in practice, a number of advisor technology companies from Canada, the UK, and Australia have tried – without much or any success – to emigrate their tools into the US, only to find that despite the number of US advisors to potentially work with, it’s arguably even harder to find a beachhead or gain a toehold.

When it comes to investment proposal generation tools, in particular, CapIntel will face an uphill battle in a marketplace where most US advisors are not used to ‘paying separately’ for proposal generation tools, where advisors have increasingly standardized their portfolios into models (which naturally makes the investment proposal process less time-consuming because the recommendations are virtually always a standard array of models), and where investment data/analytics tools have both long-standing incumbents (e.g., Morningstar, Bloomberg) and rapidly growing competitors (e.g., YCharts and Kwanti) that don’t leave many openings.

In the end, arguably there is room for tools that create a compelling conversation with prospects that stirs them to do something different and take action – as evidenced by the rapid growth of Riskalyze in particular, which is nominally a “risk tolerance” tool but has driven its success primarily by functioning as an investment proposal tool that happens to use risk tolerance as its metric for comparison.

Still, though, with the existing landscape littered with the remains of ex-US advisor technology companies that tried to expand into the US but failed to know/learn the marketplace enough to find a viable beachhead, the real question is not whether CapIntel can make an investment proposal tool that all advisors can use, but one that is compelling enough for at least a segment of advisors to actually make a switch from whatever they’re using today?

Income Lab Launches Life Hub and MoneyTree Adds New Summary As One-Page Plans Gain Traction

When financial planning first emerged with the original class of CFP certificants in 1973, the reality was that financial planning was used primarily to facilitate the sale of insurance and investment products. Relative to the solely-product-centric pitch of most product salespeople at the time, financial planning was certainly a more holistic and ‘consultative’ approach to selling. But in the early decades, the primary role of financial planning was to understand a client’s situation and conduct a ‘needs analysis’ to demonstrate the gaps… because the advisor got paid to sell the (insurance or investment) product that filled that gap.

As advisors began to charge fees for their financial planning, though, the depth and breadth of the traditional financial plan expanded further. The planning software output became more formal. Advisors sometimes even formally bound their printouts to improve the perceived quality of the output being delivered, and the sheer page count of financial plans exploded. Largely because advisors wanted to literally do more analysis to demonstrate their value to substantiate the fee being charged (or at least to demonstrate that they’d done the required analysis and that clients could trust what otherwise might be a relatively abbreviated page of recommendations at the end).

Over the past decade, though, the business model has shifted further, advisors are increasingly charging ongoing fees (in the form of AUM, or now, subscription fees) to provide ongoing financial planning advice… for which the traditional financial plan only addresses the upfront/initial part of the planning engagement, and not what happens in each of the years (or decades) that may follow. In the past, advisors simply occasionally returned to and updated the original financial plan – yet the reality is that client situations often don’t change that much in the span of just a year or two, such that “some update” may be necessary but a “whole new plan” is wasted effort.

To fill the void, in recent years an alternative approach of the “One-Page Financial Plan” has begun to emerge. In practice, though, the One-Page Financial Plan (OPFP) isn’t necessarily used as a substitute for the traditional plan upfront with a client (where even if a ‘one-page’ plan is presented, it may still be ‘supported’ by dozens of pages of technical appendix to substantiate the analysis). Instead, the OPFP is more about providing a single-page dashboard for clients (and their advisors) to monitor and understand their ongoing progress. Leading to the rise of standalone OPFP templates from advisors like Jeremy Walter’s OPFP and Mike Zung’s Beautiful Plan, as well as new planning software features like RightCapital’s new Snapshot.

And now, the one-page plan/summary appears to be gaining momentum, as MoneyTree financial planning software announced a new One-Page Summary output for clients, and Income Lab’s retirement planning software similarly introduced a new “Life Hub” module that is built around providing clients a one-page dashboard to track their retirement and ongoing distributions (including updated details of retirement balances and withdrawals, the sourcing of those withdrawals for tax efficiency, and upcoming planning milestones like starting Social Security or paying off a mortgage).

Notably, at this point the actual substance of one-page financial plans still varies by provider… a combination of the fact that different advisors have different preferences on what to show, different clients need to see different information (depending on their financial situation and the focus of their planning needs, such as retirees vs accumulators or business owners vs employees), and a simple lack of consensus about the ‘best practices’ in presenting such information in the first place.

Nonetheless, the growing momentum of planning tools rolling out one-page financial plans – not necessarily to replace the upfront financial plan, but to support the ongoing planning engagement of monitoring client progress and helping to keep track of open recommendations and action items – signals the extent to which advisory firms are increasingly looking to shift their own valuation proposition from ‘just’ the upfront planning process to demonstrating ongoing value to retain ongoing financial planning relationships. Expect to see more solutions and iterations in this direction from other providers in the coming years!

In the meantime, we’ve rolled out a beta version of our new AdvisorTech Directory, along with making updates to the latest version of our Financial AdvisorTech Solutions Map with several new companies (including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation)!

So what do you think? Does Catchlight sound like something that would be useful to scan your prospect list to better qualify the leads? Do you think there’s a gap and need for more/better investment proposal generation tools? Would you like to see more ‘One Page Financial Plan’ summary tools to use with ongoing clients? Let us know your thoughts by sharing in the comments below!