Executive Summary

Welcome to the February 2021 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This month's edition kicks off with the big news that Walmart has partnered with Ribbit Capital (one of the FinTech VC firms that backed Robinhood) to begin creating its own FinTech solutions for Walmart customers and employees… which would instantly create one of the largest distribution platforms for a FinTech solution (as Walmart reaches nearly 40% of all Americans on a weekly basis!) and also a Financial Wellness platform (as the world’s largest private employer). Yet the reality is that, as the world’s largest superstore, Walmart is arguably well positioned to become a financial products superstore as well – taking a page from the playbook of Sears, the 20th-century retailer that expanded into financial services and, in the process, spawned Allstate Insurance and the Discover card – though that still doesn’t mean that Walmart will necessarily want to enter the far-more-challenging-to-scale services business of financial advice itself.

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including:

- Former Vanguard CEO McNabb joins the Altruist advisory board, signaling that it’s not just RIAs themselves but also asset managers that would like to see a breakup of the current RIA custodial oligopoly

- Milemarker launches a new “Integration-as-a-Service” as AdvisorTech integration fatigue hits new depths even as cross-platform integration becomes more essential than ever

- DPL raises $26M of private equity capital to scale its new fee-based annuity platform for RIAs

- MaxMyInterest tries to expand the reach of its cash management solution for advisors not by integrating with their investment platform but via Redtail’s CRM instead

Read the analysis about these announcements in this month's column, and a discussion of more trends in advisor technology, including:

- Focus Financial launches its own cash management solution in partnership with Orion and competing with the RIA custodians its partner firms use

- National Guardian Life acquires Everplans as more insurers look to acquisitions as the means to facilitate their own digital transformations and overcome their Innovator’s Dilemma

- Chalice Network launches a new “Certified FinTech Advisor” designation for financial services enterprise executives trying to get up to speed in the world of Advisor FinTech

- Financial personality assessment tools are on the rise as client profiling goes beyond “just” risk tolerance to a wider range of client financial behaviors that advisors may be able to help (or, alternatively, want to screen for!)

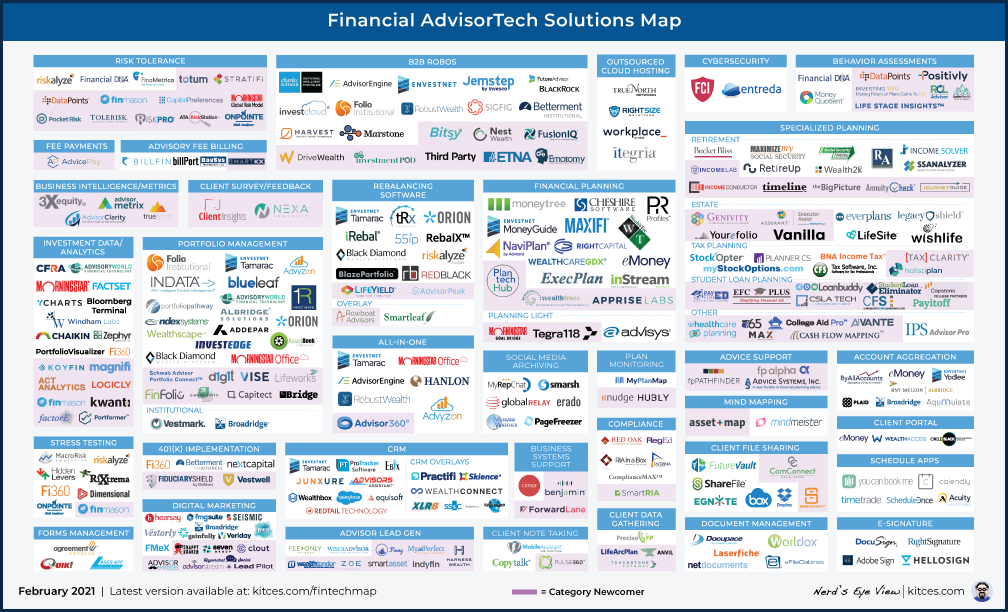

And be certain to read to the end, where we have provided an update to our popular “Financial AdvisorTech Solutions Map” as well!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

Walmart Enters FinTech To Create A (Non-Advice) Financial Products Superstore? When the first wave of robo-advisors launched in the early 2010s, it was viewed as only a matter of time before some “mega” player like Google or Amazon would enter the market, leveraging their immense reach and resources in what was presumed would be the ultimate disruptor of financial advisors. Yet aside from a brief rumor that social media platform Snapchat was considering a robo-advisor in 2016, the decade of the 2010s closed with a whimper and not a bang for robo-advisors, with most players folded or pivoted away and Betterment as the lone standing member of the original wave still growing. As while the founding proposition of most robo-advisors was that financial advisors are “too expensive” and technology can execute what advisors do at a lower cost, the reality is that financial advisors already leverage technology to execute and the biggest limiting factor for advisors serving the masses isn’t the cost to deliver services but the cost to acquire the clients in the first place, in a world where the average Client Acquisition Cost for a financial advisor is still more than $3,100 per client. Accordingly, FinTech providers themselves have been increasingly focusing on how to distribute their solutions at scale, leading to a few ‘viral’ apps (e.g., Robinhood) and the rest looking for new distribution channels (e.g., the rise of “Financial Wellness” apps in the employer channel). Yet as Schwab and Vanguard demonstrated with the success of their own robo-advisor and digital advice offerings, one of the most straightforward ways to rapidly scale the distribution of a new FinTech solution is simply to cross-sell it to existing customers as a means of expanding wallet share. Which makes it not at all surprising that this month, the world’s largest retailer, Walmart, announced that it has entered into a FinTech partnership with Ribbit Capital (one of the venture capital firms behind Robinhood) to start developing “unique and affordable financial products” for Walmart customers (and employees). Students of the history of the financial services industry may recognize the strategy as a mirror of Sears and Roebuck, the mega-retailer of the 20th century that, over time, expanded into insurance (as the original founder and parent company of Allstate), credit cards (as the original founder of the Discover card), and at one point acquired Wall Street brokerage firm Dean Witter (which at the time was the 5th largest broker in the country). And while its expansion into financial services ultimately wasn’t able to stave off Sears' own woes, the extant mega-brands it built in financial services (e.g., Allstate and Discover) remain a testament to the opportunities in attaching financial services to a large retailer's customer base. Which is even more of an opportunity for Walmart, a larger player in retail today than Sears was in its heyday, currently reaching as many as 40% of all Americans on a weekly basis and also serving as the world’s largest private employer. A key distinction, though, is that Walmart is a product superstore, and appears to be positioning its new FinTech venture as a financial products superstore… a competitor for players from Robinhood to SoFi to Stash, but not necessarily as an alternative to advisor/advice services. Of course, that doesn’t mean that Walmart might not launch its own financial advisor services solution at some point in the future – just as Walmart is beginning to look at providing more Health Services directly in its stores as well. But that still doesn’t mean that Walmart’s FinTech venture would necessarily be a threat to financial advisors; instead, Walmart might simply become a mega-employer of financial advisors, as one of the few who might actually be able to cost-effectively serve the masses simply because its existing customer base makes it possible to lower client acquisition costs enough to bring financial advice to the masses? For the time being, though, the irony is that while Walmart’s new venture is being billed as a foray into financial services, in practice it looks to be squarely focused on financial products that can most readily be mass-produced at Walmart’s size (and in a volume that’s actually capable of moving the needle on Walmart’s mind-numbing $500+ billion of annual revenue).

Altruist Nabs Former Vanguard CEO McNabb For Advisory Board As Asset Managers Also Took To Break Up The RIA Custodian Oligopoly? The business of providing custody and clearing services to RIAs is a business of scale; so much so, in fact, that all the leading RIA custodians today have built their RIA custodial businesses as an extension of some other business, from Schwab and TD Ameritrade adding RIA brokerage services to their retail brokerage platforms, Fidelity scaling up its custodial business from both its retail brokerage and its brokerage services for independent broker-dealers, and Pershing now scaling its RIA custodial platform from its existing B2B brokerage services for independent broker-dealers as well. In turn, even the “secondary” RIA custodial services have built their own businesses on top of some other brokerage platform, from SSG building on Pershing to TradePMR building on Wells Fargo’s First Clearing. In fact, the scale requirements to operate an RIA custodial offering are so significant, that there have been virtually no new entrants to the space in more than a decade – despite incredible growth of the RIA channel – and in reality, there are actually fewer RIA custodians than there were a decade ago due to industry consolidation (from Morgan Stanley buying E*Trade, which itself had bought Trust Company of America, to Schwab acquiring TD Ameritrade, which itself had bought Scottrade Advisor Services). And with industry consolidation, the competitive pressures amongst RIA custodians have only accelerated further as the ‘traditional’ brokerage business continues to be compressed (e.g., Schwab leading the way to $0 trading commissions in late 2019), and RIA custodians increasingly look to alternative revenue sources, from Schwab now generating more than 50% of its revenues from the net interest margin it earns on client cash, to TD Ameritrade infamously removing Vanguard from its NTF ETF lineup and replacing it with State Street’s new SPDR Portfolio series (and earning additional revenue from State Street’s marketing allowance to distribute its ETFs). Which made it all the more notable when nearly two years ago, Altruist launched as a new entrant to the RIA custodial business, and later that year raised an $8.5M Series A round from storied venture capital firm Venrock, building around an innovative pricing model of simply charging $1 per account for its services. From the advisor perspective, the appeal of having a new RIA custodial competitor is not simply the outright opportunity to experience the benefits of more RIA custodians competing for their business (especially after the Schwabitrade merger where Schwab alone has more than 50% market share, and the ‘big-3’ of Schwab, Fidelity, and Pershing have an estimated 80% to 90% of the entire independent RIA market), but also an opportunity for new pricing models for RIA custody services that don’t just rely on custodians profiting from advisors’ clients in the form of cash scrapes and asset manager revenue-sharing. Which isn’t just meaningful for advisors, but also for asset managers, as the independent RIA movement continues to grow at the expense of independent broker-dealers, which in theory should aid the profit margins of asset management solutions and reduce their costs (by eliminating the cost layer of the independent broker-dealer), but instead is simply leading to RIA custodians trying to earn what was previously the broker-dealer’s share (in the form of 12b-1 fees, sub-TA fees, and various other ‘marketing allowances’ and revenue-sharing agreements). In this context, it is perhaps not surprising that former Vanguard CEO Bill McNabb has become an investor and is taking a seat on the Altruist advisory board, as Vanguard – legendary for its unwillingness to engage in revenue-sharing and other shelf-space agreements with brokerage firms – has seen first-hand the challenges of the current RIA custody model (from the asset manager’s perspective) and the appeal of new RIA custodians with alternative pricing models. Ultimately, it remains to be seen whether Altruist can really crack what is still a hyper-competitive market for RIAs, and one where it’s hard to compete on “price” when RIA custodians have only ever been “free” to RIAs (again earning their revenue indirectly from everything from client cash to asset manager revenue-sharing arrangements). But Altruist managing to nab McNabb is the strongest signal yet that potential disruption of the RIA custodial space isn’t just something that some RIAs want to see as a form of greater competition and more choices – asset managers appear to be increasingly eager to stop feeling squeezed and want to see the RIA custodial model change, too?

Can Mackrill’s New Milemarker Take AdvisorTech Integrations The Extra Mile? When it comes to integrations amongst various AdvisorTech solutions – with more and more integrations necessary as the breadth of the AdvisorTech landscape map continues to grow – there is currently a never-ending conversation, that typically looks like this: Advisor: “Hello financial planning tech! I’d love to pull my clients' financial plan data into this other client portal that we use instead. How do we do that?” AdviceTech Integration Rep: “Oh yeah, that sounds great! Unfortunately, that’s not how the integration works currently, and we don’t have enough clients who also want to do it that way to warrant pulling developers off of their current projects to build that edge case for you. Sorry! I wish I had better news.” Or alternatively… Financial Planning Tech company: “Oh… we understand, but that doesn’t really fit our strategy, you see our client portal is really central to our growth plans, and we would rather you use it instead. So we won’t be offering that integration! But hey, can we get you a demo of our portal? It’s awesome!” At its core, the problem is that when the landscape of financial advisors themselves is so fragmented and independent (from independent RIAs to independent broker-dealers), the users of AdvisorTech software tend to have different visions for how they want to use the software, and how they want the components of the AdvisorTech stack to connect to one another (or not). Which is challenging, because the more AdvisorTech solutions there are, the more points of integration there may be – leading to a collective “integration fatigue” amongst financial advisors and their technology providers – and also because many AdvisorTech solutions simply weren’t architected to be that flexible. Not to mention that the growing focus on “platform as a business” models is driving many AdvisorTech solutions to try to fold their advisors into their increasingly broad offering, instead of integrating with advisors’ other best-in-class preferences. The end point for most advisory firms is two options: either make do with the integration capabilities that are offered, or spend a large chunk of money to have a consulting firm come in and build custom integrations to make things work exactly how the firm wants them to (but then they have to be maintained by the firm… or entirely rebuilt if the firm decides to switch out a key component of its tech stack in the future!). Jud and Kim Mackrill are by no means newcomers to this issue, having seen it front and center for years as they first led implementation and supported partnerships at Orion Advisor Services, and then more recently helped build out The Carson Group’s beautiful tech experience for their advisors (and dealing with and helping to solve first-hand the challenges that arise when trying to integrate a new firm’s existing data and tech stack into an existing advisor experience). Thus Milemarker was born. Positioned as an Integration as a Service (IaaS) platform, Milemarker is trying to treat the cause of the integration disease, not just the symptoms. Which according to the Mackrills, is not a problem of integrations themselves, per se, but a root cause emanating from the structure of the underlying data itself and how that data is managed. Accordingly, rather than wait around for all of the other crucial legacy players to update their data models and product architecture to make integrations more flexible, Milemarker aims to create an extraction layer for the industry, ostensibly connecting to custodians, third-party asset managers, SMA providers, AdviceTech providers, and more, but instead of integrating one of those systems to another, Milemarker will pull all of the data into the cloud via a Milemarker container that is controlled by the advisory firm. Or stated more simply, Milemarker aims to create individual data warehouses for advisory firms, which will give those firms the control to direct their client and firm data to each specific end location (or mile marker, if you will!), and better control their own destiny with their own integration workflows, as an advisor-specific version of Mulesoft (or a souped-up version of Zapier). Notably, there have been others that have come before Milemarker trying to solve this integration issue, albeit with different strategies… and the challenges of integration fatigue and the search for the integration holy grail have remained ongoing. So only time will tell if Milemarker has found the right formula to really solve the issue and open a new frontier for integration innovation. But in the end, when financial advisory firms on average are trying to integrate 10-15 pieces of software with great difficulty, while enterprises outside of the financial services industry have no problem integrating close to 100 pieces of software in their stack, there’s clearly opportunity to do better!

Focus Partners With Orion Take A Swing At RIA Custodial Cash Margins With New Client Portfolio Cash Solution. In the investment world, the saying these days is that “cash is trash”, given near-0% yields that drive advisors to try to find something – anything – to invest in instead of holding client assets in cash. Yet at the same time, the irony is that even as cash approaches record-low yields and advisors try to hold less cash than ever… cash, and the net interest margin that platforms can earn on cash, has actually become a major driver of the RIA custodial model, with Schwab earning the majority of all its revenue from the ‘tiny’ scrape it generates on what is still hundreds of billions of dollars of cash amidst its trillions of assets on the platform. The model continues to work because, even though advisors (and their clients) have such an aversion to holding near-0%-yield cash these days, there is virtually always some level of “frictional” cash that stays in client accounts, usually on the order of 1% to 3% of the total portfolio, to handle everything from last month’s new savings that haven’t been invested yet for an accumulator client, next month’s spending that needs to be distributed soon for a retired client, or the advisor’s own upcoming quarterly AUM fee. In other words, “investment” cash is often at least allocated into a short-term bond fund or similar fixed income alternative, and “excess” cash can be shopped around any number of online high-yield savings banks (or the emerging crop of third-party solutions for advisors like MaxMyInterest, Flourish Cash, and Stonecastle’s FICA for Advisors that help advisors shop for the best FDIC-insured yield), but there is still some level of "frictional" cash that tends to stay directly under the advisor’s management, often directly in the client’s brokerage account, to handle those ongoing monthly and quarterly cash inflows and outflows. In this context, it is notable that this month, Focus Financial announced a new Cash Management solution for its Focus partner firms (which collectively manage more than $200B of AUM) dubbed “Client Portfolio Cash” to offer better yields for its advisors' clients on their frictional cash. Notably, the new Focus Client Solutions offering also includes a partnership with Stonecastle’s FICA for Advisors for clients' outside cash holdings as well, and a new Credit Solutions offering to help advisors' clients get loans from residential mortgages to securities-backed lines of credit and more (competing against emerging solutions like Envestnet’s Credit Exchange and the lending capabilities of advisors serving HNW clients at wirehouses). Given the technical requirements necessary to actually track and manage integrated cash positions in a client portfolio, Focus announced that it is partnering with Orion Advisor Services – already highly adopted within the Focus network of firms – to help facilitate the cash management solution (with the potential to further scale its reach to other non-Focus firms through Orion’s base of advisors in the future). From the Focus perspective, the deal represents a significant opportunity to convert a portion of the revenue that RIA custodians earn from the RIAs on their platforms into a revenue stream for Focus itself, in addition to arguably positioning their partner firms to better compete in the HNW marketplace (where cash and lending solutions are often a competitive edge of wirehouse advisors over independents). Though Focus will also now have to navigate the tension that emerges as it shifts from a “pure” service provider to one that actually delivers a form of “proprietary” product solutions through its partner firms to their end clients (in an independent RIA channel that historically has celebrated its independence in part by repudiating the proprietary product approach of wirehouses). From the broader industry perspective, though, arguably the real significance of the Focus-Orion cash management deal is not simply the growth potential for Focus and the competitive cash management solution for its RIAs, but whether it can actually make a dent in the cash holdings – and cash profitability – of the RIA custodians its partner firms operate on, and begin to drive a shift in the currently-cash-management-dependent RIA custody business model to whatever comes next?

MaxMyInterest Integrates With Redtail As Advisor CRM Systems Become The New Integration Hub. CRM systems have traditionally been viewed by financial advisors as nothing more than a client repository – an electronic version of the old client Rolodex or little book of client names and contact information –which is largely why Microsoft Outlook is still often reported as one of the most adopted “CRMs” in the marketplace. As when it came to the actual flow of information and client data, the advisor’s investment platform – e.g., their broker-dealer or custodian – was at the center of the tech stack, exemplified by players like TD Ameritrade’s VEO and its open-architecture APIs that effectively became an AdvisorTech innovation hub for the decade of the 2010s. But on the heels of TD Ameritrade being acquired – with an uncertain future for VEO – and the ongoing growth of RIAs themselves (which are increasingly more likely to become multi-custodial as they grow), the industry is suddenly in search of a new hub to emerge… which, increasingly, is starting to become the advisor CRM system. Arguably, the CRM makes the most sense and always has. Salesforce has shown the entire world the power of using the CRM as a company’s foundation and central hub from which data flows and the workflow possibilities are endless (at least, for those willing to spend the developer resources to build them!). In this context, it is notable that MaxMyInterest, one of the early players in the realm of cash management solutions to help advisors’ clients maximize their yield on excess client cash by shopping it around available online banks, announced this month an integration with Redtail to facilitate the process of filling out forms and beginning onboarding for MaxMyInterest by drawing directly on the client details in Redtail. The significance of this integration is not just the practical usability itself, but that it is effectively an investment solution for clients that is not going through the RIA’s investment platform (i.e., its RIA custodian) but through the advisor’s CRM system instead – a broader signal that the central hub of the advisory firm’s tech stack really is beginning to shift. In fact, in the future it might even be the advisor’s CRM system, integrating with an RIA custodial platform and outside solutions, that might prompt its advisors with a notification in their CRM saying, “these 15 clients could be earning more on their cash, click here to help them start earning more!” And because CRM systems are increasingly the cross-platform workflow engine for advisory firms, these “next best action” type of alerts must live in the CRM, where all of the relevant data is to power that logic. Of course, with a recent flurry of news in cash management solutions, from SoFi acquiring Galileo to more recently MassMutual acquiring Flourish and this month Focus Financial launching its own cash management solution in partnership with Orion, the irony is that while “cash is trash” from the investment perspective, it appears that “cash is king” when it comes to business opportunities in the world of financial advisors. But the real significance to the news that MaxMyInterest is integrating with Redtail is not just the opportunity for advisors to more easily improve the yields on their clients’ excess cash holdings… but that the investment pathway to financial advisors and their clients’ cash holdings is no longer just through the advisor’s RIA custodial platform.

DPL Raises $26M From Private Equity To Scale Fee-Based Annuity Marketplace For RIAs. For most of their history, annuities were products manufactured by an insurance company and distributed to consumers through that insurer’s captive force of insurance agents, who were paid commissions as an incentive and reward for their sales efforts. Yet with the ongoing industry shift from product sales to advice, and from commissions to fees, the emerging question has become whether or how annuities will remain relevant in a more fee-based world… a change that nearly happened by regulatory fiat in 2016 when the Department of Labor’s fiduciary rule threatened to ban or at least levelize the commissions on most annuity products (only to be rolled back at the last minute by an industry legal challenge that annuity salespeople were only acting as salespeople and were not actually advisors). Nonetheless, the Department of Labor’s fiduciary rule catalyzed a shift in thinking about how annuities may be distributed in a no-commission fee-centric future, culminating in the 2019 issuance of an industry-requested Private Letter Ruling from the IRS that sanctioned the ability of RIAs to collect their advisory fees directly from a client’s annuity contract without triggering a taxable event. The caveat, however, is that just because RIAs now can utilize annuities with their clients – and be compensated in fees to manage those annuities with their clients – doesn’t mean that RIAs know when to use annuities, how to use annuities, have the infrastructure to do due diligence to evaluate and vet annuities, or have the systems in place to actually implement annuities. Which in turn is driving the rise of “annuity exchanges” – marketplaces for fee-based annuities where no-commission RIAs can shop for fee-based annuities to find and implement the right annuity for their client(s)… and then receive the technology and service support necessary to actually implement the product, from large platforms like Envestnet’s Annuity Exchange in partnership with FIDx, AdvisorTech firms like Simon Markets, IMOs turning to the RIA channel like FIG’s RIA Insurance Solutions, and DPL Financial Partners (created by David Lau, formerly the COO for Jefferson National, which formed one of the first fee-based investment-only variable annuities for RIAs before being sold to Nationwide in 2016). What’s unique about the DPL model, in particular, is that the company charges a base “membership” fee of $1,000 to $5,000 to have access to DPL’s services in the first place (from access to its marketplace of products to its support expertise on specific client issues to serving as the writing agent so the RIA doesn’t need to be insurance licensed), and then subsequently receives a servicing fee from the annuity carrier to help support the annuity on an ongoing basis. And in 2019 alone, DPL reports that its base of RIA members grew from 400 to 1,100 RIAs, and is positioned to accelerate further thanks to a recent deal with SS&C (maker of Advent and Black Diamond) to further build out an annuity marketplace directly embedded into SS&C’s portfolio management tools (with direct access to the 2,500 firms using SS&C’s solutions). And that momentum has now allowed DPL to raise a massive $26M private equity round of capital to further scale up its platform, estimating that it may drive as much as $1B in annuity sales in 2021 at its current growth trajectory. Still, though, it’s notable that even if DPL is receiving a 25 basis point servicing fee from annuity carriers – akin to a 25bps 12b-1 shareholder servicing fee from a mutual fund - $1B in annuity volume would amount to “just” $2.5M of new revenue on what was presumably a $75M+ valuation. Which means that DPL is not just betting that the momentum for annuities in RIAs will continue to build, but that it’s just the tip of the iceberg for a wholesale shift in the adoption of annuities in RIAs (which thus far account for only a minuscule percentage of the roughly $200B/year of annual flows into annuities, per LIMRA data), if the annuity industry can figure out how to create a new variety of more transparent more-RIA-friendly annuity products, and meet the real-world constraints that need to be solved for (from how RIAs bill, to how to fit annuities into model portfolios when each contract has its own anchor point on guarantees and some but not all clients may face IRS early withdrawal penalties). Nonetheless, given the literally hundreds of billions of flows that RIAs have generated in just a few years for ‘RIA-friendly’ providers like Blackrock, Vanguard, and DFA, the market opportunity arguably is immense if the annuity industry can stop designing products meant to be sold and instead try to create products that (fiduciary) RIAs would actually want to buy. Though in the end, there will still be a question of whether DPL can both grow and successfully fend off Envestnet, Simon, the IMOs, and other AdvisorTech providers eyeing the emerging annuity exchange marketplace opportunity.

National Guardian Life Acquires EverPlans As Insurers Increasingly Buy InsurTech. More than 20 years ago, Harvard professor Clayton Christensen first set forth what is known as the Innovator’s Dilemma, showing how large firm incumbents with the bulk of the existing customers and resources can still be disrupted by upstarts. At its core, the challenge of the Innovator’s Dilemma is that large firms are so large that new innovations they may create internally just aren’t large enough to move the needle on sales/revenue growth, which is problematic because early stage innovation often requires an extended period of iterative improvement to really become competitive and gain significant market share; as a result, large firms both struggle with internal innovation, and often don’t even see new disruptive competitors coming because they’re too small and fly under the radar screen… until they’ve iterated enough that they’ve created a truly disruptive offering, and by then are so far ahead with so much momentum that the incumbents struggle to catch up (and end out being “disrupted”). Accordingly, one of the emerging strategies for large incumbents that want to avoid being disrupted is to acquire potentially disruptive technology, when it’s far enough along to clearly be valuable and gaining momentum, but ‘early enough’ that the acquirer can still leverage and capitalize on the opportunity as well. In the financial services industry, this trend has been most evident in the realm of insurance companies, where many of the market leaders have been in business for well over 100 years, with a culture of steadfastness that is highly conducive to the stability one would expect and want from an insurance company making multi-decade promises… and not so conducive to keeping up with market innovation. Thus high profile deals like Northwestern Mutual acquiring LearnVest for $250M in 2015, or more recently MassMutual acquiring Flourish Cash. And now this month brings another InsurTech deal, as National Guardian Life (NGL) announces the acquisition of EverPlans, one of the early FinTech leaders in facilitating estate and end-of-life planning. At its core, EverPlans is a digital vault for storing important documents (e.g., Wills and Trusts, Powers of Attorney and Life Insurance policies), not only for easy reference and access, but also with the ability to share those documents with “Deputies” (e.g., appointed family members, or affiliated professionals like attorneys, accountants, and financial advisors, who can gain access to the needed documents, in the very moment of need when a death or disability occurs). In recent years, EverPlans has expanded to a “Professional” version of the software as well, which financial advisors can offer to their clients either as a value-added service or a way to otherwise deepen the relationship (or even establish a new relationship with the clients' heirs as they become appointed Deputies). From EverPlans' perspective, the deal with NGL gives them both an expanded market to serve (with almost 1.3 million policyholders at NGL), and more resources to continue to build and iterate on the EverPlans product (which will remain as a wholly owned subsidiary of NGL). From the NGL perspective, the EverPlans acquisition gives them a toehold in new industry technology, an appealing technology solution that aligns well as a value-add for the insurance policies it already sells, and the potential for a distribution channel to cross-sell NGL insurance to EverPlans users (“we see you have a Will that mentions children saved in EverPlans but no life insurance policies… is that something NGL can help you with?”). From the financial advisor perspective, the NGL acquisition does raise the question of where EverPlans Professional fits within NGL’s long-term plans, whether NGL might someday make EverPlans exclusive to its own affiliated agents (and make it no longer available to other financial advisors?), and/or whether NGL will someday try to cross-sell its insurance to the clients of advisors using EverPlans (which would likely frustrate many independent financial advisors), as in the long run it’s hard to see how NGL as the manufacturer of insurance policies would be interested in “just” growing EverPlans software revenues alone. More generally, though, NGL’s big investment into acquiring EverPlans accentuates how “estate planning” FinTech is shifting from its roots as software that projects potential exposure to estate taxes and identifies tax planning solutions, into software that facilitates planning for how the estate itself will be managed, divided, and executed in the unfortunate event that it’s necessary to do so.

Trust & Will Raises $15M Series B To Facilitate Consumer (And Client) Estate Planning Documents. Estate Planning attorneys face a challenge remarkably similar to financial advisors: they do complex expertise- and time-intensive work, where certain tasks can be automated by software (from trading/rebalancing the portfolio, to the process of drafting estate planning documents themselves), but there are few short-cuts to the messy conversation with the client about setting their goals and priorities in the first place (whether regarding their financial or estate planning), and both face high client acquisition costs and significant challenges in just getting clients in the first place (as both money and death are both conversations that most people would rather just avoid altogether). The first attempt to tackle this issue from a technology perspective was the launch of platforms like LegalZoom, which decided to try to make it as easy as possible for those who were self-motivated enough to get their own legal documents, with situations simple enough that they could be completed largely with self-guided technology, to be able to do so at the lowest cost possible. The caveat, though, is that even “online” estate planning from services like LegalZoom still culminates in the printing and physical signing of documents, with the attendant hassle of finding a local notary to witness the process. In this context, it was notable that in 2019, Trust & Will launched the first truly “digital will” solution, executed in Nevada (the first state to adopt Digital Wills). In the years since, Trust & Will has grown quickly, reporting most recently that the company has signed up 160,000 users for its services (a trust-based estate plan, a Will-based estate plan, or a simple Guardianship set of documents for parents) in under 3 years, and now has raised a $15M Series B round to further power its growth (and ostensibly betting that the movement from printed to digital Wills will continue its state-by-state adoption in the years to come). From the consumer perspective, the appeal of the shift to digital Will solutions is an outright reduction in the cost of estate planning – given that the cost to print and/or mail physical documents is still not trivial, especially when added to the cost and time hassle of getting a local notary to witness – such that in states where digital Wills are permitted, Trust & Will charges just $89 for an individual or $159 for a couple. The challenge, though, is still convincing the mass of consumers to take up the morbid topic of estate planning in the first place… and as a result, Trust & Will last year launched an Advisor version of the solution, specifically for financial advisors to offer/use with their own clients (and providing a new source or new trusts and wills for Trust & Will). At its core, Trust & Will for Advisors is still simply the Trust & Will service itself, offering its online document drafting solution for advisors’ clients at a 10% discount through the advisor (or up to 30% off for advisors who bulk pre-purchase Estate Plans for multiple clients), and a dashboard for the advisor to see where clients are in the process of getting their documents drafted and signed. For more complex client situations, attorney guidance is available for an additional $200 charge, though for such clients, advisors are more likely to work with local estate planning attorneys (where they can be even more involved, and also build strategic alliances and cross-referral relationships anyway). However, for advisors who have clients that only need a ‘simple’ solution of getting some documents in place, to begin with, Trust & Will increasingly competes in a new category of providers alongside Helios, Vanilla, and of course the old stalwart of LegalZoom itself. Though if the company can continue to expand its purely-digital-only digital Will solution – making it possible for clients to create and fully sign and complete their estate planning documents all at once in a single meeting with the advisor, Trust & Will seems especially well-positioned to help advisors and their clients in an area where no one seems to want to spend a lot of time or dollars to go through the process, and the combination of low cost and expediency is likely to be a material factor in real-world adoption.

Education Takes The Lead For Alts Distribution As iCapital Acquires AI Insight To Mirror CAIS IQ. Over the past decade, two major shifts in capital markets have driven a rapid rise in interest amongst financial advisors in alternative investments. On the one hand, a decade of ultra-low interest rates in the aftermath of the financial crisis (and now the coronavirus pandemic) has made it untenable for many advisors to ‘indefinitely’ buy and hold a traditional 40% slice of fixed income (in a classic 60/40 portfolio) that may only yield 1% on Treasuries and 2.5% on corporate bonds while charging a 1% AUM fee. On the other hand, while equity markets have performed far better – especially since the 2009 market bottom, up over 16%/year annualized with dividends reinvested in the nearly 12 years since! – even more eye-popping returns in the realm of private equity, as more and more fast-growth companies go public later than ever, is driving a growing hunger amongst advisors and their clients to avoid “missing out” on an increasingly material segment of the economic growth engine. All of which makes it appealing for financial advisors to access alternative investments outside of traditional (low-yield) bonds and (only-publicly-traded) stocks. Except financial advisor platforms historically have been built around brokerage platforms that primarily (or only) deal in ‘traditional’ investments. Which in turn has spawned the rise of alternative investments platforms like iCapital and CAIS to provide a marketplace of alternative investment products for financial advisors to choose from. Yet the challenge is that most financial advisors are only trained and educated in traditional portfolios and the classic building blocks of stocks and bonds (or pooled investment vehicles that hold them like mutual funds and ETFs), which means even if advisors have access to alternative investments, it doesn’t mean they’ll readily adopt (especially amongst RIAs that feel the pressure of fiduciary liability if they choose an alternative investment and fail to conduct sufficient or proper due diligence that results in a bad client outcome). Which has led to not only the growth of alternative investments designations for financial advisors like the Chartered Alternative Investment Analyst (CAIA), but in 2019 led CAIS to hire Andrew Smith Lewis, founder of the Cerego Learning Management System, to build its “CAIS IQ” alternative investments educational platform for financial advisors. And now, recognizing the success of an education-based approach to alternatives, CAIS competitor iCapital has announced the acquisition of AI (Alternative Investments) Insight, which going forward will provide its own alternative investments educational platform for financial advisors. From the iCapital perspective, the acquisition makes strategic sense, both given the sheer need for education on alternative investments for advisors who want to use them (and need to learn to do the proper due diligence first), and that if enterprises are going to seek education on alts, the last thing that iCapital wants is for advisors to build their knowledge base with a competitor’s (CAIS IQ) brand. From the advisor's perspective, though, the irony is that now advisors will have to figure out which platform gives the ‘better’ alternatives investment education in the first place (a due diligence challenge unto itself!?), in a world where arguably advisors do need a skeptical eye when the due diligence education on alternatives is being provided by the platform that only profits if advisors decide to follow through and implement what the platform teaches them. Nonetheless, it’s hard to argue with the value of more education in alternatives, and, to be fair both CAIS and iCapital will benefit as long as advisors use any alternatives (not any in particular) – which more and more are inclined to do anyway, if only to satiate client investment return needs that some see as increasingly challenging to get from traditional stock and bond portfolios in the current market environment.

Chalice Network Launches “Certified FinTech Advisor” (CFTA) Designation For Financial Services Executives. Because financial services is both a highly regulated industry, a highly fractured industry, and an unfortunately low trust industry (most recently, the legacy of nearly bringing the financial system to its knees in a giant 2008-2009 financial crisis), the pace of innovation is relatively slow. On the one hand, this is entirely intentional – a function of regulation itself – to ensure (or at least reduce the likelihood) that “innovation” in something as essential as the financial system itself doesn’t unwittingly cause consumer harm. On the other hand, the slow pace of innovation both limits the speed at which even ‘disruptors’ can really gain market adoption, and in many cases leads to outright complacency by established incumbents that they are under no threat of danger (or at least that they’ll be able to see the threat from far enough away to either respond to it, or simply preemptively acquire it!). And the matter is only further complicated by the fact that the nomenclature of “FinTech” itself is oftentimes ambiguous and inconsistent, covering a range that includes Payments and Banking (which usually has little impact in the domain of wealth management firms in particular), Blockchain and cryptocurrencies (which also has had little direct impact in wealth management, at least thus far), the rise of Artificial Intelligence and Big Data (which has a lot of relevance in large financial services firms with big amounts of data, but limited impact in individual advisory firms that have “small data” problems of individual clients instead), to robo-advisors (the threat that wasn’t) and the domain of “WealthTech” (which still only covers portfolio management but little of the remainder of what matters to financial advisors). Which means even if a firm wants to get up to speed on the competitive threats and opportunities of FinTech, it’s difficult to get a handle on where to start in the first place. In this context, it’s notable that the Chalice Network, in partnership with the Society of Financial Services Professionals, has announced the launch of a new Chalice Financial Institute, and the launch of a new “Certified FinTech Advisor” (CFTA) designation. The curriculum, as delineated on the Chalice website, covers the gamut of the broad categories of FinTech (from Big Data and AI to cryptocurrencies and blockchain to digital advice and more), trends in FinTech from consultants like Will Trout of Celent, a deep dive into digital wealth management in particular, and implications for the business of financial advice from T3 Technology guru Joel Bruckenstein. Notwithstanding the “advisor” label in the designation, though, the new CTFA program really appears to be targeted primarily at the financial services executive who is trying to get a handle not just on the domain of FinTech itself but its implications for their own enterprise and its potential ‘digital transformation’ in the future. Ultimately, the industry arguably doesn’t need yet another designation just to embody yet another online educational program, but structured education around a complex topic like FinTech should help firms that are still trying to get up to speed on the FinTech landscape and figure out its implications for themselves. Though it remains to be seen who will bite on the CFTA’s $3,500 price tag once Chalice opens the current waiting list to begin the program.

New Product Watch: The Rise of Financial Behavior and Financial Personality Tools. For most of their history in the financial services industry, “profiling” tools for financial advisors have been all about understanding a prospective client’s risk profile, an essential component of the Know Your Client (KYC) obligation to determine whether a recommended solution for a client is consistent with their tolerance for risk or whether they would be prone to panic selling in the event of a market decline. Yet the reality is that there are far more “financial behaviors” that impact an individual’s financial success than just their willingness to stay invested and tolerate market volatility, as exemplified by the research underpinning Thomas Stanley and William Danko’s “Millionaire Next Door”, from one’s frugality to their focus on goals to their ability to withstand the temptation of keeping up with the Joneses (and be ‘socially indifferent’ to the spending habits of others). When it comes to applying such tools to financial advisors, arguably the original player in this category is FinancialDNA, though the growing base of research on financial behaviors and positive psychology in the past 20 years has spawned a growing number of researchers taking those insights and turning them into assessment tools for advisors, from the original Millionaire Next Door research (now available as an assessment tool through DataPoints), to Martin Seligman’s well-being research embodied in the new InvestingYou assessment, and Tal Ben-Shahar’s positive psychology research incorporated into the recently launched Positivly. From a practical perspective, such tools may ironically be of limited value for the ‘typical’ advisor’s client, who by definition of being able to work with the advisor is already likely to be of above-average wealth accumulation (to meet typical advisor investment minimums), and thus are already likely to exhibit positive wealth behaviors (or they wouldn’t have gotten to that point in the first place). But arguably such tools would be especially helpful for advisors still working with younger clients still in the earlier stages of accumulation (especially DataPoints, which is founded on the research that specifically identified those who were most likely to become ‘prodigious accumulators of wealth’), in addition to having uses with those new clients who have come into ‘sudden money’ or similar liquidity events and have newfound wealth that may not align to their prior money behavior and habits. Especially since such tools would not only give advisors a baseline to better understand clients and the advice most likely to help them, but also where their challenges may lie (e.g., those whose financial personality is less conducive to wealth accumulation and may need some help to change certain behaviors or attitudes), and even to identify those clients who will not likely be a good fit at all (or at least, would necessitate more time from the advisor to coach than their pricing and business model allows). Though in the end, most clients (or most people in general!) can still benefit from and often appreciate an opportunity for some level of introspective financial-personal discovery from time to time anyway?

In the meantime, we’ve updated the latest version of our Financial AdvisorTech Solutions Map with several new companies, including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation!

So what do you think? Will Walmart really try to enter the financial services business, or ‘just’ create a financial products superstore? Can Altruist actually break up the RIA custodial oligopoly (with perhaps the support of asset managers who would like to see the landscape change)? Will CRM systems become the new AdvisorTech hub as advisors become less investment-centric? And will the RIA community really start allocating billions of dollars to no-commission annuities in the years to come?

Please share your thoughts in the comments below!

Special thanks to Kyle Van Pelt, who wrote the sections "Can Mackrill’s New Milemarker Take AdvisorTech Integrations The Extra Mile?" and "MaxMyInterest Integrates With Redtail As Advisor CRM Systems Become The New Integration Hub." You can connect with Kyle via LinkedIn or follow him on Twitter at @KyleVanPelt).

Leave a Reply